Impact on Bitcoin Investors and the Market: When Was Bitcoin Halving In 2025

The Bitcoin halving, a programmed event reducing the rate of newly mined Bitcoin, significantly impacts investor behavior and market dynamics. Understanding these impacts is crucial for navigating the potential volatility surrounding the 2025 halving. This section will explore the effects on both short-term and long-term investors, potential investment strategies, historical precedents, and associated risks and opportunities.

Impact on Short-Term and Long-Term Investors

Short-term investors, often focused on quick profits, may experience increased volatility around the halving. The anticipation leading up to the event can drive price increases, creating opportunities for quick gains, but also exposing them to substantial losses if the price corrects sharply afterward. Conversely, long-term investors, typically holding Bitcoin for extended periods, often view the halving as a positive event, anticipating a gradual increase in value due to reduced supply. Their strategies tend to be less reactive to short-term price fluctuations. The 2012 and 2016 halvings saw initial price increases followed by periods of consolidation before subsequent significant price appreciation, highlighting the contrasting experiences of short-term and long-term holders.

Investor Strategies Before and After the Halving

Investors employ various strategies around halving events. Before the halving, some might accumulate Bitcoin anticipating a price increase, while others might engage in leveraged trading, aiming to amplify potential gains (though this carries significant risk). After the halving, some investors may take profits, while others might continue holding, believing the price will continue to appreciate. Diversification strategies, such as investing in other cryptocurrencies or traditional assets, are also common to mitigate risk. The choice of strategy depends heavily on individual risk tolerance and investment horizon. For example, a conservative investor might choose to dollar-cost average (DCA) into Bitcoin over a longer period leading up to and following the halving, reducing their exposure to sudden price swings.

Historical Market Reactions to Halving Events

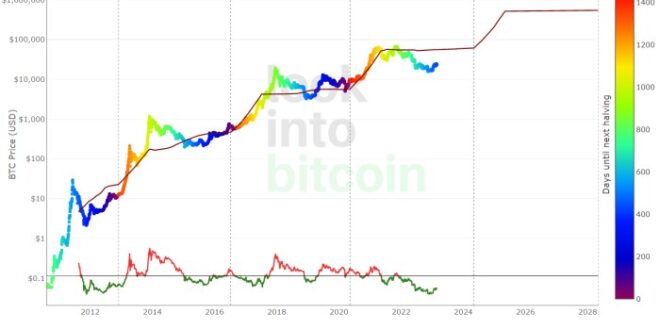

The previous Bitcoin halvings in 2012, 2016, and 2020 offer valuable insights. While each halving event unfolded differently, a common pattern emerged: a period of price appreciation leading up to the event, often driven by anticipation, followed by varying degrees of price volatility in the aftermath. The 2012 halving saw a gradual price increase post-halving, while the 2016 halving experienced a more significant surge, and the 2020 halving was followed by a period of significant growth, albeit with notable corrections along the way. Analyzing these historical patterns helps in understanding the potential range of market reactions in 2025, although past performance is not indicative of future results.

Potential Investment Opportunities and Risks

The 2025 halving presents both opportunities and risks. Opportunities include the potential for significant price appreciation driven by reduced supply and increased demand. However, risks include the possibility of price corrections following the initial surge, market manipulation, and regulatory uncertainty. The overall macroeconomic environment also plays a significant role; a global recession, for instance, could negatively impact the price of Bitcoin regardless of the halving. Furthermore, the increasing competition from alternative cryptocurrencies and blockchain technologies could also influence Bitcoin’s price trajectory. A successful navigation of these opportunities and risks requires careful analysis, diversification, and a well-defined investment strategy.

Potential Market Scenarios

| Scenario | Pre-Halving | Post-Halving |

|---|---|---|

| Bullish | Steady price increase driven by anticipation | Significant price surge followed by consolidation |

| Bearish | Price stagnation or decline due to broader market downturn | Limited price movement or a further decline |

| Neutral | Moderate price increase | Gradual price appreciation with periods of volatility |

Frequently Asked Questions (FAQs) about the 2025 Bitcoin Halving

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is anticipated in 2025. Understanding its implications is crucial for investors and market participants. This section addresses key questions surrounding the 2025 halving.

Bitcoin Halving Date in 2025, When Was Bitcoin Halving In 2025

The precise date of the 2025 Bitcoin halving is difficult to pinpoint with absolute certainty until closer to the event, as it depends on the block generation time. However, based on historical data and current block times, it’s expected to occur sometime in the Spring of 2025. Predicting the exact day requires constant monitoring of the blockchain. Experts and prediction models offer estimates, but minor variations are always possible due to network fluctuations.

Impact of the Halving on Bitcoin Supply

The Bitcoin halving mechanism reduces the rate at which new Bitcoins are created. Every four years, approximately, the reward miners receive for validating transactions and adding new blocks to the blockchain is cut in half. Before the halving, miners receive a certain number of Bitcoins per block. After the halving, this reward is reduced by 50%, leading to a slower increase in the overall Bitcoin supply. This controlled inflation is a core feature of Bitcoin’s design.

Effect of the Halving on Bitcoin Price

Historically, Bitcoin’s price has often shown an upward trend following previous halving events. This correlation is attributed to the reduced supply of newly minted Bitcoins, potentially increasing scarcity and demand. However, it’s crucial to remember that price movements are influenced by various factors beyond the halving, including market sentiment, regulatory changes, and overall economic conditions. The 2012 and 2016 halvings were followed by significant price increases, but this doesn’t guarantee a similar outcome in 2025. The market is far more mature and complex now than it was in those earlier years.

Investment Strategies Before the Halving

The period leading up to a halving presents both opportunities and risks for Bitcoin investors. Some investors might adopt a “buy-the-dip” strategy, anticipating price appreciation after the halving. Others may prefer to wait and see how the market reacts. There is no universally “correct” strategy. Thorough research, risk tolerance assessment, and diversification are vital. Consider your investment timeline and overall financial goals before making any decisions. Remember that past performance does not guarantee future results.

Risks Associated with Investing Around the Halving

Market volatility is a significant risk surrounding halving events. The anticipation of the halving can lead to price fluctuations, both upward and downward. This increased volatility can create opportunities for savvy traders but also poses a substantial risk for those with lower risk tolerance. Additionally, the cryptocurrency market is susceptible to regulatory changes, technological advancements, and security breaches, all of which can significantly impact Bitcoin’s price. Investing in Bitcoin requires a high degree of risk awareness.