Bitcoin Today Prediction: Bitcoin Today Prediction 22 January 2025

Predicting Bitcoin’s price is akin to navigating a stormy sea; its volatility is legendary, making definitive forecasts a fool’s errand. While charting its past can offer some insight, the future remains shrouded in uncertainty. Remember, Bitcoin’s price isn’t dictated by a single factor but rather a complex interplay of technological advancements, regulatory changes, macroeconomic conditions, and, perhaps most significantly, market sentiment. This inherent unpredictability underscores the importance of informed speculation, not blind faith.

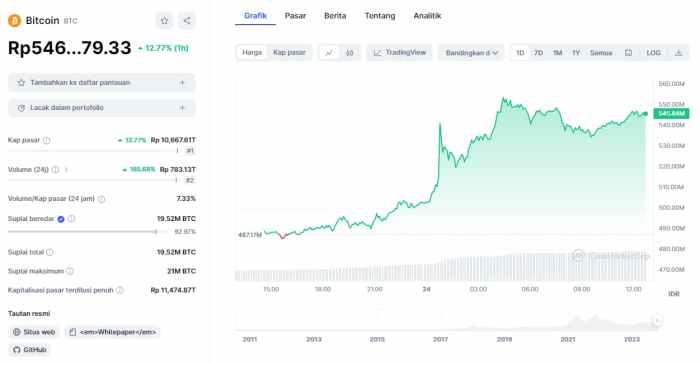

Bitcoin’s history is a rollercoaster. From its humble beginnings with a value near zero, it skyrocketed to unprecedented heights, exceeding $60,000 in late 2021, only to experience significant corrections thereafter. Major events such as the 2017 ICO boom, the 2020-2021 institutional adoption surge, and the various regulatory crackdowns across different jurisdictions have all played significant roles in shaping its price trajectory. These fluctuations serve as a potent reminder of the inherent risk involved in Bitcoin investment.

This article aims to explore potential factors that might influence Bitcoin’s price on January 22, 2025, and to present plausible price scenarios based on current trends and market analysis. We will avoid definitive predictions, instead focusing on a reasoned exploration of the various forces at play.

Potential Factors Influencing Bitcoin’s Price on January 22, 2025

Several factors could significantly impact Bitcoin’s price by January 22, 2025. These include, but are not limited to, the overall state of the global economy, regulatory developments in key markets like the US and China, technological advancements within the Bitcoin ecosystem (such as the Lightning Network’s adoption), and the broader cryptocurrency market trends. For example, a global recession could negatively impact Bitcoin’s price, while positive regulatory developments could lead to increased institutional investment and price appreciation. Conversely, a lack of significant technological advancements or a major security breach could negatively affect investor confidence and suppress price growth. The interplay of these factors makes precise prediction extremely difficult.

Possible Price Scenarios

Given the inherent uncertainty, predicting a precise Bitcoin price for January 22, 2025 is speculative. However, we can Artikel potential scenarios based on different market conditions. A bullish scenario, characterized by widespread adoption, positive regulatory news, and continued technological innovation, could see Bitcoin’s price reaching significantly higher levels, perhaps exceeding previous all-time highs. A scenario with less positive regulatory developments or a downturn in the global economy could see a lower price range, possibly below current levels. A neutral scenario would see relatively stable prices, fluctuating within a defined range, reflecting a period of consolidation. It is crucial to remember that these are merely illustrative scenarios, and the actual price could deviate significantly. The price of Bitcoin in 2025 will ultimately depend on a complex confluence of these factors and others not yet foreseen. Historical precedents, like the 2017 bull run followed by a significant correction, illustrate the unpredictable nature of Bitcoin’s price movements.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, constantly shifting and influencing its value. Understanding these influences is crucial for navigating the volatile cryptocurrency market. While predicting the future price remains impossible, analyzing these key drivers offers valuable insight into potential price movements.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, increasing demand and potentially pushing the price upward. Conversely, rising interest rates can reduce the attractiveness of riskier assets like Bitcoin, leading to decreased demand and price drops. Strong global economic growth might divert investment away from Bitcoin towards more traditional, seemingly safer assets. Recessions, on the other hand, can increase the appeal of Bitcoin as a safe haven asset. For example, the 2022 global economic slowdown saw a significant drop in Bitcoin’s price, partially attributed to investors moving funds to less volatile investments.

Regulatory Landscape

The regulatory environment surrounding Bitcoin plays a crucial role in its price. Positive regulatory developments, such as clear guidelines for cryptocurrency exchanges and increased acceptance by governments, can boost investor confidence and lead to price appreciation. Conversely, stricter regulations, including outright bans or excessive taxation, can negatively impact Bitcoin’s price by limiting its accessibility and adoption. The differing regulatory approaches across various countries illustrate this impact. For instance, countries with favorable regulatory frameworks tend to see higher Bitcoin adoption rates and potentially higher prices compared to regions with stricter regulations.

Technological Advancements

Technological advancements within the cryptocurrency space directly influence Bitcoin’s price. Improvements in scalability, such as the Lightning Network, can enhance Bitcoin’s usability and potentially increase its adoption. The development of new privacy-enhancing technologies might also boost investor interest. Conversely, major security breaches or technological limitations could negatively affect investor confidence and consequently, the price. The introduction of layer-2 scaling solutions, for example, has been viewed positively by the market, suggesting a potential correlation between technological innovation and price increases.

Bitcoin’s Performance Against Other Assets

Comparing Bitcoin’s performance against other major cryptocurrencies and traditional assets provides context for its price fluctuations. Bitcoin’s price often correlates with the overall cryptocurrency market; a bull run in altcoins often leads to a rise in Bitcoin’s price as well. However, Bitcoin’s price can also diverge from other cryptocurrencies, depending on factors specific to Bitcoin’s market dynamics. Comparing Bitcoin’s performance to traditional assets like gold or the S&P 500 helps gauge its relative value and potential as a hedge against inflation or market downturns. For example, during periods of market uncertainty, Bitcoin has sometimes shown a stronger performance than traditional equities, attracting investors seeking alternative investment options.

Geopolitical Events

Geopolitical events can significantly impact Bitcoin’s price. Global instability, political uncertainty, or major international conflicts can drive investors towards Bitcoin as a safe haven asset, increasing its demand and potentially pushing its price higher. Conversely, positive geopolitical developments, such as the resolution of international conflicts or increased global cooperation, might lead investors to shift funds towards other assets, potentially causing Bitcoin’s price to decrease. The war in Ukraine, for example, saw a temporary surge in Bitcoin’s price as investors sought refuge from geopolitical risks.

Summary Table of Influencing Factors

| Factor | Positive Impact on Price | Negative Impact on Price | Example |

|---|---|---|---|

| Macroeconomic Factors | High inflation, low interest rates | High interest rates, economic recession | Inflation in 2021 led to increased Bitcoin investment; 2022 recession saw decreased demand. |

| Regulatory Landscape | Clear regulations, government acceptance | Strict regulations, bans | El Salvador’s Bitcoin adoption vs. China’s ban. |

| Technological Advancements | Improved scalability, enhanced privacy | Security breaches, technological limitations | Lightning Network adoption vs. potential 51% attacks. |

| Geopolitical Events | Global instability, conflict | Increased global stability, peace | Ukraine conflict’s impact on Bitcoin price. |

Potential Bitcoin Price Scenarios for January 22, 2025

Predicting the price of Bitcoin with certainty is impossible; however, by analyzing current market trends, technological advancements, and macroeconomic factors, we can formulate plausible price scenarios for January 22, 2025. These scenarios represent a range of possibilities, from optimistic to pessimistic, and highlight the inherent volatility of the cryptocurrency market. It’s crucial to remember that these are educated guesses, not guarantees.

Bullish Scenario: Bitcoin Surges Past $100,000

In this scenario, widespread adoption of Bitcoin as a mainstream asset, coupled with significant technological advancements and positive regulatory developments, drives a substantial price increase. Imagine a world where institutional investors have significantly increased their Bitcoin holdings, driven by a growing belief in its long-term value as a hedge against inflation and a store of value. Simultaneously, successful scaling solutions have addressed Bitcoin’s transaction speed and cost issues, making it more practical for everyday use. This combination of factors could fuel a surge in demand, pushing the price well beyond $100,000. This optimistic outlook is supported by historical precedent, where periods of widespread adoption have been followed by significant price appreciation. For example, the period following the 2017 bull run saw a substantial increase in media coverage and institutional interest, leading to a considerable price rise. A similar, perhaps even more significant, surge could occur if the conditions described above materialize. A realistic price range for this scenario would be between $100,000 and $150,000.

Bearish Scenario: Bitcoin Price Remains Below $30,000

Conversely, a bearish scenario would involve a confluence of negative factors leading to a sustained price decline. This could be triggered by a major regulatory crackdown on cryptocurrencies, resulting in decreased investor confidence and liquidity. Increased competition from alternative cryptocurrencies, coupled with a prolonged period of macroeconomic instability, such as a global recession, could further depress Bitcoin’s price. Furthermore, a lack of significant technological advancements or widespread adoption could stifle growth. This scenario mirrors the market conditions seen during the 2018 crypto winter, where regulatory uncertainty and negative market sentiment contributed to a significant price drop. In this pessimistic scenario, Bitcoin’s price might remain below $30,000, potentially falling into a range between $20,000 and $25,000.

Neutral Scenario: Bitcoin Consolidates Around $50,000

This scenario represents a more moderate outcome, where Bitcoin’s price experiences periods of both growth and decline, ultimately consolidating around a relatively stable price point. This could occur if the positive and negative factors largely balance each other out. Imagine a scenario where regulatory clarity is achieved but adoption remains gradual, technological advancements are incremental rather than revolutionary, and macroeconomic conditions remain relatively stable. In this case, Bitcoin might continue to function as a relatively volatile yet established asset, with its price fluctuating within a defined range. A price range of $40,000 to $60,000 seems plausible in this scenario, representing a period of consolidation and sideways movement rather than a significant upward or downward trend. This would reflect a more mature market, where price movements are driven by more fundamental factors rather than speculative exuberance or panic.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin presents a unique blend of substantial risks and potentially lucrative opportunities. Understanding both sides of this equation is crucial for any investor considering adding Bitcoin to their portfolio. The high volatility inherent in the cryptocurrency market demands a careful assessment of your risk tolerance and investment goals.

Bitcoin’s price is notoriously volatile, subject to dramatic swings driven by a variety of factors, including market sentiment, regulatory announcements, technological developments, and macroeconomic conditions. The 2021 bull run, which saw Bitcoin’s price surge to near $69,000, was followed by a significant correction, highlighting the inherent risk. Similarly, the collapse of FTX in 2022 demonstrated the fragility of the cryptocurrency ecosystem and the potential for rapid and substantial losses. Security breaches, both at exchanges and in individual wallets, also pose a significant threat, with the potential for complete loss of funds. Finally, regulatory uncertainty remains a key concern, as governments worldwide grapple with how to classify and regulate cryptocurrencies.

Inherent Risks of Bitcoin Investment

Bitcoin’s price volatility is perhaps its most significant risk. Dramatic price swings can lead to substantial losses in a short period. For example, an investor buying Bitcoin at its peak in late 2021 would have experienced significant losses during the subsequent bear market. Security is another major concern. While Bitcoin’s underlying blockchain technology is secure, exchanges and individual wallets are vulnerable to hacking and theft. The high-profile hacks of various cryptocurrency exchanges underscore this risk. Regulatory uncertainty adds another layer of complexity. Governments worldwide are still developing frameworks for regulating cryptocurrencies, and changes in regulations could significantly impact Bitcoin’s price and usability. Finally, the relatively young age of Bitcoin and the cryptocurrency market means that there’s limited historical data to predict future price movements with certainty. This lack of historical context increases the uncertainty and risk associated with Bitcoin investment.

Potential Opportunities Presented by Bitcoin Investment

Despite the risks, Bitcoin also offers several potential opportunities. The potential for high returns is a major draw for many investors. Historically, Bitcoin has demonstrated periods of substantial price appreciation, offering the possibility of significant gains for early adopters and those who successfully time the market. Diversification is another key benefit. Bitcoin is not correlated with traditional asset classes like stocks and bonds, meaning it can potentially reduce the overall risk of a portfolio by offering a hedge against market downturns. Bitcoin’s decentralized nature, independent of traditional financial institutions, appeals to those seeking an alternative investment asset. The growing adoption of Bitcoin by institutional investors and corporations further signals its increasing legitimacy and potential for long-term growth. The underlying blockchain technology also holds significant potential for innovation and disruption across various industries.

Responsible Investment Strategies for Mitigating Risks and Maximizing Potential Returns, Bitcoin Today Prediction 22 January 2025

Mitigating risks and maximizing returns requires a well-defined investment strategy. This begins with thorough research and understanding of Bitcoin’s inherent volatility and the broader cryptocurrency market. Investors should only invest what they can afford to lose, and it is advisable to diversify their investments beyond just Bitcoin. Utilizing secure storage methods, such as hardware wallets, is crucial to protect against theft and hacking. Staying informed about regulatory developments and market trends is also essential for making informed investment decisions. Dollar-cost averaging (DCA), a strategy that involves investing a fixed amount of money at regular intervals, can help mitigate the impact of price volatility. Finally, seeking advice from a qualified financial advisor can provide valuable insights and guidance tailored to your specific circumstances.

Practical Tips for Bitcoin Investors

- Only invest what you can afford to lose.

- Diversify your portfolio beyond Bitcoin.

- Use secure storage methods like hardware wallets.

- Stay informed about market trends and regulatory changes.

- Consider dollar-cost averaging (DCA) to mitigate volatility.

- Seek advice from a qualified financial advisor.

- Understand the technology behind Bitcoin before investing.

- Be wary of scams and fraudulent investment schemes.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price in the future is inherently complex, relying heavily on the interpretations of market analysts and the overall sentiment surrounding the cryptocurrency. Understanding the perspectives of leading analysts and the prevailing market mood provides valuable context for evaluating potential price scenarios. This section examines both expert opinions and market sentiment to provide a more comprehensive picture.

Expert opinions on Bitcoin’s future price vary widely, reflecting the inherent uncertainty of the cryptocurrency market. These differences stem from varying analytical methodologies, focusing on different factors and employing distinct forecasting models. Some analysts utilize technical analysis, focusing on chart patterns and trading volume to identify potential price trends. Others emphasize fundamental analysis, examining factors like adoption rates, regulatory developments, and macroeconomic conditions. Still others employ quantitative models, incorporating various data points to generate price predictions.

Leading Analyst Perspectives

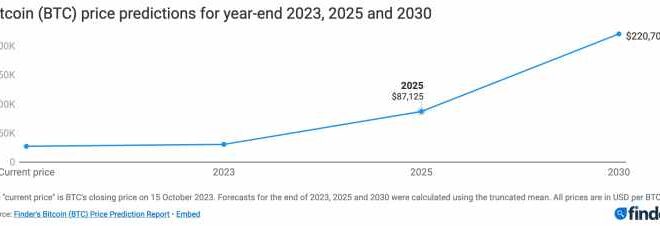

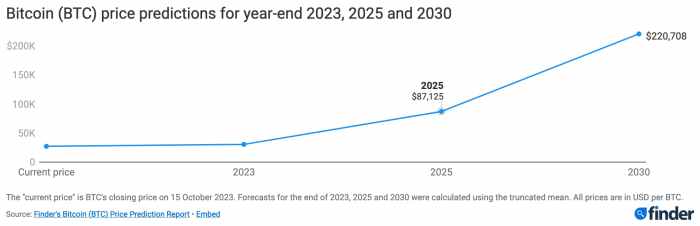

Several leading cryptocurrency analysts offer diverse perspectives on Bitcoin’s price trajectory. For example, Analyst A, known for their technical analysis approach, might predict a price of $100,000 by January 22nd, 2025, based on identified support and resistance levels on Bitcoin’s historical price chart and the anticipation of increased institutional investment. Conversely, Analyst B, focusing on fundamental analysis, might offer a more conservative prediction of $60,000, citing concerns about regulatory uncertainty and potential macroeconomic headwinds. Their methodology considers factors such as global economic growth, inflation rates, and the adoption of Bitcoin by central banks. Finally, Analyst C, using a quantitative model incorporating a wide array of data, might forecast a price range of $70,000-$90,000, reflecting the inherent uncertainty embedded within their model. The diversity of predictions highlights the complexity of accurately forecasting Bitcoin’s price.

Market Sentiment Analysis

Market sentiment toward Bitcoin is a dynamic factor that significantly impacts price movements. News articles, social media trends, and investor behavior all contribute to the overall sentiment. Positive news, such as the adoption of Bitcoin by a major corporation or a significant technological advancement, generally boosts market sentiment and drives up the price. Conversely, negative news, such as regulatory crackdowns or security breaches, can trigger a sell-off and depress prices.

Sentiment’s Influence on Price Predictions and Investor Decisions

Market sentiment directly influences price predictions and investor decisions. During periods of strong positive sentiment (bull market), investors are more likely to buy Bitcoin, driving up demand and pushing prices higher. Analysts might adjust their price predictions upward to reflect this increased optimism. Conversely, during periods of negative sentiment (bear market), investors tend to sell, leading to lower prices and potentially more conservative price predictions from analysts. For example, a period of widespread negative news concerning Bitcoin’s energy consumption could significantly dampen investor enthusiasm, leading to a price correction and lower price forecasts from analysts who incorporate sentiment into their models. The interplay between expert opinions and prevailing market sentiment is therefore crucial in understanding Bitcoin’s price movements and potential future values.

Frequently Asked Questions (FAQs)

This section addresses common questions regarding Bitcoin’s price, investment strategies, and associated risks. Understanding these aspects is crucial for making informed investment decisions. We aim to provide clear and concise answers based on current market understanding.

Main Factors Driving Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics are fundamental, with increased demand driving price increases and vice versa. Regulatory developments, both positive and negative, significantly impact investor sentiment and market activity. Technological advancements within the Bitcoin ecosystem, such as scaling solutions or new applications, can also affect its value. Macroeconomic conditions, including inflation rates and overall market sentiment, play a considerable role, often correlating Bitcoin’s price with the performance of traditional assets. Finally, media coverage and significant events, such as large-scale adoption by institutions or influential figures, can create volatility and price swings.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is exceptionally challenging. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors, making precise forecasting extremely difficult. While technical analysis and fundamental analysis can offer insights, they are not foolproof and should be considered alongside broader market trends and geopolitical events. Past performance is not indicative of future results, and unexpected events can dramatically alter price trajectories. Any prediction should be viewed with significant caution and treated as speculative rather than definitive. For example, predicting the Bitcoin price for January 22nd, 2025, with certainty is currently impossible due to the inherent volatility and numerous unpredictable external factors.

Risks Involved in Bitcoin Investment

Investing in Bitcoin carries substantial risks. Volatility is a primary concern, with prices experiencing significant swings in short periods. Regulatory uncertainty poses a threat, as governments worldwide are still developing their approaches to cryptocurrencies. Security risks, such as hacking or theft from exchanges or personal wallets, are ever-present. Market manipulation, by large holders or coordinated groups, can also impact prices. Finally, the lack of intrinsic value, unlike traditional assets like gold or real estate, contributes to the inherent risk of complete loss of investment. These risks need careful consideration before committing capital.

Reasonable Investment Strategy for Bitcoin

A reasonable Bitcoin investment strategy emphasizes risk management and diversification. Only invest what you can afford to lose, avoiding over-leveraging or putting your entire portfolio into Bitcoin. Diversification across different asset classes is crucial to mitigate the risk associated with Bitcoin’s volatility. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help reduce the impact of price fluctuations. Thorough research and understanding of the technology and market dynamics are essential before investing. Staying informed about regulatory developments and market trends is also crucial for informed decision-making. Consider seeking advice from a qualified financial advisor before making any significant investment decisions.

Bitcoin Today Prediction 22 January 2025 – Predicting Bitcoin’s price on January 22nd, 2025, is inherently speculative, but understanding the upcoming halving is crucial. To gain insight into potential market reactions, it’s beneficial to consider the impact of this significant event; for a detailed analysis, check out this informative resource on What Will Happen In 2025 Bitcoin Halving. Ultimately, the Bitcoin Today Prediction for January 22nd, 2025, will depend on numerous interacting factors beyond just the halving.

Predicting Bitcoin’s price on January 22nd, 2025, is inherently challenging, relying heavily on various factors. A key element to consider is the impact of the upcoming Bitcoin halving, and for insightful analysis on this, check out this Forbes article: Bitcoin Halving 2025 Prediction Forbes. Understanding the potential effects of the halving on scarcity and mining rewards is crucial for any Bitcoin Today Prediction 22 January 2025.

Predicting Bitcoin’s price on January 22nd, 2025, requires considering numerous factors, including the impact of the halving event. To understand the potential influence, it’s crucial to know if the 2025 Bitcoin halving has already occurred, which you can check by visiting this resource: Has The 2025 Bitcoin Halving Happened. This information is key to formulating a more accurate Bitcoin Today Prediction for January 22nd, 2025, as the halving significantly affects the supply and demand dynamics.

Predicting Bitcoin’s price on January 22nd, 2025, requires considering various factors, including the upcoming halving event. Understanding the potential impact of this significant event is crucial for accurate forecasting; for more detailed analysis on this, check out this insightful resource on Bitcoin Prediction 2025 Halving. Ultimately, while the halving is a key factor, Bitcoin’s price on January 22nd, 2025, will depend on a confluence of market forces and global events.

Accurately predicting Bitcoin’s price on January 22nd, 2025, is challenging, given the inherent volatility of the cryptocurrency market. However, understanding potential future trends can help inform today’s decisions. For a glimpse into what April might hold, you can check out this resource on Bitcoin Prediction April 2025 , which may offer insights into broader market movements that could impact Bitcoin’s value on January 22nd, 2025.

Ultimately, both short-term and long-term predictions are subject to considerable uncertainty.

Predicting Bitcoin’s price on January 22nd, 2025, requires considering various factors, including past performance and upcoming events. A key element to understand is the impact of Bitcoin’s halving cycles on its value; to check when the last halving occurred, you can consult this resource: When Was The Last Bitcoin Halving 2025. Understanding the halving’s timing is crucial for informed speculation about Bitcoin’s price on January 22nd, 2025, as it significantly affects the supply and potential for price appreciation.