Investor Sentiment and Market Behavior

Investor sentiment surrounding Bitcoin halvings significantly influences price action. The anticipation leading up to the event often fuels price increases, while the aftermath can see a period of consolidation or even a price correction, depending on various market factors and the overall macroeconomic climate. Understanding this dynamic is crucial for navigating the potential risks and opportunities presented by these cyclical events.

Investor expectations play a pivotal role in shaping the price trajectory. The halving, by reducing the rate of new Bitcoin entering circulation, is often viewed as a deflationary event, potentially increasing scarcity and driving up demand. This expectation frequently translates into bullish sentiment, leading to increased buying pressure and price appreciation in the months preceding the halving. However, the extent of this price movement is highly variable and depends on numerous factors, including overall market confidence, regulatory developments, and the broader economic landscape.

Pre-Halving Price Action and Sentiment

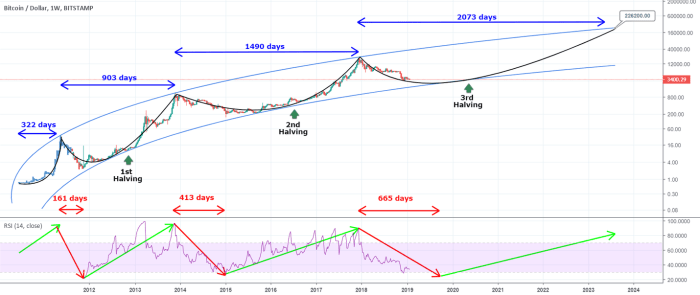

The period leading up to a Bitcoin halving typically witnesses a build-up of anticipation and speculation. Investors often position themselves early, anticipating a price surge. This increased demand pushes prices higher, creating a self-fulfilling prophecy to some extent. However, this bullish sentiment isn’t always uniform; periods of uncertainty and price corrections can occur even within this generally upward trending period. For example, the halving in 2020 saw a period of significant price increase in the months leading up to the event, but also experienced periods of price consolidation and minor corrections.

Post-Halving Price Action and Sentiment

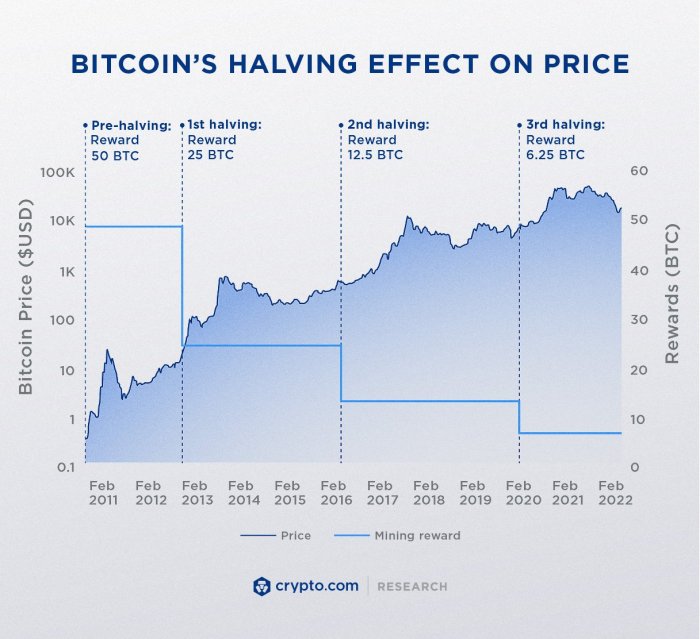

Following a halving, the market often enters a period of consolidation. The initial price surge fueled by anticipation may give way to profit-taking, leading to a price correction. The actual price movement post-halving is influenced by the interplay of several factors: the degree of pre-halving price appreciation, the overall market sentiment, the adoption rate of Bitcoin, and external economic events. The 2016 halving, for instance, saw a period of relative price stability followed by a significant price increase in the subsequent year.

Long-Term Holders vs. Short-Term Traders

Long-term holders (LTHs), often characterized by their “HODL” strategy (Hold On for Dear Life), tend to remain less affected by short-term price fluctuations around halvings. They typically focus on the long-term value proposition of Bitcoin and are less likely to sell during periods of price volatility. Conversely, short-term traders (STTs) are more susceptible to market sentiment swings and are often involved in speculative trading, potentially leading to increased volatility during periods of anticipation and price correction. Their actions can amplify price movements, both upward and downward. The behavior of these two groups significantly impacts the overall market dynamics around halvings.

Typical Market Phases Around a Halving, Next Bitcoin Halving After 2025

Imagine a graph depicting Bitcoin’s price over time. The pre-halving phase would be represented by a generally upward-sloping curve, though it might not be consistently smooth, exhibiting periods of consolidation or even minor dips. This represents the building anticipation and increased buying pressure. The halving event itself is marked on the graph. The post-halving phase is characterized by an initial period of price consolidation or a potential correction, followed by a gradual upward trend (though not guaranteed) reflecting the interplay of profit-taking and the longer-term effects of reduced supply. This upward trend, if it occurs, may take several months or even years to fully materialize. The entire cycle could be visualized as a wave-like pattern, with a peak before the halving and a subsequent trough followed by a potential, though not certain, recovery.

Long-Term Implications of the Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has profound and lasting consequences extending far beyond the immediate price volatility often observed around the event. Its long-term effects center on Bitcoin’s scarcity, its role as a store of value, and its influence on the broader cryptocurrency landscape. Understanding these implications is crucial for anyone considering Bitcoin as an investment or observing its potential to reshape the financial system.

The halving directly impacts Bitcoin’s scarcity, a fundamental characteristic driving its value proposition. By reducing the supply of newly mined Bitcoin, each coin becomes relatively more valuable. This increased scarcity mirrors the behavior of precious metals like gold, further solidifying Bitcoin’s position as a potential hedge against inflation and a store of value. This effect is not immediate; it unfolds gradually over time as market forces adjust to the reduced supply. The historical performance of Bitcoin following previous halvings supports this observation, although past performance is not indicative of future results.

Bitcoin’s Scarcity and Store of Value

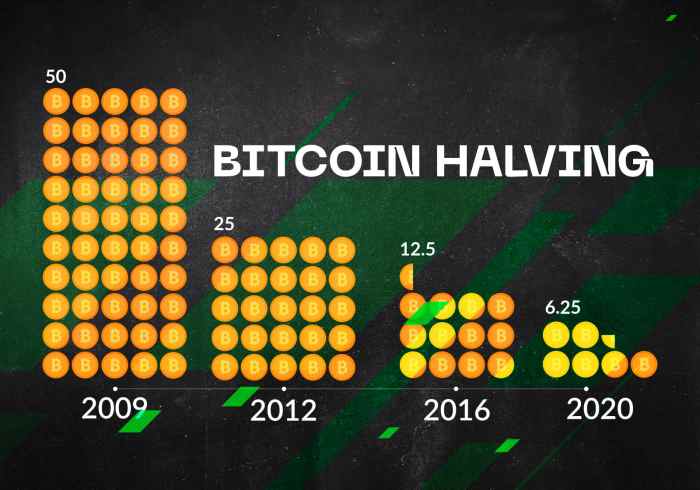

The halving’s effect on scarcity is a long-term, compounding process. Each halving reduces the inflation rate of Bitcoin, making it a more attractive asset for investors seeking to preserve their purchasing power. This is particularly relevant in periods of high inflation in fiat currencies. The limited supply of 21 million Bitcoins, coupled with the halving mechanism, creates a deflationary pressure, contrasting sharply with the inflationary tendencies of most fiat currencies. This inherent scarcity is a key differentiator, positioning Bitcoin as a unique asset class within the global financial system. The increasing difficulty in mining new Bitcoin also reinforces this scarcity, requiring ever-increasing energy expenditure to produce each coin.

Impact on the Broader Cryptocurrency Market

The Bitcoin halving doesn’t exist in isolation; its effects ripple throughout the broader cryptocurrency market. Historically, periods following Bitcoin halvings have often seen increased interest and investment in the entire crypto space, a phenomenon sometimes referred to as a “halo effect.” Altcoins, or alternative cryptocurrencies, can experience increased trading volume and price appreciation as investors seek exposure to the digital asset market. However, this correlation is not always consistent, and the impact on altcoins can vary significantly depending on market conditions and individual project fundamentals. For example, the 2020 halving saw a significant price increase in Bitcoin, but the subsequent altcoin market performance varied greatly. Some altcoins experienced substantial gains while others lagged behind.

Increased Institutional Adoption

The halving can act as a catalyst for increased institutional adoption of Bitcoin. The predictable nature of the halving, coupled with its impact on scarcity, makes Bitcoin more appealing to large-scale investors seeking long-term, stable assets. Institutional investors often favor assets with clear supply limitations and demonstrable value propositions, which aligns well with Bitcoin’s characteristics post-halving. Increased institutional participation can lead to greater price stability and liquidity, further contributing to Bitcoin’s maturation as a financial instrument. For instance, the gradual increase in Bitcoin holdings by companies like MicroStrategy has signaled a growing acceptance of Bitcoin as a legitimate asset class within institutional portfolios.

Contribution to Bitcoin’s Long-Term Narrative

The halving is an integral part of Bitcoin’s long-term narrative as a decentralized, scarce, and secure digital asset. It reinforces the core tenets of Bitcoin’s design – its limited supply and its resistance to inflation – making it a compelling alternative to traditional financial systems. Each halving serves as a milestone in Bitcoin’s evolution, further cementing its position as a digital gold and a potential store of value for a future financial landscape increasingly reliant on digital assets. This long-term narrative, underpinned by the halving mechanism, contributes to Bitcoin’s growing legitimacy and acceptance within the broader financial ecosystem.

Frequently Asked Questions (FAQ): Next Bitcoin Halving After 2025

This section addresses common queries regarding Bitcoin halvings, their impact, and investment considerations. Understanding these factors is crucial for navigating the complexities of the cryptocurrency market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin.

Next Bitcoin Halving’s Expected Date

The next Bitcoin halving is expected to occur in the Spring of 2024. The precise date depends on the time it takes to mine the 210,000 blocks leading up to the event. While predicting the exact date is challenging due to variations in mining difficulty, a reasonable estimation can be made based on the current block generation rate.

A Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. This is primarily attributed to the reduced supply of newly mined Bitcoin, creating a potential scenario of increased demand relative to supply. However, it’s crucial to remember that other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, but the market’s reaction is never guaranteed to repeat.

Investing in Bitcoin Before a Halving: Opportunities and Risks

Investing in Bitcoin before a halving presents both opportunities and significant risks. The anticipation of a price surge can drive up the price in advance of the event itself. However, the cryptocurrency market is highly volatile. Investing before a halving involves the risk of a price correction or a prolonged period of stagnation even after the event. Thorough research and a well-defined risk tolerance are paramount. Consider the potential for significant losses as well as the possibility of substantial gains. Successful investment requires a long-term perspective and a deep understanding of the market dynamics.

Potential Risks of Investing in Bitcoin

Bitcoin’s price volatility is its most prominent risk. Dramatic price swings are common, and significant losses are possible. Furthermore, the regulatory landscape for cryptocurrencies is still evolving and uncertain in many jurisdictions, creating potential legal and compliance risks. Security risks, such as hacking and theft from exchanges or personal wallets, are also considerable concerns. Finally, the inherent complexity of the technology and the market itself poses a risk for less experienced investors. Diversification of investment portfolios is strongly advised to mitigate these risks.