Bitcoin Price Prediction for 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on numerous interconnected factors. While no one can definitively state the price, analyzing potential influences offers valuable insight into possible scenarios. This analysis will explore key factors impacting Bitcoin’s value, considering both macro-economic trends and specific developments within the cryptocurrency ecosystem.

Global Economic Conditions and Bitcoin’s Price

Global economic conditions, particularly inflation and recessionary pressures, significantly impact Bitcoin’s price. High inflation, eroding the purchasing power of fiat currencies, can drive investors towards Bitcoin as a hedge against inflation. Conversely, a global recession could lead to risk-aversion among investors, potentially causing a sell-off in Bitcoin and other risk assets. The 2022 bear market, partly fueled by rising interest rates and fears of a recession, serves as a real-world example of this dynamic. The strength of the US dollar, often negatively correlated with Bitcoin’s price, will also play a crucial role. A strong dollar might attract investors away from Bitcoin, while a weakening dollar could boost Bitcoin’s appeal.

Regulatory Changes and Bitcoin’s Value

Regulatory clarity and acceptance of Bitcoin vary significantly across jurisdictions. Favorable regulatory frameworks, such as those promoting clear tax guidelines and licensing for cryptocurrency exchanges, can increase institutional investment and boost Bitcoin’s price. Conversely, restrictive regulations, including outright bans or heavy taxation, could suppress Bitcoin’s price and limit its adoption. For instance, the contrasting regulatory approaches of El Salvador (Bitcoin legal tender) and China (Bitcoin banned) have demonstrably impacted Bitcoin’s price and trading volumes in those respective regions. The evolving regulatory landscape in the US, EU, and other major economies will be a crucial determinant of Bitcoin’s price in 2025.

Technological Advancements and Bitcoin’s Price Trajectory

Technological advancements within the Bitcoin ecosystem, such as the maturation of the Lightning Network, can significantly impact its price. The Lightning Network aims to improve Bitcoin’s scalability and transaction speed, addressing limitations that currently hinder its widespread adoption for everyday payments. Increased adoption of second-layer solutions like the Lightning Network could lead to greater utility and demand for Bitcoin, positively influencing its price. Conversely, a failure to address scalability concerns could limit Bitcoin’s growth potential. The successful implementation and adoption of other Layer-2 solutions and improvements to Bitcoin’s core protocol could also contribute to price appreciation.

Institutional Investment and Bitcoin Adoption

The growing involvement of institutional investors, including large corporations and investment firms, plays a crucial role in shaping Bitcoin’s price. Increased institutional adoption signifies greater legitimacy and potentially higher liquidity, leading to price appreciation. Examples include MicroStrategy’s significant Bitcoin holdings and Tesla’s previous acceptance of Bitcoin as payment. However, institutional investors are also sensitive to market volatility and regulatory uncertainty, and their actions can contribute to price swings. A significant increase in institutional investment in 2025 could significantly drive up the price, while a lack of further institutional adoption might limit price increases.

Comparative Analysis of Bitcoin Price Predictions

Various reputable crypto analysts offer diverse predictions for Bitcoin’s price in 2025. Some analysts, citing factors like increasing adoption and scarcity, predict prices significantly above $100,000. Others, emphasizing potential regulatory headwinds and market cycles, offer more conservative estimates, potentially ranging from $50,000 to $80,000. These discrepancies stem from differing weightings given to the various factors discussed above, as well as varying methodologies and assumptions in their forecasting models. It’s crucial to approach all price predictions with a healthy dose of skepticism, recognizing the inherent uncertainty involved in forecasting future market behavior. The accuracy of these predictions will ultimately depend on the interplay of the factors mentioned previously.

Historical Bitcoin Price Trends and Analysis

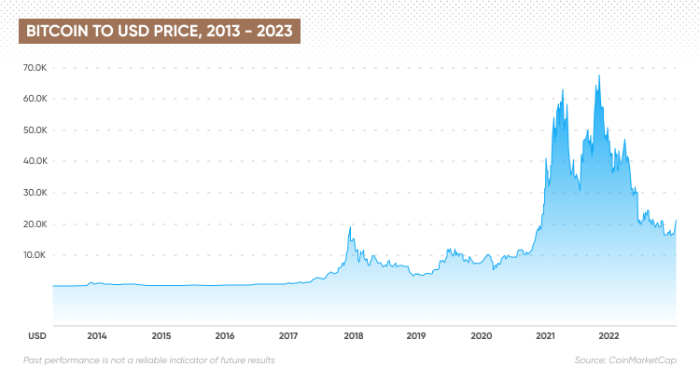

Bitcoin’s price history is a rollercoaster ride, marked by periods of explosive growth and dramatic crashes. Understanding these trends is crucial for navigating the volatile cryptocurrency market. Analyzing past price movements, coupled with an understanding of the events that influenced them, can offer valuable insights into potential future behavior, although predicting future price movements with certainty remains impossible.

Bitcoin’s price has been largely driven by a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. Examining these factors in conjunction with price movements reveals recurring patterns and offers a framework for interpreting future trends.

Significant Price Movements and Underlying Causes

Bitcoin’s journey from a nascent technology to a globally recognized asset class has been characterized by significant price fluctuations. Early adopters witnessed a gradual increase in value, followed by periods of rapid growth often fueled by media attention and increased institutional interest. Conversely, sharp declines have been triggered by factors such as regulatory uncertainty, security breaches, and broader macroeconomic downturns. For instance, the 2017 bull run saw Bitcoin’s price surge to nearly $20,000, driven by increasing public awareness and speculation, only to experience a significant correction in the following year. This volatility highlights the inherent risk associated with Bitcoin investment.

Timeline of Key Events and Their Correlation with Price Changes

The following table illustrates key events and their impact on Bitcoin’s price:

| Year | Event | Price Impact |

|---|---|---|

| 2009 | Bitcoin Genesis Block | Initial price negligible |

| 2010 | First real-world transaction (pizza purchase) | Minor price increase |

| 2011 | First major price surge | Significant price increase, followed by correction |

| 2012 | First Bitcoin halving | Gradual price increase |

| 2013 | Mt. Gox hack and price crash | Sharp price decline |

| 2016 | Second Bitcoin halving | Moderate price increase |

| 2017 | Significant media attention and institutional investment | Massive price surge, followed by a significant correction |

| 2020 | Third Bitcoin halving and COVID-19 pandemic | Price increase amidst global uncertainty |

| 2021 | El Salvador adopts Bitcoin as legal tender | Short-term price increase, followed by correction |

This table, while not exhaustive, provides a glimpse into the dynamic relationship between significant events and Bitcoin’s price fluctuations.

Psychological Factors Influencing Bitcoin’s Price Volatility

Market sentiment, driven by fear, greed, and hype, significantly influences Bitcoin’s price. Periods of intense hype often lead to speculative bubbles, resulting in rapid price increases. Conversely, periods of fear, often triggered by negative news or regulatory uncertainty, can cause sharp price drops. The “Fear and Greed Index,” a common metric used to gauge market sentiment, reflects these psychological factors and their impact on price volatility. For example, during the 2017 bull run, excessive hype and FOMO (fear of missing out) fueled the price surge, while subsequent regulatory crackdowns and market corrections led to significant sell-offs driven by fear.

Recurring Patterns in Bitcoin Price Movements

Bitcoin’s price history can be broadly categorized into bull markets (periods of sustained price increases), bear markets (periods of sustained price decreases), and periods of consolidation (periods of sideways price movement). These cycles appear to be somewhat cyclical, although the duration and intensity of each phase vary considerably. Analyzing these patterns helps in identifying potential turning points and formulating trading strategies, but it is crucial to remember that past performance is not indicative of future results. The halving events, for example, seem to consistently precede periods of price appreciation, although the timing and magnitude of these increases are unpredictable.

Bitcoin’s Role in the Global Financial Landscape

Bitcoin’s emergence has significantly altered the conversation surrounding global finance. Its decentralized nature and unique characteristics challenge established systems and offer potential solutions to long-standing financial problems. This section explores Bitcoin’s multifaceted role in the evolving global financial landscape, considering its strengths, weaknesses, and implications for the future.

Bitcoin’s position as a store of value, hedge against inflation, and alternative investment asset is a complex and actively debated topic. Its finite supply of 21 million coins is a key argument for its potential as a store of value, similar to gold, although its volatility significantly contrasts with the relative stability of precious metals.

Bitcoin as a Store of Value, Hedge Against Inflation, and Alternative Investment

Bitcoin’s value proposition rests partly on its scarcity. Unlike fiat currencies, which can be printed at will, leading to potential inflation, Bitcoin’s fixed supply makes it a potential hedge against inflationary pressures. However, Bitcoin’s price volatility presents a significant challenge to its acceptance as a reliable store of value. While some investors view its price fluctuations as an opportunity, others find it too risky for long-term storage of wealth. The comparison to gold is often made: both are considered scarce assets, but gold has a much longer history and more established track record of holding value. While Bitcoin’s price has shown periods of significant growth, it has also experienced dramatic drops, making its long-term stability as a store of value still uncertain. For example, the Bitcoin price increase of 2021 was followed by a considerable downturn in 2022, highlighting this volatility.

Bitcoin’s Potential to Disrupt Traditional Financial Systems

Bitcoin’s decentralized architecture poses a direct challenge to traditional financial intermediaries such as banks and payment processors. By removing the need for central authorities, Bitcoin theoretically offers faster, cheaper, and more transparent transactions. This has the potential to disrupt existing financial systems by providing an alternative for international remittances, reducing transaction fees, and potentially increasing financial inclusion for the unbanked population. However, regulatory uncertainty and the inherent risks associated with cryptocurrency remain significant obstacles to widespread adoption. The potential for money laundering and other illicit activities is a key concern for regulators globally.

Comparison of Bitcoin to Gold, Other Precious Metals, and Fiat Currencies

Bitcoin shares some similarities with gold in terms of scarcity, but differs significantly in its volatility and accessibility. Gold’s value is relatively stable compared to Bitcoin, although both can be subject to market fluctuations. Unlike fiat currencies, which are subject to government control and inflation, both Bitcoin and gold are considered to be relatively independent of central bank policies. However, Bitcoin’s digital nature and its dependence on technology differentiate it from physical assets like gold and other precious metals. Fiat currencies, on the other hand, benefit from established regulatory frameworks and widespread acceptance, which Bitcoin currently lacks.

Risks and Challenges Associated with Bitcoin’s Increasing Adoption

The increasing adoption of Bitcoin brings several challenges. Regulatory uncertainty remains a major hurdle, with governments worldwide grappling with how to regulate cryptocurrencies effectively. Security risks, including hacking and theft from exchanges, are also significant concerns. Furthermore, the environmental impact of Bitcoin mining, due to its high energy consumption, has drawn considerable criticism. The scalability of the Bitcoin network is another challenge, as transaction processing speeds can be slow compared to traditional payment systems. Finally, the potential for Bitcoin to be used for illicit activities remains a significant concern for law enforcement agencies globally.

Bitcoin’s Integration into Various Sectors

Bitcoin’s potential extends beyond simply being a store of value or a medium of exchange. Its integration into various sectors, such as payments, remittances, and decentralized finance (DeFi), is steadily increasing. In payments, Bitcoin offers a faster and potentially cheaper alternative to traditional methods, especially for cross-border transactions. For remittances, it can reduce the fees charged by traditional money transfer services, benefiting migrant workers and their families. Decentralized finance (DeFi) leverages blockchain technology to create new financial products and services, potentially disrupting traditional financial institutions. However, the lack of regulation and the complexity of DeFi platforms pose challenges to their widespread adoption.

Technical Analysis of Bitcoin’s Price Movement

Technical analysis offers a framework for understanding Bitcoin’s price fluctuations by examining past market data, specifically price and volume. Unlike fundamental analysis, which focuses on underlying economic factors, technical analysis relies on identifying patterns and trends to predict future price movements. This approach uses various indicators and chart patterns to pinpoint potential entry and exit points for traders.

Moving Averages, RSI, and MACD

Moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) are commonly used technical indicators. Moving averages smooth out price data, revealing underlying trends. A simple moving average (SMA) calculates the average price over a defined period, while an exponential moving average (EMA) gives more weight to recent prices. The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions, typically ranging from 0 to 100. Readings above 70 often suggest an overbought market, while readings below 30 indicate an oversold market. The MACD identifies momentum changes by comparing two moving averages, signaling potential buy or sell signals through crossovers. For example, a bullish crossover occurs when the MACD line crosses above the signal line, suggesting a potential upward price movement. Conversely, a bearish crossover indicates a potential downward trend. Analyzing these indicators together can provide a more comprehensive view of Bitcoin’s price momentum and potential trend reversals. For instance, a bullish crossover in the MACD combined with an RSI above 50 and a rising 50-day EMA could suggest a positive outlook.

Chart Patterns: Head and Shoulders, Double Tops/Bottoms

Chart patterns offer visual representations of price trends and potential reversals. A head and shoulders pattern is a bearish reversal pattern, characterized by three peaks: a central “head” flanked by two smaller “shoulders.” Once the neckline (a trendline connecting the troughs) is broken, it often signals a potential price decline. Conversely, an inverse head and shoulders pattern is a bullish reversal pattern. Double tops and double bottoms are other significant patterns. A double top indicates a potential bearish reversal, formed by two similar price peaks, while a double bottom signals a potential bullish reversal, characterized by two similar price troughs. For example, the formation of a head and shoulders pattern in Bitcoin’s chart, followed by a break below the neckline, historically indicated a significant price correction.

Support and Resistance Levels

Support levels represent price points where buying pressure is strong enough to prevent further price declines, while resistance levels mark price points where selling pressure prevents further price increases. These levels can be identified by observing previous price action, noting areas where prices have bounced or failed to break through. A break above a significant resistance level can signal a potential price surge, while a break below a significant support level can indicate a potential price drop. For instance, if Bitcoin’s price repeatedly finds support at $30,000, this level becomes a significant support area. A subsequent break below this level could signal a further price decline.

Identifying Entry and Exit Points

Technical analysis helps identify potential entry and exit points by combining indicators and chart patterns. For example, a trader might buy Bitcoin when the MACD shows a bullish crossover, the RSI is in oversold territory, and the price is approaching a key support level. Conversely, they might sell when the MACD shows a bearish crossover, the RSI is in overbought territory, and the price is approaching a key resistance level. This approach, however, requires careful risk management, using stop-loss orders to limit potential losses.

Comparison of Technical Analysis Methods

Different technical analysis methods vary in their effectiveness and time horizons.

| Method | Time Horizon | Strengths | Weaknesses |

|---|---|---|---|

| Moving Averages | Short-term to long-term | Identifies trends, smooths price data | Lagging indicator, susceptible to whipsaws |

| RSI | Short-term to medium-term | Identifies overbought/oversold conditions | Can generate false signals, subjective interpretation of thresholds |

| MACD | Short-term to medium-term | Identifies momentum changes, confirms trends | Can lag behind price movements, requires confirmation from other indicators |

| Chart Patterns | Medium-term to long-term | Provides visual representation of trends and reversals | Subjective interpretation, not always reliable |

Impact of Bitcoin Price Increase on the Economy and Society

A substantial increase in Bitcoin’s price would have profound and multifaceted effects on the global economy and society, impacting wealth distribution, financial accessibility, and environmental sustainability. Understanding these potential consequences is crucial for navigating the evolving landscape of cryptocurrency and its integration into the mainstream financial system.

Economic Effects of a Bitcoin Price Increase

A significant surge in Bitcoin’s value would create substantial wealth for early investors and current holders. This concentration of wealth could exacerbate existing economic inequalities, potentially leading to social unrest if not managed effectively. Conversely, the increased market capitalization of Bitcoin could attract further investment into the cryptocurrency market, potentially stimulating economic growth in related sectors like blockchain technology and digital asset management. The impact on traditional financial markets remains uncertain, with potential for both increased volatility and the emergence of new investment strategies. For example, a doubling of Bitcoin’s price could shift billions of dollars in value, impacting global financial indices and investment portfolios.

Social Implications of Increased Bitcoin Adoption

Wider Bitcoin adoption promises to enhance financial inclusion, particularly in underserved communities with limited access to traditional banking services. Bitcoin’s decentralized nature allows for peer-to-peer transactions without intermediaries, reducing reliance on banks and potentially lowering transaction costs. This could empower individuals in developing nations or those excluded from the traditional financial system. However, the lack of regulatory oversight and the potential for scams and fraud pose significant risks, requiring robust educational initiatives and consumer protection measures. The example of mobile money adoption in Africa demonstrates the potential for digital currencies to revolutionize financial access, but also highlights the need for responsible implementation and regulation.

Environmental Concerns Related to Bitcoin Mining

Bitcoin mining’s energy consumption is a significant environmental concern. The process requires substantial computational power, leading to high electricity demand and associated carbon emissions. This energy consumption raises questions about Bitcoin’s long-term sustainability and its compatibility with global climate goals. The shift towards renewable energy sources for mining and the development of more energy-efficient mining techniques are crucial for mitigating these environmental impacts. Comparing Bitcoin’s energy consumption to that of traditional financial systems reveals a complex picture, requiring a comprehensive lifecycle assessment to accurately gauge its overall environmental footprint.

Challenges and Opportunities of Bitcoin as a Medium of Exchange

The widespread adoption of Bitcoin as a medium of exchange presents both challenges and opportunities. Volatility remains a major obstacle, hindering its usability for everyday transactions. Furthermore, scalability limitations and the need for improved infrastructure pose significant hurdles. However, the potential for faster, cheaper, and more transparent cross-border payments could revolutionize international trade and remittances. The emergence of the Lightning Network, a second-layer scaling solution, offers a potential pathway towards addressing scalability challenges. The success of Bitcoin as a medium of exchange will depend on addressing these challenges and fostering widespread trust and understanding.

Bitcoin’s Potential for Empowering Individuals and Communities

Bitcoin’s decentralized nature offers the potential to empower individuals and communities by fostering financial autonomy and reducing reliance on traditional banking systems. This is particularly relevant in countries with unstable political or economic environments, where access to traditional financial services may be limited or unreliable. Individuals can retain greater control over their finances, reducing vulnerability to censorship or government intervention. However, the potential for misuse, including money laundering and illicit activities, needs careful consideration and robust anti-money laundering (AML) and know-your-customer (KYC) regulations. The success stories of individuals and communities leveraging Bitcoin for financial independence highlight its transformative potential, but also underscore the importance of responsible usage and regulatory frameworks.

Frequently Asked Questions about Bitcoin Price Increase in 2025: Bitcoin Price Increase 2025

Predicting the future price of Bitcoin is inherently complex, but understanding the factors influencing its value and the associated risks can help investors make informed decisions. This section addresses common questions surrounding potential Bitcoin price increases in 2025.

Major Factors Influencing Bitcoin’s Price, Bitcoin Price Increase 2025

Several interconnected factors contribute to Bitcoin’s price volatility. Market sentiment, reflecting overall investor confidence and speculation, plays a significant role. Positive news often leads to price increases, while negative news can trigger sharp declines. Regulatory changes, both at the national and international level, significantly impact Bitcoin’s adoption and accessibility. Stringent regulations can dampen growth, while favorable regulations can boost investor confidence and drive price appreciation. Technological advancements, such as improvements in scalability and transaction speed, can also influence Bitcoin’s price. Finally, macroeconomic conditions, including inflation rates, interest rates, and economic growth, influence investor behavior and allocation of capital, thereby affecting Bitcoin’s price. For example, during periods of high inflation, investors may seek alternative assets like Bitcoin as a hedge against inflation, driving demand and price.

Accuracy of Bitcoin Price Predictions for 2025

Precisely predicting Bitcoin’s price in 2025 is extremely challenging, if not impossible. The cryptocurrency market is inherently volatile, characterized by unpredictable price swings driven by a multitude of factors, many of which are beyond the scope of prediction. Unexpected events, such as significant regulatory changes, technological breakthroughs, or major geopolitical shifts, can drastically alter the market landscape and invalidate any prior predictions. While analysts may offer price forecasts based on historical trends and technical indicators, these should be treated as informed speculation rather than guaranteed outcomes. The inherent unpredictability of the market makes long-term price predictions unreliable. Consider, for instance, the rapid price fluctuations experienced in 2021 and 2022, highlighting the market’s susceptibility to sudden shifts.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Price volatility is a major concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Security risks are also present, as Bitcoin exchanges and wallets are potential targets for hacking and theft. Regulatory uncertainty adds another layer of risk; governments worldwide are still developing their regulatory frameworks for cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s price and usability. Finally, the relatively nascent nature of the cryptocurrency market introduces a degree of uncertainty and risk compared to more established asset classes. For example, the collapse of the FTX exchange in 2022 demonstrated the potential for significant financial losses within the cryptocurrency space.

Strategies for Mitigating Bitcoin Price Fluctuations

Several strategies can help mitigate the risks associated with Bitcoin’s price volatility. Diversification is crucial; spreading investments across various asset classes, including traditional investments and other cryptocurrencies, reduces overall portfolio risk. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals regardless of price, helps reduce the impact of short-term price fluctuations. Risk management techniques, such as setting stop-loss orders to limit potential losses, are also essential. Finally, thorough research and understanding of the risks involved are paramount before investing in Bitcoin. A well-defined investment strategy, aligned with individual risk tolerance and financial goals, is crucial for navigating the volatility of the cryptocurrency market.

Bitcoin Price Increase 2025 – Predicting the Bitcoin price increase in 2025 involves considering various factors, including technological advancements and regulatory changes. Naturally, the performance of related cryptocurrencies also influences this prediction; understanding the potential trajectory of Bitcoin Cash is crucial. For insights into this, check out this informative resource on the Bitcoin Cash Price 2025 , which can provide context for broader Bitcoin price estimations.

Ultimately, the Bitcoin price increase in 2025 will depend on the interplay of many market forces.

Predicting the Bitcoin price increase in 2025 involves considering various factors, including technological advancements and regulatory changes. Naturally, the performance of related cryptocurrencies also influences this prediction; understanding the potential trajectory of Bitcoin Cash is crucial. For insights into this, check out this informative resource on the Bitcoin Cash Price 2025 , which can provide context for broader Bitcoin price estimations.

Ultimately, the Bitcoin price increase in 2025 will depend on the interplay of many market forces.

Predicting the Bitcoin price increase in 2025 involves considering various factors, including technological advancements and regulatory changes. Naturally, the performance of related cryptocurrencies also influences this prediction; understanding the potential trajectory of Bitcoin Cash is crucial. For insights into this, check out this informative resource on the Bitcoin Cash Price 2025 , which can provide context for broader Bitcoin price estimations.

Ultimately, the Bitcoin price increase in 2025 will depend on the interplay of many market forces.

Predicting the Bitcoin price increase in 2025 is challenging, depending on various factors influencing market volatility. To gain a clearer perspective on potential price points, it’s helpful to consult resources exploring this very question, such as this insightful article: What Will Bitcoin Be Worth 2025. Ultimately, the Bitcoin price increase in 2025 will hinge on technological advancements, regulatory changes, and overall market sentiment.