Bitcoin USD Price Prediction

Predicting the price of Bitcoin is inherently speculative, given its volatile nature and dependence on numerous interconnected factors. However, by analyzing historical trends, market sentiment, technological advancements, and macroeconomic conditions, we can construct a range of plausible price scenarios for January 18th, 2025. These predictions are not financial advice and should be considered for informational purposes only.

Price Prediction Scenarios

The following price predictions consider both optimistic (bullish) and pessimistic (bearish) market scenarios. These scenarios are based on various factors, including the adoption rate of Bitcoin by institutions and governments, regulatory changes, technological developments within the Bitcoin ecosystem, and overall global economic conditions.

- Bullish Scenario (High Probability): $150,000 – $250,000: This scenario assumes widespread institutional adoption, positive regulatory developments globally, and continued technological innovation within the Bitcoin network, leading to increased demand and scarcity. This range is supported by historical price growth patterns and projections based on market capitalization growth models, assuming a continued increase in adoption similar to the growth experienced between 2017 and 2021, albeit at a potentially slower pace.

- Neutral Scenario (Medium Probability): $75,000 – $125,000: This scenario assumes a more moderate level of adoption and a period of market consolidation. It accounts for potential regulatory headwinds and periods of decreased investor enthusiasm. This prediction aligns with the historical pattern of Bitcoin’s price experiencing periods of both rapid growth and significant correction. For instance, the price drop from its peak in late 2021 to the lows of 2022 could be considered a similar period of correction.

- Bearish Scenario (Low Probability): $30,000 – $60,000: This scenario accounts for significant negative regulatory intervention, a prolonged cryptocurrency bear market, and a major loss of confidence in the cryptocurrency market. This scenario assumes a significant drop in demand and possibly a major technological setback affecting the Bitcoin network. This is a less likely outcome given the increasing resilience of the Bitcoin network and the growing institutional interest in Bitcoin as a store of value.

Methodology

Our price predictions are derived from a combination of quantitative and qualitative analysis. Quantitative analysis includes the use of historical price data, statistical models such as ARIMA (Autoregressive Integrated Moving Average), and technical indicators like moving averages and relative strength index (RSI). Qualitative analysis involves considering macroeconomic factors, regulatory developments, technological advancements, and overall market sentiment. Data sources include reputable cryptocurrency exchanges (such as Coinbase, Binance, Kraken), financial news outlets (like Bloomberg and Reuters), and blockchain analytics platforms. The models employed account for factors like network hash rate, transaction volume, and on-chain metrics, all considered crucial indicators of Bitcoin’s health and adoption.

Visual Representation

The potential price range for Bitcoin on January 18th, 2025, can be visualized using a probability distribution chart. The chart would have the Bitcoin price (in USD) on the x-axis and the probability of that price being reached on the y-axis. The chart would depict a bell curve, with the peak of the curve situated around the neutral scenario ($75,000 – $125,000). The bullish scenario ($150,000 – $250,000) would be represented by a portion of the curve extending to the right, with a lower probability density compared to the peak. Similarly, the bearish scenario ($30,000 – $60,000) would be represented by a portion of the curve extending to the left, also with a lower probability density than the peak. The area under the curve represents the total probability, which is 100%. The specific shape and distribution of the curve would be determined by the statistical analysis of the data and the weighting given to each scenario based on the assessment of the relevant factors.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in January 2025 requires considering a complex interplay of macroeconomic conditions, regulatory landscapes, technological advancements, and investor sentiment. These factors are not independent; they interact in dynamic ways, making precise forecasting challenging but not impossible to analyze. Understanding their potential impact is crucial for navigating the cryptocurrency market.

Macroeconomic Factors

Global macroeconomic conditions will significantly influence Bitcoin’s price. High inflation, for instance, could drive investors towards Bitcoin as a hedge against currency devaluation, potentially boosting its price. Conversely, aggressive interest rate hikes by central banks to combat inflation might divert investment away from riskier assets like Bitcoin, leading to price declines. The overall global economic outlook – whether it’s experiencing growth or recession – will also play a substantial role. A strong global economy might encourage risk appetite, benefiting Bitcoin, while a recession could trigger a flight to safety, potentially reducing demand for the cryptocurrency. For example, the 2022 economic downturn saw a significant correction in Bitcoin’s price, largely attributed to investors seeking safer havens.

Regulatory Developments

Regulatory clarity and acceptance are vital for Bitcoin’s growth and price stability. Positive regulatory developments, such as the establishment of clear guidelines for cryptocurrency exchanges and the adoption of Bitcoin as a legitimate asset class by governments, could significantly increase institutional investment and drive up the price. Conversely, restrictive regulations, including outright bans or excessively stringent compliance requirements, could stifle adoption and negatively impact the price. The ongoing regulatory debates in various jurisdictions, including the US and the EU, highlight the significant uncertainty surrounding this factor and its potential impact. The SEC’s ongoing scrutiny of various crypto projects is a prime example of this regulatory uncertainty.

Technological Advancements

Technological advancements within the Bitcoin ecosystem and the broader cryptocurrency landscape will also influence Bitcoin’s price. The development and implementation of scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, potentially increasing Bitcoin’s usability and adoption. However, the emergence of competing cryptocurrencies with superior technological features could pose a challenge to Bitcoin’s dominance and potentially impact its price. The rise of Ethereum and its smart contract capabilities, for example, has presented a competitive alternative, demonstrating the potential influence of technological innovation on Bitcoin’s market share.

Institutional Adoption versus Retail Investor Sentiment

Institutional adoption and retail investor sentiment represent two distinct but interconnected forces driving Bitcoin’s price. Large-scale investments from institutional players, such as hedge funds and corporations, can inject significant liquidity into the market, leading to price increases. However, retail investor sentiment, characterized by periods of exuberance and fear, can cause significant price volatility. For example, the 2017 Bitcoin bubble was largely driven by retail investor enthusiasm, while subsequent market corrections have been partly attributed to shifts in retail investor confidence. The balance between these two forces significantly impacts the overall price trajectory.

Bitcoin’s Historical Price Performance and Trends

Bitcoin’s journey since its inception in 2009 has been marked by extreme volatility and significant price swings, reflecting both technological advancements and broader macroeconomic factors. Understanding this historical performance is crucial for contextualizing current market conditions and formulating any future price predictions, though it’s vital to remember that past performance is not necessarily indicative of future results.

Analyzing Bitcoin’s historical price movements reveals several distinct phases, characterized by periods of rapid growth interspersed with significant corrections. These cycles are often linked to specific events, technological developments, regulatory announcements, and shifts in investor sentiment. However, the inherent complexity of the cryptocurrency market makes precise predictions challenging.

Significant Price Movements and Influencing Events

The following table summarizes key milestones in Bitcoin’s price history, highlighting significant events that impacted its value. It’s important to note that this is not an exhaustive list, and many other factors have contributed to Bitcoin’s price fluctuations. The data presented here represents approximate values and should be verified against reliable sources for precise figures.

| Year | Approximate Price (USD) | Significant Events |

|---|---|---|

| 2009 | ~$0 | Bitcoin’s creation and initial release. |

| 2010 | ~$0.01 | Early adoption and the first real-world transaction (pizza purchase). |

| 2011 | ~$30 | Increased media attention and growing interest. |

| 2013 | ~$1,000 | Significant price surge, followed by a sharp correction. Increased regulatory scrutiny in some jurisdictions. |

| 2017 | ~$20,000 | Another major price surge fueled by increased institutional interest and media hype. The peak price was followed by a significant market correction. |

| 2020-2021 | ~$60,000 | Continued price appreciation driven by institutional adoption, DeFi growth, and pandemic-related economic uncertainty. Another correction followed this peak. |

| 2022-2023 | ~$16,000 – $30,000 (variable) | Market downturn influenced by macroeconomic factors, regulatory uncertainty, and the collapse of several prominent crypto projects. |

Limitations of Using Historical Data for Prediction

While studying Bitcoin’s past performance provides valuable context, it’s crucial to acknowledge the limitations of relying solely on historical data for future price predictions. The cryptocurrency market is relatively young and highly volatile, making it susceptible to unpredictable events and shifts in market sentiment. Past patterns may not repeat themselves, and new factors can emerge that significantly impact the price. Furthermore, the influence of regulatory changes, technological innovations, and macroeconomic conditions can be difficult to accurately forecast. Therefore, any prediction based solely on historical data should be treated with considerable caution.

Risk Assessment and Investment Considerations

Investing in Bitcoin, like any other asset class, presents a unique set of risks that potential investors must carefully consider before allocating capital. Understanding these risks is crucial for making informed decisions and managing potential losses. A thorough risk assessment is paramount to determining if Bitcoin aligns with your individual risk tolerance and overall investment strategy.

Bitcoin’s inherent volatility significantly impacts its price, leading to substantial gains or losses in short periods. This high volatility stems from several factors, including market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. The price can fluctuate dramatically in response to news events, social media trends, or even unfounded rumors, making it a highly speculative investment.

Volatility and Price Fluctuations

Bitcoin’s price history demonstrates its extreme volatility. For example, in 2021, Bitcoin reached an all-time high of nearly $69,000 before experiencing a significant correction, falling to below $30,000 within months. This illustrates the potential for rapid and substantial price swings, highlighting the need for investors to have a strong understanding of risk management strategies. Investors should be prepared for potentially significant losses, and only invest what they can afford to lose. The potential for rapid price appreciation is matched by an equally significant potential for rapid price depreciation.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is constantly evolving and varies significantly across different jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty about future regulations and their potential impact on Bitcoin’s price and accessibility. Changes in regulatory frameworks could range from outright bans to stricter compliance requirements, potentially impacting trading volumes and investor confidence. The lack of a unified global regulatory framework adds to the uncertainty. For example, some countries have embraced Bitcoin and other cryptocurrencies, while others have imposed restrictions or outright bans. This inconsistency creates challenges for investors trying to navigate the legal landscape.

Security Risks, Bitcoin USD Prediction For 18 January 2025

Bitcoin’s decentralized nature, while a strength in many respects, also presents security risks. The loss of private keys, which are essential for accessing Bitcoin wallets, can result in the permanent loss of funds. Furthermore, exchanges and custodial services where Bitcoin is held are susceptible to hacking and theft, as evidenced by several high-profile incidents in the past. Investors need to be vigilant about securing their private keys and choosing reputable and secure storage solutions. The security of exchanges and other custodial services is a critical consideration. Diligent research into the security practices of any service used to hold Bitcoin is crucial.

Comparison with Other Investment Options

Compared to traditional asset classes like stocks and bonds, Bitcoin carries a significantly higher risk profile. Stocks and bonds, while subject to market fluctuations, generally exhibit lower volatility than Bitcoin. Diversified portfolios containing stocks and bonds typically offer a more predictable return profile, albeit with lower potential upside. The risk-reward ratio for Bitcoin is significantly different, offering the potential for substantially higher returns but also the possibility of significantly larger losses. This higher risk profile requires a higher risk tolerance.

Diversification Strategies

To mitigate the risks associated with investing in Bitcoin, diversification is crucial. Including Bitcoin in a well-diversified portfolio alongside other asset classes, such as stocks, bonds, and real estate, can help reduce overall portfolio volatility and protect against significant losses in any single asset. The proportion of Bitcoin in a portfolio should depend on individual risk tolerance and investment goals. It’s advisable to consult with a qualified financial advisor to determine an appropriate allocation strategy. A diversified portfolio allows for a more balanced approach to investment, reducing reliance on any single asset’s performance.

Alternative Cryptocurrencies and Market Dynamics: Bitcoin USD Prediction For 18 January 2025

The cryptocurrency market is far from a one-horse race. While Bitcoin maintains a significant lead in market capitalization and recognition, the influence of alternative cryptocurrencies (altcoins) on its price and overall market dominance is substantial and deserves careful consideration when predicting Bitcoin’s future. The interplay between Bitcoin and altcoins is complex, influenced by factors ranging from technological advancements to market sentiment.

The overall cryptocurrency market capitalization significantly impacts Bitcoin’s value. Bitcoin’s market dominance, currently above 40%, fluctuates based on the collective performance of all cryptocurrencies. A bull market across the entire crypto space generally lifts Bitcoin’s price, while a bearish trend can exert considerable downward pressure. Conversely, Bitcoin’s price movements can also influence the altcoin market; a significant Bitcoin price surge often triggers an “altcoin season,” while a Bitcoin downturn frequently leads to widespread altcoin sell-offs.

Altcoin Competition and Bitcoin’s Market Dominance

Competing cryptocurrencies, each with unique features and target markets, constantly challenge Bitcoin’s dominance. Ethereum, for example, with its smart contract capabilities and decentralized application (dApp) ecosystem, has carved a significant niche. Other altcoins focus on specific areas like privacy (Monero), scalability (Solana), or decentralized finance (DeFi) (various projects). The success of these altcoins in attracting investment and user adoption can directly impact Bitcoin’s market share and, consequently, its price. A surge in the popularity of a particular altcoin could draw investment away from Bitcoin, leading to a temporary price dip.

Cryptocurrency Market Capitalization and Bitcoin’s Value

The total market capitalization of all cryptocurrencies serves as a barometer of overall market sentiment and investor confidence. A rising market cap generally suggests bullish sentiment, which can positively influence Bitcoin’s price, even if Bitcoin’s market share remains relatively stable. Conversely, a declining market cap often indicates a bearish outlook, putting downward pressure on Bitcoin’s price. For instance, during the 2022 crypto winter, the overall market capitalization plummeted, dragging Bitcoin’s price down significantly. The correlation isn’t always perfect, but a general trend is observable.

Altcoin Season and its Effect on Bitcoin’s Price

“Altcoin season” refers to periods where altcoins experience significant price increases relative to Bitcoin. This phenomenon often occurs after a prolonged period of Bitcoin dominance, where investors seek higher potential returns by diversifying into altcoins. During an altcoin season, capital flows out of Bitcoin and into other cryptocurrencies, which can lead to a temporary decline in Bitcoin’s price. However, these periods are often followed by a resurgence in Bitcoin’s price as investors re-allocate funds or the overall market sentiment improves. The 2021 bull run saw a prominent altcoin season, where numerous altcoins significantly outperformed Bitcoin before a subsequent correction.

Comparative Analysis of Bitcoin and Major Altcoins

The following table provides a simplified comparison of Bitcoin against several major altcoins. Note that this is not exhaustive and focuses on key differentiators. Specific features and functionalities are constantly evolving.

| Feature | Bitcoin (BTC) | Ethereum (ETH) | Solana (SOL) | Cardano (ADA) |

|---|---|---|---|---|

| Primary Function | Digital Gold, Store of Value | Smart Contracts, dApps | High-Throughput Blockchain | Smart Contracts, Scalability |

| Transaction Speed | Relatively Slow | Moderate | Very Fast | Moderate |

| Market Capitalization (as of [Insert Date – needs to be updated]) | [Insert Market Cap – needs to be updated] | [Insert Market Cap – needs to be updated] | [Insert Market Cap – needs to be updated] | [Insert Market Cap – needs to be updated] |

| Consensus Mechanism | Proof-of-Work | Proof-of-Stake | Proof-of-Stake | Proof-of-Stake |

Bitcoin USD Prediction For 18 January 2025 – Accurately predicting the Bitcoin USD price for January 18th, 2025, is challenging, requiring consideration of various market factors. To gain a broader perspective on potential price movements throughout 2025, it’s helpful to examine longer-term predictions; for instance, you might find the insights offered in this report on the Bitcoin Price May 2025 Prediction Bitcoin Price May 2025 Prediction valuable.

Understanding May’s potential price range can inform our understanding of the January prediction, offering a more comprehensive view of the cryptocurrency’s trajectory.

Accurately predicting the Bitcoin USD price for January 18th, 2025, is challenging, but considering the halving event’s impact is crucial. Many analysts reference Plan B’s model when formulating their predictions, so understanding his forecast is key; you can find his analysis on the Plan B Bitcoin Halving 2025 Prediction page. Ultimately, the Bitcoin USD price on that date will depend on a multitude of market factors beyond just the halving.

Accurately predicting the Bitcoin USD price for January 18th, 2025, requires considering various factors. A helpful comparison point might be to examine predictions for slightly later in the month; for instance, you can check out the detailed analysis offered at this link for a Bitcoin Price Prediction For 21 January 2025: Bitcoin Price Prediction For 21 January 2025.

Understanding those projections can offer valuable context when formulating your own expectations for the Bitcoin USD prediction for January 18th, 2025.

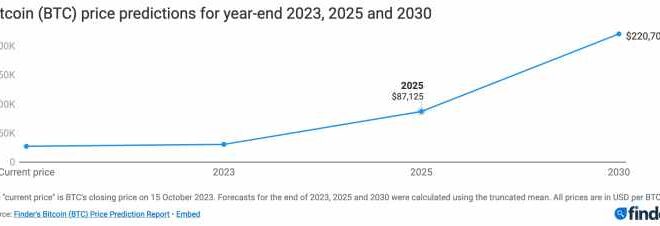

Predicting the Bitcoin USD price for January 18th, 2025, requires considering various factors, including broader market trends and technological advancements. To gain a better understanding of potential year-end values, it’s helpful to review broader predictions; for instance, you might find the analysis at Bitcoin 2025 End Of Year Prediction insightful. Ultimately, however, a precise Bitcoin USD prediction for January 18th, 2025, remains challenging due to inherent market volatility.

Accurately predicting the Bitcoin USD price on January 18th, 2025, is challenging, but understanding the factors influencing its trajectory is crucial. A key element to consider is the impact of the upcoming Bitcoin halving, and for detailed information on this event, check out the comprehensive data available at Halving Bitcoin Data 2025. This data will help contextualize any price predictions and potentially shed light on the Bitcoin USD value for that date.

Accurately predicting the Bitcoin USD price for January 18th, 2025, is challenging, requiring consideration of various market factors. To gain a broader perspective on potential price movements, it’s helpful to examine longer-term forecasts, such as those found in this comprehensive report on Prediction On Bitcoin 2025. Understanding the overall trajectory of Bitcoin’s value helps contextualize any specific short-term prediction for the Bitcoin USD price on January 18th, 2025.

Accurately predicting the Bitcoin USD price for January 18th, 2025, is challenging, requiring sophisticated models and market analysis. However, effective advertising can significantly influence market perception; consider optimizing your campaign strategy with a well-managed Google Ads Account to reach potential investors interested in Bitcoin’s future. Understanding the interplay between market sentiment and targeted advertising is key to navigating the complexities of Bitcoin USD Prediction For 18 January 2025.