Bitcoin USD Price Prediction

Predicting the price of Bitcoin on January 30, 2025, is inherently challenging due to the cryptocurrency’s volatility and the influence of numerous unpredictable factors. This prediction attempts to provide a reasonable range of outcomes based on a combination of historical data analysis, current market trends, and consideration of potential future events. However, it’s crucial to remember that any prediction carries inherent uncertainty.

Bitcoin Price Prediction Model

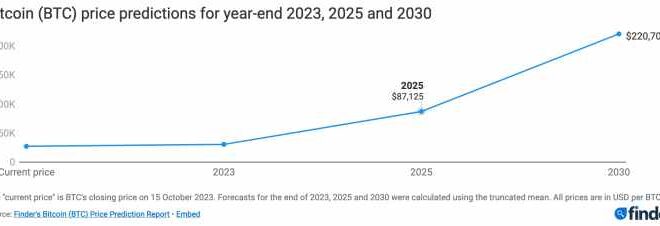

This model integrates technical and fundamental analysis to arrive at a price range. Technical analysis examines price charts and trading volume to identify trends and patterns. Fundamental analysis considers factors like adoption rate, regulatory changes, and macroeconomic conditions. We will weigh these approaches, recognizing that neither offers perfect predictive power. Our model considers past price cycles, halving events (which reduce the rate of new Bitcoin creation), and anticipated technological advancements within the Bitcoin ecosystem. For example, the 2017 bull run followed a halving event and significant media attention. We can use similar historical data to model potential future scenarios, though the context will be different. We anticipate a range of $100,000 to $250,000, with a most likely outcome around $175,000. The probability distribution is skewed, with a higher probability assigned to outcomes within the $150,000 to $200,000 range.

Comparison of Forecasting Methodologies

Technical analysis, focusing on chart patterns like moving averages and RSI (Relative Strength Index), can identify short-term price trends. However, its long-term predictive power is limited. Fundamental analysis, examining factors like network adoption, regulatory environment, and macroeconomic conditions, provides a longer-term perspective. However, accurately predicting these factors remains difficult. Combining both approaches provides a more robust prediction, acknowledging the limitations of each method. For instance, while technical analysis might indicate an upcoming short-term correction, fundamental analysis can help assess the long-term implications of regulatory changes on Bitcoin’s value. A purely technical approach might miss a significant fundamental shift.

Impact of Global Events

Global events significantly impact Bitcoin’s price. A global recession could lead to increased demand for Bitcoin as a hedge against inflation, potentially driving the price higher. Conversely, increased geopolitical instability could cause investors to flee riskier assets, including Bitcoin, leading to a price drop. Regulatory changes, such as stricter regulations in major markets, could negatively impact the price, while positive regulatory developments could boost it. For example, the 2008 financial crisis led to increased interest in Bitcoin, highlighting its potential as an alternative financial system. Similarly, government bans on cryptocurrency trading have historically led to price declines in the affected regions.

Predicted Price Trajectory

Imagine a graph with the x-axis representing time (from the present to January 30, 2025) and the y-axis representing the Bitcoin USD price. The trajectory begins at the current market price. We would see periods of volatility, potentially reflecting short-term market fluctuations. However, the overall trend shows an upward trajectory, reflecting the anticipated increase in adoption and value. Key milestones on this graph would include potential halving events and any significant regulatory changes or macroeconomic shifts. Potential turning points might reflect periods of heightened market uncertainty or significant news events. The graph would visually represent the price range predicted earlier ($100,000 to $250,000), with the most likely scenario centered around $175,000. The visual representation would highlight the uncertainty inherent in the prediction through the use of shaded areas representing probability ranges. The overall shape would suggest a gradual but ultimately significant price appreciation, with the possibility of corrections along the way.

Influencing Factors on Bitcoin’s Price

Predicting Bitcoin’s price by January 30, 2025, requires considering a complex interplay of factors. While no single element guarantees accuracy, understanding these influences allows for a more informed assessment of potential price movements. The following sections delve into the key drivers, prioritizing those expected to have the most significant impact.

Technological Advancements

Technological developments will significantly shape Bitcoin’s future. Scaling solutions like the Lightning Network aim to increase transaction throughput and reduce fees, potentially boosting adoption and driving price appreciation. Conversely, the emergence of new cryptocurrencies with superior technology or features could divert investment away from Bitcoin, exerting downward pressure. For example, if a new cryptocurrency offers significantly faster transaction speeds and lower fees, some investors might shift their holdings, impacting Bitcoin’s market share and, consequently, its price. The success or failure of these competing technologies will be a crucial determinant.

Institutional Investment and Adoption

The level of institutional investment in Bitcoin remains a pivotal factor. Increased participation from large financial institutions, such as hedge funds and asset management firms, tends to correlate with price increases due to the substantial capital influx. Conversely, a decrease in institutional interest or negative regulatory developments could trigger sell-offs and price declines. The example of MicroStrategy’s significant Bitcoin holdings demonstrates the impact of institutional investment. Their substantial purchases have often been associated with periods of Bitcoin price appreciation, signaling a level of confidence and validation within the institutional space. However, a mass exodus of institutional investors could significantly impact Bitcoin’s price negatively.

Macroeconomic Factors

Macroeconomic conditions, particularly inflation and interest rates, exert considerable influence on Bitcoin’s price, often in a manner inversely related to traditional asset classes. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates, making traditional investments more attractive, could lead to capital outflow from Bitcoin. The 2022 bear market, partly fueled by rising interest rates and broader macroeconomic uncertainty, serves as a compelling example of this correlation. This dynamic is significantly different from traditional assets like bonds, which often inversely correlate with inflation and benefit from higher interest rates. The unique position of Bitcoin as both a digital asset and an inflation hedge creates this complex interplay.

Risk Assessment and Volatility

Investing in Bitcoin, even with a price prediction, inherently involves significant risk due to its volatile nature and susceptibility to various market forces. While a predicted price for January 30, 2025, provides a potential target, the path to reaching that price is fraught with uncertainty. This section details the risks associated with Bitcoin investment and strategies for mitigating them.

Bitcoin Price Volatility and Potential Catalysts

Bitcoin’s price history demonstrates substantial volatility. Sharp price swings, both upward and downward, are common. Several factors can trigger significant volatility in the period leading up to January 30, 2025. These include regulatory changes (such as new legislation impacting cryptocurrency trading or taxation), macroeconomic events (like global recessions or shifts in monetary policy), technological developments (new blockchain technologies or competing cryptocurrencies), and market sentiment (influenced by media coverage, influencer opinions, and overall investor confidence). For example, the 2022 cryptocurrency market crash, triggered partly by macroeconomic factors and regulatory uncertainty, highlights the potential for dramatic price drops. Conversely, positive news, such as widespread institutional adoption or significant technological advancements, can lead to rapid price increases.

Risk Mitigation Strategies for Bitcoin Investments, Bitcoin USD Prediction For 30 January 2025

Several strategies can help mitigate the risks associated with Bitcoin’s price fluctuations. Diversification is crucial; allocating only a portion of one’s investment portfolio to Bitcoin reduces the impact of potential losses. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of price, helps to reduce the risk of buying high and selling low. Furthermore, understanding one’s own risk tolerance is vital. Investors with a low risk tolerance might consider smaller Bitcoin allocations or explore alternative investment strategies. Finally, staying informed about market trends and news can help investors make more informed decisions and potentially adjust their investment strategy accordingly.

Comparison of Bitcoin Risk Profile to Other Investment Options

Compared to traditional assets like stocks and bonds, Bitcoin carries a significantly higher risk profile. Stocks and bonds, while subject to market fluctuations, generally exhibit lower volatility than Bitcoin. However, Bitcoin offers the potential for significantly higher returns than these traditional assets, although this potential is accompanied by a substantially higher risk of loss. For example, while a well-diversified stock portfolio might offer an average annual return of 7-10%, Bitcoin’s returns have historically been much more volatile, with periods of substantial gains and losses. Gold, often considered a safe haven asset, tends to be less volatile than Bitcoin but also offers lower potential returns. The choice between Bitcoin and other investment options depends on an investor’s risk tolerance and investment goals. Those seeking potentially high returns are willing to accept higher risk might find Bitcoin attractive, while risk-averse investors might prefer more stable investments.

Market Sentiment and Public Opinion: Bitcoin USD Prediction For 30 January 2025

Market sentiment surrounding Bitcoin significantly influences its price. Positive sentiment, driven by factors like regulatory clarity, institutional adoption, or technological advancements, tends to push prices upward. Conversely, negative sentiment, fueled by regulatory uncertainty, security breaches, or negative media coverage, can lead to price declines. Understanding this dynamic is crucial for predicting Bitcoin’s price trajectory.

Public opinion, largely shaped by media narratives and social media trends, plays a pivotal role in driving market sentiment. News outlets, both mainstream and specialized, significantly influence how investors perceive Bitcoin’s risk and potential returns. Similarly, social media platforms, particularly Twitter and Telegram, act as powerful channels for disseminating information (and misinformation), shaping the collective mood and influencing trading decisions. This can lead to rapid price swings based on short-term emotional reactions rather than fundamental analysis.

Social Media’s Impact on Bitcoin Price

Social media platforms act as both amplifiers and catalysts for Bitcoin price fluctuations. Positive news or influential figures endorsing Bitcoin can generate a surge in buying pressure, driving up the price. Conversely, negative news or critical commentary can trigger sell-offs, leading to sharp price drops. The rapid spread of information and the inherent volatility of social media sentiment create a dynamic environment prone to speculative bubbles and sudden corrections. For example, Elon Musk’s tweets about Bitcoin have historically shown a strong correlation with short-term price movements, illustrating the significant influence of individual personalities and their online pronouncements.

News Coverage and its Influence

News coverage, ranging from mainstream financial news to specialized cryptocurrency publications, profoundly impacts public perception and, consequently, Bitcoin’s price. Positive news, such as regulatory approvals or partnerships with established financial institutions, generally boosts investor confidence and pushes prices higher. Negative news, such as security breaches or regulatory crackdowns, can trigger significant sell-offs. The tone and framing of news stories are crucial; even seemingly neutral reporting can subtly influence public opinion and drive trading activity. For instance, a news article highlighting Bitcoin’s energy consumption might negatively impact investor sentiment, regardless of the article’s objective tone.

Potential Scenarios for Sentiment Shifts

Several scenarios could significantly alter market sentiment and Bitcoin’s price. A widespread regulatory crackdown on cryptocurrency exchanges could trigger a sharp decline in price, as investors react to increased uncertainty and potential restrictions. Conversely, the widespread adoption of Bitcoin by major corporations or central banks could lead to a surge in demand and a significant price increase. Similarly, a major technological breakthrough in Bitcoin’s underlying technology could lead to renewed interest and price appreciation. These are just a few examples; the unpredictable nature of global events and their impact on public perception necessitates a cautious approach to price predictions.

Sentiment Indicators and their Correlation with Bitcoin Price

The following table summarizes various sentiment indicators and their historical correlation with Bitcoin price movements. It’s crucial to note that correlations are not always perfectly consistent and other factors invariably influence Bitcoin’s price.

| Sentiment Indicator | Description | Historical Correlation with Bitcoin Price |

|---|---|---|

| Social Media Sentiment (Twitter, Reddit) | Analysis of public sentiment expressed on social media platforms. | Generally positive correlation in the short-term, but less reliable in the long-term. |

| News Sentiment (Media Coverage) | Analysis of the overall tone of news articles related to Bitcoin. | Moderate to strong correlation, particularly for significant news events. |

| Google Trends (Bitcoin Searches) | Measures the volume of Google searches related to Bitcoin. | Often shows a lagging indicator, reflecting past price movements rather than predicting future ones. |

| Fear & Greed Index | A composite index measuring investor sentiment (fear vs. greed). | Generally, high fear correlates with price drops, while high greed correlates with price increases, but this is not always the case. |

Frequently Asked Questions (FAQs)

Predicting the price of Bitcoin on any specific date, especially one as far out as January 30, 2025, is inherently speculative. However, understanding the factors influencing Bitcoin’s price and common investor concerns can help manage expectations and inform investment decisions. The following FAQs address some of the most common questions surrounding Bitcoin price predictions.

Bitcoin Price Prediction Risks

The inherent volatility of Bitcoin makes precise price predictions extremely difficult, if not impossible. Many factors, including regulatory changes, technological advancements, and macroeconomic conditions, can significantly impact its price. For example, the collapse of FTX in late 2022 demonstrated how a single major event can cause a sharp and sudden decline in Bitcoin’s value. Therefore, relying solely on a single prediction is unwise. Investors should always diversify their portfolios and only invest what they can afford to lose.

Relevance of Historical Data for Predictions

Historical Bitcoin price data can offer insights into past trends and volatility patterns. Analyzing past price movements, trading volumes, and market sentiment can help identify potential support and resistance levels. However, it’s crucial to remember that past performance is not necessarily indicative of future results. The cryptocurrency market is constantly evolving, making historical data only one piece of the puzzle. For instance, while Bitcoin’s price has historically increased over time, it has also experienced significant corrections. Predictive models should account for this inherent volatility.

Alternative Investment Strategies

While Bitcoin offers the potential for high returns, it also carries substantial risk. Diversification is key to mitigating this risk. Investors should consider alternative investment strategies, such as investing in other cryptocurrencies (with careful due diligence), traditional assets like stocks and bonds, or real estate. The optimal allocation depends on individual risk tolerance and financial goals. For example, a conservative investor might allocate a small percentage of their portfolio to Bitcoin, while a more aggressive investor might allocate a larger percentage. However, a balanced approach, diversifying across asset classes, remains prudent.

| Question | Answer |

|---|---|

| What are the biggest risks associated with Bitcoin? | Bitcoin’s price is highly volatile and susceptible to significant fluctuations due to various factors, including regulatory changes, technological developments, and macroeconomic conditions. Market manipulation and security breaches are also potential risks. |

| What historical data is most relevant for making predictions? | Past price movements, trading volumes, and market sentiment can provide some insights, but it’s crucial to remember that past performance is not indicative of future results. The cryptocurrency market is dynamic, and new factors constantly emerge. |

| What are some alternative investment strategies to consider? | Diversification is crucial. Consider investing in other cryptocurrencies, traditional assets like stocks and bonds, or real estate. The allocation depends on individual risk tolerance and financial goals. |

| Is it possible to accurately predict the Bitcoin price on January 30, 2025? | No, accurately predicting the price of Bitcoin on a specific date far into the future is virtually impossible due to the inherent volatility and numerous unpredictable factors influencing the market. |

| What factors should I consider before investing in Bitcoin? | Thoroughly research the technology, understand the risks involved (including volatility and potential for loss), and only invest what you can afford to lose. Consider your risk tolerance and diversify your investment portfolio. |

Bitcoin USD Prediction For 30 January 2025 – Predicting the Bitcoin USD price for January 30th, 2025, is inherently challenging, influenced by numerous factors. One event potentially impacting the market is the upcoming Halving Bitcoin Cash 2025 , which could create ripple effects across the broader cryptocurrency landscape. Therefore, understanding this halving’s potential influence is crucial for any accurate Bitcoin USD prediction for that date.

Accurately predicting the Bitcoin USD price on January 30th, 2025, is challenging, but understanding key events influencing its trajectory is crucial. A significant factor to consider is the Bitcoin halving event, scheduled for sometime in 2024, which will reduce the rate of new Bitcoin creation. For more detailed information on the precise timing, check out this resource on Halving Bitcoin 2025 Time.

This halving will likely impact the Bitcoin USD Prediction for 30 January 2025, potentially increasing scarcity and influencing price.

Accurately predicting the Bitcoin USD price on January 30th, 2025, is challenging, but understanding key factors is crucial. A significant influence will be the Bitcoin halving event, whose impact on the market is thoroughly analyzed in this insightful article: Bitcoin Halving:Impact On The Market 2025. Therefore, considering the halving’s predicted effects is essential for any serious Bitcoin USD Prediction for 30 January 2025.

Predicting the Bitcoin USD price for January 30th, 2025, requires considering several factors, including the upcoming halving. Understanding the potential impact of the halving on Bitcoin’s value is crucial, and for further insight into this, you might find the article on “Giá Bitcoin Sau Halving 2025” helpful: Giá Bitcoin Sau Halving 2025. Ultimately, the Bitcoin USD prediction for that date will depend on the market’s overall reaction to the halving and other economic conditions.

Accurately predicting the Bitcoin USD price for January 30th, 2025, is challenging, requiring consideration of various market factors. To gain a broader perspective on potential price movements, it’s helpful to review longer-term forecasts, such as those found in this comprehensive analysis: Bitcoin In 2025 Price Prediction. Understanding the potential range for Bitcoin’s value in 2025 provides context for making more informed speculations about its price on that specific date.

Accurately predicting the Bitcoin USD price for January 30th, 2025, is challenging, requiring consideration of numerous market factors. To gain a broader perspective on potential price movements, it’s helpful to review broader predictions for the entire year; for a comprehensive overview, check out this detailed analysis on Prediction Of Bitcoin In 2025. Understanding the overall trajectory of Bitcoin in 2025 will help contextualize any specific price prediction for January 30th.