April 2025 Bitcoin Price Prediction

Predicting the price of Bitcoin in April 2025 is a daunting task, given its notoriously volatile nature. Bitcoin’s history is a rollercoaster of dramatic price swings, fueled by a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. Attempting any prediction requires a deep understanding of these influential forces, and even then, accuracy remains elusive. Any forecast should be viewed with considerable skepticism, recognizing the inherent uncertainty involved.

Bitcoin’s journey has been marked by periods of explosive growth and sharp corrections. Its early years saw a gradual rise from near zero to a few dollars, followed by a meteoric ascent to nearly $20,000 in late 2017, a surge driven by increased media attention and institutional interest. This was subsequently followed by a significant downturn, highlighting the market’s susceptibility to speculative bubbles and sudden shifts in investor confidence. Subsequent years have shown further volatility, with periods of strong growth interspersed with periods of consolidation and decline, influenced by factors such as halving events, regulatory announcements, and overall market sentiment. Understanding these historical fluctuations is crucial to contextualizing any future price prediction.

Factors Influencing Bitcoin’s Price

Several key factors contribute to Bitcoin’s price fluctuations. These include, but are not limited to, technological advancements within the Bitcoin network (such as the Lightning Network improving transaction speeds and scalability), regulatory developments and their impact on adoption and accessibility, macroeconomic conditions and their influence on risk appetite and investment flows, and the overall sentiment and narratives surrounding cryptocurrencies in the media and among investors. For example, positive regulatory announcements in major economies tend to boost Bitcoin’s price, while negative news or increased regulatory scrutiny can lead to sharp declines. Similarly, periods of economic uncertainty can drive investors towards Bitcoin as a potential safe haven asset, increasing its demand and consequently its price. Conversely, periods of economic stability might lead investors to seek higher returns in traditional markets, reducing Bitcoin’s appeal. The interplay of these factors creates a complex and dynamic environment, making precise price prediction incredibly challenging.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, requiring an understanding of intertwined macroeconomic, regulatory, technological, and market forces. While no one can definitively state the price, analyzing these key influences provides a framework for informed speculation.

Macroeconomic Factors

Macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, making traditional investments more attractive, could reduce Bitcoin’s appeal and exert downward pressure. Global economic growth, or a recession, also plays a crucial role; strong growth often correlates with increased risk appetite, potentially benefiting Bitcoin, while a recession might lead to investors liquidating assets, including Bitcoin. The interplay between inflation, interest rates, and global economic growth will be a major determinant of Bitcoin’s price trajectory in 2025. For example, the 2022 inflation surge saw increased Bitcoin adoption as a hedge, while subsequent interest rate hikes dampened enthusiasm.

Regulatory Developments and Government Policies

Government regulations and policies concerning cryptocurrencies will significantly shape Bitcoin’s future. Clear and favorable regulatory frameworks in major economies could boost institutional investment and mainstream adoption, leading to price appreciation. Conversely, restrictive regulations or outright bans could stifle growth and depress the price. The regulatory landscape is constantly evolving; the varying approaches taken by different governments (e.g., El Salvador’s adoption versus China’s ban) demonstrate the potential impact of policy decisions on Bitcoin’s price. The development of comprehensive, internationally coordinated regulatory frameworks would likely stabilize the market and foster growth, while inconsistent or hostile policies would create uncertainty and volatility.

Technological Advancements and Innovations

Technological advancements within the cryptocurrency space will also influence Bitcoin’s price. Improvements in scalability, transaction speed, and energy efficiency could increase Bitcoin’s utility and appeal, driving adoption and price. The development of layer-2 solutions, for example, addresses Bitcoin’s scalability limitations, making it more practical for everyday transactions. Conversely, the emergence of competing cryptocurrencies with superior technology could divert investment away from Bitcoin, potentially impacting its price negatively. The ongoing development of the Lightning Network, a layer-2 scaling solution for Bitcoin, exemplifies the potential for technological innovation to positively impact Bitcoin’s value.

Institutional Investor Adoption

The increasing involvement of institutional investors (such as hedge funds and corporations) in the Bitcoin market influences price stability. Large-scale institutional buying can create upward pressure on prices, while selling can lead to significant price drops. However, increased institutional participation often leads to greater market maturity and reduced volatility in the long run. The entry of companies like MicroStrategy and Tesla into the Bitcoin market illustrates the impact of institutional adoption. Their investments have, at times, significantly influenced Bitcoin’s price, but their long-term holdings suggest a belief in Bitcoin’s long-term value and a move towards greater market stability.

Supply and Demand Dynamics

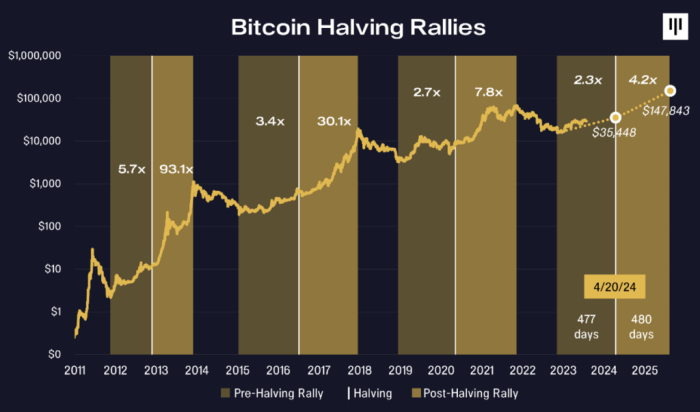

The fundamental principles of supply and demand remain central to Bitcoin’s price. Bitcoin’s fixed supply of 21 million coins creates inherent scarcity, potentially driving up its value over time, especially as demand increases. Increased demand from individual investors, institutions, or even governments could lead to significant price appreciation. Conversely, a decrease in demand, perhaps due to negative market sentiment or regulatory uncertainty, could depress the price. The halving events, which reduce the rate of Bitcoin mining, also impact supply, often leading to price increases in the past. This interplay between a limited supply and fluctuating demand is a primary driver of Bitcoin’s price fluctuations.

Analyzing Historical Price Trends and Patterns

Understanding Bitcoin’s past price movements is crucial for informed predictions about its future. Analyzing historical data allows us to identify recurring patterns, significant events impacting price, and the limitations of past predictions. This analysis helps contextualize future price forecasts, highlighting both potential upsides and the inherent volatility of the cryptocurrency market.

Bitcoin’s price history is characterized by periods of explosive growth followed by sharp corrections. These cycles are often driven by a combination of factors, including technological advancements, regulatory changes, macroeconomic conditions, and market sentiment. Examining these cycles helps us understand the underlying drivers of price volatility and potential future scenarios. Furthermore, comparing past predictions with actual outcomes illuminates the challenges of forecasting in this dynamic market.

Past Predictions and Their Accuracy

Numerous predictions regarding Bitcoin’s price have been made throughout its history, with varying degrees of accuracy. Many early predictions, often based on simplistic extrapolations of past growth, proved wildly inaccurate. For example, some analysts in 2017 predicted Bitcoin would reach $100,000 within a year, a prediction far exceeding the actual price. These inaccuracies stemmed from a failure to account for unforeseen events like regulatory crackdowns or market bubbles bursting. More sophisticated models, incorporating macroeconomic indicators and sentiment analysis, have shown improved accuracy but still remain prone to error given the inherent unpredictability of the market. For instance, predictions made during the 2018 bear market often underestimated the depth and duration of the correction. The discrepancy between predictions and reality highlights the complexity of Bitcoin’s price dynamics and the importance of considering a wide range of factors.

Key Price Milestones and Associated Events

| Date | Price (USD) | Event | Impact |

|---|---|---|---|

| January 2009 | ~$0 | Bitcoin Genesis Block | Marks the beginning of Bitcoin’s existence. |

| July 2010 | ~$0.003 | First real-world transaction (pizza purchase) | Symbolically demonstrated Bitcoin’s potential for exchange. |

| November 2013 | ~$1,100 | First major price surge | Increased mainstream awareness and attracted significant investment. |

| December 2017 | ~$19,783 | Peak of the 2017 bull market | Highlighted Bitcoin’s rapid price appreciation and widespread speculation. |

| December 2018 | ~$3,200 | Bottom of the 2018 bear market | Showcased the significant volatility and risk associated with Bitcoin investment. |

| December 2020 | ~$29,000 | Institutional adoption increasing | Significant institutional investment contributed to the price increase. |

| November 2021 | ~$68,789 | All-time high | Demonstrated continued growth despite regulatory uncertainty. |

Exploring Different Prediction Models: April 2025 Bitcoin Price Prediction

Predicting Bitcoin’s price, particularly for a date as far out as April 2025, is inherently challenging. No single model guarantees accuracy, and relying on a single approach is risky. Therefore, a multifaceted approach, incorporating several predictive models, offers a more robust and nuanced forecast. This section compares and contrasts three prominent methods: technical analysis, fundamental analysis, and quantitative models.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements. It assumes that past market behavior is indicative of future behavior. Chart patterns, such as head and shoulders, triangles, and flags, are analyzed alongside technical indicators like moving averages (e.g., 50-day, 200-day), Relative Strength Index (RSI), and MACD. These indicators provide signals about potential price reversals, overbought or oversold conditions, and momentum.

For predicting Bitcoin’s price in April 2025 using technical analysis, analysts would examine long-term charts, identifying major support and resistance levels. They would also analyze the overall trend (bullish or bearish) and look for potential breakout points from established patterns. For example, if a significant head and shoulders pattern forms, a bearish reversal might be predicted. However, the accuracy depends heavily on the analyst’s interpretation and the reliability of the historical data used. Limitations include the subjective nature of pattern recognition and the potential for false signals. The model’s effectiveness is also reduced in highly volatile markets, where price action can deviate significantly from established patterns.

Fundamental Analysis

Fundamental analysis assesses the intrinsic value of Bitcoin based on underlying factors influencing its demand and supply. These factors include adoption rates, regulatory changes, technological advancements (e.g., layer-2 scaling solutions), macroeconomic conditions (inflation, interest rates), and the overall sentiment within the cryptocurrency market. By evaluating these factors, fundamental analysts attempt to determine whether Bitcoin is overvalued or undervalued relative to its perceived worth.

Applying fundamental analysis to a 2025 prediction requires forecasting these influencing factors. For instance, widespread institutional adoption could significantly increase demand, pushing the price upwards. Conversely, stricter regulations could dampen investor enthusiasm and lead to lower prices. Predicting these future events with certainty is inherently difficult. The limitations stem from the difficulty in accurately forecasting future events and the complexity of disentangling the interplay of various factors. While fundamental analysis provides valuable context, translating qualitative factors into precise price predictions remains challenging.

Quantitative Models

Quantitative models employ mathematical and statistical techniques to analyze data and generate price predictions. These models can range from simple time series analysis (e.g., ARIMA models) to more sophisticated machine learning algorithms (e.g., neural networks, support vector machines). These models use historical price data, alongside other relevant variables identified through fundamental analysis, to build predictive models.

For a 2025 prediction, a quantitative model might incorporate historical price data, trading volume, social media sentiment, and macroeconomic indicators as input variables. The model would then be trained on historical data to identify patterns and relationships between these variables and Bitcoin’s price. The trained model could then be used to generate a price forecast for April 2025. The strengths of quantitative models lie in their ability to process large datasets and identify complex relationships that might be missed by human analysts. However, these models are only as good as the data they are trained on and their accuracy depends on the model’s ability to generalize to future, unseen data. Furthermore, the complexity of these models can make them difficult to interpret and validate. Overfitting (where the model performs well on training data but poorly on new data) is a significant risk.

Potential Price Scenarios for April 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic factors, and market sentiment. While no one can definitively say what the price will be, exploring potential scenarios based on different assumptions can provide valuable insight. The following Artikels three distinct scenarios for Bitcoin’s price in April 2025: a bullish, a bearish, and a neutral case. Each scenario considers various factors and their potential impact on the market.

Bullish Scenario: Bitcoin Price at $150,000

This scenario assumes widespread institutional adoption, continued technological advancements enhancing Bitcoin’s scalability and efficiency, and a generally positive macroeconomic environment. Positive regulatory developments, particularly in the US and other major economies, would further bolster investor confidence. A significant increase in the number of Bitcoin transactions, fueled by growing mainstream adoption and the emergence of innovative Bitcoin-based applications, is also assumed. This increased demand, coupled with a relatively stable supply, would drive the price upwards. For example, if Bitcoin successfully integrates with established financial systems, thereby enabling simpler and more widespread access, it could significantly impact the price. This scenario also assumes that a lack of major negative geopolitical events, such as a large-scale global conflict, prevents significant market volatility.

Bearish Scenario: Bitcoin Price at $30,000

This scenario envisions a less optimistic outlook. It assumes a tightening of regulatory restrictions globally, potentially impacting the accessibility and usability of Bitcoin. A significant macroeconomic downturn, such as a prolonged recession or a major financial crisis, could also lead to investors seeking safer assets, driving down Bitcoin’s price. Negative press or significant security breaches impacting the Bitcoin network could also erode investor confidence. Consider, for instance, the impact of a major regulatory crackdown on cryptocurrency exchanges, leading to decreased trading volume and liquidity. This scenario assumes a reduced demand for Bitcoin due to these factors, leading to a considerable price decline from current levels.

Neutral Scenario: Bitcoin Price at $75,000, April 2025 Bitcoin Price Prediction

This scenario represents a more balanced outlook, assuming a relatively stable macroeconomic environment with neither significant positive nor negative developments impacting the cryptocurrency market. Regulatory developments are expected to be neither overly restrictive nor particularly supportive. Technological advancements continue at a moderate pace, and institutional adoption progresses steadily but without the dramatic surge seen in the bullish scenario. Market sentiment remains relatively neutral, with neither widespread enthusiasm nor significant pessimism driving price movements. This scenario suggests a price that reflects a continuation of current market trends, with modest growth based on ongoing adoption and technological improvements, but without the extreme price fluctuations observed in the bullish and bearish scenarios.

April 2025 Bitcoin Price Prediction – Predicting the Bitcoin price in April 2025 is a complex endeavor, influenced by numerous factors. A key event impacting this prediction is the upcoming Bitcoin Halving Event in April 2025, as detailed in this informative article: Bitcoin Halving Event April 2025. This halving, reducing the rate of new Bitcoin creation, is generally expected to exert upward pressure on the price, although the extent of this effect remains a subject of ongoing debate among analysts.

Therefore, the April 2025 Bitcoin price will significantly depend on how the market reacts to this pivotal event.

Predicting the Bitcoin price in April 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. For insightful analysis on this crucial event, check out this resource on Bitcoin Halving Price Prediction 2025 to better understand its potential influence on the April 2025 Bitcoin price.

Ultimately, the April 2025 price will depend on a confluence of factors beyond just the halving.

Predicting the Bitcoin price in April 2025 is a complex undertaking, influenced by numerous factors. A key event to consider is the upcoming Bitcoin halving, significantly impacting the cryptocurrency’s supply. For a deeper dive into this pivotal event, check out this insightful resource on Halving. Bitcoin. 2025.

Understanding the halving’s potential effects is crucial for any accurate April 2025 Bitcoin price prediction.

Predicting the Bitcoin price in April 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the Bitcoin halving event, which significantly impacts the rate of new Bitcoin entering circulation. To understand its influence on the April 2025 price, it’s crucial to know precisely when the 2025 halving occurred; you can find that information here: When Was The 2025 Bitcoin Halving.

This date provides a crucial benchmark for assessing the potential impact on supply and, consequently, the predicted price in April 2025.

Predicting the Bitcoin price in April 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the Bitcoin halving event, which significantly impacts the rate of new Bitcoin entering circulation. To understand its influence on the April 2025 price, it’s crucial to know precisely when the 2025 halving occurred; you can find that information here: When Was The 2025 Bitcoin Halving.

This date provides a crucial benchmark for assessing the potential impact on supply and, consequently, the predicted price in April 2025.

Predicting the Bitcoin price in April 2025 is challenging, influenced by numerous factors. A key element to consider is the upcoming Bitcoin halving, and to keep track of the countdown, you can check out the Halving Bitcoin 2025 Clock. This event significantly impacts the supply of Bitcoin, potentially influencing its price trajectory in the months following April 2025.

Therefore, monitoring the halving’s approach is crucial for any serious April 2025 Bitcoin price prediction.