Neutral Bitcoin Price Predictions for 2025

A neutral Bitcoin price prediction for 2025 anticipates a relatively stable price, oscillating within a defined range, rather than experiencing significant bullish or bearish trends. This scenario considers various factors influencing Bitcoin’s value, including regulatory developments, market adoption, and macroeconomic conditions, resulting in a more balanced outlook compared to extremely optimistic or pessimistic predictions. This balanced perspective acknowledges the inherent volatility of cryptocurrencies while considering potential catalysts for growth and challenges that could lead to price corrections.

Factors Contributing to a Neutral Bitcoin Price Prediction

A neutral prediction for Bitcoin’s price in 2025 stems from a careful consideration of both positive and negative influences on its market value. Several experts believe that while Bitcoin’s long-term potential remains significant, the path to get there will likely involve periods of consolidation and moderate price fluctuations. This contrasts with extremely bullish or bearish predictions that often fail to account for the complexity of the cryptocurrency market.

Expert Opinions Supporting a Neutral Outlook, Bitcoin Price Usd Prediction 2025

Many financial analysts and cryptocurrency experts have voiced opinions supporting a relatively neutral stance on Bitcoin’s price trajectory in 2025. These predictions often cite factors such as increased regulatory scrutiny, macroeconomic uncertainty, and the potential for competing cryptocurrencies to gain traction. For instance, some analysts suggest that Bitcoin’s price might hover around a specific range, perhaps between $50,000 and $100,000, depending on global economic conditions and technological advancements within the cryptocurrency space. This range reflects a degree of uncertainty, acknowledging the possibility of both upside and downside movements. While specific figures vary depending on the analyst, the core concept of moderate price fluctuation remains consistent.

Neutral Prediction Arguments and Supporting Evidence

| Argument | Supporting Evidence |

|---|---|

| Increased Regulatory Scrutiny | Governments worldwide are increasingly implementing regulations for cryptocurrencies, potentially impacting trading volume and investor confidence. This could lead to price stabilization rather than explosive growth. Examples include the evolving regulatory frameworks in the EU and the ongoing discussions surrounding crypto regulation in the United States. |

| Macroeconomic Uncertainty | Global economic conditions, including inflation rates and interest rate policies, significantly influence Bitcoin’s price. Periods of economic instability can lead to investors seeking safer havens, potentially impacting Bitcoin’s value. The ongoing effects of inflation and potential recessions could lead to a more conservative price movement for Bitcoin. |

| Technological Advancements and Competition | The emergence of new cryptocurrencies and blockchain technologies could divert investment away from Bitcoin, leading to price consolidation. The constant innovation within the cryptocurrency space introduces competition and potential alternatives, limiting Bitcoin’s dominance and influencing its price. |

| Increased Institutional Adoption (Counterbalancing Factor) | While regulatory uncertainty exists, the continued adoption of Bitcoin by institutional investors could provide a degree of price support, counteracting the negative pressures. This increased institutional interest could lead to a more stable price, even during periods of macroeconomic uncertainty. However, this is not a guarantee of significant price increases. |

Risks and Uncertainties: Bitcoin Price Usd Prediction 2025

Predicting Bitcoin’s price in 2025, or any future date, is inherently fraught with risk and uncertainty. The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors that are often difficult, if not impossible, to fully anticipate. While various models attempt to forecast price movements, their limitations must be acknowledged.

The inherent volatility of Bitcoin presents a significant challenge to accurate price prediction. Price swings of 10% or more in a single day are not uncommon, making long-term forecasting exceptionally difficult. This volatility stems from various factors, including regulatory changes, market sentiment, technological developments, and macroeconomic conditions. These factors often interact in unpredictable ways, making it challenging to isolate their individual impacts on price.

Limitations of Price Prediction Models

Numerous models exist, ranging from simple technical analysis to sophisticated machine learning algorithms, attempting to predict Bitcoin’s price. However, these models all share fundamental limitations. They rely on historical data, which may not accurately reflect future market behavior. Unforeseen events can drastically alter market dynamics, rendering even the most sophisticated models ineffective. Furthermore, the underlying assumptions of many models, such as the persistence of certain trends or the stability of specific relationships between variables, may prove inaccurate over time. For instance, a model predicting Bitcoin’s price based solely on past price movements might fail to account for a sudden surge in regulatory scrutiny or a major technological breakthrough.

Impact of Unpredictable Events

The Bitcoin market is susceptible to unpredictable events that can significantly impact its price. These events, often referred to as “black swan” events, are characterized by their low probability and high impact. The 2020 COVID-19 pandemic, for example, initially caused a sharp decline in Bitcoin’s price before a subsequent recovery, highlighting the market’s sensitivity to global macroeconomic shocks. Similarly, significant regulatory changes in major economies could dramatically alter the investment landscape, leading to unpredictable price fluctuations. A sudden, widespread adoption of Bitcoin by a large institutional investor could also cause a substantial price surge. Conversely, a major security breach compromising the Bitcoin network could lead to a significant price drop.

Potential Black Swan Events

Several potential black swan events could significantly impact Bitcoin’s price. A major security flaw in the Bitcoin protocol, leading to a significant loss of funds or a network split, could severely undermine confidence in the cryptocurrency. A coordinated attack by a nation-state aiming to destabilize the Bitcoin market could also have devastating consequences. Conversely, the widespread adoption of Bitcoin by a major central bank or government could trigger an unprecedented surge in demand and price appreciation. Finally, the emergence of a superior cryptocurrency with improved technology or a more compelling use case could potentially displace Bitcoin from its dominant position. These events are difficult, if not impossible, to predict with certainty, underscoring the inherent uncertainty in any Bitcoin price forecast.

Investment Strategies and Considerations

Investing in Bitcoin, like any other asset, requires a carefully considered strategy that aligns with your individual risk tolerance and financial goals. A diversified portfolio is key to mitigating potential losses and maximizing long-term returns. It’s crucial to remember that Bitcoin’s volatility necessitates a thorough understanding of the market before committing any capital.

Diversified Investment Strategies Incorporating Bitcoin

The optimal approach involves incorporating Bitcoin into a broader investment strategy, rather than treating it as a standalone investment. This reduces the overall portfolio risk associated with Bitcoin’s price fluctuations. The proportion of Bitcoin within the portfolio should directly reflect an investor’s risk tolerance.

Risk Tolerance and Portfolio Allocation

Investors with a high-risk tolerance might allocate a larger percentage of their portfolio to Bitcoin (e.g., 10-20%), while those with a lower risk tolerance might opt for a smaller allocation (e.g., 1-5%). A balanced approach could involve combining Bitcoin with traditional assets like stocks, bonds, and real estate. For instance, a conservative investor might allocate 5% to Bitcoin, 60% to stocks, and 35% to bonds. A more aggressive investor might allocate 15% to Bitcoin, 40% to growth stocks, and 45% to emerging markets. These are merely examples; individual allocations should be tailored to personal circumstances and financial goals.

Thorough Research and Due Diligence

Before investing in Bitcoin, comprehensive research is paramount. Understanding the underlying technology (blockchain), the market’s dynamics, and the regulatory landscape is crucial. This includes researching the various Bitcoin exchanges, their security measures, and their fee structures. Reading reputable financial news sources, white papers, and industry reports can provide valuable insights into the potential risks and rewards. Consulting with a qualified financial advisor can further aid in making informed decisions. Failing to conduct thorough due diligence could lead to significant financial losses.

Risk Management and Loss Mitigation

Bitcoin’s price volatility necessitates robust risk management strategies. One approach is dollar-cost averaging (DCA), where regular investments are made regardless of price fluctuations, mitigating the risk of investing a lump sum at a market peak. Another strategy is to set stop-loss orders, automatically selling Bitcoin if the price falls below a predetermined level. Diversification, as previously mentioned, also plays a crucial role in mitigating losses. Furthermore, only investing what one can afford to lose is a fundamental principle of responsible investing. Avoid leveraging or borrowing money to invest in Bitcoin, as this significantly amplifies potential losses. Regularly reviewing and adjusting your investment strategy based on market conditions is also essential for long-term success.

Frequently Asked Questions

Predicting Bitcoin’s price is inherently complex, influenced by a multitude of interacting factors. Understanding these factors, as well as the inherent limitations of prediction, is crucial for any investor considering exposure to this volatile asset. The following sections address common questions surrounding Bitcoin’s price and investment prospects.

Significant Factors Determining Bitcoin’s Price in 2025

Several key factors will significantly impact Bitcoin’s price in 2025. These include macroeconomic conditions, regulatory developments, technological advancements within the cryptocurrency space, and overall market sentiment. For example, a global recession could negatively impact investor appetite for risk assets like Bitcoin, potentially depressing its price. Conversely, widespread adoption by institutional investors or the development of significant new use cases could drive substantial price increases. Government regulations, particularly those concerning taxation and trading, will also play a crucial role in shaping market dynamics and investor confidence. Finally, technological advancements such as the scaling of the Bitcoin network or the emergence of competing cryptocurrencies could influence Bitcoin’s dominance and, consequently, its price.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is exceptionally volatile and susceptible to unpredictable events. While analysts may offer projections based on various models and indicators, these should be viewed with considerable skepticism. Past performance is not indicative of future results, and unforeseen circumstances can dramatically alter market trends. For instance, the sudden collapse of a major cryptocurrency exchange or a significant regulatory crackdown could trigger substantial price swings. Therefore, it is essential to approach any price prediction with caution and understand that the actual price in 2025 could differ significantly from any forecast.

Potential Risks of Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its price is highly volatile, subject to large and sudden fluctuations. This volatility can lead to substantial losses for investors, particularly those with a short-term investment horizon. Furthermore, the cryptocurrency market is relatively unregulated in many jurisdictions, making it vulnerable to fraud and scams. Security risks, such as hacking and theft from exchanges or personal wallets, are also a concern. Finally, the long-term viability of Bitcoin itself is uncertain, and its value could potentially decline to zero. Investors should carefully assess their risk tolerance and only invest what they can afford to lose.

Alternative Investment Options to Bitcoin

Several alternative investment options exist for those seeking exposure to the digital asset space or diversification beyond Bitcoin. These include other cryptocurrencies such as Ethereum, which offers smart contract functionality, or stablecoins pegged to fiat currencies, offering price stability. Traditional asset classes such as stocks, bonds, and real estate also provide diversification benefits. Gold, a traditional safe-haven asset, could also be considered. The choice of alternative investments will depend on individual risk tolerance, investment goals, and financial circumstances. Thorough research and professional financial advice are recommended.

Potential Benefits of Investing in Bitcoin

Despite the risks, investing in Bitcoin offers several potential benefits. It has the potential for significant returns, as demonstrated by its historical price appreciation. Its decentralized nature offers a degree of protection against government intervention and censorship. Furthermore, Bitcoin can serve as a hedge against inflation, particularly in times of economic uncertainty, due to its fixed supply. However, it’s crucial to remember that these potential benefits are not guaranteed and come with significant risk. The potential for high returns is balanced by the possibility of substantial losses.

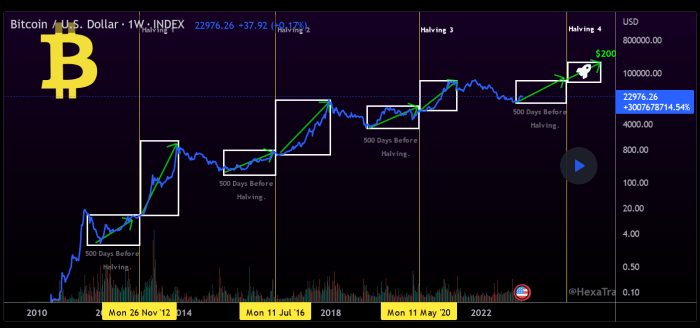

Bitcoin Price Usd Prediction 2025 – Predicting the Bitcoin price in USD for 2025 is a complex endeavor, influenced by numerous factors. A key event to consider is the Bitcoin halving, significantly impacting the rate of new Bitcoin entering circulation. To understand the potential post-halving effects, it’s helpful to examine analyses like this one on 500 Days After Bitcoin Halving 2025 , which can shed light on potential price trajectories following the reduced supply.

Ultimately, the Bitcoin price prediction for 2025 remains speculative, yet understanding the halving’s impact is crucial for informed speculation.

Predicting the Bitcoin price in USD for 2025 is challenging, involving numerous factors like adoption rates and regulatory changes. A key element to consider is the impact of the upcoming halving, as discussed in this insightful analysis of the Bitcoin 2025 Halving Prediction. Understanding the halving’s potential effect on scarcity and subsequent price fluctuations is crucial for any accurate 2025 Bitcoin price prediction.

Predicting the Bitcoin price in USD for 2025 is a complex task, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on Halving Bitcoin 2025 Time which will help contextualize future price estimations.

Ultimately, the halving’s impact on scarcity and therefore the Bitcoin price in 2025 remains a subject of ongoing debate and analysis.

Predicting the Bitcoin price in USD for 2025 is a complex task, influenced by numerous factors. A key event impacting these predictions is the upcoming Bitcoin halving, and you can track its progress using this helpful resource: Bitcoin Halving 2025 Countdown Clock. The halving’s effect on scarcity and miner profitability will undoubtedly play a significant role in shaping the Bitcoin price in 2025.

Predicting the Bitcoin price in USD for 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting these predictions is the Bitcoin Halving, scheduled for 2024; for specific details on the halving date, check out this resource: Bitcoin Halving 2025 Datum. This event significantly alters Bitcoin’s inflation rate, often leading to subsequent price increases.

Therefore, understanding the halving’s timing is crucial for any accurate Bitcoin price prediction in 2025.

Predicting the Bitcoin price in USD for 2025 is a complex task, influenced by numerous factors. A key element to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For insightful analysis on this event, check out this comprehensive report on the Bitcoin Halving 2025 Prognose. Understanding the halving’s potential effects is crucial for any accurate Bitcoin Price Usd Prediction 2025.

Predicting the Bitcoin price in USD for 2025 is a complex task, influenced by various factors. Successfully navigating this volatile market often requires targeted advertising campaigns, which is why setting up a robust Google Ads Account can be beneficial for businesses involved in cryptocurrency trading or analysis. This allows for reaching potential investors interested in Bitcoin Price Usd Prediction 2025 and related market insights.