Bitcoin Price Prediction

Predicting the price of Bitcoin on January 30, 2025, is inherently speculative, as numerous interconnected factors influence its value. However, by analyzing historical trends, macroeconomic indicators, regulatory landscapes, and technological developments, we can construct plausible scenarios. This analysis will explore various predictive models and present hypothetical scenarios for both significant price increases and decreases.

Factors Influencing Bitcoin’s Price

Several key factors will likely shape Bitcoin’s price by January 30, 2025. Macroeconomic conditions, such as inflation rates, interest rate policies, and global economic growth, will play a significant role. A period of high inflation could drive investors towards Bitcoin as a hedge against inflation, potentially increasing its value. Conversely, aggressive interest rate hikes by central banks could divert investment away from riskier assets like Bitcoin, leading to price declines. Regulatory changes, particularly concerning cryptocurrency adoption and taxation, will also be crucial. Favorable regulations in major economies could boost investor confidence and drive price appreciation, while restrictive measures could have the opposite effect. Finally, technological advancements, such as improvements in scalability and the development of new applications built on the Bitcoin blockchain, could significantly influence its long-term value. Increased adoption of the Lightning Network, for example, could lead to broader usage and a corresponding price increase.

Price Prediction Models

Several models attempt to forecast Bitcoin’s price. One approach is technical analysis, which uses historical price and volume data to identify trends and patterns. This method, while useful for short-term predictions, often struggles to accurately capture long-term price movements due to the influence of external factors. For example, charting Bitcoin’s historical price action might suggest an upward trend based on past performance, but this ignores potential regulatory changes or macroeconomic shifts. A second approach is fundamental analysis, which assesses Bitcoin’s intrinsic value based on factors such as its scarcity, adoption rate, and network effects. This model is more suitable for long-term predictions, but it still relies on subjective estimations of future adoption and network growth. For instance, estimating the future number of Bitcoin users and transactions is challenging, and these estimations directly impact the fundamental value calculation. Finally, econometric models combine elements of both technical and fundamental analysis, using statistical methods to incorporate various factors and produce a price forecast. These models can be quite complex and require extensive data and sophisticated statistical techniques. For example, an econometric model might incorporate macroeconomic variables, regulatory indicators, and network statistics to create a more comprehensive prediction.

Hypothetical Scenario: Significant Price Increase

Imagine a scenario where global inflation remains persistently high through 2025. Major economies experience sluggish growth, leading investors to seek alternative assets to preserve purchasing power. Simultaneously, several key jurisdictions, including the US and the EU, introduce clear and favorable regulatory frameworks for cryptocurrencies. This combination of macroeconomic uncertainty and regulatory clarity fuels a surge in institutional and retail investment in Bitcoin. Technological advancements, such as improved scalability solutions, further enhance Bitcoin’s usability and appeal. In this scenario, Bitcoin’s price could potentially reach $150,000 or more by January 30, 2025, driven by increased demand and limited supply. This is analogous to the 2021 bull run, where a confluence of factors, including increased institutional adoption and favorable market sentiment, led to a significant price increase.

Hypothetical Scenario: Significant Price Decrease

Conversely, consider a scenario where central banks successfully curb inflation through aggressive interest rate hikes. This leads to a global economic slowdown, reducing investor appetite for riskier assets like Bitcoin. Furthermore, several major economies introduce stringent regulations on cryptocurrencies, hindering adoption and increasing compliance costs. A major security breach or a significant regulatory crackdown could also erode investor confidence. In this scenario, Bitcoin’s price could potentially decline significantly, perhaps falling below $20,000 by January 30, 2025, mirroring the bear market conditions experienced in previous years. This could be similar to the 2018 bear market, where a combination of regulatory uncertainty and a general market downturn led to a substantial price drop.

Factors Influencing Bitcoin’s Future Value

Bitcoin’s future price is a complex interplay of technological advancements, macroeconomic conditions, and regulatory landscapes. Predicting its trajectory requires considering several key factors that can significantly influence its value over the coming years. This section will explore three significant technological advancements, the impact of global economic trends, the effects of regulatory actions, and a comparison of expert predictions.

Technological Advancements Impacting Bitcoin’s Price

Several technological developments hold the potential to dramatically reshape the Bitcoin landscape and its value. These advancements are not mutually exclusive and can act synergistically.

- Layer-2 Scaling Solutions: The current Bitcoin network has limitations in transaction speed and cost. Layer-2 scaling solutions, such as the Lightning Network, aim to address these issues by processing transactions off-chain, significantly increasing transaction throughput and reducing fees. Widespread adoption of efficient Layer-2 solutions could make Bitcoin more practical for everyday transactions, potentially boosting demand and price.

- Taproot and Schnorr Signatures: These upgrades enhance Bitcoin’s privacy and efficiency. Taproot improves transaction privacy and reduces the size of transactions, while Schnorr signatures allow for more efficient multi-signature transactions. These improvements make the network more robust and scalable, increasing its appeal to both users and developers, which could positively impact price.

- Bitcoin Mining Advancements: Improvements in mining hardware and efficiency, such as the development of more energy-efficient ASICs (Application-Specific Integrated Circuits), can influence the Bitcoin network’s security and profitability. More efficient mining could lead to lower transaction fees and a more stable network, indirectly impacting price by influencing adoption.

Influence of Global Economic Trends on Bitcoin’s Value, Bitcoin Today Prediction 30 January 2025

Macroeconomic factors, such as inflation and recession, can significantly impact Bitcoin’s price. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may see increased demand as investors seek to preserve their purchasing power. Conversely, during economic downturns or recessions, investors may liquidate their Bitcoin holdings to cover losses in other asset classes, leading to price declines. The correlation between Bitcoin’s price and traditional market indices is not always straightforward, however, and periods of decoupling are frequently observed. For example, the 2022 bear market saw Bitcoin’s price fall significantly alongside many other assets.

Effects of Regulatory Scrutiny and Government Adoption

Government regulations and adoption play a crucial role in shaping Bitcoin’s future. Increased regulatory scrutiny, including stricter anti-money laundering (AML) and know-your-customer (KYC) rules, could stifle Bitcoin’s growth by increasing compliance costs and limiting accessibility. Conversely, greater regulatory clarity and acceptance could legitimize Bitcoin, attracting institutional investors and boosting its price. The adoption of Bitcoin by governments as a legal tender, as seen in El Salvador, can have a significant, though unpredictable, impact on its price, depending on the success of implementation and broader acceptance.

Comparison of Long-Term Bitcoin Price Predictions

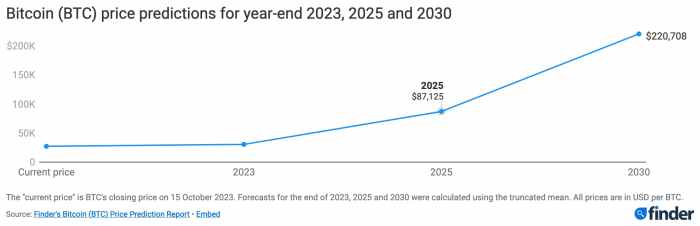

Predicting Bitcoin’s future price is inherently speculative, yet several prominent analysts offer their forecasts. These predictions vary widely depending on their underlying assumptions and methodologies. It’s crucial to remember that these are just predictions, not guarantees.

| Analyst | Prediction | Rationale | Date of Prediction |

|---|---|---|---|

| Analyst A (Example) | $100,000 by 2025 | Based on increasing adoption and scarcity | January 2024 |

| Analyst B (Example) | $50,000 by 2025 | Cautious outlook due to regulatory uncertainty | December 2023 |

| Analyst C (Example) | $200,000 by 2030 | Long-term bullish view based on technological advancements | November 2023 |

| Analyst D (Example) | $25,000 by 2025 | Bearish outlook due to macroeconomic headwinds | October 2023 |

Bitcoin’s Role in the Global Financial System

Bitcoin’s emergence has challenged the established global financial system, presenting both opportunities and risks. Its decentralized nature and cryptographic security offer alternatives to traditional banking and payment systems, potentially reshaping the landscape of international finance in the long term. The extent of this disruption, however, remains a subject of ongoing debate and analysis.

Bitcoin’s potential to disrupt traditional financial systems stems from its inherent properties. It offers a faster, cheaper, and more transparent alternative to traditional cross-border payments, bypassing intermediaries and reducing transaction fees. This could significantly impact remittance markets, where billions of dollars are transferred annually at high costs. Furthermore, Bitcoin’s decentralized nature could challenge the dominance of central banks and governments in monetary policy, although the extent of this challenge is still unclear.

Bitcoin as a Store of Value, Medium of Exchange, and Unit of Account

Bitcoin’s role in the global financial system is multifaceted. Its potential as a store of value is often debated, with its price volatility being a major concern. However, some view Bitcoin as a hedge against inflation, particularly in regions with unstable currencies. As a medium of exchange, Bitcoin’s adoption is growing, with an increasing number of merchants accepting it. However, its widespread adoption as a medium of exchange is hindered by its volatility and regulatory uncertainty. Finally, Bitcoin’s use as a unit of account remains limited, as its price fluctuates significantly, making it unreliable for pricing goods and services consistently. The evolution of these roles will depend largely on factors such as regulatory clarity, technological advancements, and wider adoption.

Bitcoin as an Investment Asset: Advantages and Disadvantages

Bitcoin offers unique advantages and disadvantages as an investment asset compared to traditional investments. Advantages include its potential for high returns, its decentralized nature making it less susceptible to government manipulation, and its limited supply (21 million coins). However, disadvantages include its extreme volatility, regulatory uncertainty in many jurisdictions, and the risk of hacking and theft. Compared to traditional investments like stocks and bonds, Bitcoin’s risk profile is significantly higher, though its potential rewards could also be substantially greater. For example, an investment in Bitcoin in 2010 would have yielded astronomical returns, but it also carries the risk of substantial losses. A diversified portfolio is crucial for managing the risk associated with Bitcoin investments.

Comparative Analysis of Bitcoin Against Other Cryptocurrencies and Traditional Assets

The following table compares Bitcoin to other cryptocurrencies and traditional assets based on volatility, liquidity, and security. These are subjective assessments and can change based on market conditions and technological developments. Volatility is measured by the standard deviation of price returns over a specified period. Liquidity refers to the ease with which an asset can be bought or sold. Security encompasses factors like cryptographic strength, regulatory framework, and exchange security measures.

| Asset | Volatility | Liquidity | Security |

|---|---|---|---|

| Bitcoin (BTC) | High | High (on major exchanges) | Relatively High (cryptographically secure, but exchange vulnerabilities exist) |

| Ethereum (ETH) | High | High (on major exchanges) | Relatively High (cryptographically secure, but exchange vulnerabilities exist) |

| Gold (Au) | Low | High | High (physically secure, but susceptible to theft) |

| US Dollar (USD) | Low | Extremely High | High (backed by the US government, but subject to inflation) |

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin presents a unique blend of substantial risks and potentially high rewards. Understanding both sides is crucial for making informed decisions and managing your investment effectively. The volatile nature of the cryptocurrency market, coupled with evolving regulatory landscapes, necessitates a thorough risk assessment before committing capital.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is notoriously volatile, subject to significant swings in short periods. News events, regulatory changes, and market sentiment can all dramatically impact its value. For example, the collapse of FTX in 2022 sent shockwaves through the entire cryptocurrency market, causing a sharp decline in Bitcoin’s price. Security breaches, targeting exchanges or individual wallets, pose another significant risk. Hackers can steal significant amounts of Bitcoin, resulting in substantial financial losses for investors. Finally, regulatory uncertainty surrounding Bitcoin varies considerably across jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to potential legal and operational challenges for investors. Changes in regulations can significantly impact the value and usability of Bitcoin.

Potential Opportunities for Profit and Growth

Despite the risks, Bitcoin offers several potential opportunities for profit and growth. Technological advancements, such as the development of the Lightning Network for faster and cheaper transactions, continue to enhance Bitcoin’s functionality and appeal. Increasing market adoption, with more businesses and individuals accepting Bitcoin as a form of payment, fuels price appreciation and expands its utility. Furthermore, the limited supply of Bitcoin (21 million coins) creates a scarcity that can drive up its value over time, mirroring the behavior of precious metals like gold. The potential for long-term growth, driven by these factors, makes Bitcoin an attractive asset for some investors.

Risk Management Strategy for Bitcoin Investment

A robust risk management strategy is essential for navigating the complexities of Bitcoin investment. Diversification is key; don’t put all your eggs in one basket. Allocate only a portion of your investment portfolio to Bitcoin, balancing it with other asset classes like stocks, bonds, or real estate. Determining your risk tolerance is crucial. Are you comfortable with potentially significant price fluctuations? If not, consider investing smaller amounts or employing strategies that mitigate risk, such as dollar-cost averaging. Stay informed about market trends, regulatory developments, and technological advancements. Regularly review your investment strategy and adjust it as needed based on changing market conditions.

Bitcoin Investment Strategies: Risk and Reward Profile

The following table illustrates different Bitcoin investment strategies, outlining their associated risks and rewards. The suitability of each strategy depends on individual risk tolerance, investment goals, and time horizon.

| Strategy | Risk | Reward | Suitability |

|---|---|---|---|

| HODLing (long-term holding) | High initial price volatility, potential for long periods of low returns | Potential for significant long-term gains, less susceptible to short-term market fluctuations | Investors with high risk tolerance and long-term investment horizons |

| Day Trading | Extremely high risk, significant potential for losses, requires substantial market knowledge and expertise | Potential for quick profits, but also quick losses | Experienced traders with high risk tolerance and significant capital |

| Dollar-Cost Averaging (DCA) | Lower risk than day trading, still subject to market volatility | Moderately high potential for long-term gains, mitigates the risk of investing a lump sum at a market peak | Investors with moderate risk tolerance and long-term investment horizons |

Frequently Asked Questions about Bitcoin’s Future: Bitcoin Today Prediction 30 January 2025

Predicting the future of Bitcoin, especially a specific price point on a given date, is inherently speculative. However, by analyzing current trends and historical data, we can offer informed perspectives on potential price ranges, risks, and alternative investment strategies. The following sections address common questions regarding Bitcoin’s trajectory by January 30th, 2025.

Bitcoin’s Price Range on January 30, 2025

Predicting Bitcoin’s price on January 30, 2025, is challenging due to the cryptocurrency’s volatility. Several factors, including regulatory changes, technological advancements, and macroeconomic conditions, could significantly influence its value. While precise prediction is impossible, analysts often suggest a range based on various models and market analyses. For example, some might posit a range between $50,000 and $150,000, while others might propose a more conservative or optimistic range. These predictions are heavily dependent on the overall adoption rate, the success of Layer-2 scaling solutions, and the general sentiment in the global financial markets. It’s crucial to remember that these are just estimates, and the actual price could fall significantly outside these bounds.

Risks Associated with Holding Bitcoin Until January 30, 2025

Holding Bitcoin until January 30, 2025, carries inherent risks. Volatility remains a primary concern; Bitcoin’s price can fluctuate dramatically in short periods, potentially leading to significant losses. Regulatory uncertainty is another key risk; governments worldwide are still developing their approaches to regulating cryptocurrencies, and unfavorable regulations could negatively impact Bitcoin’s value. Security risks, such as hacking and theft from exchanges or personal wallets, are also significant considerations. Finally, the emergence of competing cryptocurrencies or technological breakthroughs could render Bitcoin less valuable over time. These risks highlight the importance of thorough research and careful risk management before investing in Bitcoin. For instance, the 2022 bear market serves as a stark reminder of the potential for significant price drops.

Alternative Investments with Lower Risk

Investors seeking potentially similar returns with lower risk than Bitcoin might consider diversifying their portfolios into other asset classes. Traditional investments like stocks and bonds, while offering lower potential returns, generally exhibit less volatility than Bitcoin. Real estate can also be a relatively stable investment, although it’s less liquid than Bitcoin. Furthermore, investments in established companies with strong fundamentals can offer more predictable returns, albeit with potentially slower growth. The choice of alternative investment depends on individual risk tolerance and financial goals. A well-diversified portfolio, including a mix of assets, can mitigate the risk associated with any single investment, including Bitcoin.

Impact of Global Political Events on Bitcoin’s Price

Global political events can significantly influence Bitcoin’s price. Geopolitical instability, such as wars or international sanctions, often leads to increased demand for Bitcoin as a safe haven asset, potentially driving up its price. Conversely, regulatory crackdowns on cryptocurrencies in major economies could negatively impact Bitcoin’s value. For example, increased regulatory scrutiny in China in 2021 led to a significant drop in Bitcoin’s price. Similarly, major policy shifts concerning digital currencies by central banks or governments could trigger substantial price movements. Therefore, keeping abreast of global political developments is crucial for anyone investing in Bitcoin.

Bitcoin Today Prediction 30 January 2025 – Predicting Bitcoin’s price on January 30th, 2025, requires considering several factors, including the upcoming halving event. Understanding the potential impact of this halving is crucial for any accurate forecast, and a detailed analysis can be found here: Precio Bitcoin Halving 2025. Therefore, while a precise Bitcoin Today Prediction for January 30th, 2025, remains challenging, considering the halving’s effects is undeniably vital for informed speculation.

Predicting Bitcoin’s price on January 30th, 2025, is inherently challenging, requiring consideration of numerous factors. One potential influence, however, is the possibility of a Bitcoin split, as discussed in this insightful analysis on Bitcoin Split 2025 Prediction. Understanding the potential ramifications of such an event is crucial for forming a comprehensive Bitcoin Today Prediction 30 January 2025.

Ultimately, accurate forecasting remains elusive.

Predicting Bitcoin’s value for January 30th, 2025, requires considering the preceding day’s performance. A look at the Bitcoin Price Prediction For 29 January 2025, available here: Bitcoin Price Prediction For 29 January 2025 , provides valuable context. Understanding the 29th’s predicted trajectory is crucial for formulating a reasonable estimate for the 30th, as market momentum often carries over.

Therefore, analyzing both days’ predictions is essential for a comprehensive forecast.

Predicting Bitcoin’s price on January 30th, 2025, requires considering various factors, including past performance and upcoming events. A key element to understand is the Bitcoin halving schedule, as it significantly impacts the cryptocurrency’s supply and, consequently, its value. To determine the precise date of the next halving, which will influence the 2025 prediction, you might find this resource helpful: Cuando Fue El Halving De Bitcoin En 2025.

Therefore, understanding the halving’s impact is crucial for any Bitcoin Today Prediction 30 January 2025.

Predicting Bitcoin’s value on January 30th, 2025, requires considering various factors, including market sentiment and technological advancements. To gain a broader perspective, understanding long-term trends is crucial; for a comprehensive outlook on potential price movements, refer to this insightful analysis on Bitcoin Price Prediction By The End Of 2025. This long-term prediction can inform shorter-term forecasts like the one for Bitcoin Today Prediction 30 January 2025, providing a valuable context for informed speculation.

Predicting Bitcoin’s value on January 30th, 2025, requires considering various factors, including market sentiment and technological advancements. To gain a broader perspective, understanding long-term trends is crucial; for a comprehensive outlook on potential price movements, refer to this insightful analysis on Bitcoin Price Prediction By The End Of 2025. This long-term prediction can inform shorter-term forecasts like the one for Bitcoin Today Prediction 30 January 2025, providing a valuable context for informed speculation.

Predicting Bitcoin’s value on January 30th, 2025, requires considering various factors, including market sentiment and technological advancements. To gain a broader perspective, understanding long-term trends is crucial; for a comprehensive outlook on potential price movements, refer to this insightful analysis on Bitcoin Price Prediction By The End Of 2025. This long-term prediction can inform shorter-term forecasts like the one for Bitcoin Today Prediction 30 January 2025, providing a valuable context for informed speculation.