Frequently Asked Questions about the Bitcoin Halving 2025: When Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event is crucial for anyone invested in or interested in Bitcoin. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving: Definition and Price Impact

A Bitcoin halving is a programmed event where the reward given to Bitcoin miners for verifying transactions on the blockchain is cut in half. This occurs approximately every four years, reducing the rate at which new Bitcoins enter circulation. Historically, halvings have been followed by periods of increased Bitcoin price, though this is not guaranteed. The reduced supply, coupled with potentially sustained or increased demand, can create upward pressure on the price. However, other market factors significantly influence price, making it impossible to predict with certainty.

Timing of the 2025 Bitcoin Halving

The 2025 Bitcoin halving is anticipated to occur in the spring, around April or May. The exact date depends on the block generation time, which can fluctuate slightly. Predicting the precise date requires monitoring the blockchain’s block creation rate in the lead-up to the event. The halving is triggered by a specific number of blocks being mined, not a calendar date.

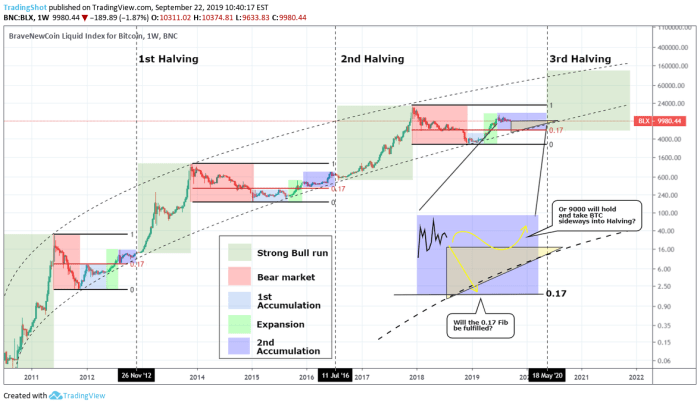

Historical Price Trends Following Previous Halvings

The Bitcoin halvings in 2012, 2016, and 2020 were followed by significant price increases, albeit with varying timelines and magnitudes. The 2012 halving saw a gradual price rise over several months. The 2016 halving led to a more substantial increase, starting several months after the event and culminating in a significant bull run. The 2020 halving was also followed by a strong bull market, though market conditions and external factors played a considerable role in each instance. It’s important to note that correlation does not equal causation; other economic and market factors contributed significantly to price movements.

Preparing for the 2025 Bitcoin Halving as an Investor, When Bitcoin Halving 2025

Preparing for the 2025 halving requires a balanced approach. Investors should thoroughly research Bitcoin and understand the underlying technology and its potential risks. A well-diversified investment portfolio is recommended, mitigating the risk associated with holding a single asset. Investors should consider their risk tolerance and investment timeline before making any decisions. Dollar-cost averaging, a strategy involving regular investments regardless of price fluctuations, can be a useful approach.

Risks and Rewards of Investing in Bitcoin Around the Halving

Investing in Bitcoin, especially around a halving event, carries both significant risks and potential rewards. The potential for substantial price appreciation is a major reward, but the cryptocurrency market is highly volatile and susceptible to sudden price swings. Regulatory uncertainty, technological advancements, and macroeconomic factors can all impact Bitcoin’s price. Thorough due diligence, a well-defined investment strategy, and an understanding of risk management are crucial for navigating the complexities of the Bitcoin market. Remember, past performance is not indicative of future results.