Bitcoin Bull Run 2025

The year 2025 looms large on the horizon for Bitcoin enthusiasts, promising the potential for another exhilarating bull run. The cryptocurrency market, still relatively young, is characterized by periods of explosive growth punctuated by significant corrections. Understanding the cyclical nature of Bitcoin’s price movements is crucial to navigating this volatile yet potentially lucrative landscape. This analysis delves into the factors that could contribute to a substantial Bitcoin price surge in 2025, examining historical trends and emerging market dynamics.

Bitcoin’s price history is a dramatic narrative of boom and bust. Since its inception, it has experienced several bull runs, each characterized by unique contributing factors. The first major bull run, culminating in late 2013, saw Bitcoin’s price surge from under $10 to over $1,000, fueled by early adoption, increasing media attention, and the excitement surrounding a novel technological innovation. The subsequent bull run, peaking in late 2017, propelled Bitcoin to nearly $20,000, driven by increased institutional interest and the emergence of Initial Coin Offerings (ICOs). These periods of rapid growth were followed by significant corrections, highlighting the inherent volatility of the cryptocurrency market. Analyzing these past cycles allows us to identify potential catalysts for a future bull run.

Bitcoin’s Price History and Past Bull Runs

The price movements of Bitcoin are complex and influenced by a confluence of factors, including technological advancements, regulatory developments, macroeconomic conditions, and market sentiment. Past bull runs have often been preceded by periods of technological innovation, such as the introduction of the Lightning Network, which aims to improve transaction speed and scalability. Regulatory clarity, or even the lack of overly restrictive regulations, can also significantly impact investor confidence and drive price appreciation. Macroeconomic factors, such as inflation or geopolitical instability, can also push investors towards alternative assets like Bitcoin, fueling demand. Finally, market sentiment, driven by media coverage, social media trends, and influencer opinions, plays a crucial role in shaping price expectations.

Potential Catalysts for a 2025 Bull Run

Several factors could potentially contribute to a Bitcoin bull run in 2025. The halving event, scheduled for 2024, which reduces the rate at which new Bitcoins are created, is expected to decrease the supply of Bitcoin, potentially increasing its scarcity and driving up its price. Increased institutional adoption, with more established financial institutions integrating Bitcoin into their investment strategies, could also significantly impact price. Technological advancements, such as improvements in scalability and interoperability, could make Bitcoin more accessible and user-friendly, attracting a wider range of investors. Furthermore, growing global awareness of Bitcoin as a store of value, particularly in the face of economic uncertainty, could further fuel demand. The interplay of these factors could create a powerful catalyst for a significant price increase.

Predictive Factors Influencing a 2025 Bitcoin Bull Run

A confluence of macroeconomic conditions, technological advancements, and evolving market sentiment could significantly influence Bitcoin’s price trajectory in 2025. Predicting a bull run with certainty is impossible, but analyzing these factors offers valuable insight into potential catalysts for price appreciation. The interplay between these elements will ultimately determine the extent and duration of any future bull market.

Macroeconomic Factors

Several macroeconomic factors could create a favorable environment for Bitcoin’s price to rise in 2025. Persistent inflation, coupled with global economic uncertainty, might drive investors towards alternative assets perceived as inflation hedges. Regulatory clarity in key markets could also boost institutional confidence and increase mainstream adoption. For example, if major economies experience high inflation rates similar to those seen in 2022, investors might seek assets like Bitcoin, which are not subject to traditional monetary policy controls. Furthermore, a clear regulatory framework in countries like the United States or the European Union could encourage institutional participation and reduce regulatory uncertainty, fostering a more positive market sentiment.

Technological Advancements

Significant technological advancements within the Bitcoin ecosystem are poised to improve scalability, transaction speed, and usability. Increased adoption of the Lightning Network, for instance, could address Bitcoin’s scalability challenges, making it more practical for everyday transactions. Furthermore, continued institutional investment and the development of innovative Bitcoin-related financial products could significantly boost demand. The Lightning Network, a layer-2 scaling solution, enables faster and cheaper Bitcoin transactions. Increased usage could make Bitcoin more appealing for everyday payments, driving demand. The growing involvement of institutional investors, like asset management firms and pension funds, demonstrates increased confidence in Bitcoin as a long-term asset. This could lead to larger-scale buying and price appreciation.

Market Sentiment Comparison

Comparing the current market sentiment with previous bull run periods reveals both parallels and discrepancies. Similar to previous cycles, we see increasing interest from retail and institutional investors, driven by technological advancements and macroeconomic uncertainty. However, unlike previous cycles, the regulatory landscape is more complex and varied across different jurisdictions, potentially impacting the pace and scale of adoption. For example, the 2017 bull run was largely driven by retail speculation and a lack of regulatory clarity, leading to a rapid price increase followed by a significant correction. In contrast, the current environment features more institutional participation and a gradual increase in regulatory scrutiny, which could lead to a more sustainable and less volatile price appreciation in 2025. The level of regulatory clarity in 2025 will be a crucial factor in determining the market’s reaction to price increases.

Potential Price Targets and Scenarios for Bitcoin in 2025

Predicting Bitcoin’s price is inherently speculative, but by analyzing historical trends, technological advancements, and macroeconomic factors, we can formulate potential price targets and scenarios for 2025. These predictions are not guarantees, but rather informed estimations based on available data and plausible future developments. It’s crucial to remember that unforeseen events can significantly impact these projections.

Predictive models often employ various methodologies, ranging from technical analysis of price charts to fundamental analysis of Bitcoin’s adoption rate and network effects. Combining these approaches, along with consideration of broader economic conditions, provides a more nuanced perspective. The following scenarios illustrate potential price outcomes, highlighting the considerable range of possibilities.

Price Target Ranges and Underlying Rationale

Several factors influence potential Bitcoin price targets. Adoption rates, regulatory changes, macroeconomic conditions (inflation, interest rates), and technological innovations all play significant roles. Conservative estimates might predict a price range based on historical bull market growth patterns, while more optimistic predictions could incorporate factors like widespread institutional adoption and increased scarcity due to halving events. Conversely, pessimistic scenarios might account for regulatory crackdowns or a general crypto market downturn.

For instance, a conservative model might extrapolate from past bull cycles, suggesting a price range between $100,000 and $150,000. This projection is based on the observation that previous bull runs have seen price increases of several hundred percent, and applying a similar percentage increase from the current price would fall within this range. More bullish models, factoring in significant institutional investment and mainstream adoption, could predict prices exceeding $250,000 or even higher. Conversely, bearish scenarios, considering negative macroeconomic factors or increased regulatory pressure, could see prices remain within a much lower range, potentially even below current levels.

Potential Scenarios and Probabilities

The following table Artikels different scenarios, their associated probabilities, and corresponding Bitcoin price predictions. These probabilities are subjective and based on current market sentiment and expert opinions, reflecting a range of possibilities.

| Scenario | Probability | Bitcoin Price Prediction (USD) | Rationale |

|---|---|---|---|

| Conservative Bull Run | 40% | $100,000 – $150,000 | Based on historical bull market growth patterns and moderate adoption rates. |

| Strong Bull Run | 30% | $150,000 – $250,000 | Driven by significant institutional investment, increased mainstream adoption, and positive macroeconomic conditions. |

| Moderate Price Increase | 20% | $50,000 – $100,000 | Reflects a slower pace of adoption and potential headwinds from regulatory uncertainty or economic downturns. |

| Bearish Market Correction | 10% | Below $50,000 | Significant negative macroeconomic factors, increased regulatory pressure, or a major security incident could lead to a price decline. |

Risks and Challenges Associated with a 2025 Bitcoin Bull Run

Predicting a Bitcoin bull run, even with compelling indicators, necessitates acknowledging significant risks and challenges that could significantly impact its trajectory. While the potential for substantial gains is alluring, investors must approach the market with a realistic understanding of the potential downsides. A comprehensive risk assessment is crucial for informed decision-making and investment protection.

Regulatory Crackdowns and Their Impact on Market Sentiment

Increased regulatory scrutiny poses a substantial threat to Bitcoin’s price trajectory. Governments worldwide are grappling with the complexities of regulating cryptocurrencies, and stricter rules could dampen investor enthusiasm. A sudden and severe regulatory crackdown, such as a complete ban on trading or stringent Know Your Customer (KYC) requirements, could trigger a sharp price correction. The 2021 China crypto ban serves as a stark reminder of the potential impact of such actions. The uncertainty surrounding future regulations creates a volatile environment that can significantly affect market confidence and price stability.

Market Manipulation and Price Volatility

The decentralized nature of Bitcoin, while a strength, also makes it vulnerable to market manipulation. Large-scale coordinated actions by individuals or groups could artificially inflate or deflate the price, leading to significant losses for unsuspecting investors. The relatively high volatility of Bitcoin, compared to traditional assets, further exacerbates the risk of manipulation. Historical instances of significant price swings, often attributed to pump-and-dump schemes or coordinated selling pressure, highlight this vulnerability. Sophisticated trading algorithms and the lack of a central regulatory body can make identifying and preventing such manipulation challenging.

Security Breaches and Exchange Hacks

The security of cryptocurrency exchanges and individual wallets remains a critical concern. High-profile exchange hacks, resulting in significant losses of Bitcoin, have occurred in the past and could easily recur. These events can severely undermine investor confidence, leading to a sell-off and a sharp decline in price. Furthermore, the increasing sophistication of cyberattacks necessitates constant vigilance and robust security measures from both exchanges and individual investors. The Mt. Gox hack, for example, dramatically impacted market sentiment and resulted in substantial losses for many investors. Protecting private keys and choosing reputable exchanges are crucial steps in mitigating this risk.

Impact of Unforeseen Global Events

Geopolitical instability, economic crises, or unexpected global events can have a profound impact on Bitcoin’s price. During times of uncertainty, investors often flock to safe-haven assets like gold, potentially diverting funds away from riskier investments such as Bitcoin. The COVID-19 pandemic, for instance, initially caused a sharp decline in Bitcoin’s price before a subsequent recovery. The ongoing war in Ukraine demonstrates how unpredictable geopolitical events can significantly influence investor behavior and market sentiment. The inherent volatility of Bitcoin makes it particularly susceptible to such external shocks.

Mitigating Risks and Protecting Investments

Diversification is a key strategy for mitigating risk. Spreading investments across various asset classes, including traditional assets and other cryptocurrencies, can help reduce exposure to the volatility of Bitcoin. Thorough due diligence is essential before investing in any cryptocurrency. Understanding the underlying technology, market dynamics, and associated risks is crucial for making informed decisions. Furthermore, investors should adopt robust security measures, such as using hardware wallets and employing strong password practices, to protect their holdings from theft or loss. Staying informed about regulatory developments and market trends is also essential for navigating the evolving landscape of the cryptocurrency market. A cautious and well-informed approach can significantly enhance the chances of successfully navigating a Bitcoin bull run while minimizing potential losses.

Investment Strategies and Considerations for a Potential Bull Run

Navigating a potential Bitcoin bull run requires careful planning and a clear understanding of your risk tolerance. Investors should approach this market with a well-defined strategy, recognizing that significant gains are often accompanied by substantial risks. The following strategies Artikel various approaches, each suited to different investor profiles. Remember, past performance is not indicative of future results, and all investments carry inherent risk.

Bitcoin Bull Run 2025 Prediction – Diversification and risk management are crucial elements of any successful Bitcoin investment strategy. Diversification means spreading your investments across different asset classes (e.g., stocks, bonds, real estate) to reduce the impact of losses in any single asset. Risk management involves setting stop-loss orders to limit potential losses and defining your acceptable risk level before making any investment.

Predicting the Bitcoin bull run of 2025 involves considering several factors, a key one being the upcoming halving event. Understanding the mechanics of this reduction in Bitcoin’s block reward is crucial for accurate forecasting, and a great resource for this is the article explaining 2025 Bitcoin Halving Nedir. Ultimately, this halving event is expected to significantly impact the supply dynamics, potentially fueling another significant price increase and contributing to the anticipated 2025 bull run.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak. For example, an investor might invest $100 per week into Bitcoin, consistently adding to their holdings over time. This approach reduces the impact of volatility and averages out the purchase price.

- Pros: Reduces emotional decision-making, mitigates risk of buying high, simple to implement.

- Cons: May miss out on significant gains if the market experiences a rapid surge, requires consistent discipline.

Lump-Sum Investment

This strategy involves investing a significant amount of capital at a single point in time. It’s a high-risk, high-reward approach that relies on accurately timing the market. For example, an investor might invest $10,000 all at once, hoping to capitalize on a significant price increase. This approach is only suitable for investors with a high risk tolerance and strong conviction in the market’s future direction.

- Pros: Potential for significant gains if the market moves favorably, simple to execute.

- Cons: High risk of substantial losses if the market declines, requires precise market timing.

Gradual Accumulation

This strategy combines elements of DCA and lump-sum investing. An investor might make a larger initial investment and then supplement it with smaller, regular investments over time. This approach offers a balance between risk and reward, allowing for participation in market gains while mitigating the risk of a single large investment at an unfavorable price. For instance, an investor could initially invest $5,000 and then add $500 per month.

- Pros: Balances risk and reward, allows for adjustments based on market conditions, more flexible than lump-sum.

- Cons: Requires some market analysis and timing, may not capture maximum gains if the market surges rapidly.

Short-Term Trading

Short-term trading involves buying and selling Bitcoin frequently to capitalize on short-term price fluctuations. This is a high-risk strategy that requires significant market knowledge, technical analysis skills, and a high tolerance for risk. Successful short-term trading depends on accurately predicting short-term price movements, which is notoriously difficult.

- Pros: Potential for quick profits if predictions are accurate.

- Cons: Extremely high risk, requires significant expertise and time commitment, high transaction fees.

Portfolio Diversification, Bitcoin Bull Run 2025 Prediction

It is crucial to diversify your portfolio beyond just Bitcoin. Allocating a portion of your investment to other assets, such as stocks, bonds, or real estate, can significantly reduce overall portfolio risk. A diversified portfolio can help cushion against losses in Bitcoin and provide stability during market downturns. For example, a conservative investor might allocate only 5% of their portfolio to Bitcoin, while a more aggressive investor might allocate up to 20%, depending on their risk tolerance and overall financial goals.

- Pros: Reduces overall portfolio risk, improves long-term stability.

- Cons: May limit potential gains from Bitcoin if it experiences a significant bull run.

Bitcoin’s Long-Term Outlook Beyond 2025: Bitcoin Bull Run 2025 Prediction

Bitcoin’s future beyond 2025 is a complex interplay of technological advancements, regulatory shifts, and evolving societal acceptance. While predicting the future with certainty is impossible, analyzing current trends and potential developments allows for informed speculation on its long-term trajectory and role within the global financial system. Several factors will significantly influence Bitcoin’s continued success or potential decline.

Predicting Bitcoin’s long-term value and market dominance requires considering its inherent properties and the external forces shaping the cryptocurrency landscape. Its decentralized nature, limited supply, and growing adoption are strengths, but regulatory uncertainty and technological competition represent ongoing challenges.

Bitcoin Adoption and Network Effects

The continued growth of Bitcoin’s adoption is crucial for its long-term success. Increased adoption leads to network effects, making the network more secure and valuable. As more individuals and institutions utilize Bitcoin, its price is likely to increase due to higher demand. For example, the increasing use of Bitcoin as a store of value by institutional investors, such as MicroStrategy, demonstrates the potential for significant adoption and price appreciation. Conversely, slow adoption rates or significant regulatory hurdles could limit its growth potential.

Technological Advancements and Scalability

Bitcoin’s scalability is a persistent concern. Technological advancements, such as the Lightning Network, aim to address transaction speed and cost issues. The success of layer-2 solutions and potential future upgrades to the Bitcoin protocol will significantly impact its ability to handle a larger volume of transactions, influencing its usability and appeal to a wider range of users and businesses. A failure to improve scalability could hinder widespread adoption and limit its long-term growth.

Regulatory Landscape and Global Acceptance

The regulatory landscape surrounding Bitcoin varies significantly across jurisdictions. Clearer and more consistent regulatory frameworks could boost investor confidence and encourage wider adoption. Conversely, overly restrictive regulations could stifle innovation and limit Bitcoin’s growth. The evolution of regulatory approaches in different countries will play a significant role in shaping Bitcoin’s future. For instance, El Salvador’s adoption of Bitcoin as legal tender, despite initial challenges, demonstrates the potential for national-level acceptance, while stricter regulations in other countries highlight the ongoing uncertainty.

Bitcoin’s Role in the Global Financial System

Bitcoin’s long-term role in the global financial system is uncertain but holds several potential scenarios. It could become a widely accepted store of value, competing with gold and other traditional assets. Alternatively, it might evolve into a more widely used medium of exchange, challenging existing payment systems. Another possibility is its integration into existing financial systems, acting as a supplementary asset or a component of decentralized finance (DeFi) applications. The eventual outcome depends on factors such as regulatory developments, technological advancements, and the overall evolution of the financial landscape.

Bitcoin’s Position as a Leading Cryptocurrency

Maintaining its position as a leading cryptocurrency will depend on Bitcoin’s ability to adapt and innovate. The emergence of alternative cryptocurrencies with superior technological features or more focused applications poses a challenge. Bitcoin’s first-mover advantage, established brand recognition, and strong network effect provide a significant competitive edge. However, failure to adapt to technological advancements or to address scalability concerns could potentially diminish its dominance. The continued success of Bitcoin will depend on its ability to maintain its security, enhance its functionality, and adapt to the evolving needs of the cryptocurrency market.

Frequently Asked Questions (FAQs) about Bitcoin Bull Run 2025 Predictions

Predicting the future of Bitcoin, or any asset for that matter, is inherently uncertain. However, by analyzing historical trends, technological advancements, and macroeconomic factors, we can formulate educated guesses about potential price movements. The following sections address some common questions regarding a potential Bitcoin bull run in 2025.

Key Factors Driving Predictions for a Bitcoin Bull Run in 2025

Several factors contribute to the anticipation of a Bitcoin bull run in 2025. These include the Bitcoin halving event, which is scheduled to occur in 2024 and historically precedes bull runs due to reduced supply. Furthermore, increasing institutional adoption, growing global interest in cryptocurrencies, and potential regulatory clarity in major markets could all fuel significant price increases. Technological advancements, such as the development of the Lightning Network improving transaction speeds and scalability, also play a vital role. Finally, macroeconomic events like inflation or geopolitical instability can drive investors towards Bitcoin as a hedge against traditional assets.

Potential Risks Associated with Investing in Bitcoin During a Bull Run

Investing in Bitcoin during a bull run presents several inherent risks. The extreme volatility characteristic of Bitcoin means rapid price swings are common, leading to significant potential losses. Market manipulation, though difficult to prove, remains a possibility, and scams targeting unsuspecting investors are prevalent during periods of heightened activity. Furthermore, the regulatory landscape remains uncertain globally, and changes in regulations could negatively impact the price. Lastly, a sudden correction or “market crash” is always a possibility, even during a bull run, potentially resulting in substantial losses for investors. The 2021 bull run, followed by a significant correction in 2022, serves as a stark reminder of this risk.

Protecting Bitcoin Investment During a Potential Bull Run

Protecting your Bitcoin investment during a bull run requires a strategic approach. Diversification is key; avoid putting all your eggs in one basket. Allocate only a portion of your investment portfolio to Bitcoin, balancing it with other assets. Dollar-cost averaging (DCA) is a prudent strategy, involving regular purchases of Bitcoin regardless of price fluctuations, mitigating the risk of buying high. Secure storage is paramount; utilize reputable hardware wallets or robust software solutions to safeguard your private keys. Staying informed about market trends and regulatory changes through reputable news sources is crucial for making informed decisions. Finally, consider setting stop-loss orders to limit potential losses if the price unexpectedly drops.

Realistic Price Targets for Bitcoin in 2025

Predicting precise Bitcoin price targets is speculative. However, based on various models and analyses, a range of $100,000 to $250,000 seems plausible for 2025. This range considers the historical price patterns after previous halving events, the increasing adoption of Bitcoin by institutions, and potential macroeconomic factors. Reaching the higher end of this range would require sustained growth and significant adoption, while the lower end represents a more conservative scenario. It is crucial to remember that these are just estimates, and the actual price could be significantly higher or lower. For instance, some analysts predict significantly higher prices based on factors like scarcity and increased adoption by emerging markets. Conversely, others predict lower prices due to potential regulatory hurdles or unforeseen technological challenges.

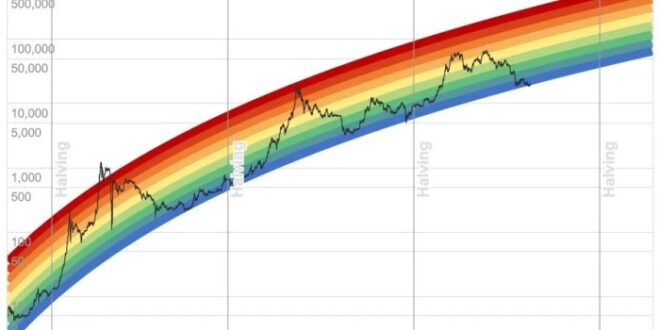

Visual Representation of Bitcoin Price Predictions

This section details a chart visualizing potential Bitcoin price trajectories for 2025, encompassing various scenarios based on differing market conditions and influencing factors discussed previously. Understanding these visual representations is crucial for interpreting the range of possible outcomes and managing expectations regarding Bitcoin’s future price.

The chart employs a line graph format, with the x-axis representing time (specifically, the months of 2025) and the y-axis representing the Bitcoin price in US dollars. Multiple lines are plotted, each representing a different prediction scenario.

Bitcoin Price Prediction Scenarios

The chart includes three distinct price prediction scenarios: a bullish scenario, a neutral scenario, and a bearish scenario. Each scenario is represented by a differently colored line. The bullish scenario (e.g., represented by a bright green line) projects a significant price increase throughout the year, potentially reaching prices well above previous all-time highs. The neutral scenario (e.g., a light blue line) shows a relatively flat trajectory, with modest fluctuations around a specific price point, reflecting a period of market consolidation. The bearish scenario (e.g., a dark red line) depicts a significant price decline, possibly retracing to levels seen in previous market corrections.

Key data points for each scenario are marked on the graph with distinct symbols (e.g., circles, squares, triangles) and labeled with the corresponding price and month. For example, the bullish scenario might show a projected price of $100,000 in December 2025, marked by a green circle with the label “Bullish – Dec: $100,000”. Similarly, the neutral scenario might show a price of $40,000 in December 2025, marked by a blue square with the label “Neutral – Dec: $40,000”, and the bearish scenario might show a price of $20,000, marked by a red triangle with the label “Bearish – Dec: $20,000”.

Additional Chart Features

To enhance clarity and understanding, the chart includes a title clearly stating “Bitcoin Price Prediction Scenarios for 2025”. A legend is provided, explaining the meaning of each line color and symbol. Vertical grid lines mark the beginning of each month, and horizontal grid lines aid in reading the price values. The y-axis scale is adjusted to accommodate the highest projected price in the bullish scenario, ensuring all data points are clearly visible and easily interpreted. Finally, a shaded area could be included to represent the range of uncertainty surrounding the predictions, highlighting the inherent volatility of the cryptocurrency market. This area might encompass the neutral and both extreme scenarios. This visual representation offers a comprehensive overview of potential Bitcoin price movements in 2025, allowing for informed decision-making based on a range of possibilities.

Predicting the Bitcoin bull run of 2025 involves considering several factors, one of the most significant being the halving event. To understand the timing of this crucial event, which significantly impacts Bitcoin’s scarcity and potential price surge, you should check out this resource: Kapan Halving Bitcoin 2025. Ultimately, the halving’s impact on the 2025 bull run remains a key element in any accurate prediction.

Predicting the Bitcoin bull run of 2025 involves considering various factors, including technological advancements and overall market sentiment. A key element in this prediction is understanding the potential price point in specific months, such as April. To gain insight into this, check out this detailed analysis on the April 2025 Bitcoin Price Prediction , which can help inform broader predictions about the overall bullish trend for the year.

Ultimately, this granular data contributes to a more comprehensive forecast for the Bitcoin bull run in 2025.

Many analysts predict a significant Bitcoin bull run in 2025, fueled by various factors. A key element often cited in these predictions is the Bitcoin halving event scheduled for that year, which reduces the rate of new Bitcoin creation. To understand the mechanics and potential impact of this event, it’s helpful to review information on the Halving Bitcoin 2025 Que Es.

This scarcity, driven by the halving, is expected to increase Bitcoin’s value and contribute to the anticipated bull run. Therefore, understanding the halving is crucial for comprehending the 2025 Bitcoin price projections.

Predicting the Bitcoin bull run of 2025 requires considering various factors, including overall market sentiment and technological advancements. To gain a clearer short-term perspective, it’s helpful to consult resources focusing on immediate price movements, such as this prediction for the next 24 hours in 2025: Bitcoin Next 24 Hours Prediction 2025. Understanding these shorter-term trends can contribute to a more comprehensive analysis of the potential for a significant bull run in 2025.

Predicting the Bitcoin bull run of 2025 requires considering various factors, including overall market sentiment and technological advancements. To gain a clearer short-term perspective, it’s helpful to consult resources focusing on immediate price movements, such as this prediction for the next 24 hours in 2025: Bitcoin Next 24 Hours Prediction 2025. Understanding these shorter-term trends can contribute to a more comprehensive analysis of the potential for a significant bull run in 2025.