Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event reducing the rate at which new Bitcoins are mined, is a significant occurrence in the cryptocurrency’s lifecycle. Scheduled for approximately 2025, this event is anticipated to have a considerable impact on Bitcoin’s price and overall market dynamics, though the extent of this impact remains a subject of ongoing debate and speculation within the crypto community. Understanding the mechanics of the halving, its historical impact, and the current market conditions is crucial for informed assessment.

Bitcoin Halving Mechanics and Historical Price Impact

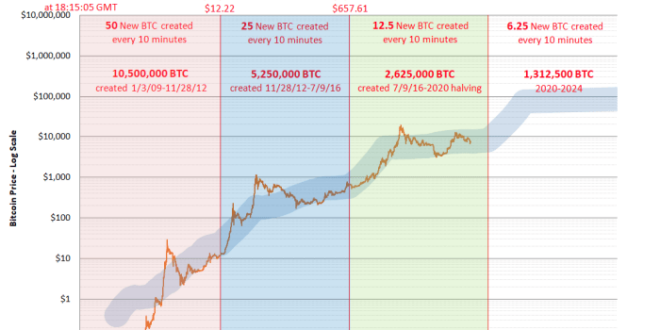

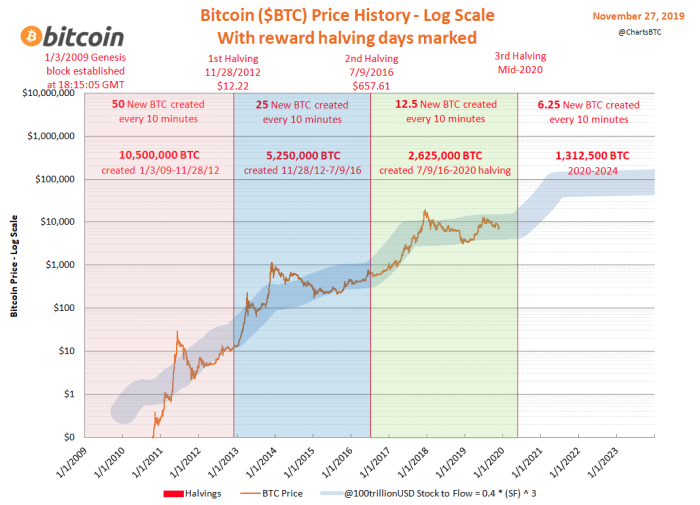

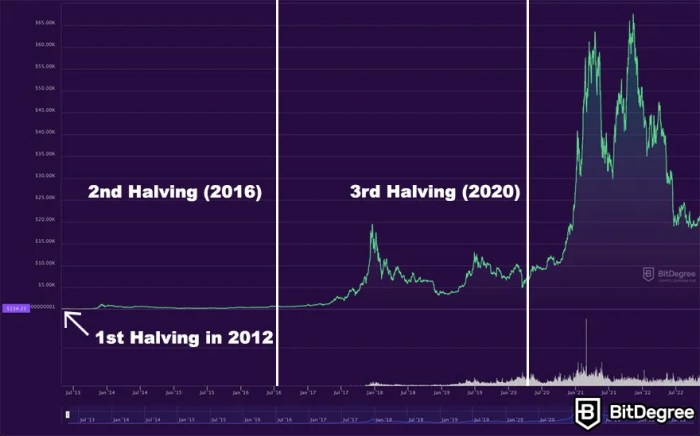

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Every 210,000 blocks mined (approximately every four years), the reward given to miners for verifying transactions and adding new blocks to the blockchain is cut in half. This process reduces the inflation rate of Bitcoin, creating a scarcity effect that many believe influences its price. Historically, Bitcoin’s price has generally seen an increase following each halving event, though the timing and magnitude of these price increases have varied significantly. This price appreciation is often attributed to the reduced supply of newly mined Bitcoin coupled with sustained or increased demand.

Timeline of Past Bitcoin Halvings and Price Movements

Date Of Halving Bitcoin 2025 – Analyzing past halvings provides valuable insights into potential future price action. Let’s examine the three previous halvings:

| Halving Date | Approximate Bitcoin Price Before Halving (USD) | Approximate Bitcoin Price After Halving (USD) | Timeframe for Price Increase | Market Conditions |

|---|---|---|---|---|

| November 2012 | ~$12 | ~$1000 (approx. 83x increase) | ~1 year | Early adoption, increasing awareness, relatively low market capitalization. |

| July 2016 | ~$650 | ~$20,000 (approx. 30x increase) | ~2 years | Growing institutional interest, increased media coverage, higher market capitalization. |

| May 2020 | ~$8,700 | ~$65,000 (approx. 7.5x increase) | ~1 year | Mainstream adoption, significant institutional investment, high market capitalization. |

It is important to note that the timeframes and magnitudes of price increases following each halving have been significantly different. The price increase after each halving has not been immediate and often took several months, even years to reach its peak. Other market factors beyond the halving itself have undoubtedly played a role in these price movements.

Pinpointing the exact Date Of Halving Bitcoin 2025 requires understanding the halving cycle. To determine this precise date, you’ll want to consult resources dedicated to predicting this event, such as this helpful guide: When Is The Halving Of Bitcoin 2025. Using this information, you can then accurately calculate the anticipated Date Of Halving Bitcoin 2025.

Comparison of Market Conditions Leading Up to the 2025 Halving, Date Of Halving Bitcoin 2025

The market conditions leading up to the 2025 halving differ significantly from previous cycles. While previous halvings occurred during periods of relatively nascent market development, the 2025 halving will take place in a more mature and regulated environment. Increased regulatory scrutiny, macroeconomic uncertainty (inflation, recessionary fears), and the emergence of competing cryptocurrencies are all factors that could influence Bitcoin’s price trajectory. The level of institutional investment and overall market sentiment will also play a crucial role.

Factors Influencing Bitcoin Price After the 2025 Halving

Several factors could influence Bitcoin’s price following the 2025 halving. Positive factors include the reduced inflation rate, continued institutional adoption, and increasing demand from retail investors. Negative factors include regulatory uncertainty, macroeconomic headwinds, and competition from alternative cryptocurrencies or technological advancements. The overall market sentiment and the prevailing economic climate will also play a crucial role.

Hypothetical Price Action Scenario Following the 2025 Halving

Let’s consider a hypothetical scenario. Assume that leading up to the halving, Bitcoin trades in a range of $30,000 – $40,000. Following the halving, we might see an initial price surge driven by anticipation and reduced supply. This could push the price to, say, $50,000 – $60,000 within six months. However, if macroeconomic conditions worsen, or regulatory pressures intensify, this rally could be short-lived, leading to a period of consolidation or even a price correction. Conversely, if institutional adoption continues to grow, and the broader market remains bullish, the price could potentially reach significantly higher levels, perhaps exceeding $100,000 within a year or two. This scenario, however, is purely speculative and dependent on numerous unpredictable factors. This is comparable to the 2020 halving where Bitcoin saw a gradual increase to its all-time high in 2021, but also experienced periods of correction along the way.

Investor Sentiment and Market Speculation

Bitcoin halving events have historically been associated with significant shifts in investor sentiment and considerable market speculation, impacting Bitcoin’s price trajectory. Understanding these dynamics is crucial for navigating the potential volatility surrounding the 2025 halving.

The anticipation surrounding a halving event typically creates a period of heightened market activity. This is driven by the fundamental principle of supply and demand: a reduced supply of newly mined Bitcoin, coupled with persistent demand, is theoretically expected to push prices higher. However, the actual price movements are far more complex and influenced by a multitude of factors beyond this simple supply-demand model.

Historical Trends in Investor Sentiment

Past halving events have shown a mixed bag of investor responses. The 2012 halving saw a relatively muted price reaction, while the 2016 halving was followed by a substantial price increase. The 2020 halving exhibited a more complex pattern, with a period of price consolidation before a significant surge. These varied outcomes highlight the influence of broader macroeconomic factors, regulatory changes, and overall market sentiment, which are often more influential than the halving itself. For example, the 2020 halving coincided with increased institutional interest in Bitcoin, which likely contributed to the eventual price rise.

Speculation and Market Manipulation

The period leading up to a halving event is often characterized by increased speculation. Traders anticipate the price increase and may engage in bullish strategies, potentially driving prices higher even before the actual halving occurs. Conversely, some market participants may engage in short-selling, betting on a price decline, either due to profit-taking after a pre-halving rally or because they believe the halving’s price impact will be less significant than anticipated. This interplay between bullish and bearish sentiment creates considerable volatility. While proving direct market manipulation is difficult, the potential for coordinated actions by large market players to influence price movements around halving events cannot be ignored.

Potential for Increased Volatility

The 2025 halving is likely to see increased market volatility, mirroring past events. The uncertainty surrounding macroeconomic conditions, regulatory developments, and the overall cryptocurrency market climate will significantly influence Bitcoin’s price. The period leading up to the halving might witness intense price swings driven by speculative trading and anticipation. Similarly, the post-halving period could see price corrections as traders take profits or adjust their positions based on the actual market response to the reduced Bitcoin supply. Consider the 2020 halving; while the price did eventually rise significantly, it experienced periods of both substantial gains and considerable drops in the months following the event.

Investor Perspectives on the 2025 Halving

Investor perspectives on the 2025 halving are diverse. Some believe the halving will trigger a significant price increase, citing the historical precedent and the fundamental principle of reduced supply. Others are more cautious, emphasizing the importance of macroeconomic factors and the potential for regulatory headwinds to dampen any positive price impact. Still others maintain a neutral stance, arguing that the halving’s effect is overstated and that other market forces will be more decisive in determining Bitcoin’s price. This range of opinions underscores the inherent uncertainty surrounding the event and highlights the need for careful risk assessment.

Assessing Risk Associated with Investing in Bitcoin

Investing in Bitcoin around the 2025 halving carries significant risk. The potential for price volatility is substantial, and investors could experience significant losses if the market moves contrary to their expectations. Thorough due diligence, including understanding the fundamental aspects of Bitcoin and the broader cryptocurrency market, is crucial. Diversification of investment portfolios, limiting exposure to Bitcoin, and adopting a long-term investment strategy can help mitigate some of the inherent risks. Moreover, a careful consideration of personal risk tolerance is paramount before making any investment decisions. It’s vital to remember that past performance is not indicative of future results, and that all investments carry a degree of risk.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event with potentially profound long-term consequences for the cryptocurrency’s value, market position, and global impact. Understanding these implications requires considering its effects on scarcity, adoption, and the broader financial landscape.

Bitcoin’s Scarcity and Value Proposition

The halving directly impacts Bitcoin’s inherent scarcity. By reducing the supply of newly minted coins, the halving increases the relative scarcity of existing Bitcoin. This, according to the fundamental principles of supply and demand, should exert upward pressure on its price, assuming demand remains consistent or increases. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. The long-term impact hinges on whether the increased scarcity outweighs any potential decrease in demand. The inherent deflationary nature of Bitcoin, amplified by the halving, is a key element of its value proposition as a store of value, contrasting with inflationary fiat currencies.

Bitcoin’s Position Within the Cryptocurrency Market

The 2025 halving is likely to significantly impact Bitcoin’s dominance within the broader cryptocurrency market. While alternative cryptocurrencies (altcoins) offer various functionalities and innovations, Bitcoin’s established network effects, first-mover advantage, and brand recognition remain considerable assets. A post-halving price surge could further solidify Bitcoin’s position as the leading cryptocurrency, potentially attracting more institutional and retail investors seeking exposure to the digital asset market. Conversely, a lack of substantial price appreciation could lead to increased interest in altcoins perceived as offering higher potential returns, albeit with potentially higher risk.

Adoption of Bitcoin as a Store of Value and Medium of Exchange

The long-term effects of the halving on Bitcoin’s adoption depend on various factors, including regulatory clarity, technological advancements, and overall macroeconomic conditions. Increased scarcity and potential price appreciation could boost Bitcoin’s appeal as a store of value, attracting investors seeking inflation hedges and portfolio diversification. However, its widespread adoption as a medium of exchange faces challenges related to volatility, transaction fees, and scalability. The halving itself doesn’t directly address these issues, but a significant price increase could indirectly improve its viability as a medium of exchange by reducing the impact of transaction fees relative to the asset’s value.

Impact on the Global Financial System

The long-term implications for the global financial system are complex and uncertain. Widespread Bitcoin adoption could challenge the dominance of fiat currencies and central banks, potentially leading to increased financial innovation and competition. However, the potential for Bitcoin to be used in illicit activities, its environmental impact through energy consumption, and its regulatory uncertainty remain significant concerns. The 2025 halving might accelerate the ongoing discussion and debate around Bitcoin’s role in the global financial architecture, potentially prompting regulatory responses and further technological developments to address the challenges associated with its growing influence.

Projected Long-Term Effects of the 2025 Halving

| Aspect | Before Halving | After Halving (Projected) | Long-Term Impact |

|---|---|---|---|

| Bitcoin Price | Variable, subject to market forces | Potential significant increase, followed by consolidation | Increased price volatility in the short term, potentially establishing a new higher price floor in the long term |

| Bitcoin Mining Difficulty | Relatively stable, adjusted periodically | Significant increase, reflecting the reduced block reward | Increased centralization risk if smaller miners are forced out of the network. This could be offset by technological advancements in mining efficiency. |

| Bitcoin Network Security | Strong, due to large hash rate | Potentially further strengthened by increased miner profitability (assuming price increase) | Enhanced security and resilience against attacks, provided price maintains or increases. |

| Bitcoin Adoption | Growing but still limited | Potential acceleration in adoption as a store of value, with slower adoption as a medium of exchange | Increased mainstream acceptance and institutional investment, but continued challenges related to scalability and regulatory uncertainty. |

Frequently Asked Questions (FAQs) about the Bitcoin Halving in 2025: Date Of Halving Bitcoin 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. Understanding its mechanics and potential impact is crucial for anyone involved in or observing the Bitcoin market. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed reduction in the rate at which new Bitcoins are created. This process is hardcoded into the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. The initial reward was 50 BTC per block, and it has been halved three times already, currently standing at 6.25 BTC per block.

The Exact Date of the 2025 Bitcoin Halving

The precise date of the 2025 halving is difficult to pinpoint with absolute certainty until the event nears. It’s dependent on the time it takes to mine 210,000 blocks. This time is variable, influenced by the computational power (hashrate) dedicated to mining Bitcoin. However, based on current mining rates, the halving is estimated to occur sometime in the Spring of 2025, likely around April or May. Previous halvings have provided a useful benchmark, though predicting the exact date requires close monitoring of the block generation rate in the months leading up to the event.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving. This is primarily attributed to the reduced supply of newly minted coins. The 2012 and 2016 halvings were followed by significant price rallies, although other market factors undoubtedly played a role. The 2020 halving also saw a price surge, but it’s important to note that this correlation isn’t guaranteed. Many other factors, including regulatory changes, macroeconomic conditions, and overall investor sentiment, influence Bitcoin’s price. It’s crucial to avoid viewing the halving as a guaranteed price predictor.

Buying Bitcoin Before the Halving: Risks and Rewards

Investing in Bitcoin before a halving presents both potential rewards and significant risks. The reduced supply could drive up demand, leading to price appreciation. However, the market is volatile, and prices can fluctuate dramatically based on numerous factors unrelated to the halving itself. Investing before a halving involves speculation; there’s no guarantee of profit. Thorough research, understanding your risk tolerance, and only investing what you can afford to lose are crucial considerations. The potential for significant gains needs to be weighed against the possibility of substantial losses.

Potential Risks Associated with the 2025 Halving

While the halving is often viewed positively, potential negative impacts exist. A sudden influx of sellers aiming to capitalize on anticipated price increases could lead to temporary price drops. Moreover, the cryptocurrency market is susceptible to external factors like regulatory changes or macroeconomic downturns, which could overshadow the halving’s effect. Furthermore, a decrease in miner profitability due to the halved reward might lead to some miners exiting the network, potentially impacting its security and stability, although this risk is mitigated by the fact that miners are incentivized by transaction fees as well as block rewards. It’s crucial to acknowledge that the halving is not a guaranteed path to riches and carries inherent risks.

Pinpointing the exact Date Of Halving Bitcoin 2025 requires careful analysis of the blockchain’s block generation times. For a detailed breakdown and potential date predictions, you might find the information presented at Bitcoin Halving 2025 Daye helpful. Ultimately, the Date Of Halving Bitcoin 2025 will be confirmed only upon the actual halving event itself.

Predicting the exact Date Of Halving Bitcoin 2025 requires careful analysis of the blockchain’s block generation times. Understanding the mechanics behind this event is crucial, and for more in-depth information, you might find the article on Halving De Bitcoin 2025 helpful. This resource provides valuable context for accurately estimating the Date Of Halving Bitcoin 2025, a key date for Bitcoin investors.

Pinpointing the exact Date Of Halving Bitcoin 2025 requires careful consideration of the Bitcoin network’s block generation times. To stay updated on the projected date, a reliable resource is crucial; for precise predictions, check out this comprehensive analysis on the Date For Bitcoin Halving 2025. Understanding this date is key to forecasting potential market impacts related to the Date Of Halving Bitcoin 2025.

Pinpointing the exact Date Of Halving Bitcoin 2025 requires careful consideration of the Bitcoin network’s block generation times. To stay updated on the projected date, a reliable resource is crucial; for precise predictions, check out this comprehensive analysis on the Date For Bitcoin Halving 2025. Understanding this date is key to forecasting potential market impacts related to the Date Of Halving Bitcoin 2025.

Pinpointing the exact Date Of Halving Bitcoin 2025 requires careful consideration of the block reward reduction mechanism. To stay updated on the precise timing and implications of this significant event, regularly check a reliable countdown, such as the one provided by Bitcoin Halving Countdown 2025. This resource will help you accurately anticipate the Date Of Halving Bitcoin 2025 and its potential market effects.