Bitcoin Price Prediction End 2025

Bitcoin, the pioneering cryptocurrency, has experienced a tumultuous journey since its inception in 2009. From a niche digital asset to a globally recognized investment vehicle, its price has demonstrated remarkable volatility, swinging wildly between periods of explosive growth and sharp corrections. Understanding this volatility and its underlying drivers is crucial for any attempt at price prediction.

Bitcoin’s price is a complex interplay of several factors. Regulatory landscapes play a significant role; supportive government policies can boost investor confidence and drive price increases, while restrictive regulations can lead to market downturns. Technological advancements, such as the implementation of the Lightning Network for faster transactions, also influence price by enhancing Bitcoin’s usability and scalability. Market sentiment, driven by media coverage, social media trends, and overall economic conditions, is perhaps the most volatile factor, capable of causing dramatic short-term price swings. For example, positive news about institutional adoption can trigger a price surge, while negative news regarding security breaches or regulatory crackdowns can lead to a significant drop.

Predicting Bitcoin’s price with accuracy presents significant challenges. The cryptocurrency market is inherently speculative and influenced by unpredictable events, making precise forecasting extremely difficult. Unlike traditional assets with established valuation models, Bitcoin’s value is largely determined by supply and demand dynamics within a relatively young and volatile market. Furthermore, the influence of unforeseen events, such as unexpected regulatory changes or major technological breakthroughs, can dramatically alter price trajectories. Historical price data, while useful for identifying trends, is not a reliable predictor of future performance given the unique and rapidly evolving nature of the cryptocurrency market. For example, while Bitcoin’s price in 2021 surpassed $60,000, this high was followed by a significant correction, demonstrating the difficulty in predicting long-term price movements.

Factors Influencing Bitcoin’s Price

The price of Bitcoin is a multifaceted issue, influenced by a complex interplay of economic, technological, and regulatory factors. These factors are often intertwined, making it difficult to isolate the impact of any single element.

Regulatory Changes and Their Impact

Government regulations significantly impact the Bitcoin market. Positive regulatory frameworks can boost investor confidence, leading to price increases. Conversely, restrictive or unclear regulations can create uncertainty and depress prices. Examples include countries like El Salvador adopting Bitcoin as legal tender, which had a positive short-term impact, while China’s crackdown on cryptocurrency mining led to a significant price drop. The evolving regulatory landscape globally remains a major uncertainty in price prediction.

Technological Advancements and Their Influence, Bitcoin Price Prediction End 2025

Technological developments within the Bitcoin ecosystem influence its price. Improvements in scalability, transaction speed, and security can enhance Bitcoin’s usability and appeal to a wider range of users and investors. Conversely, technological setbacks or security vulnerabilities can negatively impact its price. For instance, the development of the Lightning Network aimed to address scalability issues and potentially boost adoption and price. Conversely, a major security breach could severely erode confidence and depress the price.

Market Sentiment and Its Role in Price Volatility

Market sentiment plays a crucial role in Bitcoin’s price volatility. Positive news, such as large institutional investments or mainstream media coverage, can create FOMO (fear of missing out) and drive prices up. Conversely, negative news, such as security breaches or regulatory crackdowns, can lead to panic selling and price drops. Social media trends and overall investor confidence heavily influence market sentiment and, consequently, Bitcoin’s price. The rapid spread of information and the influence of social media make the market susceptible to sudden shifts in sentiment, leading to significant price fluctuations.

Market Analysis & Influencing Factors

Predicting Bitcoin’s price in 2025 requires a comprehensive understanding of the current market dynamics and the various factors influencing its trajectory. While predicting the future with certainty is impossible, analyzing these elements allows for a more informed assessment. The cryptocurrency market is inherently volatile, and Bitcoin, as the dominant player, is susceptible to both positive and negative influences.

The cryptocurrency market’s current state is characterized by a complex interplay of factors. Regulatory uncertainty in various jurisdictions continues to be a significant headwind, impacting investor confidence and market liquidity. Simultaneously, increasing institutional adoption and the maturation of the underlying technology are contributing to greater stability and potentially higher valuations. The overall market sentiment, often influenced by news cycles and technological developments, plays a crucial role in determining short-term price fluctuations.

Macroeconomic Factors and Bitcoin’s Value

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates, often implemented by central banks to combat inflation, can reduce the attractiveness of riskier assets, including cryptocurrencies, as investors seek safer, higher-yielding investments. The correlation between Bitcoin’s price and the US dollar index (DXY) often reflects this dynamic, with a strong dollar typically putting downward pressure on Bitcoin’s value. For example, during periods of high inflation in 2021 and 2022, Bitcoin saw significant price increases, albeit interspersed with sharp corrections, reflecting the flight to safety and inflation hedging aspects of the cryptocurrency.

Bitcoin’s Performance Compared to Other Cryptocurrencies

Bitcoin’s performance is often compared to other major cryptocurrencies like Ethereum, Solana, and Cardano. While Bitcoin maintains its position as the largest cryptocurrency by market capitalization, alternative cryptocurrencies (altcoins) can experience periods of outsized gains, driven by technological advancements, specific use cases, or market hype. These periods can sometimes lead to capital flowing out of Bitcoin and into altcoins, resulting in temporary price corrections for Bitcoin. However, Bitcoin’s established market dominance and its role as a store of value often see investors returning to it during periods of market uncertainty. For example, during the 2022 crypto winter, Bitcoin’s price decline was less severe than that of many altcoins, highlighting its relative resilience.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem can significantly impact its price. The development of the Lightning Network, for example, aims to improve scalability and transaction speed, addressing some of Bitcoin’s limitations. Successful implementations and widespread adoption of such upgrades could increase Bitcoin’s utility and potentially drive its price higher. Conversely, technological setbacks or security breaches could negatively affect investor confidence and lead to price declines. The ongoing development and integration of second-layer solutions, such as the Lightning Network, and improvements in wallet security are continuously evolving aspects of Bitcoin’s technological landscape.

Institutional Investment and Large-Scale Adoption

The increasing involvement of institutional investors, such as hedge funds and corporations, is a significant driver of Bitcoin’s price. Large-scale purchases by these entities inject substantial capital into the market, increasing demand and pushing prices upward. Furthermore, the growing adoption of Bitcoin as a payment method by businesses and the integration of Bitcoin-related services into mainstream financial platforms contribute to its legitimacy and increase its potential for future price appreciation. The entry of MicroStrategy and Tesla into the Bitcoin market, for example, signaled a shift in institutional perception and significantly influenced price movements.

Technical Analysis & Price Predictions

Predicting Bitcoin’s price is inherently speculative, but technical analysis provides a framework for informed estimations based on historical price and volume data. Several methods exist, each with strengths and weaknesses, offering a range of potential outcomes. Combining these methods with fundamental analysis and consideration of macroeconomic factors paints a more complete picture.

Moving Averages and Chart Patterns

Technical analysts frequently utilize moving averages to smooth out price fluctuations and identify trends. Simple moving averages (SMA) and exponential moving averages (EMA) are commonly employed. SMAs calculate the average price over a defined period, while EMAs give more weight to recent prices. Analysts look for crossovers between different moving averages (e.g., a 50-day SMA crossing above a 200-day SMA, suggesting a bullish trend) and use them to generate buy or sell signals. Chart patterns, such as head and shoulders, double tops/bottoms, and triangles, provide visual representations of potential price reversals or continuations. For instance, a head and shoulders pattern often precedes a bearish trend, indicating a potential price drop. The interpretation of these patterns requires experience and judgment.

Bitcoin Price Predictions for End of 2025

Several reputable sources offer Bitcoin price predictions, but it’s crucial to remember these are estimations, not guarantees. The methodologies vary widely, ranging from complex algorithms incorporating various market indicators to simpler extrapolations of existing trends. These predictions should be considered alongside other analyses, not as definitive forecasts.

| Source | Price Prediction (USD) | Methodology | Underlying Assumptions |

|---|---|---|---|

| (Example Source 1 – Replace with actual source and data) Cryptocurrency Analyst A | $100,000 – $150,000 | Algorithmic model incorporating on-chain metrics, market sentiment, and macroeconomic factors. | Continued institutional adoption, positive regulatory developments, and sustained global economic growth. |

| (Example Source 2 – Replace with actual source and data) Investment Bank B | $75,000 – $100,000 | Analysis of historical price trends, combined with projections based on adoption rates and network growth. | Moderate institutional adoption, potential regulatory hurdles, and a stable global economy. |

| (Example Source 3 – Replace with actual source and data) Financial News Outlet C | $50,000 – $75,000 | Qualitative assessment considering market sentiment, technological developments, and potential regulatory risks. | Slower than expected adoption rates, potential regulatory challenges, and economic uncertainty. |

Risk Assessment & Investment Strategies: Bitcoin Price Prediction End 2025

Investing in Bitcoin, like any other asset class, carries inherent risks. Understanding these risks and developing a suitable investment strategy is crucial for mitigating potential losses and maximizing potential gains. This section details the key risks associated with Bitcoin and Artikels several investment approaches catering to different risk appetites.

Bitcoin Investment Risks

Bitcoin’s price volatility is perhaps its most significant risk. Its value can fluctuate dramatically in short periods, leading to substantial gains or losses. For example, Bitcoin’s price experienced a significant surge in late 2020, followed by a sharp correction in early 2021. Regulatory uncertainty also poses a significant challenge. Governments worldwide are still developing frameworks for regulating cryptocurrencies, and changes in these regulations can significantly impact Bitcoin’s price and accessibility. Furthermore, the relatively nascent nature of the cryptocurrency market makes it susceptible to scams, hacks, and other security breaches. Finally, the lack of intrinsic value, unlike traditional assets like gold or real estate, contributes to its inherent volatility and risk profile.

Investment Strategies Based on Risk Tolerance

The optimal investment strategy depends heavily on an individual’s risk tolerance.

- High-Risk, High-Reward Strategy: This strategy involves investing a significant portion of one’s portfolio in Bitcoin, anticipating substantial price appreciation. It’s suitable for investors with a high risk tolerance and a long-term investment horizon. This strategy often involves buying and holding Bitcoin for an extended period, regardless of short-term price fluctuations.

- Moderate-Risk Strategy: This approach involves diversifying investments across Bitcoin and other asset classes, such as stocks, bonds, or real estate. A portion of the portfolio is allocated to Bitcoin to capture potential upside while mitigating risk through diversification. This approach might involve dollar-cost averaging, where regular investments are made regardless of price fluctuations.

- Low-Risk Strategy: This strategy minimizes exposure to Bitcoin’s volatility by allocating only a small percentage of the portfolio to it. The majority of the portfolio is invested in more stable assets. Investors might consider using Bitcoin as a small part of a diversified portfolio to gain exposure to the cryptocurrency market without significant risk.

Diversification Strategies for a Crypto Portfolio

Diversification within the cryptocurrency market is essential to mitigate risk. Simply investing in Bitcoin alone leaves you exposed to its specific volatility. A diversified portfolio might include other cryptocurrencies like Ethereum, Solana, or stablecoins like Tether or USD Coin. Each cryptocurrency has its own risk profile and market dynamics, and diversification can help to reduce overall portfolio volatility. The allocation of assets within the portfolio will depend on the individual’s risk tolerance and investment goals. For example, a more risk-averse investor might allocate a larger portion to stablecoins, while a more risk-tolerant investor might allocate more to altcoins with higher growth potential.

Calculating Potential Returns and Losses

Calculating potential returns and losses involves estimating future Bitcoin prices and comparing them to the initial investment cost.

Potential Return/Loss = (Future Price – Initial Price) / Initial Price * 100%

For example, if you invested $10,000 in Bitcoin at a price of $20,000 per Bitcoin (0.5 Bitcoin) and the price rises to $30,000, your potential return would be:

($30,000 – $20,000) / $20,000 * 100% = 50%

Conversely, if the price falls to $15,000, your potential loss would be:

($15,000 – $20,000) / $20,000 * 100% = -25%

It is crucial to remember that these are just potential scenarios, and the actual returns or losses can vary significantly depending on market conditions. These calculations should be considered alongside a thorough risk assessment and a well-defined investment strategy.

Regulatory Landscape & Legal Considerations

The regulatory landscape surrounding Bitcoin is complex and varies significantly across jurisdictions, impacting both its price and adoption rate. While some countries have embraced Bitcoin as a potential asset class or even a form of payment, others maintain a cautious or outright hostile stance. This regulatory patchwork creates uncertainty for investors and businesses alike, influencing market sentiment and ultimately, the price of Bitcoin.

Government regulations profoundly affect Bitcoin’s price and adoption. Stringent regulations can limit investment, increase transaction costs, and stifle innovation. Conversely, supportive regulations can boost confidence, attract investment, and increase the accessibility and usability of Bitcoin. The regulatory approach taken by a particular government can also influence the level of institutional adoption within that country, leading to significant price fluctuations depending on the size and influence of the adopting institution.

Bitcoin Regulation by Jurisdiction

The global regulatory landscape is a mosaic of different approaches. Some countries, such as El Salvador, have legally recognized Bitcoin as legal tender, while others, like China, have banned cryptocurrency trading and mining altogether. Many countries fall somewhere in between, with varying levels of regulation focused on areas like anti-money laundering (AML) and know-your-customer (KYC) compliance. The European Union, for instance, is developing a comprehensive regulatory framework for crypto assets, aiming for a standardized approach across member states. The United States, meanwhile, has a more fragmented approach with different agencies overseeing different aspects of the cryptocurrency market. This lack of unified regulation across major global economies presents significant challenges for Bitcoin’s widespread adoption and price stability.

Impact of Regulatory Uncertainty on Bitcoin Price

Regulatory uncertainty is a major factor influencing Bitcoin’s price volatility. Announcements of new regulations or changes to existing ones can trigger significant price swings, either positive or negative, depending on the nature of the regulations. For example, a crackdown on cryptocurrency exchanges in a major market can lead to a sharp price drop, while the introduction of a clear regulatory framework might attract institutional investors and lead to a price increase. The ongoing debate surrounding Bitcoin’s regulatory status in the United States, for example, has been a significant contributor to its price fluctuations. The lack of clarity often leads to market hesitancy and increased volatility.

Legal Challenges Related to Bitcoin Ownership and Transactions

Legal challenges surrounding Bitcoin ownership and transactions primarily revolve around issues of taxation, security, and illicit activities. Determining the tax implications of Bitcoin transactions can be complex, varying widely depending on the jurisdiction. Issues related to the security of Bitcoin wallets and exchanges, including the potential for hacking and theft, also pose legal challenges. Furthermore, the use of Bitcoin in illicit activities, such as money laundering and financing terrorism, continues to be a major concern for regulators worldwide. This necessitates robust AML/KYC compliance measures, further influencing the regulatory environment. Legal precedents in this area are still developing, leading to ongoing uncertainty for users and businesses.

Bitcoin’s Long-Term Potential

Bitcoin’s long-term potential hinges on its ability to solidify its position as both a store of value and a medium of exchange. Its decentralized nature, limited supply, and growing adoption are key factors influencing its future trajectory. However, significant hurdles remain, including regulatory uncertainty and volatility, which will continue to shape its long-term prospects.

Bitcoin’s potential as a store of value stems from its scarcity. With a fixed supply of 21 million coins, Bitcoin’s value could appreciate over time as demand increases, mirroring the behavior of precious metals like gold. Its decentralized nature, independent of government control, further enhances its appeal as a hedge against inflation and geopolitical instability. As a medium of exchange, Bitcoin’s adoption is growing, albeit slowly, with an increasing number of merchants accepting it as payment. However, its volatility remains a significant obstacle to widespread adoption as a daily transactional currency.

Bitcoin’s Value Proposition Compared to Gold and Real Estate

Gold, a traditional store of value, has historically held its worth over long periods, although its value can fluctuate. Real estate, another established asset class, offers tangible ownership and potential rental income but suffers from lower liquidity compared to Bitcoin. Bitcoin offers a unique blend of features: it’s digitally scarce, globally accessible, and potentially more liquid than real estate, although less established as a store of value compared to gold. The relative advantages and disadvantages of each asset class depend heavily on individual investment goals and risk tolerance. For example, an investor seeking a low-risk, long-term store of value might prefer gold, while someone seeking higher potential returns with greater risk might favor Bitcoin. Someone prioritizing tangible assets and steady income might choose real estate.

Bitcoin’s Role in the Future of Finance

Bitcoin’s potential to disrupt traditional financial systems is significant. Its decentralized nature challenges the centralized control of traditional banking and financial institutions. The potential for faster, cheaper, and more transparent cross-border payments is a compelling argument for its adoption. However, widespread adoption requires addressing scalability issues and regulatory uncertainties. The evolution of decentralized finance (DeFi) built upon blockchain technology, of which Bitcoin is a foundational element, further highlights Bitcoin’s potential to reshape the financial landscape. For instance, the ability to lend, borrow, and trade assets without intermediaries opens new possibilities for financial inclusion and efficiency. The success of this disruption, however, depends on overcoming challenges such as security vulnerabilities and regulatory compliance.

Frequently Asked Questions

This section addresses common queries regarding Bitcoin’s price, investment risks, and future potential. Understanding these aspects is crucial for anyone considering involvement in the cryptocurrency market.

Main Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors. Supply and demand dynamics play a significant role; increased demand relative to limited supply tends to drive prices up, while the opposite leads to price decreases. Regulatory actions from governments worldwide can significantly impact investor sentiment and, consequently, the price. News events, both positive and negative, surrounding Bitcoin and the broader cryptocurrency landscape also influence market perception. Technological advancements within the Bitcoin network itself, such as scaling solutions, can also impact price. Finally, macroeconomic factors like inflation and the performance of traditional financial markets can indirectly affect Bitcoin’s price, as investors may shift assets depending on market conditions. For instance, during periods of high inflation, investors may see Bitcoin as a hedge against inflation, leading to increased demand and price appreciation. Conversely, a bearish stock market may lead some investors to sell Bitcoin to cover losses in other investments.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries inherent risks. Volatility is a primary concern; Bitcoin’s price can experience dramatic swings in short periods. This volatility makes it a high-risk investment, potentially leading to significant losses. Security risks are also present; exchanges and personal wallets can be vulnerable to hacking, resulting in the loss of funds. Regulatory uncertainty adds another layer of risk, as government regulations can change rapidly, impacting the legal status and usability of Bitcoin. Furthermore, the relatively nascent nature of the cryptocurrency market means that there’s a higher degree of uncertainty compared to more established markets. For example, the collapse of FTX in 2022 highlighted the risks associated with centralized cryptocurrency exchanges and the importance of due diligence before investing.

Safe Investment Strategies for Bitcoin

Safe Bitcoin investment involves careful planning and risk management. Diversification is key; don’t put all your eggs in one basket. Only invest what you can afford to lose. Thorough research is essential; understand the technology, the risks, and the market dynamics before investing. Secure storage is crucial; use reputable hardware wallets or software wallets with strong security features to protect your Bitcoin. Consider dollar-cost averaging (DCA) to mitigate the impact of volatility by investing smaller amounts regularly over time, rather than a lump sum. Finally, stay informed about market trends and regulatory developments. For instance, instead of investing a large sum immediately, an investor could opt to invest a smaller, fixed amount each month, regardless of the price fluctuations. This strategy reduces the risk of investing a large amount at a market peak.

Potential Future of Bitcoin

Bitcoin’s future is uncertain but holds considerable potential. Widespread adoption could lead to increased value and utility. Technological advancements could improve scalability and efficiency, making Bitcoin more practical for everyday transactions. Increased institutional adoption could also boost Bitcoin’s legitimacy and price. However, challenges remain, including scalability issues, regulatory hurdles, and competition from other cryptocurrencies. The long-term success of Bitcoin will depend on various factors, including its ability to overcome technological limitations, navigate regulatory landscapes, and maintain its position as a leading cryptocurrency. For example, the development of the Lightning Network aims to address Bitcoin’s scalability issues, potentially leading to wider adoption and increased price.

Credible Sources for Bitcoin Price Predictions

It’s crucial to approach Bitcoin price predictions with caution, as no one can predict the future with certainty. However, several sources offer valuable insights. Reputable financial news outlets and cryptocurrency-focused publications often provide market analysis and forecasts based on technical and fundamental factors. Independent analysts and researchers who use rigorous methodologies can offer insightful perspectives. Always critically evaluate information from any source and consider multiple viewpoints before making investment decisions. Remember that past performance is not indicative of future results. For example, while CoinDesk and Bloomberg provide valuable market data and analysis, their predictions should be considered alongside other sources and your own research.

Illustrative Examples

Predicting Bitcoin’s price is inherently speculative, but examining potential scenarios helps illustrate the range of possibilities. These scenarios are not predictions but rather thought experiments based on different macroeconomic conditions and market sentiment. They are simplified representations for illustrative purposes.

Bullish Scenario: Bitcoin Surges to $150,000

In this optimistic scenario, Bitcoin’s price reaches $150,000 by the end of 2025. Several factors contribute to this outcome. Widespread institutional adoption, fueled by increasing regulatory clarity and positive media coverage, drives significant demand. Simultaneously, macroeconomic instability, such as persistent inflation or geopolitical uncertainty, pushes investors towards Bitcoin as a safe haven asset. Technological advancements, such as the Lightning Network’s wider adoption, enhance Bitcoin’s scalability and usability, further boosting its appeal. This scenario resembles the period leading up to Bitcoin’s previous all-time high, but with a more mature and established regulatory landscape. Imagine a world where major financial institutions routinely offer Bitcoin-related products and services, attracting substantial investment.

Bearish Scenario: Bitcoin Falls to $20,000

This scenario paints a less optimistic picture, with Bitcoin’s price plummeting to $20,000 by the end of 2025. A major contributing factor could be a prolonged cryptocurrency bear market, potentially triggered by a significant regulatory crackdown or a series of high-profile security breaches undermining investor confidence. A global recession, reducing risk appetite and diverting capital away from speculative assets like Bitcoin, could also contribute to this downward trend. This scenario would resemble the crypto winter of 2018-2020, but potentially more severe due to unforeseen events or regulatory changes. Picture a market where negative news headlines dominate, leading to widespread sell-offs and a dramatic decrease in trading volume.

Neutral Scenario: Bitcoin Stabilizes Around $50,000

This scenario depicts a more moderate outcome, with Bitcoin’s price stabilizing around $50,000 by the end of 2025. This outcome would likely result from a balance of positive and negative factors. While institutional adoption continues, it proceeds at a slower pace than in the bullish scenario. Macroeconomic conditions remain relatively stable, neither significantly boosting nor hindering Bitcoin’s price. Regulatory uncertainty persists, preventing a major surge in price but also avoiding a drastic collapse. This scenario is analogous to periods of consolidation within the broader cryptocurrency market, where prices fluctuate within a defined range, reflecting a degree of market maturity and investor caution. Imagine a scenario where Bitcoin is treated more like a mature asset class, with gradual price appreciation and relatively low volatility.

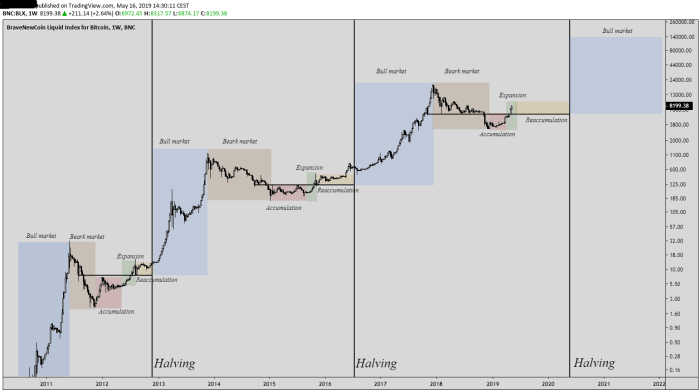

Bitcoin Price Prediction End 2025 – Predicting the Bitcoin price at the end of 2025 is challenging, involving numerous factors. A key element influencing this prediction is the impact of the upcoming Bitcoin Halving, a significant event that reduces the rate of new Bitcoin creation. To better understand this influence, you should check out this informative resource on Bitcoin Halving Cycles 2025. Ultimately, the halving’s effect on scarcity and potential price increases remains a central factor in any 2025 Bitcoin price forecast.

Predicting the Bitcoin price at the end of 2025 involves considering various factors, including regulatory changes and market sentiment. A key aspect to analyze for such a prediction is understanding the trajectory throughout the year, and a good starting point is examining a specific month. For insights into potential price movements, you might find the Bitcoin Price Prediction For February 2025 helpful in building a broader perspective on the year’s end price.

Ultimately, accurate forecasting remains challenging, but such intermediate predictions can offer valuable context for a complete 2025 assessment.

Accurately predicting the Bitcoin price at the end of 2025 is challenging, dependent on numerous factors. A key element influencing this prediction is the impact of the 2025 halving event, which will reduce the rate of new Bitcoin creation. For a detailed analysis of this crucial event’s potential price effects, refer to this insightful resource on Bitcoin 2025 Halving Price Prediction.

Understanding the halving’s implications is vital for forming a comprehensive Bitcoin price prediction for the end of 2025.

Predicting the Bitcoin price at the end of 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the next Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. For a visual representation of how past halvings have correlated with price movements, you can check out this insightful chart: Bitcoin Halving Chart 2025 Price.

Understanding this historical trend is crucial for any serious Bitcoin price prediction for 2025.

Accurately predicting the Bitcoin price at the end of 2025 is challenging, influenced by numerous factors. A key element to consider is the impact of the 2025 halving, which will reduce the rate of new Bitcoin creation. For insightful analysis on this, check out this resource on Bitcoin Prediction After Halving 2025 , which helps contextualize the potential price trajectory.

Ultimately, the Bitcoin price prediction for end of 2025 hinges on the interplay of supply reduction and market demand following the halving event.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the date of the next Bitcoin halving, which significantly affects the supply of new Bitcoins. To understand the timing of this crucial event, you can check the details on the Date Bitcoin Halving 2025 page.

This information is vital when formulating any reasonable Bitcoin price prediction for late 2025.