Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s designed to control inflation and maintain the scarcity of Bitcoin over time. Understanding the mechanics and historical impact of these halvings is crucial for anyone interested in Bitcoin’s long-term trajectory.

Bitcoin Halving Mechanics and Historical Price Impact

The Bitcoin halving event directly impacts the block reward miners receive for processing transactions and adding new blocks to the blockchain. Before the first halving, miners received 50 BTC per block. Each halving cuts this reward in half. This controlled reduction in new Bitcoin supply is intended to mimic the scarcity of precious metals like gold, potentially driving up its value over time. Historically, halving events have been followed by periods of significant price appreciation, although the magnitude and duration of these increases have varied. This correlation, however, doesn’t guarantee future price movements. Other market factors, such as regulatory changes, technological advancements, and overall economic conditions, play a significant role.

Anticipated Supply Reduction in 2025 and Scarcity

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a 50% decrease in the rate of new Bitcoin creation. This further reduction in supply, coupled with continued demand, is expected by many to increase Bitcoin’s scarcity and potentially drive its price upwards. The argument is that a fixed supply of 21 million Bitcoin, combined with decreasing inflation, makes Bitcoin a desirable asset in a world of inflationary fiat currencies. However, the actual price impact is difficult to predict precisely, and depends heavily on the interplay of various market forces. For instance, increased adoption and institutional investment could amplify the effect of the halving, while negative news or regulatory crackdowns could mitigate it.

Timeline of Past Halving Events and Subsequent Price Movements

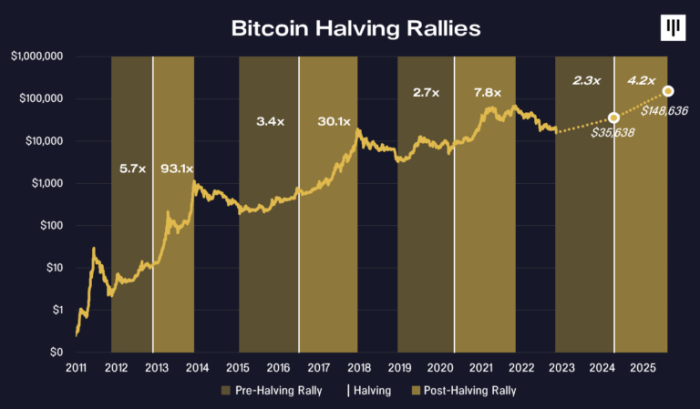

The following table summarizes the past Bitcoin halving events and their subsequent price movements. It’s important to note that while there’s a correlation between halvings and price increases, it’s not a guaranteed outcome. Other market factors significantly influence Bitcoin’s price.

| Halving Date | Block Reward Before | Block Reward After | Approximate Price Before Halving (USD) | Approximate Price After Halving (USD) – Peak | Time to Peak (Months) |

|---|---|---|---|---|---|

| November 2012 | 50 BTC | 25 BTC | ~13 USD | ~1147 USD | ~18 |

| July 2016 | 25 BTC | 12.5 BTC | ~650 USD | ~20000 USD | |

| May 2020 | 12.5 BTC | 6.25 BTC |

Note: These are approximate figures and the exact timing and peak prices can vary depending on the source and methodology used. The “Time to Peak” represents the approximate time it took for the Bitcoin price to reach its peak after each halving. This time frame has varied considerably.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors, both internal to the cryptocurrency market and external macroeconomic forces, will significantly influence its price trajectory. While no model can definitively predict the future, understanding the strengths and weaknesses of different approaches can offer a more nuanced perspective.

Price Prediction Models for Cryptocurrencies

Several models attempt to forecast cryptocurrency prices. These range from simple moving averages, which track price trends over specific periods, to more sophisticated algorithms incorporating factors like trading volume, market capitalization, and social media sentiment. Simple models are easy to understand and implement but often lack predictive power, failing to account for sudden market shifts or unforeseen events. More complex models, such as those employing machine learning, can potentially capture more intricate relationships, but they are vulnerable to overfitting (performing well on historical data but poorly on new data) and require significant computational resources. Furthermore, the inherent volatility of cryptocurrencies makes accurate long-term prediction exceptionally challenging. For example, models that accurately predicted Bitcoin’s price in 2021 may have drastically underestimated its subsequent downturn.

Factors Influencing Bitcoin’s Price Beyond the Halving

The halving event, while significant, is not the sole determinant of Bitcoin’s price. Regulatory developments play a crucial role; stricter regulations could dampen investor enthusiasm, while favorable regulations could stimulate growth. Macroeconomic conditions, such as inflation rates, interest rates, and overall economic stability, also exert considerable influence. A global recession, for example, might lead investors to seek safer assets, potentially impacting Bitcoin’s price negatively. Finally, market sentiment, fueled by news events, social media trends, and overall investor confidence, is a powerful driver. Positive news coverage or widespread adoption by institutional investors can create a bullish market, while negative news or regulatory uncertainty can trigger a sell-off.

Hypothetical Price Scenario Post-Halving

Considering the aforementioned factors, a hypothetical scenario might unfold as follows. A bullish scenario, assuming positive regulatory developments, sustained macroeconomic stability, and continued institutional adoption, could see Bitcoin’s price reach $150,000 to $200,000 by the end of 2026. This aligns with past halving cycles, where price increases followed a similar pattern, albeit with considerable volatility. Conversely, a bearish scenario, incorporating factors like stricter regulations, a global economic downturn, and a loss of investor confidence, might see the price stagnate or even decline to a range of $50,000 to $75,000 during the same period. This scenario acknowledges the risk of a significant market correction, potentially driven by external factors beyond the halving’s direct impact. The actual outcome will likely fall somewhere between these two extremes, shaped by the interplay of numerous unpredictable variables.

Market Sentiment and Investor Behavior

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically been associated with significant shifts in market sentiment and investor behavior. Understanding these past trends is crucial for predicting potential reactions to the 2025 halving. The reduced supply often fuels anticipation of price increases, leading to periods of both heightened speculation and volatility.

Analyzing past halvings reveals a consistent pattern: a period of increased price volatility preceding and following the event, driven by varying levels of optimism and fear among investors. This volatility is amplified by the inherent speculative nature of the cryptocurrency market, where price movements can be influenced by news cycles, regulatory changes, and broader macroeconomic factors as well as fundamental supply and demand.

Institutional and Retail Investor Reactions

Institutional investors, with their typically longer-term investment horizons and risk management strategies, tend to react more cautiously to halving events. Their actions are often less driven by short-term price fluctuations and more focused on the long-term potential of Bitcoin as a store of value or an asset within a diversified portfolio. Conversely, retail traders, often characterized by shorter time horizons and higher risk tolerance, may engage in more speculative trading activities around the halving, potentially leading to amplified price swings. The 2012 and 2016 halvings saw significant price increases following the events, attracting many retail investors. However, the 2020 halving saw a less dramatic price response, highlighting the complexity of predicting market reactions.

Comparison of Market Sentiment Across Halvings

The table below compares the market sentiment surrounding previous Bitcoin halvings with current expectations for 2025. Note that these are broad generalizations and individual investor sentiment can vary widely.

| Halving Year | Pre-Halving Sentiment | Post-Halving Sentiment | Price Action (General Trend) |

|---|---|---|---|

| 2012 | Relatively subdued, Bitcoin still nascent | Increasing optimism, early adoption | Gradual increase, significant gains later |

| 2016 | Growing anticipation, increased media coverage | Strong bullish sentiment, significant price surge | Significant price increase, long bull market |

| 2020 | High anticipation, but also some skepticism due to the bear market | Mixed sentiment, initial price increase followed by consolidation | Initial increase, followed by a period of sideways trading and eventual price increase |

| 2025 (Expected) | High anticipation, but uncertainty remains due to macroeconomic factors and regulatory environment | Uncertain, depending on broader market conditions and adoption rate | Uncertain, potential for significant price increase or consolidation depending on various factors |

Technical Analysis and Chart Patterns

Technical analysis plays a crucial role in predicting Bitcoin’s price movements, especially around significant events like halvings. By examining historical price data and identifying recurring patterns, analysts can form hypotheses about potential future price action. The 2025 halving presents an opportunity to apply these techniques and forecast potential price scenarios.

Key Technical Indicators and Their Relevance to the 2025 Halving

Several technical indicators are commonly used to analyze Bitcoin’s price. These indicators provide different perspectives on market momentum, trend strength, and potential reversal points. Their relevance to the 2025 halving stems from the expectation that the reduced supply of newly mined Bitcoin will exert upward pressure on price, influencing these indicators’ readings. Understanding how these indicators behave around past halvings helps in predicting their behavior in 2025. For example, the Relative Strength Index (RSI) often shows overbought conditions after a significant price surge, suggesting a potential correction. Similarly, moving averages can identify potential support and resistance levels, offering insights into price targets. The Moving Average Convergence Divergence (MACD) can signal changes in momentum, providing early warnings of potential price reversals.

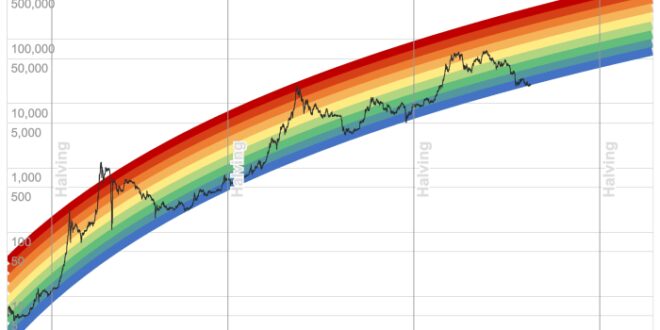

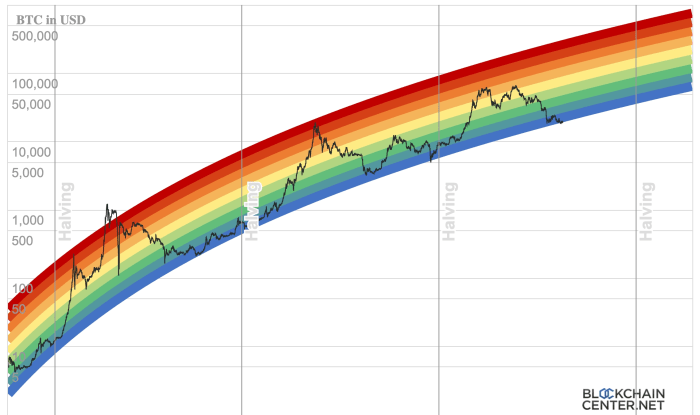

Interpreting Historical Chart Patterns Related to Past Halvings

Analyzing historical Bitcoin price charts around previous halvings reveals recurring patterns. For instance, the price often experiences a period of consolidation or sideways trading before the halving, followed by a significant price increase in the months after. This increase is often attributed to the anticipation of the reduced supply and the resulting scarcity. However, the magnitude and duration of these price increases vary. Studying these variations, considering factors like overall market sentiment and macroeconomic conditions, provides a more nuanced understanding of potential outcomes. For example, the halving in 2012 saw a more gradual price increase compared to the sharper rise after the 2016 halving. These differences highlight the importance of considering the broader context when interpreting historical patterns.

Hypothetical Price Chart Scenarios After the 2025 Halving

Imagine a hypothetical price chart showing Bitcoin’s price in the months leading up to and following the 2025 halving. One scenario could depict a gradual price increase in the months before the halving, followed by a sharp surge immediately after, reaching a peak before undergoing a correction. This would be reflected in the RSI reaching overbought territory, and the MACD showing a bullish crossover followed by a bearish divergence. The 200-day moving average could act as support during the correction. Another scenario could show a more subdued price reaction, with a gradual increase after the halving, possibly influenced by macroeconomic factors or a lack of strong investor sentiment. In this case, the RSI would remain within a range, and the MACD might not exhibit such dramatic crossovers. A third scenario might even show a temporary price drop immediately after the halving, followed by a gradual recovery and eventual price increase. This would reflect a bearish sentiment overriding the initial supply shock. This illustrates the range of potential outcomes, emphasizing the inherent uncertainty in price prediction. These scenarios are merely illustrative, and actual price movements may differ significantly.

The Impact of External Factors

Predicting Bitcoin’s price after the 2025 halving requires considering factors beyond its internal dynamics. Macroeconomic conditions, geopolitical events, and regulatory landscapes significantly influence investor sentiment and, consequently, Bitcoin’s market performance. Understanding these external pressures is crucial for a comprehensive price forecast.

Macroeconomic factors exert considerable influence on Bitcoin’s price. High inflation, for example, can drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates often lead to capital flowing back into traditional, higher-yielding investments, potentially decreasing demand for Bitcoin. The strength of the US dollar also plays a role, as a stronger dollar can negatively impact the price of Bitcoin, which is primarily traded in USD. The interplay of these factors creates a complex environment where economic downturns might paradoxically boost Bitcoin’s appeal as a safe haven, while periods of economic stability could shift investment preferences elsewhere.

Macroeconomic Influence on Bitcoin Price

Inflation and interest rate changes directly impact Bitcoin’s price trajectory. High inflation might increase Bitcoin’s demand as a hedge, pushing prices up. Conversely, rising interest rates might decrease Bitcoin’s attractiveness compared to higher-yielding assets, potentially leading to price drops. For instance, the 2022 interest rate hikes by the Federal Reserve coincided with a significant Bitcoin price decline. The correlation isn’t always direct, however, as other factors can influence the market simultaneously. A strong US dollar, for example, can suppress Bitcoin’s price regardless of inflationary pressures. Analyzing the combined effects of these macroeconomic variables is essential for accurate price prediction.

Geopolitical Events and Regulatory Changes

Geopolitical instability and regulatory uncertainty can significantly impact investor confidence in Bitcoin. Major international conflicts, political upheavals, or unexpected policy shifts can create volatility in the cryptocurrency market. For instance, the 2014 Russian annexation of Crimea led to increased uncertainty in global markets, influencing Bitcoin’s price. Similarly, regulatory changes, such as stricter KYC/AML regulations or outright bans, can negatively impact Bitcoin’s adoption and price. Conversely, positive regulatory developments, like the clarification of Bitcoin’s legal status in a major jurisdiction, can boost investor confidence and drive price appreciation. The interplay between geopolitical risks and regulatory frameworks is a key determinant of Bitcoin’s price volatility and long-term trajectory.

Regulatory Impact on Bitcoin’s Price Trajectory

Different regulatory scenarios can drastically alter Bitcoin’s post-halving price trajectory. A highly restrictive regulatory environment, involving strict bans or heavy taxation, could suppress Bitcoin’s price and limit its adoption. Conversely, a supportive regulatory framework, offering clear guidelines and promoting innovation, could foster broader adoption and lead to significant price increases. For example, a scenario where major governments worldwide embrace Bitcoin as a legitimate asset class could lead to a surge in demand and a substantial price appreciation. Conversely, a scenario where Bitcoin is classified as a security in many jurisdictions could significantly dampen its growth. The uncertainty surrounding future regulations is a significant factor in predicting Bitcoin’s future price.

Long-Term Bitcoin Price Projections: Bitcoin Prediction Halving 2025

Predicting Bitcoin’s price far into the future is inherently speculative, relying on numerous interconnected factors with varying degrees of uncertainty. However, by considering different scenarios regarding adoption, technological advancements, and macroeconomic conditions, we can construct plausible long-term price trajectories. These projections should be viewed as potential outcomes rather than definitive forecasts.

Long-term price predictions often hinge on the interplay between supply and demand. The 2025 halving will reduce Bitcoin’s inflation rate, potentially increasing scarcity and driving demand. However, the actual price impact depends on various external factors and investor sentiment.

Price Prediction Scenarios

Several scenarios can be envisioned for Bitcoin’s long-term price, each with distinct underlying assumptions. A conservative scenario assumes slow and steady adoption, limited technological breakthroughs, and persistent macroeconomic volatility. A bullish scenario, on the other hand, anticipates widespread adoption, significant technological improvements (like Lightning Network scaling), and a more stable global economic climate. Finally, a bearish scenario incorporates factors such as increased regulatory pressure, significant security breaches, or a prolonged period of global economic downturn.

Factors Contributing to Bull and Bear Markets

A sustained bull market post-2025 halving could be driven by several factors: increased institutional investment, broader regulatory clarity, successful integration of Bitcoin into existing financial systems, and a growing understanding of Bitcoin’s value proposition as a hedge against inflation and geopolitical uncertainty. Conversely, a prolonged bear market might result from factors such as stricter regulatory crackdowns, major security vulnerabilities impacting trust, a global economic crisis diminishing risk appetite, or the emergence of a competing cryptocurrency with superior technology or adoption.

Illustrative Price Trajectory Chart, Bitcoin Prediction Halving 2025

Imagine a chart with time (in years, starting from 2025) on the x-axis and Bitcoin price (in USD) on the y-axis. Three lines represent the different scenarios:

* Conservative: This line shows a gradual, relatively modest increase in price over time, perhaps reaching $100,000-$200,000 within a decade, but with significant price fluctuations along the way. This reflects a scenario where Bitcoin’s adoption remains steady but faces challenges from competition and regulatory uncertainty.

* Bullish: This line demonstrates a much steeper upward trajectory, potentially reaching $1,000,000 or more within the same timeframe. This scenario assumes high adoption rates, significant technological improvements, and a positive macroeconomic environment. The line will still show some volatility, but the overall trend is strongly upward.

* Bearish: This line illustrates a prolonged period of stagnation or even decline, potentially remaining below current prices for an extended period. This scenario accounts for negative factors such as regulatory crackdowns, major security incidents, or a prolonged economic downturn significantly impacting investor confidence.

These trajectories are illustrative and should not be interpreted as precise predictions. The actual price will depend on the complex interaction of numerous unpredictable factors. The chart visually demonstrates how different assumptions about adoption, technology, and the broader economic climate can lead to vastly different price outcomes.

Risks and Uncertainties

Investing in Bitcoin, especially around a halving event like the one anticipated in 2025, carries inherent risks. While the halving historically has been associated with price increases, it’s crucial to understand that this is not guaranteed and several factors can significantly impact the outcome. The cryptocurrency market is notoriously volatile, and unforeseen events can dramatically alter Bitcoin’s price trajectory.

Predicting the future price of Bitcoin with certainty is impossible. The following section details some of the key risks and potential mitigation strategies.

Market Volatility and Price Fluctuations

Bitcoin’s price is known for its extreme volatility. Sharp price swings, both upward and downward, are common. The halving, while historically bullish, doesn’t eliminate this volatility. In fact, the anticipation leading up to the halving can itself create periods of heightened volatility as investors position themselves. For example, the period leading up to the 2020 halving saw significant price movements, both before and after the event itself. The subsequent price action was also quite volatile, illustrating the uncertainty surrounding these events.

Regulatory Uncertainty and Government Intervention

Government regulations regarding cryptocurrencies vary significantly across the globe. Changes in regulations, or even the threat of stricter regulations, can significantly impact Bitcoin’s price. For instance, a sudden ban on cryptocurrency trading in a major market could trigger a sharp price drop. Conversely, favorable regulatory developments could boost prices. The lack of clear, consistent global regulation presents a considerable ongoing risk.

Technological Disruptions and Security Breaches

Bitcoin’s underlying technology is not immune to vulnerabilities. A significant security breach, a major software bug, or the emergence of a superior competing technology could negatively affect Bitcoin’s price and adoption. While Bitcoin’s decentralized nature provides resilience, it’s not entirely invulnerable to such risks. Consider the potential impact of a successful 51% attack, although highly unlikely due to the network’s size and hash rate.

Black Swan Events and Unforeseen Circumstances

Unexpected events, often referred to as “black swan” events, can have a profound and unpredictable impact on Bitcoin’s price. These are events that are highly improbable but can have catastrophic consequences. Examples include global economic crises, major geopolitical events, or even unforeseen technological breakthroughs. The COVID-19 pandemic serves as a recent example of a black swan event that significantly impacted global markets, including Bitcoin.

Potential Risks and Mitigation Strategies

It’s crucial to acknowledge the potential for significant downside risk. Below is a list of potential risks, their likelihood (estimated as low, medium, or high), and potential mitigation strategies.

- Risk: Sharp price drops due to market corrections. Likelihood: High. Mitigation: Diversify your portfolio, avoid investing more than you can afford to lose, and employ dollar-cost averaging.

- Risk: Increased regulatory scrutiny or bans. Likelihood: Medium. Mitigation: Stay informed about regulatory developments, consider geographically diversified holdings, and explore jurisdictions with favorable regulatory environments.

- Risk: Technological vulnerabilities or security breaches. Likelihood: Low. Mitigation: Use reputable exchanges and wallets, practice good security hygiene (strong passwords, two-factor authentication), and stay updated on security advisories.

- Risk: Black swan events (e.g., global economic crisis). Likelihood: Low. Mitigation: Diversification across asset classes, holding a portion of your assets in stable, less volatile investments.

- Risk: Competition from alternative cryptocurrencies. Likelihood: Medium. Mitigation: Research and understand the competitive landscape, consider investing in a diversified portfolio of cryptocurrencies, and monitor technological advancements in the space.