Bitcoin Halving and Miner Economics

The Bitcoin halving, a pre-programmed event reducing the block reward paid to miners, significantly impacts the economics of Bitcoin mining. This event, occurring approximately every four years, forces miners to adapt their operational strategies to maintain profitability in a constantly evolving landscape. Understanding these impacts is crucial for assessing the long-term sustainability of the Bitcoin network.

The halving directly reduces miners’ revenue. With fewer bitcoins awarded for successfully validating transactions and adding blocks to the blockchain, miners’ income per block is cut in half. This necessitates adjustments to maintain operational profitability.

Miner Profitability and Operational Strategies After Halving, Bitcoin Halving 2025 Date And Time

The immediate impact of a halving is a decrease in miner revenue. This reduction can lead to several outcomes. Some less-efficient miners, those with higher operating costs (e.g., older equipment, higher electricity prices), may become unprofitable and be forced to shut down operations. This process, often referred to as a “miner capitulation,” can temporarily reduce the network’s hashrate (the total computational power securing the network). However, historically, the hashrate has generally recovered after a period of adjustment. Miners often respond by increasing efficiency, upgrading their equipment to newer, more energy-efficient models, or seeking locations with lower electricity costs. The competition among miners to maintain profitability leads to innovation and efficiency gains within the industry.

Potential Miner Adjustments to Reduced Block Rewards

Miners employ several strategies to counter the reduced block rewards. One common approach is to upgrade their mining hardware to more efficient models, thereby reducing their operating costs per unit of hash power. This allows them to maintain profitability even with a smaller block reward. Another strategy involves relocating mining operations to regions with lower electricity prices. Countries with abundant hydroelectric power or other cheap energy sources often become attractive locations for Bitcoin mining. Furthermore, miners may diversify their revenue streams. This could include participating in other activities like providing mining services to others, earning fees from transaction processing, or engaging in activities related to Bitcoin’s lightning network.

Long-Term Sustainability of Bitcoin Mining

The long-term sustainability of Bitcoin mining is a complex issue dependent on several factors. The halving events are designed into the Bitcoin protocol to control inflation and maintain the scarcity of Bitcoin. While individual miners may face challenges, the network’s overall security and sustainability are not necessarily threatened. Historically, halvings have been followed by periods of price appreciation for Bitcoin, potentially offsetting the reduced block reward. However, this is not guaranteed. The ongoing development of more energy-efficient mining hardware, exploration of renewable energy sources for mining, and the overall adoption of Bitcoin as a store of value and medium of exchange will all play a significant role in determining the long-term sustainability of Bitcoin mining. The interplay between technological advancements, regulatory environments, and market forces will ultimately shape the future of Bitcoin mining.

The Halving’s Influence on Bitcoin Adoption and Usage: Bitcoin Halving 2025 Date And Time

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is anticipated to have a multifaceted impact on Bitcoin’s adoption and usage by both individuals and businesses. While the precise effects remain subject to market dynamics, several key areas are expected to be influenced. The reduced supply, coupled with sustained or increased demand, could potentially lead to price appreciation, impacting both the perception and accessibility of Bitcoin.

The halving’s effect on Bitcoin adoption will be complex, intertwined with broader macroeconomic factors and technological advancements. A price increase following the halving could make Bitcoin a more attractive investment, leading to increased adoption by individuals seeking higher returns. Conversely, a significant price surge could also price out potential users, hindering wider adoption. The interplay between these forces will shape the overall impact.

Bitcoin Adoption by Individuals

Increased price volatility following a halving could attract speculative investors, leading to a short-term surge in adoption. However, sustained adoption hinges on factors beyond price fluctuations, such as user-friendliness, regulatory clarity, and the development of robust infrastructure supporting Bitcoin transactions. For example, the widespread adoption of simpler payment methods like Lightning Network could make Bitcoin more accessible to everyday users, mitigating the negative impact of potential price increases. Conversely, increased regulatory scrutiny or negative media coverage could dampen adoption regardless of price movements.

Bitcoin Adoption by Businesses

Businesses may view a post-halving price increase as a potential hedge against inflation or a store of value, prompting them to incorporate Bitcoin into their treasury management strategies. However, the volatility inherent in Bitcoin remains a significant barrier to widespread business adoption. The cost and complexity of integrating Bitcoin into existing payment systems also present challenges. Successful adoption by businesses will likely depend on the development of more user-friendly and cost-effective solutions, alongside increasing regulatory clarity around the use of Bitcoin for commercial transactions. Companies like MicroStrategy, which have already invested heavily in Bitcoin, demonstrate a path towards corporate adoption, but this remains a niche segment for now.

Influence on Bitcoin-Related Applications and Services

A price increase after the halving could stimulate investment in Bitcoin-related technologies and services. This could lead to improvements in wallet security, transaction speed, and the development of innovative applications built on the Bitcoin blockchain. Increased demand for services like custodial solutions and Bitcoin-focused financial products could also result. However, the success of these ventures depends on factors beyond the halving itself, such as market demand, technological feasibility, and competitive landscape. The development of decentralized finance (DeFi) applications built on Bitcoin’s layer-2 solutions, for instance, could significantly boost its usage and adoption if these solutions gain wider acceptance and prove to be scalable and user-friendly.

Comparison with Other Cryptocurrencies

The halving’s impact on Bitcoin adoption needs to be considered in the context of the broader cryptocurrency market. Other cryptocurrencies also experience periods of price volatility and technological development, and some have their own forms of supply adjustments. However, Bitcoin’s first-mover advantage, brand recognition, and established network effect give it a significant edge. While other cryptocurrencies might experience short-term gains or losses in response to Bitcoin’s price movements, Bitcoin’s long-term trajectory is likely to remain relatively independent. The relative scarcity of Bitcoin, further emphasized by the halving, could make it a more resilient asset compared to cryptocurrencies with less constrained supply.

Frequently Asked Questions (FAQ) about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its price, mining profitability, and overall network security. Understanding its mechanics and potential consequences is crucial for anyone involved in the Bitcoin ecosystem. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the block reward in half, meaning miners receive fewer Bitcoins for verifying transactions and adding new blocks to the blockchain. This built-in deflationary mechanism is designed to control inflation and maintain the long-term value of Bitcoin.

Predicted Date and Time of the 2025 Halving

Predicting the exact date and time of the 2025 halving requires monitoring the Bitcoin blockchain’s block generation rate. While the average block time is approximately 10 minutes, it fluctuates due to various factors including network hashrate and difficulty adjustments. Therefore, pinpointing the exact moment is difficult until the event is imminent. However, based on the consistent block generation rate, estimations place the halving around April 2025. The specific time will be determined as the 210,000th block approaches its mining.

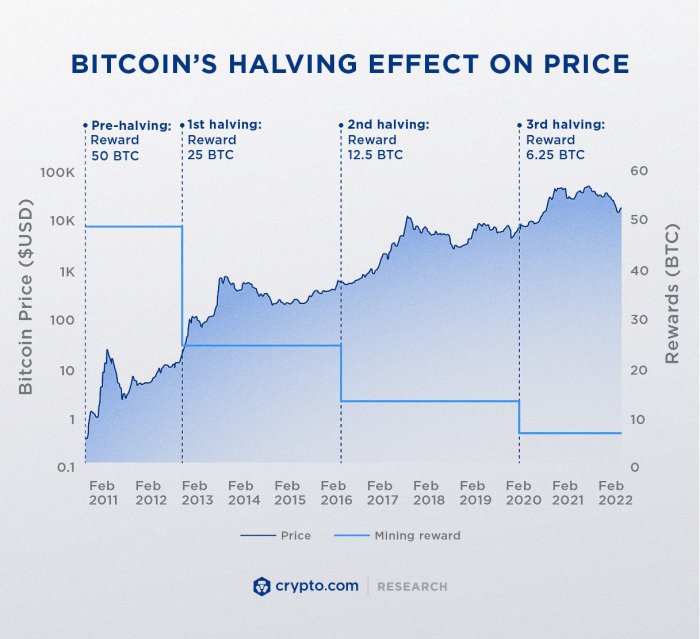

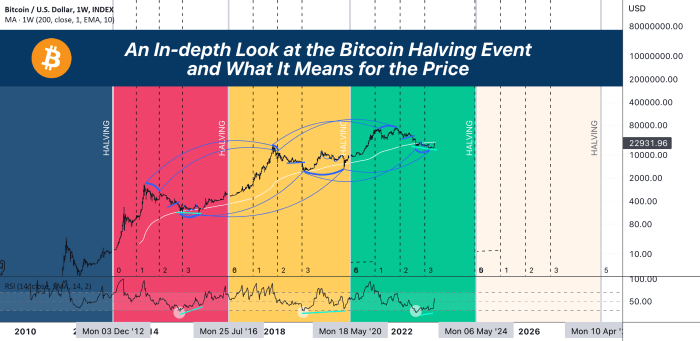

The Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has experienced periods of increased volatility and, often, significant price appreciation following previous halvings. This is attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving demand. However, it’s crucial to remember that numerous factors influence Bitcoin’s price, and past performance is not indicative of future results. The 2025 halving’s impact on price will depend on a confluence of factors including macroeconomic conditions, regulatory developments, and overall market sentiment. For example, the 2016 halving was followed by a significant price increase, while the 2020 halving saw a more gradual rise, influenced by other market forces.

Impact on Bitcoin Miners

The halving directly reduces miners’ revenue per block. This can lead to decreased profitability, forcing some less-efficient miners to shut down their operations. The impact varies depending on miners’ operating costs (electricity, hardware, etc.). Miners with lower operating costs are better positioned to withstand the reduced block reward. The halving often leads to a period of consolidation in the mining industry, with more efficient, larger-scale operations surviving and potentially gaining market share. This can contribute to a more centralized mining landscape, although the overall network security typically remains robust.

Long-Term Impact on Bitcoin’s Value

The long-term effect of the halving on Bitcoin’s value is a subject of ongoing debate. Proponents argue that the reduced inflation rate contributes to Bitcoin’s scarcity and increases its long-term value proposition as a store of value. However, other factors like technological advancements, regulatory changes, and competing cryptocurrencies could influence its price trajectory. Long-term price predictions are inherently speculative. Past halvings have shown a tendency for price increases in the medium term, but the magnitude and duration of these increases are unpredictable. The 2025 halving’s long-term impact will depend on a variety of interconnected economic and technological factors, making definitive predictions challenging.

Illustrative Examples of Past Halving Impacts

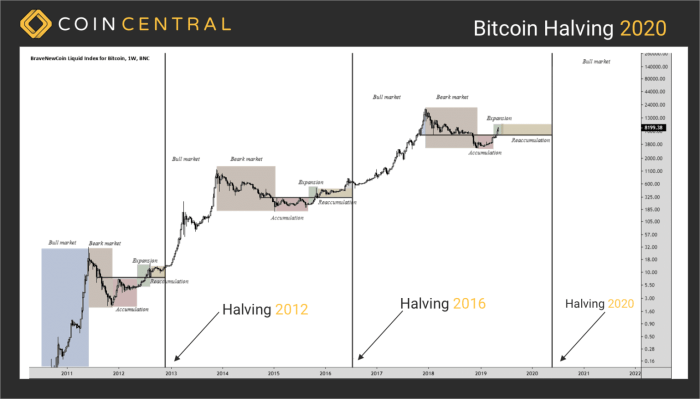

Analyzing previous Bitcoin halvings provides valuable insights into the potential consequences of the 2025 event. By examining the price movements, mining difficulty adjustments, and network activity surrounding past halvings, we can gain a better understanding of the likely impacts. It’s crucial to remember, however, that past performance is not necessarily indicative of future results, and other market factors always play a significant role.

The Bitcoin halving, which occurs approximately every four years, reduces the rate at which new Bitcoins are created. This reduction in supply has historically been associated with price increases, though the extent and timing of these increases vary. The impact on mining is also significant, forcing miners to adapt to reduced rewards and increased competition.

The 2012 Halving

The first Bitcoin halving occurred in November 2012. Prior to the halving, the block reward was 50 BTC. After the halving, it dropped to 25 BTC. The price of Bitcoin experienced a period of consolidation following the halving, before a substantial price increase began several months later. This demonstrates the often delayed impact of the halving on price. The mining difficulty adjusted accordingly, reflecting the reduced block reward and the ongoing competition for block rewards. Network activity, measured by transaction volume and hash rate, also generally increased in the period following the halving, though it is difficult to isolate this increase from other market forces.

The 2012 halving showed a delayed but significant price increase, highlighting the complex interplay between halving effects and overall market sentiment. The adjustment of mining difficulty reflected the reduced reward, demonstrating the mechanism’s effectiveness.

The 2016 Halving

The second halving, in July 2016, reduced the block reward from 25 BTC to 12.5 BTC. This halving was followed by a more pronounced and rapid price increase compared to the 2012 event. The price began to rise noticeably in the months leading up to the halving, indicating anticipation of the event’s impact. Mining difficulty again adjusted to reflect the reduced reward, and the network hash rate experienced a gradual increase post-halving. This increase reflects the continued investment in mining infrastructure despite the lower reward per block.

The 2016 halving demonstrated a more immediate and significant price reaction than the 2012 halving, suggesting that market awareness and anticipation play a crucial role.

The 2020 Halving

The third halving, in May 2020, saw the block reward reduced from 12.5 BTC to 6.25 BTC. This halving coincided with a period of significant growth in the overall cryptocurrency market, making it challenging to isolate the halving’s specific impact on price. However, the price of Bitcoin did see a substantial rise in the months following the halving. The network hash rate continued its upward trajectory, demonstrating the resilience and growth of the Bitcoin network despite the reduced block rewards. The mining difficulty, as in previous halvings, adjusted in response to the reduced reward and the overall network hash rate.

The 2020 halving occurred during a broader bull market, making it difficult to definitively attribute price increases solely to the halving. However, the continued growth in network hash rate highlighted the enduring attractiveness of Bitcoin mining despite the reduced rewards.

Network Hash Rate Changes Around Halving Events

Visualizing the network hash rate changes around previous halvings would show a generally upward trend, though not always linear. The immediate post-halving period might show a slight dip or plateau as miners adjust to the reduced profitability, followed by a resumption of growth as new miners enter the market or existing miners increase their hash power. The rate of increase would vary depending on several factors, including the overall state of the cryptocurrency market, the price of Bitcoin, and the cost of energy. The overall pattern, however, would illustrate the persistent growth and resilience of the Bitcoin network. A descriptive representation would show a graph starting at a certain point, gradually increasing, possibly with minor dips or plateaus around the halving events, but ultimately continuing its upward trajectory. The slope of the increase would vary between halvings reflecting the changing market conditions.