Bitcoin Cash Price History and Trends: Bitcoin Cash Prediction 2025

Bitcoin Cash (BCH), a cryptocurrency forked from Bitcoin in 2017, has experienced a volatile price history marked by significant highs and lows. Understanding its past performance is crucial for any attempt to predict its future trajectory. This section will delve into the historical price fluctuations, key events influencing its value, and long-term trends, offering a comparative analysis with other prominent cryptocurrencies.

Significant Events Impacting Bitcoin Cash’s Price

Several key events have dramatically shaped Bitcoin Cash’s price. The initial hard fork from Bitcoin in August 2017 created a surge in price as investors sought to acquire the new asset. Subsequent hard forks, while intended to improve the cryptocurrency, often resulted in temporary price drops due to market uncertainty and division within the community. Major cryptocurrency exchange listings and delistings also significantly impacted BCH’s trading volume and price. Regulatory announcements and changes in overall market sentiment towards cryptocurrencies have played a similarly important role, influencing both short-term and long-term price movements. Periods of increased adoption and network usage have generally been associated with price increases, while negative news or security breaches have often triggered declines.

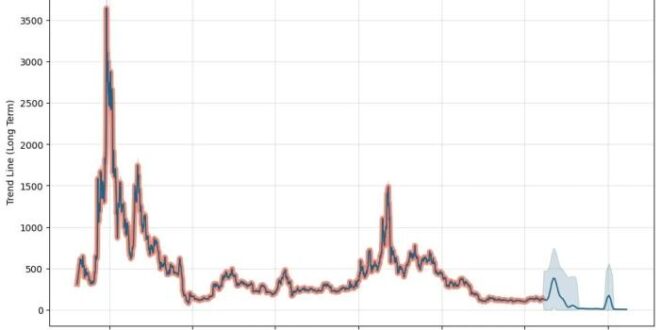

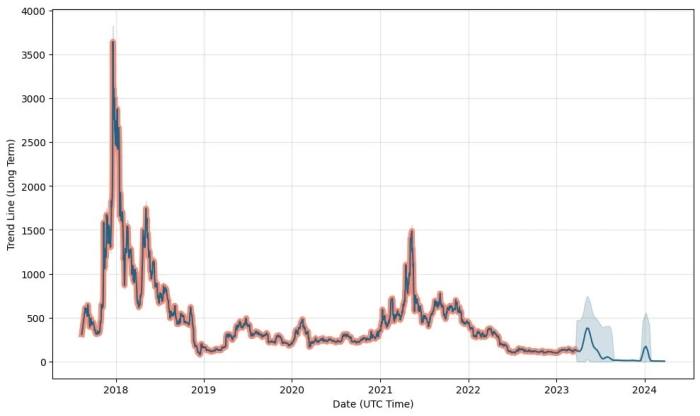

Bitcoin Cash Price History and Long-Term Trends

Since its inception, Bitcoin Cash has shown considerable price volatility. Initially, its price soared following the hard fork, reaching an all-time high shortly after its launch. However, it subsequently experienced several significant corrections, mirroring the broader cryptocurrency market’s cyclical nature. Long-term trends reveal a pattern of periods of growth interspersed with substantial price drops. These fluctuations are often linked to market speculation, technological developments within the Bitcoin Cash ecosystem, and the overall sentiment in the broader cryptocurrency market. While identifying definitive long-term patterns is challenging due to the relatively short lifespan of the cryptocurrency and the inherent volatility of the market, a general trend of price following the overall crypto market sentiment is observable.

Comparison of Bitcoin Cash’s Price Performance to Other Cryptocurrencies

Bitcoin Cash’s price performance has generally tracked alongside other major cryptocurrencies, particularly Bitcoin. However, it has exhibited periods of outperformance and underperformance relative to its peers. During periods of strong market-wide growth, BCH’s price has often mirrored the gains seen in Bitcoin and Ethereum. Conversely, during market downturns, BCH has typically experienced similar percentage drops, reflecting its correlation with the broader cryptocurrency market. A direct comparison with other cryptocurrencies requires considering factors such as market capitalization, trading volume, and the specific technological features and use cases of each cryptocurrency. While correlation exists, independent factors influence each cryptocurrency’s price trajectory.

Illustrative Representation of Bitcoin Cash Price History

The following table provides a simplified representation of Bitcoin Cash’s price history. Due to the dynamic nature of cryptocurrency prices, this table should be considered a general illustration rather than a precise historical record. Real-time data should be consulted for the most up-to-date information.

| Year | Approximate Price Range (USD) | Notable Events |

|---|---|---|

| 2017 | $300 – $4000 | Hard fork from Bitcoin, initial price surge |

| 2018 | $100 – $1500 | Market-wide correction, price decline |

| 2019 | $100 – $500 | Consolidation, relatively stable price |

| 2020 | $150 – $600 | Gradual price increase |

| 2021 | $300 – $1500 | Significant price increase mirroring market trends |

| 2022 | $100 – $600 | Market downturn, price decline |

| 2023 | $150 – $400 (as of October 26, 2023) | Continued volatility, reflecting broader market conditions |

Factors Influencing Bitcoin Cash’s Future Price

Predicting the future price of Bitcoin Cash (BCH) is inherently complex, influenced by a multitude of interconnected factors. While past performance is not indicative of future results, understanding these influential elements provides a framework for informed speculation. This section will explore key factors shaping BCH’s potential trajectory.

Technological Advancements and Bitcoin Cash Value

Technological advancements play a crucial role in determining the long-term viability and value of Bitcoin Cash. Improvements in scalability, transaction speed, and security directly impact user experience and adoption rates. For example, the implementation of new consensus mechanisms or upgrades to the underlying protocol could enhance BCH’s efficiency and attract more users and developers, thereby potentially increasing its value. Conversely, a failure to adapt to technological changes or security vulnerabilities could negatively affect its price. The development and adoption of sidechains or layer-2 solutions could also significantly impact BCH’s scalability and transaction fees, influencing its appeal to users and businesses.

Adoption and Market Demand’s Influence on Price

The level of adoption and overall market demand significantly impact Bitcoin Cash’s price. Widespread merchant acceptance, increased usage in daily transactions, and growing institutional investment are all positive indicators. For instance, if major retailers start accepting BCH payments, the demand could surge, driving up its price. Conversely, a lack of widespread adoption and limited merchant acceptance could hinder price appreciation. The sentiment within the cryptocurrency community and broader investor confidence also significantly influence market demand and, subsequently, price fluctuations. A positive market sentiment tends to correlate with price increases, while negative sentiment often leads to price drops.

Regulatory Changes and Governmental Policies’ Impact

Governmental regulations and policies play a critical role in shaping the cryptocurrency landscape. Favorable regulations, such as clear guidelines for cryptocurrency usage and taxation, could lead to increased institutional investment and wider adoption, positively impacting BCH’s price. Conversely, restrictive regulations or outright bans could severely limit BCH’s growth and depress its price. Different jurisdictions’ approaches to cryptocurrency regulation create varying levels of uncertainty and risk, influencing investor behavior and price volatility. The legal status of Bitcoin Cash in different countries is a key factor affecting its overall market value.

Bitcoin’s Price and Its Effect on Bitcoin Cash

Bitcoin’s price movements often influence the price of altcoins, including Bitcoin Cash. Historically, there’s been a correlation between Bitcoin’s price and the prices of other cryptocurrencies. A significant surge in Bitcoin’s value can sometimes trigger a “risk-on” sentiment in the broader crypto market, leading to increased investment in altcoins like BCH. Conversely, a sharp decline in Bitcoin’s price can lead to a sell-off in altcoins, including BCH, as investors might move their capital into more stable assets. This correlation, however, isn’t always consistent and can vary based on market sentiment and individual asset performance.

Bitcoin Cash’s Strengths and Weaknesses Compared to Competitors

Understanding Bitcoin Cash’s competitive landscape is crucial for assessing its future price. A comparative analysis of its strengths and weaknesses against other cryptocurrencies provides valuable insight.

- Strengths: Lower transaction fees compared to Bitcoin, faster transaction times, larger block size enabling higher throughput.

- Weaknesses: Lower market capitalization than Bitcoin, less established network effect, potential for security vulnerabilities despite improvements.

This comparison highlights the need for continuous technological innovation and wider adoption to overcome existing challenges and compete effectively in the dynamic cryptocurrency market. The ongoing development and implementation of improvements to the Bitcoin Cash network will play a significant role in its ability to compete successfully against other cryptocurrencies.

Bitcoin Cash Adoption and Use Cases

Bitcoin Cash, despite facing challenges in the broader cryptocurrency market, maintains a dedicated user base and finds application in specific niches. Its focus on fast and low-cost transactions has carved a unique space, albeit smaller than Bitcoin or Ethereum. Understanding its adoption rate and use cases is crucial for predicting its future trajectory.

Current Adoption Rate of Bitcoin Cash

Precisely quantifying Bitcoin Cash adoption is difficult due to the decentralized nature of the network and the lack of a central authority tracking all transactions. However, several metrics offer insights. The number of active addresses, transaction volume, and market capitalization provide a general indication of usage. While not as high as Bitcoin or Ethereum, Bitcoin Cash demonstrates consistent, albeit modest, levels of activity. The number of merchants accepting Bitcoin Cash as payment, although not extensive, provides another measure of adoption. Growth in these areas is uneven and often influenced by market sentiment and technological developments within the Bitcoin Cash ecosystem.

Key Industries and Sectors Utilizing Bitcoin Cash

Bitcoin Cash’s primary strength lies in its transactional efficiency. This makes it suitable for industries requiring quick and inexpensive payments. The gaming industry, for instance, has seen some adoption, with games utilizing Bitcoin Cash for in-game purchases and rewards. Similarly, some e-commerce platforms and point-of-sale systems integrate Bitcoin Cash as a payment option, although this remains a niche application compared to traditional payment methods. The remittance sector also presents a potential use case, where the low transaction fees are attractive for cross-border payments, especially in regions with underdeveloped financial infrastructure.

Potential for Future Adoption in Emerging Markets

Emerging markets, characterized by limited access to traditional banking systems and high transaction costs for international remittances, offer significant potential for Bitcoin Cash adoption. The speed and low cost of Bitcoin Cash transactions could disrupt traditional remittance channels, providing a cheaper and faster alternative for sending and receiving money across borders. However, widespread adoption will require addressing challenges such as digital literacy, internet access, and regulatory uncertainty in these markets. Successful implementations in pilot programs and partnerships with local businesses could accelerate this process.

Examples of Successful Bitcoin Cash Implementations, Bitcoin Cash Prediction 2025

While widespread mainstream adoption remains limited, several examples showcase successful Bitcoin Cash implementations. Some businesses, particularly smaller retailers and online stores, have integrated Bitcoin Cash into their payment systems, reporting positive experiences with reduced transaction fees and faster processing times. Certain gaming platforms have also integrated Bitcoin Cash, leveraging its speed for in-game transactions and rewarding players with Bitcoin Cash. These implementations, though not yet large-scale, demonstrate the potential for Bitcoin Cash in specific niches.

Bitcoin Cash Use Cases Across Various Sectors

| Sector | Use Case | Example |

|---|---|---|

| Gaming | In-game purchases and rewards | Hypothetical example: A mobile game using Bitcoin Cash for purchasing in-app items and rewarding players for achievements. |

| E-commerce | Online payments | Hypothetical example: An online retailer accepting Bitcoin Cash as a payment option alongside credit cards and PayPal. |

| Remittances | Cross-border payments | Hypothetical example: A remittance service using Bitcoin Cash to facilitate faster and cheaper international money transfers. |

| Micropayments | Small value transactions | Hypothetical example: A content platform using Bitcoin Cash for micropayments for accessing premium content. |

Technical Analysis of Bitcoin Cash

Technical analysis offers a valuable perspective on Bitcoin Cash’s potential price movements, complementing fundamental analysis by focusing on price charts and trading volume to identify patterns and predict future trends. It’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Key Technical Indicators for Bitcoin Cash Price Prediction

Several key technical indicators help assess Bitcoin Cash’s momentum, trend strength, and potential reversal points. These indicators provide signals that, when combined with chart analysis, can contribute to a more comprehensive price prediction.

Bitcoin Cash Prediction 2025 – Moving Averages (MA): Moving averages, such as the 50-day and 200-day simple moving averages (SMA) or exponential moving averages (EMA), smooth out price fluctuations and highlight the overall trend. A bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, suggesting upward momentum. Conversely, a bearish crossover signals potential downward pressure. For example, a 50-day SMA crossing above the 200-day SMA could be interpreted as a bullish signal.

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Readings above 70 generally indicate an overbought market, suggesting a potential price correction, while readings below 30 suggest an oversold market, potentially indicating a price rebound. For instance, an RSI reading of 80 might signal a potential short-term price decline.

MACD (Moving Average Convergence Divergence): The MACD indicator compares two moving averages to identify changes in momentum. A bullish signal occurs when the MACD line crosses above its signal line, suggesting increasing upward momentum. Conversely, a bearish signal occurs when the MACD line crosses below its signal line.

Bitcoin Cash Price Chart Analysis: Support and Resistance Levels

Analyzing Bitcoin Cash’s historical price charts reveals key support and resistance levels. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels are price points where selling pressure is expected to outweigh buying pressure, hindering further price increases. Identifying these levels is crucial for predicting potential price reversals and setting stop-loss and take-profit orders.

For example, if Bitcoin Cash consistently finds support around $100, this level could be considered a significant support area. Conversely, if it repeatedly fails to break through a resistance level of $200, this could suggest a temporary ceiling for the price.

Technical Pattern Implications for Bitcoin Cash’s Future

Various technical patterns can provide insights into Bitcoin Cash’s future price movements. These patterns, identified on price charts, often indicate potential trend reversals or continuations.

Head and Shoulders Pattern: This bearish reversal pattern suggests a potential price decline after a period of upward movement. It’s characterized by three peaks, with the middle peak (the head) being the highest. A break below the neckline confirms the pattern and signals a potential downward trend.

Double Bottom Pattern: This bullish reversal pattern indicates a potential price increase after a period of downward movement. It’s characterized by two consecutive lows at approximately the same price level. A break above the neckline confirms the pattern and suggests a potential upward trend.

Comparison of Technical Analysis Methodologies for Bitcoin Cash

Different technical analysis methodologies exist, each with its strengths and weaknesses. While some focus on price action alone, others incorporate volume analysis or other indicators. The choice of methodology depends on the trader’s experience and risk tolerance.

For instance, some traders might prefer candlestick chart analysis, focusing solely on the price action depicted by the candlesticks, while others might incorporate indicators like RSI or MACD to confirm their interpretations.

Summary of Key Technical Indicators and Implications

| Indicator | Bullish Signal | Bearish Signal | Implication |

|---|---|---|---|

| Moving Averages (MA) | Short-term MA crosses above long-term MA | Short-term MA crosses below long-term MA | Indicates trend change (upward or downward) |

| RSI | RSI below 30 | RSI above 70 | Suggests oversold/overbought conditions, potential reversal |

| MACD | MACD line crosses above signal line | MACD line crosses below signal line | Indicates change in momentum |

Market Sentiment and Predictions

Gauging the overall market sentiment towards Bitcoin Cash is a complex task, influenced by a variety of factors ranging from broader cryptocurrency market trends to specific developments within the Bitcoin Cash ecosystem. While not enjoying the same level of mainstream recognition as Bitcoin or Ethereum, Bitcoin Cash maintains a dedicated community and continues to be actively traded.

Current market sentiment is generally characterized by cautious optimism. While significant price surges are less frequent than in the past, Bitcoin Cash’s price tends to correlate with the overall cryptocurrency market. Positive news regarding cryptocurrency regulation or technological advancements often leads to increased interest and price appreciation, while negative news, such as regulatory crackdowns or security breaches affecting other cryptocurrencies, can dampen investor enthusiasm.

Factors Influencing Investor Confidence

Several key factors significantly impact investor confidence in Bitcoin Cash. These include the ongoing development and adoption of Bitcoin Cash, its transaction fees, network security, and the overall health of the broader cryptocurrency market. Positive developments in any of these areas can boost investor confidence, while negative developments can lead to decreased investment. For example, a successful upgrade to the Bitcoin Cash protocol improving transaction speed or scalability would likely be viewed positively by investors. Conversely, a major security vulnerability or a significant drop in the number of daily transactions could negatively impact confidence. The level of media coverage and general public awareness also plays a role, as increased visibility often translates into greater interest and investment.

Bitcoin Cash Price Predictions for 2025

Predicting the price of any cryptocurrency, including Bitcoin Cash, is inherently speculative. Various analysts offer diverse predictions, often based on different methodologies and assumptions. While precise figures are impossible to guarantee, a range of predictions from various sources suggests a potential price fluctuation between $500 and $5000 by 2025. These predictions often consider factors like Bitcoin Cash adoption rates, technological advancements, regulatory changes, and the overall state of the global economy. For instance, a prediction of a higher price might be based on the assumption of widespread adoption by merchants and businesses, while a lower prediction might reflect a more pessimistic outlook on the overall cryptocurrency market.

Risks and Uncertainties Associated with Price Predictions

It’s crucial to acknowledge the inherent risks and uncertainties involved in cryptocurrency price predictions. The cryptocurrency market is highly volatile and susceptible to unexpected events. Factors such as unforeseen regulatory changes, significant technological breakthroughs or setbacks, major security breaches, and shifts in overall market sentiment can drastically impact the price of Bitcoin Cash. Furthermore, the predictions themselves often rely on assumptions that may not materialize, leading to significant discrepancies between predicted and actual prices. For example, a prediction based on the assumption of widespread adoption might be inaccurate if adoption rates remain low.

Comparison of Bitcoin Cash Price Predictions

| Analyst/Source | Predicted Price (2025) | Underlying Assumptions |

|---|---|---|

| Analyst A (Example) | $1000 | Moderate adoption, positive regulatory environment, continued technological development. |

| Analyst B (Example) | $3000 | High adoption, favorable regulatory landscape, significant technological advancements. |

| Analyst C (Example) | $500 | Slow adoption, negative regulatory developments, limited technological progress. |

Predicting Bitcoin Cash’s value in 2025 involves considering various factors, including its own adoption rate and the overall cryptocurrency market. A key influence on the broader crypto market, and thus potentially Bitcoin Cash, is Bitcoin’s halving schedule; understanding the timing is crucial. To learn more about when the next Bitcoin halving concludes, check this resource: Cuando Termina El Halving De Bitcoin 2025.

This information can help contextualize potential price movements for Bitcoin Cash in 2025.

Predicting Bitcoin Cash’s price in 2025 is challenging, given its inherent volatility and dependence on broader market trends. Understanding Bitcoin’s projected value is crucial, however, as it significantly influences altcoins like Bitcoin Cash. For insights into the potential impact of the 2025 Bitcoin halving, check out this analysis: What Is Bitcoin Predicted Price In 2025 Halving? Ultimately, the Bitcoin halving’s effect on Bitcoin’s price will likely ripple through the cryptocurrency market, indirectly impacting Bitcoin Cash’s 2025 forecast.

Predicting Bitcoin Cash’s value in 2025 is challenging, depending heavily on broader market trends. A significant factor will likely be the impact of the anticipated Bitcoin Halving, as discussed in this insightful article on the Bitcoin Halving 2025 Bullrun. Therefore, any Bitcoin Cash prediction for 2025 needs to consider the potential ripple effects of this event on the cryptocurrency market as a whole.

Predicting Bitcoin Cash’s value in 2025 is challenging, influenced by various factors including its own adoption rate and the broader cryptocurrency market. A significant event impacting the entire crypto space, and thus potentially Bitcoin Cash, is the Bitcoin halving; understanding this event is crucial for any prediction. For detailed information on the timing and implications of the next Bitcoin halving, refer to this insightful article: Halving Bitcoin When 2025.

Ultimately, the Bitcoin halving’s effect on Bitcoin Cash’s price in 2025 remains a subject of ongoing speculation and analysis.

Predicting Bitcoin Cash’s value in 2025 is challenging, influenced by various factors including its own adoption rate and the broader cryptocurrency market. A key event impacting the entire crypto space is the Bitcoin halving, and understanding its timing is crucial. To gain insight into this, consult the detailed analysis on the Bitcoin halving date in 2025 available at Fecha Halving Bitcoin 2025.

This information can then help refine your Bitcoin Cash prediction for 2025, considering the potential ripple effects on the entire market.

Predicting Bitcoin Cash’s value in 2025 is challenging, influenced by various market factors. A key event impacting the broader crypto market, and thus potentially Bitcoin Cash, is the Bitcoin halving. To understand the timing of this significant event, check the precise date on this resource: Bitcoin Halving 2025 Exact Date. This halving’s impact on Bitcoin’s price could indirectly affect Bitcoin Cash’s trajectory in 2025.

Predicting Bitcoin Cash’s value in 2025 is challenging, involving numerous factors like adoption rates and regulatory changes. Successfully navigating this market requires effective marketing, and a well-structured Google Ads Account can significantly improve your reach to potential investors interested in Bitcoin Cash predictions and related information. Therefore, a strong online presence is crucial for anyone seriously considering the Bitcoin Cash prediction for 2025.