Bitcoin Price Prediction

Bitcoin, the world’s first cryptocurrency, has captivated the global financial landscape with its remarkable volatility and unpredictable price swings. Since its inception in 2009, Bitcoin’s journey has been nothing short of a rollercoaster, experiencing periods of explosive growth followed by sharp corrections. This inherent unpredictability makes forecasting its future price a complex endeavor, demanding a careful consideration of numerous interacting factors. This article aims to explore some key potential influences on Bitcoin’s price leading up to January 15, 2025.

Bitcoin’s emergence disrupted traditional financial systems, offering a decentralized, peer-to-peer alternative to fiat currencies. Its impact is far-reaching, sparking debates about its role as a store of value, a medium of exchange, and its potential to reshape global finance. Its decentralized nature, secured by blockchain technology, has attracted both ardent supporters and skeptical critics. Understanding its past performance and current market dynamics is crucial to forming any reasonable prediction.

Factors Influencing Bitcoin’s Price in 2025

Several factors could significantly influence Bitcoin’s price by January 15, 2025. These include macroeconomic conditions, regulatory developments, technological advancements, and overall market sentiment. Predicting the precise interplay of these factors is challenging, yet analyzing their potential impact allows for a more informed perspective.

Macroeconomic Conditions and Bitcoin’s Price

Global economic stability, inflation rates, and interest rate policies significantly impact Bitcoin’s value. For example, periods of high inflation can drive investors towards Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, rising interest rates can make other investment options more attractive, potentially reducing demand for Bitcoin. Analyzing historical correlations between macroeconomic indicators and Bitcoin’s price can provide insights into potential future trends. For instance, the correlation between Bitcoin’s price and the US Consumer Price Index (CPI) has shown periods of positive correlation during inflationary periods.

Regulatory Landscape and Bitcoin Adoption

Government regulations play a pivotal role in shaping Bitcoin’s trajectory. Clear and supportive regulatory frameworks can boost investor confidence and encourage wider adoption, potentially driving up the price. Conversely, restrictive regulations can stifle growth and lead to price declines. The varying regulatory approaches across different countries further complicate the prediction, as increased adoption in one region may not necessarily translate to a global price surge. The ongoing debate surrounding Bitcoin’s classification as a security or a commodity highlights the complexities of its regulatory landscape.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem, such as improvements in scalability and transaction speed, can positively influence its price. The development of the Lightning Network, for example, aims to address scalability issues, making Bitcoin transactions faster and cheaper. Conversely, security breaches or technological setbacks could negatively impact investor confidence and lead to price drops. Continuous innovation is crucial for Bitcoin’s long-term sustainability and potential price appreciation. Successful upgrades and implementations of Layer-2 solutions, such as the Lightning Network, are likely to contribute positively to Bitcoin’s price.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various economic, technological, and social factors. Understanding these influences is crucial for navigating the volatile cryptocurrency market. While predicting the precise price remains challenging, analyzing these factors provides valuable insight into potential price movements.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price upward. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to price decreases. Strong global economic growth might see investors allocate more capital to traditional markets, reducing Bitcoin’s appeal. The interaction between these factors is complex; for example, high inflation coupled with slow economic growth could create a scenario where Bitcoin’s safe-haven appeal outweighs the negative impact of rising interest rates. Conversely, strong economic growth alongside low inflation could diminish Bitcoin’s appeal as a hedge, potentially impacting its price negatively.

Regulatory Developments and Their Impact on Bitcoin

Government policies and legal frameworks play a crucial role in shaping Bitcoin’s trajectory. Clear and favorable regulations can boost investor confidence, attracting institutional investment and driving price appreciation. For example, if a major jurisdiction like the US were to establish a comprehensive regulatory framework for cryptocurrencies, clarifying tax implications and defining legal status, it could lead to a significant surge in Bitcoin adoption and price. Conversely, stringent or unclear regulations, such as outright bans or excessive taxation, can create uncertainty and stifle adoption, potentially leading to price declines. Consider a scenario where a large country unexpectedly imposes a complete ban on cryptocurrency transactions: This would likely cause a significant and immediate negative impact on Bitcoin’s price, as a substantial portion of the market would be eliminated overnight. Conversely, a scenario where a major global financial institution announces it will begin offering Bitcoin-backed investment products would likely result in a substantial price increase.

Technological Advancements and Bitcoin’s Market Position

Technological advancements in the Bitcoin ecosystem and the emergence of competing cryptocurrencies influence Bitcoin’s market position. Improvements in Bitcoin’s scalability, such as the Lightning Network, can enhance transaction speed and reduce fees, making it more user-friendly and potentially increasing adoption. However, the development of faster, more efficient, or more feature-rich cryptocurrencies could challenge Bitcoin’s dominance. For example, a hypothetical new cryptocurrency offering significantly faster transaction speeds and lower fees while maintaining a high level of security could potentially draw investors away from Bitcoin, impacting its market share and price. A comparison of Bitcoin’s underlying technology to a hypothetical competitor could highlight its strengths and weaknesses. Bitcoin’s proven track record and established network effect remain significant advantages, but innovations in areas like consensus mechanisms and smart contract functionality could potentially shift the balance.

Market Sentiment and Bitcoin Price Fluctuations, Bitcoin Price Prediction For 15 January 2025

Investor confidence, media coverage, and social media trends significantly influence Bitcoin’s price volatility. Positive news, such as large institutional investments or positive regulatory developments, can boost investor sentiment and drive prices higher. Conversely, negative news, such as security breaches or regulatory crackdowns, can trigger sell-offs and price declines. Consider a hypothetical news story: “Major Hedge Fund Announces $1 Billion Bitcoin Investment.” Such a headline would likely generate significant positive media attention and social media buzz, leading to increased buying pressure and a likely price increase. Conversely, a story about a major exchange being hacked and a significant amount of Bitcoin being stolen would have the opposite effect, potentially triggering a sharp price drop due to fear and uncertainty.

Adoption Rates and Long-Term Implications for Bitcoin

The rate of Bitcoin adoption by institutional investors, retail users, and merchants has profound long-term implications for its price. Increased institutional investment brings significant capital inflows, potentially driving prices upward. Widespread retail adoption expands the user base, increasing demand and potentially stabilizing price fluctuations. Merchant acceptance makes Bitcoin a viable means of payment, boosting its utility and further driving adoption. For example, if major retailers like Amazon were to start accepting Bitcoin payments, it would likely lead to a significant increase in demand and a substantial price increase. Similarly, a large influx of institutional investment, such as a significant investment from a major pension fund, could drive prices upward due to increased demand. Conversely, a lack of widespread adoption could hinder Bitcoin’s growth and limit its price appreciation potential.

Historical Price Analysis and Trends

Bitcoin’s price history is characterized by extreme volatility and significant growth punctuated by sharp corrections. Understanding these past movements, including the events that influenced them, is crucial for informed speculation about future price behavior. Analyzing historical data allows us to identify potential patterns, although it’s important to remember that past performance is not necessarily indicative of future results.

Bitcoin’s price has been heavily influenced by a complex interplay of factors, including regulatory changes, technological advancements, market sentiment, and macroeconomic conditions. By examining these influences alongside price movements, we can attempt to discern recurring themes and potential predictive signals.

Bitcoin Price Performance: 2010-2023

The following table provides a summary of Bitcoin’s average quarterly price and significant events for selected years. Note that this is a simplified overview, and a more granular analysis would be necessary for a comprehensive understanding. Data sources for this table would include reputable cryptocurrency market tracking websites such as CoinMarketCap and CoinGecko.

| Year | Quarter | Average Price (USD) | Significant Event |

|---|---|---|---|

| 2010 | Q4 | ~ $0.003 | Early adoption and limited trading volume |

| 2011 | Q4 | ~$2 | Increased media attention and early exchange listings |

| 2013 | Q4 | ~$1100 | Significant price surge, driven by growing interest and media coverage |

| 2017 | Q4 | ~$10,000 | Mainstream media attention and institutional investment |

| 2021 | Q1 | ~$40,000 | Increased institutional adoption and Tesla’s Bitcoin investment |

| 2021 | Q4 | ~$47,000 | El Salvador adopts Bitcoin as legal tender |

| 2022 | Q4 | ~$17,000 | Crypto market downturn and macroeconomic factors |

| 2023 | Q3 | ~$26,000 | Gradual market recovery |

Recurring Patterns and External Correlations

Bitcoin’s price history exhibits periods of explosive growth followed by significant corrections. These cycles often correlate with broader macroeconomic trends, regulatory announcements, and technological developments within the cryptocurrency ecosystem. For instance, periods of economic uncertainty or increased regulatory scrutiny have historically led to price declines, while positive news and technological advancements tend to fuel upward price movements. However, identifying and predicting the timing and magnitude of these cycles remains extremely challenging.

Bitcoin Price Performance Compared to Other Asset Classes

A line graph comparing Bitcoin’s price performance to gold, a major stock index (e.g., S&P 500), and a bond index would illustrate the relative volatility and risk-return profiles of these different asset classes.

The x-axis of the graph would represent time (e.g., years from 2010 to 2023), while the y-axis would represent the price or index value (normalized to a common starting point for easier comparison). Data points would represent the closing price or index value for each asset class at regular intervals (e.g., monthly or quarterly). The graph would clearly show Bitcoin’s significantly higher volatility compared to gold, stocks, and bonds, highlighting its potential for both higher returns and greater losses. The graph would also demonstrate periods of correlation and divergence between Bitcoin’s price and the prices of other asset classes, suggesting potential influences of macroeconomic factors and investor sentiment. For example, periods of economic uncertainty might see investors move out of riskier assets (like Bitcoin and stocks) into safer havens (like gold and bonds), while periods of economic growth could see investors allocate more capital to riskier assets with higher growth potential.

Expert Opinions and Predictions: Bitcoin Price Prediction For 15 January 2025

Predicting Bitcoin’s price in 2025 involves navigating a complex interplay of factors, and expert opinions offer a range of perspectives, reflecting diverse analytical methodologies and market interpretations. While a precise figure remains elusive, examining these viewpoints reveals potential price trajectories and underlying assumptions.

Summary of Expert Opinions

Leading cryptocurrency analysts and experts offer a spectrum of Bitcoin price predictions for January 15, 2025. Some analysts, employing technical analysis based on chart patterns and historical price movements, predict relatively conservative price increases, perhaps in the range of $100,000 to $150,000. These predictions often incorporate indicators like moving averages and relative strength index (RSI) to identify potential support and resistance levels. Conversely, other experts, focusing on fundamental analysis, which considers factors like adoption rates, regulatory developments, and technological advancements, suggest significantly higher price targets, potentially reaching $250,000 or more. This divergence stems from differing assessments of Bitcoin’s long-term value proposition and the potential for widespread institutional adoption. A notable area of consensus is the expectation of continued volatility, with significant price fluctuations throughout the period leading up to January 2025.

Prediction Models and Methodologies

Two primary models dominate Bitcoin price prediction: technical analysis and fundamental analysis. Technical analysis relies on historical price and volume data to identify patterns and trends, using tools like moving averages, Fibonacci retracements, and candlestick patterns to predict future price movements. For example, a bullish head and shoulders pattern might suggest an upcoming price surge. Conversely, fundamental analysis focuses on broader macroeconomic factors, technological advancements, and regulatory landscapes impacting Bitcoin’s underlying value. This approach might incorporate metrics like the network’s hash rate, the number of active users, and the overall market capitalization of cryptocurrencies. A higher hash rate, indicating greater network security, might suggest a stronger price floor. The methodologies differ significantly; technical analysis is inherently short-term focused, whereas fundamental analysis attempts to project long-term value based on underlying fundamentals. The results often diverge, reflecting the limitations of each approach.

Limitations of Price Prediction and Uncertainties

Predicting Bitcoin’s price, or any asset’s price for that matter, is inherently fraught with uncertainty. Numerous unforeseen events – such as significant regulatory changes, major technological breakthroughs, or unforeseen geopolitical crises – can dramatically impact the market. Furthermore, the cryptocurrency market is highly susceptible to speculative bubbles and emotional trading, leading to periods of extreme volatility that defy even the most sophisticated prediction models. For instance, the 2017 Bitcoin bubble and subsequent crash highlight the unpredictable nature of the market. Even the most rigorous analysis can only offer probabilities, not certainties, and historical performance is not necessarily indicative of future results. Therefore, all predictions should be viewed with a degree of skepticism and treated as potential scenarios rather than guaranteed outcomes. The inherent volatility and the influence of external factors make precise price prediction an extremely challenging, if not impossible, task.

Potential Scenarios for January 15, 2025

Predicting Bitcoin’s price with certainty is impossible, but by analyzing current trends and potential future events, we can Artikel three plausible scenarios for its value on January 15, 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. The assumptions underlying each scenario are based on macroeconomic factors, regulatory developments, technological advancements, and overall market sentiment.

Bullish Scenario: Bitcoin Surges Past $100,000

This scenario envisions a significant surge in Bitcoin’s price, potentially exceeding $100,000 by January 15, 2025. This bullish outlook hinges on several key factors. Firstly, widespread adoption by institutional investors and governments could drive substantial demand. Imagine a future where major financial institutions actively incorporate Bitcoin into their portfolios, mirroring the early adoption of the internet by businesses. Secondly, continued technological advancements, such as the development of layer-2 scaling solutions that address transaction speed and fees, would enhance Bitcoin’s usability and appeal. Finally, a positive global macroeconomic environment, characterized by low inflation and stable economic growth, could create a favorable climate for risk assets like Bitcoin. This scenario assumes a significant increase in institutional investment, widespread adoption among retail investors, and a generally positive global economic outlook. The price range in this scenario would likely be between $80,000 and $150,000. This high price range reflects the substantial increase in demand and the limited supply of Bitcoin, which is capped at 21 million coins.

Bearish Scenario: Bitcoin Falls Below $20,000

Conversely, a bearish scenario suggests Bitcoin’s price could fall below $20,000 by January 15, 2025. This outcome depends on several negative factors. A significant global economic downturn, perhaps triggered by a major financial crisis or prolonged recession, could severely impact risk appetite, causing investors to divest from Bitcoin and other volatile assets. Furthermore, increased regulatory scrutiny and stricter governmental controls on cryptocurrency trading could stifle growth and reduce investor confidence. Imagine a scenario where governments worldwide implement stringent regulations, making it difficult and costly to trade Bitcoin, similar to past crackdowns on other speculative markets. Technological setbacks or major security breaches could also negatively impact investor sentiment and drive down prices. This bearish scenario assumes a global economic recession, increased regulatory pressure, and a lack of significant technological advancements. The price range in this scenario would likely be between $10,000 and $30,000, reflecting a significant loss of investor confidence and a potential flight to safer assets.

Neutral Scenario: Bitcoin Consolidates Around $40,000

A neutral scenario suggests Bitcoin’s price will consolidate around the $40,000 mark by January 15, 2025. This scenario assumes a relatively stable global economic environment with moderate growth and some regulatory developments. Institutional adoption continues at a steady pace, but without the explosive growth seen in the bullish scenario. Technological advancements continue, improving Bitcoin’s efficiency but not drastically altering its fundamental properties. Market sentiment remains relatively neutral, with neither overwhelming optimism nor significant pessimism driving price movements. This scenario assumes a continuation of current trends with neither significant positive nor negative developments significantly impacting the price. The price range in this scenario would be between $30,000 and $50,000, reflecting a period of sideways movement and consolidation following previous price volatility.

Risk Management and Investment Strategies

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding and mitigating these risks is crucial for successful and sustainable participation in the cryptocurrency market. A well-defined risk management strategy, combined with sound investment approaches, can significantly improve your chances of achieving your financial goals.

Diversification and dollar-cost averaging are two key strategies that can help manage risk. Effective risk management also necessitates thorough research, realistic expectations, and emotional discipline.

Diversification

Diversification involves spreading your investments across various assets to reduce the impact of any single investment’s poor performance. Instead of putting all your eggs in one basket (Bitcoin), consider diversifying your portfolio to include other cryptocurrencies, stocks, bonds, or real estate. This approach minimizes the overall risk to your investment portfolio. For example, allocating 10% of your investment portfolio to Bitcoin, 20% to other cryptocurrencies like Ethereum, 30% to stocks, and 40% to bonds, would create a more resilient portfolio compared to a 100% Bitcoin investment. This reduces the impact of potential Bitcoin price crashes.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This strategy helps mitigate the risk of buying high and selling low, a common pitfall of lump-sum investments. For instance, investing $100 in Bitcoin every week, regardless of the price, reduces the impact of short-term price fluctuations. If the price drops, you buy more Bitcoin; if the price rises, you buy less. Over the long term, DCA can lead to a lower average purchase price compared to a lump-sum investment.

Thorough Research and Due Diligence

Before investing in Bitcoin or any other cryptocurrency, it is essential to conduct thorough research and due diligence. This involves understanding the technology behind Bitcoin, its potential risks and rewards, and the regulatory landscape surrounding cryptocurrencies. Analyze market trends, read reputable financial news sources, and understand the potential impact of technological advancements, regulatory changes, and market sentiment on Bitcoin’s price. Ignoring this crucial step can lead to uninformed investment decisions and potential financial losses. For example, researching the history of Bitcoin’s price volatility and the factors influencing it would help in better assessing its future price movements.

Realistic Expectations and Avoiding Emotional Decision-Making

The cryptocurrency market is highly volatile, and Bitcoin’s price can fluctuate dramatically in short periods. Setting realistic expectations and avoiding emotional decision-making are crucial for long-term success. Avoid making impulsive investment decisions based on fear or greed. Instead, stick to your investment plan and avoid reacting to short-term price movements. For example, having a predetermined exit strategy, based on your risk tolerance and financial goals, will help you avoid emotional decisions when the market experiences significant volatility. Remember that past performance is not indicative of future results.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price prediction for January 15, 2025, and the broader implications of investing in this cryptocurrency. Understanding the inherent volatility and the multitude of factors influencing Bitcoin’s price is crucial for informed decision-making.

Bitcoin’s Most Likely Price on January 15, 2025

Predicting the precise price of Bitcoin on any given date is inherently unreliable. Numerous unpredictable factors, from regulatory changes to macroeconomic shifts, can significantly impact its value. While various models and analysts offer projections, these should be viewed as potential scenarios, not guarantees. For example, a model might predict a price based on past trends and current adoption rates, but unforeseen events like a major security breach or a sudden surge in regulatory pressure could drastically alter the outcome. Therefore, any specific price prediction for January 15, 2025, should be treated with considerable caution. It’s more prudent to consider a range of possibilities rather than a single point estimate.

Factors Influencing Bitcoin’s Price in the Coming Years

Several key factors are likely to shape Bitcoin’s price trajectory over the next few years. Understanding these factors allows for a more nuanced assessment of the potential risks and rewards associated with Bitcoin investment.

- Regulatory Landscape: Government regulations globally will significantly influence Bitcoin’s accessibility and adoption. Favorable regulations could lead to increased institutional investment and broader acceptance, potentially driving up the price. Conversely, restrictive regulations could limit growth and depress the price.

- Technological Advancements: Improvements in Bitcoin’s underlying technology, such as scaling solutions (like the Lightning Network) and enhanced security measures, could boost confidence and adoption, positively impacting the price. Conversely, significant technological vulnerabilities could lead to a price decline.

- Macroeconomic Conditions: Global economic events, such as inflation, recession, and geopolitical instability, can influence investor sentiment towards riskier assets like Bitcoin. During periods of economic uncertainty, Bitcoin might be seen as a hedge against inflation, driving demand and price. However, during economic downturns, investors might sell Bitcoin to cover losses in other investments, resulting in price drops.

- Adoption and Market Sentiment: Widespread adoption by businesses and individuals is crucial for sustained price growth. Positive media coverage and increased public awareness can boost market sentiment, leading to price increases. Conversely, negative news or controversies can trigger sell-offs and price declines.

- Competition from Other Cryptocurrencies: The emergence of new cryptocurrencies with potentially superior features or more efficient technology could divert investment away from Bitcoin, impacting its market share and price.

Bitcoin as an Investment

Bitcoin offers the potential for significant returns, but it’s also exceptionally volatile. The price can fluctuate dramatically in short periods, leading to substantial gains or losses. Investing in Bitcoin requires a high-risk tolerance and a thorough understanding of the technology and market dynamics. It’s essential to remember that past performance is not indicative of future results. Before investing, conduct extensive research, consider your risk tolerance, and only invest what you can afford to lose. Diversification across multiple asset classes is also a prudent strategy to mitigate risk.

Protecting Against Bitcoin Price Volatility

Managing the risk associated with Bitcoin’s price volatility requires a multifaceted approach.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, helps to mitigate the impact of volatility. This strategy reduces the risk of investing a large sum at a market peak.

- Diversification: Don’t put all your eggs in one basket. Diversify your investment portfolio across various asset classes, including stocks, bonds, and other cryptocurrencies. This reduces your overall exposure to Bitcoin’s price fluctuations.

- Risk Tolerance Assessment: Understand your own risk tolerance before investing in Bitcoin. If you’re uncomfortable with significant price swings, Bitcoin might not be a suitable investment for you.

- Long-Term Perspective: Bitcoin’s price has historically shown periods of significant growth over the long term. If you’re a long-term investor, you may be better positioned to weather short-term volatility.

Bitcoin Price Prediction For 15 January 2025 – Predicting the Bitcoin price for January 15th, 2025, requires considering various factors, including market sentiment and technological advancements. To get a better grasp of the short-term volatility, checking out resources like this prediction for the next 24 hours in 2025, Bitcoin Next 24 Hours Prediction 2025 , can be helpful. Ultimately, however, the Bitcoin price on January 15th, 2025, will depend on the cumulative effect of these short-term fluctuations and long-term trends.

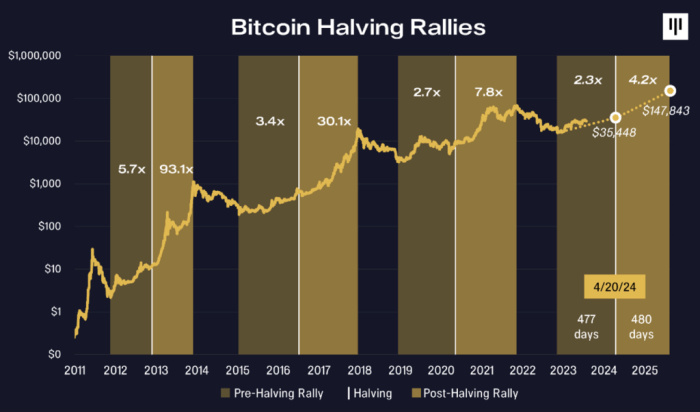

Predicting the Bitcoin price for January 15th, 2025, is inherently speculative, but a major factor to consider is the impact of the upcoming Bitcoin halving. Understanding the potential consequences of this event is crucial for any accurate forecast, and for more detailed information, check out this insightful analysis on the Bitcoin Halving 2025 Impact. Ultimately, the halving’s influence on scarcity and miner profitability will significantly shape the Bitcoin price prediction for that date.

Accurately predicting the Bitcoin price for January 15th, 2025, is challenging, requiring consideration of various market factors. A key element in such forecasting involves understanding potential future crashes; for insights into this, check out this analysis on When Will Bitcoin Crash Again 2025 Prediction. Ultimately, the Bitcoin price on that date will depend on the interplay of these factors and overall market sentiment.

Predicting the Bitcoin price for January 15th, 2025, is challenging, but a key factor influencing it will be the Bitcoin Halving event of 2024. To understand the potential impact, it’s helpful to review predictions surrounding the halving itself; you can find insightful analysis on this at Bitcoin Halving 2025 Prediction Price. Therefore, assessing the post-halving market sentiment is crucial for any accurate Bitcoin price prediction for January 15th, 2025.

Predicting the Bitcoin price for January 15th, 2025, is challenging, but a significant factor to consider is the upcoming halving event. To stay informed about the exact date and track the countdown, check out this helpful resource: Bitcoin Halving 2025 Date & Countdown Btc Clock. Understanding the halving’s impact on Bitcoin’s supply is crucial for any serious price prediction for that date.

Predicting the Bitcoin price for January 15th, 2025, is inherently speculative, but a major factor influencing any forecast is the upcoming halving. Understanding the implications of this event is crucial for accurate prediction; to learn more, check out this helpful resource on What Does Halving Bitcoin 2025 Mean. The halving’s effect on Bitcoin’s scarcity and potential price increase will significantly shape the market leading up to and beyond that date.

Predicting the Bitcoin price for January 15th, 2025, is inherently speculative, but a major factor influencing any forecast is the upcoming halving. Understanding the implications of this event is crucial for accurate prediction; to learn more, check out this helpful resource on What Does Halving Bitcoin 2025 Mean. The halving’s effect on Bitcoin’s scarcity and potential price increase will significantly shape the market leading up to and beyond that date.