2025 Bitcoin Halving

The 2025 Bitcoin halving, scheduled for sometime in April, marks a significant event in the cryptocurrency’s lifecycle. This event, where the reward for Bitcoin miners is cut in half, has historically been associated with periods of significant price volatility and altered market sentiment. Understanding the historical impact and considering current economic factors is crucial for navigating the potential market shifts.

Historical Impact of Previous Halvings

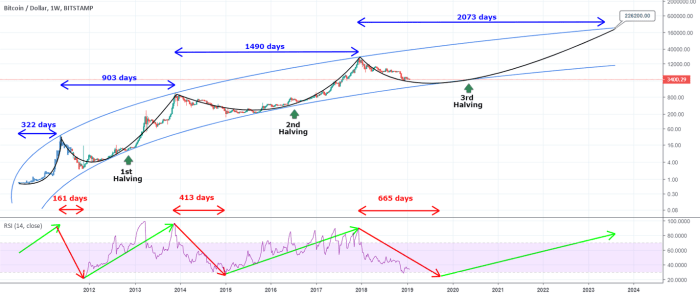

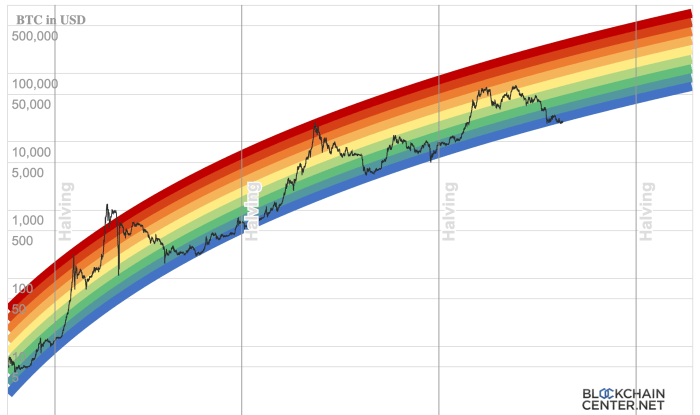

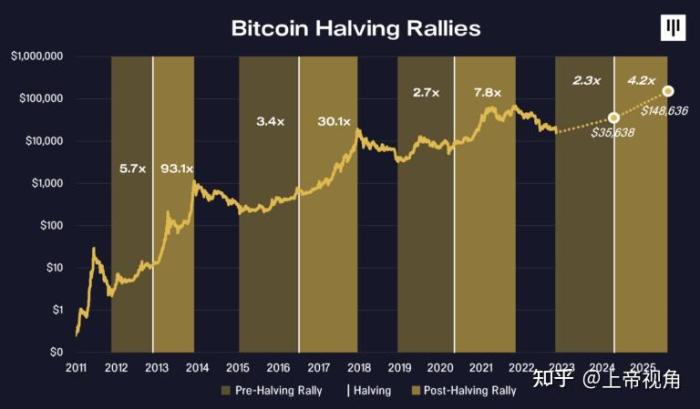

Previous Bitcoin halvings have demonstrated a correlation, though not a guaranteed causation, with subsequent price increases. The first halving in 2012 saw a relatively muted response, possibly due to the nascent nature of the Bitcoin market at the time. However, the 2016 halving preceded a substantial bull run, and the 2020 halving also led to a significant price surge, although the subsequent market behavior was complex and influenced by other factors. It’s important to note that while price increases followed these events, other macroeconomic factors and market speculation played a significant role in the overall price trajectory. The observed price movements after previous halvings should be viewed as historical context, not as a predictive model.

Economic Factors Influencing the 2025 Halving

Several economic factors could significantly influence the 2025 halving’s impact. Global macroeconomic conditions, including inflation rates, interest rate policies, and geopolitical events, will undoubtedly play a role. The regulatory landscape surrounding cryptocurrencies, particularly in major markets like the US and the EU, will also be a key determinant. Furthermore, the overall adoption rate of Bitcoin as a store of value, a medium of exchange, and an investment asset will shape market sentiment and price action. The level of institutional investment and the prevalence of retail investor participation will also contribute to the price dynamics post-halving. For example, a global recession could dampen the bullish effects of the halving, while strong regulatory clarity might encourage increased institutional investment.

Comparison of Market Conditions

Comparing the market conditions leading up to the 2025 halving with previous events reveals key differences. Unlike previous halvings, the 2025 event occurs within a landscape of increased regulatory scrutiny and a more mature cryptocurrency market. The overall market capitalization of cryptocurrencies is significantly higher now, suggesting a potentially larger impact from the halving. However, the current market is also characterized by greater volatility and uncertainty compared to the periods leading up to previous halvings. The increased institutional involvement adds another layer of complexity, as institutional investors may react differently to the halving than retail investors. For example, the increased regulatory uncertainty contrasts sharply with the relatively unregulated environment before the 2016 halving.

Potential Price Scenarios Post-Halving

Several price scenarios are plausible following the 2025 halving. A bullish scenario could see Bitcoin’s price significantly increase due to the reduced supply and increased demand. This scenario assumes continued adoption, positive regulatory developments, and overall positive macroeconomic conditions. A price surge similar to, or even exceeding, that seen after the 2020 halving is possible under this optimistic outlook. Conversely, a bearish scenario could see a relatively muted price response or even a price decline. This scenario considers factors such as negative macroeconomic conditions, increased regulatory pressure, or a general loss of investor confidence in the cryptocurrency market. A prolonged bear market, similar to the one experienced in 2022, could offset the positive impact of the halving. A more moderate scenario might involve a gradual price increase, reflecting a balance between the reduced supply and the prevailing market conditions. This would represent a less dramatic price movement compared to the previous bullish and bearish scenarios. Each scenario is contingent on a complex interplay of economic and market factors, making precise prediction challenging.

Mining Difficulty and Hash Rate Adjustments: 2025 Bitcoin Halving Prediction

The 2025 Bitcoin halving, reducing the block reward from 6.25 BTC to 3.125 BTC, will significantly impact the economics of Bitcoin mining. This change directly affects miner profitability, triggering adjustments in mining difficulty and potentially influencing the network’s overall hash rate. Understanding these dynamics is crucial for predicting the future trajectory of the Bitcoin price and network security.

The halving’s immediate effect is a decrease in the reward miners receive for successfully adding blocks to the blockchain. This reduction, if all other factors remain constant, would make mining less profitable. However, the Bitcoin network incorporates a self-regulating mechanism to maintain its operational efficiency.

Mining Difficulty Adjustment

Bitcoin’s mining difficulty adjusts approximately every two weeks to maintain a consistent block generation time of around 10 minutes. Following a halving, the reduced block reward initially lowers the profitability of mining. Consequently, less-profitable miners may exit the network, leading to a decrease in the overall hash rate. This reduction in hash rate will, in turn, cause the mining difficulty to decrease. The network automatically adjusts the difficulty downward to compensate for the reduced hash rate, ensuring that the block generation time remains relatively stable. The magnitude of this difficulty adjustment depends on the extent to which the hash rate decreases. For example, if the hash rate drops by 20%, the difficulty would also likely adjust downward to prevent excessively long block times.

Hash Rate Impact and Network Security

The halving’s impact on the Bitcoin network’s hash rate is complex and depends on several interacting factors. While a decrease in profitability might lead some miners to shut down their operations, it could also spur innovation and efficiency improvements. Miners might upgrade their equipment to lower their operating costs or seek out cheaper energy sources to remain competitive. Historically, Bitcoin’s hash rate has generally increased following previous halvings, despite the initial dip in profitability. This increase can be attributed to several factors, including the anticipation of future price increases, technological advancements in mining hardware, and the entry of new, more efficient miners into the network.

Historical Hash Rate Response and Future Trends

Examining the historical response of the hash rate to previous halvings provides valuable insights for predicting future trends. The 2012 and 2016 halvings both saw an initial drop in the hash rate followed by a significant rebound and subsequent growth. This pattern suggests that despite the immediate challenges posed by reduced profitability, the long-term outlook for the hash rate remains positive. However, it’s important to note that the future is not guaranteed to mirror the past. Factors such as regulatory changes, technological advancements, and overall market sentiment could all influence the hash rate’s response to the 2025 halving. For example, the increasing prevalence of environmentally friendly mining practices could affect the overall hash rate, as miners may need to adjust to new regulations or costs associated with sustainable energy sources. Similarly, technological advancements in mining hardware could lead to an unexpected increase in the hash rate, potentially offsetting the effects of the reduced block reward. The 2025 halving could thus lead to a unique pattern compared to the previous events, and close observation will be crucial.

Bitcoin Supply and Demand Dynamics

The 2025 Bitcoin halving will significantly impact the cryptocurrency’s supply and demand dynamics, potentially influencing its price trajectory. A reduced supply coupled with potentially increased demand could lead to price appreciation, but several factors will play a crucial role in determining the actual outcome.

The halving event, which reduces the rate at which new Bitcoins are mined, directly affects market scarcity. This reduction in supply, all else being equal, creates a tighter market, potentially increasing the value of each Bitcoin. However, the extent of this price increase will depend on the interplay between supply and demand. Historically, Bitcoin’s price has shown a tendency to rise following previous halving events, but this isn’t guaranteed.

Impact of Reduced Bitcoin Supply on Market Scarcity and Price

The halving cuts the rate of new Bitcoin issuance in half. This directly impacts the inflation rate of Bitcoin, making it a more deflationary asset. This decreased supply, combined with consistent or increasing demand, creates upward pressure on price. The degree of price increase will depend on several factors, including overall market sentiment, regulatory developments, and macroeconomic conditions. For example, the 2016 halving led to a significant price increase in the following year, while the 2020 halving saw a more gradual price appreciation. The impact on price in 2025 will depend on how these factors play out.

Investor Sentiment and Market Speculation’s Influence on Demand

Investor sentiment and market speculation are powerful drivers of Bitcoin’s price. Leading up to the halving, anticipation can fuel increased demand, driving the price higher. This is often driven by the expectation of future scarcity and potential price appreciation. However, if negative sentiment prevails, for instance due to broader market downturns or regulatory uncertainty, this could offset the positive impact of the reduced supply. Post-halving, the actual price movement will depend on whether the initial bullish sentiment is sustained or if profit-taking leads to price corrections. For example, the price surged significantly in the months leading up to the 2020 halving, but saw a period of consolidation and then a significant increase after the event.

Potential Impact of Institutional Investment on Bitcoin Price

Institutional investors, such as large corporations and investment funds, have increasingly shown interest in Bitcoin. Their participation can significantly influence the market. A continued influx of institutional investment after the 2025 halving could provide strong support for the price, absorbing sell-offs and potentially driving further price appreciation. Conversely, a decrease in institutional interest could put downward pressure on the price, counteracting the effects of reduced supply. For instance, the entry of MicroStrategy and Tesla into the Bitcoin market had a noticeable impact on its price.

Bitcoin Supply Before and After the 2025 Halving, 2025 Bitcoin Halving Prediction

The following table compares the Bitcoin supply before and after the 2025 halving, illustrating the change in the issuance rate. These figures are estimates and actual numbers may vary slightly.

| Date | Halving Event | Bitcoin Issued (per block) | Total Supply (approximate) |

|---|---|---|---|

| March 2024 (estimated) | Pre-Halving | 6.25 BTC | 21,000,000 – (approx. 20,990,000) |

| March 2025 (estimated) | Post-Halving | 3.125 BTC | 21,000,000 – (approx. 20,995,000) |

Regulatory Landscape and its Influence

The regulatory landscape surrounding Bitcoin and cryptocurrencies is rapidly evolving, presenting both opportunities and challenges for the market. The level of regulatory scrutiny and the specific approaches adopted by different governments will significantly impact Bitcoin’s price and overall adoption in 2025 and beyond. A clear understanding of these dynamics is crucial for navigating the complexities of the cryptocurrency market.

The potential impact of varying regulatory approaches on Bitcoin’s price is substantial. For example, widespread adoption and clear regulatory frameworks could foster investor confidence, leading to increased demand and price appreciation. Conversely, outright prohibition or overly restrictive regulations could stifle innovation, limit market access, and potentially depress prices. The interplay between regulatory certainty and market forces will be a defining factor in Bitcoin’s future trajectory.

Global Regulatory Approaches and Their Impact on Bitcoin Adoption

Different jurisdictions are adopting diverse approaches to regulating cryptocurrencies. Some countries, like El Salvador, have embraced Bitcoin as legal tender, while others maintain a more cautious or even hostile stance. The United States, for instance, is grappling with a patchwork of state and federal regulations, creating uncertainty for businesses operating in the cryptocurrency space. Conversely, countries like Singapore and Switzerland have adopted a more progressive approach, fostering innovation through clear regulatory frameworks that aim to balance risk mitigation with the promotion of technological advancement. This diversity in regulatory environments will likely influence the geographic distribution of Bitcoin adoption and its overall market valuation. The existence of more permissive regulatory frameworks could lead to a concentration of Bitcoin-related businesses and activity in those regions.

The Influence of Specific Regulations on Bitcoin’s Price

Specific regulatory actions, such as those targeting stablecoins or implementing new tax policies, can directly impact Bitcoin’s price. For example, stringent regulations on stablecoins, aimed at protecting consumers from risks associated with these instruments, could reduce their liquidity and indirectly affect the overall liquidity of the cryptocurrency market, potentially influencing Bitcoin’s price. Similarly, the implementation of clear and consistent tax policies regarding Bitcoin transactions could improve transparency and potentially increase investor confidence, leading to price appreciation. However, overly burdensome tax regimes could discourage investment and negatively affect the price. The case of the US’s evolving stance on cryptocurrency taxation provides a real-world example; shifts in policy have demonstrably affected market sentiment and short-term price fluctuations. The ongoing debate surrounding the classification of Bitcoin as a security, commodity, or currency further highlights the uncertainty and the potential for regulatory shifts to trigger significant market reactions.

Stablecoin Regulations and Their Impact

Regulations aimed at governing stablecoins are likely to have a ripple effect across the entire cryptocurrency market, including Bitcoin. Increased scrutiny of algorithmic stablecoins, for example, could lead to increased volatility in the broader market, impacting Bitcoin’s price. Conversely, regulations that promote transparency and stability in the stablecoin market could lead to increased confidence in the cryptocurrency ecosystem as a whole, potentially benefitting Bitcoin. The collapse of TerraUSD (UST) in 2022 serves as a stark reminder of the systemic risks associated with poorly regulated stablecoins and the potential for contagion effects across the market, underscoring the importance of robust regulatory frameworks.

Technological Advancements and Their Impact

The 2025 Bitcoin halving will undoubtedly be influenced by technological advancements within the Bitcoin ecosystem. These advancements have the potential to significantly alter Bitcoin’s price trajectory, adoption rate, and overall functionality. Several key areas warrant close examination.

Layer-2 Scaling Solutions and Their Effects on Transaction Fees and Network Congestion

The increasing popularity of Bitcoin has led to network congestion and higher transaction fees. Layer-2 scaling solutions, such as the Lightning Network, aim to alleviate these issues by processing transactions off-chain. This allows for faster and cheaper transactions while maintaining the security of the main Bitcoin blockchain. Successful implementation and widespread adoption of Layer-2 solutions could significantly boost Bitcoin’s usability, making it more attractive for everyday transactions and potentially driving up demand. For example, the Lightning Network’s capacity has steadily increased, demonstrating its potential to handle a significantly larger transaction volume than the base layer. Wider adoption could lead to lower fees and faster confirmation times, making Bitcoin more competitive with other payment systems.

Impact of Advancements in Mining Technology on Mining Profitability and Efficiency

Advancements in mining hardware, such as the development of more energy-efficient ASICs (Application-Specific Integrated Circuits), directly affect the profitability and efficiency of Bitcoin mining. More efficient miners can process transactions at a lower cost, potentially leading to increased competition and a decrease in the overall cost of mining. However, this also creates a cyclical effect: increased efficiency can lead to a higher hash rate, potentially increasing the difficulty and requiring even more powerful hardware to remain profitable. This dynamic interplay between technological advancements and market forces is crucial in shaping the long-term viability of Bitcoin mining. For instance, the introduction of the Antminer S19 series marked a significant leap in mining efficiency, leading to a period of increased competition and hash rate growth.

Development and Adoption of New Privacy-Enhancing Technologies and Their Influence on Bitcoin’s Price and Usage

Enhanced privacy features are increasingly important in the cryptocurrency space. Developments in privacy-enhancing technologies, such as CoinJoin protocols and shielded transactions, could significantly impact Bitcoin’s adoption. Increased privacy could attract users who are currently hesitant due to concerns about transaction transparency. However, the implementation of such technologies must be carefully balanced with the need for transparency and regulatory compliance. A successful implementation could increase the appeal of Bitcoin to a wider range of users, potentially leading to higher demand and price appreciation. The development of privacy coins, such as Monero, highlights the market demand for enhanced privacy features in cryptocurrencies, showcasing a potential path for Bitcoin’s future development.

Alternative Cryptocurrencies and Their Role

The 2025 Bitcoin halving will undoubtedly impact the broader cryptocurrency market, and understanding the potential interplay between Bitcoin and alternative cryptocurrencies (altcoins) is crucial for navigating this period. The performance of altcoins will be significantly influenced by factors such as Bitcoin’s price movement, overall market sentiment, and the specific technological advancements and use cases of individual altcoins. This analysis will explore the potential dynamics between Bitcoin and altcoins leading up to and following the halving event.

The potential performance of Bitcoin compared to leading altcoins around the 2025 halving is complex and depends on several interacting factors. Historically, Bitcoin’s price has tended to appreciate after a halving event, driven by the reduced inflation rate of new Bitcoin entering circulation. However, this doesn’t automatically translate to underperformance by altcoins. Some altcoins might experience significant growth during this period, particularly those offering innovative solutions or catering to niche markets not addressed by Bitcoin. For instance, altcoins focused on decentralized finance (DeFi), scalability solutions (like layer-2 protocols), or non-fungible tokens (NFTs) could potentially attract substantial investment, even as Bitcoin’s price increases. The relative performance will depend on the specific altcoin’s fundamentals, market adoption, and the broader macroeconomic climate.

Altcoin Performance and Bitcoin Dominance

Altcoin performance significantly impacts Bitcoin’s dominance in the cryptocurrency market. Bitcoin dominance refers to Bitcoin’s market capitalization as a percentage of the total cryptocurrency market capitalization. Strong altcoin performance typically correlates with a decrease in Bitcoin dominance, as investors diversify their portfolios into other projects. Conversely, if altcoins underperform, Bitcoin’s dominance tends to increase as investors seek the perceived safety and established market position of Bitcoin. For example, the 2017 bull market saw a significant rise in altcoin prices, leading to a substantial decrease in Bitcoin dominance. The subsequent bear market saw Bitcoin’s dominance rebound as investors gravitated towards the more established asset. The 2025 halving could trigger similar dynamics, depending on the market response to both Bitcoin’s price action and the performance of individual altcoins.

Altcoin Market Share Capture Potential

The potential for altcoins to capture market share from Bitcoin post-halving is a key area of speculation. While Bitcoin retains a significant first-mover advantage and brand recognition, the halving event might create an opportunity for altcoins to gain traction. If Bitcoin’s price increase is less pronounced than anticipated, or if a significant altcoin demonstrates superior utility or technological advancement, it could lead to a shift in investor sentiment and market share. The success of such a shift would depend on the altcoin’s ability to deliver on its promises and attract a substantial user base. Consider the example of Ethereum, which, despite Bitcoin’s dominance, has carved out a substantial market share due to its role in the DeFi ecosystem and smart contract functionality.

Investor Portfolio Allocation Dynamics

Investor portfolio allocation between Bitcoin and altcoins will likely shift in response to the 2025 halving. Leading up to the halving, some investors might adopt a “buy the dip” strategy, accumulating Bitcoin in anticipation of price appreciation post-halving. Others might diversify into altcoins, seeking higher potential returns, even if they entail higher risk. Post-halving, the allocation dynamics will depend on the actual price movements of both Bitcoin and altcoins. A strong Bitcoin price rally could see investors increase their Bitcoin holdings, while a period of altcoin outperformance might lead to a greater allocation towards alternative cryptocurrencies. This dynamic is further complicated by macroeconomic factors, regulatory changes, and overall market sentiment, making precise prediction challenging. For example, during periods of economic uncertainty, investors often gravitate towards perceived safe haven assets, which could increase Bitcoin’s share of portfolios.

Frequently Asked Questions (FAQs)

This section addresses some common questions regarding the upcoming 2025 Bitcoin halving, providing clarity on its mechanics, potential impact, and associated risks. Understanding these aspects is crucial for anyone interested in navigating the cryptocurrency market around this significant event.

Bitcoin Halving Mechanism and Supply Implications

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The reward given to miners for successfully adding a block to the blockchain is halved. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This reduction in the rate of new Bitcoin creation directly impacts the overall supply, making it a deflationary asset in the long run, as the maximum supply is capped at 21 million Bitcoins.

Expected Date and Time of the 2025 Bitcoin Halving

While the exact date and time of the 2025 halving cannot be definitively stated until the block is mined, it is anticipated to occur sometime in the spring or early summer of 2025. The halving is triggered by the mining of the 720,000th block, and the precise timing depends on the mining difficulty and overall network hash rate. Predicting the exact date requires real-time monitoring of the Bitcoin blockchain. Past halvings have provided a reasonable timeframe for estimating the next one, however.

Historical and Potential Future Effects on Bitcoin’s Price

Historically, Bitcoin’s price has exhibited upward trends following previous halving events. This is often attributed to the decreased supply of newly mined Bitcoin, potentially increasing scarcity and driving demand. The 2012 and 2016 halvings were followed by significant price increases, although the timeframes and magnitudes of these price movements varied. However, it’s crucial to remember that many other factors influence Bitcoin’s price, and past performance is not indicative of future results. The 2025 halving’s impact on price will depend on various market conditions, including overall economic sentiment, regulatory developments, and adoption rates.

Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin, particularly around a halving event, carries inherent risks. Increased volatility is expected in the period leading up to and following the halving due to heightened speculation and anticipation. Price fluctuations can be dramatic, leading to potential significant losses for investors. Furthermore, the cryptocurrency market is susceptible to manipulation, and the halving could be a target for market manipulation attempts. Regulatory uncertainty also poses a risk, as changes in regulations could negatively impact the price of Bitcoin. It is vital to conduct thorough research, understand the risks involved, and only invest what one can afford to lose.

2025 Bitcoin Halving Prediction – Predicting the market impact of the 2025 Bitcoin halving is a complex endeavor, with analysts offering diverse opinions on its potential effects. For a detailed Spanish-language analysis on the precise timing of this event, you might find the article, Cuando Termina El Halving De Bitcoin 2025 , helpful. Ultimately, the 2025 halving’s influence on Bitcoin’s price will depend on a confluence of factors beyond just the reduced block reward.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, with many analysts offering varied forecasts. Understanding the historical impact of previous halvings is crucial for informed speculation. For a detailed look at the upcoming event, you can consult this resource on the Next Halving Bitcoin 2025 , which provides valuable insights into potential market reactions.

Ultimately, the 2025 Bitcoin Halving Prediction remains a subject of ongoing discussion and analysis within the cryptocurrency community.

Predicting the market impact of the 2025 Bitcoin halving is a complex undertaking, with various analysts offering diverse perspectives. To stay abreast of the countdown and potentially better inform your predictions, consider checking the Halving Bitcoin 2025 Clock for a real-time view of the approaching event. This resource can aid in understanding the timeframe and potentially contribute to a more nuanced 2025 Bitcoin Halving Prediction.

The 2025 Bitcoin halving is a significant event predicted to impact the cryptocurrency’s price. Understanding the potential consequences requires considering various factors, including broader market trends. For a more focused perspective on the predicted price movements around that time, you might find the analysis at Bitcoin Prediction October 2025 helpful. Returning to the halving, its effects will likely ripple throughout the year, making October’s predictions particularly relevant to the overall 2025 forecast.

Predicting the precise market impact of the 2025 Bitcoin Halving is complex, with various analysts offering different perspectives. A key factor in these predictions is knowing the exact date, which you can find by checking this helpful resource: Que Dia Es El Halving De Bitcoin 2025. Understanding the timing allows for more accurate modeling of the potential price shifts following the halving event.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, with various analysts offering diverse perspectives. Understanding the implications requires looking ahead to future halvings; for insights into the subsequent halving events, you might find this resource helpful: Bitcoin Next Halving After 2025. Ultimately, the 2025 halving’s effect on Bitcoin’s price will depend on a multitude of market factors beyond just the reduced block reward.