Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the reward given to Bitcoin miners for successfully adding new blocks of transactions to the blockchain. This event, occurring approximately every four years, is designed to control the rate at which new Bitcoins enter circulation, mimicking a deflationary monetary policy. Understanding its mechanics and historical impact is crucial for navigating the cryptocurrency landscape.

Bitcoin Halving Mechanics

The Bitcoin halving mechanism is embedded within the Bitcoin code. Every 210,000 blocks mined, the block reward—the amount of Bitcoin awarded to miners—is cut in half. This process began with a block reward of 50 BTC in 2009 and has been halved three times already. The next halving, in 2025, will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in the rate of new Bitcoin creation aims to maintain scarcity and potentially influence the cryptocurrency’s price. The halving doesn’t directly affect the overall supply limit of 21 million Bitcoin, but it does significantly alter the rate at which that supply is released into circulation.

Historical Impact of Bitcoin Halvings, Bitcoin Halving Event 2025

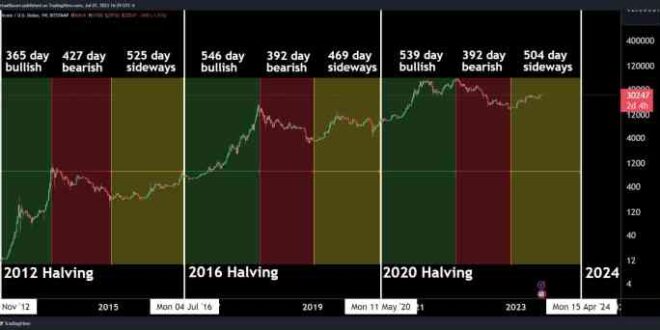

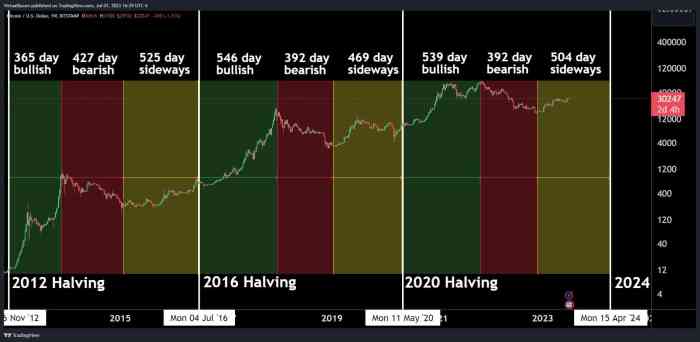

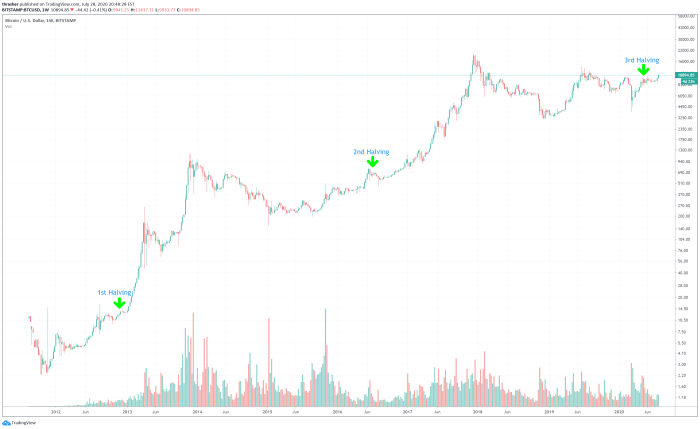

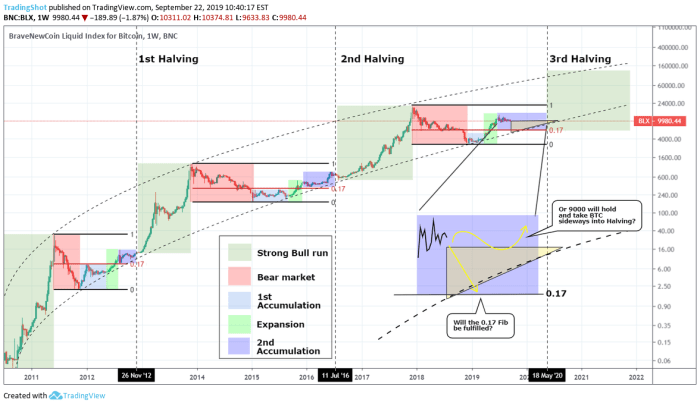

Previous halving events have shown a correlation with subsequent price increases in Bitcoin. While correlation doesn’t equal causation, the reduced supply coupled with increasing demand has often led to upward price pressure. The first halving in 2012 saw a gradual price increase in the following months. The second halving in 2016 was followed by a period of consolidation before a significant price surge began in late 2017. The third halving in 2020 was followed by a significant bull run into 2021. However, it is important to note that other market factors, such as regulatory changes, technological advancements, and overall economic conditions, also play a significant role in Bitcoin’s price fluctuations. Network activity, measured by metrics like hash rate (a measure of computational power securing the network) and transaction volume, has generally increased after halvings, reflecting increased miner participation and user engagement.

Timeline of Past Halving Events

The following timeline highlights key events surrounding the previous Bitcoin halvings:

Bitcoin Halving Event 2025 – 2012 Halving:

- November 28, 2012: Block reward halved from 50 BTC to 25 BTC.

- Late 2012 – 2013: Gradual price increase observed.

2016 Halving:

- July 9, 2016: Block reward halved from 25 BTC to 12.5 BTC.

- Late 2017: Significant price surge begins.

2020 Halving:

- May 11, 2020: Block reward halved from 12.5 BTC to 6.25 BTC.

- 2020-2021: A significant bull run followed.

Comparison of Past Halving Metrics

| Halving Date | Block Reward (BTC) | Approximate Mining Difficulty (before halving) | Approximate Bitcoin Price (USD) before halving (at time of halving) |

|---|---|---|---|

| November 28, 2012 | 50 → 25 | ~1400 | ~$13 |

| July 9, 2016 | 25 → 12.5 | ||

| May 11, 2020 | 12.5 → 6.25 |

Anticipated Effects of the 2025 Halving

The 2025 Bitcoin halving, scheduled to reduce the block reward from 6.25 BTC to 3.125 BTC, is a significant event anticipated to impact various aspects of the Bitcoin ecosystem. Understanding its potential effects requires analyzing its influence on scarcity, mining profitability, and overall market sentiment, ultimately shaping price predictions.

The halving directly impacts Bitcoin’s scarcity by reducing the rate at which new coins enter circulation. This decrease in supply, coupled with potentially sustained or increased demand, is a key driver of price appreciation in previous halving cycles. The reduced influx of new Bitcoin makes each existing coin comparatively more valuable, theoretically increasing its price. This fundamental principle of supply and demand is central to the anticipated effects of the 2025 halving.

Impact on Mining Profitability and Hash Rate

The halving significantly alters the economics of Bitcoin mining. With a reduced block reward, miners’ revenue per block decreases. This could lead to some less-efficient miners becoming unprofitable and exiting the network, potentially causing a temporary decrease in the hash rate (the total computational power securing the network). However, the long-term effect on the hash rate is complex and depends on several factors including the price of Bitcoin, the cost of electricity, and the efficiency of mining hardware. Historically, the hash rate has generally recovered after previous halvings, often exceeding pre-halving levels as more efficient miners remain and technological advancements improve mining efficiency. For example, following the 2020 halving, while there was an initial dip, the hash rate ultimately recovered and surpassed previous highs.

Comparison of Market Sentiment Across Halvings

Market sentiment surrounding previous halvings has been a mix of anticipation, speculation, and volatility. The 2012 halving occurred during Bitcoin’s early stages, with relatively lower market capitalization and less widespread adoption. The 2016 halving saw a more mature market, with increased institutional interest and greater public awareness. The 2020 halving took place amidst a period of growing institutional adoption and increasing global recognition of Bitcoin as a store of value. The current climate leading up to the 2025 halving is characterized by increased regulatory scrutiny, macroeconomic uncertainty, and a broader range of cryptocurrencies competing for investor attention. This contrasts with the previous cycles, where Bitcoin largely dominated the cryptocurrency landscape.

Hypothetical Price Movement Scenario Post-Halving

Consider a scenario where the price of Bitcoin remains relatively stable in the months leading up to the halving, reflecting a market cautiously optimistic about the event. Immediately following the halving, a short-term price dip is possible, driven by miners adjusting to reduced profitability. However, if the overall macroeconomic climate remains relatively favorable, and demand for Bitcoin remains robust (perhaps driven by institutional investment or increased adoption in emerging markets), the price could then experience a gradual increase over the subsequent 12-18 months. This rise would be fueled by the decreasing supply of new Bitcoin, coupled with consistent demand. Conversely, a prolonged bear market or negative regulatory news could offset the positive effects of the halving, leading to a more subdued price response or even a prolonged period of sideways trading. The extent of price movement will heavily depend on the interplay of various market forces, including investor sentiment, regulatory developments, and overall macroeconomic conditions. A similar pattern of initial dip followed by a gradual rise was observed after the 2020 halving, although the specific timing and magnitude varied significantly.

Mining and the 2025 Halving

The Bitcoin halving event in 2025, scheduled to reduce the block reward from 6.25 BTC to 3.125 BTC, presents significant challenges for Bitcoin miners. This reduction directly impacts their profitability, forcing them to adapt or potentially exit the market. The ensuing changes will likely reshape the Bitcoin mining landscape and influence the network’s overall decentralization.

The reduced block reward means miners will receive less Bitcoin for each block they successfully mine. This directly impacts their revenue stream, making the operation less lucrative unless other factors, such as the Bitcoin price or mining efficiency, compensate for the decreased reward. The profitability of mining depends on a complex interplay of factors including the Bitcoin price, the difficulty of mining, electricity costs, and the efficiency of mining hardware.

Challenges Faced by Bitcoin Miners

The halving will create a challenging environment for Bitcoin miners. Many miners operate on thin margins, and a sudden reduction in their primary income source will force them to reassess their operations. Increased electricity costs, coupled with the halving, could render some mining operations unprofitable, leading to potential shutdowns. The increased competition for limited block rewards will further exacerbate this situation. Miners with less efficient hardware or higher electricity costs will be disproportionately affected. For example, a miner operating in a region with high electricity prices might find it difficult to remain competitive after the halving, even with highly efficient equipment. This situation could force miners to consider relocating their operations to areas with lower energy costs, further impacting their operational expenses.

Miner Adaptation Strategies

To maintain profitability, miners will need to adopt various strategies. This could involve upgrading to more efficient mining hardware (ASICs) to reduce energy consumption per hash, negotiating lower electricity prices with energy providers, or diversifying revenue streams. Some miners might explore alternative revenue models, such as offering hosting services for other miners or participating in other crypto-related ventures. Successful adaptation will depend on miners’ ability to optimize their operations and remain competitive in a more challenging environment. For instance, miners could form pools to share resources and reduce individual risks, enabling them to withstand periods of lower profitability. The adoption of more energy-efficient mining equipment will also be crucial for survival in the post-halving landscape.

Potential Consolidation within the Mining Industry

The 2025 halving is likely to accelerate consolidation within the Bitcoin mining industry. Less profitable operations will struggle to survive, leading to mergers, acquisitions, or outright closures. Larger, more established mining companies with access to cheaper electricity and advanced technology will be better positioned to weather the storm. This consolidation could result in a smaller number of larger mining entities controlling a significant portion of the Bitcoin mining hash rate. This scenario is not entirely unprecedented; we’ve seen similar trends in the past after previous halving events, where smaller players were forced out of the market, leaving room for larger, more efficient operations to dominate.

Influence on Bitcoin Network Decentralization

The potential consolidation of the Bitcoin mining industry raises concerns about the network’s decentralization. A more concentrated mining landscape could increase the risk of censorship or manipulation, as a smaller number of powerful entities could exert greater influence over the network. However, it’s important to note that decentralization is a multifaceted concept. While a reduction in the number of miners might seem to reduce decentralization, the geographic distribution of the remaining miners and the continued use of open-source mining software could mitigate some of these risks. The overall impact on decentralization will depend on the extent of consolidation and the actions taken by the remaining miners and the Bitcoin community to maintain a diverse and distributed network.

Investor Sentiment and Market Predictions

The 2025 Bitcoin halving is a significant event expected to impact the cryptocurrency market. Predicting its exact effects on Bitcoin’s price is challenging, given the inherent volatility of the market and the influence of various external factors. However, analyzing past halvings and current market sentiment provides valuable insights into potential price movements and investment strategies.

Predicting Bitcoin’s price after a halving is notoriously difficult, as numerous factors beyond the halving itself influence the market. These factors include regulatory changes, macroeconomic conditions, technological advancements, and overall investor confidence. Despite this inherent uncertainty, various market analysts and commentators offer predictions, ranging from conservative to extremely bullish scenarios.

Market Predictions Following the 2025 Halving

Several models and analyses exist to predict Bitcoin’s price post-halving. Some analysts base their predictions on historical price action following previous halvings, extrapolating past trends into the future. Others incorporate more sophisticated models, considering factors like on-chain metrics, network activity, and macroeconomic indicators. These predictions vary considerably. For example, some analysts predict a relatively modest price increase, perhaps in the range of a few thousand dollars, while others foresee a much more substantial rise, potentially reaching six-figure price targets. It’s crucial to remember that these are merely predictions, and the actual price movement could differ significantly. The lack of a universally accepted model highlights the complexity and uncertainty involved. One example is PlanB’s stock-to-flow model, which, while popular, has not always accurately predicted price movements.

The Role of Investor Sentiment

Investor sentiment plays a crucial role in shaping Bitcoin’s price. Periods of intense optimism or fear can lead to significant price swings, regardless of fundamental factors. Before the halving, anticipation can drive price increases as investors position themselves for the expected scarcity. After the halving, if the price doesn’t immediately surge as some predict, negative sentiment might lead to selling pressure, potentially causing a temporary price dip. Conversely, a strong price rally following the halving could reinforce positive sentiment, attracting new investors and further driving the price up. This dynamic interplay between expectations and actual price action underscores the importance of managing risk and understanding the emotional aspects of the market. The 2017 bull market, for example, was fueled by strong investor enthusiasm, while the subsequent bear market reflected a shift in sentiment.

Investment Strategies in Light of the Halving

The upcoming halving presents investors with various strategic choices. Some might opt for a “buy and hold” strategy, believing in Bitcoin’s long-term potential and ignoring short-term volatility. Others might adopt a more active approach, aiming to profit from price fluctuations through timing their entries and exits. Dollar-cost averaging (DCA), a strategy involving regular investments regardless of price, can mitigate risk. Diversification across different assets, including other cryptocurrencies or traditional investments, is another strategy to reduce portfolio volatility. The optimal strategy depends on individual risk tolerance, investment horizon, and market outlook. A conservative investor might favor DCA and diversification, while a more aggressive investor might attempt to time the market, accepting higher risk for potentially greater rewards.

Potential Risks and Rewards

Investing in Bitcoin around the halving presents both substantial risks and rewards. The potential rewards are significant, as historical data suggests price increases following previous halvings. However, the market is highly volatile, and price movements can be unpredictable. Regulatory uncertainty, security breaches, and macroeconomic events can all negatively impact Bitcoin’s price. Furthermore, the hype surrounding the halving can lead to inflated expectations, potentially resulting in a post-halving correction. Therefore, thorough research, risk assessment, and a well-defined investment strategy are crucial. It’s essential to only invest what one can afford to lose, and to be prepared for potential losses. The success of any investment strategy depends heavily on understanding the risks involved and adapting to changing market conditions.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is anticipated to have profound and lasting effects on the cryptocurrency’s trajectory. While short-term market volatility is expected, the long-term implications extend far beyond price fluctuations, impacting adoption, technological advancements, and institutional involvement.

The reduced supply of newly minted Bitcoin, coupled with potentially increased demand, is projected to exert upward pressure on its price. This, in turn, could catalyze a ripple effect across various facets of the Bitcoin ecosystem.

Bitcoin Adoption and Use Cases

The halving’s impact on price could significantly influence Bitcoin’s adoption as a store of value and a medium of exchange. A rising price may attract more individuals and businesses, leading to increased usage in everyday transactions and as a hedge against inflation, mirroring the historical trends observed after previous halvings. Furthermore, a higher price might encourage the development of more user-friendly interfaces and applications, simplifying Bitcoin’s accessibility for the average user. This could lead to increased adoption in developing nations with unstable fiat currencies, where Bitcoin could offer a more reliable alternative.

Influence on Bitcoin-Related Technologies and Applications

The potential increase in Bitcoin’s value following the halving is likely to incentivize further investment in Bitcoin-related technologies. We might see increased development in areas such as the Lightning Network, which aims to improve transaction speed and scalability. Improved scalability and reduced transaction fees would make Bitcoin more practical for everyday use, further driving adoption. Moreover, advancements in custodial solutions and security technologies could enhance the overall user experience, making Bitcoin more appealing to a wider range of investors. For example, hardware wallet manufacturers might experience increased demand, leading to more robust and user-friendly security options.

Increased Institutional Investment

A sustained price increase following the halving could attract significant institutional investment. Large financial institutions, hedge funds, and corporations may view Bitcoin as a less volatile and more attractive asset class compared to other cryptocurrencies, particularly given the halving’s predictable impact on supply. This increased institutional interest could lead to greater liquidity in the market, contributing to price stability and attracting even more investment. The increased participation of institutional investors could also drive further innovation in the Bitcoin space, as these entities often have significant resources to allocate towards research and development. We’ve already seen a gradual increase in institutional adoption in previous cycles, and the 2025 halving could act as a significant catalyst for further growth.

Projected Growth Trajectory

Imagine a graph charting Bitcoin’s price. Following the 2025 halving, the initial phase shows a period of heightened volatility, with potential short-term price spikes and dips. However, as the halving’s effect on scarcity becomes apparent, the trajectory begins a steady, albeit possibly uneven, upward trend. Key milestones could include surpassing previous all-time highs, increased institutional adoption reflected in higher trading volumes, and the successful integration of layer-two solutions like the Lightning Network. Potential hurdles could include regulatory uncertainty in various jurisdictions, macroeconomic factors influencing global markets, and unforeseen technological challenges. However, based on past halving cycles, the overall trajectory suggests a long-term upward trend, although the exact pace and magnitude remain uncertain. This projected growth resembles a gradually ascending staircase, with periods of consolidation interspersed with periods of more significant upward movements, punctuated by potential setbacks that represent temporary steps back before resuming the climb.

Frequently Asked Questions: Bitcoin Halving Event 2025

The Bitcoin halving is a significant event in the cryptocurrency world, sparking much discussion and speculation. Understanding the mechanics and potential implications is crucial for anyone involved in or observing the Bitcoin ecosystem. This section addresses some of the most common questions surrounding the halving.

Bitcoin Halving Event

A Bitcoin halving event is a programmed reduction in the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is built into the Bitcoin protocol itself, ensuring a predictable and controlled inflation rate. The initial reward for miners was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC.

Effect of a Halving on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of increased price appreciation. This is primarily attributed to the decreased supply of newly minted Bitcoin. The reduced supply, coupled with persistent or increasing demand, can lead to upward pressure on the price. However, it’s crucial to remember that price is influenced by many factors beyond the halving, including market sentiment, regulatory changes, and overall economic conditions. The 2012 and 2016 halvings were followed by significant price increases, but this doesn’t guarantee a similar outcome in 2025. Other market forces will play a significant role.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is anticipated to occur in early 2025. The exact date depends on the rate at which miners solve complex cryptographic puzzles to add new blocks to the blockchain. While a precise date can’t be given far in advance, estimations based on the average block time consistently place it around the spring of 2025.

Risks and Rewards of Investing Around a Halving

Investing in Bitcoin around a halving presents both significant risks and potential rewards. The reduced supply can create a bullish narrative, leading to price increases. However, the cryptocurrency market is notoriously volatile, and factors unrelated to the halving can cause sharp price fluctuations. Investing only what you can afford to lose is paramount. Moreover, the period leading up to a halving often sees increased speculation and price volatility, potentially creating both buying and selling opportunities. Thorough research and risk management are crucial. For example, the 2016 halving saw a significant price increase in the following months, but this was followed by a period of correction.

Impact of the Halving on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. With fewer newly minted Bitcoins awarded per block, miners’ revenue is reduced. This can lead to several outcomes: some less efficient miners might be forced to shut down operations due to reduced profitability, leading to a consolidation of the mining industry. Others might increase their mining efficiency to compensate for the reduced reward. The price of Bitcoin will also play a crucial role; if the price increases sufficiently, it could offset the reduced reward per block, maintaining profitability for miners. The interplay between the halving, Bitcoin’s price, and mining profitability is a complex dynamic.