Market Predictions and Analyst Opinions

The Bitcoin halving in 2025, and its potential impact on both Bitcoin and Ethereum, is a subject of considerable debate among market analysts. Predicting the future price of cryptocurrencies is inherently difficult, influenced by a complex interplay of technical factors, regulatory developments, and macroeconomic trends. However, by examining the opinions of reputable analysts, we can gain a clearer understanding of the range of possible outcomes.

Bitcoin Halving 2025 Ethereum – Several factors contribute to the diversity of predictions. The macroeconomic environment, including inflation rates, interest rate policies, and overall economic growth, significantly impacts investor sentiment and risk appetite. Regulatory clarity (or lack thereof) in various jurisdictions also plays a crucial role, influencing institutional investment and market stability. Finally, the technological advancements and adoption rates within the cryptocurrency ecosystem itself are key determinants of long-term price movements.

Analyst Predictions Post-Halving

The following table summarizes predictions from various analysts, categorized by their overall outlook. It’s important to remember that these are just opinions, and past performance is not indicative of future results. Always conduct your own thorough research before making any investment decisions.

The upcoming Bitcoin Halving in 2025 is a significant event expected to impact both Bitcoin and other cryptocurrencies, including Ethereum. Its effect on Ethereum’s price and market position is a subject of much debate. For detailed predictions on the Bitcoin Halving’s overall consequences, check out this insightful analysis: Bitcoin Halving 2025 Prediction. Understanding this prediction is crucial for assessing the potential ripple effects on the Ethereum ecosystem and its future trajectory.

| Analyst | Perspective | Prediction (Example) | Influencing Factors |

|---|---|---|---|

| Analyst A (Example) | Bullish | Bitcoin price to reach $150,000 by 2026 due to increased scarcity and institutional adoption. | Increased institutional investment, positive regulatory developments in key markets. |

| Analyst B (Example) | Neutral | Bitcoin price to consolidate around $50,000-$75,000 in the short term, with potential for further growth depending on macroeconomic conditions. | Global economic uncertainty, potential regulatory crackdowns. |

| Analyst C (Example) | Bearish | Bitcoin price to experience a significant correction post-halving due to overvaluation and potential regulatory hurdles. | High inflation, rising interest rates, stricter regulatory frameworks. |

| Analyst D (Example) | Bullish | Ethereum price to surpass $5,000 due to increased DeFi activity and network upgrades. | Growing adoption of Ethereum for decentralized finance applications, successful implementation of sharding. |

Impact on Investors and the Cryptocurrency Market

The Bitcoin halving in 2025, and its potential ripple effects on Ethereum, presents a complex investment landscape. Understanding how this event might impact different investor profiles is crucial for navigating the market’s volatility. The reduced supply of newly mined Bitcoin, traditionally associated with price increases, creates both opportunities and risks for investors. Similarly, Ethereum’s price may experience correlated movements due to its position as a leading cryptocurrency.

The halving’s impact will vary significantly depending on an investor’s timeline and risk tolerance. Long-term holders, often known as “hodlers,” may view the halving as a positive catalyst, anticipating future price appreciation. Conversely, short-term traders might see increased volatility as an opportunity for quick profits, but also face higher risk of losses.

Impact on Long-Term Holders

Long-term investors typically prioritize capital appreciation over short-term gains. For Bitcoin, historical data suggests that halving events have been followed by periods of significant price increases. This is due to the reduced inflation rate of Bitcoin, making it potentially more scarce and valuable. However, this is not guaranteed, and external factors like macroeconomic conditions and regulatory changes can significantly influence the price. Ethereum’s price movement after Bitcoin halvings is less predictable but often shows some correlation. A long-term strategy might involve accumulating Bitcoin and Ethereum before or immediately after the halving, expecting gradual appreciation over several years. This approach minimizes the impact of short-term price fluctuations.

Impact on Short-Term Traders

Short-term traders, aiming for quick profits, might employ strategies like day trading or swing trading around the halving event. The increased volatility leading up to and following the halving can present opportunities for significant gains. However, the risk of substantial losses is equally high. Accurate market timing is crucial, and even experienced traders can suffer losses during periods of extreme volatility. Short-term traders often leverage technical analysis to identify potential entry and exit points, but relying solely on technical indicators without considering fundamental factors can be perilous.

Risk and Reward Comparison: Bitcoin vs. Ethereum

Bitcoin, as the oldest and most established cryptocurrency, generally exhibits lower volatility than many altcoins, including Ethereum. However, its market capitalization is significantly larger, meaning that substantial price movements require enormous amounts of capital. Ethereum, while more volatile, offers potentially higher returns due to its role in the decentralized finance (DeFi) ecosystem and its ongoing technological development. Investing in Bitcoin around the halving presents a lower-risk, potentially lower-reward scenario, while investing in Ethereum carries a higher-risk, potentially higher-reward profile. This risk-reward balance needs to be carefully considered based on individual investment goals and tolerance for risk.

Hypothetical Investment Strategies

Risk-Averse Investor Strategy

A risk-averse investor might allocate a small percentage of their portfolio to Bitcoin and Ethereum before the halving, focusing on dollar-cost averaging to mitigate risk. This involves making regular, smaller investments over time, regardless of price fluctuations. This strategy aims to reduce the impact of buying high and selling low. Diversification into other asset classes, such as bonds or index funds, would further reduce overall portfolio risk. A portion could also be allocated to stablecoins to preserve capital during periods of high market volatility.

Risk-Tolerant Investor Strategy

A risk-tolerant investor might allocate a larger percentage of their portfolio to Bitcoin and Ethereum, potentially leveraging margin trading or other high-risk strategies. This approach seeks to maximize potential returns but significantly increases the risk of substantial losses. A risk-tolerant investor might also consider investing in DeFi protocols or other high-growth crypto projects. However, thorough research and understanding of the risks associated with these investments are crucial. This strategy requires a high level of market knowledge and a strong risk tolerance.

Technological Developments and Their Influence

The 2025 Bitcoin halving, coupled with ongoing technological advancements in both Bitcoin and Ethereum, will significantly impact the future trajectory of these cryptocurrencies. Understanding these developments is crucial for predicting price movements and assessing long-term adoption. This section will explore key technological advancements and their potential influence on both networks.

Technological advancements in both Bitcoin and Ethereum are poised to shape their respective futures, influencing scalability, energy efficiency, and ultimately, price and adoption. These improvements will likely play out differently for each cryptocurrency due to their inherent design differences.

Bitcoin’s Technological Advancements and Their Impact

Several technological advancements are expected to influence Bitcoin before and after the 2025 halving. These improvements focus primarily on enhancing transaction speed and scalability without compromising security. For instance, the Lightning Network, a layer-2 scaling solution, continues to mature. Its wider adoption could drastically increase Bitcoin’s transaction throughput, making it more suitable for everyday use. Simultaneously, research into more energy-efficient mining hardware and techniques continues, potentially reducing Bitcoin’s environmental footprint and making mining more accessible to a wider range of participants. These developments, if successful, could lead to increased adoption and potentially higher prices due to increased utility and reduced operational costs. The successful implementation of Taproot, a significant upgrade improving transaction privacy and efficiency, is already influencing the network. Further improvements to the underlying protocol are likely, albeit at a slower pace compared to Ethereum’s more frequent upgrades.

Ethereum’s Technological Advancements and Their Impact

Ethereum’s development is characterized by a more rapid pace of innovation. The transition to proof-of-stake (PoS) via the Merge, already completed, has drastically reduced its energy consumption. Future upgrades, such as sharding, are designed to further enhance scalability by dividing the network into smaller, more manageable parts. This should significantly increase transaction throughput and reduce transaction fees, making Ethereum more competitive as a platform for decentralized applications (dApps) and smart contracts. The evolution of the Ethereum Virtual Machine (EVM) and the development of more efficient programming languages will also improve the developer experience and facilitate the creation of more sophisticated and scalable dApps. These combined advancements are expected to drive increased adoption of Ethereum as a platform for various decentralized applications and potentially lead to higher ETH prices due to increased demand and utility.

Scalability and Energy Efficiency Comparison

Bitcoin, with its proof-of-work (PoW) consensus mechanism, currently faces significant scalability challenges and higher energy consumption compared to Ethereum’s post-Merge PoS system. While the Lightning Network offers a solution for Bitcoin’s scalability, its widespread adoption remains a challenge. Ethereum’s transition to PoS has already dramatically reduced its energy footprint. Future upgrades like sharding promise further scalability improvements, positioning Ethereum to handle a significantly larger transaction volume. The contrast in energy efficiency and scalability will likely continue to influence the adoption of both cryptocurrencies, with Ethereum potentially gaining a competitive edge in areas requiring high transaction throughput and low fees. The long-term success of both networks, however, will depend on the successful implementation and adoption of these technological advancements. For example, the success of layer-2 scaling solutions on Bitcoin like the Lightning Network, and the successful implementation of sharding on Ethereum will be key factors determining their future scalability and adoption.

Regulatory Landscape and Geopolitical Factors

The Bitcoin 2025 halving and its potential impact on Ethereum will undoubtedly be influenced by the evolving regulatory landscape and geopolitical events. The cryptocurrency market’s inherent volatility is amplified by uncertainty surrounding government policies and international relations. Understanding these factors is crucial for predicting market behavior and assessing investment risks.

The interplay between regulatory actions and geopolitical shifts will significantly shape the trajectory of both Bitcoin and Ethereum. Stringent regulations in one jurisdiction could drive activity to more lenient regions, while geopolitical instability could create uncertainty and impact investor confidence. These factors are interconnected and their combined effect is difficult to predict with absolute certainty, yet crucial to consider.

Global Regulatory Changes and Their Impact

Differing regulatory approaches across nations create a complex environment for cryptocurrencies. For example, the European Union’s Markets in Crypto-Assets (MiCA) regulation aims to standardize crypto asset markets within the EU, potentially increasing investor confidence and fostering innovation within a defined framework. Conversely, a more restrictive approach in another major economy could limit adoption and depress prices. The impact of these varying regulatory landscapes will likely manifest in capital flows, trading volume shifts, and ultimately, price fluctuations. A globally harmonized regulatory framework remains a distant prospect, leaving the market vulnerable to fragmented and potentially conflicting rules. The lack of uniform regulations could lead to arbitrage opportunities, but also creates a higher risk environment for investors.

Geopolitical Events and Market Volatility

Geopolitical instability can profoundly impact cryptocurrency markets. Major global events, such as wars, economic sanctions, or significant shifts in international relations, often trigger increased volatility in all asset classes, including cryptocurrencies. For instance, the ongoing conflict in Ukraine saw significant fluctuations in Bitcoin’s price, reflecting broader market uncertainty. Similarly, heightened tensions between major global powers could lead to capital flight into perceived “safe haven” assets, potentially impacting the demand for Bitcoin and Ethereum. The degree of impact depends on the nature and severity of the event, as well as investor sentiment and market perception of the cryptocurrency’s role in a volatile geopolitical landscape.

Regulatory Environments and Investor Behavior

Different regulatory environments directly influence investor behavior. Clear, predictable regulations can attract institutional investment and foster long-term growth. Conversely, unclear or overly restrictive rules can drive investors towards unregulated markets or alternative assets, hindering mainstream adoption. For example, a country with strict KYC/AML (Know Your Customer/Anti-Money Laundering) regulations might see less participation from privacy-conscious investors, while a jurisdiction with a more permissive approach might attract a larger pool of individuals and businesses, potentially increasing trading activity. This disparity in regulatory environments can create uneven growth patterns and price discrepancies across different markets.

Long-Term Outlook and Potential Scenarios

The 2025 Bitcoin halving, coupled with Ethereum’s ongoing development, presents a complex landscape for long-term price prediction. While past halvings have historically preceded bull runs for Bitcoin, several factors—including macroeconomic conditions, regulatory changes, and technological advancements—will significantly influence the trajectory of both cryptocurrencies beyond 2025. Predicting precise price movements is impossible, but analyzing potential scenarios allows for a more nuanced understanding of the possibilities.

The interplay between Bitcoin’s scarcity-driven value proposition and Ethereum’s utility as a platform for decentralized applications (dApps) will be crucial. Increased adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs) could significantly boost Ethereum’s price, while Bitcoin’s position as a store of value may remain relatively stable, even during periods of market volatility.

Scenario 1: Gradual Growth and Consolidation

This scenario envisions a relatively slow and steady price appreciation for both Bitcoin and Ethereum post-halving. The market experiences a period of consolidation, with investors taking a more cautious approach after a potential initial price surge following the halving. Macroeconomic factors, such as inflation and interest rate adjustments, play a significant role in shaping the market’s overall sentiment. Bitcoin’s price might gradually increase, reaching new all-time highs over several years, while Ethereum sees sustained growth driven by DeFi adoption and enterprise blockchain solutions. The overall market atmosphere is one of cautious optimism, with institutional investors continuing to accumulate assets, and retail investors participating more selectively. Imagine a market where both Bitcoin and Ethereum see consistent, albeit moderate, gains over a three-to-five-year period, punctuated by periods of sideways trading and minor corrections. This scenario reflects a relatively stable macroeconomic environment and a gradual increase in mainstream adoption.

Scenario 2: Explosive Growth and Volatility, Bitcoin Halving 2025 Ethereum

This scenario depicts a more bullish outlook, characterized by significant price increases for both Bitcoin and Ethereum in the years following the halving. A confluence of factors—a favorable macroeconomic environment, widespread institutional adoption, and a surge in retail investor enthusiasm—could trigger a rapid increase in prices. This would be accompanied by significant market volatility, with periods of sharp price increases followed by corrections. Imagine a scenario where Bitcoin surpasses its previous all-time high within a year of the halving, potentially reaching prices significantly higher than previous cycles. Similarly, Ethereum could experience a parabolic price increase, driven by the explosive growth of the DeFi ecosystem and increased adoption of its smart contract platform. This scenario reflects a period of strong investor confidence and a rapid expansion of the cryptocurrency market.

Scenario 3: Stagnation and Bear Market

This scenario presents a less optimistic outlook, where both Bitcoin and Ethereum experience prolonged periods of price stagnation or even decline. Adverse macroeconomic conditions, increased regulatory scrutiny, or a significant security breach within the cryptocurrency ecosystem could trigger a prolonged bear market. In this scenario, investor sentiment would be negative, with many investors selling their holdings. Bitcoin’s price might remain below its previous all-time high for an extended period, while Ethereum’s growth would be significantly hampered by a decline in DeFi activity and reduced investor interest. Imagine a market characterized by low trading volumes, negative news headlines, and a general lack of investor confidence. This scenario reflects a pessimistic macroeconomic environment and a potential loss of confidence in the cryptocurrency market.

Frequently Asked Questions: Bitcoin Halving 2025 Ethereum

This section addresses common queries regarding Bitcoin halvings, their impact on Bitcoin and Ethereum, and the implications for investors. Understanding these fundamental concepts is crucial for navigating the complexities of the cryptocurrency market, especially in anticipation of significant events like the 2025 Bitcoin halving.

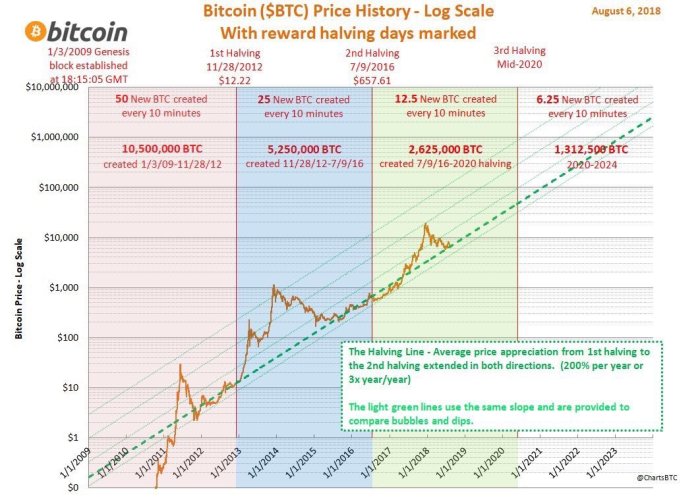

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the block reward—the amount of Bitcoin miners receive for verifying transactions and adding new blocks to the blockchain—in half. For example, the reward started at 50 BTC per block and has been halved three times, currently standing at 6.25 BTC per block. This controlled reduction in supply is a core element of Bitcoin’s deflationary monetary policy.

Bitcoin Halving’s Price Impact

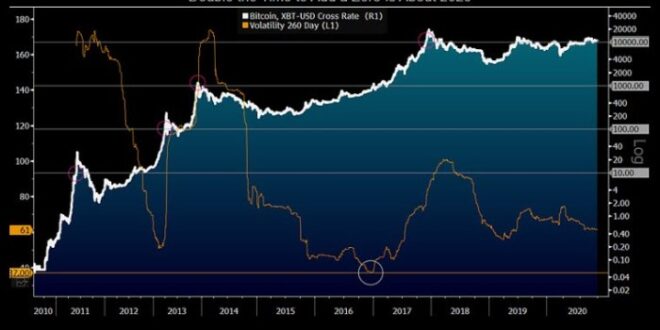

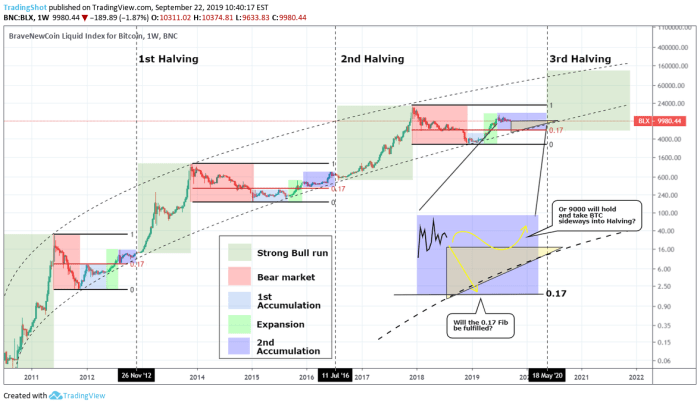

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The first halving in 2012 saw a gradual price increase over the following year. The second halving in 2016 was followed by a substantial bull market that culminated in the 2017 peak. The third halving in 2020 also preceded a notable price surge, although the market dynamics were influenced by other factors as well. It’s important to note that while past performance is not indicative of future results, the halving’s impact on price is largely attributed to the decreased supply of new Bitcoin entering the market, potentially increasing scarcity and driving up demand. Short-term price volatility is common around the halving event itself, however, with both upward and downward price swings possible.

Predicted Impact of the 2025 Halving on Ethereum

Predicting the precise impact of the 2025 Bitcoin halving on Ethereum’s price is challenging. However, a correlation is often observed between the two cryptocurrencies. A Bitcoin bull market, potentially triggered by the halving, could lead to increased investor confidence in the broader cryptocurrency market, benefiting Ethereum as well. Conversely, a negative reaction in Bitcoin could negatively affect the entire market, impacting Ethereum. The strength of this correlation varies, influenced by factors such as Ethereum’s own development progress, regulatory developments, and overall market sentiment. For example, the 2020 Bitcoin halving did positively influence Ethereum, but the degree of correlation is not consistently predictable.

Investing in Bitcoin or Ethereum Before the 2025 Halving

Investing in cryptocurrencies carries substantial risk. While the Bitcoin halving may create positive price momentum, it’s not a guaranteed investment strategy. The cryptocurrency market is highly volatile and susceptible to market manipulation, regulatory changes, and technological disruptions. Before investing, thorough research, risk assessment, and diversification are essential. Investors should only invest what they can afford to lose and understand the potential for both significant gains and losses. The decision to invest in Bitcoin or Ethereum before the 2025 halving depends entirely on individual risk tolerance, investment goals, and a comprehensive understanding of the market dynamics.

The Bitcoin Halving in 2025 is a significant event anticipated to impact both Bitcoin and Ethereum’s market dynamics. Understanding the precise timing is crucial for investors, and to clarify this, you can check out this resource: When Was The Bitcoin Halving In 2025. The halving’s effects on Bitcoin’s scarcity and potential price fluctuations will undoubtedly have ripple effects across the broader cryptocurrency market, including Ethereum.

The Bitcoin Halving in 2025 is a significant event impacting both Bitcoin and the broader cryptocurrency market, including Ethereum. Understanding the precise timing is crucial for strategic planning. To find out exactly when this halving will occur, you can check this useful resource: Cuando Es El Halving De Bitcoin 2025. This date will influence Bitcoin’s price and potentially affect Ethereum’s price as well, given their interconnectedness within the crypto ecosystem.

The Bitcoin Halving in 2025 is a significant event expected to impact both Bitcoin and Ethereum’s price dynamics. Understanding the potential consequences requires careful consideration of various factors. To help with projections, you can utilize a useful tool like the Bitcoin Halving 2025 Calculator to model potential scenarios. This calculator can assist in assessing the potential effects of the halving on Bitcoin’s price, indirectly influencing the Ethereum market as well.

The Bitcoin Halving in 2025 is a significant event expected to impact both Bitcoin and Ethereum’s price dynamics. Understanding the potential consequences requires careful consideration of various factors. To help with projections, you can utilize a useful tool like the Bitcoin Halving 2025 Calculator to model potential scenarios. This calculator can assist in assessing the potential effects of the halving on Bitcoin’s price, indirectly influencing the Ethereum market as well.