Bitcoin Halving 2025

The Bitcoin halving, a programmed event occurring approximately every four years, significantly reduces the rate at which new Bitcoins are mined. This event has historically been associated with notable shifts in Bitcoin’s price and market sentiment, making the 2025 halving a key focus for investors and analysts alike. Understanding the historical impact, projected supply changes, and current market conditions is crucial for navigating this potentially volatile period.

Historical Impact of Previous Halvings

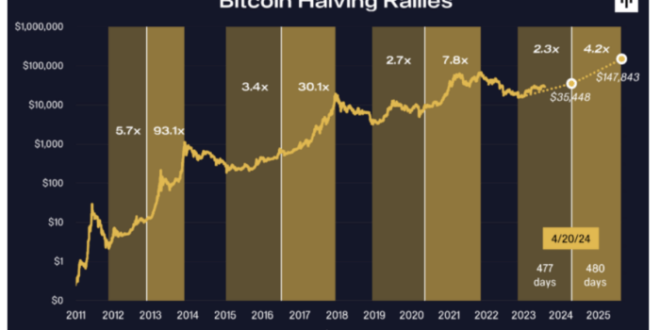

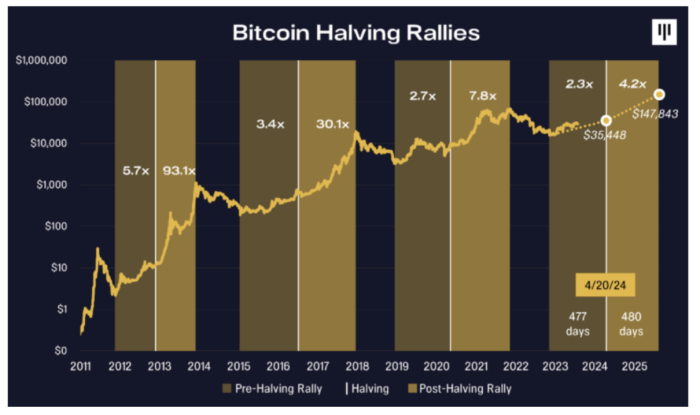

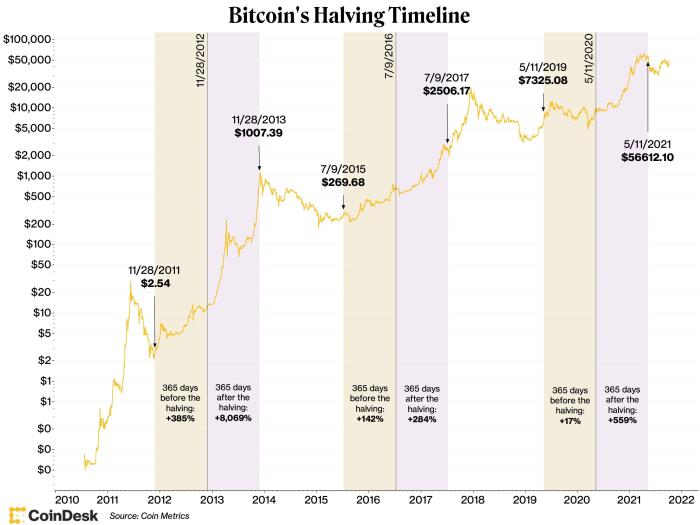

The previous Bitcoin halvings, in 2012, 2016, and 2020, each resulted in a period of increased price volatility followed by significant price appreciation, although the timeframe and magnitude varied. The 2012 halving saw a gradual price increase in the following months. The 2016 halving led to a more pronounced price surge, starting several months after the event and continuing into the following year. The 2020 halving also saw a price increase, although the market experienced considerable volatility throughout the period. While correlation doesn’t equal causation, the historical data suggests a strong relationship between halvings and subsequent price appreciation. This is often attributed to the reduced supply of newly mined Bitcoin, creating a potential scenario of increased scarcity and higher demand.

Projected Supply Reduction and Potential Consequences

The 2025 halving will reduce the Bitcoin block reward from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the rate of new Bitcoin entering circulation. This reduced supply, combined with potentially sustained or increased demand, is expected to exert upward pressure on the price. The magnitude of this price increase will, however, depend on various factors including overall market sentiment, macroeconomic conditions, regulatory developments, and the adoption rate of Bitcoin. A reduced supply in the face of high demand has historically driven asset price appreciation in other markets as well, for example, rare collectibles or precious metals.

Comparison of Market Conditions Leading Up to Previous Halvings

The market conditions leading up to the 2025 halving differ significantly from previous events. While the previous halvings occurred during periods of relative market maturity (though still early in Bitcoin’s lifecycle), the current market is characterized by increased regulatory scrutiny, macroeconomic uncertainty, and a more mature, albeit still volatile, cryptocurrency ecosystem. The previous halvings were also preceded by periods of significantly lower Bitcoin prices compared to today’s values. This difference in starting point could affect the trajectory and magnitude of any post-halving price movement. The existence of competing cryptocurrencies and decentralized finance (DeFi) protocols also presents a different landscape than in prior cycles.

Potential for Increased Price Volatility

The period surrounding the 2025 halving is likely to be characterized by heightened price volatility. This is due to the anticipation of the event itself, coupled with the inherent volatility of the cryptocurrency market. Investors may engage in speculative trading, leading to price swings in either direction. External factors such as regulatory changes or macroeconomic events could also amplify this volatility. The uncertainty surrounding the future regulatory landscape and the overall economic outlook will influence investor sentiment and potentially drive significant price fluctuations. This volatility is a characteristic feature of the crypto market and has been observed consistently around past halving events.

Hypothetical Price Scenario Following the Halving

Considering the historical impact of previous halvings, the projected supply reduction, and the current market conditions, a plausible, yet speculative, scenario could unfold as follows: A period of increased volatility leading up to the halving, followed by a short-term price dip immediately after the event (a common “buy the rumor, sell the news” phenomenon). Subsequently, a gradual price increase could occur over the next 12-18 months, potentially reaching a range between $100,000 and $200,000, depending on various market forces. This range represents a significant increase from current levels, but it’s crucial to remember that this is a hypothetical scenario and the actual price movement could differ substantially. Similar price predictions have been made in the past, with varying degrees of accuracy, emphasizing the inherent unpredictability of the cryptocurrency market.

Market Predictions and Analyst Opinions

Predicting Bitcoin’s price after the 2025 halving is a complex endeavor, with analysts employing diverse methodologies and arriving at widely varying conclusions. These predictions are inherently uncertain, influenced by a multitude of interconnected factors that are difficult to accurately model.

The range of predictions for Bitcoin’s price post-halving is substantial, spanning from relatively conservative estimates to significantly bullish forecasts. This divergence stems from the different analytical approaches employed and the varying weight assigned to specific influencing factors.

Analyst Prediction Methodologies

Analysts utilize a variety of methods to forecast Bitcoin’s price. Some rely on quantitative models, incorporating historical price data, on-chain metrics (such as transaction volume and network activity), and macroeconomic indicators. Others incorporate qualitative factors, such as regulatory developments, adoption rates, and overall market sentiment. Stock-to-flow models, for example, are a popular, albeit controversial, quantitative approach that attempts to predict price based on the scarcity of Bitcoin. These models often focus on the reduction in Bitcoin’s inflation rate following the halving. Conversely, some analysts focus heavily on qualitative factors, analyzing news cycles, technological advancements, and regulatory actions. The lack of a universally accepted methodology contributes to the wide range of predictions.

Factors Influencing Prediction Accuracy

Several factors significantly impact the accuracy of price predictions. Unforeseen regulatory changes, for instance, can drastically alter market sentiment and price trajectory. Major technological breakthroughs or security vulnerabilities could similarly have profound effects. Moreover, the unpredictable nature of human behavior and market psychology plays a crucial role. External macroeconomic events, such as global recessions or geopolitical instability, can also significantly influence Bitcoin’s price. The complexity of the interplay between these factors makes precise predictions extremely challenging.

Dissenting Opinions and Alternative Perspectives

Not all analysts believe the halving will lead to a substantial price increase. Some argue that the market has already priced in the expected scarcity, rendering the halving’s impact less significant than previously believed. Others point to potential negative factors, such as increased regulatory scrutiny or a broader cryptocurrency market downturn, that could offset any positive price pressure from the halving. These dissenting voices emphasize the importance of considering a wider range of potential outcomes beyond simply extrapolating from historical halving cycles.

Comparison of Analyst Predictions

| Analyst | Predicted Price (USD) | Methodology | Reasoning |

|---|---|---|---|

| PlanB (Stock-to-Flow Model) | (Historical Prediction – no longer actively updating) | Stock-to-Flow Model | Based on Bitcoin’s scarcity and historical price behavior. Note: This model has faced significant criticism and its accuracy has been debated extensively. |

| (Analyst Name 2) | (Insert Prediction) | (Insert Methodology, e.g., On-chain analysis, Macroeconomic factors) | (Insert Reasoning) |

| (Analyst Name 3) | (Insert Prediction) | (Insert Methodology, e.g., Sentiment analysis, Market psychology) | (Insert Reasoning) |

| (Analyst Name 4) | (Insert Prediction) | (Insert Methodology, e.g., Combination of quantitative and qualitative factors) | (Insert Reasoning) |

The Role of Mining and Hashrate: Halving Bitcoin 2025 Quando

The Bitcoin halving, a programmed event reducing the block reward for miners by half, significantly impacts the profitability of mining operations and, consequently, the network’s hashrate and security. Understanding this interplay is crucial for comprehending the potential consequences of the 2025 halving.

The halving directly affects miners’ revenue. With fewer newly minted Bitcoins awarded for each block successfully mined, miners must rely more heavily on transaction fees to maintain profitability. This can lead to several responses from miners, including increased efficiency through technological upgrades, consolidation within the mining industry, or, in extreme cases, some miners shutting down their operations if the cost of electricity and equipment exceeds the revenue generated. The overall impact on the mining landscape will depend on the interplay of Bitcoin’s price, energy costs, and technological advancements in mining hardware.

Miner Profitability and Responses to the Halving

The profitability of Bitcoin mining is a complex equation involving the Bitcoin price, mining difficulty, energy costs, and the block reward. The halving directly impacts the block reward, reducing the income stream for miners. Historically, we’ve seen periods of consolidation in the mining industry following halvings, with less efficient or higher-cost operations being forced to exit the market. This can lead to a more centralized mining landscape in the short term, though it’s often followed by periods of innovation and expansion as technology improves. For example, after the 2020 halving, we saw a significant increase in mining difficulty as new, more efficient miners entered the market, demonstrating the industry’s resilience and adaptability. This dynamic interplay between profitability, technological advancement, and market forces shapes the post-halving landscape.

Hashrate and its Relationship to the Halving

The hashrate, representing the total computational power dedicated to securing the Bitcoin network, is directly influenced by miner profitability. A decrease in profitability often leads to a temporary decline in hashrate as less profitable miners cease operations. However, the network typically recovers and even surpasses previous hashrate levels due to several factors, including technological advancements in mining hardware, the entry of new miners attracted by potentially higher future Bitcoin prices, and the natural market adjustment. Examining previous halvings reveals this pattern. The 2012, 2016, and 2020 halvings all initially saw a temporary dip in hashrate, followed by substantial growth. The speed and magnitude of this recovery vary based on several economic and technological factors.

Hashrate Changes After Previous Halvings

Comparing hashrate changes following past halvings provides valuable insights. While a temporary drop in hashrate is typical immediately following a halving, the subsequent recovery has consistently been robust. The 2012 halving saw a relatively small initial dip followed by substantial growth. Similarly, the 2016 and 2020 halvings followed a similar pattern, albeit with varying degrees of initial decline and subsequent recovery speed. Analyzing these past events helps to create a reasonable expectation of the potential hashrate fluctuations following the 2025 halving, although it’s important to note that market conditions and technological advancements are constantly evolving.

Impact of the Halving on Bitcoin’s Security and Decentralization

The halving’s impact on Bitcoin’s security and decentralization is a crucial aspect to consider. A reduced block reward directly impacts miner profitability, potentially leading to a more centralized mining landscape in the short term if less efficient miners exit. However, the long-term impact is more nuanced. Technological advancements often lead to increased efficiency, offsetting the reduced block reward and maintaining a robust hashrate. Furthermore, a higher Bitcoin price can compensate for the reduced block reward, incentivizing miners to remain active. The net effect is a complex interplay of economic and technological forces. While a temporary decrease in decentralization might occur, the network’s overall security, measured by its hashrate, typically recovers and often strengthens over time.

Visual Representation of Hashrate and Price

Imagine a graph with two lines: one representing the Bitcoin price and the other the Bitcoin network hashrate. Initially, both lines might show a correlation, with a rising Bitcoin price leading to increased miner profitability and thus a higher hashrate. After a halving, the price line might experience a period of uncertainty, possibly dipping slightly before recovering. The hashrate line, however, often exhibits a temporary decline immediately after the halving, reflecting reduced miner profitability. Over time, though, the hashrate line usually recovers and often surpasses its previous peak, driven by technological improvements and the potential for price appreciation. The graph would visually demonstrate a complex relationship where the initial impact of a halving on hashrate is often temporary, and long-term growth depends on the price and technological advancements in the mining industry. The correlation between the two lines isn’t always perfectly linear, but a general trend of eventual convergence is often observed.

Long-Term Implications for Bitcoin

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially profound long-term implications for Bitcoin’s adoption, market position, and the broader cryptocurrency landscape. Understanding these potential effects is crucial for investors and stakeholders alike. The reduced supply, coupled with potentially sustained or increased demand, is expected to influence Bitcoin’s price and overall market dominance.

Bitcoin’s Adoption and Market Position After the Halving

The halving mechanism, inherent to Bitcoin’s design, is intended to control inflation and maintain scarcity. Historically, halvings have been followed by periods of increased price appreciation, though the timing and magnitude vary. This suggests a potential increase in Bitcoin’s adoption, driven by both speculative investment and a growing recognition of its value as a store of value and a decentralized digital asset. Increased price appreciation could also lead to greater institutional acceptance and wider integration into traditional financial systems. Conversely, a failure to see significant price increases post-halving could potentially slow adoption and dampen investor enthusiasm. The success of the halving in driving further adoption will depend on several factors, including macroeconomic conditions, regulatory clarity, and the overall state of the global financial markets.

Impact on the Broader Cryptocurrency Market

The halving’s impact extends beyond Bitcoin. Increased Bitcoin price appreciation could trigger a “flight to safety” effect, potentially drawing investment away from altcoins (alternative cryptocurrencies) and into Bitcoin. This could lead to a period of consolidation in the cryptocurrency market, with Bitcoin solidifying its dominance. However, a significant price decline following the halving could negatively impact the entire market, causing a widespread sell-off across various cryptocurrencies. The interconnectedness of the crypto market means that Bitcoin’s performance significantly influences the fortunes of other digital assets. For example, the 2021 bull market, partly fueled by Bitcoin’s price surge, saw many altcoins experience significant gains. Conversely, the 2022 bear market saw a significant decline across the board.

Bitcoin’s Value Proposition Compared to Other Cryptocurrencies

Post-halving, Bitcoin’s value proposition will likely be further strengthened by its established network effect, first-mover advantage, and scarcity. Its position as the most recognizable and widely accepted cryptocurrency remains a significant advantage. However, altcoins offering unique functionalities, such as enhanced scalability or smart contract capabilities, will continue to compete for market share. The competition will likely center on the utility and specific features offered by each cryptocurrency, alongside the perceived risk and return profile. For example, Ethereum, with its smart contract functionality, will continue to be a major competitor, while other projects focusing on specific niches, such as decentralized finance (DeFi) or non-fungible tokens (NFTs), might also attract investors.

Potential for Institutional Investment

The halving could catalyze increased institutional investment in Bitcoin. The reduced supply and potential for price appreciation make Bitcoin an attractive asset for institutional investors seeking diversification and inflation hedging. However, regulatory uncertainty and concerns about volatility remain significant barriers to entry for many institutional players. Successful navigation of regulatory hurdles and a demonstration of sustained price stability post-halving would be crucial in encouraging greater institutional participation. We’ve already seen some large companies, like MicroStrategy, making significant Bitcoin investments. The success of such strategies will influence the behavior of other institutional investors.

Long-Term Price and Adoption Scenarios

Predicting Bitcoin’s future price and adoption is inherently challenging. However, we can Artikel several potential scenarios based on various factors.

Scenario 1: Sustained Growth. A successful halving, coupled with positive macroeconomic conditions and increased regulatory clarity, could lead to sustained price appreciation and wider adoption, potentially pushing Bitcoin’s price to significantly higher levels within the next decade. This scenario would likely see Bitcoin firmly establish itself as a mainstream asset.

Scenario 2: Consolidation and Gradual Growth. A more moderate scenario involves a period of price consolidation following the halving, with gradual growth over the long term. This could be driven by increased adoption in emerging markets and further institutional investment.

Scenario 3: Volatility and Uncertainty. Negative macroeconomic conditions, regulatory setbacks, or a lack of significant price appreciation post-halving could lead to increased market volatility and slower adoption. This scenario might see Bitcoin’s price fluctuate significantly, with periods of both growth and decline.

The actual trajectory will depend on a complex interplay of factors, making precise predictions impossible. However, understanding these potential scenarios is vital for navigating the long-term implications of the 2025 halving.

Frequently Asked Questions

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding the mechanics and implications of this event is crucial for anyone interested in Bitcoin. This section addresses common questions surrounding the halving, offering clarity on its impact and associated risks and rewards.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is embedded within Bitcoin’s code, ensuring a predictable and controlled inflation rate. Essentially, the reward miners receive for successfully adding a block to the blockchain is cut in half. This controlled deflationary aspect is a core feature of Bitcoin’s design.

Date of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in April 2024. The precise date depends on the time it takes to mine 210,000 blocks, but it’s anticipated to fall within that month. While the exact date can fluctuate slightly, the approximate timeframe remains consistent due to the predictable nature of Bitcoin’s block generation.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is often attributed to the reduced supply of new Bitcoins entering the market, creating potential scarcity and increasing demand. For example, the halvings in 2012 and 2016 were followed by significant price rallies, although the timeframes and magnitude of these increases varied. It’s important to note, however, that correlation does not equal causation; other market factors also significantly influence Bitcoin’s price. The 2020 halving, while not immediately followed by a dramatic price surge, saw a substantial increase in price later that year. Therefore, predicting future price movements solely based on past halving events is unreliable.

Risks Associated with Investing Around the Halving

Investing in Bitcoin around a halving carries inherent risks. The price is volatile, and while historical trends suggest potential upward movement, there’s no guarantee. The market could react negatively to unforeseen events, such as regulatory changes, technological disruptions, or broader economic downturns, potentially leading to price drops regardless of the halving. Furthermore, the hype surrounding the halving can lead to speculative bubbles, which are prone to bursting, resulting in significant losses for investors. Over-leveraged positions are particularly vulnerable during periods of price volatility.

Potential Benefits of Investing Around the Halving, Halving Bitcoin 2025 Quando

The potential benefits stem from the decreased supply of newly mined Bitcoin. This reduced supply, combined with sustained or increased demand, could theoretically lead to price appreciation. Investors who correctly anticipate the halving’s impact and manage their risk effectively might see significant returns. Long-term investors who believe in Bitcoin’s underlying technology and its potential as a store of value might find the halving a compelling entry point or an opportunity to accumulate more Bitcoin at potentially lower prices before a potential price increase. However, this is speculative, and the market’s reaction is not guaranteed.

Determining the precise date for the Bitcoin halving in 2025 requires understanding the underlying mechanism. To clarify this process, it’s helpful to consult a resource explaining the halving itself, such as this informative article: Que Es Halving Bitcoin 2025. With a clearer understanding of the halving’s mechanics, predicting the exact “Halving Bitcoin 2025 Quando” becomes more straightforward.

Understanding the “Halving Bitcoin 2025 Quando” requires a close look at the reward reduction schedule. To track the precise date and time of this significant event, you can utilize a dedicated countdown resource like the Bitcoin Halving 2025 Countdown website. This tool provides a convenient way to monitor the approaching halving and its potential impact on the Bitcoin price and network dynamics, helping you better understand the “Halving Bitcoin 2025 Quando” timeframe.

Determining the precise timing of the Bitcoin 2025 halving is straightforward; however, predicting its market impact is far more complex. Understanding the potential price movements requires considering various factors, and a helpful resource for exploring this is available at Bitcoin Price After 2025 Halving. Ultimately, the Bitcoin 2025 halving’s influence on the price remains a subject of ongoing discussion and analysis within the cryptocurrency community.

Understanding the “Halving Bitcoin 2025 Quando” requires knowing the precise date of the next halving event. To clarify this, you should check out this helpful resource: When Is 2025 Bitcoin Halving. This resource provides the specific date, allowing for accurate predictions and analyses related to “Halving Bitcoin 2025 Quando” and its potential market impact. Therefore, consulting this link is crucial for informed discussions on the topic.

Determining the precise timing of the Bitcoin Halving in 2025 requires careful consideration of the blockchain’s block generation times. To stay informed and track the exact date, a useful resource is the Bitcoin Halving 2025 Countdown Clock , which provides a constantly updating countdown. Understanding this countdown is key to accurately predicting when the Halving Bitcoin 2025 Quando event will occur.

Understanding the “Halving Bitcoin 2025 Quando” requires knowing the precise timing of the event. For a definitive answer on the exact date, you should consult a reliable resource that tracks this information, such as this helpful page detailing the Bitcoin Halving 2025 Time. This precise timing is crucial for anyone trying to predict the market impact of the Halving Bitcoin 2025 Quando.