Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event occurring approximately every four years, is a significant event in the cryptocurrency’s lifecycle. It reduces the rate at which new Bitcoins are created, impacting the supply and potentially influencing its price. Understanding the historical impact and potential scenarios surrounding the 2025 halving is crucial for navigating the evolving cryptocurrency market.

Historical Impact of Previous Halvings

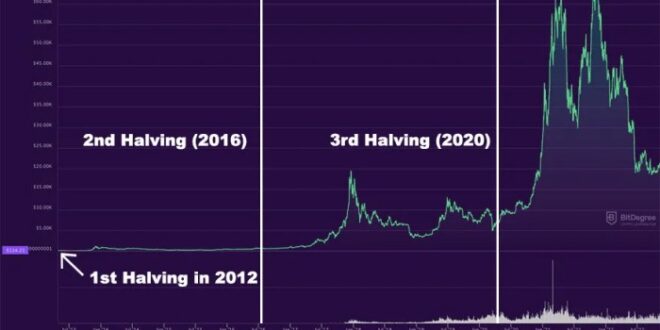

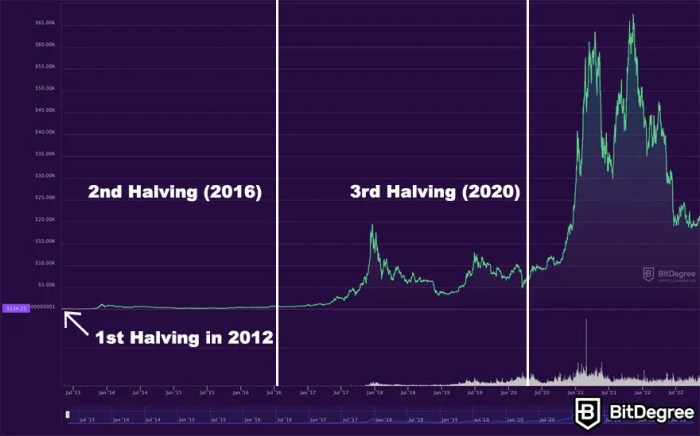

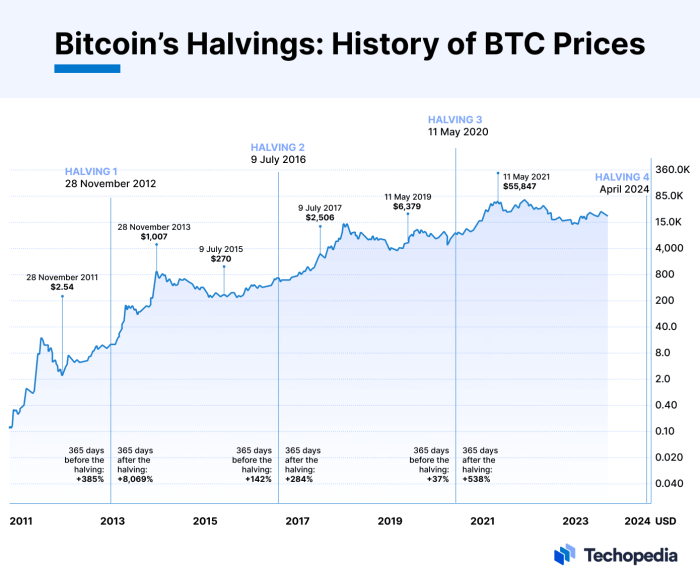

Previous Bitcoin halvings have demonstrated a notable correlation with subsequent price increases, although the timing and magnitude of these increases have varied. The 2012 halving was followed by a gradual price appreciation, while the 2016 halving preceded a significant bull run. The 2020 halving also led to a substantial price surge, albeit followed by a period of consolidation and correction. These historical trends suggest a potential positive impact on price, but it’s crucial to remember that other market forces also play a significant role.

Potential Price Scenarios for 2025

Predicting Bitcoin’s price with certainty is impossible, but several scenarios are plausible leading up to and following the 2025 halving. A bullish scenario might involve sustained price appreciation in anticipation of the halving, followed by a further surge after the event, mirroring the patterns observed in previous cycles. A more conservative scenario could see a gradual price increase leading up to the halving, followed by a period of consolidation or even a temporary price dip before resuming an upward trend. A bearish scenario, while less likely given historical precedent, could involve a prolonged period of low prices due to macroeconomic factors or other market influences. The actual outcome will depend on a complex interplay of factors. For example, the 2020 halving coincided with the global pandemic, impacting the price trajectory.

Reduction in Mining Rewards and its Effect on Miners

The 2025 halving will reduce the block reward for Bitcoin miners from 6.25 BTC to 3.125 BTC. This reduction in revenue will likely put pressure on less efficient miners, potentially leading to some exiting the market. This could lead to a higher degree of network centralization as larger, more efficient mining operations consolidate their market share. The effect on overall network security is a subject of ongoing debate, with some arguing that a more centralized network might be less resilient to attacks. Conversely, others argue that the more efficient miners remaining will strengthen the network.

Comparison of Market Conditions Leading Up to the 2025 Halving

The market conditions leading up to the 2025 halving are different from previous halvings. The 2012 and 2016 halvings occurred during periods of relatively low regulatory scrutiny and less mainstream adoption. The 2020 halving took place amidst increased institutional investment and regulatory uncertainty. The 2025 halving is expected to occur in a market that is more mature, with increased institutional involvement and regulatory oversight, making accurate prediction more challenging.

Influence of Macroeconomic Factors

Macroeconomic factors, such as inflation, interest rates, and global economic growth, are expected to significantly influence Bitcoin’s price after the 2025 halving. Periods of high inflation often lead investors to seek alternative assets like Bitcoin as a hedge against inflation. Conversely, rising interest rates can reduce the attractiveness of Bitcoin compared to other, higher-yielding investments. Global economic uncertainty can also impact Bitcoin’s price, potentially increasing demand during times of instability. The interplay between these macroeconomic forces and the halving’s impact on supply will determine the overall price trajectory. For example, the 2022 bear market, triggered by macroeconomic factors such as rising interest rates and inflation, highlights the significant influence of these external forces.

The Impact on Bitcoin Mining

The Bitcoin halving in 2025 will significantly impact the Bitcoin mining landscape, primarily through a reduction in block rewards. This reduction will necessitate adaptations across the mining ecosystem, affecting profitability, energy consumption, and technological innovation. The subsequent sections will delve into the specific challenges and potential responses to this pivotal event.

Reduced Mining Rewards and Profitability Challenges

The halving cuts the Bitcoin reward miners receive for successfully validating blocks in half. This directly impacts profitability, as operating costs—including electricity, hardware maintenance, and cooling—remain largely constant. Miners operating at the margin, those whose revenue barely covers their expenses, will likely face the greatest challenges. Some miners might become unprofitable and be forced to shut down operations, leading to a consolidation of the mining industry. This could potentially increase the concentration of mining power in the hands of larger, more efficient operations.

Energy Consumption Implications Post-Halving

Bitcoin mining is an energy-intensive process. The halving, while not directly reducing the energy used per transaction, will likely impact the overall energy consumption of the network. With reduced profitability, less efficient mining operations will likely cease operations, leading to a reduction in the total hashrate. This decrease in hashrate could, in turn, reduce overall energy consumption. However, the remaining miners may invest in more energy-efficient hardware or optimize their operations to compensate for the reduced rewards, potentially offsetting some of this reduction. The net effect on overall energy consumption is complex and dependent on several factors including the adoption of new technologies and the price of Bitcoin.

Mining Difficulty Adjustments and Profitability

Bitcoin’s mining difficulty adjusts automatically to maintain a consistent block time of approximately 10 minutes. Following a halving, the network’s hashrate will likely decrease initially as some less profitable miners exit. The difficulty adjustment mechanism will respond to this decrease, making it easier for the remaining miners to find and solve blocks. This adjustment, while maintaining the block time, can still impact profitability. If the hashrate reduction is substantial, the difficulty adjustment might not fully compensate for the reduced block reward, potentially squeezing profit margins further. Conversely, a smaller decrease in hashrate could lead to a less significant difficulty adjustment, leaving some miners still struggling with profitability.

Technological Advancements in Mining Hardware

The ongoing development of more energy-efficient and powerful ASICs (Application-Specific Integrated Circuits) plays a crucial role in the post-halving landscape. Companies are constantly striving to improve the efficiency and hash rate of their mining hardware. Advancements in chip design, cooling technologies, and power management systems can significantly impact the profitability of mining operations. For instance, a 10% increase in hash rate with a 5% reduction in energy consumption could dramatically alter the economic viability of mining after the halving, allowing miners to stay profitable despite the reduced rewards. The adoption rate of such advancements will be a key determinant of the industry’s overall resilience.

Hypothetical Miner Adaptation Scenario

Let’s imagine a scenario where a significant portion of smaller miners shut down after the halving due to unprofitability. Larger, well-capitalized mining operations, however, might leverage their economies of scale and invest in the latest, most efficient mining hardware. They might also explore strategies like diversifying their revenue streams, perhaps through providing hosting services to other miners or engaging in other blockchain-related activities. Simultaneously, some smaller miners might consolidate, forming pools to share resources and reduce individual operating costs. This scenario illustrates a likely outcome: a more centralized and technologically advanced mining ecosystem following the 2025 halving. The price of Bitcoin will also play a significant role in this adaptation, with a higher price offsetting the reduced rewards and potentially attracting new miners.

Investor Sentiment and Market Predictions: Halving Day Bitcoin 2025

The Bitcoin halving, a predictable event reducing the rate of new Bitcoin creation, has historically been associated with significant shifts in investor sentiment and subsequent price movements. Understanding past trends and potential market indicators is crucial for navigating the 2025 halving. While past performance is not indicative of future results, analyzing previous cycles offers valuable insights into potential market behavior.

Investor behavior surrounding previous Bitcoin halvings has been characterized by a mixture of anticipation, speculation, and volatility. Leading up to the halving, we often see a period of price appreciation driven by the expectation of scarcity and increased demand. Following the halving, the market typically experiences a period of consolidation, before potentially resuming an upward trend. However, this pattern isn’t guaranteed and the extent of price movements varies significantly.

Historical Investor Behavior

The 2012, 2016, and 2020 halvings all exhibited different price trajectories post-event. The 2012 halving saw a gradual price increase following the event, while the 2016 halving led to a more pronounced bull market. The 2020 halving, occurring amidst a global pandemic and increased institutional interest, saw a substantial price surge. These differing outcomes highlight the complexity of predicting market reactions and the influence of external factors. Analyzing on-chain metrics like transaction volume and miner behavior alongside macroeconomic conditions provides a more nuanced perspective.

Hypothetical Investment Strategy

A cautious approach to investing around the 2025 halving is recommended. A hypothetical strategy could involve dollar-cost averaging (DCA) in the months leading up to the event, gradually accumulating Bitcoin at different price points to mitigate risk. This strategy aims to avoid investing a lump sum at potentially inflated prices just before the halving. Post-halving, continued DCA or a more strategic approach based on market conditions could be employed. Diversification across different asset classes is also advisable to manage overall portfolio risk. For example, one might allocate a portion of their investment portfolio to established assets such as gold or government bonds, mitigating potential Bitcoin price drops.

Potential Risks and Opportunities

The primary risk is the potential for a significant price correction after the initial post-halving price surge. The market could experience a period of consolidation or even a downturn, as seen in previous cycles. Opportunities exist for those who can accurately predict the market’s reaction. Timing the market perfectly is notoriously difficult, however, and attempting to do so often leads to losses. The opportunity lies in a long-term perspective, recognizing that the halving fundamentally reduces Bitcoin’s inflation rate, theoretically increasing its scarcity and long-term value.

Influence of Social Media and News Coverage, Halving Day Bitcoin 2025

Social media and news coverage significantly influence investor sentiment. Positive news and hype surrounding the halving can lead to increased demand and price appreciation, while negative news or FUD (fear, uncertainty, and doubt) can trigger sell-offs. It is crucial to critically evaluate information from various sources and avoid emotional decision-making driven by social media trends. Maintaining a balanced perspective and relying on fundamental analysis is vital for informed investment choices.

Key Market Indicators

Several key market indicators can influence price movements around the halving. These include:

- Hash Rate: A measure of the computing power securing the Bitcoin network. A higher hash rate generally indicates greater network security and potentially higher prices.

- Miner Capitulation: When miners sell their Bitcoin holdings due to low profitability. This can be a bearish signal, indicating potential price weakness.

- On-Chain Metrics: Data points such as transaction volume, active addresses, and the number of unspent transaction outputs (UTXOs) can provide insights into network activity and investor behavior.

- Macroeconomic Factors: Global economic conditions, inflation rates, and regulatory changes can significantly impact the price of Bitcoin and other cryptocurrencies.

Analyzing these indicators in conjunction with historical data and investor sentiment can provide a more comprehensive view of the market and inform investment decisions.

Long-Term Implications for Bitcoin

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, presents a pivotal moment with potentially profound long-term consequences for the cryptocurrency’s trajectory. Understanding these implications requires analyzing its effect on adoption, market position, price stability, regulatory landscape, and comparative performance against other cryptocurrencies.

The halving’s impact on Bitcoin’s long-term prospects is multifaceted and depends on several interacting factors. While scarcity is a key driver of value, other factors like technological advancements, regulatory clarity, and overall market sentiment play significant roles.

Bitcoin Adoption and the Halving

The reduced supply of newly mined Bitcoin, resulting from the halving, could theoretically increase its scarcity and perceived value, thereby potentially boosting adoption. Increased scarcity could attract institutional investors seeking inflation hedges, while the decreased supply could drive up demand among individual investors. However, mass adoption also depends on factors such as user-friendliness, transaction speed, and the overall economic climate. For instance, if global economic instability increases, the demand for Bitcoin as a safe haven asset might surge, regardless of the halving. Conversely, a period of economic prosperity might dampen interest, even with the halving’s effect on supply.

Bitcoin’s Position in the Cryptocurrency Market

The halving’s effect on Bitcoin’s dominance within the broader cryptocurrency market is complex. While the halving might increase Bitcoin’s price, potentially attracting investment away from altcoins, it doesn’t guarantee sustained dominance. The rise of competing cryptocurrencies with potentially superior technology or features could challenge Bitcoin’s leading position. For example, the emergence of layer-2 scaling solutions for other cryptocurrencies could improve their transaction speeds and reduce fees, potentially attracting users away from Bitcoin. Furthermore, regulatory developments favoring specific altcoins could also impact Bitcoin’s market share.

Bitcoin Price Volatility and Stability Post-Halving

The halving’s impact on Bitcoin’s price volatility is a subject of ongoing debate. Historically, halvings have been followed by periods of price appreciation, but this is not guaranteed. The price increase following a halving can be attributed to the decreased supply coupled with sustained or increased demand. However, external factors like macroeconomic conditions, regulatory changes, and market sentiment can significantly influence price movements, potentially leading to either increased or decreased volatility. The 2012 and 2016 halvings saw subsequent price increases, but the market conditions were different then. The 2025 halving’s effect will depend heavily on prevailing market dynamics.

Regulatory Frameworks and Bitcoin’s Future

Regulatory frameworks will play a crucial role in shaping Bitcoin’s future post-halving. Clear and consistent regulations can foster institutional adoption and investor confidence, potentially leading to increased price stability and wider acceptance. Conversely, unclear or overly restrictive regulations could stifle innovation and adoption, negatively impacting Bitcoin’s long-term prospects. For example, a well-defined regulatory framework in a major market like the United States could dramatically impact institutional investment and global adoption. Conversely, a highly restrictive regulatory environment could limit Bitcoin’s growth.

Bitcoin vs. Other Cryptocurrencies: A Long-Term Perspective

Comparing Bitcoin’s long-term prospects with other cryptocurrencies requires considering various factors. Bitcoin’s first-mover advantage, established network effect, and brand recognition give it a significant edge. However, newer cryptocurrencies might offer superior technology, scalability, or specific functionalities that could attract users and investment. For example, Ethereum’s smart contract capabilities and the development of layer-2 solutions have broadened its appeal, posing a potential long-term challenge to Bitcoin’s dominance. Ultimately, the long-term success of Bitcoin and other cryptocurrencies will depend on technological advancements, regulatory clarity, and overall market adoption.

Frequently Asked Questions (FAQs)

This section addresses common queries surrounding the Bitcoin halving event, focusing on its mechanics, impact, and implications for investors and the environment. Understanding these aspects is crucial for navigating the complexities of this significant event in the Bitcoin ecosystem.

The Bitcoin Halving Mechanism and Purpose

The Bitcoin halving is a programmed event embedded within the Bitcoin protocol. It occurs approximately every four years, reducing the rate at which new Bitcoins are created (mined) by half. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin. The reward given to miners for verifying transactions and adding new blocks to the blockchain is halved. For example, the reward started at 50 BTC per block, then halved to 25 BTC, then 12.5 BTC, and will be reduced to 6.25 BTC in the 2025 halving. This controlled reduction in the supply of new Bitcoins aims to mirror the scarcity of precious metals like gold, theoretically increasing its value over time.

The Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving event. This correlation is attributed to the reduced supply of new Bitcoins entering the market, potentially increasing demand and driving up the price. However, it’s crucial to note that this is not a guaranteed outcome, and other market factors significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, though the timing and magnitude varied. Market sentiment, regulatory changes, and overall economic conditions all play a role in determining the actual price movements.

Expected Date of the 2025 Halving

The next Bitcoin halving is expected to occur in early April 2025. The exact date depends on the block generation time, which can fluctuate slightly. However, this timeframe is widely anticipated within the cryptocurrency community, and it serves as a significant milestone for Bitcoin investors and miners alike.

Potential Risks and Rewards of Investing Around the Halving

Investing in Bitcoin around a halving presents both significant risks and potential rewards. The potential reward is the possibility of substantial price appreciation following the halving, as seen historically. However, the risk lies in the inherent volatility of the cryptocurrency market. Price fluctuations can be dramatic, and investing significant amounts without a thorough understanding of the risks could lead to substantial losses. Furthermore, market sentiment can shift rapidly, influencing price regardless of the halving event. It is advisable to conduct extensive research and consider one’s risk tolerance before investing.

Environmental Concerns Surrounding Bitcoin Mining Post-Halving

The energy consumption of Bitcoin mining is a significant environmental concern. The halving, while reducing the rate of new Bitcoin creation, does not directly address the energy consumption per coin mined. Miners may continue to use significant energy to compete for block rewards, even with the reduced payout. This concern has prompted discussions on the adoption of more energy-efficient mining techniques and the use of renewable energy sources within the Bitcoin mining industry. The long-term sustainability of Bitcoin mining remains a topic of ongoing debate and development.

Illustrative Examples

Visualizing potential Bitcoin price trajectories and comparing them to past halving cycles offers valuable insights into the potential impact of the 2025 halving. While precise prediction is impossible, these visualizations provide a framework for understanding potential scenarios.

Potential Bitcoin Price Trajectory Post-2025 Halving

This visualization depicts a hypothetical Bitcoin price trajectory. Imagine a graph with time on the x-axis (spanning from mid-2024 to mid-2026) and price (in USD) on the y-axis. Before the halving (around April 2025), the price might show some volatility, potentially a gradual increase driven by anticipation. The halving event itself could trigger a short-term price surge, depicted as a sharp upward spike on the graph. This initial surge might be followed by a period of consolidation or even a slight dip, as the market digests the event. However, assuming positive investor sentiment and continued adoption, the graph would then show a gradual, sustained upward trend throughout 2026, possibly exceeding previous all-time highs, reflecting the reduced inflation rate of newly mined Bitcoin. Annotations on the graph would indicate the halving date, significant price movements (peaks and troughs), and potential contributing factors like regulatory developments or macroeconomic events. For example, a downward blip could be annotated with “Regulatory uncertainty in [Country X]” and an upward spike with “Increased institutional investment”. This illustrates a bullish scenario; a bearish scenario would show a less pronounced or even negative price movement post-halving.

Comparison of Bitcoin Price Performance Around Previous Halvings

This visual comparison would involve three separate line graphs, each representing a period surrounding a previous Bitcoin halving (2012, 2016, and 2020). Each graph would display the Bitcoin price over a two-year period: one year before and one year after the halving. The graphs would be presented side-by-side for easy comparison. Key similarities might include an initial price increase in anticipation of the halving, followed by a period of volatility immediately after. Differences could be observed in the magnitude and duration of the price increase post-halving. For instance, the 2017 bull run following the 2016 halving was significantly more pronounced than the price movement following the 2012 halving. Annotations on each graph would highlight the halving date, significant price peaks and troughs, and the approximate time it took for the price to recover from any post-halving dips. This comparison would underscore the varied market responses to previous halving events, emphasizing the unpredictable nature of price movements and the importance of considering various factors beyond the halving itself. For example, the 2020 halving coincided with the start of the Covid-19 pandemic, significantly impacting global markets and Bitcoin’s price trajectory. This illustrates the interplay between Bitcoin’s inherent characteristics and external macroeconomic factors.

Formatting the Article

Presenting complex information clearly and engagingly is crucial for a successful article on the Bitcoin halving. Effective formatting ensures readers can easily digest the data and understand the implications of this significant event. This section details the formatting choices to enhance readability and comprehension.

Section Headings and Subheadings

The article should be divided into logical sections, each with a clear and concise heading. Subheadings break down larger sections into smaller, more manageable chunks of information. For example, “Bitcoin Halving 2025: The Impact on Bitcoin Mining” could be further broken down into subheadings like “Miner Revenue Changes,” “Hashrate Adjustments,” and “Energy Consumption Implications.” This hierarchical structure provides a roadmap for the reader, allowing them to easily navigate the content.

Use of Bullet Points and Tables

Bullet points are ideal for presenting lists of key facts, advantages, or disadvantages. For example, a list of potential impacts on investor sentiment could be effectively presented using bullet points. Tables are best suited for presenting data in a structured format. For instance, a table comparing the Bitcoin price and mining difficulty before and after previous halvings would be highly beneficial. This table would have columns for “Halving Date,” “Price Before Halving,” “Price After Halving (1 year),” “Mining Difficulty Before,” and “Mining Difficulty After.”

Visual Aids: Charts and Graphs

Visual aids significantly improve understanding and engagement. A line graph showing the historical Bitcoin price alongside the dates of previous halvings would clearly illustrate the potential price impact. Another useful graph would be a bar chart comparing the hashrate before and after previous halvings. A pie chart could visually represent the distribution of Bitcoin mining across different regions. These visuals provide a quick and intuitive grasp of complex data.

Ensuring Clarity, Conciseness, and Readability

Short, clear sentences and paragraphs are essential for readability. Avoid jargon and technical terms unless they are clearly defined. Use active voice whenever possible, and break up long paragraphs into shorter ones to improve flow. Using headings, subheadings, bullet points, and visuals enhances readability and allows readers to quickly scan the article and locate the information they need. A consistent tone and style throughout maintain a professional and engaging feel.

Illustrative Examples: Price Prediction

Predicting the Bitcoin price after the 2025 halving is inherently speculative. However, we can use historical data to illustrate potential scenarios. For example, the 2016 halving saw a price increase from approximately $650 to over $20,000 within two years. The 2020 halving saw a price increase from around $9,000 to over $60,000 within a similar timeframe. While past performance doesn’t guarantee future results, these examples highlight the potential for significant price volatility following a halving event. This should be presented with a disclaimer emphasizing the uncertainty inherent in market predictions. A chart illustrating these price movements would further enhance understanding.

Bitcoin’s Halving Day in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding the mechanics behind this reduction in block rewards is crucial, and a helpful resource for this is the detailed analysis provided by Halving De Bitcoin 2025. This resource will help you better prepare for and understand the implications of Halving Day Bitcoin 2025 and its potential market effects.

Bitcoin’s Halving Day in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding the mechanics behind this reduction in block rewards is crucial, and a helpful resource for this is the detailed analysis provided by Halving De Bitcoin 2025. This resource will help you better prepare for and understand the implications of Halving Day Bitcoin 2025 and its potential market effects.

Bitcoin’s Halving Day in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding the mechanics behind this reduction in block rewards is crucial, and a helpful resource for this is the detailed analysis provided by Halving De Bitcoin 2025. This resource will help you better prepare for and understand the implications of Halving Day Bitcoin 2025 and its potential market effects.

Bitcoin’s Halving Day in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding the mechanics behind this reduction in block rewards is crucial, and a helpful resource for this is the detailed analysis provided by Halving De Bitcoin 2025. This resource will help you better prepare for and understand the implications of Halving Day Bitcoin 2025 and its potential market effects.

Bitcoin’s Halving Day in 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding the mechanics behind this reduction in block rewards is crucial, and a helpful resource for this is the detailed analysis provided by Halving De Bitcoin 2025. This resource will help you better prepare for and understand the implications of Halving Day Bitcoin 2025 and its potential market effects.

Bitcoin’s 2025 halving day is a significant event for the cryptocurrency market, sparking much speculation about its impact. Understanding potential price movements requires careful analysis, and a helpful resource for this is the detailed prediction found at Bitcoin 2025 Halving Price Prediction. Considering these predictions is crucial when forming your own outlook on the implications of Halving Day Bitcoin 2025.