Bitcoin USD Price Prediction: Bitcoin USD Prediction For 22 January 2025

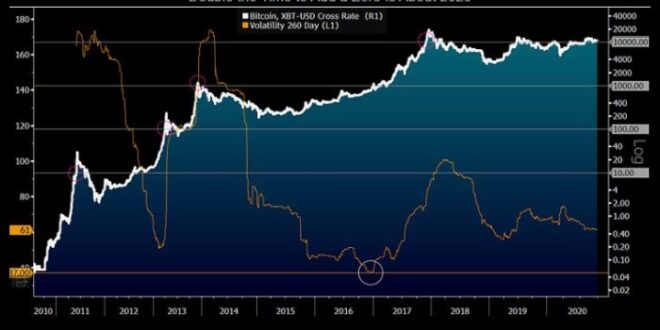

Predicting the price of Bitcoin on January 22, 2025, is inherently challenging. Bitcoin’s history is marked by extreme volatility, with periods of dramatic price increases followed by significant corrections. This unpredictable nature stems from a confluence of factors, making precise long-term forecasting incredibly difficult, even for seasoned market analysts.

Bitcoin’s price is influenced by a complex interplay of macroeconomic conditions and technological advancements. Global economic uncertainty, regulatory changes, and the adoption rate by institutions and individuals all significantly impact its value. Technological developments, such as improvements in scaling solutions or the emergence of competing cryptocurrencies, can also trigger substantial price fluctuations. Furthermore, the relatively limited supply of Bitcoin (21 million coins) contributes to its potential for price appreciation, but also makes it susceptible to speculative bubbles and sharp price drops.

Challenges in Predicting Bitcoin’s Long-Term Price

Accurately forecasting Bitcoin’s price years into the future is fraught with difficulties. The cryptocurrency market is still relatively young and highly susceptible to speculative trading, making it exceptionally difficult to apply traditional financial modeling techniques. Unforeseen events, such as major regulatory shifts or technological breakthroughs, can dramatically alter the market landscape, rendering any long-term prediction obsolete. For instance, the 2017 Bitcoin bull run, followed by a significant correction in 2018, highlights the unpredictability of the market. Similarly, the impact of global events like the COVID-19 pandemic demonstrated how external factors can significantly influence Bitcoin’s price. Furthermore, the influence of social media sentiment and news cycles can cause short-term price spikes and dips, making long-term projections even more precarious. These factors underscore the inherent limitations in making reliable long-term Bitcoin price predictions.

Bitcoin Adoption and Market Sentiment

Predicting Bitcoin’s price in 2025 requires understanding not only its technical aspects but also the crucial interplay between its adoption rate and the prevailing market sentiment. These two factors are intrinsically linked and significantly influence price fluctuations.

Bitcoin adoption is a complex phenomenon, varying considerably across geographical regions and demographics. While some countries have embraced Bitcoin as a legitimate form of payment and investment, others maintain stricter regulatory environments, hindering its widespread adoption. Similarly, demographic factors such as age, income level, and technological proficiency play a role in determining individual levels of Bitcoin ownership and usage.

Bitcoin Adoption Across Regions and Demographics

Current data suggests a higher adoption rate in regions with robust technological infrastructure and a more accepting regulatory framework. Countries like El Salvador, where Bitcoin is legal tender, showcase a higher rate of adoption compared to countries with strict cryptocurrency regulations. Demographically, younger generations (Millennials and Gen Z) tend to show a greater interest and understanding of Bitcoin, potentially driven by their familiarity with technology and decentralized systems. However, older generations may remain more skeptical due to a lack of understanding or perceived risks. This disparity creates a nuanced adoption landscape, impacting overall market demand and price volatility. For example, while widespread adoption in developing nations could boost demand, regulatory uncertainty in developed markets might dampen it.

Influence of Social Media and News Coverage on Market Sentiment

Social media platforms and traditional news outlets significantly shape market sentiment towards Bitcoin. Positive news coverage, such as institutional investment or technological advancements, often leads to increased optimism and higher prices. Conversely, negative news, such as regulatory crackdowns or security breaches, can trigger a sell-off and depress prices. The speed and reach of social media amplify these effects, creating rapid shifts in sentiment and price volatility. For instance, a single tweet from a prominent influencer can cause a significant price surge or drop, demonstrating the power of social media in shaping market psychology. The narrative surrounding Bitcoin – whether it’s portrayed as a revolutionary technology or a speculative bubble – directly impacts investor behavior and consequently, the price.

Market Sentiment’s Impact on Bitcoin’s Price

Market sentiment and Bitcoin’s price share a strong correlation. Positive sentiment, characterized by optimism and confidence, typically leads to increased demand and higher prices. Conversely, negative sentiment, marked by fear and uncertainty, can trigger selling pressure and price declines. This relationship can be visualized using a scatter plot.

Visual Representation: Market Sentiment vs. Bitcoin Price

Imagine a scatter plot with the x-axis representing a quantitative measure of market sentiment (e.g., a composite index derived from social media sentiment analysis, news coverage tone, and investor surveys). The y-axis represents the Bitcoin price. Each data point would represent a specific time period, showing the corresponding market sentiment and Bitcoin price. A positive correlation would be evident if the data points generally trend upwards from left to right, indicating that higher market sentiment is associated with higher prices. Conversely, a negative correlation would show a downward trend. Outliers, representing significant events or unexpected news, would also be visible, illustrating how sudden shifts in sentiment can impact price volatility. The plot’s overall trend and the distribution of data points would provide a visual representation of the strength and direction of the relationship between market sentiment and Bitcoin’s price. This visualization would need to be updated regularly to reflect the constantly evolving market dynamics. For example, a period of intense positive media coverage and social media hype could be represented by a cluster of data points in the upper right quadrant, while a period of regulatory uncertainty might be reflected by points in the lower left quadrant.

Frequently Asked Questions (FAQs)

Investing in Bitcoin, like any other asset, involves both potential rewards and significant risks. Understanding these aspects is crucial before making any investment decisions, especially with a long-term horizon like January 22, 2025. The following FAQs aim to clarify some common concerns.

Potential Upsides and Downsides of Investing in Bitcoin by January 22, 2025

Bitcoin’s price has historically shown substantial volatility. Potential upsides include significant capital appreciation if the cryptocurrency continues its upward trend. For instance, an investment made at a lower price point could yield substantial returns if Bitcoin reaches a projected higher value by January 2025. However, the downside is equally significant. The cryptocurrency market is known for its extreme price swings, and Bitcoin’s price could decline dramatically, resulting in substantial financial losses. Market events, regulatory changes, and technological advancements can all contribute to this volatility. Consider the example of the 2017-2018 Bitcoin bubble, where prices soared to nearly $20,000 before crashing significantly. Such volatility underscores the inherent risk involved.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Numerous factors influence Bitcoin’s price, including market sentiment, regulatory changes, technological developments, and macroeconomic conditions. These factors are complex and often unpredictable. While some analysts attempt to forecast prices using technical analysis or fundamental analysis, these methods are not foolproof. Past performance is not indicative of future results, and even the most sophisticated models can be inaccurate. Therefore, any price prediction should be viewed with a high degree of skepticism. It’s crucial to rely on your own research and risk assessment rather than blindly following any prediction.

Factors to Consider Before Investing in Bitcoin

Before investing in Bitcoin, several key factors warrant careful consideration. First, assess your risk tolerance. Bitcoin is a highly volatile asset, and you should only invest an amount you can afford to lose completely. Secondly, define your financial goals. Is this a short-term investment or a long-term strategy? Your time horizon will influence your investment strategy and risk tolerance. Third, understand the technology behind Bitcoin. Familiarize yourself with blockchain technology, its limitations, and its potential. Finally, seek advice from a qualified financial advisor before making any investment decisions. They can help you assess your risk profile and determine if Bitcoin aligns with your overall financial goals.

Sources of Reliable Information About Bitcoin, Bitcoin USD Prediction For 22 January 2025

Reliable information about Bitcoin can be found from various sources. Reputable financial news outlets such as Bloomberg, Reuters, and the Wall Street Journal often provide in-depth coverage of the cryptocurrency market. Specialized cryptocurrency research firms, like CoinMetrics and Messari, offer data-driven analyses and insights into the Bitcoin ecosystem. Additionally, the Bitcoin whitepaper itself provides foundational information about the technology and its intended purpose. It is crucial to critically evaluate information from any source and cross-reference data from multiple reputable sources to form a comprehensive understanding.

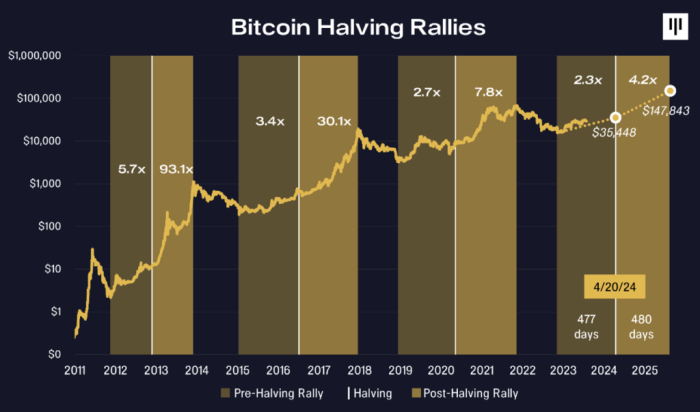

Predicting the Bitcoin USD price for January 22nd, 2025, is challenging, but historical trends offer some insight. Understanding past price movements relative to Bitcoin halving events is crucial; a helpful resource for this is the Bitcoin Halving History Chart 2025 , which provides valuable context. By analyzing this chart, we can better contextualize potential price fluctuations and improve our Bitcoin USD Prediction for 22 January 2025.

Accurately predicting the Bitcoin USD price for January 22nd, 2025, requires considering various market factors. To gain a broader perspective on potential future price movements, it’s helpful to examine longer-term forecasts. For instance, understanding the predicted price trajectory for later in the year, as outlined in this insightful analysis on Bitcoin Price Prediction For November 2025 , can provide valuable context when assessing the January prediction.

Ultimately, both short-term and long-term predictions contribute to a more complete understanding of Bitcoin’s potential value.

Predicting the Bitcoin USD price for January 22nd, 2025, is challenging, but understanding key factors is crucial. A significant influence will likely be the upcoming Bitcoin halving event, as discussed in detail on this informative resource: Halving. Bitcoin. 2025..

This event’s impact on scarcity and potential price increases will undoubtedly shape the Bitcoin USD Prediction for January 22nd, 2025.

Accurately predicting the Bitcoin USD price on January 22, 2025, is challenging, as numerous factors influence its value. A key element to consider is the impact of the Bitcoin halving, and to understand its timing, it’s important to check if it has already occurred by consulting this resource: Has The 2025 Bitcoin Halving Happened. The halving’s effect on scarcity and potential price increase will significantly impact any Bitcoin USD prediction for that date.

Accurately predicting the Bitcoin USD price for January 22nd, 2025, is challenging, but understanding the broader market trends is crucial. A key factor influencing this prediction will be Bitcoin’s price performance following the 2025 halving, a topic explored in detail on this insightful resource: Bitcoin Price Post Halving 2025. Therefore, analyzing the post-halving price trajectory is essential for any robust Bitcoin USD prediction for January 22nd, 2025.

Accurately predicting the Bitcoin USD price for January 22, 2025, is challenging, but understanding the market’s trajectory is key. A significant factor influencing this prediction is the Bitcoin halving event in 2024, and its projected impact on price. For a detailed analysis of this event’s potential consequences, check out this comprehensive resource on Bitcoin Price Prediction Halving 2025.

Ultimately, the 2025 Bitcoin USD prediction will depend on various market forces, including the halving’s effects.

Accurately predicting the Bitcoin USD price for January 22, 2025, is challenging, relying heavily on various market factors. To effectively reach potential investors interested in this prediction, a robust marketing strategy is crucial; consider leveraging a well-structured Google Ads Account to target your audience with relevant information. This targeted approach can significantly improve the visibility of your Bitcoin USD prediction for January 22, 2025, analysis.