When is the 2025 Bitcoin Halving?: When Was The 2025 Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and the next halving is anticipated to significantly impact the cryptocurrency market. Predicting the exact moment requires careful consideration of block times, which can fluctuate slightly.

The Bitcoin halving event is significant because it directly influences the inflation rate of Bitcoin. By reducing the supply of newly minted coins, the halving can potentially increase the scarcity and, consequently, the value of Bitcoin. This is based on the fundamental economic principle of supply and demand. A decreased supply, all else being equal, can lead to increased demand and a higher price.

Bitcoin Halving History and Price Impact

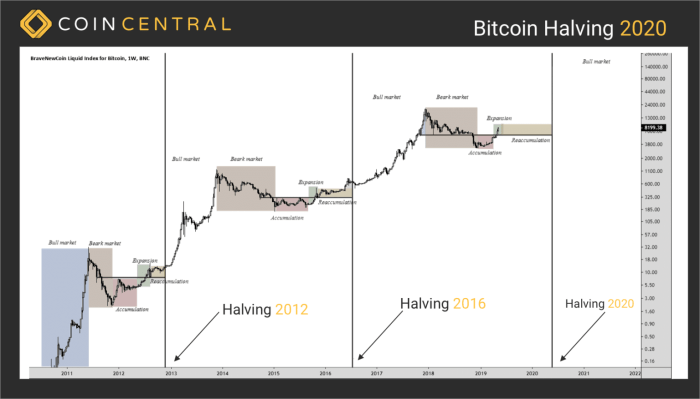

Historically, Bitcoin halvings have coincided with periods of significant price appreciation. However, it’s crucial to remember that correlation does not equal causation. Other market factors, such as regulatory changes, technological advancements, and overall economic conditions, also play a substantial role in Bitcoin’s price fluctuations. The first halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. The price subsequently rose significantly over the following year. The second halving in July 2016, reducing the reward to 12.5 BTC, was followed by another substantial price increase. The third halving in May 2020, lowering the reward to 6.25 BTC, also saw a notable price surge, although the market experienced considerable volatility in the following period. Analyzing these historical events provides valuable context, but it does not guarantee a similar outcome for the 2025 halving.

Expected Impact of the 2025 Halving

Predicting the exact impact of the 2025 halving on Bitcoin’s price is challenging and speculative. While past halvings have generally been followed by price increases, external factors could significantly influence the market’s reaction. For instance, a global recession or stringent regulatory measures could dampen the positive effects of the halving. Conversely, widespread adoption of Bitcoin by institutional investors or the development of groundbreaking Bitcoin-related technologies could amplify its price appreciation. It is important to remember that market behavior is complex and influenced by numerous intertwined factors. Therefore, any prediction should be treated with caution. The 2025 halving will reduce the block reward to 3.125 BTC. The actual price impact will depend on a multitude of factors beyond the halving itself.

The 2025 Bitcoin Halving Date and Time

While pinpointing the exact second is impossible until the block is mined, the 2025 Bitcoin halving is expected to occur around April 2025. The precise date and time will depend on the actual time it takes to mine the blocks leading up to the event. The Bitcoin network adjusts its difficulty to maintain a consistent block time of approximately 10 minutes. Fluctuations in network hash rate (the computational power securing the network) can slightly alter the timing of the halving. Therefore, it’s a close approximation, rather than a precise prediction.

Understanding Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or more precisely, every 210,000 blocks mined. It’s a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin over time.

The Bitcoin halving mechanism is embedded within the Bitcoin code itself. Every 210,000 blocks mined, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. This halving continues until all 21 million Bitcoins are mined, a process expected to complete around the year 2140.

Bitcoin Creation Rate Reduction

The halving directly impacts the rate of new Bitcoin creation. Before a halving, a certain number of Bitcoins enter circulation with each block mined. After the halving, the rate of new Bitcoin entering circulation is reduced by 50%. This controlled reduction in supply is a core element of Bitcoin’s deflationary model, intended to counteract the effects of inflation. The reduced supply can theoretically lead to increased demand and potentially higher prices, although market forces are complex and other factors also play a significant role.

Economic Principles Underlying the Halving

The halving is based on fundamental economic principles of supply and demand. By reducing the supply of new Bitcoins, the halving aims to increase its value, particularly in the long term. This mirrors the concept of scarcity in economics – the rarer a commodity, the more valuable it tends to be, all other things being equal. The predictable nature of the halving, programmed into the Bitcoin protocol, also contributes to its perceived value and stability, as it provides a clear and transparent schedule for future supply reductions. The halving is a form of programmed monetary policy designed to control inflation within the Bitcoin system.

Long-Term Effects on Bitcoin Scarcity

The halving contributes significantly to Bitcoin’s inherent scarcity. The fixed supply of 21 million Bitcoins, combined with the halving mechanism, creates a deflationary pressure that differentiates Bitcoin from fiat currencies which can be printed at will. Each halving reduces the rate of new Bitcoin entering circulation, progressively increasing its scarcity over time. This programmed scarcity is a major selling point for Bitcoin, attracting investors who believe in its long-term value proposition based on its limited supply and increasing scarcity. While predicting future price movements is inherently speculative, the halving is generally considered a significant factor influencing Bitcoin’s long-term scarcity and potential value.

Market Predictions and Impact

The 2025 Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is expected to have a substantial impact on its price and the broader market. Predicting the exact consequences, however, remains challenging due to the inherent volatility of the cryptocurrency market and the influence of numerous external factors. Analyzing expert opinions and considering historical trends offers a framework for understanding potential scenarios.

Expert predictions regarding Bitcoin’s price post-halving vary widely. Some analysts, citing the historical correlation between halvings and price increases, anticipate a substantial price surge. They point to previous halvings as evidence, suggesting that the reduced supply of newly mined Bitcoin creates scarcity and drives up demand. For example, PlanB, a well-known on-chain analyst, has previously presented models suggesting significantly higher Bitcoin prices following halvings. However, it’s crucial to remember that these models are based on historical data and don’t account for unforeseen circumstances. Other analysts are more cautious, arguing that the market’s maturity and the increasing regulatory scrutiny could dampen the traditional halving effect. They highlight the potential for macroeconomic factors, such as inflation and interest rates, to significantly influence Bitcoin’s price regardless of the halving.

Potential Market Reactions, When Was The 2025 Bitcoin Halving

The period leading up to the 2025 halving is likely to see increased market speculation. Investors might begin accumulating Bitcoin in anticipation of the price increase, potentially driving the price upwards even before the event occurs. Following the halving, the market’s reaction will depend on various factors, including the overall macroeconomic environment and investor sentiment. A positive market reaction could see a sustained price rally, potentially exceeding previous post-halving highs. Conversely, a negative reaction, possibly driven by regulatory uncertainty or a broader market downturn, could lead to a price correction or even a prolonged bear market. The interplay between supply reduction and overall market sentiment will be key.

Factors Beyond the Halving

Several factors beyond the halving itself could significantly influence Bitcoin’s price. Macroeconomic conditions, including inflation, interest rates, and global economic growth, play a crucial role. Regulatory developments, both positive and negative, can also have a substantial impact. For example, increased regulatory clarity in certain jurisdictions could attract institutional investment, while stricter regulations could stifle growth. Technological advancements within the Bitcoin ecosystem, such as the adoption of the Lightning Network for faster and cheaper transactions, could also influence its price. Finally, widespread adoption by mainstream businesses and consumers remains a significant driver of future price movements.

Hypothetical Scenario: Halving’s Impact on Investor Groups

Imagine a scenario where the 2025 halving leads to a moderate price increase, similar to the post-2020 halving. Long-term holders (HODLers) would likely benefit the most, seeing significant returns on their investments. Short-term traders might experience both gains and losses, depending on their timing and risk tolerance. Institutional investors, with their greater capital and risk management capabilities, could strategically capitalize on price fluctuations, potentially mitigating risks and maximizing returns. Finally, new investors entering the market after the halving might face higher entry points, requiring a longer-term perspective to achieve significant gains. This diverse impact highlights the complexity of predicting the halving’s overall consequences.

Technical Aspects of the Halving

The Bitcoin halving is not a simple event; it’s a precise, coded adjustment to the Bitcoin protocol, implemented through a software update. This update alters a fundamental parameter governing Bitcoin’s issuance rate, impacting the reward miners receive for processing transactions and securing the network. The process requires careful coordination and testing to ensure the seamless continuation of the blockchain.

The halving is implemented by modifying the Bitcoin Core codebase. Specifically, the code that determines the block reward is altered. This reward, currently 6.25 BTC per block, is halved to 3.125 BTC after a predetermined number of blocks have been mined (approximately every four years). This change is not implemented through a “switch” but by adjusting a variable within the code that calculates the reward based on the block height. The update then needs to be adopted by a significant majority of nodes in the Bitcoin network for the change to take effect. Failure to adopt the update by a majority of nodes could lead to a chain split, a scenario that the Bitcoin community works diligently to prevent.

Bitcoin Code Changes for the Halving

The core change involves modifying the reward calculation function within the Bitcoin Core code. This function uses the block height to determine the current block reward. The halving is implemented by adding a conditional statement that checks the block height against a pre-defined threshold. Once the threshold is reached, the function outputs a halved reward. The code update also includes thorough testing and validation to ensure the integrity of the blockchain and to avoid unintended consequences. This process involves rigorous testing on testnets before deployment to the main network. Specific commits to the Bitcoin Core repository publicly document these changes, allowing for transparency and community review.

Miner Adaptation to Reduced Block Reward

The reduced block reward significantly impacts Bitcoin miners’ profitability. To compensate, miners typically adapt in several ways. They might upgrade their mining hardware to increase efficiency and hash rate, thus maintaining their share of the block reward. Alternatively, miners may consolidate operations, merging resources to increase their overall profitability. Some miners might choose to switch to more profitable cryptocurrencies, leading to a potential shift in the overall mining landscape. Historically, past halvings have led to a temporary decrease in mining profitability followed by a period of adjustment and adaptation. The long-term impact often depends on factors such as Bitcoin’s price and the overall mining difficulty. The 2012 and 2016 halvings, for example, both saw initial dips in miner profitability followed by significant price increases, making mining profitable again.

Comparison of Past and Anticipated 2025 Halving

| Aspect | 2012 Halving | 2016 Halving | Anticipated 2025 Halving |

|---|---|---|---|

| Block Reward Reduction | 50 BTC to 25 BTC | 25 BTC to 12.5 BTC | 12.5 BTC to 6.25 BTC |

| Mining Difficulty Adjustment | Gradual increase post-halving | Gradual increase post-halving | Anticipated gradual increase post-halving |

| Price Impact | Significant price increase in the following years | Significant price increase in the following years | Prediction varies widely; some anticipate a similar price increase, while others predict more muted effects depending on macroeconomic conditions. |

| Miner Adaptation | Hardware upgrades, consolidation | Hardware upgrades, consolidation | Expected similar adaptation strategies, potentially intensified due to increasing energy costs. |

The Halving’s Influence on Mining

The Bitcoin halving, a pre-programmed event reducing the block reward miners receive, significantly impacts the economics of Bitcoin mining. This event creates a ripple effect across the entire mining ecosystem, influencing profitability, hash rate, and the potential for centralization. Understanding these impacts is crucial for anyone involved in or observing the Bitcoin network.

The halving directly affects miner profitability by reducing their revenue stream. With fewer newly minted Bitcoins awarded per block, miners must rely more heavily on transaction fees to remain profitable. This necessitates a careful recalculation of operational costs, including electricity, hardware maintenance, and labor, against the reduced reward. Miners with high operational costs or inefficient hardware might find themselves forced to shut down operations or upgrade their equipment, leading to a period of adjustment and consolidation within the mining landscape.

Bitcoin Mining Profitability After Halving

The profitability of Bitcoin mining after a halving is complex and depends on several factors. The most significant factor is the Bitcoin price. A higher Bitcoin price can offset the reduced block reward, maintaining or even increasing profitability for miners. Conversely, a lower Bitcoin price can exacerbate the impact of the halving, leading to widespread losses and potentially a significant drop in the hash rate. Historically, the price of Bitcoin has tended to increase in anticipation of and following a halving, but this is not guaranteed. For example, the 2016 halving saw a price increase in the following year, while the 2020 halving resulted in a more gradual price increase over a longer period. This demonstrates the complexity of the interplay between the halving and market forces.

Hash Rate Changes Following a Halving

The Bitcoin hash rate, a measure of the total computational power securing the network, often experiences fluctuations following a halving. Initially, a decrease in the hash rate is possible as less profitable miners are forced to shut down. This is because the reduced block reward makes mining less economically viable for those operating at the margin. However, in the long term, the hash rate tends to recover and even increase. This is often driven by a combination of factors including the increasing Bitcoin price, the entry of more efficient miners, and the ongoing technological advancements in mining hardware. The 2020 halving, for instance, saw a temporary dip followed by a substantial recovery and a new all-time high in the hash rate.

Centralization of Bitcoin Mining

The halving can potentially influence the centralization of Bitcoin mining. As smaller, less efficient miners exit the market due to reduced profitability, larger, more established mining operations with economies of scale tend to gain a larger share of the network’s hash rate. This concentration of mining power in fewer hands raises concerns about the network’s security and decentralization. However, the extent of this centralization is debated. While some argue that it poses a risk, others point to the ongoing innovation in mining technology and the global distribution of mining operations as mitigating factors. The impact on centralization is ultimately a dynamic process influenced by multiple variables, including technological advancements, regulatory changes, and the price of Bitcoin.

Halving and Mining Difficulty Relationship

Imagine a graph with “Block Reward Halving Events” on the x-axis and “Mining Difficulty” on the y-axis. The graph would show a series of steps. Each step represents a halving event. After each halving, the y-axis value (mining difficulty) would gradually increase, though not necessarily immediately. The increase is because the Bitcoin network automatically adjusts the mining difficulty to maintain a consistent block generation time of approximately 10 minutes. Even though the reward per block is halved, the difficulty adjusts to ensure that the rate of block creation remains relatively stable. This means that although miners receive less reward, the computational effort required to mine a block also becomes more challenging. The graph would show a stair-step pattern, where each halving leads to a period of adjustment before the difficulty eventually rises again, reflecting the network’s self-regulating mechanism.

Frequently Asked Questions (FAQ)

This section addresses some of the most common questions surrounding the upcoming Bitcoin halving in 2025. Understanding these key aspects will help you navigate the potential market shifts and opportunities. We will delve into the mechanics of the halving, its historical impact on price, and the potential risks and rewards involved.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin. Essentially, the reward miners receive for verifying transactions and adding new blocks to the blockchain is cut in half. This controlled reduction in supply is a core component of Bitcoin’s deflationary monetary policy. For example, the initial block reward was 50 BTC, halved to 25 BTC, then 12.5 BTC, and will be reduced to 6.25 BTC in 2024.

The Precise Timing of the 2025 Bitcoin Halving

While the exact date and time cannot be known with absolute certainty until the block is mined, the 2025 Bitcoin halving is projected to occur sometime in the spring of 2025. The halving happens after a specific number of blocks are mined, not a fixed date. Therefore, slight variations are possible based on the mining difficulty and overall network hash rate. Predicting the precise moment requires monitoring the block creation rate leading up to the event.

Bitcoin Price Impact of the Halving

Historically, Bitcoin halvings have been followed by significant price increases. The first halving in 2012 saw a relatively modest price increase, while the subsequent halvings in 2016 and 2020 resulted in substantial price rallies in the months and years following the event. However, it’s crucial to understand that correlation does not equal causation. Other factors, such as market sentiment, regulatory changes, and macroeconomic conditions, significantly influence Bitcoin’s price. While past halvings offer some indication, predicting the exact price impact of the 2025 halving is impossible. The 2020 halving, for instance, was followed by a significant price surge, but the market also experienced considerable volatility before the price increase solidified.

Risks and Opportunities Associated with the Halving

The Bitcoin halving presents both opportunities and risks. A potential opportunity lies in the reduced supply, which could lead to increased price appreciation, benefiting long-term holders. However, a risk is the potential for increased price volatility in the period leading up to and following the halving, as investors speculate on its impact. Furthermore, the halving could impact the profitability of Bitcoin mining, potentially leading to consolidation within the mining industry. The potential for increased regulation or negative market sentiment also presents significant risks. For example, a significant negative macroeconomic event could outweigh the positive impact of the halving on Bitcoin’s price. Conversely, a sustained period of positive economic growth and increased adoption could amplify the positive effects of the halving.

Illustrative Example: Impact on Mining

The Bitcoin halving significantly impacts Bitcoin mining profitability. This is because the reward miners receive for successfully adding a block to the blockchain is cut in half. This reduction, coupled with fluctuating Bitcoin prices and electricity costs, creates a complex scenario for miners. The following table illustrates how different factors can influence profitability before and after the 2025 halving, providing a simplified model for understanding the potential consequences.

Mining Profitability Scenarios Before and After the 2025 Halving

The table below presents four hypothetical scenarios demonstrating the potential impact of the halving on mining profitability. It’s crucial to remember that these are simplified examples and real-world conditions are far more nuanced, influenced by hash rate, mining difficulty adjustments, and the efficiency of mining hardware. These factors are not explicitly included in this simplified model for clarity.

| Scenario | Electricity Cost (USD/kWh) | Bitcoin Price (USD) | Profitability (USD/day, estimated) |

|—|—|—|—|

| Scenario 1 (Pre-Halving, Favorable) | 0.10 | 40,000 | 100 |

| Scenario 2 (Pre-Halving, Unfavorable) | 0.15 | 30,000 | 20 |

| Scenario 3 (Post-Halving, Favorable) | 0.10 | 50,000 | 75 |

| Scenario 4 (Post-Halving, Unfavorable) | 0.15 | 35,000 | -10 |

Scenario 1 represents a favorable pre-halving situation with relatively low electricity costs and a high Bitcoin price, resulting in substantial daily profitability. Scenario 2 shows a less favorable pre-halving scenario with higher electricity costs and a lower Bitcoin price, leading to significantly reduced profitability. Scenario 3 illustrates a post-halving scenario where a higher Bitcoin price compensates for the halved block reward, maintaining reasonable profitability. Finally, Scenario 4 demonstrates the risk of unprofitability after the halving if electricity costs remain high and the Bitcoin price doesn’t increase sufficiently. This could lead to miners shutting down operations or switching to more energy-efficient hardware. The actual profitability will depend on many other factors, including the efficiency of the mining hardware, mining pool fees, and transaction fees.

Illustrative Example

Predicting Bitcoin’s price after a halving is notoriously difficult, as numerous factors influence the market. While no one can definitively state the future price, analyzing various predictions from different sources offers a glimpse into potential price trajectories. These predictions should be viewed with caution, as they are based on varying methodologies and assumptions.

Bitcoin Price Predictions Post-2025 Halving

The following table presents hypothetical price predictions for Bitcoin after the 2025 halving. It is crucial to understand that these are illustrative examples only, and the actual price will depend on a multitude of market forces. The methodologies used are simplified for illustrative purposes and may not fully reflect the complexity of real-world prediction models.

| Analyst/Source | Predicted Price (USD) | Timeframe | Methodology |

|—|—|—|—|

| Analyst A (Fictional) | $150,000 | 12 months post-halving | Stock-to-flow model adjusted for adoption rate and regulatory uncertainty. |

| Analyst B (Fictional) | $200,000 | 18 months post-halving | Combination of on-chain metrics, macroeconomic factors, and historical price action. |

| Research Firm X (Fictional) | $100,000 | 6 months post-halving | Focus on network activity and miner behavior. |

| Analyst C (Fictional) | $75,000 | 24 months post-halving | Conservative approach considering potential market corrections and regulatory risks. |