Expert Opinions and Market Sentiment

Predicting the price of Bitcoin in 2025 is inherently speculative, relying heavily on expert opinions and prevailing market sentiment. Analyzing these factors provides a nuanced perspective, though it’s crucial to remember that even the most seasoned analysts can be wrong. These predictions are not financial advice, and individual investment decisions should be based on thorough research and risk tolerance.

Bitcoin Price Estimate 2025 – Numerous analysts and financial institutions offer Bitcoin price predictions, often diverging significantly. These differences stem from varying methodologies, underlying assumptions about technological advancements, regulatory changes, and macroeconomic conditions. Understanding these differing perspectives helps to contextualize the overall market sentiment.

Predicting the Bitcoin price in 2025 is challenging, with various analysts offering widely differing Bitcoin Price Estimate 2025 figures. To gain a broader perspective on potential future values, it’s helpful to consult resources that explore this question directly, such as this insightful article: What Will Bitcoin Price Be In 2025. Ultimately, a Bitcoin Price Estimate 2025 remains speculative, dependent on numerous market factors and technological advancements.

Summary of Prominent Price Predictions

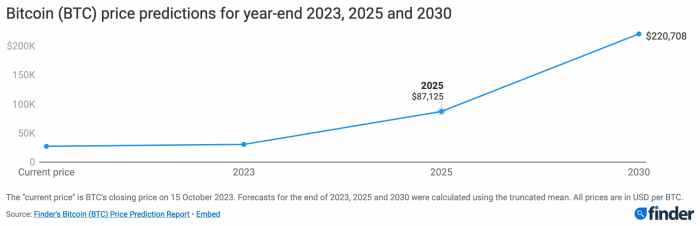

While specific numerical predictions vary widely, a range of forecasts from prominent analysts and institutions exists. For instance, some analysts, basing their predictions on factors like increasing institutional adoption and the scarcity of Bitcoin, project prices well above $100,000 by 2025. Others, emphasizing potential regulatory hurdles and market volatility, offer considerably more conservative estimates, perhaps in the range of $50,000 to $75,000. Some extremely bearish predictions even suggest lower prices, but these are often associated with significant negative macroeconomic scenarios.

Estimating Bitcoin’s price in 2025 involves considering various factors, including adoption rates and regulatory landscapes. A crucial aspect of this estimation is understanding the predicted price at the year’s end; for a detailed outlook on this, you can refer to the comprehensive analysis provided at Bitcoin Price Prediction Dec 2025. Ultimately, these December predictions significantly influence the overall 2025 Bitcoin price estimate.

Common Themes and Divergences in Predictions

A common theme across many predictions is the acknowledgement of Bitcoin’s volatility. The degree to which this volatility impacts the price, however, is a point of significant divergence. Analysts who foresee higher prices often emphasize the potential for Bitcoin to become a mainstream store of value, similar to gold. Conversely, those with more conservative projections highlight the risks associated with regulatory uncertainty and the potential for competing cryptocurrencies to erode Bitcoin’s dominance. Another key divergence lies in the assumptions made about the overall macroeconomic environment – a strong global economy might fuel Bitcoin adoption, while a recession could lead to a sell-off.

Predicting the Bitcoin price in 2025 involves considering various factors, including adoption rates and regulatory changes. For a detailed perspective on potential price trajectories, you might find the analysis at Bitcoin Coin Price 2025 helpful. Ultimately, any Bitcoin price estimate for 2025 remains speculative, depending on market forces and unforeseen events.

Current Market Sentiment Towards Bitcoin

Market sentiment towards Bitcoin fluctuates constantly. It’s influenced by a range of factors including price movements, regulatory news, technological developments, and overall macroeconomic conditions. At any given time, the sentiment can be broadly categorized as bullish (positive), bearish (negative), or neutral. Bullish sentiment is typically characterized by high trading volume, price increases, and optimistic predictions. Bearish sentiment is reflected in price declines, decreased trading activity, and negative forecasts. Neutral sentiment suggests a period of consolidation or sideways trading, with less pronounced optimism or pessimism.

Predicting the Bitcoin price in 2025 is challenging, with various estimates circulating. A key factor influencing overall projections is the price at the end of the year, and to understand this, checking out a dedicated forecast for the Bitcoin Price Dec 2025, like this one Bitcoin Price Dec 2025 , is helpful. Ultimately, these December figures will significantly impact broader 2025 Bitcoin Price Estimate models.

Comparative Analysis of Expert Opinions

A comparative analysis reveals both consensus and disagreement among experts. There’s a general agreement that Bitcoin’s long-term potential is significant, but the timeline and magnitude of price appreciation remain highly debated. Areas of consensus often center around Bitcoin’s scarcity and its potential as a hedge against inflation. However, disagreements arise concerning the speed of adoption, the impact of regulation, and the overall macroeconomic outlook. For example, some analysts might highlight the potential for institutional investment to drive prices higher, while others emphasize the risk of regulatory crackdowns that could suppress growth. This divergence highlights the inherent uncertainty in predicting future price movements.

Estimating the Bitcoin price in 2025 involves considering numerous factors, including adoption rates and regulatory changes. For a detailed perspective on potential price trajectories, you might find the analysis from Bitcoin Price Prediction 2025 Walletinvestor insightful. Ultimately, any Bitcoin price estimate for 2025 remains speculative, dependent on market forces and unforeseen events.

Potential Scenarios for Bitcoin’s Price in 2025: Bitcoin Price Estimate 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic conditions, and market sentiment. However, by considering various factors, we can Artikel plausible price scenarios for 2025. These scenarios are not predictions but rather illustrative possibilities based on different sets of assumptions.

Bullish Scenario: Bitcoin Surges to $200,000

This scenario assumes widespread institutional adoption, continued technological improvements (like the Lightning Network’s maturation), and a generally positive global macroeconomic environment. Increased regulatory clarity in major jurisdictions could further boost confidence. A surge in demand driven by both individual investors and large institutional players, coupled with a limited supply of Bitcoin, would fuel a significant price increase. The hypothetical price chart would show a steady, upward trend throughout the period, accelerating in the latter half of 2024 and into 2025, culminating in a price exceeding $200,000 by the end of the year. This scenario would be highly beneficial for early Bitcoin investors, generating substantial returns. Businesses accepting Bitcoin would see increased transaction volumes and reduced processing fees. However, the high price could also create accessibility issues for individuals with lower disposable incomes. The volatility associated with such a rapid price increase could also pose challenges for businesses managing Bitcoin-related assets.

Bearish Scenario: Bitcoin Falls to $20,000

This scenario envisions a confluence of negative factors. A global economic recession, coupled with increased regulatory scrutiny and a crackdown on cryptocurrencies in major markets, could severely impact investor confidence. Negative news events surrounding Bitcoin, or a major security breach affecting a significant exchange, could trigger a sell-off. The hypothetical price chart would illustrate a gradual decline throughout 2024, accelerating as negative factors accumulate, potentially bottoming out around $20,000 by the end of 2025. This scenario would negatively impact investors who purchased Bitcoin at higher prices, potentially leading to significant losses. Businesses accepting Bitcoin would see reduced transaction volumes, and the decreased price could make it less attractive as a store of value. Individuals holding Bitcoin would experience a significant reduction in their asset’s value.

Neutral Scenario: Bitcoin Stabilizes Around $50,000, Bitcoin Price Estimate 2025

This scenario assumes a relatively stable macroeconomic environment and a gradual increase in Bitcoin adoption. Regulatory uncertainty persists, but there are no major negative shocks to the market. Technological advancements continue, but their impact on price is less dramatic than in the bullish scenario. The hypothetical price chart would show some fluctuation, but generally remain within a range centered around $50,000 throughout 2024 and 2025. This scenario represents a moderate outcome, where investors see neither substantial gains nor significant losses. Businesses adopting Bitcoin would experience a steady flow of transactions, while individuals would see their holdings maintain relative value. This scenario, while less exciting than the bullish scenario, provides a degree of stability and predictability.

Risks and Considerations

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these risks is crucial for making informed investment decisions and mitigating potential losses. While the potential for high returns is alluring, the volatility and uncertainty of the cryptocurrency market demand a cautious approach.

Bitcoin’s price is notoriously volatile, experiencing significant fluctuations in short periods. This volatility stems from various factors, including regulatory uncertainty, market sentiment, technological developments, and macroeconomic conditions. For example, news of a major regulatory crackdown in a key market can trigger a sharp price drop, while positive announcements from large institutional investors can lead to rapid price increases. This inherent unpredictability makes Bitcoin a high-risk investment unsuitable for risk-averse individuals.

Market Volatility

The cryptocurrency market is known for its extreme price swings. Factors such as news events, regulatory changes, and even social media trends can dramatically impact Bitcoin’s price. Consider the 2017-2018 Bitcoin bubble, where prices soared to nearly $20,000 before crashing significantly. This illustrates the potential for both substantial gains and devastating losses in a relatively short timeframe. Investors should be prepared for significant price fluctuations and only invest what they can afford to lose.

Portfolio Diversification

Diversification is a fundamental principle of sound investment strategy. It involves spreading investments across different asset classes to reduce overall portfolio risk. Holding a significant portion of one’s investment portfolio in Bitcoin, without diversification into other assets like stocks, bonds, or real estate, exposes the investor to substantial risk. A diversified portfolio helps to cushion the impact of losses in any single asset class. For example, if the stock market experiences a downturn, a diversified portfolio with Bitcoin holdings might still see gains in the cryptocurrency market, mitigating the overall loss.

Risk Management Strategies

Effective risk management is paramount when investing in Bitcoin. This involves employing strategies to limit potential losses and protect investment capital. These strategies could include setting stop-loss orders (automatically selling Bitcoin when the price drops to a predetermined level), dollar-cost averaging (investing a fixed amount of money at regular intervals regardless of price), and only investing a portion of one’s overall portfolio in Bitcoin. Furthermore, thorough research and due diligence are essential before making any investment decisions, understanding the potential risks and rewards involved. A well-defined investment plan, tailored to individual risk tolerance and financial goals, is crucial for navigating the complexities of the Bitcoin market.

Frequently Asked Questions (FAQ)

Predicting the future price of Bitcoin is inherently challenging due to the cryptocurrency’s volatility and susceptibility to various market forces. The following FAQs aim to address common concerns and provide informed perspectives, acknowledging the inherent uncertainties involved.

Bitcoin’s Most Likely Price in 2025

Pinpointing a precise Bitcoin price for 2025 is impossible. Numerous factors, including regulatory changes, technological advancements, and overall market sentiment, will significantly influence its value. While some analysts predict prices in the tens of thousands of dollars, others suggest more conservative figures. It’s crucial to remember that past performance is not indicative of future results, and any prediction carries a considerable degree of risk. For example, the price surge in 2021 followed by a significant correction in 2022 highlights the unpredictable nature of the market. A realistic approach involves considering a range of potential outcomes rather than relying on a single, specific price point.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. On one hand, its limited supply and growing adoption as a store of value could lead to significant price appreciation over time. The potential for high returns attracts many investors. However, the inherent volatility and regulatory uncertainty present substantial risks. Significant price drops can occur, potentially resulting in substantial losses. Therefore, a long-term Bitcoin investment strategy should be approached cautiously, with a thorough understanding of the associated risks and a tolerance for significant price fluctuations. Diversification within a broader investment portfolio is strongly recommended.

Protecting Against Bitcoin Price Volatility

Mitigating the risk associated with Bitcoin’s price volatility requires a strategic approach. Diversification is key; don’t invest all your funds in Bitcoin. Spread your investments across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk. Dollar-cost averaging is another effective strategy. This involves investing a fixed amount of money at regular intervals, regardless of the current price. This reduces the impact of buying high and helps to average out the cost basis over time. Finally, only invest what you can afford to lose. Bitcoin’s price can fluctuate dramatically, and it’s essential to have a risk management plan in place.

Major Factors Influencing Bitcoin’s Price in 2025

Several key factors could significantly influence Bitcoin’s price in 2025. These include: global macroeconomic conditions (inflation, interest rates); regulatory developments (government policies and legal frameworks); technological advancements (scaling solutions, new applications); adoption rates (institutional and retail investment); and overall market sentiment (investor confidence and speculation). The interplay of these factors will ultimately determine Bitcoin’s trajectory. For instance, widespread institutional adoption could drive price increases, while stringent regulatory crackdowns could lead to price declines.

Disclaimer

This report provides estimates for the potential price of Bitcoin in 2025. These are solely estimations based on current market trends, expert opinions, and various analytical models. It is crucial to understand that predicting the future price of any cryptocurrency, including Bitcoin, is inherently speculative and subject to significant uncertainty. No guarantee of accuracy can be provided.

The information presented here is for educational and informational purposes only and should not be construed as financial advice. The cryptocurrency market is highly volatile and susceptible to rapid and unpredictable price swings influenced by numerous factors, including regulatory changes, technological advancements, market sentiment, and global economic conditions. Past performance is not indicative of future results. Investing in cryptocurrencies carries a substantial risk of loss, including the potential loss of your entire investment.

Investment Risks

Investing in Bitcoin or any cryptocurrency involves significant risks. The market is notoriously volatile, and prices can fluctuate dramatically in short periods. Factors such as regulatory uncertainty, security breaches, hacking incidents, and market manipulation can all negatively impact the value of your investment. For example, the collapse of FTX in 2022 demonstrated the fragility of the cryptocurrency market and the potential for substantial losses for investors. This underscores the importance of thorough due diligence and a comprehensive understanding of the risks before investing.

No Guarantee of Profit

It is imperative to remember that there is no guarantee of profit when investing in cryptocurrencies. The projections and estimations presented in this report are not promises of future returns. Many factors beyond our control could influence Bitcoin’s price, leading to outcomes significantly different from those predicted. Even with careful analysis and consideration of various scenarios, the possibility of substantial losses remains. For instance, while Bitcoin has experienced periods of significant growth, it has also seen substantial price corrections, demonstrating the inherent risk involved.

Individual Responsibility

The decision to invest in Bitcoin or any other cryptocurrency is entirely your own and should be made after careful consideration of your personal financial situation, risk tolerance, and investment goals. It is highly recommended that you seek advice from a qualified financial advisor before making any investment decisions. This report should not be the sole basis for your investment strategy. Remember, you are solely responsible for the outcomes of your investment choices.