Understanding Bitcoin Halving

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial element of Bitcoin’s design, intended to control inflation and maintain the scarcity of the cryptocurrency.

Bitcoin Halving Mechanics and Impact on Supply

The halving mechanism directly affects the block reward miners receive for successfully adding new transactions to the blockchain. Before the first halving, miners received 50 BTC per block. Each halving cuts this reward in half. This means that the supply of new Bitcoins entering circulation is steadily reduced over time. This controlled reduction in supply is a key factor contributing to Bitcoin’s deflationary nature, unlike traditional fiat currencies with inflationary monetary policies. The predictable nature of the halving contributes to its significance in the cryptocurrency market.

Historical Impact of Bitcoin Halvings

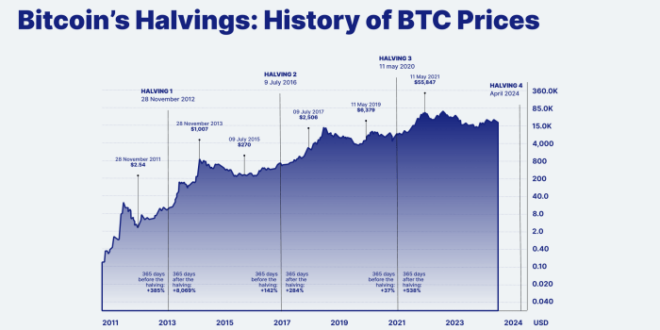

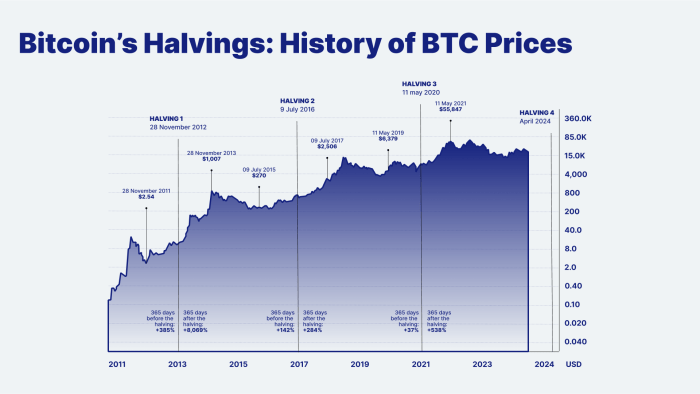

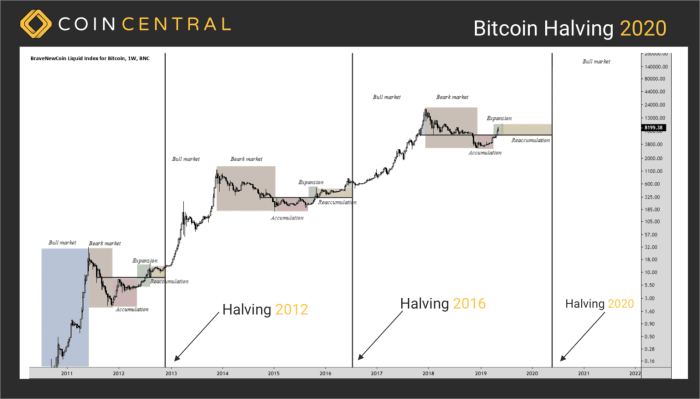

The previous Bitcoin halvings have demonstrably influenced both the price and market sentiment surrounding Bitcoin. While correlation doesn’t equal causation, a noticeable price increase has generally followed each halving event. This is often attributed to the reduced supply creating upward pressure on demand, particularly among long-term holders who anticipate future price appreciation. However, other factors, including macroeconomic conditions, regulatory changes, and overall market sentiment, also play significant roles. The impact is not immediate; the price increases typically unfold over months or even years after the halving.

Comparison of Expected 2025 Halving Effects with Previous Halvings

Predicting the exact impact of the 2025 halving is impossible. However, by analyzing previous events, we can form reasonable expectations. The 2025 halving will likely follow a similar pattern to its predecessors, with a gradual increase in price after the event. However, the magnitude of this increase is highly uncertain and will depend on various factors such as the state of the global economy, the regulatory environment for cryptocurrencies, and the overall adoption rate of Bitcoin. The impact might be less pronounced than previous halvings if the market is already saturated or if significant negative factors affect the cryptocurrency market. Conversely, if the overall market sentiment remains positive and adoption accelerates, the impact could be more significant.

Past Bitcoin Halving Data

The table below summarizes the dates of past halvings, the block rewards before and after each event, and notable price movements in the subsequent months. Note that these price movements are not solely attributable to the halving.

| Halving Date | Block Reward (Before) | Block Reward (After) | Significant Price Movement (Following Months) |

|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | Substantial price increase over the next year |

| July 9, 2016 | 25 BTC | 12.5 BTC | Significant price appreciation starting in late 2016 and continuing into 2017 |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | A period of price consolidation followed by a substantial increase in late 2020 and early 2021 |

Predicting the 2025 Bitcoin Halving’s Impact

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, is anticipated to occur in 2025. Predicting its precise impact on price is inherently complex, involving numerous intertwined factors. While past halvings have generally been followed by price increases, extrapolating this trend directly to 2025 is overly simplistic and ignores the evolving macroeconomic landscape and regulatory environment.

Predicting the Bitcoin price around the 2025 halving requires considering its historical behavior alongside current market conditions and future uncertainties. Past halvings have shown a correlation with subsequent price increases, but the magnitude and timing of these increases have varied considerably. Moreover, external factors like regulatory changes and global economic shifts can significantly influence Bitcoin’s price trajectory, making accurate prediction exceptionally challenging.

Bitcoin Price Prediction: Pre- and Post-Halving

Several factors suggest a potential price increase leading up to and following the 2025 halving. The reduced supply of newly mined Bitcoin, coupled with potentially sustained or increased demand, could exert upward pressure on the price. However, this increase is unlikely to be immediate or linear. We might see a gradual price appreciation in the months leading up to the halving, driven by anticipatory buying, followed by a period of consolidation or even a temporary price dip immediately after the halving, before a more significant price surge driven by the reduced supply. For example, the 2012 halving saw a relatively slow price increase in the months following the event, while the 2016 halving saw a more pronounced price surge after a period of relative stability. Predicting a specific price point is impossible, but a scenario of moderate growth leading up to the halving followed by a potentially more substantial rise post-halving seems plausible.

Influential Factors on Bitcoin Price

Numerous factors beyond the halving itself could significantly impact Bitcoin’s price. Macroeconomic conditions, such as inflation rates, interest rate changes, and global economic growth, play a crucial role. A period of high inflation might drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. Conversely, a global recession could lead to a sell-off across asset classes, including Bitcoin. Regulatory changes also hold considerable weight. Increased regulatory clarity and adoption could attract institutional investors, driving up demand and price. Conversely, restrictive regulations could suppress price growth. Technological advancements, such as the development of layer-2 scaling solutions and improvements in Bitcoin’s security, could positively influence its adoption and price. Conversely, significant technological setbacks or security breaches could negatively impact investor confidence and price.

Impact on Bitcoin Mining Profitability and Hash Rate, When Is 2025 Bitcoin Halving

The halving directly affects Bitcoin mining profitability by reducing the reward for each successfully mined block. This reduction could lead to some less efficient miners exiting the market, resulting in a temporary decrease in the hash rate (the total computational power securing the Bitcoin network). However, historical data suggests that the hash rate tends to recover relatively quickly, often driven by the anticipation of future price increases. Miners may adjust their operations to remain profitable, focusing on energy efficiency and economies of scale. The long-term impact on mining profitability and the hash rate will depend on the interplay between the reduced block reward and the price of Bitcoin. A significant price increase could offset the reduced reward, maintaining or even increasing mining profitability.

Timeline of Key Events and Potential Market Reactions

The following timeline illustrates key events leading up to the 2025 halving and potential market reactions. These are projections and actual events might differ significantly.

- 2023-2024: Increased speculation and anticipation surrounding the 2025 halving; potential price increases driven by accumulating bullish sentiment.

- Mid-2024: Market begins to price in the upcoming halving, with potentially heightened volatility.

- Q3 2024 – Q1 2025: Gradual price appreciation as the halving date approaches. Increased on-chain activity and network congestion are possible.

- March/April 2025 (estimated): Bitcoin halving occurs. Potential short-term price dip or consolidation as the market adjusts to the reduced block reward.

- Post-Halving (2025-2026): Gradual price increase driven by reduced supply and potentially increased demand. The magnitude of this increase will depend on various factors discussed previously.

The 2025 Halving: When Is 2025 Bitcoin Halving

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, is a significant event that consistently sparks considerable market speculation. The upcoming 2025 halving is no exception, with investors already anticipating its potential impact on Bitcoin’s price and overall market dynamics. Understanding current market sentiment and potential investment strategies is crucial for navigating this period.

Market Sentiment Surrounding the 2025 Bitcoin Halving

Current market sentiment regarding the 2025 Bitcoin halving is mixed. While many believe the halving will be bullish, leading to a price increase due to decreased supply, others remain cautious. Some analysts point to historical data showing a price surge following previous halvings, while others highlight macroeconomic factors and regulatory uncertainty that could potentially offset the halving’s positive impact. The overall sentiment is one of cautious optimism, with many investors waiting for clearer signals before making significant investment decisions. The level of hype surrounding this halving is arguably less intense than previous ones, perhaps due to a greater awareness of the inherent volatility of the cryptocurrency market.

Risks and Opportunities Associated with Investing in Bitcoin

Investing in Bitcoin, particularly around a halving event, presents both significant risks and opportunities. A major risk is the inherent volatility of the cryptocurrency market. Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Furthermore, regulatory uncertainty in various jurisdictions poses a considerable risk, as changes in regulations can significantly impact the value and usability of Bitcoin. On the opportunity side, the halving is expected to reduce the supply of new Bitcoin, potentially leading to increased scarcity and, consequently, higher prices. Historically, Bitcoin’s price has shown upward trends in the periods following previous halvings, though this is not guaranteed to repeat. Successfully navigating these risks and capitalizing on the opportunities requires a thorough understanding of the market, risk tolerance, and a well-defined investment strategy.

Investor Strategies in Anticipation of the Halving

Investors are employing various strategies in anticipation of the 2025 halving, broadly categorized by their time horizon.

When Is 2025 Bitcoin Halving – The importance of having a clear investment strategy cannot be overstated. A well-defined plan helps manage risk and capitalize on opportunities presented by market fluctuations.

- Long-Term Hodlers: This strategy involves buying and holding Bitcoin for an extended period, regardless of short-term price fluctuations. The belief is that the long-term value of Bitcoin will appreciate significantly, particularly after the halving. This strategy minimizes the impact of short-term volatility. Example: An investor who bought Bitcoin in 2012 and held it through multiple market cycles has seen significant returns despite periods of significant price drops.

- Short-Term Traders: This strategy focuses on exploiting short-term price movements. Traders might buy Bitcoin before the halving, anticipating a price increase, and then sell it shortly after to capitalize on the potential surge. This strategy carries higher risk due to Bitcoin’s volatility. Example: A trader might buy Bitcoin several months before the halving, aiming to sell at the peak of the post-halving price increase. However, this requires accurate market timing, which is difficult to achieve.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of the price. This mitigates the risk of investing a large sum at a market peak. Example: An investor might invest $100 per week in Bitcoin, regardless of the price, thereby averaging out the cost over time. This strategy is particularly suitable for long-term investors.

The Importance of Diversification

Diversification is crucial in any investment portfolio, and this is especially true when including Bitcoin. Bitcoin’s high volatility makes it a risky asset. Holding a diversified portfolio, including other asset classes such as stocks, bonds, and real estate, can significantly reduce overall portfolio risk. By spreading investments across different asset classes, investors can mitigate the impact of potential losses in any single asset, including Bitcoin. A diversified portfolio aims to balance risk and return, providing a more stable and resilient investment strategy. For example, an investor might allocate 5% to 10% of their portfolio to Bitcoin, while the remaining portion is invested in more traditional assets. This approach reduces the overall risk associated with Bitcoin’s volatility.