Bitcoin Target Price Prediction 2025

Bitcoin, the world’s first and most well-known cryptocurrency, has captivated investors and technologists alike with its revolutionary potential. However, its journey has been anything but smooth, characterized by periods of explosive growth followed by dramatic crashes. Understanding price predictions, therefore, requires a careful examination of its volatile history and the inherent uncertainties of the cryptocurrency market. Accurately predicting Bitcoin’s price in 2025 is a challenging task, but analyzing past trends and market forces can offer some insight into potential scenarios.

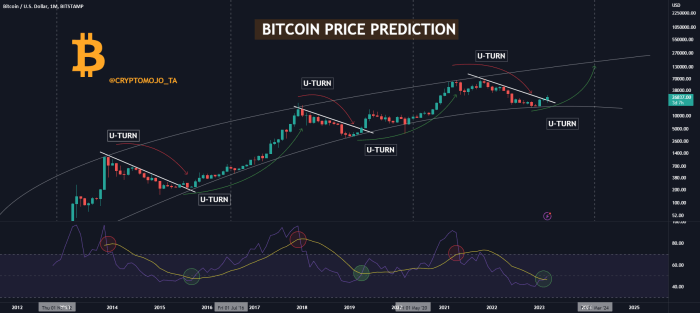

Bitcoin’s price history is a rollercoaster ride. From its humble beginnings in 2009, where a single Bitcoin was virtually worthless, its value has fluctuated wildly. Significant events such as the 2017 bull run, which saw Bitcoin reach nearly $20,000, and the subsequent crash in 2018, highlight the cryptocurrency’s inherent volatility. The 2021 bull run, pushing Bitcoin beyond $60,000, and the subsequent market correction in 2022 further emphasize this unpredictability. These fluctuations have been driven by a complex interplay of factors, including regulatory announcements, technological advancements, market sentiment, and macroeconomic conditions.

Factors Influencing Bitcoin Price Prediction

Predicting Bitcoin’s price in 2025 is fraught with uncertainty. Numerous factors, often interconnected and difficult to quantify, will influence its trajectory. These include technological advancements within the Bitcoin network (such as the Lightning Network improving transaction speeds), regulatory changes across different jurisdictions, the overall macroeconomic environment (including inflation rates and interest rates), and the evolving sentiment of both institutional and retail investors. For example, positive regulatory developments could lead to increased institutional adoption, driving up demand and price. Conversely, negative regulatory actions or a global economic downturn could trigger a significant price decline. The unpredictable nature of these factors makes precise price prediction exceptionally difficult. Any prediction should be considered a speculative estimate, not a guaranteed outcome. Past performance, while informative, is not indicative of future results.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of interacting factors. While no one can definitively state the price, understanding these influences offers a framework for informed speculation. The interplay between macroeconomic conditions, regulatory landscapes, technological advancements, market sentiment, and institutional adoption will significantly shape Bitcoin’s trajectory.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors exert a considerable influence on Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can make alternative investments more attractive, potentially drawing capital away from Bitcoin and depressing its price. Recessionary pressures, characterized by economic uncertainty and decreased investor confidence, may lead to a sell-off in risk assets like Bitcoin. The correlation between Bitcoin’s price and traditional markets, while not always consistent, remains a significant factor. For example, the 2022 bear market saw a significant decline in Bitcoin’s price alongside a broader market downturn.

Regulatory Changes and Governmental Policies

Governmental regulations and policies play a crucial role in shaping Bitcoin’s adoption and price. Favorable regulatory frameworks, such as clear guidelines on taxation and legal status, can encourage institutional investment and broader adoption, potentially driving up the price. Conversely, restrictive regulations or outright bans can stifle growth and suppress price. The varied regulatory approaches across different countries will continue to impact Bitcoin’s global accessibility and market capitalization. For instance, the varying regulatory stances of the US and China have historically impacted Bitcoin’s price.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem are vital for its long-term growth and price stability. Layer-2 scaling solutions, such as the Lightning Network, aim to increase transaction speed and reduce fees, enhancing Bitcoin’s usability and attracting a wider user base. Improvements in infrastructure, such as increased mining efficiency and enhanced wallet security, also contribute to a more robust and attractive network. These improvements can boost investor confidence and potentially increase demand. For example, the successful implementation and adoption of the Lightning Network could significantly impact transaction fees and potentially increase Bitcoin’s adoption rate.

Market Sentiment, Media Coverage, and Social Media Trends

Market sentiment, heavily influenced by media coverage and social media trends, significantly impacts Bitcoin’s price volatility. Positive news coverage and enthusiastic social media discussions can fuel price rallies, while negative news or FUD (fear, uncertainty, and doubt) can trigger sharp declines. The prevalence of “Bitcoin maximalists” versus proponents of alternative cryptocurrencies also influences market sentiment and price fluctuations. The 2017 Bitcoin bull run, fueled by widespread media attention and social media hype, serves as a prime example of the impact of positive sentiment.

Institutional Adoption and Corporate Investment

The growing adoption of Bitcoin by institutional investors and large corporations is a significant driver of its price. As institutional investors allocate a portion of their portfolios to Bitcoin, it adds legitimacy and stability to the market, reducing volatility and potentially increasing its long-term value. Companies holding Bitcoin on their balance sheets, such as MicroStrategy, demonstrate a growing acceptance of Bitcoin as an asset class. This trend suggests a shift towards Bitcoin as a mainstream investment option.

Competing Cryptocurrencies and Bitcoin’s Dominance, Bitcoin Target Price Prediction 2025

The emergence of competing cryptocurrencies presents both challenges and opportunities for Bitcoin. While alternative cryptocurrencies may attract investors away from Bitcoin, potentially impacting its dominance, they also contribute to the overall growth of the cryptocurrency market. The success of competing cryptocurrencies in specific niches could indirectly benefit Bitcoin by increasing awareness and adoption of blockchain technology. The ongoing competition will shape the cryptocurrency landscape and Bitcoin’s position within it, influencing its price and market share. The rise of Ethereum, for example, demonstrates the potential for alternative cryptocurrencies to carve out significant market share.

Different Price Prediction Models: Bitcoin Target Price Prediction 2025

Predicting Bitcoin’s future price is a complex endeavor, fraught with uncertainty. Numerous methodologies exist, each with its strengths and weaknesses, leading to a wide range of predictions. Understanding these different approaches is crucial for interpreting price forecasts and assessing their reliability. This section explores three primary model types: technical analysis, fundamental analysis, and statistical modeling.

Technical Analysis Models

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. It assumes that past market behavior is indicative of future behavior. This approach relies heavily on charts and indicators, ignoring fundamental factors like Bitcoin’s underlying technology or adoption rate.

Several technical indicators are commonly used, including moving averages (simple moving average, exponential moving average), relative strength index (RSI), and MACD (moving average convergence divergence). For example, a bullish crossover of a short-term moving average above a long-term moving average might signal an upward price trend. However, technical analysis is subjective; different analysts may interpret the same chart data differently. Its predictive power is also limited, as it doesn’t account for unexpected events like regulatory changes or major technological advancements.

Fundamental Analysis Models

Fundamental analysis assesses the intrinsic value of Bitcoin based on factors affecting its supply and demand. This involves considering the adoption rate by businesses and individuals, the security of the network, the development of related technologies, and regulatory landscapes. Unlike technical analysis, fundamental analysis aims to determine whether Bitcoin’s current price accurately reflects its underlying value.

A common approach is to compare Bitcoin’s market capitalization to other assets or to estimate its future value based on projected adoption rates and transaction volumes. For instance, analysts might project a future price based on a scenario where Bitcoin becomes a widely accepted global payment system. However, fundamental analysis relies on many assumptions about future adoption and technological developments, which are inherently uncertain. Predicting these factors accurately is challenging, limiting the precision of fundamental price predictions.

Statistical Modeling

Statistical modeling uses mathematical and statistical techniques to forecast Bitcoin’s price. These models may incorporate various factors, including historical price data, market sentiment, and macroeconomic indicators. Examples include time series models (ARIMA, GARCH), machine learning algorithms (neural networks, support vector machines), and econometric models. These models aim to identify relationships between different variables and extrapolate them to predict future prices.

For example, an ARIMA model could use past price data to predict future price movements based on identified patterns and trends. Machine learning algorithms can analyze vast datasets to identify complex relationships and make predictions. However, the accuracy of statistical models depends heavily on the quality and completeness of the data used and the assumptions made about the relationships between variables. Unexpected events can significantly impact the accuracy of these predictions. Furthermore, overfitting to historical data can lead to inaccurate forecasts.

Comparison of Price Prediction Models

The predictions made by different models often vary significantly, reflecting the limitations and assumptions inherent in each approach. Technical analysis may predict short-term price fluctuations, while fundamental analysis offers longer-term price targets based on underlying value assessments. Statistical models attempt to bridge the gap, incorporating both historical data and fundamental factors. Discrepancies arise due to different data sources, methodologies, and underlying assumptions. It’s crucial to consider the strengths and weaknesses of each approach before relying on any single prediction.

Summary of Models

| Model Name | Methodology | Example Prediction (Illustrative) | Limitations |

|---|---|---|---|

| Technical Analysis | Chart patterns, indicators (e.g., moving averages, RSI) | $100,000 by end of 2025 (based on a bullish head and shoulders pattern) | Subjective, ignores fundamentals, susceptible to market manipulation |

| Fundamental Analysis | Assessment of adoption rate, network security, regulatory environment | $250,000 by 2025 (based on projected adoption and scarcity) | Relies on uncertain future assumptions, difficult to quantify |

| Statistical Modeling (e.g., ARIMA) | Time series analysis, machine learning | $150,000 – $200,000 by 2025 (based on historical data and macroeconomic factors) | Data quality and model assumptions are crucial, susceptible to unexpected events |

Expert Opinions and Market Sentiment

Predicting Bitcoin’s price is inherently speculative, even for seasoned experts. However, analyzing the opinions of prominent figures in finance and the overall market sentiment provides valuable context for understanding potential price trajectories in 2025. These predictions are heavily influenced by various factors, including technological advancements, regulatory changes, and macroeconomic conditions.

Diverse expert opinions on Bitcoin’s future price in 2025 vary widely, reflecting the inherent uncertainty of the cryptocurrency market. Some analysts, basing their predictions on adoption rates and technological advancements, anticipate significantly higher prices, while others, emphasizing regulatory risks and market volatility, foresee more conservative growth or even potential price corrections. Understanding this spectrum of viewpoints is crucial for a balanced perspective.

Prominent Analyst Predictions

Several prominent financial analysts and Bitcoin experts have offered their predictions for Bitcoin’s price in 2025. These predictions, often published in reports or interviews, should be viewed as informed speculation rather than definitive forecasts. For example, some analysts have suggested price targets exceeding $100,000 based on factors such as increasing institutional adoption and the limited supply of Bitcoin. Conversely, others have offered more conservative estimates, citing potential regulatory headwinds or macroeconomic uncertainties as reasons for slower growth. These differing viewpoints highlight the challenges in accurately predicting Bitcoin’s future price. It is important to note that these predictions are not financial advice and individual investors should conduct their own thorough research before making any investment decisions.

Overall Market Sentiment

The overall market sentiment toward Bitcoin fluctuates significantly, influenced by factors such as news events, regulatory announcements, and macroeconomic conditions. Periods of positive sentiment often coincide with price increases, while negative sentiment can trigger price declines. Currently, the market sentiment shows a mixed picture, with some investors expressing optimism about Bitcoin’s long-term potential, while others remain cautious about its volatility and regulatory uncertainties. This dynamic interplay between optimism and caution shapes the overall market behavior and influences price movements. For instance, a major regulatory crackdown in a key market could trigger a negative sentiment shift, impacting price predictions.

Impact of Unforeseen Events

Unforeseen events, such as global economic crises, technological breakthroughs, or significant regulatory changes, can profoundly impact Bitcoin’s price and invalidate many existing predictions. A global recession, for example, could lead to a flight to safety, potentially impacting Bitcoin’s price negatively. Conversely, a major technological breakthrough in Bitcoin’s underlying technology could lead to increased adoption and a surge in price. The unpredictable nature of these events makes accurate long-term price forecasting extremely challenging. Consider, for example, the unexpected impact of the COVID-19 pandemic, which initially caused a significant market downturn but later contributed to a surge in Bitcoin’s price as investors sought alternative assets. The unpredictability of such events necessitates a cautious approach to any long-term price prediction.

Potential Scenarios for Bitcoin in 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively say where Bitcoin’s price will be in 2025, exploring plausible scenarios can provide a framework for understanding potential outcomes. The following Artikels three distinct scenarios – bullish, bearish, and neutral – each based on different underlying assumptions.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario envisions a significant surge in Bitcoin’s price, potentially exceeding previous all-time highs. This outcome hinges on several key factors: widespread institutional adoption, positive regulatory developments in major economies, increasing global macroeconomic uncertainty driving investors towards alternative assets, and continued technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s maturation and improved scalability solutions. For example, if major financial institutions increase their Bitcoin holdings significantly, and governments globally adopt more crypto-friendly regulations, this could lead to a massive influx of capital into the market, driving prices upwards. A price range of $150,000 to $250,000 or even higher is conceivable under this bullish scenario.

Bearish Scenario: Bitcoin Price Consolidation or Decline

Conversely, a bearish scenario suggests a period of price stagnation or even a decline in Bitcoin’s value. Several factors could contribute to this outcome. Increased regulatory scrutiny, leading to tighter controls and restrictions on cryptocurrency trading, could dampen investor enthusiasm. A global economic downturn or a major security breach impacting the Bitcoin network could also trigger a sell-off. Furthermore, the emergence of competing cryptocurrencies with superior technology or features could divert investor interest away from Bitcoin. In this bearish scenario, Bitcoin’s price might consolidate around its current price range or even fall to levels below $20,000, mirroring the price action seen during previous market corrections.

Neutral Scenario: Bitcoin Price Remains Relatively Stable

This scenario projects a relatively stable Bitcoin price throughout 2025, with moderate fluctuations around a central point. This outcome suggests a balance between positive and negative factors. While some positive developments, such as increased adoption in specific sectors, might drive prices upwards, other challenges, like regulatory uncertainty or macroeconomic headwinds, could prevent a major price surge. This scenario would likely see Bitcoin trading within a range of $30,000 to $70,000, experiencing periods of both growth and decline but ultimately remaining relatively stable compared to the bullish and bearish scenarios.

Visual Representation of Scenarios

The visual representation would be a line graph showing three distinct lines representing the price trajectory of Bitcoin under each scenario. The X-axis would represent time (throughout 2025), and the Y-axis would represent the Bitcoin price in USD. The bullish scenario line would show a steep upward trend, starting from a point reflecting the current price and rising significantly towards the projected high range. The bearish scenario line would exhibit a downward or flat trend, possibly dipping below the starting price. The neutral scenario line would remain relatively flat with moderate fluctuations within the projected range. The graph would clearly label each line, its corresponding scenario, and the projected price ranges for each. The overall visual would clearly demonstrate the contrasting price trajectories under each scenario.

Risks and Considerations

Investing in Bitcoin, like any other asset class, carries inherent risks. Predicting its future price with certainty is impossible, and significant financial losses are a possibility. Understanding these risks is crucial before committing any capital. The following sections detail key considerations for potential Bitcoin investors.

Market Volatility and Manipulation are Significant Risks. Bitcoin’s price is notoriously volatile, subject to dramatic swings in short periods. This volatility stems from several factors, including regulatory uncertainty, technological developments, and the influence of large investors (“whales”). The relatively small market capitalization compared to traditional asset classes amplifies these price fluctuations. The decentralized nature of Bitcoin, while a strength in some respects, also makes it susceptible to manipulation. Coordinated efforts by large holders to artificially inflate or deflate the price are a genuine concern, potentially leading to significant losses for smaller investors. The Mt. Gox exchange collapse in 2014, resulting from a combination of security breaches and potentially manipulative trading activity, serves as a stark reminder of these risks.

Market Volatility and Manipulation

Bitcoin’s price history demonstrates its susceptibility to dramatic price swings. For example, in 2021, Bitcoin experienced a rapid surge to nearly $65,000, followed by a significant correction. These large price movements can occur rapidly and unpredictably, impacting investors’ portfolios considerably. The potential for market manipulation, particularly by large investors (“whales”) who control significant portions of the market, adds another layer of risk. Their coordinated actions can influence price movements, potentially leading to sharp increases or decreases regardless of fundamental factors. Regulations aimed at mitigating market manipulation in traditional markets are less developed in the cryptocurrency space, leaving the market more vulnerable.

Research and Diversification

Thorough due diligence is paramount before investing in Bitcoin. Understanding the underlying technology, the regulatory landscape, and the inherent risks is crucial. Simply relying on price predictions without a comprehensive understanding of the asset is unwise. Diversification is also essential. Investing a significant portion of one’s portfolio in a single, volatile asset like Bitcoin is extremely risky. A diversified portfolio, including a mix of assets with varying levels of risk and correlation, can help mitigate losses and improve overall portfolio resilience. For example, an investor could allocate a small percentage of their portfolio to Bitcoin while maintaining the majority in more established asset classes like stocks and bonds. This strategy reduces the impact of any single asset’s underperformance on the overall portfolio.

Frequently Asked Questions (FAQ)

Predicting the future price of Bitcoin is inherently challenging due to the volatile nature of the cryptocurrency market and the numerous factors influencing its value. While precise predictions are impossible, we can explore likely price ranges and the factors contributing to price fluctuations. This FAQ section addresses common questions about Bitcoin’s price prediction for 2025 and related investment considerations.

Bitcoin’s Most Likely Price in 2025

Providing a single, definitive Bitcoin price for 2025 is unrealistic. The cryptocurrency market is susceptible to rapid and unpredictable shifts driven by technological advancements, regulatory changes, and overall market sentiment. Various prediction models suggest a wide range of potential outcomes, from significantly lower prices than today to substantially higher ones. For instance, some analysts might predict a price range between $100,000 and $200,000, while others might offer a more conservative estimate, or even a more bullish one, depending on their underlying assumptions and methodologies. The ultimate price will depend on the interplay of many unpredictable variables.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. They are based on complex models that often make simplifying assumptions about future events. These models can’t account for unexpected “black swan” events – unforeseen circumstances that drastically alter market dynamics. Furthermore, different prediction models employ different methodologies and assumptions, leading to widely varying outcomes. It’s crucial to treat all predictions with a healthy dose of skepticism and to understand the limitations of any forecasting method. Past performance is not indicative of future results. For example, a model predicting a price based on past growth rates might fail to account for a sudden regulatory crackdown or a major technological shift.

Factors Impacting Bitcoin’s Price in 2025

Several key factors could significantly influence Bitcoin’s price in 2025. These include:

- Regulatory Landscape: Increased regulatory clarity and acceptance could boost investor confidence, while stricter regulations could suppress price growth.

- Technological Advancements: Improvements in scalability, transaction speed, and security could drive adoption and increase value. Conversely, significant technological setbacks could negatively impact price.

- Adoption Rate: Widespread adoption by businesses and individuals is crucial for sustained price growth. Factors such as ease of use and merchant acceptance play a significant role.

- Macroeconomic Conditions: Global economic factors like inflation, interest rates, and recessionary pressures can significantly influence investor appetite for risky assets like Bitcoin.

- Market Sentiment and Speculation: Public perception and speculative trading can create significant price volatility, independent of underlying fundamentals.

Investing in Bitcoin: A Balanced Perspective

Investing in Bitcoin can offer significant potential rewards but also carries substantial risks. The high volatility makes it a risky investment, particularly for those with a low risk tolerance. On the other hand, the potential for high returns attracts investors seeking diversification beyond traditional markets. Before investing, it’s essential to understand the risks involved, diversify your portfolio, and only invest what you can afford to lose. Conduct thorough research and consider seeking advice from a qualified financial advisor.

Reliable Sources for Bitcoin Price Predictions

While no source offers perfectly accurate predictions, several reputable sources provide analysis and forecasts based on market data and expert opinions. These include established financial news outlets, cryptocurrency research firms, and independent analysts. However, it’s crucial to critically evaluate the information, considering the methodology, assumptions, and potential biases of each source. Never rely on a single source for investment decisions. Always cross-reference information from multiple reliable sources and conduct your own due diligence before making any investment choices.

Bitcoin Target Price Prediction 2025 – Predicting Bitcoin’s target price in 2025 involves considering various factors, including adoption rates and regulatory landscapes. To gain a broader perspective on long-term potential, it’s helpful to examine longer-term projections; for instance, you might find insights by checking out this analysis on What Will Bitcoin Price Be In 2030. Understanding these extended forecasts can inform more accurate 2025 price estimations, as they provide context for the overall trajectory of Bitcoin’s value.

Predicting Bitcoin’s target price in 2025 involves considering various factors, including technological advancements and regulatory changes. To gain a broader perspective on long-term potential, it’s helpful to consider projections further out, such as those found in this insightful article on the Bitcoin Price In 2030. Understanding these longer-term trends can inform more accurate predictions for Bitcoin’s target price in 2025, allowing for a more nuanced and comprehensive analysis.

Accurately predicting the Bitcoin target price for 2025 is challenging, depending on numerous factors influencing market dynamics. A comprehensive analysis requires considering various perspectives, including adoption rates and regulatory changes. For a detailed overview of potential price trajectories, you might find the information at Bitcoin Price 2025 Prediction helpful. Ultimately, Bitcoin Target Price Prediction 2025 remains a subject of ongoing discussion and speculation within the cryptocurrency community.

Predicting Bitcoin’s target price for 2025 involves considering various factors, including adoption rates and regulatory landscapes. A key resource for understanding potential price movements is a comprehensive analysis like the one provided by Bitcoin Price 2025 Prediction , which offers valuable insights into market trends. Ultimately, refining a Bitcoin Target Price Prediction 2025 requires a nuanced understanding of these market dynamics and future technological advancements.

Predicting Bitcoin’s target price for 2025 is challenging, dependent on numerous factors including regulatory landscape and adoption rates. A key element influencing this prediction is the potential impact of Bitcoin ETFs, which could significantly boost market interest. For a detailed analysis on this specific area, check out this resource on Bitcoin Etf Price Prediction 2025 , which can then help inform broader Bitcoin price projections for 2025.

Ultimately, both factors intertwine to shape the overall Bitcoin market outlook.