Bitcoin Halving Countdown

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, occurring approximately every four years. It’s a programmed reduction in the rate at which new Bitcoins are created, fundamentally impacting the cryptocurrency’s inflation rate and often influencing its market price. Understanding this event is crucial for anyone involved in or interested in the Bitcoin ecosystem.

Bitcoin Halving Mechanics and Supply, Bitcoin Halving Countdown 2025

The Bitcoin halving mechanism is hardcoded into the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. This process continues until all 21 million Bitcoins are mined, a process expected to complete around the year 2140. This controlled supply is a core feature of Bitcoin, designed to mimic scarcity similar to precious metals like gold. The halving directly reduces the rate of new Bitcoin entering circulation, theoretically increasing its scarcity and potentially impacting its value.

Historical Halvings and Market Reactions

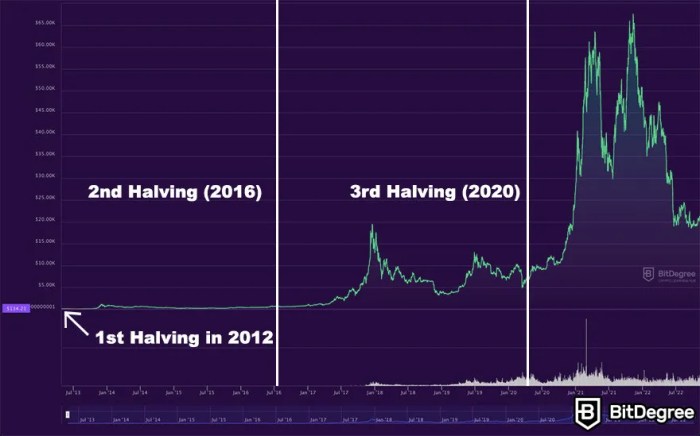

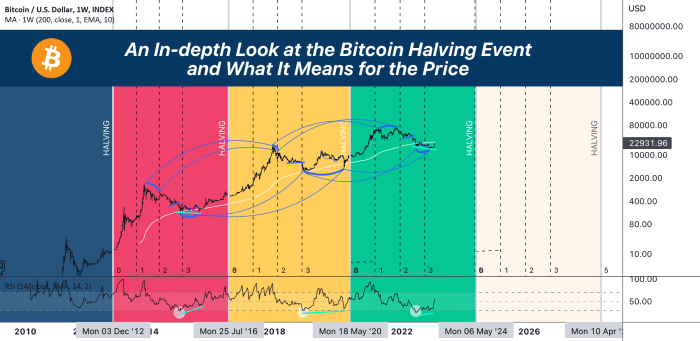

A timeline of past halvings and their subsequent market effects reveals a complex relationship, not always a simple cause-and-effect. The first halving occurred in November 2012. While the price didn’t immediately skyrocket, it did experience a significant increase over the following year. The second halving in July 2016 was followed by a period of relative consolidation before a major price surge began in late 2017. The third halving in May 2020 saw a similar pattern, with a period of sideways trading followed by a price increase, though the timing and magnitude varied from the previous cycles. It’s crucial to note that many other factors influence Bitcoin’s price, including regulatory changes, technological advancements, and overall market sentiment.

Halvings and Bitcoin Price: A Visual Representation

Imagine a line graph with time on the x-axis and Bitcoin price on the y-axis. Three distinct points would mark the halving events of 2012, 2016, and 2020. Following each halving, the graph would show an initial period of relatively flat or slightly downward movement, followed by a more pronounced upward trend, although the slope and duration of this upward trend would vary considerably. The graph would not show a direct, immediate jump in price after each halving, emphasizing the complex interplay of various market forces influencing Bitcoin’s value. The visual representation would highlight that while halvings are significant events, they are not the sole determinant of Bitcoin’s price trajectory. It would demonstrate a correlation, not necessarily a direct causation.

The 2025 Bitcoin Halving

The 2025 Bitcoin halving, scheduled for approximately April 2025, is a significant event in the cryptocurrency world, anticipated to impact Bitcoin’s price, mining landscape, and overall market dynamics. This reduction in the rate of newly minted Bitcoin, from 6.25 BTC per block to 3.125 BTC, is a pre-programmed event inherent in Bitcoin’s design. The historical precedent of previous halvings suggests a potential, though not guaranteed, surge in price following the event. However, the exact impact remains a subject of ongoing debate and analysis.

Expert Opinions and Predictions Regarding the 2025 Halving

Various experts offer contrasting predictions for Bitcoin’s price following the 2025 halving. Some analysts, basing their predictions on historical trends and the stock-to-flow model, anticipate a substantial price increase. The stock-to-flow model, for example, suggests that the scarcity of Bitcoin, amplified by the halving, will drive up demand and subsequently the price. Others, however, are more cautious, citing macroeconomic factors, regulatory uncertainty, and the potential for market manipulation as reasons to temper expectations. For instance, some argue that the increasing institutional adoption might not directly translate into a significant price surge post-halving, depending on the overall market sentiment and economic climate. These differing perspectives highlight the inherent uncertainty surrounding any price prediction.

Comparison of Price Prediction Models and Methodologies

Different prediction models employ varying methodologies. The stock-to-flow model, as mentioned, focuses on Bitcoin’s scarcity. Other models incorporate on-chain metrics such as transaction volume, active addresses, and network hash rate to gauge market sentiment and predict price movements. Some quantitative models use complex algorithms and historical data to forecast future prices, often factoring in market volatility and external economic influences. Qualitative models, on the other hand, rely heavily on expert opinion and analysis of market trends. The accuracy of these models varies significantly, and none can definitively predict the future price of Bitcoin. For example, while the stock-to-flow model has shown some correlation with past price movements, it hasn’t perfectly predicted every price surge.

Potential Market Scenarios Leading Up to and Following the Halving

Several market scenarios are plausible. A bullish scenario could involve increasing anticipation leading up to the halving, culminating in a significant price surge immediately afterward, driven by reduced supply and heightened investor interest. A more bearish scenario might see a price stagnation or even a decline before the halving, due to factors unrelated to the halving itself, such as a broader cryptocurrency market downturn or regulatory crackdowns. A neutral scenario could involve a moderate price increase following the halving, reflecting a balance between supply reduction and other market forces. The actual outcome will likely depend on a complex interplay of factors, including investor sentiment, regulatory developments, and macroeconomic conditions.

Potential Impacts on Bitcoin’s Mining Industry and Hash Rate

The halving directly impacts Bitcoin miners’ profitability, as the reward for successfully mining a block is halved. This could lead to a shakeout in the mining industry, with less efficient miners forced to shut down operations due to reduced profitability. Consequently, the network hash rate – a measure of the computational power securing the Bitcoin network – might temporarily decrease. However, the long-term impact on the hash rate is uncertain. Increased efficiency in mining hardware and the potential for new miners entering the market could offset the reduction in profitability, maintaining or even increasing the hash rate over time. This is further complicated by factors like energy prices and government regulations. The historical data shows fluctuations in hash rate following previous halvings, illustrating the dynamic nature of this aspect of the Bitcoin ecosystem.

Factors Influencing Bitcoin’s Price After the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently complex, influenced by a confluence of macroeconomic conditions, regulatory landscapes, and technological advancements. While the halving itself is a significant event, reducing the rate of new Bitcoin issuance, its impact on price is mediated by other factors. These factors can either amplify or dampen the expected bullish effect of the halving.

Macroeconomic Factors

Global economic conditions significantly influence Bitcoin’s price. Periods of high inflation or economic uncertainty often lead investors to seek alternative assets, potentially driving up demand for Bitcoin as a hedge against inflation or a store of value. Conversely, periods of economic stability or rising interest rates can decrease demand as investors shift towards traditional assets offering higher returns. For example, the 2022 bear market coincided with rising inflation and increased interest rates globally. Conversely, periods of economic downturn, like the 2008 financial crisis, could lead to increased Bitcoin adoption as a decentralized and less regulated alternative.

Regulatory Changes

Government regulations play a crucial role in shaping Bitcoin’s market. Positive regulatory developments, such as clearer guidelines for Bitcoin exchanges and institutional investment, can boost investor confidence and increase market liquidity. Conversely, restrictive regulations, such as outright bans or heavy taxation, can suppress demand and negatively impact Bitcoin’s price. The regulatory environment varies considerably across different jurisdictions, impacting price fluctuations based on regional adoption and investment flows. For instance, El Salvador’s adoption of Bitcoin as legal tender initially caused a price surge, although the long-term effects are still being assessed.

Technological Advancements

Technological advancements within the Bitcoin ecosystem influence adoption rates and, consequently, price. Improvements in scalability, transaction speed, and energy efficiency can make Bitcoin more attractive to a wider range of users and businesses. The development of the Lightning Network, for example, addresses scalability issues and facilitates faster, cheaper transactions. Conversely, a major security breach or a significant technological flaw could severely damage investor confidence and negatively impact the price. The development of competing cryptocurrencies with superior technology could also potentially divert investment away from Bitcoin.

Bullish and Bearish Price Scenarios

The following table Artikels potential bullish and bearish scenarios for Bitcoin’s price post-halving, considering the interplay of macroeconomic factors, regulations, and technological advancements. These are speculative scenarios and should not be considered financial advice.

| Scenario | Macroeconomic Conditions | Regulatory Environment | Technological Advancements |

|---|---|---|---|

| Bullish | Sustained inflation, economic uncertainty, flight to safety | Favorable regulations globally, increased institutional adoption | Significant improvements in scalability and usability, widespread adoption of Layer-2 solutions |

| Bearish | Economic recovery, falling inflation, rising interest rates | Stringent regulations, increased scrutiny, regulatory uncertainty | Lack of significant technological advancements, emergence of competing cryptocurrencies |

Investing and Trading Strategies Around the Halving

The Bitcoin halving, a significant event reducing the rate of new Bitcoin creation, historically precedes periods of price volatility. Understanding this volatility is key to developing effective investment and trading strategies. Investors and traders employ diverse approaches, balancing risk and potential reward, to navigate this period. Effective risk management is paramount, as the market can be unpredictable.

Investment Strategies for the Halving Period

Several investment strategies can be employed around the halving. A long-term hold strategy, also known as “HODLing,” involves buying and holding Bitcoin regardless of short-term price fluctuations, anticipating long-term appreciation. Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, mitigating the risk of investing a lump sum at a market peak. Finally, a more active approach might involve buying before the halving in anticipation of a price increase, but this carries a higher risk. The success of each strategy depends on individual risk tolerance and market conditions.

Risk Management Techniques for Bitcoin Investments

Managing risk is crucial in the volatile cryptocurrency market. Diversification, allocating investments across different assets (not just Bitcoin), reduces exposure to a single asset’s price fluctuations. Setting stop-loss orders automatically sells Bitcoin if the price falls below a predetermined level, limiting potential losses. Position sizing, determining the amount of capital to allocate to Bitcoin, prevents overexposure to risk. Thorough research and understanding of market trends and fundamentals are also critical components of effective risk management. For example, a trader might set a stop-loss order at 15% below their purchase price to limit potential losses if the price unexpectedly drops.

Trading Opportunities Before and After the Halving

The period surrounding the halving often presents trading opportunities. Before the halving, some traders anticipate a price increase and buy Bitcoin, aiming to sell at a higher price after the event. Conversely, some might employ short-selling strategies, betting on a price decrease. After the halving, the price might initially consolidate or even decline before resuming an upward trend, creating potential opportunities for both long and short-term trading. However, accurately predicting market movements remains challenging, and losses are always a possibility. The 2012 and 2016 halvings saw varying price responses, highlighting the unpredictability of the market.

Creating a Diversified Cryptocurrency Portfolio

A diversified portfolio reduces risk by spreading investments across multiple cryptocurrencies. Begin by researching different cryptocurrencies, understanding their underlying technologies, and assessing their potential. Consider factors like market capitalization, adoption rate, and development team. Allocate funds based on your risk tolerance and investment goals, perhaps assigning a larger portion to established cryptocurrencies like Bitcoin and Ethereum, while allocating a smaller portion to potentially high-growth but riskier altcoins. Regularly rebalance your portfolio to maintain your desired asset allocation. For example, a diversified portfolio might include 60% Bitcoin, 20% Ethereum, and 20% spread across several promising altcoins, with this allocation adjusted periodically based on market performance.

Bitcoin Halving and its Long-Term Implications

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has profound long-term implications for the cryptocurrency’s scarcity, value proposition, and potential for widespread adoption. Understanding these implications is crucial for anyone interested in Bitcoin’s future.

Bitcoin’s Increasing Scarcity

The halving mechanism directly impacts Bitcoin’s scarcity. By reducing the rate at which new Bitcoins enter circulation, each halving event gradually decreases the supply. This controlled scarcity is a key differentiator for Bitcoin compared to fiat currencies, which can be printed at will. The predictable nature of the halving, built into the Bitcoin protocol, further enhances its scarcity, making it a potentially valuable asset in the long term. This controlled scarcity mirrors that of precious metals like gold, contributing to its perceived value as a store of value. The diminishing supply, coupled with increasing demand, is expected to exert upward pressure on the price, though market dynamics are complex and other factors also play a role.

Bitcoin as a Store of Value

The halving’s effect on scarcity significantly strengthens Bitcoin’s potential as a store of value. Historically, scarce assets have tended to hold or increase their value over time, especially during periods of economic uncertainty. The halving reinforces Bitcoin’s deflationary nature, a key characteristic sought after in a store of value asset. While volatility remains a characteristic of Bitcoin’s price, the halving events are often viewed as catalysts for long-term price appreciation, contributing to its attractiveness as a hedge against inflation or currency devaluation. Examples of investors holding Bitcoin for the long term, treating it similarly to gold, are increasingly common, further bolstering its status as a potential store of value.

Bitcoin’s Mainstream Adoption as a Payment Method

While the halving doesn’t directly impact Bitcoin’s usability as a payment method, its effect on price and scarcity could indirectly influence adoption. A higher price, driven by increased scarcity and demand, might initially hinder its use for everyday transactions due to higher transaction fees and the value of each unit. However, second-layer solutions like the Lightning Network aim to address scalability issues, potentially making Bitcoin more viable for everyday payments. The long-term impact of the halving on adoption hinges on the balance between price appreciation and the development and adoption of technologies that improve Bitcoin’s transaction speed and efficiency. Increased regulatory clarity and wider merchant acceptance would also be crucial factors.

Bitcoin’s Long-Term Price Trajectory

Image Description: The image depicts a stylized line graph showing Bitcoin’s price over several decades, incorporating multiple halving events. The x-axis represents time, spanning from the Bitcoin genesis block to several years into the future. The y-axis represents Bitcoin’s price in USD, using a logarithmic scale to better visualize the exponential growth potential. Each halving event is marked with a distinct vertical line, followed by a period of price appreciation, though with fluctuations and periods of consolidation. The overall trend is upward, reflecting the increasing scarcity and potential for long-term price growth. The graph is not a prediction, but rather a visualization of a possible long-term trajectory based on historical data and the theoretical effects of the halving. The post-halving price increases are shown as steeper curves than the periods between halvings, reflecting the potential impact of reduced supply on demand. The graph also includes shaded areas representing periods of market volatility and correction, illustrating that price increases are not always linear. The final section of the graph shows a continued upward trend, albeit with fluctuations, suggesting that even after multiple halvings, Bitcoin’s price could continue to appreciate over the long term. The overall visual impression is one of long-term growth potential, tempered by periods of market correction, highlighting the inherent volatility while still conveying a positive long-term outlook.

Frequently Asked Questions (FAQ): Bitcoin Halving Countdown 2025

This section addresses common questions surrounding the Bitcoin halving, a significant event in the Bitcoin network’s history. Understanding the halving mechanism, its historical impact, and potential future effects is crucial for anyone interested in Bitcoin’s trajectory. We will cover the mechanics of the halving, its influence on price, investment considerations, and the inherent risks associated with Bitcoin.

The Bitcoin Halving Explained

The Bitcoin halving is a programmed event that occurs approximately every four years. It reduces the rate at which new Bitcoins are created (mined) by half. This built-in mechanism is designed to control inflation and maintain the scarcity of Bitcoin. Essentially, miners receive half the reward for successfully adding a block of transactions to the blockchain after each halving. This controlled reduction in supply is a core feature of Bitcoin’s design.

The Date of the Next Bitcoin Halving

The next Bitcoin halving is projected to occur in April 2024. While the exact date and time depend on the block creation time, which can fluctuate slightly, it is expected to happen around this period. The Bitcoin network’s algorithm automatically triggers the halving based on the number of blocks mined.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is largely attributed to the reduced supply of newly minted Bitcoin, potentially increasing its value due to increased demand. However, it’s crucial to remember that this is not a guaranteed outcome. Other factors, such as market sentiment, regulatory changes, and macroeconomic conditions, significantly influence Bitcoin’s price. For example, the halving in 2012 was followed by a period of price appreciation, similarly, the 2016 halving preceded a significant price surge. However, other factors outside the halving itself also played a role in these price movements.

Investing in Bitcoin Before the Halving: Risks and Rewards

Investing in Bitcoin before a halving presents both significant risks and potential rewards. The anticipation of a price increase following the halving can lead to increased demand and potentially higher prices. However, the cryptocurrency market is highly volatile, and prices can fluctuate dramatically in either direction. Investing before the halving involves the risk of potential price drops before the anticipated increase materializes. A thorough understanding of the market and risk tolerance is essential.

Potential Risks of Investing in Bitcoin

Bitcoin, like other cryptocurrencies, is characterized by significant price volatility. Prices can experience sharp increases and decreases in short periods. This volatility stems from various factors, including market speculation, regulatory uncertainty, technological advancements, and security concerns. Furthermore, the cryptocurrency market is relatively young and still evolving, making it susceptible to unforeseen events and risks. It’s crucial to invest only what you can afford to lose and to diversify your investment portfolio.