Bitcoin’s Role in the Broader Financial Landscape: Bitcoin Bull Run 2024

Bitcoin’s emergence has significantly altered the conversation surrounding finance, challenging established systems and prompting a reevaluation of traditional monetary policies. Its decentralized nature and inherent scarcity present a compelling alternative to fiat currencies, while its potential impact on global finance remains a subject of ongoing debate and analysis.

Bitcoin’s position within the broader financial landscape is complex and multifaceted. It functions simultaneously as a digital currency, a store of value, and a speculative asset, attracting a diverse range of participants, from individual investors to institutional players. Its decentralized architecture, independent of central banks and governments, offers a potential hedge against inflation and currency devaluation, a feature that resonates strongly with investors seeking portfolio diversification and protection from geopolitical risks.

Bitcoin as a Hedge Against Inflation

Bitcoin’s limited supply of 21 million coins is a key factor contributing to its potential as an inflation hedge. Unlike fiat currencies, which are susceptible to inflationary pressures through government printing, Bitcoin’s fixed supply creates a deflationary mechanism. Historically, during periods of high inflation in various countries, the value of Bitcoin has often increased, suggesting a negative correlation between traditional currency inflation and Bitcoin’s price. This characteristic attracts investors seeking to preserve their purchasing power in an environment of monetary instability. For example, during periods of high inflation in Argentina or Venezuela, Bitcoin adoption increased significantly as citizens sought to protect their savings.

Bitcoin Compared to Gold and Stocks, Bitcoin Bull Run 2024

Bitcoin shares some similarities with traditional asset classes like gold and stocks, but also possesses unique characteristics. Like gold, Bitcoin is often viewed as a store of value, a safe haven asset during times of economic uncertainty. However, unlike gold, Bitcoin is easily transferable and divisible, facilitating quicker and more efficient transactions. Compared to stocks, Bitcoin offers a different investment profile. Stocks represent ownership in a company and are subject to the company’s performance and market sentiment. Bitcoin, on the other hand, is not tied to any specific company or economy, making its price influenced by factors such as supply and demand, technological advancements, and regulatory developments. The volatility inherent in Bitcoin’s price is significantly higher than that of gold or established stock markets, presenting both opportunities and risks for investors.

Bitcoin’s Impact on Traditional Financial Systems

The long-term impact of Bitcoin on traditional financial systems remains uncertain, but its potential for disruption is undeniable. The technology underpinning Bitcoin, blockchain, has the potential to revolutionize various financial processes, enhancing transparency, security, and efficiency. However, the decentralized nature of Bitcoin also presents challenges for regulators, who are grappling with how to effectively oversee this new asset class and mitigate associated risks, such as money laundering and illicit activities. The ongoing evolution of Bitcoin and its integration into the broader financial ecosystem will continue to shape its role and impact on traditional systems in the years to come.

The Future of Bitcoin and its Potential for Growth

Predicting the future of Bitcoin is inherently speculative, yet by analyzing current trends and potential developments, we can construct plausible scenarios for its price and adoption in the coming years. Several key factors will significantly influence Bitcoin’s trajectory, including technological improvements, regulatory landscapes, and institutional involvement.

Technological Advancements, Regulatory Frameworks, and Institutional Investment will shape Bitcoin’s future.

Technological Advancements Impacting Bitcoin

The evolution of Bitcoin’s underlying technology will play a crucial role in its future. Improvements in scalability, such as the Lightning Network’s development and implementation, could significantly increase transaction speeds and reduce fees, making Bitcoin more suitable for everyday use. Furthermore, advancements in privacy-enhancing technologies, like confidential transactions, could address concerns about transparency and attract a wider range of users. Conversely, a major security breach or the emergence of a superior blockchain technology could negatively impact Bitcoin’s dominance. For example, the successful implementation of a competing blockchain with faster transaction speeds and lower fees could divert users and investment away from Bitcoin.

Regulatory Frameworks and Their Influence

Global regulatory frameworks will be pivotal in shaping Bitcoin’s future. Clear and consistent regulations could foster institutional investment and mainstream adoption, leading to increased price stability and broader usage. Conversely, restrictive or inconsistent regulations across different jurisdictions could hinder Bitcoin’s growth and create uncertainty in the market, potentially leading to price volatility and decreased adoption. The regulatory approach taken by major economies, such as the US and China, will significantly impact global Bitcoin adoption. For instance, if the US were to adopt a framework that clearly defines Bitcoin as a commodity, it could attract significant institutional investment, while a ban in a major economy like China could negatively impact the market.

Institutional Investment and its Effect on Bitcoin’s Price

Increased institutional investment is a significant factor in Bitcoin’s potential for growth. As more large financial institutions, corporations, and sovereign wealth funds allocate assets to Bitcoin, its price could see significant upward pressure. This increased demand could lead to greater price stability and reduced volatility. However, a sudden withdrawal of institutional investment, perhaps due to market downturns or regulatory changes, could trigger a sharp price correction. The example of MicroStrategy’s significant Bitcoin holdings illustrates the impact of institutional investment. Their substantial investment has contributed to the overall market sentiment and potentially influenced the price.

Potential Bitcoin Price Trajectory

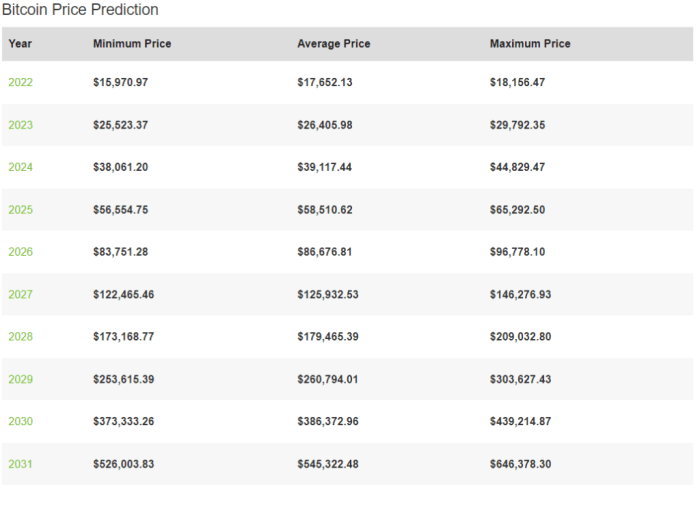

Several scenarios could unfold regarding Bitcoin’s price over the next few years. A bullish scenario could see Bitcoin’s price reach significantly higher levels, driven by factors such as widespread adoption, increased institutional investment, and positive regulatory developments. In this scenario, the price could potentially reach $100,000 or even higher within the next few years, mirroring the growth seen in previous bull runs. Conversely, a bearish scenario could involve regulatory uncertainty, technological setbacks, or a broader economic downturn, leading to a prolonged period of price stagnation or even a significant price decline. This could see Bitcoin’s price drop below its current levels, potentially reaching the low thousands of dollars.

Visual Representation of Bitcoin’s Potential Growth

A line graph illustrating Bitcoin’s potential price trajectory would show a fluctuating line. The x-axis would represent time (years), and the y-axis would represent Bitcoin’s price in USD. The line would initially show a period of relatively low price, followed by a period of steep upward growth in a bullish scenario, possibly reaching a peak and then experiencing some consolidation or correction. A second, lower line would illustrate a bearish scenario, characterized by a lower peak and more pronounced price corrections. The graph would highlight the uncertainty inherent in predicting future price movements.

Frequently Asked Questions about Bitcoin Bull Run 2024

The anticipation surrounding a potential Bitcoin bull run in 2024 is high, fueled by the halving event and other market factors. Understanding the nuances of this phenomenon is crucial for anyone considering participation in the cryptocurrency market. This section addresses some frequently asked questions to provide clarity and context.

Bitcoin Bull Run Definition

A Bitcoin bull run refers to a sustained period of significant price appreciation in Bitcoin. This upward trend is typically characterized by rapid price increases, fueled by increased investor demand, positive market sentiment, and often, a confluence of technological advancements or macroeconomic events. Historically, these periods have been marked by substantial volatility, with both significant gains and potential for equally significant losses. The 2017 bull run, for example, saw Bitcoin’s price surge from under $1,000 to nearly $20,000, before experiencing a substantial correction. Understanding the cyclical nature of Bitcoin’s price movements is key to navigating these periods.

Bitcoin Bull Run 2024 Start Date

Predicting the precise start of a Bitcoin bull run is inherently challenging. While the Bitcoin halving event, scheduled for April 2024, is often cited as a potential catalyst, it’s not a guaranteed trigger. Many analysts point to the halving’s historical correlation with subsequent price increases, as the reduced supply of newly mined Bitcoin can create scarcity and drive up demand. However, other factors, such as regulatory changes, macroeconomic conditions, and overall market sentiment, also play significant roles. Some predict a bull run beginning in late 2023 or early 2024, while others believe it might start later or not materialize at all. The uncertainty highlights the speculative nature of cryptocurrency investments.

Potential Bitcoin Price During a Bull Run

Estimating the peak price of Bitcoin during a potential bull run is highly speculative. Various analysts offer different price targets, ranging from conservative estimates to significantly more bullish projections. These predictions are based on various models, including historical price patterns, market capitalization comparisons to other assets, and adoption rate forecasts. However, it’s crucial to remember that these are just predictions, and the actual price could significantly deviate from these estimates. The price could potentially reach new all-time highs, surpassing previous peaks, but it’s equally possible that the price may fall short of expectations or experience sharp corrections along the way.

Bitcoin Investment Safety During a Bull Run

Investing in Bitcoin during a bull run can be both lucrative and risky. While the potential for high returns is attractive, the inherent volatility of the cryptocurrency market necessitates a cautious approach. It’s essential to only invest what you can afford to lose, diversify your portfolio to mitigate risk, and conduct thorough research before making any investment decisions. Avoid impulsive decisions based solely on hype or fear of missing out (FOMO). Furthermore, understand that regulatory uncertainty and potential market manipulation can significantly impact Bitcoin’s price, adding another layer of risk to consider. Responsible investing practices are paramount to navigating the complexities of a bull run.