Bitcoin Price Prediction August 2025

Predicting the price of Bitcoin in August 2025 is inherently speculative, given the volatile nature of the cryptocurrency market. However, by analyzing current trends and potential future influences, we can Artikel three plausible scenarios: bullish, bearish, and neutral. These scenarios consider macroeconomic factors, regulatory developments, and technological advancements within the Bitcoin ecosystem.

Potential Price Scenarios for Bitcoin in August 2025

Three distinct scenarios illustrate the range of possible Bitcoin prices in August 2025. Each scenario considers different combinations of factors influencing Bitcoin’s value. These are simplified representations and the actual price could fall outside these ranges.

Bullish Scenario: Continued Adoption and Institutional Investment

A bullish scenario envisions widespread adoption of Bitcoin as a store of value and a medium of exchange. Increased institutional investment, coupled with positive macroeconomic conditions, could drive significant price appreciation. Factors contributing to this scenario include growing global acceptance of cryptocurrencies, successful integration of Bitcoin into traditional financial systems, and continued technological innovation within the Bitcoin network. For example, the successful development and adoption of the Lightning Network could significantly improve Bitcoin’s scalability and transaction speed, boosting its attractiveness to both individuals and institutions. In this scenario, we might see a price range between $150,000 and $250,000 per Bitcoin.

Bearish Scenario: Regulatory Crackdown and Macroeconomic Downturn

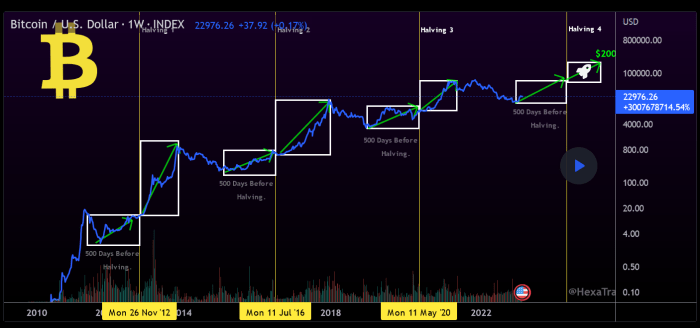

Conversely, a bearish scenario assumes increased regulatory scrutiny and a global economic downturn. Stringent regulations restricting Bitcoin’s use, coupled with a prolonged period of high inflation and interest rates, could significantly depress Bitcoin’s price. A major security breach impacting the Bitcoin network or a loss of confidence in the cryptocurrency market could also contribute to a bearish outcome. A scenario like this could see Bitcoin trading in the range of $20,000 to $40,000. This scenario is similar to the market downturn experienced in 2022, which saw a significant drop in Bitcoin’s value due to a combination of factors including increased regulatory uncertainty and macroeconomic instability.

Neutral Scenario: Consolidation and Gradual Growth

A neutral scenario suggests a period of consolidation and gradual price appreciation. This scenario assumes a balance between positive and negative influences. While there might be some regulatory hurdles and macroeconomic uncertainties, the overall adoption of Bitcoin continues at a moderate pace. Technological advancements contribute to the improvement of the network, but without causing a dramatic shift in market sentiment. In this case, the price might range from $50,000 to $100,000 per Bitcoin. This scenario mirrors periods of relative stability observed in Bitcoin’s price history, where gradual growth is interspersed with periods of sideways trading.

Impact of Macroeconomic Factors on Bitcoin Price Scenarios

Macroeconomic factors, such as inflation and interest rates, significantly influence all three scenarios. High inflation could drive investors towards Bitcoin as a hedge against inflation, bolstering a bullish or neutral scenario. Conversely, high interest rates could divert investment away from riskier assets like Bitcoin, potentially leading to a bearish outcome. Low inflation and stable interest rates would likely favor a neutral scenario.

Influence of Regulatory Changes on Bitcoin’s Price

Regulatory changes across different jurisdictions will profoundly impact Bitcoin’s price. Favorable regulations, such as clear guidelines and licensing frameworks, could boost investor confidence and drive a bullish outcome. Conversely, stringent regulations or outright bans could trigger a bearish market response. A patchwork of inconsistent regulations across various countries could lead to a more neutral scenario, with price movements driven primarily by other factors. For instance, the implementation of clear regulatory frameworks in major economies like the US and EU could positively influence investor sentiment, while restrictive measures in other regions could lead to localized price fluctuations.

Comparison of Price Scenarios

| Scenario | Predicted Price Range (USD) | Supporting Factors | Potential Risks |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread adoption, institutional investment, positive macroeconomic conditions, technological advancements | Overvaluation, regulatory crackdowns, market manipulation |

| Bearish | $20,000 – $40,000 | Regulatory crackdowns, macroeconomic downturn, loss of investor confidence, security breaches | Prolonged bear market, significant capital loss |

| Neutral | $50,000 – $100,000 | Moderate adoption, gradual technological improvements, balanced macroeconomic conditions | Stagnation, missed opportunities for growth |

Factors Influencing Bitcoin’s Value in 2025

Predicting Bitcoin’s price is inherently complex, influenced by a confluence of economic, technological, and regulatory factors. By August 2025, several key elements will likely shape its value, impacting both its adoption rate and market capitalization. Understanding these factors is crucial for navigating the evolving cryptocurrency landscape.

Technological Advancements and Bitcoin Adoption

Layer-2 scaling solutions, such as the Lightning Network, are designed to address Bitcoin’s scalability limitations. These technologies aim to significantly increase transaction speeds and reduce fees, making Bitcoin more practical for everyday use. Wider adoption of Layer-2 solutions could lead to increased transaction volume and a surge in demand, potentially driving up Bitcoin’s price. For example, if the Lightning Network achieves widespread integration, allowing for near-instantaneous and low-cost transactions, it could unlock Bitcoin’s potential as a daily payment system, boosting its price significantly. Conversely, a failure to overcome scalability issues could hinder adoption and negatively impact its value.

Institutional Adoption and Investment

The level of institutional involvement in Bitcoin will be a major determinant of its price in 2025. Continued investment from large corporations, hedge funds, and other institutional players will likely provide significant price support. For instance, if major financial institutions continue to allocate a portion of their assets to Bitcoin, bolstering its legitimacy and market depth, the price is expected to rise. Conversely, a significant pullback of institutional investment could trigger a price correction. The growing acceptance of Bitcoin as a legitimate asset class by institutional investors is a key factor in its long-term growth.

Bitcoin’s Scarcity and Inflation Hedge

Bitcoin’s fixed supply of 21 million coins is a fundamental aspect of its value proposition. This inherent scarcity contrasts sharply with traditional fiat currencies, which are subject to inflationary pressures. As global inflation persists or worsens, Bitcoin’s scarcity could become increasingly attractive to investors seeking to preserve their purchasing power. This could drive demand and push the price upward. The historical correlation between periods of high inflation and Bitcoin’s price appreciation supports this thesis. For example, during periods of high inflation in various countries, Bitcoin has often seen increased investment, showcasing its potential as a hedge.

Regulatory Landscape and Governmental Actions

The regulatory environment surrounding Bitcoin will significantly impact its price trajectory. Favorable regulations in major economies could foster greater adoption and investment, while restrictive policies could stifle growth. Clear and consistent regulatory frameworks can increase investor confidence and attract mainstream adoption. Conversely, uncertainty or unfavorable regulations could lead to decreased investment and price volatility. The regulatory landscape will be a key battleground, shaping the future of Bitcoin’s market access and acceptance.

Market Sentiment and Public Perception

Public perception and market sentiment play a crucial role in determining Bitcoin’s price. Positive news coverage, technological breakthroughs, and increased mainstream adoption can fuel investor enthusiasm, leading to price increases. Conversely, negative news, security breaches, or regulatory crackdowns can trigger sell-offs and price declines. Maintaining a positive narrative and addressing any concerns about security and scalability will be vital in maintaining positive market sentiment. Major events, such as successful large-scale adoption by a major corporation or positive regulatory decisions, can dramatically alter public perception and impact price.

Bitcoin Adoption and Market Trends by August 2025

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and considering potential catalysts, we can formulate a plausible scenario for Bitcoin adoption and market trends by August 2025. This projection will consider institutional investment, regulatory developments, and the broader macroeconomic climate.

Bitcoin Adoption Among Individuals and Institutions

By August 2025, we can anticipate a significant increase in Bitcoin adoption, although widespread mainstream acceptance remains uncertain. Institutional adoption is likely to be a key driver. Several large financial institutions have already begun exploring Bitcoin as an asset class, and this trend is expected to continue, fueled by the potential for diversification and higher returns. However, regulatory clarity remains a crucial factor; more favorable regulations will accelerate adoption, while stricter rules could hinder growth. Individual adoption will likely increase, but at a potentially slower pace than institutional adoption. This is due to factors such as education and awareness, along with continued volatility in the cryptocurrency market. The growth will be fueled by increasing accessibility through user-friendly platforms and continued media coverage, although widespread adoption among the general population may lag behind institutional investors. We can expect a scenario similar to the early days of the internet; while some individuals and businesses embrace the technology, the mass adoption curve may be more gradual. For example, the early adoption of PayPal demonstrates a similar pattern, with initial hesitancy eventually giving way to widespread use.

Potential Market Trends

Several market trends could significantly impact Bitcoin’s trajectory by August 2025. The emergence of new cryptocurrencies, particularly those with innovative technological advancements or stronger regulatory support, could pose a challenge to Bitcoin’s dominance. However, Bitcoin’s first-mover advantage and established network effect provide a considerable barrier to entry for competitors. Investor sentiment will remain a significant factor; positive news and market performance tend to attract investment, while negative news or regulatory uncertainty can lead to sell-offs. Macroeconomic factors, such as inflation and interest rates, will also play a crucial role, potentially impacting the overall demand for Bitcoin as a store of value or hedge against inflation. The rise of decentralized finance (DeFi) and its integration with Bitcoin could also influence the market, potentially increasing its utility and adoption.

Impact of Bitcoin ETFs on Market Liquidity and Price Volatility

The approval of a Bitcoin exchange-traded fund (ETF) in major markets would likely have a profound impact on Bitcoin’s price and liquidity. Increased accessibility through traditional brokerage accounts would draw a larger pool of investors, potentially increasing both market liquidity and price volatility in the short term. Increased trading volume would lead to greater price discovery, potentially reducing volatility over the long term. However, a sudden influx of new investors could initially lead to increased price swings as the market adjusts to the increased trading activity. This effect can be compared to the impact of the introduction of new trading instruments in other markets, which often causes temporary volatility before stabilizing. The approval of a Bitcoin ETF could potentially lead to similar effects, although the magnitude would depend on several factors, including the specific ETF structure and the overall market conditions.

Hypothetical Chart Illustrating Potential Adoption Rates and Market Capitalization

A hypothetical chart illustrating potential Bitcoin adoption rates and market capitalization by August 2025 would show a gradual increase in both metrics. The X-axis would represent time (from the present to August 2025), and the Y-axis would show two lines: one for adoption rate (percentage of global users or institutions using Bitcoin) and another for market capitalization (in US dollars). The adoption rate line would show a slow but steady increase, starting from a baseline representing the current adoption rate and reaching a significantly higher level by August 2025. This increase would not be linear, potentially showing periods of faster growth followed by periods of slower growth, reflecting the influence of various market factors. The market capitalization line would follow a similar trend, although it would likely be more volatile, reflecting the inherent price volatility of Bitcoin. Both lines would likely show an upward trend, indicating increasing adoption and market value. The chart would also include annotations indicating key events or factors that might influence the trajectory of both lines, such as the approval of a Bitcoin ETF or significant regulatory developments. The chart would illustrate a projected scenario, not a definitive forecast, highlighting the inherent uncertainties associated with predicting future market trends.

Risks and Challenges Facing Bitcoin in 2025

Predicting the future of Bitcoin is inherently speculative, but considering historical trends and current developments allows us to identify potential risks and challenges Bitcoin might encounter by August 2025. These challenges range from regulatory hurdles to inherent vulnerabilities within the network itself, all of which could significantly impact its price and adoption.

Increased Regulatory Scrutiny and its Impact

The increasing mainstream adoption of Bitcoin has inevitably led to heightened regulatory scrutiny globally. Governments are grappling with how to classify Bitcoin, tax transactions, and mitigate potential risks associated with money laundering and illicit activities. Increased regulatory pressure could manifest in various forms, including stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations for exchanges, limitations on cross-border transactions, and even outright bans in certain jurisdictions. This could stifle innovation, reduce liquidity, and negatively impact Bitcoin’s price by limiting accessibility and investment. For example, the ongoing debate surrounding Bitcoin regulation in the European Union and the varying approaches taken by different nations illustrate the potential for fragmented and unpredictable regulatory landscapes. A highly fragmented regulatory environment creates uncertainty and potentially discourages widespread adoption.

Security and Scalability Risks of the Bitcoin Network

While Bitcoin’s blockchain technology is inherently secure due to its decentralized and cryptographic nature, it’s not impervious to threats. The network’s scalability remains a persistent challenge. The relatively slow transaction speeds and high fees during periods of high network congestion could hinder its widespread adoption as a daily payment method. Furthermore, the risk of 51% attacks, though statistically improbable, remains a theoretical concern. A sufficiently powerful entity controlling over 50% of the network’s hashing power could potentially reverse transactions and manipulate the blockchain. While highly unlikely given the distributed nature of Bitcoin mining, this possibility represents a systemic risk. Moreover, vulnerabilities in individual wallets or exchanges remain a significant threat, as evidenced by past high-profile hacks and thefts.

Competition from Alternative Cryptocurrencies, Bitcoin August 2025 Prediction

Bitcoin faces increasing competition from other cryptocurrencies, many of which offer improved scalability, faster transaction speeds, and enhanced features. Altcoins such as Ethereum, Solana, and Cardano are vying for market share, attracting developers and investors with their innovative functionalities and potentially higher returns. This competition could potentially dilute Bitcoin’s dominance and impact its price. The rise of decentralized finance (DeFi) platforms built on alternative blockchains further intensifies this competitive pressure, offering alternative investment opportunities and potentially drawing capital away from Bitcoin.

Economic and Geopolitical Uncertainty

Bitcoin’s price is highly sensitive to macroeconomic factors and geopolitical events. Global economic downturns, inflation, and political instability can all significantly impact Bitcoin’s value. For example, the 2022 crypto market crash was partly attributed to rising inflation and increased interest rates globally. Uncertainties surrounding global monetary policies, potential regulatory crackdowns, and unforeseen geopolitical events could cause significant price volatility and erode investor confidence. The interconnectedness of global financial markets means that events in one region can quickly ripple across the world, affecting Bitcoin’s price and adoption.

Comparison of Bitcoin Investment Risks with Traditional Assets

Investing in Bitcoin carries unique risks compared to traditional assets like stocks and bonds. While traditional assets are often subject to market fluctuations, their values are generally tied to underlying fundamentals (e.g., company earnings, government bonds). Bitcoin’s value, on the other hand, is largely driven by speculative demand and market sentiment, making it significantly more volatile. The lack of intrinsic value, compared to the dividend yields or interest payments of traditional assets, also contributes to this higher risk profile. Furthermore, the regulatory uncertainty surrounding Bitcoin adds another layer of risk not typically associated with established financial instruments. While diversification across asset classes is often recommended, the high volatility of Bitcoin necessitates careful risk management strategies.

Bitcoin’s Long-Term Outlook Beyond August 2025: Bitcoin August 2025 Prediction

Predicting the future of Bitcoin beyond August 2025 requires considering several factors, including technological advancements, regulatory landscapes, and evolving market dynamics. While no one can definitively say what will happen, analyzing current trends and potential developments offers a glimpse into possible scenarios. The long-term outlook hinges on Bitcoin’s ability to overcome existing challenges and adapt to a changing technological and financial environment.

The long-term potential of Bitcoin is substantial, driven by its decentralized nature and potential to disrupt traditional financial systems. Its scarcity, limited supply of 21 million coins, is a key driver of its value proposition. However, its future isn’t guaranteed and depends heavily on its ability to evolve and adapt to technological innovations and societal shifts. Successfully navigating regulatory hurdles and maintaining network security are crucial for continued growth.

Potential Technological Developments Impacting Bitcoin

Several technological developments could significantly influence Bitcoin’s future. The Lightning Network, for example, aims to improve transaction speed and reduce fees, addressing current limitations of the Bitcoin blockchain. Layer-2 scaling solutions, such as the Lightning Network and others, are crucial for Bitcoin’s ability to handle a larger number of transactions. Furthermore, advancements in cryptography and consensus mechanisms could enhance Bitcoin’s security and efficiency. The development of more user-friendly wallets and interfaces will also play a vital role in wider adoption. For instance, the development of hardware wallets with improved security features could address concerns about private key management. These advancements could potentially increase transaction throughput, making Bitcoin more practical for everyday use.

Bitcoin’s Role in the Future of Finance and Global Economics

Bitcoin’s potential role in the future of finance and global economics is multifaceted. It could become a significant store of value, competing with gold and other traditional assets. Its decentralized nature offers the potential for financial inclusion, enabling individuals in underserved regions to access financial services without relying on traditional banking systems. However, its volatility and regulatory uncertainty remain significant hurdles. The successful integration of Bitcoin into existing financial infrastructure would require significant collaboration between regulators, financial institutions, and the Bitcoin community. A scenario where Bitcoin is widely accepted as a form of payment for goods and services, alongside existing fiat currencies, is plausible, although the timeline remains uncertain. This could lead to a more decentralized and potentially more efficient global financial system.

Long-Term Outlook Summary

Bitcoin’s long-term outlook beyond August 2025 is characterized by both significant potential and considerable uncertainty. Technological advancements, particularly in scaling solutions and user experience, are key to its widespread adoption. Its potential role in reshaping global finance and economics is undeniable, but regulatory hurdles and market volatility pose ongoing challenges. Key milestones could include increased institutional adoption, broader regulatory clarity, and the successful integration of Bitcoin into mainstream financial systems. The successful implementation of Layer-2 solutions and the widespread adoption of user-friendly wallets are crucial for achieving mass adoption and realizing Bitcoin’s full potential. Ultimately, Bitcoin’s future depends on its ability to adapt and evolve within a rapidly changing technological and regulatory landscape.

Frequently Asked Questions about Bitcoin’s Future

Predicting the future of Bitcoin, especially pinpointing its price at a specific date, is inherently challenging. Numerous intertwined factors influence its value, making precise forecasts unreliable. This section addresses common questions regarding Bitcoin’s future trajectory, highlighting the uncertainties involved and the potential risks and opportunities.

Bitcoin Price Target Likelihood by August 2025

Accurately predicting Bitcoin’s price by August 2025 is impossible. While various analytical models exist, they rely on assumptions that may not hold true. Factors like regulatory changes, macroeconomic conditions (inflation, recession), technological advancements (layer-2 scaling solutions), and overall market sentiment significantly impact price. For example, a sudden surge in institutional investment could drive the price upward, while a major security breach could trigger a sharp decline. Even sophisticated models, such as those employing machine learning, struggle to account for unforeseen events or sudden shifts in market psychology. Past price movements offer some insight, but they are not reliable predictors of future performance. Think of it like predicting the weather: you can make educated guesses based on current conditions, but unforeseen events can drastically alter the outcome.

Risks Associated with Long-Term Bitcoin Investment

Investing in Bitcoin involves substantial risks. Volatility is paramount; its price can fluctuate dramatically in short periods. Regulatory uncertainty poses another significant risk; governments worldwide are still developing frameworks for cryptocurrencies, and changes in regulations could negatively impact Bitcoin’s value or even legality. Technological disruptions, such as the emergence of a superior cryptocurrency or a significant vulnerability discovered in Bitcoin’s code, could also diminish its dominance. Furthermore, the security of personal Bitcoin wallets is crucial; loss of private keys renders the funds inaccessible. Finally, the speculative nature of the market means that price is heavily influenced by investor sentiment and market hype, making it susceptible to bubbles and crashes, as seen in previous market cycles.

Impact of Global Economic Events on Bitcoin’s Price in 2025

Global economic events significantly influence Bitcoin’s price. For instance, high inflation might drive investors towards Bitcoin as a hedge against inflation, increasing its demand and price. Conversely, a global recession could lead to risk aversion, causing investors to sell off Bitcoin and other risk assets, pushing the price down. Geopolitical instability, such as major international conflicts or significant shifts in global power dynamics, can also create uncertainty and volatility in the cryptocurrency market. For example, the 2022 war in Ukraine led to increased volatility in both traditional and cryptocurrency markets. A significant shift in central bank policy, such as a major change in interest rates, could also dramatically impact investor behavior and Bitcoin’s price.

Potential Technological Advancements Affecting Bitcoin’s Future

Several technological advancements could significantly impact Bitcoin’s future. Scaling solutions, like the Lightning Network, aim to increase transaction speed and reduce fees, addressing current limitations. Privacy-enhancing technologies are also being developed to improve the anonymity of Bitcoin transactions. Further innovations in consensus mechanisms, such as the exploration of more energy-efficient alternatives to Proof-of-Work, could enhance Bitcoin’s sustainability and scalability. The development of new cryptographic techniques could also enhance security and resilience against attacks. These advancements, if successful, could lead to wider adoption and increased utility for Bitcoin, potentially driving its value higher.