Bitcoin 2025 Halving

The Bitcoin halving, a programmed event occurring roughly every four years, reduces the rate at which new Bitcoins are mined. This event has historically been associated with significant shifts in Bitcoin’s price and market sentiment. Understanding the historical impact and considering current economic factors is crucial for anticipating the potential effects of the 2025 halving.

Historical Impact of Previous Halvings

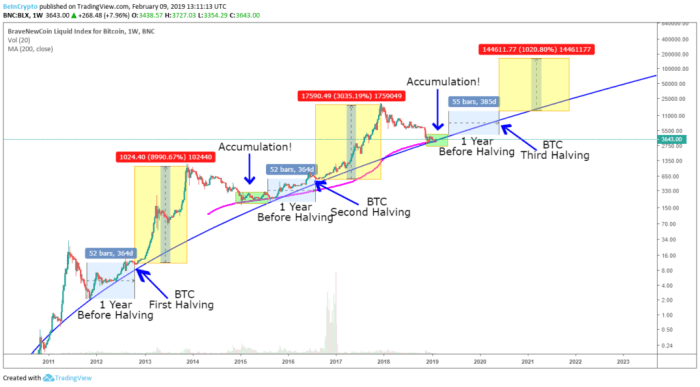

Previous Bitcoin halvings have demonstrably influenced both price and market sentiment. The 2012 halving saw a gradual price increase in the following months and years, while the 2016 halving preceded a substantial bull run. The 2020 halving also led to a significant price surge, although the market dynamics were complex and influenced by various other factors. While a direct causal link isn’t definitively proven, the halving’s impact on the supply of newly minted Bitcoin undeniably creates a scarcity effect, potentially influencing investor behavior and driving demand. The reduced supply, combined with sustained or increased demand, is a key element in the price increase observed following previous halvings.

Economic Factors Influencing Bitcoin’s Price in 2025

Several economic factors will likely influence Bitcoin’s price in 2025, both leading up to and following the halving. These include macroeconomic conditions such as inflation rates, interest rates set by central banks, and the overall state of the global economy. The adoption of Bitcoin by institutional investors and governments will also play a crucial role. Furthermore, technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s expansion, could significantly impact transaction speeds and costs, thus influencing adoption and price. Finally, the level of regulatory clarity and acceptance of Bitcoin in various jurisdictions will be a significant determinant. For example, the growing acceptance of Bitcoin as a legitimate asset class by institutional investors, as seen in recent years with companies like MicroStrategy holding substantial Bitcoin reserves, could lead to increased demand.

Comparison of Market Conditions Leading Up to Past Halvings

Comparing the market conditions leading up to the 2025 halving with those preceding previous halvings reveals both similarities and differences. The 2012 and 2016 halvings occurred during periods of relatively lower market capitalization and less mainstream awareness of Bitcoin. The 2020 halving, however, took place after Bitcoin had already achieved significantly greater recognition and adoption. The current market situation presents a unique set of circumstances. While Bitcoin’s market capitalization is substantially larger than in previous cycles, the regulatory landscape remains uncertain in many jurisdictions. The level of institutional adoption is also significantly higher, which could potentially dampen the volatility observed in previous cycles. The degree of mainstream adoption is also a key differentiating factor.

Potential Impact of Regulatory Changes

Regulatory changes can profoundly impact Bitcoin’s price, both before and after the halving. Clear and favorable regulations could boost investor confidence and attract institutional investment, potentially leading to price appreciation. Conversely, unfavorable or overly restrictive regulations could suppress price growth or even trigger a market downturn. The ongoing debate surrounding Bitcoin’s regulatory status in various countries highlights the uncertainty. For instance, a country implementing a clear and favorable regulatory framework for Bitcoin could significantly increase demand, potentially driving up the price. Conversely, a sudden crackdown or ban in a major market could cause a significant price drop.

Price Predictions and Market Sentiment

Predicting Bitcoin’s price is notoriously difficult, influenced by a complex interplay of factors. The 2025 halving, while a significant event, is just one piece of the puzzle. We’ll explore potential price scenarios, considering institutional investment, adoption rates, and macroeconomic conditions.

Price predictions for Bitcoin in 2025 vary wildly depending on the source and their underlying assumptions. The halving will undoubtedly impact the supply of newly mined Bitcoin, potentially increasing scarcity and driving up demand. However, other factors, such as regulatory changes, technological advancements, and overall market sentiment, could significantly influence the actual price.

Potential Bitcoin Price Scenarios for 2025, Bitcoin 2025 Halving Prediction

Several scenarios are plausible, ranging from conservative to bullish. A conservative estimate might place Bitcoin’s price somewhere between $100,000 and $150,000 by the end of 2025, assuming relatively stable market conditions and continued institutional adoption. A more bullish prediction, factoring in increased adoption and positive macroeconomic factors, could see the price reaching $250,000 or even higher. Conversely, a bearish scenario, considering factors like increased regulatory scrutiny or a major market downturn, could see the price remain below $100,000. These scenarios are not mutually exclusive and the actual price will likely fall somewhere within this range, or potentially outside of it. For example, a significant technological breakthrough or widespread adoption in a major economy could drastically shift the price upwards. Conversely, a major security breach or regulatory crackdown could negatively impact the price.

Influence of Institutional Investors and Large-Scale Adoption

The growing involvement of institutional investors is a key factor shaping Bitcoin’s price trajectory. Large-scale investments from hedge funds, corporations, and even sovereign wealth funds can inject significant liquidity into the market, driving up demand and pushing prices higher. Similarly, increased adoption by businesses and individuals, particularly in developing economies with high inflation, can significantly increase demand. The successful integration of Bitcoin into existing financial systems would further accelerate this trend. For instance, if a major payment processor like PayPal significantly expands its Bitcoin integration, it could trigger a surge in demand and price. Conversely, a lack of institutional interest or negative news regarding adoption could negatively impact price.

Expert Opinions and Forecasts

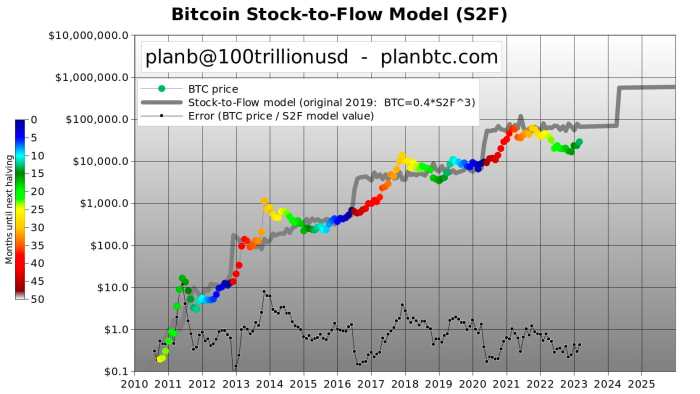

Several reputable sources in the cryptocurrency industry offer varying price predictions. While it’s impossible to definitively state which prediction will be accurate, analyzing a range of expert opinions provides a broader perspective. Some analysts point to historical price trends following previous halvings, while others focus on on-chain metrics and network activity to inform their predictions. It’s crucial to remember that these are predictions, not guarantees, and that unforeseen events can significantly alter the market. For example, PlanB, a well-known on-chain analyst, has previously offered price predictions based on the Stock-to-Flow model, although these predictions haven’t always aligned perfectly with market reality.

Hypothetical Scenario: Interplay of Factors

Let’s consider a hypothetical scenario: Assume a successful regulatory framework emerges in the US, fostering greater institutional confidence. Simultaneously, a major technology company announces plans to integrate Bitcoin payments, sparking widespread adoption among consumers. Coupled with the 2025 halving, this confluence of positive factors could lead to a significant surge in demand, potentially pushing Bitcoin’s price well above $250,000. However, if, in this same scenario, a major global economic downturn occurs, this could counteract the positive factors and limit the price increase, even with the halving and increased adoption. The interplay of these various economic and technological forces highlights the inherent uncertainty in predicting Bitcoin’s price.

Mining and Network Security Post-Halving: Bitcoin 2025 Halving Prediction

The Bitcoin halving, occurring approximately every four years, reduces the block reward miners receive for verifying transactions and adding new blocks to the blockchain. This directly impacts miner profitability, potentially influencing the network’s security and decentralization. Understanding the mechanics of mining and the historical responses to previous halvings is crucial for predicting the outcome of the 2025 event.

The process of Bitcoin mining involves solving complex cryptographic puzzles using specialized hardware (ASICs). Miners compete to solve these puzzles first, and the first to do so gets to add the next block to the blockchain and claim the block reward. The halving cuts this reward in half. Prior to the halving, miners earn a certain amount of Bitcoin per block. After the halving, this amount is reduced, leading to decreased revenue for each block mined unless the price of Bitcoin increases proportionally. This reduction in profitability necessitates adjustments within the mining industry.

Miner Profitability and the Halving

Miner profitability is determined by several factors: the block reward, the price of Bitcoin, mining difficulty, electricity costs, and the efficiency of mining hardware. The halving directly impacts the block reward, the most significant component of miner revenue. For example, the 2020 halving reduced the block reward from 12.5 BTC to 6.25 BTC. While the price of Bitcoin subsequently rose, many miners still faced reduced profitability in the short term. This situation necessitates a careful analysis of the interplay between the halving, Bitcoin’s price, and operational costs to accurately predict the post-halving mining landscape. Miners often adjust their operations by upgrading to more efficient hardware, seeking cheaper energy sources, or consolidating operations to maintain profitability.

Impact on Network Security and Decentralization

The Bitcoin network’s security relies on the collective computing power of its miners, measured by the hashrate. A higher hashrate makes it computationally infeasible for attackers to alter the blockchain. Reduced miner profitability post-halving could lead to some miners leaving the network, potentially lowering the hashrate. This decrease could theoretically make the network more vulnerable to attacks, though the extent of the vulnerability is debatable and depends on several factors, including the price of Bitcoin. Decentralization, the distribution of mining power across many entities, is also at stake. If large mining pools become disproportionately dominant due to the exit of smaller miners, it could compromise decentralization.

Hashrate and Mining Difficulty Adjustments

Historically, Bitcoin’s hashrate has generally increased following halvings, despite the reduced block reward. This is largely attributed to the price of Bitcoin often rising after halvings, offsetting the reduced reward. Mining difficulty, a measure of how hard it is to solve the cryptographic puzzles, automatically adjusts to maintain a consistent block time of approximately 10 minutes. After a halving, the difficulty initially remains relatively stable or increases slowly. The increase in difficulty reflects the continued competition for the reduced block reward. For instance, comparing the hashrate and difficulty before and after the 2016 and 2020 halvings reveals a generally upward trend in hashrate despite the halved reward. This suggests that market forces and technological advancements tend to outweigh the immediate negative impact of the halving on the network’s security.

Miner Responses to Reduced Profitability

Miners employ various strategies to adapt to reduced profitability. These include upgrading to more energy-efficient ASICs, consolidating mining operations to achieve economies of scale, relocating to regions with cheaper electricity, and diversifying revenue streams by offering other services alongside mining, such as hosting nodes or participating in staking for other cryptocurrencies. The extent to which these strategies are effective will depend on the price of Bitcoin and the overall market conditions. Some miners may choose to shut down their operations entirely if the reduced profitability becomes unsustainable, leading to a temporary decrease in the hashrate before market forces and technological advancements re-establish a new equilibrium.

Predicting the Bitcoin 2025 halving’s impact is a complex endeavor, involving numerous factors influencing price volatility. Understanding the mechanics of this event is crucial, and a good resource for this is the comprehensive guide on the Bitcoin Halving Event 2025. Ultimately, Bitcoin 2025 Halving Prediction remains speculative, yet informed analysis of past halvings can offer valuable insights.

Predicting the Bitcoin 2025 halving’s impact on price is a popular pastime among crypto enthusiasts. Understanding the precise date of this event is crucial for accurate forecasting, and for that information, you can check out this useful resource: Halving Bitcoin 2025 Fecha. Ultimately, the Bitcoin 2025 Halving Prediction remains a subject of ongoing discussion and analysis within the cryptocurrency community.

Predicting the Bitcoin 2025 halving’s impact on price is a complex undertaking, involving numerous factors. Understanding the mechanics of the halving itself is crucial for any accurate prediction; for a detailed explanation, refer to this helpful resource: Que Es El Halving Bitcoin 2025. Ultimately, the Bitcoin 2025 halving prediction remains a subject of ongoing debate and analysis within the cryptocurrency community.

Predicting the Bitcoin 2025 halving’s impact is a complex task, involving numerous factors influencing price volatility. A key aspect of these predictions hinges on knowing the precise date of the halving, which you can find out by visiting this resource: When Is The Halving Of Bitcoin 2025. Understanding the timing is crucial for accurately forecasting the potential market consequences of the Bitcoin 2025 halving.

Predicting the Bitcoin 2025 halving’s impact on price is a popular pastime, with many analysts offering diverse forecasts. A key factor in these predictions is understanding the precise timing of the event; to clarify this, you might find it helpful to check this resource on When Was The Bitcoin Halving In 2025. Knowing the exact date allows for more accurate modeling of the subsequent supply reduction and its potential market effects on Bitcoin 2025 Halving Prediction.

Predicting the Bitcoin 2025 halving’s impact on price is a popular pastime, with many analysts offering diverse forecasts. A key factor in these predictions is understanding the precise timing of the event; to clarify this, you might find it helpful to check this resource on When Was The Bitcoin Halving In 2025. Knowing the exact date allows for more accurate modeling of the subsequent supply reduction and its potential market effects on Bitcoin 2025 Halving Prediction.