Bitcoin Price History & Trends (Pre-2025): Bitcoin May 2025 Price Prediction

Bitcoin’s price history is a volatile yet fascinating narrative of technological innovation, market speculation, and regulatory uncertainty. Since its inception, Bitcoin has experienced dramatic price swings, transitioning between periods of explosive growth (bull markets) and sharp declines (bear markets). Understanding these past cycles is crucial for analyzing potential future price movements, although predicting the future of Bitcoin with certainty remains impossible.

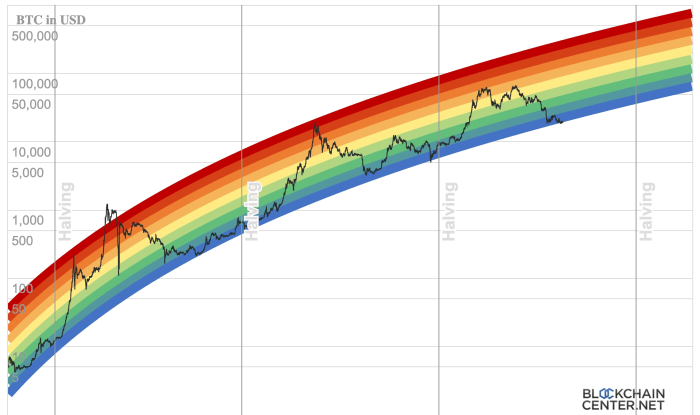

Bitcoin’s price journey can be broadly categorized into distinct cycles, each characterized by unique events and market sentiment. Analyzing these cycles reveals recurring patterns, although the intensity and duration of each cycle vary. The interplay between technological advancements, regulatory actions, and overall market sentiment significantly shapes Bitcoin’s price trajectory.

Significant Price Fluctuations and Market Cycles

Bitcoin’s early years saw relatively low prices and limited trading volume. The first significant price surge occurred in 2013, reaching approximately $1,100 before a sharp correction. Subsequent bull markets emerged in 2017 (peaking near $20,000) and again in late 2020/early 2021 (reaching almost $65,000). Each bull market was followed by a substantial bear market, characterized by prolonged price declines and decreased trading activity. These cycles demonstrate Bitcoin’s inherent volatility and the influence of speculative investment. The 2017 bull run, for example, was fueled by significant media attention and increased institutional interest, while the subsequent bear market was partly attributed to regulatory concerns and a general crypto market downturn. The 2020-2021 bull run was similarly influenced by factors such as increased institutional adoption, DeFi growth, and the pandemic-induced economic uncertainty.

Key Events Influencing Bitcoin’s Price

Several key events have significantly impacted Bitcoin’s price over the years. These events include:

| Year | Event | Price Impact | Analysis |

|---|---|---|---|

| 2012 | First Bitcoin Halving | Gradual Price Increase | Reduced supply of newly mined Bitcoin led to increased scarcity and upward price pressure. |

| 2013 | Mt. Gox Hack | Sharp Price Decline | Loss of investor confidence due to the theft of a large number of Bitcoins from the Mt. Gox exchange. |

| 2017 | Increased Institutional Interest & Media Hype | Significant Price Surge | Increased mainstream awareness and adoption from institutional investors fueled a speculative bubble. |

| 2020-2021 | Second and Third Bitcoin Halvings, Increased Institutional Adoption, DeFi Boom | Massive Price Surge | The halving events, coupled with increased institutional investment and the growth of decentralized finance (DeFi), created a perfect storm for price appreciation. |

| 2022 | Macroeconomic Uncertainty, Increased Regulatory Scrutiny | Significant Price Decline | Global economic instability and increased regulatory pressure contributed to a substantial price correction. |

Comparison of Previous Price Cycles

Comparing previous Bitcoin price cycles reveals some common patterns. Each bull market is typically preceded by a period of relative price stability or consolidation, followed by a rapid price increase fueled by increasing adoption and investor enthusiasm. Bear markets, conversely, are often characterized by a loss of investor confidence, regulatory uncertainty, or macroeconomic headwinds. While past performance is not indicative of future results, analyzing these cycles can provide valuable insights into potential future price movements. The duration and magnitude of each cycle, however, have varied significantly, highlighting the unpredictable nature of the cryptocurrency market. For instance, the recovery time from bear markets has varied considerably, depending on factors such as technological developments and the overall economic climate.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, technological advancements, and regulatory developments. While no one can definitively state the price, analyzing these factors provides a framework for understanding potential price movements.

Macroeconomic Factors and Bitcoin’s Price

Global economic conditions significantly influence Bitcoin’s price. High inflation, for instance, might drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and price. Conversely, rising interest rates could make alternative investments more attractive, potentially reducing Bitcoin’s appeal and lowering its price. Strong global economic growth could lead to increased investment in riskier assets, including Bitcoin, while a recession might trigger a sell-off as investors seek safer havens. The interplay between these factors is complex and difficult to predict precisely; for example, the 2022 bear market saw both high inflation and rising interest rates, leading to a significant Bitcoin price drop. However, the long-term impact of macroeconomic factors on Bitcoin’s value remains a topic of ongoing debate among economists and analysts.

Technological Advancements and Bitcoin’s Price

Technological improvements play a crucial role in Bitcoin’s future. Widespread adoption of the Lightning Network, a layer-2 scaling solution, could significantly increase transaction speeds and reduce fees, making Bitcoin more usable for everyday transactions. This increased usability could boost demand and, consequently, the price. Similarly, other scalability solutions aiming to improve Bitcoin’s transaction throughput could have a positive impact. Conversely, a failure to implement or adopt these technologies could hinder Bitcoin’s growth and limit price appreciation. The success of these advancements hinges on developer activity, community support, and market adoption. For instance, the increasing use of the Lightning Network for micropayments demonstrates the potential for technological improvements to positively influence Bitcoin’s price.

Regulatory Developments and Bitcoin’s Price

Government regulations and institutional adoption are pivotal factors. Clear and favorable regulatory frameworks in major economies could legitimize Bitcoin and encourage institutional investment, driving up its price. Conversely, restrictive regulations could stifle adoption and depress the price. Increased institutional adoption, such as by major corporations or investment firms, could inject significant capital into the market, leading to price increases. However, a lack of regulatory clarity or negative regulatory actions could create uncertainty and volatility, potentially impacting the price negatively. For example, the evolving regulatory landscape in the United States, with differing approaches from various states and agencies, highlights the uncertainty surrounding regulatory impact.

Comparative Impact of Technological and Regulatory Scenarios

A scenario with both widespread Lightning Network adoption and favorable regulation would likely create a highly positive impact on Bitcoin’s price, potentially leading to substantial price appreciation. Conversely, a scenario with limited technological progress and stringent regulation could significantly hinder Bitcoin’s growth, resulting in a lower price or even stagnation. The combination of these factors creates a wide range of potential outcomes. For instance, comparing the relatively positive regulatory environment in some European countries with the more uncertain landscape in the US illustrates the varying impacts of regulation on market sentiment and price.

Hypothetical Geopolitical Event and Bitcoin’s Price

A hypothetical scenario: a major global conflict or political instability could trigger a flight to safety, increasing demand for Bitcoin as a decentralized and less susceptible asset. This could lead to a sharp increase in Bitcoin’s price as investors seek refuge from traditional financial systems. However, the severity and duration of such an event would significantly influence the extent of the price impact. The effect might be temporary, with prices reverting to previous trends once stability is restored. Historically, periods of geopolitical uncertainty have often led to increased interest in alternative assets like gold and Bitcoin, illustrating the potential for such events to influence price.

Bitcoin Adoption and Market Sentiment

Predicting Bitcoin’s price in 2025 requires understanding the interplay between its adoption rate and overall market sentiment. While predicting the future is inherently uncertain, analyzing current trends and potential catalysts allows us to formulate plausible scenarios. This section will explore the projected growth of Bitcoin adoption across various sectors and its impact on price volatility.

Projected Growth of Bitcoin Adoption

By 2025, we can expect significant growth in Bitcoin adoption across individuals, institutions, and governments. Increased public awareness, coupled with advancements in user-friendly interfaces and improved regulatory clarity in some jurisdictions, will likely drive wider individual adoption. Institutional investors, already showing increasing interest, are poised to further increase their holdings, driven by diversification strategies and the potential for long-term appreciation. Governmental adoption, while still nascent in many areas, could accelerate, particularly in countries seeking to diversify their reserves or implement innovative financial technologies. The pace of adoption will depend on factors like regulatory developments, technological advancements, and macroeconomic conditions. For example, El Salvador’s adoption of Bitcoin as legal tender, while controversial, demonstrated a government’s willingness to embrace the cryptocurrency, setting a precedent for others.

Impact of Institutional Investment on Bitcoin’s Price, Bitcoin May 2025 Price Prediction

Increased institutional investment is expected to have a substantial positive impact on Bitcoin’s price. Large-scale purchases by institutional investors, such as asset management firms and hedge funds, can significantly reduce the cryptocurrency’s supply available on the open market, leading to price appreciation. This is similar to how large institutional buying in traditional markets can drive up the price of stocks or other assets. The entry of established financial institutions lends credibility to Bitcoin, attracting further investment and reducing perceived risk for individual investors. However, mass sell-offs by these institutions could also lead to significant price corrections. The level of institutional involvement will therefore be a key factor determining price movements.

Influence of Social Media Sentiment and News Coverage

Social media sentiment and news coverage significantly influence Bitcoin’s price volatility. Positive news, such as regulatory approvals or technological breakthroughs, can trigger buying frenzies and price surges. Conversely, negative news, such as security breaches or regulatory crackdowns, can lead to sell-offs and price drops. The amplification effect of social media, where news spreads rapidly and often without thorough verification, can exacerbate these price swings. For example, Elon Musk’s tweets about Bitcoin have historically been associated with significant price movements, highlighting the influence of influential figures and their pronouncements. This underscores the importance of discerning reliable information sources and mitigating emotional reactions when making investment decisions.

Comparative Analysis of Bitcoin’s Adoption Rate

Comparing Bitcoin’s adoption rate to other cryptocurrencies reveals its dominant position, although altcoins continue to gain traction in specific niches. While Bitcoin’s market capitalization significantly surpasses that of other cryptocurrencies, the adoption rate for specific use cases (e.g., decentralized finance or non-fungible tokens) might be higher for certain altcoins. Compared to traditional assets, Bitcoin’s adoption rate is still relatively low, but its growth trajectory suggests a potential for wider acceptance in the future. The comparison depends heavily on the metric used – market capitalization, transaction volume, or number of users – and each provides a different perspective on adoption.

Potential Scenarios for Bitcoin Adoption and Price Implications

The following scenarios illustrate potential outcomes for Bitcoin adoption by 2025 and their corresponding price implications:

- Scenario 1: Widespread Adoption: Significant institutional and governmental adoption, coupled with increased individual user base. Price Implication: Substantial price appreciation, potentially exceeding $100,000.

- Scenario 2: Moderate Adoption: Gradual institutional adoption, steady growth in individual users, but limited governmental involvement. Price Implication: Moderate price appreciation, potentially reaching $50,000 – $100,000.

- Scenario 3: Slow Adoption: Limited institutional and governmental adoption, slower growth in individual users, hampered by regulatory uncertainty or technological challenges. Price Implication: Limited price appreciation or potential price stagnation, possibly remaining below $50,000.

- Scenario 4: Negative News Driven Decline: Major security breach or significant negative regulatory development leading to widespread distrust. Price Implication: Significant price decline, potentially below current market levels.

It is important to note that these are simplified scenarios and the actual outcome could be a combination of these or a completely different scenario. External factors such as global economic conditions and geopolitical events will also play a crucial role.

Bitcoin May 2025 Price Prediction – Predicting the Bitcoin price in May 2025 is inherently speculative, but a key factor influencing forecasts is the upcoming halving event. To keep track of the countdown, you can utilize this helpful resource: Bitcoin Halving 2025 Timer. This event’s impact on Bitcoin’s scarcity and potential price appreciation in May 2025 remains a subject of ongoing discussion and analysis within the cryptocurrency community.

Predicting the Bitcoin price in May 2025 is challenging, but understanding the upcoming halving is crucial. To accurately gauge its potential impact, it’s essential to consider what the reduced block reward will mean for miners and the overall network. For a detailed analysis of this significant event, check out this insightful article on What Will Happen In 2025 Bitcoin Halving.

This understanding is vital for forming a more informed prediction about the Bitcoin May 2025 price.

Predicting the Bitcoin price in May 2025 is challenging, given the inherent volatility of the cryptocurrency market. However, understanding the impact of the upcoming halving is crucial for any accurate forecast. For insightful analysis on this pivotal event, check out the Plan B Bitcoin Halving 2025 Prediction , which offers valuable context for forming your own Bitcoin May 2025 price prediction.

Ultimately, numerous factors will influence the final price, making it a complex but fascinating area of speculation.

Predicting the Bitcoin price in May 2025 is inherently speculative, but understanding the impact of the halving is crucial. The halving event significantly affects the rate of new Bitcoin entering circulation, a key factor in price fluctuations. To fully grasp the potential effects, it’s helpful to know How Long Does Bitcoin Halving Last In 2025 , as this timeframe influences the market’s response and subsequent price adjustments.

Therefore, considering the halving’s duration is vital for any serious Bitcoin May 2025 price prediction.

Predicting Bitcoin’s price in May 2025 involves considering various factors, including market sentiment and technological advancements. To gain a clearer perspective on potential future trends, understanding the trajectory leading up to that point is crucial. For insights into a key interim period, check out this analysis on Bitcoin Prediction September 2025 , which can inform our understanding of the broader market dynamics influencing the May 2025 price prediction.

Ultimately, the September predictions offer valuable context for assessing the longer-term prospects of Bitcoin.

Predicting the Bitcoin price in May 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting this prediction is the Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Is Bitcoin Halving Date 2025 , as the halving’s proximity to May 2025 will undoubtedly play a role in shaping the price.

Therefore, accurately forecasting Bitcoin’s May 2025 value requires considering the halving’s impact on supply and demand.