Bitcoin Halving 2025: Bitcoin Halving Exact Date 2025

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is scheduled for 2025. This event, which occurs approximately every four years, reduces the rate at which new Bitcoins are created, impacting supply and potentially influencing its price. Pinpointing the exact date requires understanding the technical mechanisms governing Bitcoin’s block generation.

The precise date of the Bitcoin halving in 2025 is determined by the number of blocks mined. Bitcoin’s protocol dictates that a new block is added to the blockchain roughly every 10 minutes. However, this is an average; the actual time can fluctuate due to factors like network hashrate variations and mining difficulty adjustments. The halving occurs after a fixed number of blocks (210,000) are mined after the previous halving. Therefore, predicting the exact date necessitates careful monitoring of block generation times leading up to the event. Slight deviations from the average block time accumulate over time, potentially shifting the halving date by a day or two.

Bitcoin Halving Date Calculation

The calculation is relatively straightforward: We start with the last halving, which occurred around May 11, 2020. Since then, approximately 210,000 blocks have been added to the blockchain to reach the next halving event. By tracking the average block time and any significant deviations, we can project a likely date. However, due to the inherent variability in block generation, only an approximate date can be predicted with certainty. For example, periods of high network activity might lead to slightly faster block times, potentially bringing the halving date forward. Conversely, lower network activity could delay it. This uncertainty is a characteristic feature of the Bitcoin network.

Comparison with Previous Halvings

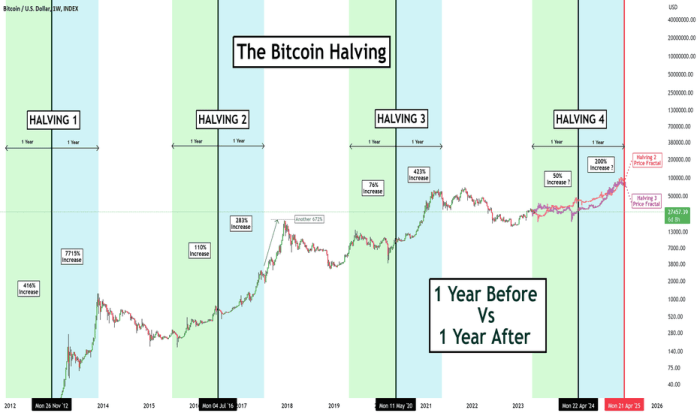

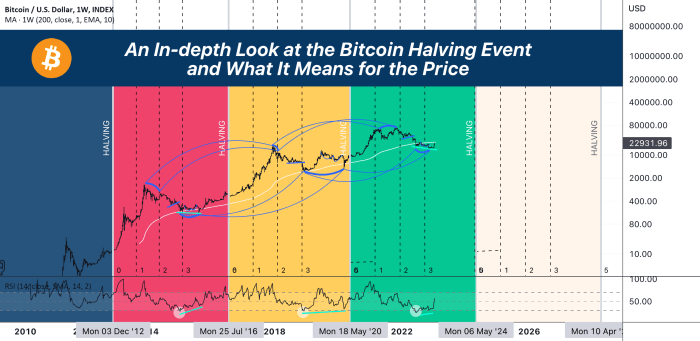

Previous halvings have shown some minor variations in their precise timing. The first halving occurred on November 28, 2012, the second on July 9, 2016, and the third on May 11, 2020. These dates demonstrate the inherent unpredictability, albeit within a relatively narrow timeframe, arising from the stochastic nature of block generation. While a pattern of roughly four-year intervals is observable, the exact date deviates slightly due to the aforementioned factors influencing block generation. Analyzing past data helps refine prediction models but does not eliminate the inherent uncertainty.

Timeline Leading to the 2025 Halving

Predicting a precise date far in advance is challenging due to the unpredictable nature of the network. However, a general timeline can be constructed. The period leading up to the halving will likely see increased speculation and volatility in the Bitcoin market. As the halving date approaches, miners will adjust their strategies, and the overall network hash rate may experience fluctuations. Key milestones include the increasing anticipation in the months leading up to the event, a potential price surge or dip as investors react to the impending supply reduction, and finally, the actual halving event itself, which will mark a significant shift in Bitcoin’s monetary policy. The period immediately following the halving will likely be characterized by continued market volatility as the effects of the reduced supply become apparent.

Impact of the 2025 Halving on Bitcoin’s Price

The Bitcoin halving, a programmed event reducing the rate of newly mined Bitcoin by half, has historically been associated with significant price movements. Understanding the potential impact of the 2025 halving requires analyzing past trends and considering various market factors. While past performance is not indicative of future results, studying previous halvings offers valuable insights into potential price reactions.

Historical Price Movements Following Previous Halvings

The Bitcoin halving events of 2012, 2016, and 2020 each preceded periods of substantial price appreciation. Following the 2012 halving, Bitcoin’s price experienced a gradual increase over the subsequent year. The 2016 halving was followed by a more dramatic price surge, leading to a significant bull market. Similarly, the 2020 halving was followed by a substantial price rally, although the market experienced significant volatility throughout this period. These historical patterns suggest a potential positive correlation between halving events and subsequent price increases, though the magnitude and timing of these increases vary considerably. It’s crucial to remember that numerous other factors influenced these price movements beyond the halving itself, including regulatory changes, technological advancements, and overall market sentiment.

Potential Short-Term and Long-Term Effects on Bitcoin’s Price

The short-term impact of the 2025 halving on Bitcoin’s price is likely to be characterized by increased volatility. As the halving date approaches, anticipation and speculation could lead to price fluctuations. Some traders might buy Bitcoin in anticipation of a price surge, while others might sell to secure profits, creating a dynamic market environment. In the long term, the halving’s effect on Bitcoin’s price is anticipated to be positive, due to the reduced supply of newly mined coins. This reduced supply, combined with sustained or increased demand, could exert upward pressure on the price, potentially leading to a significant price increase over an extended period. However, the actual extent of this price increase will depend on numerous external factors.

Factors Influencing Price Volatility Surrounding the Halving

Several factors can significantly influence the price volatility surrounding the 2025 halving. Macroeconomic conditions, such as inflation rates and interest rate policies, can impact investor sentiment and overall market performance, affecting Bitcoin’s price. Regulatory developments and changes in government policies towards cryptocurrencies can also have a considerable impact. Furthermore, technological advancements within the Bitcoin ecosystem, such as the adoption of the Lightning Network, can influence the price by improving scalability and transaction efficiency. Finally, overall market sentiment and investor confidence play a crucial role, with periods of fear and uncertainty potentially leading to price drops, while periods of optimism can drive price increases.

Comparison of Market Predictions and Assessment of Their Credibility

Various analysts and market commentators offer diverse predictions regarding Bitcoin’s price following the 2025 halving. Some predict significant price increases, while others suggest more moderate gains or even potential price corrections. The credibility of these predictions varies greatly, depending on the methodology employed, the underlying assumptions made, and the track record of the analyst or firm making the prediction. It’s important to critically evaluate the source of the prediction and the rationale behind it before considering it as a reliable indicator of future price movements. For example, predictions based solely on historical price trends without considering other relevant factors are generally less credible than those incorporating a broader range of economic and market indicators.

Hypothetical Price Scenario Based on Various Market Conditions

Under a scenario of strong global economic growth and continued institutional adoption of Bitcoin, the price could potentially reach significantly higher levels after the 2025 halving. For instance, a price range of $100,000 to $200,000 or even higher could be conceivable. Conversely, in a scenario characterized by global economic downturn, increased regulatory scrutiny, or a significant loss of investor confidence, the price might experience a more moderate increase or even a period of stagnation or decline following the halving. A scenario involving a relatively stable global economy and moderate institutional adoption might see a price increase within the $50,000 to $100,000 range. These are purely hypothetical scenarios and the actual price movement will depend on the interplay of numerous unpredictable factors.

The Halving’s Effect on Bitcoin Mining

The Bitcoin halving, a pre-programmed event occurring approximately every four years, significantly impacts the Bitcoin mining ecosystem. This event reduces the reward miners receive for successfully adding new blocks to the blockchain, altering the economics of mining and potentially influencing the network’s overall security and stability. Understanding the effects of this halving is crucial for comprehending the future trajectory of Bitcoin.

The halving reduces the reward for Bitcoin miners by precisely half. For example, before the 2020 halving, miners were rewarded with 12.5 BTC per block. After the halving, this reward dropped to 6.25 BTC. The upcoming 2025 halving will reduce the reward from 6.25 BTC to 3.125 BTC per block. This decrease directly affects the profitability of mining operations.

Mining Profitability and Network Security

The reduced mining reward directly impacts profitability. Miners must balance their operational costs (electricity, hardware maintenance, and facility expenses) against the Bitcoin reward they receive. A decrease in the reward necessitates either a decrease in operational costs or an increase in the Bitcoin price to maintain profitability. If the Bitcoin price does not rise sufficiently to compensate for the reduced reward, some less-efficient miners may become unprofitable and cease operations. This could, in theory, reduce the network’s overall hash rate (the computational power securing the network), potentially making it vulnerable to attacks. However, historically, Bitcoin’s price has often increased following halving events, offsetting the reduced reward. The increased scarcity of newly mined Bitcoin is often cited as a primary driver for this price increase. The long-term effect on network security is thus complex and depends on various interconnected factors, including technological advancements in mining hardware and the overall market demand for Bitcoin.

Miner Responses to Reduced Rewards

Miners respond to reduced rewards in several ways. Some might upgrade their hardware to increase efficiency and reduce their cost per Bitcoin mined. Others may seek cheaper electricity sources, relocate to areas with more favorable energy policies, or consolidate operations to achieve economies of scale. Some miners may choose to shut down entirely if their operations become unprofitable. The overall response depends on the individual miner’s operational costs, risk tolerance, and market outlook. The industry has seen consolidation in the past, with larger, more efficient mining operations surviving while smaller, less-efficient operations are forced to exit the market.

Comparison of Mining Landscapes Before and After Previous Halvings

The Bitcoin mining landscape has dramatically changed between halving events. The first halving in 2012 saw a relatively small mining community, primarily composed of individual hobbyists and early adopters. Subsequent halvings have witnessed the rise of large-scale, industrial-grade mining operations, often located in regions with cheap electricity. These operations utilize highly specialized hardware (ASICs) and sophisticated management systems. The competition has intensified, and the technological advancement of mining hardware has consistently outpaced the decreasing reward, leading to a more centralized yet efficient mining network. The 2016 and 2020 halvings both demonstrated that the Bitcoin price reacted positively in the long run, despite the initial uncertainty surrounding the impact of reduced rewards.

Historical Mining Rewards

| Year | Halving Event | Reward (BTC per block) | Approximate Block Reward USD (at time of halving) |

|---|---|---|---|

| 2009 | Genesis Block | 50 | N/A (Bitcoin had negligible value) |

| 2012 | First Halving | 25 | ~13 USD |

| 2016 | Second Halving | 12.5 | ~650 USD |

| 2020 | Third Halving | 6.25 | ~9000 USD |

| 2024 | Fourth Halving (Projected) | 3.125 | To be determined |

Bitcoin Halving and Market Sentiment

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, significantly impacts market sentiment. This impact is multifaceted, influenced by a complex interplay of factors leading up to and following the event itself. Understanding these dynamics is crucial for navigating the volatility often associated with halving cycles.

Investor behavior surrounding Bitcoin halvings is shaped by anticipation and speculation. The reduced supply of newly mined Bitcoin is often interpreted as a bullish signal, potentially driving up demand and price. Conversely, concerns about the impact on mining profitability and the potential for a post-halving price correction can lead to periods of uncertainty and caution.

Factors Shaping Investor Behavior

Several key factors contribute to the prevailing market sentiment. The most prominent is the expectation of scarcity. The halving, by definition, reduces the inflation rate of Bitcoin, making it a potentially more attractive asset for long-term investors. This perception of increased scarcity often fuels bullish sentiment. Additionally, the anticipation of the halving itself can create a self-fulfilling prophecy, with investors buying Bitcoin in advance, pushing prices higher. Conversely, factors such as macroeconomic conditions, regulatory uncertainty, and overall market risk appetite can temper this bullish sentiment. For example, a global economic downturn might overshadow the positive effects of the halving.

Media Coverage and Social Media Influence

Media coverage plays a crucial role in shaping public perception and influencing investor decisions. Positive news articles and social media posts often amplify bullish sentiment, attracting new investors and encouraging existing ones to hold onto their assets. Conversely, negative news or fear-mongering can lead to sell-offs and price declines. The tone and narrative presented by major media outlets and influential figures on social media platforms significantly impact the overall market sentiment. This influence can be amplified during the period leading up to the halving, as anticipation and speculation build.

Comparison of Investor Behavior Across Previous Halvings

Analyzing investor behavior during previous halvings offers valuable insights. The 2012 halving saw a gradual price increase in the months following the event, while the 2016 halving was followed by a more significant price surge. The 2020 halving presented a more complex picture, with a period of price appreciation followed by a substantial correction. These differences highlight the importance of considering other market factors alongside the halving itself. Each halving occurs within a unique macroeconomic and geopolitical environment, impacting investor behavior and the resulting price action.

Assessing Market Sentiment Effectively, Bitcoin Halving Exact Date 2025

Effectively assessing market sentiment requires a multi-pronged approach. Analyzing on-chain data, such as transaction volume, mining difficulty, and the number of active addresses, can provide valuable insights into the behavior of market participants. Monitoring social media sentiment using tools that track s and sentiment analysis can offer another perspective. Furthermore, paying close attention to the pronouncements of key market players, including prominent investors and analysts, can help gauge the overall market mood. A balanced approach, combining quantitative data with qualitative assessments, provides a more complete understanding of prevailing market sentiment.

Bitcoin Halving Exact Date 2025 – Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of the blockchain’s block time. However, speculation about the event often focuses on its potential impact on price; to explore predictions on this, check out this resource on Bitcoin Halving 2025 Price. Ultimately, the precise date of the halving, while important, remains subject to the inherent variability of Bitcoin’s mining process.

Predicting the Bitcoin Halving exact date in 2025 requires careful consideration of block times. While pinpointing the precise day remains challenging, understanding the halving’s timing is crucial. For a detailed breakdown of the projected timeframe, consult this resource on Bitcoin Halving Time 2025. This information helps refine estimations for the exact date of the 2025 Bitcoin Halving, though some minor variance is always possible.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of the blockchain’s block time. However, speculation about its impact on price is rampant, leading many to explore predictions like those found on this helpful resource: Bitcoin Halving 2025 Price Prediction. Ultimately, while price predictions remain uncertain, the precise date of the halving itself will be determined by the network’s consistent block generation.

Pinpointing the Bitcoin Halving Exact Date 2025 requires understanding the blockchain’s block generation times. For those seeking this information in Spanish, a helpful resource is available: Cuando Es El Halving De Bitcoin 2025. This site provides insights into the precise timing, crucial for investors anticipating the event’s market impact on the Bitcoin Halving Exact Date 2025.

Pinpointing the Bitcoin Halving exact date in 2025 requires precise block counting. To understand the timing better, a helpful resource is available at When Is Next Bitcoin Halving 2025 , which provides insights into the projected timeframe. Ultimately, the exact date will depend on the rate of block creation leading up to the event, affecting the Bitcoin Halving exact date in 2025.

Pinpointing the exact date of the Bitcoin Halving in 2025 requires careful consideration of block times. However, to stay updated on the approaching event and its projected timeline, you can utilize a reliable countdown resource like the Bitcoin Halving 2025 Countdown This will help you better anticipate the Bitcoin Halving Exact Date 2025 and its potential market impact.