Bitcoin Price Prediction September 2025

Bitcoin, the world’s first decentralized cryptocurrency, has experienced a tumultuous yet fascinating journey since its inception in 2009. From a niche digital asset to a globally recognized investment vehicle, its rise has been marked by periods of explosive growth and dramatic corrections. Currently, Bitcoin holds a significant position in the cryptocurrency market, though its dominance has fluctuated over time. Understanding its future price, however, remains a complex undertaking.

Predicting Bitcoin’s price with certainty is inherently challenging due to its volatile nature. Unlike traditional assets, Bitcoin’s value is not tied to tangible assets or government-backed guarantees. Its price is heavily influenced by speculative trading, making it susceptible to rapid and significant swings based on market sentiment, news events, and technological developments. Any prediction should therefore be considered highly speculative and subject to considerable uncertainty.

Factors Influencing Bitcoin’s Price

Several key factors contribute to the price fluctuations of Bitcoin. These factors interact in complex ways, making accurate prediction difficult. Understanding these elements is crucial for any attempt to assess potential future price movements. For example, the 2021 bull run was partly fueled by institutional adoption and increased mainstream media coverage, while the subsequent downturn was partly attributed to regulatory uncertainty and macroeconomic factors.

Regulatory Changes and Their Impact

Government regulations significantly influence Bitcoin’s price. Stringent regulations can dampen investor enthusiasm and limit accessibility, potentially leading to price declines. Conversely, supportive or clear regulatory frameworks can foster confidence and attract more investment, potentially driving prices higher. The varying regulatory landscapes across different countries highlight this complexity; some jurisdictions have embraced Bitcoin, while others maintain a cautious or restrictive stance. The ongoing debate surrounding Bitcoin’s regulatory status globally underscores its inherent volatility and the unpredictable nature of its price trajectory. Consider, for instance, the impact of China’s ban on cryptocurrency trading in 2021, which led to a noticeable dip in the Bitcoin price.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem also play a crucial role. Upgrades to the Bitcoin network, such as the Lightning Network which aims to improve transaction speeds and reduce fees, can positively influence investor sentiment and potentially increase adoption. Conversely, significant security breaches or technological limitations could negatively impact confidence and drive down prices. The ongoing development and implementation of layer-2 scaling solutions, for example, are seen by many as crucial for Bitcoin’s long-term viability and potential price appreciation.

Market Sentiment and Investor Behavior

Market sentiment, driven by news events, social media trends, and overall investor psychology, is a powerful force shaping Bitcoin’s price. Periods of heightened fear and uncertainty can trigger sell-offs, leading to sharp price drops. Conversely, periods of optimism and excitement can fuel buying sprees, driving prices significantly higher. The “Fear and Greed Index” frequently used to gauge market sentiment provides a clear illustration of how emotional factors influence Bitcoin’s price volatility. A high “greed” score often correlates with price peaks, while a high “fear” score frequently precedes market corrections.

Analyzing Historical Trends and Patterns

Predicting Bitcoin’s price in September 2025 requires a thorough understanding of its historical performance. Analyzing past price movements, comparing them to other assets, and identifying recurring patterns can offer valuable insights, although it’s crucial to remember that past performance is not indicative of future results. The cryptocurrency market is inherently volatile and influenced by numerous unpredictable factors.

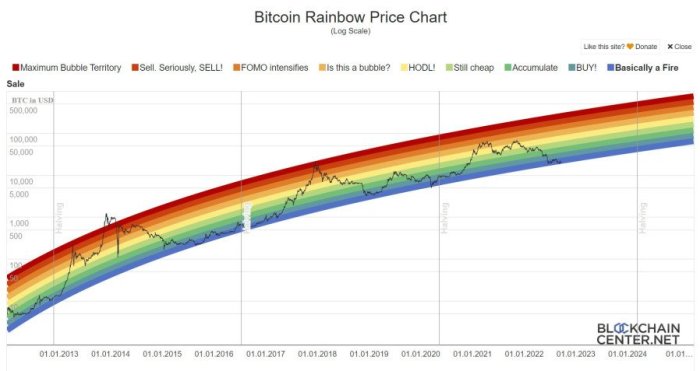

Bitcoin’s price history is marked by periods of explosive growth followed by significant corrections. The initial years saw gradual appreciation, followed by a massive surge in 2017, reaching almost $20,000 before a sharp decline. Subsequent years have shown a similar pattern of bull and bear markets, with each cycle generally exhibiting higher highs and higher lows than the previous one. These fluctuations are largely attributed to factors like regulatory changes, technological advancements, adoption rates, and market sentiment.

Significant Past Price Movements and Underlying Causes

Bitcoin’s price movements are complex and influenced by a multitude of interconnected factors. The 2017 bull run, for example, was fueled by increased media attention, institutional investment interest, and the emergence of new cryptocurrency exchanges. Conversely, the subsequent bear market was triggered by regulatory crackdowns in various countries, concerns about market manipulation, and a general crypto winter. The 2020-2021 bull run was partly driven by the COVID-19 pandemic, as investors sought alternative assets and inflation hedges. The subsequent downturn can be linked to macroeconomic factors such as rising interest rates and increased regulatory scrutiny. These examples highlight the interplay between technological advancements, investor sentiment, macroeconomic conditions, and regulatory frameworks in shaping Bitcoin’s price trajectory.

Comparison with Other Major Assets

Comparing Bitcoin’s performance to traditional assets like gold and stocks reveals interesting contrasts. While gold is often seen as a safe haven asset, its price movements are generally less volatile than Bitcoin’s. Stocks, on the other hand, exhibit a wider range of price fluctuations, influenced by company-specific factors and broader economic trends. However, Bitcoin’s correlation with both gold and stocks has varied over time, sometimes exhibiting a positive correlation and at other times a negative one, indicating that its price is not always driven by the same factors influencing traditional markets. This lack of strong correlation suggests Bitcoin occupies a unique niche in the investment landscape.

Recurring Patterns or Cycles in Bitcoin’s Price Fluctuations

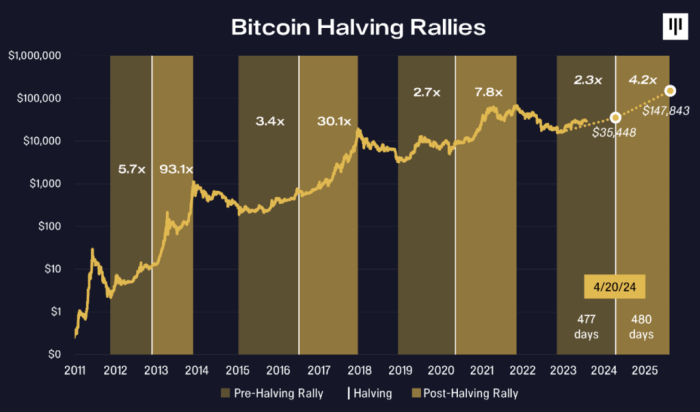

While not perfectly predictable, some analysts have observed recurring patterns in Bitcoin’s price cycles. These cycles often involve periods of intense growth followed by significant corrections, sometimes lasting for several years. The length and intensity of these cycles can vary, but they seem to be influenced by factors such as the halving events (which reduce the rate of new Bitcoin creation), technological advancements, and overall market sentiment. Identifying these patterns can be helpful in developing informed investment strategies, but it is crucial to remember that these are not guarantees and the market can always surprise. For example, the four-year cycle hypothesis, often cited, suggests that Bitcoin experiences a major bull run roughly every four years, coinciding with the halving events. While past data may suggest this pattern, it’s not a foolproof prediction for future cycles.

Influence of Technological Factors

Bitcoin’s price in September 2025 will be significantly influenced by several key technological factors. These factors, ranging from the predictable halving events to the evolving landscape of Layer-2 scaling solutions, will collectively shape the cryptocurrency’s trajectory. Understanding these influences is crucial for any comprehensive price prediction.

Bitcoin’s underlying technology and its evolution are paramount in determining its future value proposition. The interplay between these technological advancements and market forces will ultimately decide its price.

Bitcoin Halving Events and Price Impact

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation by half, has historically shown a strong correlation with subsequent price increases. This is due to the reduced supply of new coins entering the market, creating a scarcity effect that can drive up demand and, consequently, price. The halving events act as significant supply-side shocks to the market. For example, the halving events of 2012 and 2016 were followed by significant bull runs, although the timing and magnitude of these price increases varied. Predicting the exact impact of the next halving (expected before September 2025) is challenging, but historically, it has been a catalyst for significant price appreciation. The magnitude of this price increase, however, depends on various other market factors, including overall economic conditions and investor sentiment.

Layer-2 Scaling Solutions and Bitcoin Adoption

Layer-2 scaling solutions, such as the Lightning Network, aim to address Bitcoin’s scalability limitations by processing transactions off-chain. This enhances Bitcoin’s transaction speed and reduces fees, making it more practical for everyday use. Widespread adoption of Layer-2 solutions could significantly increase Bitcoin’s usability and appeal to a broader audience, potentially driving up demand and price. The success of these solutions hinges on their user-friendliness, security, and overall adoption rate. If Layer-2 solutions prove successful in scaling Bitcoin’s transaction capacity and improving user experience, they could be a significant catalyst for price appreciation. Conversely, if these solutions fail to gain traction, it could limit Bitcoin’s growth potential.

Bitcoin’s Underlying Technology and Future Price

Bitcoin’s underlying technology, specifically its decentralized and secure nature, forms the bedrock of its value proposition. Continued improvements in security protocols, advancements in mining efficiency, and the overall robustness of the network will directly influence investor confidence and, consequently, the price. The ongoing development and implementation of new technologies that enhance Bitcoin’s security and efficiency, such as improved consensus mechanisms or more energy-efficient mining techniques, can positively influence its long-term price. Conversely, any significant security breaches or technological vulnerabilities could negatively impact investor confidence and lead to price drops. The evolution of Bitcoin’s underlying technology is therefore a crucial factor to consider when predicting its future price.

Regulatory Landscape and its Impact: Bitcoin Prediction September 2025

The regulatory environment surrounding Bitcoin is rapidly evolving, presenting both challenges and opportunities for its future price trajectory. Differing approaches across jurisdictions create a complex landscape, impacting investor confidence, adoption rates, and ultimately, the price of Bitcoin. Understanding these regulatory nuances is crucial for accurate price prediction.

The global regulatory response to Bitcoin has been diverse, ranging from outright bans to comprehensive regulatory frameworks. Some countries have embraced Bitcoin’s potential, actively seeking to regulate it rather than suppress it, while others remain hesitant, viewing it with suspicion due to its decentralized nature and potential for illicit activities. This varied approach significantly influences Bitcoin’s market dynamics and accessibility.

Bitcoin Regulation Across Jurisdictions

Several countries have taken different approaches to regulating Bitcoin. For instance, El Salvador has adopted Bitcoin as legal tender, integrating it into its financial system. This move, while bold, has been met with mixed results, highlighting the complexities of integrating a volatile cryptocurrency into a national economy. In contrast, China has implemented a near-total ban on Bitcoin trading and mining, effectively pushing Bitcoin activity underground. The European Union is pursuing a more balanced approach, working towards a comprehensive regulatory framework for cryptocurrencies that aims to balance innovation with consumer protection. The United States, meanwhile, has a fragmented regulatory landscape, with different agencies overseeing various aspects of the Bitcoin ecosystem, leading to some uncertainty for businesses operating in the space. These diverse approaches create a patchwork of regulatory environments that affect Bitcoin’s global market dynamics.

Potential Impact of Future Regulations on Bitcoin’s Price

Future regulatory developments will likely significantly impact Bitcoin’s price. Increased regulatory clarity and standardization across major economies could lead to greater institutional investment and mainstream adoption, potentially driving Bitcoin’s price upwards. Conversely, overly restrictive regulations or inconsistent enforcement could stifle innovation and limit adoption, potentially depressing Bitcoin’s price. For example, a hypothetical global ban on Bitcoin mining, mirroring China’s actions, could significantly reduce Bitcoin’s supply and potentially increase its scarcity value, leading to a price surge. However, such a ban could also trigger a significant sell-off by miners forced to liquidate their holdings. The ultimate impact will depend on the specific nature and implementation of future regulations. A scenario where regulatory frameworks are developed to enhance security and transparency, reducing risks associated with money laundering and fraud, could attract significant institutional investment and positively impact the price. Conversely, overly burdensome regulations could create barriers to entry for smaller investors and businesses, potentially slowing down adoption.

Market Sentiment and Investor Behavior

Predicting Bitcoin’s price in September 2025 requires understanding the complex interplay of market sentiment and investor behavior. These factors, often driven by news cycles and broader economic conditions, can significantly impact price volatility and overall market trends. Analyzing past patterns, while not guaranteeing future outcomes, offers valuable insights into how these forces might shape Bitcoin’s future.

Media coverage and public perception play a crucial role in shaping Bitcoin’s price. Positive news, such as institutional adoption or regulatory clarity, tends to fuel bullish sentiment and drive prices upward. Conversely, negative news, including security breaches or regulatory crackdowns, can trigger sell-offs and price declines. For example, Elon Musk’s tweets regarding Tesla’s Bitcoin holdings have historically shown a direct correlation with short-term price fluctuations, illustrating the power of public perception driven by influential figures.

Media Coverage and Public Perception

The influence of media narratives on Bitcoin’s price is undeniable. A predominantly positive media portrayal, focusing on Bitcoin’s potential as a store of value or a hedge against inflation, can attract new investors and push prices higher. Conversely, negative or fear-mongering coverage, highlighting risks such as price volatility or regulatory uncertainty, can discourage investment and lead to price drops. This dynamic is further amplified by social media, where narratives can spread rapidly, impacting investor confidence and influencing trading decisions. The 2017 Bitcoin bubble, fueled by both mainstream and social media hype, serves as a stark example of this phenomenon. The subsequent crash, partly driven by negative media coverage focusing on the speculative nature of the market, highlights the double-edged sword of media influence.

Institutional Investor Behavior, Bitcoin Prediction September 2025

Institutional investors, such as hedge funds and investment firms, are increasingly participating in the Bitcoin market. Their involvement brings significant capital and often influences price trends through large-scale buying and selling. Their actions are typically more calculated and less prone to emotional swings than those of retail investors. For instance, the entry of Grayscale Investments into the Bitcoin market represented a major milestone, injecting significant capital and bolstering confidence in the asset. Conversely, large-scale sell-offs by institutional players can trigger significant price corrections. Their investment decisions are often based on sophisticated analyses of market fundamentals and long-term growth potential, making their impact on Bitcoin’s price relatively stable compared to retail investors.

Retail Investor Sentiment

Retail investor sentiment, characterized by emotional responses and herd behavior, significantly influences Bitcoin’s short-term price volatility. Periods of intense fear or greed can lead to dramatic price swings. For example, during periods of market uncertainty, retail investors might panic-sell, causing price drops. Conversely, periods of intense excitement and hype can lead to rapid price increases. This behavior is often influenced by social media trends, news headlines, and the overall market mood. Understanding retail investor sentiment requires monitoring social media sentiment analysis, analyzing trading volumes from retail exchanges, and tracking overall market fear and greed indices. This can provide valuable insights into short-term price fluctuations, although predicting the exact timing and magnitude of these fluctuations remains a significant challenge.

Macroeconomic Factors and Bitcoin’s Price

Bitcoin’s price, while often driven by internal factors like technological advancements and market sentiment, is significantly influenced by broader macroeconomic conditions. Understanding this interplay is crucial for predicting its future trajectory. Global economic health, inflation rates, interest rate policies, and geopolitical instability all play a role in shaping investor behavior and, consequently, Bitcoin’s value.

Bitcoin’s price often acts as a safe haven asset during times of economic uncertainty. This inverse relationship with traditional markets can be explained by Bitcoin’s decentralized nature and limited supply, making it attractive to investors seeking to hedge against inflation or currency devaluation. Conversely, periods of economic stability and growth can lead to reduced demand for Bitcoin as investors shift their focus towards more traditional, higher-yield investments.

Inflation’s Impact on Bitcoin’s Price

High inflation erodes the purchasing power of fiat currencies. This can drive investors towards alternative assets, like Bitcoin, perceived as a hedge against inflation. For example, during periods of high inflation in countries like Argentina or Venezuela, Bitcoin adoption surged as citizens sought to preserve their wealth. However, the correlation isn’t always perfect; Bitcoin’s price can be influenced by other factors, and it’s not a guaranteed inflation hedge. Its volatility means it can experience significant price swings even during periods of relatively stable inflation.

Interest Rates and Bitcoin’s Price

Interest rate hikes by central banks, often implemented to combat inflation, can negatively impact Bitcoin’s price. Higher interest rates make traditional investments like bonds more attractive, drawing capital away from riskier assets such as Bitcoin. Conversely, lower interest rates can stimulate investment in riskier assets, potentially boosting Bitcoin’s price. The 2022 interest rate hikes by the Federal Reserve, for instance, coincided with a significant downturn in the cryptocurrency market, illustrating this relationship.

Recessionary Pressures and Bitcoin’s Price

Recessions typically lead to increased market volatility and risk aversion. Investors tend to move towards safer assets, reducing demand for Bitcoin and potentially leading to price declines. The 2008 financial crisis, while predating Bitcoin’s widespread adoption, provides a historical context: investors sought safety in government bonds and other established assets, illustrating a potential pattern for Bitcoin during future economic downturns. However, the argument can also be made that Bitcoin could act as a safe haven during recessions, attracting investors seeking to preserve capital outside of traditional, potentially failing, financial systems.

Geopolitical Events and Bitcoin’s Price

Geopolitical events, such as wars, political instability, or sanctions, can significantly impact Bitcoin’s price. These events often create uncertainty in global markets, leading to increased demand for safe-haven assets, including Bitcoin. The 2022 Russian invasion of Ukraine, for example, led to increased volatility in global markets and saw Bitcoin’s price fluctuate significantly as investors reacted to the geopolitical uncertainty. The impact, however, is complex and depends on various factors, including the specific event’s nature and duration, as well as the broader market sentiment.

Potential Scenarios for Bitcoin in September 2025

Predicting the price of Bitcoin in September 2025 is inherently speculative, given the cryptocurrency’s volatile nature and susceptibility to a wide array of influencing factors. However, by examining historical trends, technological advancements, regulatory developments, and macroeconomic conditions, we can construct plausible scenarios illustrating potential price movements. These scenarios are not predictions, but rather illustrative possibilities based on different assumptions.

Bullish Scenario: Bitcoin Surges Past $200,000

This scenario envisions a significantly bullish market for Bitcoin by September 2025. Several factors contribute to this optimistic outlook. Widespread institutional adoption, coupled with continued growth in developing economies, could drive demand significantly higher. Technological improvements, such as the successful implementation of layer-2 scaling solutions, might enhance Bitcoin’s transaction speed and reduce fees, making it more attractive for everyday use. Favorable regulatory developments in key jurisdictions could also boost investor confidence. This scenario assumes a generally positive macroeconomic environment, with relatively low inflation and stable global financial markets. A successful halving event in 2024 could also contribute to a scarcity-driven price increase. Similar to the price surge seen after previous halvings, this could trigger a new bull market cycle. For example, the halving in 2016 preceded a substantial price increase in 2017.

Bearish Scenario: Bitcoin Price Falls Below $30,000

Conversely, a bearish scenario suggests a significant decline in Bitcoin’s price by September 2025. This scenario hinges on several negative factors. A global economic recession, coupled with increased regulatory scrutiny and crackdowns on cryptocurrency exchanges, could significantly dampen investor enthusiasm. Negative news events, such as a major security breach affecting a major exchange or a large-scale market manipulation scheme, could trigger a sell-off. Technological challenges, such as persistent scalability issues or the emergence of a superior competing cryptocurrency, could also erode Bitcoin’s dominance. Furthermore, a prolonged period of high inflation and rising interest rates could make Bitcoin less attractive compared to traditional assets. This scenario also considers the possibility of a lackluster response to the 2024 halving event, which could potentially fail to spark the expected price surge.

Neutral Scenario: Bitcoin Consolidates Around $50,000

A neutral scenario suggests that Bitcoin’s price will remain relatively stable, consolidating around a specific price range by September 2025. This scenario assumes a balanced interplay of bullish and bearish factors. While some positive developments, such as increased adoption in certain sectors or minor regulatory advancements, could provide support, these would be offset by countervailing forces like macroeconomic uncertainty or minor regulatory setbacks. This scenario expects a gradual and steady growth, potentially interrupted by periodic corrections, but without experiencing major price swings either upwards or downwards. This reflects a more cautious and less volatile market environment. Think of it as a period of sideways trading, similar to the consolidation periods seen in Bitcoin’s history before significant price movements.

Scenario Summary

| Scenario | Price Range (USD) | Key Factors |

|---|---|---|

| Bullish | >$200,000 | Widespread adoption, technological advancements, favorable regulation, positive macroeconomic environment, successful halving |

| Bearish | <$30,000 | Global recession, increased regulation, negative news events, technological challenges, high inflation, weak halving response |

| Neutral | ~$50,000 | Balanced interplay of bullish and bearish factors, gradual growth with periodic corrections, sideways trading |

Risks and Uncertainties

Predicting the price of Bitcoin in September 2025, or any future date, is inherently risky. Numerous factors influence its value, many of which are unpredictable and beyond the control of any model. While historical trends and patterns can offer insights, they cannot guarantee future performance. The inherent volatility of Bitcoin necessitates a cautious approach to any prediction.

The limitations of predictive models are significant. These models rely on historical data and assumptions about future conditions, both of which can be flawed. Unforeseen events, such as a major regulatory crackdown, a significant technological breakthrough, or a global economic crisis, can dramatically alter the Bitcoin price trajectory, rendering any prediction obsolete. Furthermore, the inherent complexity of the cryptocurrency market, with its diverse range of actors and influences, makes accurate forecasting extremely challenging. Even sophisticated models incorporating various macroeconomic and technological factors can fail to accurately capture the nuances of this dynamic market.

Model Limitations and Unforeseen Events

Predictive models, no matter how sophisticated, are fundamentally limited. They are based on past data, assuming that future trends will resemble past trends. This assumption is often unreliable in a rapidly evolving market like cryptocurrency. For example, a model might accurately predict Bitcoin’s price based on past adoption rates, but fail to account for the emergence of a competing cryptocurrency with superior technology or a sudden shift in regulatory landscape. Unexpected events, such as a major security breach or a significant change in investor sentiment, can cause dramatic and unpredictable price swings. The 2022 crypto winter, triggered by a combination of factors including rising interest rates and the collapse of TerraUSD, serves as a stark reminder of the market’s vulnerability to unforeseen circumstances. Similarly, the unexpected surge in Bitcoin’s price in late 2020 and early 2021 highlights the difficulty in accurately predicting such rapid price movements.

The Importance of Diversification and Risk Management

Given the inherent risks associated with Bitcoin investment, diversification and robust risk management strategies are crucial. Investing solely in Bitcoin exposes an investor to significant volatility and potential losses. A diversified portfolio, including a mix of assets such as stocks, bonds, and other cryptocurrencies, can help mitigate risk. This approach reduces the impact of any single asset’s underperformance on the overall portfolio value. Furthermore, risk management involves carefully assessing one’s risk tolerance, setting realistic investment goals, and avoiding excessive leverage or speculative trading. For example, an investor with a low-risk tolerance might choose to allocate only a small percentage of their portfolio to Bitcoin, while a more risk-tolerant investor might allocate a larger percentage. Regularly reviewing and adjusting one’s investment strategy based on market conditions and personal circumstances is also a vital component of effective risk management. This might involve reducing exposure to Bitcoin during periods of high volatility or increasing exposure during periods of perceived stability.

Frequently Asked Questions

This section addresses common queries regarding Bitcoin’s price and investment risks, offering insights into the factors influencing its volatility and potential future scenarios. Understanding these aspects is crucial for making informed investment decisions.

Important Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors. Supply and demand dynamics, driven by investor sentiment and market speculation, play a significant role. Technological advancements, such as network upgrades or the development of new applications, can also impact price. Regulatory changes, both globally and within specific jurisdictions, exert considerable influence, often creating periods of uncertainty or volatility. Macroeconomic factors, such as inflation, interest rates, and geopolitical events, also contribute to price fluctuations, as investors often view Bitcoin as a hedge against these uncertainties. Finally, the overall sentiment and behavior of investors, including institutional adoption and retail participation, are powerful drivers of price movements.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is inherently challenging. The cryptocurrency market is highly volatile and susceptible to sudden shifts driven by news, speculation, and unpredictable events. Unlike traditional assets with established historical patterns, Bitcoin’s relatively short history and unique characteristics make reliable forecasting exceptionally difficult. While technical analysis and fundamental analysis can offer insights, they are not foolproof and cannot account for unexpected external factors. Numerous predictions have proven inaccurate, highlighting the limitations of attempting to pinpoint future price points with precision. For example, predictions made in 2017 about Bitcoin reaching $100,000 were far off the mark in the short term.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries significant risks. Price volatility is a major concern, with substantial price swings occurring frequently. The market is susceptible to manipulation, and security breaches, such as hacks of exchanges, can lead to significant losses. Regulatory uncertainty poses another risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. Furthermore, the decentralized nature of Bitcoin means there’s limited consumer protection compared to traditional financial instruments. To mitigate these risks, investors should diversify their portfolios, conduct thorough research, and only invest what they can afford to lose. Utilizing secure storage methods like hardware wallets and diversifying across different investment vehicles can also help to reduce overall risk.

Regulation’s Impact on Bitcoin’s Price

Regulatory changes can significantly impact Bitcoin’s price, often causing both short-term volatility and long-term effects. Positive regulatory developments, such as the establishment of clear guidelines and licensing frameworks, can boost investor confidence and lead to price increases. Conversely, negative or uncertain regulatory environments, including bans or restrictions on cryptocurrency trading or use, can trigger significant price drops. For instance, China’s crackdown on cryptocurrency mining and trading in 2021 led to a substantial decline in Bitcoin’s price. The regulatory landscape is constantly evolving, making it crucial for investors to stay informed about changes and their potential impact.

Disclaimer and Caveat

This analysis regarding potential Bitcoin price movements in September 2025 is presented solely for informational purposes. It should not be interpreted as financial advice, a recommendation to buy or sell Bitcoin, or any other cryptocurrency. The information provided is based on historical data, market trends, and expert opinions, but future price movements are inherently uncertain.

Bitcoin and other cryptocurrencies are highly volatile investments. Their prices can fluctuate dramatically in short periods, leading to substantial gains or significant losses. Past performance is not indicative of future results. Any investment decision involving Bitcoin or other digital assets should be made after careful consideration of your personal risk tolerance, financial situation, and thorough independent research. Remember, you could lose all the money you invest.

Investment Risks

Investing in Bitcoin carries considerable risk. The cryptocurrency market is notoriously susceptible to rapid and unpredictable price swings driven by various factors, including regulatory changes, technological advancements, market sentiment, and macroeconomic conditions. For example, the collapse of FTX in 2022 demonstrated the potential for significant and sudden losses in the cryptocurrency market, impacting investor confidence and causing widespread price declines across various cryptocurrencies. The lack of regulatory oversight in many jurisdictions further contributes to the inherent risk. Before investing, it is crucial to fully understand these risks and only invest what you can afford to lose.

Disclaimer Regarding Predictions

The projections and scenarios presented in this analysis are based on current market trends and forecasts, but are not guarantees of future performance. Numerous unforeseen events could significantly impact Bitcoin’s price. The inherent volatility of the cryptocurrency market renders precise predictions extremely difficult, if not impossible. It is essential to remember that any price forecast is just one possible outcome among many, and should not be considered a definitive statement about future price action. Consider the 2017 Bitcoin bull run, followed by a significant correction; this illustrates the unpredictable nature of the market and the potential for sharp price reversals. Relying solely on any prediction could result in significant financial losses.

Bitcoin Prediction September 2025 – Predicting Bitcoin’s price in September 2025 is challenging, as numerous factors influence its value. A key element to consider is the impact of the 2025 Bitcoin halving, which is likely to affect the supply and subsequently the price. For more in-depth analysis on this crucial event, you can refer to this comprehensive resource on the 2025 Bitcoin Halving Price Prediction.

Understanding the halving’s potential effects is vital for any serious Bitcoin prediction for September 2025.

Predicting Bitcoin’s price in September 2025 is challenging, as various factors influence its trajectory. A key event to consider is the Bitcoin halving in 2024, and its subsequent impact; understanding this is crucial for any accurate forecast. To gain insight into the post-halving dynamics, it’s helpful to review this analysis: What Happens After Bitcoin Halving 2025.

Ultimately, this understanding will inform more realistic Bitcoin Prediction September 2025 scenarios.

Predicting Bitcoin’s price in September 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the impact of the 2025 Bitcoin Halving on Bitcoin’s supply dynamics is crucial for any accurate forecast. This significant event is likely to influence the market leading up to and beyond September 2025, potentially impacting price predictions considerably.

Predicting Bitcoin’s price in September 2025 is challenging, influenced by various factors including halving events. To understand the potential impact on Bitcoin’s value in September 2025, it’s crucial to know when the next halving occurs after April 2025; you can find that information here: When Is The Next Bitcoin Halving After April 2025. This knowledge significantly aids in formulating more accurate Bitcoin price predictions for September 2025, considering the reduced reward for miners.

Predicting Bitcoin’s price in September 2025 is challenging, but understanding the upcoming halving event is crucial for any forecast. Key data points surrounding this event, such as the reduced block reward and its potential impact on scarcity, are readily available from resources like Halving Bitcoin 2025 Data. Analyzing this information is essential to forming a more informed Bitcoin Prediction September 2025.

Predicting Bitcoin’s price in September 2025 is challenging, heavily influenced by factors like adoption rates and regulatory changes. A key event impacting this prediction is the next Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the timing of this crucial event, you should consult this helpful resource: When In 2025 Is The Next Bitcoin Halving.

Knowing the halving date allows for a more informed assessment of Bitcoin’s potential price trajectory in September 2025.