Frequently Asked Questions (FAQ)

The Bitcoin halving is a significant event in the cryptocurrency world, impacting the supply and potentially the price of Bitcoin. Understanding this event is crucial for anyone invested in or interested in Bitcoin’s future. This FAQ section addresses some of the most common questions surrounding the upcoming 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. Approximately every four years, the reward given to Bitcoin miners for verifying transactions on the blockchain is cut in half. This built-in deflationary mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time.

The Next Bitcoin Halving: Timing and Historical Context

The next Bitcoin halving is expected to occur in the spring of 2025. Bitcoin’s halving events have occurred at roughly four-year intervals since its inception. The first halving took place in November 2012, the second in July 2016, and the third in May 2020. Historically, these events have been followed by periods of increased Bitcoin price volatility, although the extent and duration of these price movements vary.

Impact of the Halving on Bitcoin’s Price

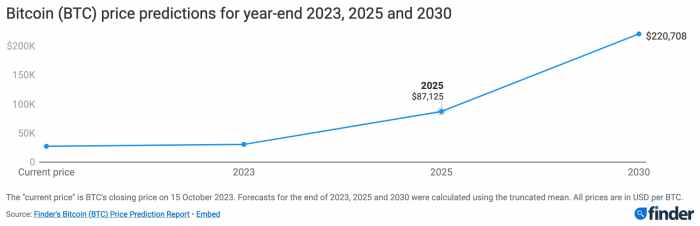

The halving’s effect on Bitcoin’s price is complex and not fully predictable. The reduced supply of newly mined Bitcoin can create upward price pressure due to increased scarcity. However, other market factors such as overall economic conditions, regulatory changes, and investor sentiment also play a significant role. Looking back, the 2012 halving was followed by a gradual price increase, the 2016 halving preceded a significant bull market, and the 2020 halving led to a period of price volatility before a substantial price surge. These examples demonstrate the potential for price appreciation, but also highlight the uncertainty involved.

Risks and Opportunities of the 2025 Halving

The 2025 halving presents both risks and opportunities. A potential risk is that the anticipated price increase may not materialize, or that the increase might be followed by a sharp correction. The market could also react negatively to unforeseen events or regulatory changes. Opportunities include the potential for significant price appreciation, leading to substantial returns for long-term holders. The reduced inflation rate might also increase Bitcoin’s appeal as a store of value.

Preparing for the 2025 Bitcoin Halving

Investors can adopt various strategies to prepare for the 2025 halving. These include dollar-cost averaging (DCA) to accumulate Bitcoin gradually over time, regardless of price fluctuations. Another strategy is to diversify investments across various asset classes, mitigating potential losses if the Bitcoin price fails to rise as anticipated. Thorough research and understanding of Bitcoin’s underlying technology and market dynamics are also essential. Finally, maintaining a long-term perspective and avoiding impulsive decisions based on short-term price movements is crucial.

Illustrative Examples: 2025 Bitcoin Halving

Understanding the historical trends and potential outcomes surrounding Bitcoin halvings is crucial for informed decision-making. The following examples offer insights into past cycles and potential investor strategies for the 2025 halving.

Historical Halving Metrics

This table compares key metrics across previous Bitcoin halving cycles. Note that these are approximations and the actual values may vary slightly depending on the data source. The post-halving price increase is not directly caused by the halving but rather reflects market dynamics influenced by the reduced supply.

| Halving Date | Pre-Halving Price (USD) (Approximate) | Post-Halving Price Peak (USD) (Approximate) | Hashrate (Pre-Halving) (Approximate EH/s) | Block Reward (BTC) |

|---|---|---|---|---|

| November 28, 2012 | $13 | $1,147 | 0.001 | 50 |

| July 9, 2016 | $650 | $20,000 | 1.5 | 25 |

| May 11, 2020 | $8,700 | $64,800 | 100 | 12.5 |

Visual Representation of Historical Price Movements

Imagine a line graph charting Bitcoin’s price over time. Each halving event is marked with a vertical dashed line. After each halving, the price initially shows a period of relative stability, followed by a period of significant upward movement, reaching a peak some time later. The graph would also depict periods of volatility and price corrections, indicating that the price increase is not linear and subject to market forces. The slope of the upward movement varies between halving cycles. The graph would illustrate that while a price increase typically follows a halving, the magnitude and timing are not predictable.

Investor Strategies and Potential Outcomes

Understanding various investor strategies and their potential outcomes is vital for navigating the market around a halving event. These strategies are not mutually exclusive and can be combined. Past performance is not indicative of future results.

- HODLing (Holding): This strategy involves buying Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. Potential outcomes include significant gains if the price appreciates, but also potential losses if the price decreases substantially. The longer the holding period, the greater the potential for gains or losses.

- Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of price. This mitigates the risk of investing a large sum at a market peak. Potential outcomes include a more stable average entry price and reduced emotional decision-making, but may result in lower overall gains if the price increases rapidly.

- Short-Term Trading: This involves attempting to profit from short-term price fluctuations. This strategy is highly risky and requires significant market knowledge and expertise. Potential outcomes range from substantial profits to significant losses depending on market timing and prediction accuracy.

The 2025 Bitcoin halving is a significant event expected to impact the cryptocurrency market. For businesses looking to capitalize on the increased interest and potential volatility, a robust online marketing strategy is crucial. Consider setting up a Google Ads Account to reach potential investors and traders actively searching for Bitcoin-related information. Effective advertising around the halving could significantly boost your reach and ultimately, your bottom line in this exciting period for Bitcoin.