Bitcoin Halving 2025

The Bitcoin halving, scheduled for approximately early 2025, is a significant event in the cryptocurrency’s lifecycle. This event, programmed into Bitcoin’s code, reduces the rate at which new Bitcoins are created by 50%. This reduction in supply, coupled with relatively consistent demand, is anticipated to have a considerable impact on Bitcoin’s price and overall market dynamics.

Bitcoin Halving Mechanics and Historical Impact

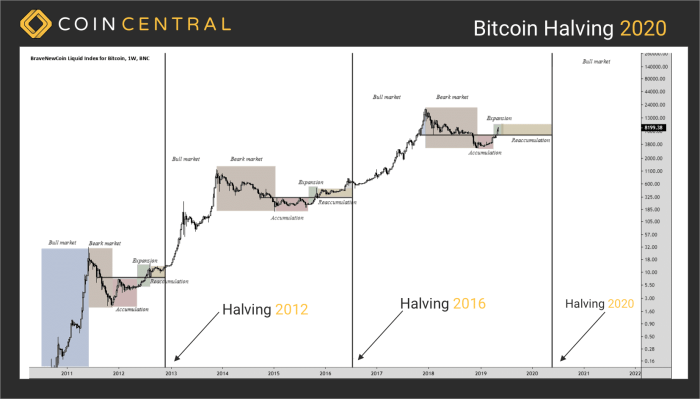

The Bitcoin halving is a predetermined event occurring roughly every four years. It halves the block reward, the amount of Bitcoin miners receive for verifying transactions and adding them to the blockchain. Historically, previous halvings have been followed by periods of significant price appreciation, although the timing and magnitude of these price increases have varied. The 2012 halving preceded a substantial bull run, and the 2016 halving also contributed to a significant price surge, though the timing of the price increase wasn’t immediately after the event in both cases. The impact is not immediate, but rather unfolds over time, influenced by several market factors. The reduced supply acts as a deflationary pressure, potentially driving up the price as demand remains relatively constant or increases.

Projected Price Scenarios Following the 2025 Halving

Predicting the exact price of Bitcoin after the 2025 halving is inherently speculative. However, several scenarios are plausible. A conservative scenario might see a gradual price increase over several months or years, mirroring the patterns observed after previous halvings. A more bullish scenario could involve a sharp and rapid price surge, fueled by increased investor demand and anticipation. Conversely, a bearish scenario could see the price remaining relatively stagnant or even declining, if macroeconomic factors negatively influence the cryptocurrency market. The price trajectory will depend heavily on several factors, including overall market sentiment, regulatory developments, and the adoption rate of Bitcoin. For instance, if institutional adoption increases significantly, it could lead to higher demand and price appreciation. Conversely, a major regulatory crackdown could suppress price growth. Similar to the previous cycles, it’s likely that the immediate post-halving period might see some volatility before a clearer trend emerges.

Comparison with Previous Halving Events

While the halving mechanism remains consistent, the market conditions surrounding each event have differed significantly. The 2012 and 2016 halvings occurred in vastly different macroeconomic environments and at different stages of Bitcoin’s adoption. The 2025 halving will likely be influenced by factors like increasing institutional interest, the emergence of competing cryptocurrencies, and the ongoing evolution of regulatory landscapes. The similarities lie in the fundamental principle of reduced supply, but the differences in external factors will shape the unique trajectory of the post-2025 halving period. It is crucial to consider that the market’s reaction to the halving is not solely determined by the halving itself, but also by other events and trends.

Influence of Macroeconomic Factors

Global macroeconomic factors will play a pivotal role in shaping Bitcoin’s price following the 2025 halving. High inflation rates might drive investors towards Bitcoin as a hedge against inflation, boosting demand. Conversely, tighter monetary policies from central banks could negatively impact risk assets, potentially depressing Bitcoin’s price. Regulatory changes, both positive (e.g., clear regulatory frameworks) and negative (e.g., outright bans), will also exert significant influence. The interplay between these macroeconomic forces and the halving’s impact on supply will determine the ultimate outcome. For example, if global inflation remains high and regulatory uncertainty decreases, Bitcoin might see substantial price appreciation. Conversely, if inflation subsides and stringent regulations are implemented, the price impact could be muted or even negative.

The Impact of the Halving on Miners

The Bitcoin halving, a programmed event that reduces the block reward paid to miners by half, presents significant challenges to the mining industry. This reduction directly impacts the profitability of mining operations, forcing miners to adapt or risk becoming unsustainable. The 2025 halving, in particular, will be closely watched to see how miners respond to this significant shift in the economic landscape of Bitcoin mining.

The reduced block reward after a halving necessitates miners to reassess their operational efficiency and profitability. The immediate impact is a decrease in revenue, potentially leading to losses if operating costs remain unchanged. This pressure necessitates strategic adjustments to ensure the long-term viability of mining operations.

Challenges Faced by Bitcoin Miners After a Halving

Miners face several key challenges following a halving. Reduced profitability is the most immediate concern. Maintaining operations becomes more difficult as revenue streams shrink, forcing miners to scrutinize energy costs, hardware maintenance, and personnel expenses. Some miners may find it impossible to continue operating profitably at the new, lower reward rate, leading to potential shutdowns. This could be exacerbated by fluctuating Bitcoin prices, adding further uncertainty to their already precarious position. The 2012 and 2016 halvings provide examples of this effect, though the specific impact varied based on the prevailing market conditions and technological advancements. For example, miners who had invested in older, less energy-efficient equipment were disproportionately affected compared to those with newer, more efficient hardware.

Strategies for Adapting to Reduced Profitability

To counteract the reduced profitability, miners can adopt several strategies. Improving energy efficiency is paramount. This could involve upgrading to more efficient mining hardware, negotiating better electricity rates, or relocating to regions with cheaper energy. Diversification of revenue streams is another crucial strategy. Some miners might explore offering hosting services to other miners or participating in other blockchain activities to supplement their income. Finally, focusing on operational efficiency is key. This involves optimizing mining processes, reducing waste, and streamlining operations to minimize costs. The success of these strategies will depend heavily on the prevailing market conditions and the miner’s ability to adapt quickly and efficiently. For example, large mining operations with economies of scale might be better positioned to weather the storm compared to smaller, less-capitalized entities.

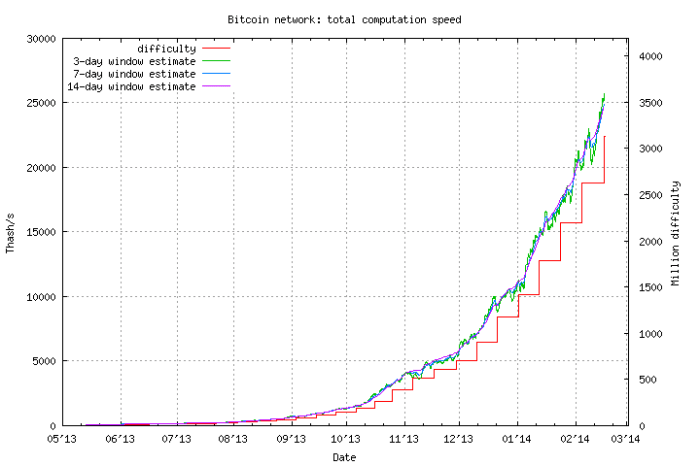

Impact on Hashrate and Network Security

The halving’s impact on the hashrate – the computational power securing the Bitcoin network – is complex and unpredictable. While reduced profitability might lead some miners to exit the market, resulting in a lower hashrate, this effect could be mitigated by technological advancements and the entry of new, more efficient miners. The overall network security, therefore, depends on the balance between these competing forces. A significant drop in hashrate could compromise network security, making the network vulnerable to attacks. However, a stable or even slightly increased hashrate could indicate the network’s resilience to the halving’s effects. Past halvings have demonstrated that the network’s security has generally remained robust despite the reduction in block rewards.

Potential for Consolidation in the Bitcoin Mining Industry

The halving could accelerate consolidation within the Bitcoin mining industry. Smaller, less efficient miners might be forced to sell their equipment or merge with larger operations to survive. This could lead to a more concentrated mining landscape, dominated by a smaller number of larger players. This consolidation could have both positive and negative implications. While it might lead to increased efficiency and stability, it could also raise concerns about centralization and reduced competition. The 2016 halving showed some signs of this trend, with larger mining pools gaining market share. The extent of consolidation in 2025 will depend on various factors, including the price of Bitcoin and the development of new mining technologies.

Investor Sentiment and Market Predictions

Bitcoin halving events are typically met with a mixture of anticipation and uncertainty within the investment community. The halving, which reduces the rate at which new Bitcoins are mined, is often viewed as a fundamentally bullish event due to its deflationary impact on the supply. However, the actual price reaction is complex and influenced by numerous other market factors.

Investor sentiment surrounding halving events is often characterized by increased volatility. Leading up to the event, we see a surge in both bullish and bearish predictions, reflecting the inherent uncertainty in predicting market behavior. The period immediately following the halving often witnesses significant price fluctuations, as investors react to the actual outcome and adjust their positions accordingly. This volatility creates both opportunities and risks for investors.

Typical Investor Sentiment

Historically, the sentiment surrounding Bitcoin halvings has been predominantly bullish. Many investors believe the reduced supply will ultimately lead to increased scarcity and, consequently, higher prices. This belief is often amplified by the narrative of Bitcoin as a scarce digital asset, akin to gold. However, this positive sentiment is not universally shared. Some investors remain skeptical, pointing to the potential for a period of price stagnation or even a temporary decline following the halving due to the reduced miner revenue and potential market sell-offs. The overall sentiment is a dynamic interplay of these bullish and bearish perspectives, leading to significant market volatility.

Prominent Market Predictions for the 2025 Halving

Several analysts and market commentators have offered price predictions for Bitcoin following the 2025 halving. These predictions vary widely, ranging from relatively conservative estimates to extremely bullish scenarios. For instance, some analysts have suggested a gradual price increase, perhaps reaching new all-time highs within a year or two of the halving, while others have predicted exponentially higher price targets, based on various models and assumptions. It’s crucial to note that these predictions are speculative and should not be taken as financial advice. The actual price movement will depend on a multitude of factors, including macroeconomic conditions, regulatory developments, and overall market sentiment. The lack of a universally accepted model for predicting Bitcoin’s price further underscores the inherent uncertainty. For example, PlanB’s Stock-to-Flow model, which previously generated significant attention, has not accurately predicted price movements in recent years, highlighting the limitations of such predictive models.

The Role of Speculation and Market Manipulation

Speculation plays a significant role in shaping Bitcoin’s price, particularly around events like the halving. Increased anticipation and uncertainty create an environment ripe for speculation, with investors driving price movements based on their expectations rather than fundamental analysis. Market manipulation, while difficult to definitively prove, is also a concern. Large holders or coordinated groups could potentially influence the price through coordinated buying or selling, exacerbating existing volatility. The decentralized nature of Bitcoin makes it challenging to fully regulate or prevent such activities. The opacity of large institutional holdings and the prevalence of leveraged trading further contribute to the complexity of understanding the underlying market forces. Examples of coordinated sell-offs or pump-and-dump schemes, although not directly linked to the halving, demonstrate the potential for manipulation to influence the market.

Investment Strategies in Anticipation of the Halving

Investors employ various strategies in anticipation of the Bitcoin halving. Some adopt a “buy-and-hold” strategy, believing in the long-term value proposition of Bitcoin and its scarcity. Others might choose a more active approach, potentially employing dollar-cost averaging to mitigate risk or engaging in short-term trading based on price fluctuations. Sophisticated investors might use derivatives like options or futures contracts to hedge against potential price declines or to speculate on future price movements. The optimal strategy depends heavily on individual risk tolerance, investment horizon, and market outlook. Diversification, a core principle of prudent investing, is also crucial, as Bitcoin’s price remains highly volatile and susceptible to external factors. A balanced portfolio, incorporating both Bitcoin and other asset classes, can help mitigate risk and improve overall portfolio performance.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, will have profound and lasting consequences on Bitcoin’s trajectory and the broader cryptocurrency landscape. While the immediate impact on price is often speculative, the long-term implications are more predictable, stemming from the fundamental changes in Bitcoin’s economic model. These changes will influence adoption, market dominance, and the competitive dynamics within the crypto ecosystem.

The halving’s impact on Bitcoin’s scarcity is undeniable. Reducing the rate of new Bitcoin entering circulation will inevitably increase its relative scarcity over time. This inherent deflationary pressure, coupled with increasing demand, is projected to contribute to long-term price appreciation, potentially solidifying Bitcoin’s position as a store of value asset, similar to gold. However, this outcome is not guaranteed and depends on various macroeconomic factors and the overall adoption rate.

Bitcoin’s Market Position and Adoption, Bitcoin Halving Time 2025

The 2025 halving could significantly bolster Bitcoin’s adoption. The decreased supply, combined with potential price increases, may attract more institutional and individual investors seeking inflation hedges or long-term growth opportunities. Increased adoption could lead to broader acceptance by merchants and businesses, further solidifying Bitcoin’s position as a viable payment method and a mainstream asset. For example, the 2012 and 2016 halvings were followed by significant price increases, though these were accompanied by periods of volatility. The sustained increase in Bitcoin’s market capitalization post-halvings suggests a potential for similar growth following the 2025 event, although the magnitude remains uncertain.

Bitcoin’s Continued Dominance

While Bitcoin’s dominance in the cryptocurrency market is currently under pressure from alternative cryptocurrencies (altcoins), the 2025 halving could reinforce its leading position. The increased scarcity and potential price appreciation could attract investment away from altcoins, particularly those without a clear value proposition or strong underlying technology. However, the continued innovation and development of altcoins, offering functionalities Bitcoin lacks, presents a challenge to Bitcoin’s long-term dominance. The success of altcoins in specific niches, such as decentralized finance (DeFi) or non-fungible tokens (NFTs), could potentially limit Bitcoin’s market share.

Impact on the Overall Cryptocurrency Market

The 2025 halving’s influence extends beyond Bitcoin. The potential price appreciation of Bitcoin could lead to a positive “spillover effect” on the overall cryptocurrency market, boosting investor sentiment and driving increased interest in altcoins. However, a significant price surge in Bitcoin could also attract regulatory scrutiny, potentially impacting the entire cryptocurrency market. Furthermore, the halving’s impact on miner profitability could trigger a consolidation within the mining industry, leading to increased centralization and potentially influencing the security and decentralization of the Bitcoin network.

Influence on Alternative Cryptocurrencies

The 2025 halving could accelerate the development and adoption of alternative cryptocurrencies designed to address Bitcoin’s perceived limitations. For instance, altcoins focusing on improved scalability, faster transaction speeds, or enhanced smart contract functionality might gain traction as investors seek alternatives to Bitcoin’s relatively slow transaction processing times and limited smart contract capabilities. This could lead to increased competition and innovation within the cryptocurrency ecosystem, ultimately benefiting users and potentially fostering the development of more efficient and user-friendly blockchain technologies. Conversely, a significant increase in Bitcoin’s price could draw investment away from altcoins, slowing their development and adoption in the short term.

Technical Aspects and Blockchain Analysis

The Bitcoin halving, a pre-programmed event reducing the block reward miners receive for validating transactions, introduces significant technical changes to the Bitcoin blockchain. These changes ripple through the network, impacting transaction fees, network congestion, and ultimately, Bitcoin’s scalability and efficiency. Understanding these technical implications is crucial for navigating the post-halving landscape.

The reduced block reward directly affects the economics of Bitcoin mining. With fewer newly minted bitcoins entering circulation per block, miners will rely more heavily on transaction fees to remain profitable. This economic shift has several foreseeable technical consequences.

Reduced Block Reward and Transaction Fees

A lower block reward incentivizes miners to prioritize transactions with higher fees. This creates a competitive environment where users willing to pay higher fees have their transactions included in blocks faster. We can expect to see an increase in average transaction fees following the halving, particularly during periods of high network activity. This dynamic mirrors the situation observed after previous halvings. For example, the 2020 halving led to a noticeable increase in average transaction fees in the months following the event, before stabilizing at a higher level than before. This increase in fees acts as a natural congestion control mechanism, but it can also price out smaller transactions or users with limited resources.

Impact on Network Congestion

The interplay between reduced block reward and increased transaction fees directly influences network congestion. While higher fees can alleviate some congestion by prioritizing transactions, a significant surge in transaction volume could still lead to increased waiting times for transaction confirmations. This could manifest as slower transaction processing and a potential backlog of unconfirmed transactions. The network’s capacity, measured in transactions per second (TPS), remains relatively constant; therefore, increased demand with unchanged capacity leads to higher fees and potential congestion. Historical data from previous halvings shows a correlation between increased transaction fees and periods of higher network congestion.

Bitcoin Scalability and Efficiency

The halving indirectly impacts Bitcoin’s scalability and efficiency. While the halving itself doesn’t directly change the underlying blockchain protocol, the economic pressures it creates may accelerate the adoption of layer-2 scaling solutions. Layer-2 solutions, such as the Lightning Network, process transactions off-chain, reducing the load on the main Bitcoin blockchain. The increased transaction fees resulting from the halving could incentivize users to explore these more efficient alternatives, thereby improving the overall scalability and efficiency of the Bitcoin ecosystem. The long-term success of layer-2 solutions, however, depends on factors beyond the halving, including user adoption, developer activity, and the overall usability of these technologies.

Hypothetical Scenario: Post-Halving Technical Consequences

Imagine a scenario where the 2025 halving coincides with a period of significantly increased Bitcoin adoption and transaction volume. The reduced block reward, coupled with heightened demand, could lead to a substantial increase in average transaction fees, potentially pricing out some users. This could, in turn, result in temporary network congestion and slower transaction confirmation times. However, simultaneously, we might observe a significant increase in Lightning Network usage as users seek more cost-effective and faster transaction solutions. This scenario highlights the complex interplay between the halving’s economic impact and the technical realities of the Bitcoin network. The overall outcome would depend on the balance between increased demand, the effectiveness of fee-based congestion control, and the adoption rate of layer-2 solutions.

Frequently Asked Questions (FAQs): Bitcoin Halving Time 2025

This section addresses common queries regarding the Bitcoin halving event scheduled for 2025, clarifying its mechanics, historical impact, and associated risks. Understanding these aspects is crucial for both seasoned investors and newcomers considering involvement in the cryptocurrency market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. Each halving cuts the block reward received by miners in half, impacting the overall supply of new Bitcoins entering circulation.

Bitcoin Halving Date in 2025

While the exact date is dependent on the block mining rate, the 2025 Bitcoin halving is anticipated to occur sometime in the Spring or early Summer. Predicting the precise date requires monitoring the blockchain’s block generation time, which can fluctuate slightly. However, based on historical data and current mining activity, a reasonable estimate places the event within a relatively narrow timeframe.

Halving’s Effect on Bitcoin Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The reduced supply of newly mined Bitcoins, coupled with continued demand, often creates upward pressure on the price. The 2012 and 2016 halvings, for instance, were followed by substantial price increases, though the timeframes and magnitudes varied. It’s important to note that other factors, including macroeconomic conditions and market sentiment, also significantly influence Bitcoin’s price.

Guaranteed Price Increase After Halving?

No, a price increase after a halving is not guaranteed. While historical data suggests a correlation between halvings and price rises, it’s not a deterministic relationship. Market dynamics are complex and influenced by a multitude of factors beyond the halving itself. For example, regulatory changes, technological advancements, or broader economic downturns can all impact Bitcoin’s price regardless of the halving event. The 2020 halving, while ultimately leading to a price increase, did not show immediate and dramatic results.

Risks of Investing Around the Halving

Investing in Bitcoin, especially around a halving event, carries inherent risks. The cryptocurrency market is notoriously volatile, and prices can experience significant fluctuations in short periods. Speculative trading and market manipulation can exacerbate price volatility. Furthermore, the halving itself doesn’t eliminate the underlying risks associated with Bitcoin’s decentralized and unregulated nature. Investors should carefully assess their risk tolerance and only invest what they can afford to lose.

Illustrative Data Presentation

Understanding the historical impact of Bitcoin halvings is crucial for informed speculation about the 2025 event. Analyzing past trends in price and mining activity helps to contextualize potential future scenarios, though it’s vital to remember that past performance is not indicative of future results. The following data provides a comparative overview of previous halvings and a projection of potential price movements after the 2025 halving.

Bitcoin Halving Statistics Comparison

The table below compares key statistics from the previous three Bitcoin halving events. Note that the “Price After” column reflects the price at a specific point after the halving, and the actual price trajectory varied considerably over longer timeframes. This data is intended to illustrate general trends, not precise predictions.

| Halving Date | Block Reward Before | Block Reward After | Price Before (USD) (Approximate) | Price After (USD) (Approximate, within a year) |

|---|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | $13 | $100+ |

| July 9, 2016 | 25 BTC | 12.5 BTC | $650 | $20,000+ |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | $8,700 | $60,000+ |

Projected Bitcoin Price Scenarios Post-Halving

Predicting the Bitcoin price after any event, including a halving, is inherently speculative. However, we can illustrate potential price trajectories based on historical trends and current market sentiment. The following descriptions represent three distinct scenarios: bullish, bearish, and neutral. Remember these are illustrative and not financial advice.

Bitcoin Halving Time 2025 – Imagine a chart with a horizontal axis representing time (months after the 2025 halving) and a vertical axis representing Bitcoin price in USD. Three lines would represent the different scenarios:

Bullish Scenario: This line would show a steep upward trend, potentially exceeding previous all-time highs within a year or two of the halving. This scenario assumes sustained positive market sentiment, increased institutional adoption, and limited selling pressure. An example would be a price trajectory similar to the post-2020 halving, albeit potentially steeper, given the increased global adoption and institutional interest since then.

Bearish Scenario: This line would show a relatively flat or slightly downward trend, potentially even falling below the pre-halving price. This scenario assumes a continuation of macroeconomic uncertainty, negative regulatory news, or significant selling pressure from long-term holders. A real-life example that could mirror this scenario would be the prolonged bear market following the 2018 halving, where the price remained significantly below its pre-halving peak for an extended period.

Neutral Scenario: This line would show a gradual upward trend, possibly reaching new highs but at a slower pace than the bullish scenario. This scenario represents a balance between bullish and bearish forces, reflecting a period of consolidation and gradual price appreciation. A potential parallel would be the relatively slower price appreciation in the months following the 2012 halving, which eventually led to a substantial price increase over a longer timeframe.

The Bitcoin Halving Time 2025 is a significant event for the cryptocurrency, impacting the rate of new Bitcoin creation. Understanding the precise timing of this halving is crucial for market analysis, and you can find detailed information about this at Bitcoin Halving 2025 Time. This resource provides valuable insights into the Bitcoin Halving Time 2025 and its potential consequences.

The Bitcoin Halving Time 2025 is a significant event for the cryptocurrency, impacting the rate of new Bitcoin creation. To stay informed about the precise date and its potential market effects, it’s helpful to check the dedicated Bitcoin Halving Countdown 2025 resource. Understanding this countdown is crucial for anyone interested in Bitcoin Halving Time 2025 and its broader implications.

Bitcoin Halving Time 2025 is a significant event for the cryptocurrency, impacting the rate of new Bitcoin creation. Understanding this event is crucial for investors, and a great resource to learn more is available at Bitcoin Halving 2025. This website provides detailed information about the Bitcoin Halving Time 2025 and its potential consequences for the market.

Bitcoin Halving Time 2025 is a significant event for the cryptocurrency, impacting the rate of new Bitcoin creation. Understanding this event is crucial for investors, and a great resource to learn more is available at Bitcoin Halving 2025. This website provides detailed information about the Bitcoin Halving Time 2025 and its potential consequences for the market.

The Bitcoin Halving Time 2025 is a significant event for the cryptocurrency’s future, impacting its inflation rate and potentially its price. Understanding this event requires examining the specifics of the reward halving, which you can learn more about by visiting this comprehensive resource on the 2025 Bitcoin Halving. Ultimately, the 2025 Bitcoin Halving Time will be a defining moment, shaping the trajectory of Bitcoin for years to come.

The Bitcoin Halving Time 2025 is a significant event for the cryptocurrency’s future, impacting its inflation rate and potentially its price. Understanding this event requires examining the specifics of the reward halving, which you can learn more about by visiting this comprehensive resource on the 2025 Bitcoin Halving. Ultimately, the 2025 Bitcoin Halving Time will be a defining moment, shaping the trajectory of Bitcoin for years to come.