Bitcoin Prediction Dec 2025

Bitcoin, launched in 2009, has experienced a turbulent journey marked by periods of explosive growth and dramatic crashes. Its decentralized nature and limited supply have fueled its appeal as a potential store of value and hedge against inflation, but its price remains highly volatile, influenced by a complex interplay of factors. Predicting its future price with certainty is, therefore, an extremely challenging task.

Bitcoin’s price is subject to significant fluctuations, often driven by market sentiment. Positive news, such as widespread adoption by major corporations or positive regulatory developments, can lead to price surges. Conversely, negative news, including regulatory crackdowns or security breaches, can trigger sharp declines. This inherent volatility is a defining characteristic of Bitcoin and makes long-term predictions inherently risky.

Factors Influencing Bitcoin’s Price

Several key factors contribute to Bitcoin’s price volatility and influence potential future values. These include macroeconomic conditions, regulatory landscape, technological advancements, and overall market sentiment. Understanding these factors is crucial for any attempt at price prediction, though it does not guarantee accuracy.

The global economic climate plays a significant role. During periods of economic uncertainty or inflation, investors may turn to Bitcoin as a safe haven asset, driving up demand and price. Conversely, periods of economic stability may lead to reduced demand. Regulatory changes, both globally and nationally, significantly impact Bitcoin’s price. Favorable regulations can boost investor confidence and increase adoption, while restrictive measures can lead to price drops. For example, a country banning Bitcoin exchanges could significantly impact the global price. Technological advancements within the Bitcoin ecosystem, such as improvements to scalability or the development of new applications, can also influence price. The successful implementation of the Lightning Network, for instance, could potentially increase Bitcoin’s transaction speed and reduce fees, potentially driving up its value. Finally, overall market sentiment, fueled by media coverage, social media trends, and influencer opinions, can create speculative bubbles or lead to significant price corrections. A sudden surge in positive news can lead to a rapid price increase, while negative sentiment can trigger a sell-off.

Challenges in Predicting Bitcoin’s Price

Accurately predicting Bitcoin’s price in December 2025, or any future date, is exceptionally difficult due to the inherent volatility of the cryptocurrency market and the numerous unpredictable factors at play. Past performance is not indicative of future results, and attempts to extrapolate historical trends often prove inaccurate. The cryptocurrency market is susceptible to unpredictable events, such as unexpected regulatory changes, significant security breaches, or sudden shifts in market sentiment. These events can dramatically alter the price trajectory, rendering even the most sophisticated models ineffective. Furthermore, the relatively short history of Bitcoin limits the availability of reliable historical data for robust predictive modeling. The limited data makes it difficult to establish reliable patterns and correlations that could inform accurate predictions. While various analytical tools and models are employed, including technical analysis and fundamental analysis, their predictive power remains limited in the face of the inherent uncertainties of the cryptocurrency market. For example, predictions made in 2017 about Bitcoin’s price in 2020 were widely off the mark, highlighting the challenges in forecasting this volatile asset.

Analyzing Historical Trends

Predicting Bitcoin’s price in 2025 requires a thorough examination of its historical performance. By identifying patterns and significant events, we can gain valuable insights into potential future price movements. While past performance doesn’t guarantee future results, analyzing historical trends provides a crucial foundation for informed speculation.

Analyzing Bitcoin’s price history reveals a volatile yet generally upward trajectory. The cryptocurrency’s value has experienced dramatic swings, influenced by factors such as regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. Understanding these influences is vital to interpreting historical data and projecting potential future scenarios.

Bitcoin Price Fluctuations and Significant Events

A chart depicting Bitcoin’s price from its inception to the present would show a series of exponential growth periods punctuated by sharp corrections. Key events such as the Mt. Gox hack in 2014, the 2017 bull run, and the 2021 bull market would be clearly visible as periods of significant price increases followed by substantial declines. Conversely, periods of relative stability or sideways trading would also be evident, highlighting the cyclical nature of Bitcoin’s price action. The chart would visually demonstrate the impact of both positive and negative news cycles on the price, offering a visual representation of the market’s overall sentiment and behavior over time. Imagine a line graph, with the x-axis representing time and the y-axis representing Bitcoin’s price in USD. The graph would exhibit periods of steep upward slopes representing bull markets, followed by sharp downward slopes during bear markets. The visual would clearly indicate the volatility inherent in the cryptocurrency market.

Bitcoin Halving Events and Their Impact

Bitcoin’s protocol incorporates a “halving” event approximately every four years. This event reduces the rate at which new Bitcoins are mined by half, effectively decreasing the supply entering the market. Historically, Bitcoin halving events have been followed by periods of significant price appreciation. For example, the halving events of 2012 and 2016 were followed by substantial bull runs. This correlation is often attributed to the interplay between supply and demand: a reduced supply of newly mined Bitcoin, coupled with persistent or increasing demand, can lead to price increases. However, it’s crucial to note that other factors also contribute to price movements, and the impact of halving events is not always immediate or uniform. The 2020 halving, for instance, saw a period of relative consolidation before the significant price surge of late 2020 and early 2021. Therefore, while halving events are a significant factor to consider, they shouldn’t be viewed in isolation. Other macroeconomic and market-specific factors must also be taken into account for a complete analysis.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, technological advancements, and regulatory landscapes. While precise forecasting remains impossible, analyzing these factors offers valuable insight into potential price drivers.

Macroeconomic factors will significantly shape Bitcoin’s trajectory. High inflation, for instance, could boost Bitcoin’s appeal as a hedge against currency devaluation, potentially driving demand and price increases. Conversely, rising interest rates might divert investment away from riskier assets like Bitcoin towards more stable, interest-bearing instruments, potentially suppressing its price. The overall global economic climate, including recessionary fears or periods of robust growth, will also influence investor sentiment and consequently, Bitcoin’s value. For example, the 2022 bear market was partly attributed to rising interest rates and increased inflation globally.

Macroeconomic Influences on Bitcoin’s Value

Inflation and interest rate fluctuations are key macroeconomic indicators impacting Bitcoin’s price. High inflation can increase demand for Bitcoin as a store of value, pushing prices upward. Conversely, higher interest rates can make traditional investments more attractive, potentially reducing Bitcoin’s appeal and lowering its price. The strength of the US dollar, often inversely correlated with Bitcoin’s price, is another significant macroeconomic factor. A strengthening dollar can lead to a decrease in Bitcoin’s value, as investors may shift to the more stable currency. Conversely, a weakening dollar could boost Bitcoin’s price as investors seek alternative assets. The interplay of these factors makes precise prediction challenging but highlights their significant influence.

Technological Developments and Bitcoin Adoption

Technological advancements, particularly in layer-2 scaling solutions like the Lightning Network, are crucial for Bitcoin’s future. These solutions aim to improve transaction speeds and reduce fees, thereby enhancing Bitcoin’s usability and accessibility. Wider adoption of layer-2 solutions could lead to increased transaction volume and network activity, potentially driving up demand and price. The development and implementation of new privacy-enhancing technologies could also increase Bitcoin’s appeal to a wider range of users. For example, advancements in privacy coins built on top of Bitcoin’s blockchain could improve its fungibility and appeal to a broader audience. These technological innovations have the potential to positively influence Bitcoin’s price by increasing its utility and scalability.

Regulatory Frameworks and Bitcoin’s Market

Regulatory clarity and acceptance are critical for Bitcoin’s mainstream adoption and price stability. Favorable regulatory frameworks in major economies could legitimize Bitcoin as an investment asset and encourage institutional investment, leading to price appreciation. Conversely, overly restrictive or unclear regulations could stifle growth and negatively impact the price. Different jurisdictions’ approaches to Bitcoin regulation will significantly affect its market dynamics. For instance, the increasing acceptance of Bitcoin in El Salvador, despite its volatility, contrasts with the more cautious approach taken by many other countries. The evolution of regulatory frameworks globally will undoubtedly be a key determinant of Bitcoin’s price in 2025.

Different Prediction Models

Predicting Bitcoin’s price in 2025, or any future date, is inherently challenging. No model guarantees accuracy, and all are subject to inherent limitations and biases. However, understanding the strengths and weaknesses of different approaches allows for a more nuanced perspective on potential price movements. We will examine two primary methods: technical analysis and fundamental analysis.

Predicting Bitcoin’s future price relies heavily on two distinct analytical approaches: technical analysis and fundamental analysis. While both aim to forecast price movements, they utilize different data sets and methodologies. Understanding their contrasting strengths and weaknesses is crucial for interpreting any prediction.

Technical Analysis and its Limitations

Technical analysis focuses on historical price and volume data to identify patterns and trends. It assumes that past market behavior predicts future behavior. Common tools include chart patterns (head and shoulders, double tops/bottoms), indicators (RSI, MACD, moving averages), and support/resistance levels. For example, a strong upward trend line, coupled with increasing trading volume, might suggest continued price appreciation. Conversely, a bearish divergence (price making higher highs, while an indicator like RSI makes lower highs) could signal a potential price reversal. However, technical analysis is entirely reactive; it doesn’t consider underlying factors driving price changes. Its reliance on historical data makes it susceptible to “confirmation bias,” where analysts only focus on data supporting their pre-existing beliefs. Furthermore, the effectiveness of technical indicators can vary significantly depending on market conditions and timeframes. A successful indicator in a bull market might be completely useless during a bear market.

Fundamental Analysis and its Limitations

Fundamental analysis, on the other hand, assesses the intrinsic value of Bitcoin based on factors influencing its supply and demand. This includes evaluating the adoption rate, regulatory landscape, technological developments, macroeconomic conditions, and competition from other cryptocurrencies. For example, widespread institutional adoption could significantly boost demand, driving the price upward. Conversely, increased regulatory scrutiny might dampen investor enthusiasm, leading to a price decline. While fundamental analysis offers a more holistic view compared to technical analysis, it struggles with the inherent volatility of the cryptocurrency market. Predicting future adoption rates or regulatory changes is extremely difficult, introducing significant uncertainty into any forecast. Furthermore, the subjective nature of evaluating these factors can lead to biased interpretations and conflicting predictions. The influence of market sentiment, often irrational, can significantly overshadow even the most well-reasoned fundamental analysis.

Comparison of Prediction Models

The following table summarizes the strengths and weaknesses of technical and fundamental analysis in predicting Bitcoin’s price:

| Model | Strengths | Weaknesses | Example Application |

|---|---|---|---|

| Technical Analysis | Identifies short-term price trends; relatively easy to learn and apply; uses readily available data. | Reactive, not proactive; susceptible to confirmation bias; limited predictive power for long-term price movements; effectiveness varies depending on market conditions. | Using moving averages to identify potential support and resistance levels, and predicting short-term price corrections based on overbought/oversold conditions (RSI). |

| Fundamental Analysis | Considers underlying factors driving price movements; provides a more holistic view; potentially useful for long-term predictions. | Difficult to predict future adoption rates and regulatory changes; subjective interpretation of factors; influenced by market sentiment and irrational exuberance/fear. | Assessing the impact of increasing institutional adoption on Bitcoin’s price, or predicting a price drop due to negative regulatory news. |

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is inherently speculative, but analyzing expert opinions and prevailing market sentiment offers valuable context for understanding potential price movements in December 2025. While no one can definitively predict the future, examining diverse perspectives provides a more nuanced picture than relying on a single prediction model. The following analysis categorizes expert opinions based on their bullish, bearish, or neutral stances, and explores the overall market sentiment’s influence on Bitcoin’s potential price.

Categorization of Expert Predictions

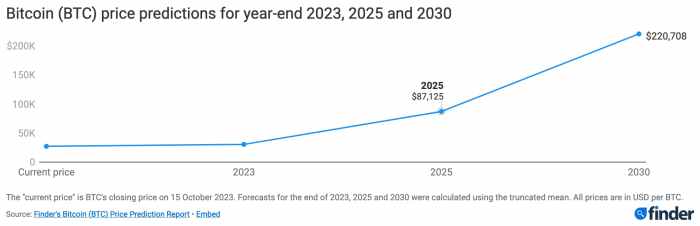

Several prominent cryptocurrency analysts and experts have offered predictions for Bitcoin’s price in 2025. These predictions often reflect varying perspectives on technological advancements, regulatory developments, and macroeconomic factors. Grouping these opinions into bullish, bearish, and neutral categories helps to illustrate the range of possible outcomes.

Bullish Predictions

Many analysts maintain a bullish outlook on Bitcoin, citing factors like increasing institutional adoption, growing global demand, and the potential for Bitcoin to act as a hedge against inflation. For example, some experts have suggested price targets exceeding $100,000 or even higher, based on their assessment of long-term adoption and scarcity. These predictions often emphasize Bitcoin’s position as a decentralized digital gold and its potential to maintain its value despite market volatility. These predictions are frequently underpinned by fundamental analysis, focusing on Bitcoin’s underlying technology and its potential for future growth. A hypothetical scenario supporting this view might involve widespread adoption by institutional investors, coupled with a significant increase in global demand driven by macroeconomic instability.

Bearish Predictions

Conversely, some experts hold a more bearish view. These predictions often cite concerns about regulatory uncertainty, potential market corrections, or the emergence of competing cryptocurrencies. Bearish analysts might point to historical price volatility and the inherent risks associated with investing in cryptocurrencies. They might predict a price significantly lower than current levels, potentially influenced by a major market downturn or regulatory crackdown. For instance, a scenario where governments globally impose strict regulations could lead to decreased demand and consequently a lower price.

Neutral Predictions, Bitcoin Prediction Dec 2025

A significant number of analysts adopt a neutral stance, acknowledging the potential for both significant gains and substantial losses. They emphasize the unpredictable nature of the cryptocurrency market and the numerous factors that could influence Bitcoin’s price. These analysts typically highlight the need for caution and diversification in cryptocurrency investments. They might suggest a range of possible outcomes rather than a specific price prediction, acknowledging the influence of unpredictable events like unforeseen technological breakthroughs or geopolitical instability. Their approach is often characterized by a focus on risk management and a balanced assessment of the market’s potential.

Overall Market Sentiment and its Impact

Market sentiment plays a crucial role in shaping Bitcoin’s price. Periods of high optimism, often fueled by positive news or technological advancements, can lead to price increases. Conversely, periods of fear and uncertainty can result in significant price drops. In 2025, the overall market sentiment towards Bitcoin will likely be influenced by factors such as regulatory developments, technological innovations within the cryptocurrency space, and macroeconomic conditions. A positive overall sentiment, driven by factors like increased institutional adoption and successful scaling solutions, could contribute to a bullish market, while negative sentiment, perhaps driven by regulatory crackdowns or a broader economic downturn, could lead to a bearish market. The interplay of these factors will be key in determining the prevailing market sentiment and its subsequent influence on Bitcoin’s price.

Potential Scenarios for Bitcoin in 2025: Bitcoin Prediction Dec 2025

Predicting Bitcoin’s price is inherently speculative, given its volatile nature and susceptibility to various macroeconomic and technological factors. However, by considering historical trends, technological advancements, and regulatory landscapes, we can construct plausible scenarios for Bitcoin’s price in December 2025. These scenarios are not exhaustive, but they represent a range of possibilities.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario envisions a significantly bullish market for Bitcoin by December 2025. Several factors could contribute to this outcome. Widespread institutional adoption, driven by increasing regulatory clarity and the development of robust Bitcoin-related financial products, could fuel significant price increases. Furthermore, continued technological advancements, such as the scaling solutions like the Lightning Network improving transaction speeds and reducing fees, would enhance Bitcoin’s usability and appeal to a broader audience. Global macroeconomic instability, such as persistent inflation or geopolitical uncertainty, could also drive investors towards Bitcoin as a safe haven asset. In this scenario, Bitcoin could reach prices significantly exceeding its previous all-time highs, potentially reaching the $200,000 to $300,000 range or even higher, depending on the extent of adoption and market sentiment. This would result in substantial gains for early investors and a significant influx of new capital into the cryptocurrency market.

Bearish Scenario: Bitcoin Experiences a Significant Correction

Conversely, a bearish scenario could see Bitcoin’s price fall considerably below its current levels by December 2025. This downturn could be triggered by a number of events, including a major regulatory crackdown on cryptocurrencies in key markets, a significant security breach impacting investor confidence, or a prolonged period of macroeconomic stability that reduces the appeal of Bitcoin as a safe haven asset. Furthermore, the emergence of competing cryptocurrencies with superior technology or features could also erode Bitcoin’s market dominance. In this scenario, Bitcoin’s price could potentially drop to the $10,000 to $20,000 range or even lower, leading to significant losses for investors and potentially causing a ripple effect throughout the broader cryptocurrency market. The overall sentiment would be extremely negative, potentially leading to a period of consolidation and uncertainty. This scenario mirrors the significant corrections experienced by Bitcoin in the past, although the extent of the decline is difficult to predict with certainty. The 2018 bear market, for instance, saw a price drop of over 80% from its all-time high.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

A neutral scenario would see Bitcoin’s price experience moderate growth or consolidation around its current price levels by December 2025. This scenario assumes a balance between bullish and bearish factors. Regulatory clarity might be achieved in some jurisdictions but not others, technological advancements continue at a steady pace, and macroeconomic conditions remain relatively stable. This would lead to a more predictable and less volatile market, with steady, if not spectacular, price appreciation. Bitcoin might trade within a range of $40,000 to $80,000, reflecting a period of maturation and consolidation within the cryptocurrency market. This scenario would likely be less dramatic for investors than either the bullish or bearish scenarios, offering moderate returns but less risk. This could be considered a more likely outcome given the inherent uncertainty associated with predicting future price movements. Similar periods of consolidation have been observed in Bitcoin’s history, allowing for organic growth and increased adoption without the volatility of significant price swings.

Frequently Asked Questions (FAQ)

Predicting Bitcoin’s price is inherently complex, influenced by numerous interacting factors. While precise figures are impossible, exploring potential price ranges and the underlying influences provides a clearer understanding of the market’s dynamics. This FAQ section addresses common questions about Bitcoin’s potential price trajectory in December 2025 and the associated risks and rewards.

Bitcoin Price Ranges in December 2025

Various prediction models and expert opinions suggest a wide range of potential Bitcoin prices in December 2025. Some analysts predict values exceeding $100,000, while others offer more conservative estimates, ranging from $50,000 to $75,000. These discrepancies stem from differing assumptions about adoption rates, regulatory developments, and macroeconomic conditions. For example, a scenario with widespread institutional adoption and positive regulatory changes could lead to higher price predictions, while a scenario with increased regulatory scrutiny or a broader economic downturn could result in lower predictions. It’s crucial to remember that these are speculative estimations, not guarantees.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable due to the volatile nature of the cryptocurrency market. Numerous factors beyond technical analysis influence Bitcoin’s price, including regulatory changes, macroeconomic events, investor sentiment, and technological advancements. Historical price movements offer some insights, but past performance is not indicative of future results. Predictions should be viewed as educated guesses, not definitive forecasts. Consider predictions from multiple sources and understand their underlying assumptions before making any investment decisions. For example, a prediction based solely on historical growth rates may not account for unforeseen market disruptions.

Factors Affecting Bitcoin’s Price in 2025

Several key factors could significantly influence Bitcoin’s price in 2025. These include: widespread adoption by institutional investors and businesses; regulatory clarity and acceptance from governments worldwide; macroeconomic conditions, such as inflation and economic growth; technological advancements in the Bitcoin ecosystem; and overall market sentiment and investor confidence. For instance, a major regulatory crackdown in a significant market could trigger a sharp price decline, while a successful integration of Bitcoin into mainstream financial systems could propel its value upwards. The interplay of these factors makes precise forecasting challenging.

Risks of Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Its price volatility is well-documented, leading to significant potential gains but also considerable losses. Regulatory uncertainty remains a concern, as governments worldwide grapple with how to regulate cryptocurrencies. Security risks associated with holding Bitcoin, such as hacking and theft, are also significant factors to consider. Furthermore, the market is susceptible to manipulation and speculative bubbles. For example, a sudden loss of investor confidence could lead to a rapid price crash, causing substantial financial losses for investors. Due diligence and careful risk management are essential.

Strategies for Managing Risk When Investing in Bitcoin

Managing risk when investing in Bitcoin involves diversification, careful consideration of your risk tolerance, and limiting your investment to an amount you can afford to lose. Diversifying your investment portfolio across different asset classes reduces reliance on Bitcoin’s performance. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, mitigates the impact of volatility. Thorough research and understanding of the underlying technology and market dynamics are also crucial. Staying informed about regulatory developments and market trends allows for more informed decision-making. For example, spreading your investment across several cryptocurrencies or combining Bitcoin with traditional assets like stocks and bonds reduces overall risk.

Bitcoin Prediction Dec 2025 – Accurately predicting Bitcoin’s price in December 2025 is challenging, given its volatile nature. However, understanding potential trajectories requires considering various factors, including market sentiment and technological advancements. To gain a clearer picture of the potential mid-year landscape, reviewing forecasts like the one found in this analysis of Bitcoin May 2025 Prediction can be beneficial. Ultimately, extrapolating from a May prediction to a December forecast requires careful consideration of intervening events and market shifts.

Predicting Bitcoin’s price in December 2025 is a challenging endeavor, requiring consideration of numerous factors influencing the market. Understanding the trajectory of related cryptocurrencies is also crucial; for example, checking the projected value of Bitcoin Cash offers valuable insight. You can find a detailed analysis of this at Bitcoin Cash Price Prediction 2025. Ultimately, however, any Bitcoin prediction for December 2025 remains speculative, dependent on broader economic trends and technological developments.

Speculating on Bitcoin Prediction Dec 2025 involves considering numerous factors, including technological advancements and regulatory changes. A key aspect of this involves understanding potential price movements, which is thoroughly explored in the comprehensive analysis provided by this resource: Bitcoin December 2025 Price Prediction. Ultimately, the Bitcoin Prediction Dec 2025 remains a complex subject dependent on market forces and unforeseen events.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by various factors including halving events. Understanding the impact of these events is crucial; to accurately gauge this, it’s helpful to know when the last Bitcoin halving before 2025 occurred, which you can find out by checking this resource: When Was The Last Bitcoin Halving Before 2025. This knowledge provides valuable context for forming a more informed prediction regarding Bitcoin’s value in December 2025.

Predicting Bitcoin’s price in December 2025 is challenging, given its inherent volatility. A key factor influencing these predictions is the impact of the 2024 halving, which will reduce Bitcoin’s inflation rate. To understand potential price movements after this event, you might find this resource helpful: Bitcoin Price After Halving 2025 Usd. Ultimately, Bitcoin’s December 2025 price will depend on a complex interplay of factors beyond just the halving’s effect.

Predicting Bitcoin’s price in December 2025 is challenging, given its inherent volatility. A key factor influencing these predictions is the impact of the 2024 halving, which will reduce Bitcoin’s inflation rate. To understand potential price movements after this event, you might find this resource helpful: Bitcoin Price After Halving 2025 Usd. Ultimately, Bitcoin’s December 2025 price will depend on a complex interplay of factors beyond just the halving’s effect.

Predicting Bitcoin’s price in December 2025 is challenging, given its inherent volatility. A key factor influencing these predictions is the impact of the 2024 halving, which will reduce Bitcoin’s inflation rate. To understand potential price movements after this event, you might find this resource helpful: Bitcoin Price After Halving 2025 Usd. Ultimately, Bitcoin’s December 2025 price will depend on a complex interplay of factors beyond just the halving’s effect.