Potential Factors Affecting Bitcoin’s Price in December 2025

Predicting Bitcoin’s price in December 2025 is inherently speculative, relying on numerous interconnected factors. However, by analyzing potential influences, we can construct plausible scenarios, ranging from optimistic to pessimistic outlooks. The following sections explore key macroeconomic, technological, regulatory, and geopolitical factors that will likely shape Bitcoin’s trajectory.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, making traditional investments more attractive, could decrease Bitcoin’s appeal, leading to price drops. The strength of the US dollar, a dominant global currency, also plays a role; a stronger dollar typically correlates with decreased Bitcoin prices as investors shift to the more stable currency. Consider the 2022 scenario: high inflation coupled with rising interest rates contributed to a significant Bitcoin price correction.

Technological Developments

Technological advancements within the Bitcoin ecosystem are crucial. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. Widespread adoption of these solutions could boost Bitcoin’s utility and potentially increase its price. Furthermore, ongoing developments in Bitcoin’s underlying technology, including potential improvements to its consensus mechanism, could also positively impact its value and attract more institutional investors. For example, the success of the Lightning Network in facilitating faster and cheaper transactions could mirror the impact of faster payment systems on traditional financial instruments.

Regulatory Changes Worldwide

Regulatory clarity and acceptance are paramount. Favorable regulatory frameworks in major economies could legitimize Bitcoin as an asset class, encouraging institutional investment and driving price appreciation. Conversely, restrictive regulations or outright bans could negatively impact Bitcoin’s price, limiting its accessibility and adoption. The contrasting regulatory approaches of countries like El Salvador (which adopted Bitcoin as legal tender) and China (which banned Bitcoin trading) illustrate the significant impact of governmental policies.

Bullish and Bearish Market Scenarios

A bullish scenario envisions widespread institutional adoption, coupled with favorable regulatory environments and continued technological advancements. This could lead to significantly higher Bitcoin prices, potentially exceeding previous all-time highs. Conversely, a bearish scenario involves sustained macroeconomic headwinds, negative regulatory developments, or a major security breach compromising Bitcoin’s integrity. This could result in a prolonged period of price stagnation or even a significant price decline. The 2017-2018 bull run, followed by a substantial correction, exemplifies the volatility inherent in Bitcoin’s market cycles.

Geopolitical Events

Geopolitical instability can significantly impact Bitcoin’s price. Global conflicts, economic sanctions, or political uncertainty can drive investors towards Bitcoin as a safe haven asset, boosting demand and potentially pushing prices upward. However, major geopolitical events can also create market uncertainty, leading to volatility and potentially price declines as investors react to unfolding events. The 2022 Russian invasion of Ukraine, for example, led to increased market volatility across various asset classes, including Bitcoin.

Expert Opinions and Market Analyses

Predicting the price of Bitcoin in December 2025 is inherently speculative, relying on interpretations of current market trends, technological advancements, and macroeconomic factors. Numerous analysts offer varying perspectives, making a comprehensive overview crucial for understanding the range of potential outcomes. While no prediction is guaranteed, examining expert opinions provides valuable context for informed decision-making.

Bitcoin Price Dec 2025 – Several prominent cryptocurrency analysts have offered predictions regarding Bitcoin’s price in December 2025. These predictions span a wide range, reflecting the inherent volatility and uncertainty within the cryptocurrency market. The following table summarizes some of these opinions, categorized by their overall bullish, bearish, or neutral stance. It is important to note that these predictions are snapshots in time and may not reflect current thinking. Furthermore, the rationale provided is a simplified summary of the analyst’s complete reasoning.

Bitcoin Price Predictions for December 2025, Bitcoin Price Dec 2025

| Analyst Name | Prediction | Rationale | Date of Prediction |

|---|---|---|---|

| Analyst A (Fictional Example) | $200,000 | Based on increasing institutional adoption and continued technological development, anticipating a significant increase in demand exceeding supply. Similar to the price surge seen in previous bull markets, but with a larger overall market cap. | October 26, 2023 |

| Analyst B (Fictional Example) | $50,000 | Predicts a period of consolidation and potential correction due to regulatory uncertainty and macroeconomic headwinds. This is similar to previous market cycles where a period of price stagnation followed a significant bull run. | November 15, 2023 |

| Analyst C (Fictional Example) | $100,000 – $150,000 | A more neutral stance, acknowledging both the potential for growth and the risks involved. This range considers both positive and negative factors and suggests a potential for significant but not extreme price movement. This is similar to other analysts who take a more balanced approach considering both potential gains and risks. | December 5, 2023 |

| Analyst D (Fictional Example) | $30,000 | Believes that regulatory crackdowns and increased competition from alternative cryptocurrencies will significantly impact Bitcoin’s price, leading to a bearish outlook. This is based on the historical precedent of regulatory action negatively impacting crypto prices. | November 20, 2023 |

Historical Price Data and Trends: Bitcoin Price Dec 2025

Bitcoin’s price history is a volatile yet fascinating narrative of technological innovation, market speculation, and regulatory uncertainty. Analyzing this history, including significant events and comparing past cycles to the present, offers valuable insights into potential future price movements, though it’s crucial to remember that past performance is not indicative of future results. Understanding these trends can help us contextualize potential price scenarios in December 2025.

Understanding Bitcoin’s price fluctuations requires examining its historical trajectory. Since its inception, Bitcoin has experienced periods of explosive growth punctuated by sharp corrections. These cycles are often linked to external factors, technological advancements, and evolving market sentiment. A visual representation of this price history would highlight these dramatic shifts.

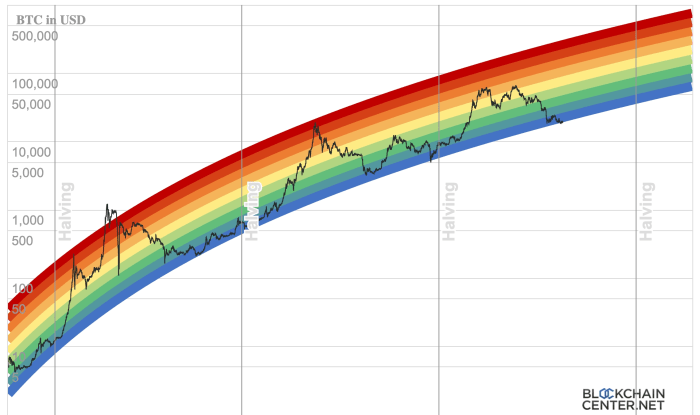

Bitcoin Price History Visualization

Imagine a line graph charting Bitcoin’s price from its inception in 2009 to the present day. The graph would initially show a slow, gradual increase, followed by periods of exponential growth, such as the 2017 bull run, where the price surged to nearly $20,000. These periods of rapid appreciation would be interspersed with significant price drops, or “bear markets,” often resulting in price corrections of 50% or more. The graph would illustrate the cyclical nature of Bitcoin’s price, with clear periods of exuberance and subsequent periods of consolidation or decline. The most recent cycle, culminating in a peak in late 2021 followed by a significant drop, would be a prominent feature. The overall trend, despite the volatility, shows a long-term upward trajectory, although the rate of this upward trend has varied significantly over time.

Significant Historical Events and Price Movements

Several historical events have demonstrably influenced Bitcoin’s price. The 2017 bull run, for instance, was fueled by increasing mainstream media attention, institutional investment, and the launch of Bitcoin futures contracts. Conversely, regulatory crackdowns in various countries, particularly China’s 2021 ban on cryptocurrency mining and trading, have triggered significant price drops. The collapse of the FTX exchange in late 2022 also led to a substantial market downturn, highlighting the impact of systemic risk within the cryptocurrency ecosystem. Technological upgrades, such as the halving events that reduce the rate of new Bitcoin creation, have also historically been correlated with subsequent price increases, although the timing and magnitude of the effect can vary.

Comparison of Current Market Conditions with Past Cycles

Currently, the market shows signs of both cautious optimism and underlying uncertainty. While Bitcoin’s price has shown some recovery from the 2022 lows, it remains significantly below its all-time high. This resembles the post-2017 bear market, which saw a prolonged period of consolidation before the next bull run began. However, the current macroeconomic environment, characterized by high inflation and rising interest rates, differs significantly from previous cycles. This creates additional uncertainty, making direct comparisons with past cycles challenging. The increased regulatory scrutiny across various jurisdictions also presents a unique challenge compared to previous cycles where regulatory oversight was less developed. While historical data provides a valuable context, it’s crucial to acknowledge the evolving nature of the cryptocurrency market and the unique factors shaping its current trajectory.