Risks and Opportunities in Bitcoin Investment

Bitcoin, while offering potentially substantial returns, presents a unique set of risks and opportunities for investors. Understanding these aspects is crucial for making informed decisions and managing potential losses effectively. This section will delve into the inherent volatility of Bitcoin, explore strategies for risk mitigation, and highlight the long-term potential this cryptocurrency presents.

Inherent Risks of Bitcoin Investment

Investing in Bitcoin carries significant risks due to its inherent volatility and the relatively nascent nature of the cryptocurrency market. Price fluctuations can be dramatic, influenced by factors ranging from regulatory announcements to market sentiment and technological developments. These fluctuations can lead to substantial losses in a short period. Furthermore, the decentralized and unregulated nature of Bitcoin makes it susceptible to fraud, theft, and hacking. The lack of a central authority overseeing transactions means that recovering losses from these activities can be extremely difficult. Finally, the legal landscape surrounding Bitcoin is still evolving, and regulatory changes could significantly impact its value and accessibility.

Strategies for Mitigating Bitcoin Investment Risks

Several strategies can help mitigate the risks associated with Bitcoin investment. Diversification is paramount. Don’t invest all your capital in Bitcoin; spread your investments across different asset classes to reduce overall portfolio risk. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals regardless of price, helps reduce the impact of volatility. Only invest what you can afford to lose. This crucial principle emphasizes the importance of understanding that Bitcoin’s price can, and likely will, fluctuate significantly. Thorough research and due diligence are also essential. Understand the technology behind Bitcoin, the market dynamics, and the potential risks before investing. Finally, secure storage is critical. Use reputable hardware or software wallets to protect your Bitcoin from theft or hacking. Consider using multi-signature wallets for an added layer of security.

Long-Term Opportunities Presented by Bitcoin

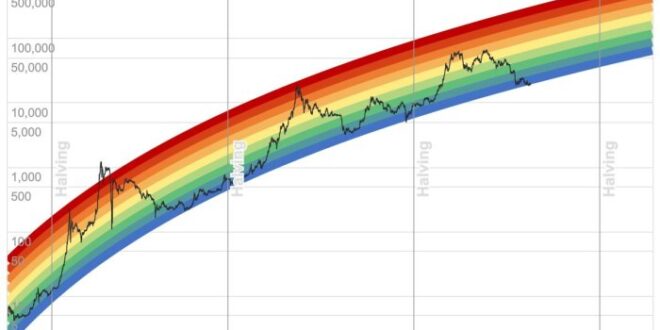

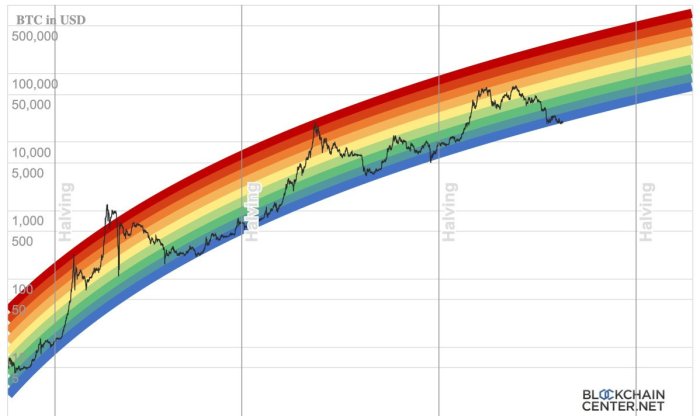

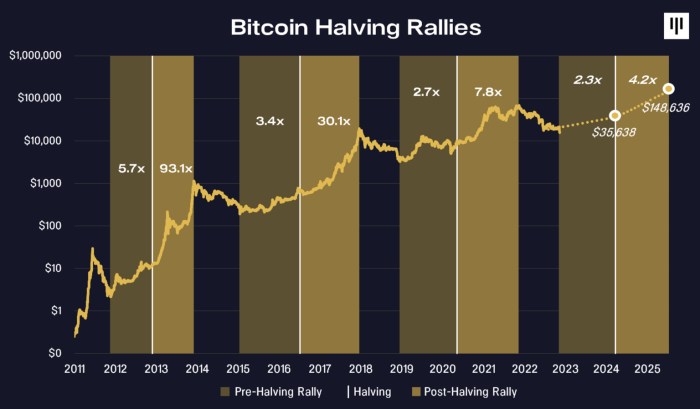

Despite the risks, Bitcoin presents compelling long-term opportunities. Its decentralized nature offers a potential hedge against inflation and traditional financial systems. As Bitcoin adoption increases globally, its value could appreciate significantly. Furthermore, the underlying blockchain technology powering Bitcoin has applications beyond cryptocurrency, with potential uses in supply chain management, digital identity, and other sectors. The limited supply of Bitcoin (21 million coins) could contribute to its scarcity value over time, potentially driving price appreciation. Consider the example of gold, a scarce resource whose value has historically held relatively steady over the long term. Bitcoin, with its inherent scarcity, could follow a similar trajectory, albeit with significantly higher volatility in the short term.

Comparing Bitcoin to Other Cryptocurrencies

Predicting the relative performance of Bitcoin against other leading cryptocurrencies in 2025 is inherently speculative, as the cryptocurrency market is highly volatile and influenced by numerous unpredictable factors. However, by analyzing current trends and technological advancements, we can make informed comparisons and explore potential scenarios.

While Bitcoin maintains its position as the dominant cryptocurrency by market capitalization, the potential for altcoins to outperform Bitcoin in specific periods remains a significant factor. This stems from several key differences in their underlying technologies, market dynamics, and overall adoption rates.

Bitcoin’s Projected Price Performance Compared to Other Leading Cryptocurrencies

Several factors contribute to Bitcoin’s projected price. Its established network effect, brand recognition, and first-mover advantage provide a strong foundation. However, the potential for increased regulatory scrutiny and the emergence of more scalable and efficient alternatives could impact its price trajectory. For example, Ethereum, with its smart contract capabilities and burgeoning DeFi ecosystem, may experience periods of higher growth, potentially outpacing Bitcoin’s gains. Similarly, other cryptocurrencies focusing on specific niches, like privacy coins or those with enhanced scalability solutions, could see significant price appreciation based on market demand and technological adoption. Predicting exact price ratios is impossible, but scenarios where altcoins temporarily outperform Bitcoin are plausible. For instance, a hypothetical scenario could see Ethereum’s price increase by 500% while Bitcoin increases by 300% in a given year, reflecting market preferences and technological advancements.

Potential for Altcoins to Outpace Bitcoin’s Growth, Bitcoin Price Analysis 2025

The potential for altcoins to surpass Bitcoin’s growth is linked to several factors. First, many altcoins offer innovative technologies addressing Bitcoin’s limitations, such as scalability and transaction speed. Second, the altcoin market is characterized by greater volatility, which, while risky, also presents opportunities for significant gains. Third, the emergence of new use cases and decentralized applications (dApps) built on altcoin platforms can drive demand and price appreciation. For example, the rise of decentralized finance (DeFi) has fueled the growth of Ethereum and other platforms supporting smart contracts. However, it’s crucial to remember that this increased volatility also carries substantially higher risk. A sudden market shift could lead to significant losses in altcoin investments.

Key Differences in Underlying Technologies and Market Dynamics

Bitcoin and other cryptocurrencies differ significantly in their underlying technologies and market dynamics. Bitcoin utilizes a proof-of-work consensus mechanism, known for its security but limited scalability. Many altcoins employ alternative consensus mechanisms, such as proof-of-stake, aiming for improved efficiency and reduced energy consumption. Furthermore, Bitcoin’s limited supply of 21 million coins contributes to its perceived scarcity and potential for long-term price appreciation. However, many altcoins have larger or even unlimited supplies, impacting their potential for price appreciation. Market dynamics also vary. Bitcoin benefits from widespread recognition and adoption, while altcoins often target specific niches or user bases. This creates different market sensitivities and growth potentials. For instance, a cryptocurrency focusing on privacy might experience heightened demand during periods of increased regulatory uncertainty, while Bitcoin’s price may be more influenced by broader macroeconomic factors.

Bitcoin’s Role in the Future of Finance

Bitcoin’s emergence has sparked a fundamental reassessment of traditional financial systems. Its decentralized nature and cryptographic security challenge established norms, offering a potential path towards a more inclusive and transparent financial landscape. This section will explore Bitcoin’s disruptive potential and its evolving role within the broader context of decentralized finance (DeFi).

Bitcoin’s potential to disrupt traditional financial systems stems from its core design principles. Unlike fiat currencies controlled by central banks, Bitcoin operates on a distributed ledger technology (blockchain), making it resistant to censorship and single points of failure. This inherent resilience could empower individuals and businesses by reducing reliance on intermediaries like banks and payment processors, potentially lowering transaction costs and increasing financial accessibility, especially in regions with underdeveloped banking infrastructure. For example, the ability to send Bitcoin across borders without significant delays or fees offers a compelling alternative to traditional international remittance systems.

Bitcoin’s Role in Decentralized Finance (DeFi)

Bitcoin, while not a DeFi protocol itself, serves as a foundational asset within the DeFi ecosystem. Its inherent scarcity and established market capitalization provide a degree of stability and trust, attracting users and developers to build DeFi applications around it. Bitcoin’s integration with DeFi protocols allows for various applications, including lending, borrowing, and yield farming. For instance, Bitcoin can be wrapped into tokens like wBTC, allowing it to be used within Ethereum-based DeFi platforms, thereby expanding its utility and participation in the broader decentralized finance ecosystem. This interoperability is key to the expansion of Bitcoin’s utility beyond its original purpose as a peer-to-peer electronic cash system.

Bitcoin’s Long-Term Impact on the Global Financial Landscape

Predicting Bitcoin’s long-term impact is inherently speculative, but several scenarios are plausible. One possibility is widespread adoption as a store of value, akin to gold, reducing reliance on volatile fiat currencies and providing a hedge against inflation. This could lead to significant shifts in global monetary policy and potentially challenge the dominance of the US dollar as the world’s reserve currency. Alternatively, Bitcoin could become more integrated into everyday transactions, facilitating cross-border payments and microtransactions, ultimately reshaping the landscape of global commerce. However, significant regulatory hurdles and technological challenges remain, making it unlikely that Bitcoin will completely replace traditional financial systems in the foreseeable future. The ongoing evolution of Bitcoin’s technology and its integration into the wider financial ecosystem will play a crucial role in determining its ultimate impact. A real-life example of Bitcoin’s growing influence can be seen in the increasing number of institutional investors allocating a portion of their portfolios to Bitcoin, signifying a growing acceptance of Bitcoin as a legitimate asset class.

Frequently Asked Questions (FAQ): Bitcoin Price Analysis 2025

This section addresses some of the most common questions surrounding Bitcoin’s price and investment potential, aiming to provide clarity and inform potential investors. Understanding these factors is crucial for making well-informed decisions in the volatile cryptocurrency market.

Main Factors Driving Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors, making it notoriously difficult to predict with certainty. Supply and demand dynamics play a significant role, with increased demand leading to higher prices and vice versa. Regulatory announcements from governments worldwide can also have a substantial impact, as can major technological advancements or adoption by large institutions. Market sentiment, driven by news events, social media trends, and overall investor confidence, is another key driver. Finally, macroeconomic conditions, such as inflation rates and global economic stability, can influence investor appetite for riskier assets like Bitcoin. For example, periods of high inflation often see increased interest in Bitcoin as a hedge against inflation, driving up its price.

Bitcoin as an Investment for 2025

Predicting Bitcoin’s price in 2025 is speculative, but assessing its potential involves weighing both advantages and disadvantages. On the positive side, Bitcoin’s decentralized nature and limited supply offer potential for long-term growth, especially if widespread adoption continues. Its established position as the leading cryptocurrency also provides a degree of stability compared to newer, less-tested alternatives. However, Bitcoin’s extreme volatility presents a significant risk. Sharp price swings are common, and substantial losses are possible. Furthermore, the regulatory landscape remains uncertain, and government actions could negatively impact its value. The success of Bitcoin as an investment in 2025 hinges on various factors, including global economic conditions, technological developments, and regulatory clarity. Considering the inherent risks and potential rewards is crucial for any investment strategy.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries inherent risks. Price volatility is paramount, with significant price swings occurring frequently. This volatility can lead to substantial losses in a short period. Security risks are also a concern, with the potential for hacking and theft from exchanges or personal wallets. Regulatory uncertainty adds another layer of risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. This uncertainty could lead to restrictions or bans that negatively impact Bitcoin’s value. Finally, the speculative nature of Bitcoin means its price is largely driven by market sentiment and can be susceptible to manipulation. The lack of intrinsic value, unlike traditional assets like gold or real estate, also contributes to its risk profile.

Protecting Against Bitcoin Price Volatility

Managing the risk associated with Bitcoin’s volatility requires a multi-faceted approach. Diversification is key; don’t put all your investment eggs in one basket. Allocate only a portion of your investment portfolio to Bitcoin, balancing it with other assets like stocks, bonds, or real estate. Dollar-cost averaging is another effective strategy. Instead of investing a lump sum, invest smaller amounts regularly over time, reducing the impact of any single price fluctuation. Furthermore, secure storage is crucial. Use reputable hardware wallets or cold storage solutions to protect your Bitcoin from theft or hacking. Finally, staying informed about market trends and regulatory developments can help you make more informed decisions and mitigate some of the risks. Remember, thorough research and a well-defined risk tolerance are essential before investing in Bitcoin.

Illustrative Scenarios

Predicting the price of Bitcoin in 2025 is inherently speculative, given the volatile nature of the cryptocurrency market. However, by considering various macroeconomic factors, technological advancements, and regulatory changes, we can construct plausible scenarios. These scenarios are not predictions, but rather illustrative examples of potential price movements based on different market conditions.

The following three scenarios—bullish, bearish, and neutral—explore potential paths for Bitcoin’s price trajectory in 2025. Each scenario Artikels the key factors driving the price movement and provides a descriptive representation of the overall market sentiment.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario envisions a significantly positive outlook for Bitcoin in 2025, driven by widespread adoption and positive regulatory developments.

- Widespread Institutional Adoption: Major financial institutions increasingly integrate Bitcoin into their investment strategies, leading to substantial demand.

- Positive Regulatory Landscape: Governments globally adopt more favorable regulatory frameworks for cryptocurrencies, reducing uncertainty and fostering growth.

- Technological Advancements: Significant upgrades to the Bitcoin network, such as the Lightning Network’s widespread adoption, improve scalability and transaction speeds, attracting a wider user base.

- Global Macroeconomic Instability: Continued global economic uncertainty drives investors towards Bitcoin as a safe-haven asset.

Illustrative Representation: A vibrant, upward-trending graph, showcasing exponential growth, with a backdrop of positive news headlines and images representing institutional adoption and technological advancements. The overall tone is optimistic and confident, representing a strong bull market. The price could reach levels exceeding $200,000, perhaps even surpassing $300,000, mirroring the rapid growth experienced in previous bull runs but on a larger scale, potentially exceeding the 2021 peak by a considerable margin.

Bearish Scenario: Bitcoin Experiences a Significant Correction

This scenario Artikels a less optimistic outlook, characterized by negative market sentiment and regulatory headwinds.

- Increased Regulatory Scrutiny: Governments worldwide implement stricter regulations, hindering Bitcoin’s growth and potentially leading to decreased trading volumes.

- Economic Recession: A global economic downturn reduces investor risk appetite, leading to a sell-off in riskier assets, including Bitcoin.

- Security Concerns: Major security breaches or hacks targeting Bitcoin exchanges or wallets erode investor confidence.

- Emergence of Competing Cryptocurrencies: New cryptocurrencies with superior technology or features attract investors away from Bitcoin.

Illustrative Representation: A sharply declining graph, depicting a significant price correction. The background features images of negative news headlines, regulatory restrictions, and depictions of market uncertainty. The overall mood is pessimistic and cautious, reflecting a bear market characterized by significant losses. The price might fall below $10,000, possibly even lower, reflecting a substantial drop from current levels and reminiscent of previous bear market corrections, but potentially more severe due to the factors mentioned.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario presents a more balanced perspective, suggesting a period of consolidation and moderate price appreciation.

- Gradual Institutional Adoption: Institutional adoption proceeds at a slower pace than in the bullish scenario, leading to moderate demand.

- Regulatory Uncertainty: Regulatory clarity remains elusive, creating uncertainty and limiting significant price movements.

- Technological Improvements: Technological advancements occur, but their impact on price is less dramatic than in the bullish scenario.

- Stable Macroeconomic Conditions: The global economy experiences moderate growth, with neither significant booms nor recessions.

Illustrative Representation: A relatively flat graph with moderate upward trends, punctuated by periods of consolidation. The background includes images representing a balance between positive and negative news, illustrating a market characterized by cautious optimism. The overall tone is neutral, representing a period of sideways trading and gradual price increases. The price might hover around the $30,000 – $50,000 range, showcasing a steady, albeit less dramatic, growth trajectory compared to the bullish scenario, but significantly higher than the bearish prediction. This reflects a scenario where Bitcoin maintains its position as a significant asset but without the explosive growth or sharp corrections seen in the other scenarios.