Bitcoin Price Prediction January 2025 USD

Bitcoin, the world’s first and most well-known cryptocurrency, has captivated investors and technologists alike with its volatile nature and potential for massive returns. Its price has experienced dramatic swings, from near-zero to tens of thousands of dollars per coin, making accurate long-term price predictions exceptionally challenging but undeniably intriguing. Understanding the factors influencing Bitcoin’s price is crucial for anyone attempting to navigate this complex market, whether they are seasoned investors or simply curious onlookers. This prediction utilizes a multifaceted approach, considering macroeconomic trends, technological advancements, regulatory developments, and market sentiment to offer a reasoned estimate.

Predicting Bitcoin’s price requires a careful consideration of several interconnected factors. These include the overall health of the global economy, the adoption rate of Bitcoin by businesses and institutions, the development and implementation of Bitcoin-related technologies, the regulatory landscape surrounding cryptocurrencies, and the prevailing sentiment within the cryptocurrency community. For example, a global recession might drive investors towards Bitcoin as a safe haven asset, increasing demand and potentially driving up the price. Conversely, stricter government regulations could stifle growth and negatively impact the price.

Factors Influencing Bitcoin’s Price in 2025

This section details the key elements contributing to our Bitcoin price prediction for January 2025. We’ll analyze the interplay between macroeconomic conditions, technological innovations, regulatory actions, and market sentiment to arrive at a comprehensive forecast. The analysis will consider historical price movements, comparing them to periods of similar economic and technological conditions. It will also draw parallels with the adoption of other disruptive technologies to provide context and potential scenarios.

Methodology for Bitcoin Price Prediction

Our prediction employs a hybrid approach, combining quantitative and qualitative analysis. Quantitative analysis involves examining historical price data, transaction volumes, and market capitalization to identify trends and patterns. We utilize statistical models, incorporating relevant macroeconomic indicators such as inflation rates, interest rates, and GDP growth. Qualitative analysis considers factors that are difficult to quantify, such as regulatory changes, technological breakthroughs, and shifts in market sentiment. This approach allows us to incorporate both the objective data and the subjective factors that can significantly impact Bitcoin’s price. For example, the successful implementation of the Lightning Network, a second-layer scaling solution, could significantly improve Bitcoin’s transaction speed and reduce fees, potentially driving up demand. Conversely, a major security breach affecting a major exchange could negatively impact investor confidence and lead to a price drop. The model uses weighted averages based on the relative importance assigned to each factor.

Historical Bitcoin Price Analysis

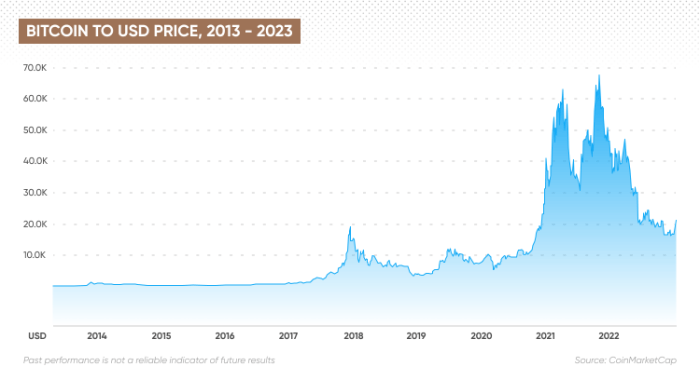

Bitcoin’s price history since its inception in 2009 reveals a volatile yet undeniably upward trajectory, punctuated by periods of explosive growth and significant corrections. Analyzing this history, considering macroeconomic factors and technological advancements, provides valuable insights into potential future price movements. Understanding these past patterns is crucial for informed speculation about Bitcoin’s future.

Analyzing Bitcoin’s price requires considering its relatively short history compared to established financial assets. Its journey from a virtually unknown digital currency to a globally recognized asset class has been marked by both remarkable gains and dramatic falls. This volatility is inherent to its decentralized nature and its position as a nascent asset.

Major Price Trends and Patterns

Bitcoin’s price has exhibited several distinct phases. Initially, its value was extremely low, fluctuating minimally. The first major price surge occurred in 2013, driven by increased media attention and early adoption. Subsequent periods of rapid growth were followed by sharp corrections, reflecting the inherent risk associated with a new asset class. These cycles, often characterized by periods of hype and subsequent “bubble bursts,” are a recurring feature of Bitcoin’s price action. The bull runs of 2017 and 2021, culminating in all-time highs, exemplify this pattern. These periods were marked by intense speculation and significant institutional investment. Conversely, the bear markets that followed saw considerable price drops, driven by factors such as regulatory uncertainty and market sentiment shifts.

Correlation with Macroeconomic Events

Bitcoin’s price has often reacted to macroeconomic events, demonstrating a complex relationship with broader financial markets. The halving events, which occur approximately every four years and reduce the rate of new Bitcoin creation, have historically been associated with periods of price appreciation. This is attributed to the reduced supply of Bitcoin, potentially increasing its scarcity and value. For example, the halving events of 2012, 2016, and 2020 were followed by significant price increases, although the timing and magnitude of the subsequent price movements varied. Regulatory changes, both positive and negative, have also had a considerable impact. Favorable regulatory announcements or the adoption of Bitcoin by institutional investors have generally led to price increases, while negative regulatory actions or increased scrutiny have often resulted in price declines. The regulatory crackdown on cryptocurrencies in certain countries in 2021, for instance, triggered significant market corrections.

Impact of Technological Advancements

Technological advancements within the Bitcoin ecosystem have also played a significant role in shaping its price. The development of the Lightning Network, which aims to improve transaction speed and scalability, has been viewed positively by the market. Similarly, improvements in wallet security and user experience have contributed to increased adoption and, consequently, price appreciation. Conversely, significant network upgrades or forks, while potentially beneficial in the long term, can also cause short-term price volatility as the market adjusts to the changes. The creation of altcoins, while competing with Bitcoin for market share, has also indirectly influenced its price, often reflecting shifts in investor sentiment and market trends.

Influencing Factors

Macroeconomic conditions exert a significant influence on Bitcoin’s price, often acting as a powerful headwind or tailwind depending on the prevailing global economic climate. Understanding these dynamics is crucial for navigating the volatility inherent in the cryptocurrency market. The interconnectedness of global finance means that events in one region can quickly ripple across the entire system, impacting Bitcoin’s value.

Global inflation rates, interest rate policies, and the possibility of a global recession are key macroeconomic factors that directly shape investor sentiment and, consequently, Bitcoin’s price.

Global Inflation’s Impact on Bitcoin Value

High inflation erodes the purchasing power of fiat currencies. This can drive investors towards alternative assets, including Bitcoin, perceived as a hedge against inflation. The limited supply of Bitcoin (21 million coins) is a key argument for this perspective. Historically, periods of high inflation have sometimes been correlated with increased Bitcoin adoption and price appreciation. However, it’s important to note that this correlation isn’t always straightforward. For example, during periods of extreme inflation, investors may prioritize stability over potential gains, leading to a flight to safer haven assets like gold, rather than the more volatile Bitcoin. The effectiveness of Bitcoin as an inflation hedge is still a subject of ongoing debate among economists.

Interest Rate Hikes and Cryptocurrency Markets

Central banks often raise interest rates to combat inflation. Higher interest rates typically increase the attractiveness of traditional investment vehicles like bonds, which offer a fixed return. This can lead to a decrease in demand for riskier assets, such as Bitcoin, as investors shift their capital towards safer, higher-yielding options. The 2022 interest rate hikes by the Federal Reserve, for instance, coincided with a significant downturn in the cryptocurrency market, illustrating this relationship. The increased cost of borrowing also impacts businesses operating within the cryptocurrency ecosystem, potentially hindering growth and development.

Global Recession’s Potential Effect on Bitcoin Price

A global recession typically leads to increased market uncertainty and risk aversion among investors. During such periods, investors often divest from riskier assets, including cryptocurrencies, in favor of more stable investments. The 2008 financial crisis provides a relevant example, though Bitcoin did not exist at that time, the overall market sentiment during such events highlights a likely negative impact on Bitcoin’s price. The reduced economic activity during a recession could also lead to decreased trading volume and liquidity in the cryptocurrency market, further exacerbating price declines. The severity of the recession and the duration of the downturn would play a critical role in determining the extent of the impact on Bitcoin’s price.

Influencing Factors

The price of Bitcoin is a complex interplay of various factors, but among the most significant are adoption rates and regulatory landscapes. These elements, often intertwined, exert considerable influence on investor sentiment and market dynamics, ultimately shaping Bitcoin’s value. Understanding their impact is crucial for any price prediction.

Institutional adoption and government regulations are particularly impactful, alongside the broader public’s increasing awareness and acceptance of Bitcoin as a viable asset. These three areas collectively form a powerful force shaping the future trajectory of Bitcoin’s price.

Institutional Adoption’s Impact on Bitcoin Price, Bitcoin Price Prediction January 2025 Usd

The increasing involvement of institutional investors, such as corporations and large financial institutions, significantly impacts Bitcoin’s price. Large-scale purchases by these entities inject substantial capital into the market, driving up demand and, consequently, price. For example, MicroStrategy’s significant Bitcoin acquisitions have been cited as contributing to price increases in the past. Conversely, significant sell-offs by institutions can trigger downward pressure on the price. The entry of institutional investors lends credibility and legitimacy to Bitcoin, attracting further investment and contributing to price stability in the long run, mitigating the volatility often associated with solely retail-driven markets. This influx of institutional capital signifies a shift towards mainstream acceptance and reduces the dominance of speculative trading, leading to a potentially more sustainable price trajectory.

Government Regulations and Bitcoin’s Price

Government regulations and legal frameworks play a crucial role in shaping Bitcoin’s price. Clear, supportive regulations can foster investor confidence, leading to increased adoption and higher prices. Conversely, restrictive or unclear regulations can create uncertainty and discourage investment, potentially suppressing price growth. Different jurisdictions’ approaches to Bitcoin regulation demonstrate this effect; countries with relatively favorable regulatory environments often see higher levels of Bitcoin adoption and trading activity compared to those with more restrictive policies. For example, El Salvador’s adoption of Bitcoin as legal tender initially caused a price surge, though this effect proved temporary. The uncertainty surrounding regulatory developments in major markets like the US continues to influence Bitcoin price volatility. Future regulatory clarity, especially in large economies, is likely to be a major driver of price stability and potential growth.

Growing Public Awareness and Acceptance

Increased public awareness and acceptance of Bitcoin as a store of value, a medium of exchange, or a potential investment vehicle directly influences its price. Wider adoption leads to higher demand, pushing prices upward. This increased acceptance is fueled by various factors, including greater media coverage, educational initiatives, and the growing accessibility of Bitcoin through user-friendly platforms and services. The increasing use of Bitcoin in everyday transactions, even on a small scale, signifies a shift towards mainstream adoption and reduces the perception of Bitcoin as solely a speculative asset. The more people understand and use Bitcoin, the more likely it is that its price will reflect its growing utility and adoption. This organic growth, driven by increased public understanding and use, contributes to a more sustainable and less volatile price trajectory over the long term.

Influencing Factors

Technological advancements play a crucial role in shaping Bitcoin’s future price. Improvements in various areas, from scaling solutions to mining efficiency, directly impact the cryptocurrency’s usability, security, and overall value proposition. These advancements can drive adoption, enhance network resilience, and ultimately influence investor sentiment.

Layer-2 Scaling Solutions and Bitcoin Usability

Layer-2 scaling solutions, such as the Lightning Network, aim to address Bitcoin’s scalability limitations. By processing transactions off-chain, these solutions significantly reduce transaction fees and increase transaction speed. This enhanced usability makes Bitcoin more attractive for everyday transactions, potentially boosting demand and driving price appreciation. For example, widespread adoption of the Lightning Network could allow for microtransactions, facilitating the use of Bitcoin in scenarios previously impractical due to high fees, such as online tipping or small purchases. Increased usability translates to broader adoption, which, in turn, can exert upward pressure on price.

Advancements in Mining Technology and Bitcoin Security

Advancements in mining hardware and techniques directly influence Bitcoin’s security and energy efficiency. More efficient mining equipment leads to a more secure network by increasing the computational power dedicated to securing the blockchain. This enhanced security fosters trust and confidence in the system, potentially attracting more investors and contributing to price stability. For instance, the introduction of ASICs (Application-Specific Integrated Circuits) revolutionized Bitcoin mining, significantly increasing hash rate and security. However, it also centralized mining power to a degree, which presents a separate security consideration. The ongoing development of more energy-efficient mining hardware is crucial for Bitcoin’s long-term sustainability and positive public perception.

Innovations in Bitcoin’s Underlying Technology and its Value

Continuous innovation in Bitcoin’s underlying technology, including potential upgrades to its consensus mechanism or the introduction of new features, can significantly influence its value. These improvements can enhance the network’s efficiency, security, and functionality, attracting developers and investors alike. For example, the development of Taproot, a significant upgrade to Bitcoin’s scripting language, improved transaction privacy and efficiency. Such enhancements demonstrate the network’s capacity for evolution and adaptation, reinforcing its long-term viability and potentially increasing its value. Future innovations could further enhance Bitcoin’s capabilities, driving its price upward.

Price Prediction Models and Scenarios

Predicting the price of Bitcoin is inherently complex, influenced by a multitude of interconnected factors. While no model can guarantee accuracy, analyzing various scenarios helps to understand the potential range of outcomes for January 2025. The following Artikels three distinct scenarios – bullish, neutral, and bearish – each built upon different assumptions regarding regulatory developments, market sentiment, and technological advancements.

Bullish Scenario: Continued Adoption and Institutional Investment

This scenario assumes a continued rise in Bitcoin adoption, driven by increasing institutional investment, positive regulatory developments in key markets (such as the US and EU), and further integration into traditional financial systems. Growing demand coupled with a relatively constrained supply would push the price significantly higher. This scenario also anticipates advancements in the Bitcoin ecosystem, such as the Layer-2 scaling solutions, potentially improving transaction speeds and reducing costs, thus boosting adoption further. Technological innovation in the broader crypto space could also spill over positively, creating a more favorable overall market environment.

This bullish outlook is supported by the historical precedent of Bitcoin’s price appreciation following periods of increased institutional interest and regulatory clarity. For example, the significant price increase in late 2020 and early 2021 coincided with increased institutional adoption and positive news regarding regulatory frameworks.

Neutral Scenario: Consolidation and Sideways Movement

The neutral scenario envisions a period of price consolidation and sideways trading. This scenario anticipates a balance between bullish and bearish forces. While adoption continues to grow, it does so at a more moderate pace compared to the bullish scenario. Regulatory uncertainty, macroeconomic factors like inflation and interest rates, and potential market corrections could all contribute to a period of price stability or relatively small fluctuations around the current price. This doesn’t necessarily imply a negative outlook; instead, it suggests a period of market maturity and price discovery before the next significant price movement. This scenario could be likened to the price action seen in the mid-2010s after the initial surge in Bitcoin’s price, before the next major bull run.

Bearish Scenario: Regulatory Crackdown and Market Correction

This bearish scenario assumes a more pessimistic outlook, driven by factors such as increased regulatory scrutiny and crackdowns on cryptocurrencies in major markets, a significant macroeconomic downturn impacting investor risk appetite, or a major security breach undermining confidence in the Bitcoin network. These factors could trigger a substantial market correction, leading to a considerable drop in Bitcoin’s price. Furthermore, unforeseen technological challenges or the emergence of a competing technology could also contribute to a bearish trend. This scenario, while less optimistic, serves as a crucial reminder of the inherent volatility of the cryptocurrency market. A similar, though less severe, correction was observed in 2018 following the 2017 bull run.

Scenario Comparison

| Scenario | Key Assumptions | Predicted Price Range (USD) | Supporting Factors |

|---|---|---|---|

| Bullish | High institutional adoption, positive regulatory developments, technological advancements | $150,000 – $250,000 | Increased demand, limited supply, positive market sentiment |

| Neutral | Moderate adoption growth, regulatory uncertainty, macroeconomic factors | $30,000 – $60,000 | Balanced bullish and bearish pressures, market consolidation |

| Bearish | Regulatory crackdowns, macroeconomic downturn, technological setbacks | $10,000 – $20,000 | Reduced demand, increased selling pressure, negative market sentiment |

Risks and Uncertainties

Predicting the price of Bitcoin in January 2025, or any future date, is inherently risky due to the volatile nature of the cryptocurrency market and the multitude of factors influencing its price. While models can provide estimations, they cannot account for every eventuality, particularly unforeseen circumstances. The following sections detail some key risks and uncertainties.

Regulatory Uncertainty significantly impacts Bitcoin’s price. Governments worldwide are still developing their regulatory frameworks for cryptocurrencies. Changes in regulations, whether supportive or restrictive, can cause dramatic price swings. For instance, a sudden ban on Bitcoin trading in a major economy could trigger a sharp price drop, while the adoption of favorable regulations could lead to a surge. The lack of a globally unified regulatory approach adds to the uncertainty.

Market Volatility is a defining characteristic of the cryptocurrency market. Bitcoin’s price can experience sharp increases and decreases within short periods, often driven by speculation, news events, and market sentiment. The 2021 bull run, followed by the significant correction in 2022, exemplifies this volatility. This inherent unpredictability makes long-term price predictions challenging, as unexpected market shifts can invalidate even the most sophisticated models.

Impact of Unforeseen Events

Black swan events, by definition, are unpredictable and have a significant impact on the market. These events, such as a major global financial crisis, a widespread cyberattack targeting cryptocurrency exchanges, or a sudden shift in public opinion towards cryptocurrencies, can dramatically alter Bitcoin’s price trajectory. The 2008 financial crisis, for example, while not directly impacting Bitcoin (which was relatively new then), showed how unexpected macroeconomic events can disrupt even established markets, and the impact on a nascent asset like Bitcoin could be even more pronounced.

Limitations of Price Prediction Models

All price prediction models, regardless of their sophistication, have limitations. They rely on historical data and assumptions about future trends, which may not hold true. The models often fail to accurately capture the influence of human behavior, such as herd mentality and emotional decision-making, which play a crucial role in cryptocurrency price movements. For example, a model based solely on historical price trends might not anticipate a sudden surge driven by a viral social media campaign or a significant technological development.

Technological Risks

The Bitcoin network itself faces potential technological risks. While highly secure, vulnerabilities could be discovered, potentially leading to exploits or security breaches. The development of more efficient or scalable blockchain technologies could also impact Bitcoin’s dominance in the cryptocurrency market. Competition from alternative cryptocurrencies offering improved features or faster transaction speeds could also affect Bitcoin’s price. For instance, the emergence of layer-2 scaling solutions has been a significant development impacting transaction fees and speed, and the long-term effect on Bitcoin’s price remains to be seen.

Disclaimer and Conclusion Summary

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is exceptionally volatile and influenced by a multitude of interconnected factors, many of which are unpredictable. Any price prediction, including those presented in this analysis, should be considered a potential outcome among many, not a guaranteed future. Investing in Bitcoin carries significant risk, and potential losses could exceed initial investment. This analysis is for informational purposes only and should not be construed as financial advice. Consult with a qualified financial advisor before making any investment decisions.

This analysis aimed to provide a reasoned assessment of potential Bitcoin price scenarios in January 2025, acknowledging the considerable uncertainties involved. The following summarizes the key findings:

Key Findings

Bitcoin Price Prediction January 2025 Usd – The analysis considered historical price data, various influencing factors (regulatory changes, technological advancements, macroeconomic conditions, and market sentiment), and several predictive modeling approaches to arrive at a range of potential price outcomes. While precise prediction is impossible, the analysis highlighted the importance of understanding the interplay of these factors in shaping Bitcoin’s price trajectory.

- Historical analysis revealed periods of significant price volatility, underscoring the inherent risk associated with Bitcoin investment.

- Influencing factors such as regulatory frameworks and widespread adoption were identified as having potentially significant impacts on future price movements. For example, positive regulatory developments in major economies could drive substantial price increases, while negative news could trigger sharp declines. Similarly, increased institutional adoption could lead to higher prices, while decreased adoption could have the opposite effect.

- Price prediction models, while useful for exploring potential scenarios, yielded a wide range of possible outcomes, reflecting the inherent uncertainty of the market. Some models suggested potential price increases exceeding $100,000, while others indicated significantly lower values. These differences stem from the models’ underlying assumptions and the limitations of extrapolating past trends into the future.

- Significant risks and uncertainties remain. These include unforeseen technological disruptions, changes in investor sentiment, and the potential for significant regulatory interventions. The inherent volatility of the cryptocurrency market necessitates a cautious approach to any investment decisions.

Frequently Asked Questions (FAQ)

Predicting Bitcoin’s price is notoriously difficult, influenced by a complex interplay of factors. This FAQ section aims to clarify common questions and misconceptions surrounding Bitcoin price predictions for January 2025 and beyond. While precise predictions are impossible, understanding the key influences can improve informed decision-making.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a dynamic reflection of supply and demand, influenced by a wide array of economic, technological, and regulatory factors. Macroeconomic conditions, such as inflation rates and overall market sentiment, significantly impact investor behavior and Bitcoin’s perceived value as a hedge against inflation or a safe haven asset. Technological advancements, including network upgrades and the development of new applications built on the Bitcoin blockchain, can also boost or hinder price appreciation. Regulatory developments, from government pronouncements to the adoption of Bitcoin by financial institutions, profoundly shape investor confidence and market accessibility. Finally, the actions of major players like institutional investors and whales can trigger significant price fluctuations. For example, Elon Musk’s tweets about Bitcoin have historically resulted in notable price swings.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is inherently challenging. Unlike traditional assets with established valuation models, Bitcoin’s value is driven by a combination of factors that are difficult to quantify and predict with precision. While various prediction models exist, ranging from technical analysis based on historical price patterns to fundamental analysis focusing on underlying economic factors, none guarantee accuracy. Past performance is not indicative of future results, and unforeseen events – such as regulatory changes or major security breaches – can significantly alter the price trajectory. Therefore, any price prediction should be treated with considerable caution. For instance, predictions made in 2020 about Bitcoin’s price in 2023 varied wildly, highlighting the difficulty in accurately forecasting its value.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its price volatility is exceptionally high, meaning substantial gains can quickly turn into substantial losses. The cryptocurrency market is relatively new and unregulated in many jurisdictions, making it susceptible to manipulation and fraud. Security risks, including the potential for hacking and theft from exchanges or personal wallets, are also present. Furthermore, the regulatory landscape is constantly evolving, and changes in government policies can dramatically impact Bitcoin’s price and legal status. For example, China’s crackdown on cryptocurrency mining in 2021 caused a significant price drop. Therefore, investors should only invest what they can afford to lose and thoroughly research the risks before committing any funds.

Predicting the Bitcoin price in January 2025 in USD is challenging, with various factors influencing its trajectory. A potential downturn is a significant consideration; for instance, exploring analyses like those found on this resource regarding a Bitcoin Price Drop 2025 can provide valuable context. Ultimately, the Bitcoin Price Prediction January 2025 USD remains speculative, hinging on market sentiment and technological developments.

Predicting the Bitcoin price in January 2025 USD is challenging, with various factors influencing its trajectory. For diverse perspectives and community discussions on potential price movements, checking out online forums like Bitcoin Price 2025 Reddit can be helpful. Ultimately, though, any Bitcoin Price Prediction January 2025 USD remains speculative and depends on market dynamics.

Predicting the Bitcoin price in January 2025 in USD is challenging, with various factors influencing its trajectory. For diverse perspectives and community discussions on potential price movements, check out the insightful conversations on Bitcoin Price 2025 Reddit. Returning to the January 2025 prediction, analysts often consider halving events and overall market sentiment as key determinants.

Predicting the Bitcoin price in January 2025 USD is challenging, requiring analysis of various market factors. For a broader perspective on potential price movements throughout the year, it’s helpful to consult a comprehensive visual representation like the Bitcoin Price Prediction 2025 Chart. This chart can provide valuable context for understanding the potential range of Bitcoin’s value by January 2025 in USD, allowing for a more informed prediction.

Predicting the Bitcoin price in January 2025 in USD is challenging, with various models offering diverse forecasts. For a comprehensive perspective on potential long-term price movements, it’s helpful to consider alternative analyses, such as those presented in the insightful Bitcoin Price 2025 Plan B report. Understanding Plan B’s methodology can provide context for interpreting shorter-term predictions for the Bitcoin price in January 2025.