2025 Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the supply of Bitcoin available for circulation. Understanding the mechanics of this event and its historical influence is crucial for predicting its potential impact on Bitcoin’s price in 2025.

The Bitcoin halving mechanism is designed to control inflation. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. Initially, miners received 50 BTC per block. After the first halving, this reduced to 25 BTC, then 12.5 BTC, and will be 6.25 BTC after the 2024 halving, setting the stage for the 2025 halving’s impact. This deliberate reduction in the supply of newly minted Bitcoin is expected to influence market dynamics, potentially leading to price increases due to increased scarcity.

Bitcoin Halving’s Historical Impact on Price

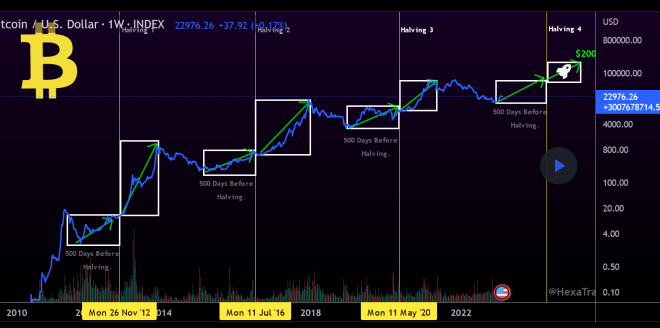

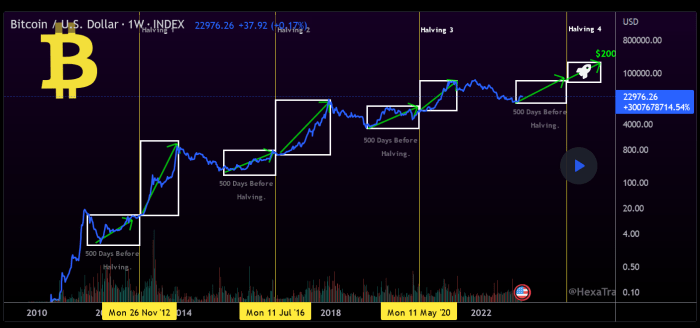

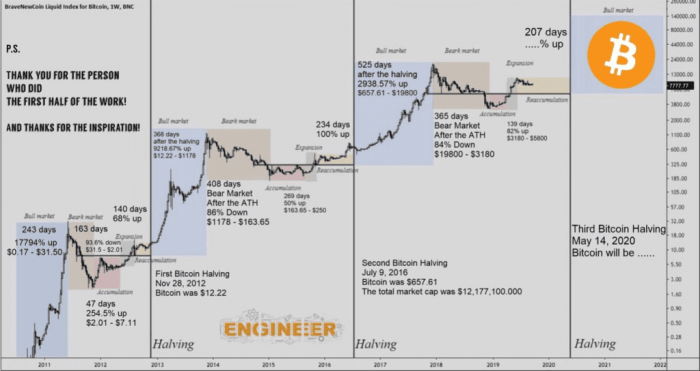

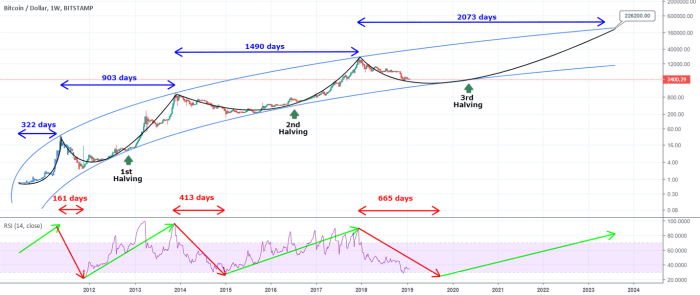

Historically, Bitcoin’s price has experienced significant upward trends following previous halving events. The halving itself doesn’t directly cause price increases, but it creates a predictable decrease in the rate of new Bitcoin entering the market. This reduction in supply, coupled with consistent or increasing demand, often results in upward pressure on price. The 2012 and 2016 halvings were followed by substantial price rallies, although the timeframes and magnitudes varied. The market conditions surrounding each halving, including overall market sentiment, regulatory changes, and adoption rates, played a crucial role in shaping the subsequent price movements. For example, the 2012 halving was followed by a period of relatively slower price appreciation, while the 2016 halving was followed by a more pronounced and rapid increase in price.

Anticipated Supply Reduction in 2025 and its Potential Influence

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a further reduction in the rate of new Bitcoin entering circulation, potentially exacerbating the scarcity effect. The extent to which this impacts price will depend on several interacting factors. If demand remains strong or increases, the reduced supply could lead to significant price appreciation. However, if demand weakens or remains stagnant, the impact on price could be muted or even negative.

Factors Influencing Bitcoin’s Price Post-Halving, 2025 Bitcoin Halving Price Prediction

Several factors beyond the halving itself influence Bitcoin’s price. These include: macroeconomic conditions (e.g., inflation, interest rates), regulatory developments (e.g., government policies on cryptocurrencies), technological advancements (e.g., scaling solutions, layer-2 technologies), and overall market sentiment (e.g., investor confidence, media coverage). For example, the 2020 halving coincided with a period of increasing institutional adoption and a generally bullish market sentiment, contributing to a significant price surge. Conversely, macroeconomic factors like rising interest rates could dampen the positive impact of the halving. Predicting the precise impact of the 2025 halving requires careful consideration of these intertwined factors.

Predicting the 2025 Bitcoin Price: 2025 Bitcoin Halving Price Prediction

Accurately predicting the price of Bitcoin in 2025, or any time for that matter, is inherently challenging. Numerous interconnected factors influence its value, making any forecast inherently speculative. However, by analyzing key macroeconomic trends, regulatory landscapes, technological advancements, and historical market behavior, we can build a framework for informed speculation.

Macroeconomic Factors Influencing Bitcoin’s Price

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, often implemented to combat inflation, can reduce investment in riskier assets like Bitcoin, leading to price declines. Recessionary fears can also trigger a flight to safety, potentially impacting Bitcoin’s price depending on whether it’s viewed as a safe haven or a risky asset during economic uncertainty. The 2022 bear market, coinciding with rising interest rates and inflation, serves as a recent example of this interplay.

Regulatory Developments and Government Policies

Government regulations and policies play a crucial role in shaping Bitcoin’s trajectory. Favorable regulations, such as clear guidelines for Bitcoin trading and taxation, can increase institutional and retail investor confidence, potentially driving up the price. Conversely, restrictive policies, including outright bans or excessive taxation, can stifle adoption and negatively impact the price. The varying regulatory approaches adopted by different countries, from China’s ban to El Salvador’s adoption as legal tender, highlight the significant impact of government actions.

Technological Advancements and Bitcoin Adoption

Technological advancements within the Bitcoin ecosystem, such as the Lightning Network improving transaction speed and scalability, can enhance its usability and appeal, potentially boosting adoption and price. Increased adoption, whether through broader merchant acceptance or increased institutional holdings, typically leads to higher demand and, consequently, price appreciation. The ongoing development of layer-2 solutions and improvements in wallet security are examples of factors that could positively influence Bitcoin’s price.

Comparison of Current Market Sentiment with Previous Halving Events

Comparing current market sentiment with periods leading up to previous Bitcoin halving events offers valuable insights. While past performance is not indicative of future results, analyzing investor behavior and market dynamics surrounding previous halvings can help identify potential patterns. The 2012 and 2016 halvings, for example, were followed by significant price increases, although the timing and magnitude varied. Understanding the factors driving investor sentiment – fear, uncertainty, and doubt (FUD) versus excitement and anticipation – is crucial for informed speculation.

Institutional Investment and Price Volatility

Institutional investment in Bitcoin has significantly increased in recent years. Large-scale investments by corporations and financial institutions can inject substantial liquidity into the market, potentially reducing price volatility and driving sustained price growth. However, significant institutional selling can also lead to sharp price corrections. The involvement of firms like MicroStrategy, which has made substantial Bitcoin acquisitions, illustrates the potential impact of institutional participation on both price stability and volatility.

Historical Data and Price Analysis

Understanding Bitcoin’s price behavior following previous halving events is crucial for predicting its potential trajectory in 2025. Analyzing historical data reveals patterns and trends that can inform, though not definitively predict, future price movements. While past performance is not indicative of future results, it provides a valuable framework for analysis.

Bitcoin’s price has historically exhibited a period of growth following each halving event. This growth is often attributed to the decreased supply of newly mined Bitcoin, creating a potential increase in scarcity and demand. However, the timing and intensity of these price increases vary considerably. The influence of external factors, such as macroeconomic conditions and regulatory changes, also plays a significant role.

Bitcoin Price Movements After Previous Halvings

The following analysis considers the three previous Bitcoin halving events: November 2012, July 2016, and May 2020. A visual representation, although not provided here in image form, would show a clear trend: a period of relative price stability leading up to the halving, followed by a period of price appreciation of varying duration and intensity post-halving.

A hypothetical chart would show the following: The X-axis represents time, spanning several years before and after each halving event. The Y-axis represents Bitcoin’s price in USD. For each halving, we’d see a relatively flat or slightly declining price in the year leading up to the event. Immediately following the halving, the chart would show a gradual increase in price, accelerating in some cases, then potentially plateauing or experiencing corrections before resuming an upward trend. Key data points to be included would be the exact date of each halving, the price of Bitcoin at that time, and the approximate peak price achieved in the subsequent bull market. The duration of the bull market following each halving would also be a crucial data point to note.

Duration and Intensity of Post-Halving Price Movements

The duration of price increases following halvings has varied significantly. Following the 2012 halving, the price increase was relatively gradual and extended over a period of approximately two years. The 2016 halving was followed by a more dramatic and rapid price surge, reaching its peak within a year. The 2020 halving, while exhibiting a significant price increase, showed a more prolonged and less explosive upward trajectory compared to 2016, influenced by various market conditions including the COVID-19 pandemic. The intensity of the price movements is also highly variable, with some periods experiencing rapid, exponential growth, while others show more moderate, steady gains. This variability underscores the complexity of predicting the precise timing and magnitude of future price movements.

Different Price Prediction Models

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, relying on various models each with its own strengths and weaknesses. No single model offers a definitive answer, and a diversified approach is often preferred. Understanding the methodologies and limitations of each approach is crucial for interpreting any prediction.

Different methodologies exist for predicting Bitcoin’s price, each with its own set of assumptions and limitations. These models offer a range of potential outcomes, highlighting the inherent uncertainty in forecasting future market behavior. The following sections detail three prominent approaches: technical analysis, on-chain metrics, and fundamental analysis.

Technical Analysis

Technical analysis uses historical price and volume data to identify patterns and predict future price movements. This method focuses on chart patterns, indicators (like moving averages and RSI), and candlestick formations to gauge market sentiment and potential price trends. While it can be useful in identifying short-term price fluctuations, its predictive power over longer periods, such as the impact of a halving, is debated. Technical analysis struggles to account for external factors significantly impacting Bitcoin’s price, such as regulatory changes or macroeconomic events. Furthermore, the subjective interpretation of chart patterns can lead to discrepancies in predictions. A common example of a technical indicator used is the Relative Strength Index (RSI), which measures the magnitude of recent price changes to evaluate overbought or oversold conditions. However, relying solely on RSI for long-term predictions is unreliable.

On-Chain Metrics

On-chain analysis examines data directly from the Bitcoin blockchain, such as transaction volume, active addresses, mining difficulty, and the number of unspent transaction outputs (UTXOs). Proponents argue that these metrics offer insights into network activity and overall market sentiment, potentially predicting future price movements. For instance, a surge in active addresses might suggest growing adoption and potentially higher demand, pushing the price upwards. However, correlating on-chain data with price is not always straightforward. External factors can influence on-chain activity, making it difficult to isolate the direct impact of network activity on price. Furthermore, the interpretation of on-chain data can be subjective, and there’s no universally accepted model for translating these metrics into price predictions. For example, a high hash rate might indicate a secure network, but it doesn’t directly translate to a specific price target.

Fundamental Analysis

Fundamental analysis evaluates the intrinsic value of Bitcoin based on factors like its scarcity, adoption rate, technological advancements, and regulatory landscape. This approach attempts to determine whether the current price reflects the underlying value of the asset. Factors like the limited supply of 21 million Bitcoins and increasing institutional adoption are often cited as supporting arguments for long-term price appreciation. However, accurately predicting future adoption rates and regulatory changes is challenging. Fundamental analysis struggles to account for short-term market volatility driven by speculation and sentiment. It often provides a long-term perspective rather than precise short-term price targets. For instance, a bullish fundamental outlook might suggest a long-term price increase but wouldn’t necessarily predict the exact price in 2025.

Comparison of Price Prediction Models

The following table summarizes the predictions from different models, acknowledging the wide range of potential outcomes and the inherent uncertainties involved. It’s important to remember that these are just examples, and numerous other models and predictions exist.

| Model Name | Prediction Range (USD) | Methodology | Assumptions |

|---|---|---|---|

| Technical Analysis (Model A) | $100,000 – $150,000 | Moving averages, RSI, chart patterns | Continued institutional adoption, stable macroeconomic environment |

| On-Chain Metrics (Model B) | $75,000 – $125,000 | Active addresses, transaction volume, hash rate | Increased network activity reflects growing demand |

| Fundamental Analysis (Model C) | $150,000 – $250,000+ | Scarcity, adoption rate, technological advancements | Continued global adoption, positive regulatory developments |

Potential Risks and Uncertainties

Predicting the price of Bitcoin, especially around a halving event, is inherently risky. While historical data suggests a positive correlation between halvings and price increases, numerous factors can significantly impact the actual outcome, potentially leading to price movements far different from expectations. Understanding these potential risks is crucial for any investor considering exposure to Bitcoin in 2025.

Several significant threats could negatively affect Bitcoin’s price trajectory in 2025. These risks span technological vulnerabilities, regulatory actions, market manipulation, and unpredictable global events.

Security Breaches and Technological Vulnerabilities

A major security breach affecting a significant cryptocurrency exchange or wallet provider could severely damage investor confidence. The 2021 Mt. Gox hack, which resulted in the loss of hundreds of thousands of Bitcoins, serves as a stark reminder of the potential for large-scale theft and the subsequent negative impact on market sentiment. Similarly, the discovery of previously unknown vulnerabilities in the Bitcoin protocol itself could trigger a sharp price decline as investors reassess the security of the network. The potential for 51% attacks, though unlikely given the current network hash rate, remains a theoretical risk.

Regulatory Crackdowns and Legal Uncertainty

Governments worldwide are increasingly scrutinizing the cryptocurrency market. Stringent regulations, including outright bans or excessively burdensome compliance requirements, could significantly stifle Bitcoin adoption and negatively impact its price. The regulatory landscape is constantly evolving, and unforeseen changes in policy, especially coordinated international action, could create significant volatility. For example, a sudden ban on cryptocurrency trading in a major market like the United States or China could trigger a dramatic price drop.

Market Manipulation and Whale Activity

The relatively small number of extremely large Bitcoin holders (“whales”) gives them considerable influence over the market. These whales can manipulate the price through coordinated buying or selling, creating artificial price swings. Such actions can lead to significant losses for smaller investors and erode confidence in the market. Historical examples of coordinated market manipulation in other asset classes illustrate the potential for similar activity in the Bitcoin market.

Unforeseen Global Events

Macroeconomic factors and geopolitical events can significantly influence Bitcoin’s price. A global recession, a major international conflict, or a significant financial crisis could trigger a flight to safety, potentially causing investors to sell their Bitcoin holdings in favor of more stable assets. The COVID-19 pandemic, for example, initially caused a sharp decline in Bitcoin’s price before a subsequent recovery, highlighting the impact of unpredictable global events. Similarly, unexpected changes in inflation rates or monetary policy can dramatically alter investor sentiment and influence Bitcoin’s value.

Uncertainty Surrounding Technological Developments

The cryptocurrency landscape is constantly evolving. The emergence of competing cryptocurrencies with superior technology or more efficient scaling solutions could divert investment away from Bitcoin, potentially impacting its market dominance and price. Conversely, successful technological advancements within the Bitcoin network itself, such as the implementation of the Lightning Network, could enhance its usability and potentially drive up its value. The uncertainty surrounding future technological developments introduces a considerable element of risk.

Alternative Perspectives and Scenarios

Predicting the price of Bitcoin in 2025, even with the halving event factored in, is inherently uncertain. Several scenarios, each with its own set of drivers and risks, can be envisioned. These scenarios offer a range of potential outcomes, from extremely bullish to decidedly bearish, and a more neutral middle ground.

Bullish Scenario: Bitcoin Surges Past $200,000

A bullish scenario for Bitcoin in 2025 hinges on several factors aligning favorably. Widespread institutional adoption, driven by regulatory clarity and increased institutional investor confidence, could significantly increase demand. Furthermore, continued technological advancements, such as the development of layer-2 scaling solutions and improved privacy features, could enhance Bitcoin’s utility and appeal to a broader user base. Growing macroeconomic uncertainty, potentially fueled by inflation or geopolitical instability, could further drive investors towards Bitcoin as a safe-haven asset. If these factors converge, a price exceeding $200,000 by the end of 2025 is not unrealistic. This would mirror the price appreciation seen after previous halving events, albeit on a potentially larger scale, given the increased global awareness and adoption of Bitcoin since its inception. For example, the price increase following the 2016 halving was substantial, and with increased institutional involvement and a larger market capitalization, a similar or even greater surge is conceivable.

Bearish Scenario: Bitcoin Price Stagnates or Declines

Conversely, a bearish scenario for Bitcoin in 2025 could stem from several interconnected factors. Increased regulatory scrutiny and potential government crackdowns in major markets could significantly dampen investor enthusiasm and reduce trading volume. A prolonged period of macroeconomic stability, reducing the appeal of Bitcoin as a safe-haven asset, could also contribute to a price decline. Furthermore, the emergence of competing cryptocurrencies with superior technological advantages could divert investment away from Bitcoin, potentially leading to market share erosion. A significant security breach or a major hacking incident involving a large Bitcoin exchange could severely undermine confidence in the cryptocurrency market, resulting in a substantial price drop. If these factors materialize, Bitcoin’s price could stagnate or even decline significantly below its current value by the end of 2025. This would represent a significant departure from the historical pattern of price appreciation following halving events.

Neutral Scenario: Bitcoin Price Consolidates Within a Range

A more balanced, neutral scenario suggests that Bitcoin’s price in 2025 will consolidate within a specific range. This scenario acknowledges the potential for both bullish and bearish factors to influence the market. While the halving event will likely create upward price pressure, countervailing forces, such as regulatory uncertainty or technological challenges, could prevent an explosive price surge. As a result, the price might fluctuate within a range, perhaps between $50,000 and $150,000, depending on the interplay of these competing factors. This range reflects a more cautious outlook, recognizing the inherent volatility of the cryptocurrency market and the unpredictable nature of external factors. This is a more realistic assessment, considering the unpredictable nature of market forces and the potential for both positive and negative developments to affect Bitcoin’s price.

Frequently Asked Questions

This section addresses common queries regarding the Bitcoin halving and its impact on price predictions, highlighting the inherent uncertainties and risks associated with Bitcoin investment. Understanding these aspects is crucial for making informed investment decisions.

Bitcoin Halving Significance

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created by 50%. This occurs approximately every four years. Its significance for price prediction stems from the belief that reduced supply, coupled with relatively stable or increasing demand, can lead to price appreciation. The halving events of 2012, 2016, and 2020 have historically been followed by periods of significant price increases, although the timing and magnitude of these increases have varied considerably. This historical correlation, however, doesn’t guarantee future price movements.

Accuracy of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Numerous models exist, employing various methodologies (technical analysis, fundamental analysis, on-chain metrics, etc.), but none offer foolproof accuracy. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors, including regulatory changes, macroeconomic conditions, technological advancements, and market sentiment. Past performance is not indicative of future results, and even sophisticated models can be significantly off the mark. For example, many predictions surrounding the 2021 bull run were wildly inaccurate, both in terms of peak price and timing.

Key Factors Influencing Bitcoin’s 2025 Price

Several key factors will likely shape Bitcoin’s price in 2025. These include the upcoming halving event (reducing supply), the overall macroeconomic environment (inflation, interest rates), regulatory developments (both positive and negative), technological advancements within the Bitcoin ecosystem (like the Lightning Network), and the level of institutional and retail adoption. Geopolitical events and broader market sentiment will also play a crucial role. For instance, a global recession could negatively impact Bitcoin’s price, while widespread institutional adoption could drive prices higher.

Potential Risks of Bitcoin Investment

Investing in Bitcoin carries substantial risks. Price volatility is a major concern; Bitcoin’s price can fluctuate dramatically in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing frameworks for cryptocurrencies. Security risks, including hacking and theft from exchanges or personal wallets, are also significant. Furthermore, the relatively nascent nature of the cryptocurrency market makes it susceptible to manipulation and speculative bubbles. Finally, the lack of intrinsic value, unlike traditional assets like gold or real estate, makes Bitcoin’s value entirely dependent on market sentiment and adoption. Consider the Mt. Gox hack in 2014, which resulted in the loss of millions of dollars worth of Bitcoin, as a stark example of the security risks involved.

2025 Bitcoin Halving Price Prediction – Predicting the Bitcoin price after the 2025 halving is a complex undertaking, influenced by numerous market factors. To better understand potential price trajectories, it’s helpful to visualize historical trends and the impact of previous halvings. A useful resource for this is the Bitcoin Halving Chart 2025 , which provides a clear representation of past halving events and their subsequent price movements.

Analyzing this chart can offer valuable insights into potential price scenarios for the 2025 Bitcoin halving, although it’s crucial to remember that past performance is not indicative of future results.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, influenced by numerous factors. To accurately gauge potential price movements, a thorough understanding of historical data is crucial. For comprehensive insights into the relevant historical trends, you can consult this resource on Halving Bitcoin 2025 Data , which provides valuable context for formulating more informed predictions regarding the 2025 Bitcoin Halving Price Prediction.

Predicting the Bitcoin price after the 2025 halving is a complex task, influenced by various market factors. Understanding the historical impact of previous halvings is crucial, and a key date to consider is the actual Bitcoin Halving Day in 2025, which you can learn more about at Bitcoin Halving Day 2025. This date serves as a significant marker for analyzing potential price movements following the reduction in Bitcoin’s block reward, ultimately impacting the 2025 Bitcoin Halving Price Prediction.

Predicting the Bitcoin price after the 2025 halving is a complex task, influenced by various market factors. Understanding the historical impact of previous halvings is crucial, and a key date to consider is the actual Bitcoin Halving Day in 2025, which you can learn more about at Bitcoin Halving Day 2025. This date serves as a significant marker for analyzing potential price movements following the reduction in Bitcoin’s block reward, ultimately impacting the 2025 Bitcoin Halving Price Prediction.

Predicting the Bitcoin price after the 2025 halving is a complex task, influenced by various market factors. Understanding the historical impact of previous halvings is crucial, and a key date to consider is the actual Bitcoin Halving Day in 2025, which you can learn more about at Bitcoin Halving Day 2025. This date serves as a significant marker for analyzing potential price movements following the reduction in Bitcoin’s block reward, ultimately impacting the 2025 Bitcoin Halving Price Prediction.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, with various analysts offering widely differing opinions. A key factor in these predictions is the precise timing of the halving event itself, which you can find detailed information on at Bitcoin Halving Time 2025. Understanding this date is crucial for accurately forecasting the subsequent market behavior and potential price movements of Bitcoin in 2025 and beyond.