Bitcoin Cash Price Prediction 2025

Bitcoin Cash (BCH) emerged in 2017 as a hard fork from Bitcoin, aiming to improve scalability and transaction speed. Its history is marked by significant development efforts focusing on improving its functionality and adoption. While initially experiencing considerable growth, its trajectory has been more volatile compared to Bitcoin, influenced by various market factors and technological developments.

Factors influencing cryptocurrency prices are multifaceted and interconnected. These include overall market sentiment, regulatory changes, technological advancements within the cryptocurrency itself and its ecosystem, adoption rates by businesses and individuals, macroeconomic conditions (inflation, recession, etc.), and the activities of large investors (whales). Supply and demand dynamics play a crucial role, with scarcity often driving price increases. News events, both positive and negative, can also significantly impact prices, often leading to substantial volatility.

Bitcoin Cash’s current market position is characterized by a relatively smaller market capitalization compared to Bitcoin and other major cryptocurrencies. It maintains a dedicated community and continues to be actively developed, but its price has shown periods of both growth and significant decline, reflecting the overall volatility inherent in the cryptocurrency market. Its trading volume and market share fluctuate, influenced by the factors mentioned above. While it holds a niche in the cryptocurrency landscape, its future price remains uncertain and subject to various market forces.

Bitcoin Cash’s Technological Advantages and Limitations

Bitcoin Cash’s primary focus has been on improving transaction speed and reducing fees compared to Bitcoin. This is achieved through a larger block size, allowing for more transactions to be processed per unit of time. However, this approach also has its limitations. The larger block size can lead to increased storage requirements for nodes, potentially affecting decentralization and network participation. Furthermore, the development and adoption of competing cryptocurrencies with similar or superior technological solutions continue to impact Bitcoin Cash’s overall market share and influence its price. The success of Bitcoin Cash in the future will depend on its ability to address these limitations and maintain its competitive edge in a rapidly evolving market.

Market Sentiment and Adoption Rate

The overall sentiment within the cryptocurrency market significantly impacts Bitcoin Cash’s price. Periods of bullish sentiment, often fueled by positive news or technological advancements, can lead to price increases. Conversely, bearish sentiment, often driven by regulatory uncertainty or negative news, can cause significant price drops. The rate of adoption by businesses and individuals also plays a crucial role. Increased usage and acceptance of Bitcoin Cash as a payment method can drive demand and consequently, price appreciation. However, limited adoption compared to other cryptocurrencies could limit its price potential. For example, the widespread adoption of Bitcoin as a store of value has significantly influenced its price, while Bitcoin Cash has yet to achieve similar levels of adoption in this area.

Regulatory Landscape and Macroeconomic Factors

The regulatory landscape surrounding cryptocurrencies is constantly evolving, and its impact on Bitcoin Cash’s price can be substantial. Favorable regulations can boost investor confidence and drive price increases, while stricter regulations can lead to decreased investor interest and price declines. Macroeconomic factors, such as inflation and economic recession, also influence the cryptocurrency market. During periods of high inflation, investors might seek refuge in cryptocurrencies as a hedge against inflation, potentially leading to price increases. However, during economic recessions, investors might sell off assets, including cryptocurrencies, to raise cash, leading to price declines. The impact of these factors on Bitcoin Cash is often intertwined with the overall performance of the broader cryptocurrency market.

Factors Affecting Bitcoin Cash Price

Bitcoin Cash’s price, like any cryptocurrency, is a complex interplay of various factors. Understanding these influences is crucial for anyone seeking to analyze its potential future value. These factors range from global economic conditions to the specific technological advancements within the Bitcoin Cash ecosystem itself.

Macroeconomic Factors

Broad economic trends significantly impact Bitcoin Cash’s price. Periods of high inflation often see investors seek alternative stores of value, potentially driving demand for Bitcoin Cash and other cryptocurrencies. Conversely, periods of economic uncertainty or contraction can lead to risk-averse behavior, causing investors to sell off assets like Bitcoin Cash, pushing the price down. For example, the global inflationary pressures of 2021-2022 coincided with periods of increased interest in Bitcoin Cash, though this correlation isn’t always direct or predictable. Interest rate hikes by central banks, impacting the overall cost of borrowing and investment, also play a crucial role in influencing investor sentiment towards riskier assets like cryptocurrencies.

Comparison with Other Cryptocurrencies

Bitcoin Cash’s price is also affected by its position relative to other cryptocurrencies. Its larger block size compared to Bitcoin, for example, allows for faster transaction speeds and lower fees, making it a potentially more attractive option for everyday transactions. However, Bitcoin’s established brand recognition and market dominance continue to influence investor preference. Similarly, the emergence of other layer-1 blockchains with innovative features, such as improved scalability or smart contract functionality, can draw investment away from Bitcoin Cash. The competition within the cryptocurrency space is fierce, constantly shaping relative valuations.

Technological Advancements

Technological upgrades and developments within the Bitcoin Cash network directly impact its price. Successful hard forks introducing new features, improved security protocols, or enhanced scalability solutions can boost investor confidence and drive price appreciation. Conversely, technical glitches, security vulnerabilities, or delays in planned upgrades can negatively affect market sentiment and depress the price. The implementation of new consensus mechanisms or the adoption of innovative technologies could dramatically alter Bitcoin Cash’s value proposition.

Regulatory Changes

Government regulations and policies significantly influence cryptocurrency prices. Clear and supportive regulatory frameworks can increase investor confidence and institutional adoption, potentially leading to higher prices. Conversely, restrictive regulations, bans, or uncertainties surrounding legal status can create volatility and depress prices. The regulatory landscape varies widely across different jurisdictions, creating a complex and dynamic environment that significantly impacts Bitcoin Cash’s value. For instance, a country’s decision to classify Bitcoin Cash as a security or a commodity would directly impact its market behavior.

Community Sentiment and Adoption, Bitcoin Cash Price Prediction 2025 Usd

Community sentiment and adoption rates play a crucial role in determining Bitcoin Cash’s price. Positive media coverage, growing community engagement, and increased adoption by merchants and businesses can fuel price increases. Conversely, negative news, community disputes, or a decline in user adoption can negatively impact the price. The overall perception of Bitcoin Cash within the cryptocurrency community and the broader financial market significantly influences its value. A large-scale adoption by a major retailer, for example, could trigger a significant price surge.

Price Prediction Models and Methodologies

Predicting the price of Bitcoin Cash, or any cryptocurrency, is inherently challenging due to the volatile nature of the market and the influence of numerous unpredictable factors. Several models, however, attempt to forecast future prices with varying degrees of accuracy. These models generally fall under the umbrellas of technical analysis and fundamental analysis, each employing distinct methodologies and relying on different types of data.

Several forecasting methods exist for predicting cryptocurrency prices, each with its strengths and limitations. Understanding these methodologies is crucial for interpreting price predictions and assessing their reliability. The accuracy of any prediction is ultimately limited by the inherent unpredictability of the market.

Technical Analysis Methods

Technical analysis focuses on historical price and volume data to identify patterns and trends that might predict future price movements. It assumes that past market behavior is indicative of future behavior. Common tools include chart patterns (e.g., head and shoulders, triangles), indicators (e.g., Relative Strength Index (RSI), Moving Averages), and candlestick patterns. Applying technical analysis to Bitcoin Cash involves studying its historical price charts, identifying trends and patterns, and using indicators to gauge momentum and potential reversals. For example, a sustained upward trend in price accompanied by increasing trading volume might suggest a bullish outlook, while a bearish divergence between price and RSI could signal an impending price correction. Predicting the 2025 price would involve projecting these identified trends forward, acknowledging the inherent uncertainty involved.

Fundamental Analysis Methods

Fundamental analysis evaluates the intrinsic value of Bitcoin Cash based on factors beyond just price history. This includes assessing the underlying technology, adoption rate, network activity, regulatory landscape, and overall market sentiment. A strong fundamental outlook, characterized by widespread adoption, technological advancements, and positive regulatory developments, generally suggests a higher potential for price appreciation. Conversely, negative news or regulatory crackdowns could exert downward pressure. To predict the 2025 price using fundamental analysis, one would need to forecast the evolution of these factors and assess their combined impact on Bitcoin Cash’s value. For example, a significant increase in the number of merchants accepting Bitcoin Cash as a payment method, coupled with positive regulatory developments, could contribute to a price increase.

Comparison of Prediction Methods

The following table compares technical and fundamental analysis in the context of Bitcoin Cash price prediction:

| Method | Data Used | Strengths | Weaknesses |

|---|---|---|---|

| Technical Analysis | Historical price and volume data, chart patterns, indicators | Relatively easy to implement, provides short-term trading signals | Subjective interpretation, prone to false signals, limited predictive power for long-term forecasts |

| Fundamental Analysis | Technology, adoption rate, network activity, regulatory landscape, market sentiment | Provides a long-term perspective, considers intrinsic value | Difficult to quantify factors, relies on subjective assessments, susceptible to unforeseen events |

Applying Prediction Methods to Bitcoin Cash’s 2025 Price

Applying these methods to predict Bitcoin Cash’s 2025 price requires a combination of both technical and fundamental analysis. Technical analysis could identify potential price targets based on historical trends and patterns, while fundamental analysis would assess the long-term viability and potential of Bitcoin Cash. However, it’s crucial to acknowledge that any prediction is just an educated guess, and the actual price in 2025 could significantly deviate from any forecast due to the unpredictable nature of the cryptocurrency market. A comprehensive prediction would involve considering various scenarios, incorporating both bullish and bearish possibilities, and acknowledging the inherent uncertainties involved. For instance, a scenario could involve projecting a price increase based on increasing adoption and technological improvements, contrasted with a scenario reflecting potential regulatory hurdles or a broader cryptocurrency market downturn.

Potential Scenarios for Bitcoin Cash in 2025

Predicting the price of any cryptocurrency, including Bitcoin Cash (BCH), is inherently speculative. However, by considering various macroeconomic factors, technological advancements, and adoption rates, we can construct plausible scenarios for BCH’s price in 2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. It’s crucial to remember that these are hypothetical projections and not financial advice.

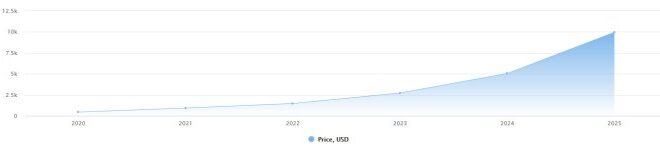

Bullish Scenario: Significant Price Appreciation

This scenario assumes widespread adoption of Bitcoin Cash as a payment system, driven by its relatively low transaction fees and faster transaction speeds compared to Bitcoin. Increased merchant acceptance, coupled with positive regulatory developments and a broader cryptocurrency market bull run, could significantly boost BCH’s price. We also assume successful integration of innovative scaling solutions and features, enhancing its utility and attracting further investment. This scenario envisions a global economic climate favorable to risk assets, leading to increased investment in cryptocurrencies. For example, a scenario similar to the 2017 bull market, but with more widespread institutional adoption, could propel BCH to a price significantly higher than its previous all-time high. Imagine a world where BCH is a leading payment method in emerging markets, facilitating cross-border transactions with ease and low costs, thereby increasing demand.

Bearish Scenario: Stagnant or Declining Price

Conversely, a bearish scenario assumes several unfavorable factors. This could involve increased regulatory scrutiny leading to restrictions on cryptocurrency trading or usage. A prolonged cryptocurrency bear market, characterized by low investor confidence and decreased trading volume, would negatively impact BCH’s price. Furthermore, a failure to innovate and compete effectively with other cryptocurrencies could lead to a decline in market share and, consequently, a lower price. For instance, if BCH fails to address scalability challenges or attract significant developer support, it might lose ground to competitors offering superior features. The overall economic climate plays a role here; a global recession could drastically reduce investor appetite for risky assets like cryptocurrencies, pushing BCH’s price down.

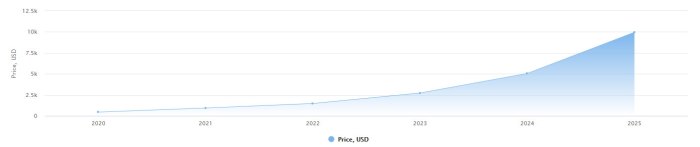

Neutral Scenario: Moderate Price Growth

This scenario assumes a more balanced outlook, reflecting a continuation of the current market trends. BCH experiences moderate growth, driven by steady adoption and technological improvements. However, this growth is tempered by the inherent volatility of the cryptocurrency market and the potential for regulatory uncertainty. The price appreciates gradually, but without the dramatic increases or decreases seen in the bullish and bearish scenarios. This could be considered a baseline scenario, assuming neither significant positive nor negative developments drastically alter the trajectory of BCH’s price. Think of a scenario where BCH maintains its position as a medium-of-exchange cryptocurrency, experiencing slow but steady growth aligned with the overall maturation of the cryptocurrency market.

| Scenario | Price Prediction (USD) | Underlying Assumptions and Factors |

|---|---|---|

| Bullish | $10,000 – $20,000+ | Widespread adoption, positive regulatory environment, significant technological advancements, broader cryptocurrency bull market. |

| Bearish | Below $100 | Increased regulatory scrutiny, prolonged cryptocurrency bear market, lack of innovation, negative economic climate. |

| Neutral | $500 – $1,500 | Moderate adoption, steady technological improvements, balanced market conditions, moderate regulatory environment. |

Risks and Uncertainties

Investing in Bitcoin Cash, like any cryptocurrency, carries inherent risks. The volatile nature of the cryptocurrency market, coupled with the relatively young age of Bitcoin Cash itself, introduces significant uncertainties that potential investors must carefully consider. Understanding these risks and implementing appropriate mitigation strategies is crucial for responsible investment.

Regulatory Uncertainty

Governments worldwide are still grappling with how to regulate cryptocurrencies. Changes in regulatory frameworks, including taxation policies, legal classifications, and trading restrictions, could significantly impact Bitcoin Cash’s price and accessibility. For example, a sudden ban on cryptocurrency trading in a major market could trigger a sharp price drop. Conversely, clear and favorable regulatory frameworks could boost investor confidence and lead to price appreciation. The lack of consistent global regulation creates a significant risk factor.

Market Volatility

Bitcoin Cash’s price is notoriously volatile, subject to dramatic swings based on various factors including news events, market sentiment, technological developments, and even social media trends. A single negative headline or a major security breach could lead to a significant price decline. Conversely, positive news or increased adoption could drive substantial price increases. Historical price charts clearly illustrate this extreme volatility, making it crucial for investors to have a high risk tolerance and a long-term investment horizon. For instance, the price of Bitcoin Cash has experienced fluctuations exceeding 50% in a single day in the past.

Technological Risks

Bitcoin Cash, like all blockchain technologies, faces potential technological risks. These include the possibility of security vulnerabilities, scaling challenges, and the emergence of competing technologies. A successful attack exploiting a security vulnerability could result in a loss of funds for users and damage the reputation of the cryptocurrency. Similarly, if Bitcoin Cash struggles to scale to handle increasing transaction volumes, it could lose its competitive edge to faster and more efficient alternatives. The ongoing development and evolution of blockchain technology introduce an element of uncertainty regarding Bitcoin Cash’s long-term viability.

Security Risks

Investing in Bitcoin Cash involves risks related to the security of digital wallets and exchanges. Hacking attempts, phishing scams, and loss of private keys can lead to the loss of funds. The decentralized nature of Bitcoin Cash makes it difficult to recover lost funds in many cases. Investors need to take robust security measures, such as using strong passwords, enabling two-factor authentication, and storing private keys securely offline. The security of exchanges where Bitcoin Cash is traded is also a critical concern, as evidenced by past instances of exchange hacks resulting in significant losses for users.

Mitigation Strategies

To mitigate these risks, investors should adopt a diversified investment portfolio, not placing all their funds into Bitcoin Cash. Thorough research and due diligence are crucial before investing. Understanding the technology behind Bitcoin Cash and the factors that influence its price is essential. Furthermore, adopting robust security practices, such as using reputable exchanges and secure wallets, is paramount. Finally, maintaining a long-term perspective and avoiding impulsive decisions based on short-term price fluctuations can help manage risk effectively. A well-defined risk management strategy is crucial for successful investment in Bitcoin Cash.

Investment Strategies and Considerations

Investing in Bitcoin Cash, like any cryptocurrency, involves inherent risks and requires a thoughtful approach. The strategies Artikeld below cater to different risk tolerances, emphasizing the importance of careful consideration and diversification. Remember that past performance is not indicative of future results, and all investments carry the potential for loss.

Investing in Bitcoin Cash necessitates understanding your own risk tolerance and aligning your investment strategy accordingly. A crucial element is diversification, minimizing exposure to the volatility inherent in the cryptocurrency market.

Risk Tolerance and Investment Strategies

Different investment strategies are suitable for various risk profiles. Conservative investors might allocate a small percentage of their portfolio to Bitcoin Cash, perhaps viewing it as a long-term holding. Moderate investors could allocate a larger percentage, perhaps incorporating dollar-cost averaging to mitigate risk. Aggressive investors might allocate a significant portion, accepting higher risk for potentially higher returns. For example, a conservative investor might allocate 2% of their portfolio to Bitcoin Cash, while an aggressive investor might allocate 10% or more. This allocation should be adjusted based on market conditions and individual financial circumstances. It’s crucial to never invest more than you can afford to lose.

Diversification in Cryptocurrency Investments

Diversification is paramount in managing risk within the volatile cryptocurrency market. Holding only Bitcoin Cash exposes you to significant potential losses should its price decline sharply. A diversified portfolio might include other cryptocurrencies with different functionalities and market capitalizations, such as Ethereum or Litecoin, along with traditional assets like stocks and bonds. This approach reduces the impact of a single cryptocurrency’s price fluctuations on your overall portfolio. For instance, if Bitcoin Cash experiences a downturn, the gains from other assets in your portfolio can potentially offset the losses.

Purchasing and Securing Bitcoin Cash

Purchasing Bitcoin Cash typically involves using a cryptocurrency exchange. These platforms allow users to buy Bitcoin Cash using fiat currencies like USD or EUR. Reputable exchanges offer varying levels of security features. After purchasing, securing your Bitcoin Cash is critical. This involves using a secure hardware wallet, a physical device that stores your private keys offline, offering superior protection against hacking and theft. Software wallets, while convenient, present higher security risks and should be used with caution. Always prioritize strong passwords and enable two-factor authentication wherever possible. Remember to thoroughly research any exchange or wallet before using it, verifying its reputation and security measures. The process of buying Bitcoin Cash on a reputable exchange involves creating an account, verifying your identity, linking a payment method, placing an order for Bitcoin Cash, and then transferring it to a secure wallet.

Bitcoin Cash vs. Bitcoin: Bitcoin Cash Price Prediction 2025 Usd

Bitcoin Cash (BCH) and Bitcoin (BTC) are both cryptocurrencies stemming from the same origins but have diverged significantly in their technological approach, philosophical underpinnings, and market performance. Understanding their key differences is crucial for anyone considering investment in either asset.

Bitcoin Cash emerged from a Bitcoin hard fork in 2017, primarily driven by disagreements over Bitcoin’s scalability. This comparison will highlight the core distinctions between these two prominent cryptocurrencies.

Technological Differences

The core technological difference lies in block size and transaction processing. Bitcoin utilizes a smaller block size, leading to higher transaction fees and slower confirmation times during periods of high network activity. Bitcoin Cash, conversely, increased the block size significantly, aiming for faster and cheaper transactions. This difference impacts the overall user experience and network efficiency. For example, during periods of high trading volume, Bitcoin transaction fees can spike dramatically, making smaller transactions impractical. Bitcoin Cash, with its larger block size, aims to mitigate this issue.

Philosophical Differences

The philosophical divergence between Bitcoin and Bitcoin Cash centers on their primary goals. Bitcoin prioritizes decentralization and security, often emphasizing its role as a store of value similar to digital gold. Bitcoin Cash, on the other hand, prioritizes scalability and its function as a medium of exchange, aiming to be a more readily usable cryptocurrency for everyday transactions. This difference in focus influences their respective development priorities and community engagement.

Market Capitalization and Performance

Bitcoin consistently maintains a substantially larger market capitalization than Bitcoin Cash. This reflects investor sentiment and the overall perceived value and adoption of each cryptocurrency. While Bitcoin has established itself as the dominant cryptocurrency, Bitcoin Cash has experienced periods of growth and decline, reflecting its own market dynamics and technological developments. For example, comparing their respective price charts over the past few years would show Bitcoin’s significantly higher price and market dominance. This disparity in market capitalization is a critical factor to consider for any investor.

Strengths and Weaknesses

Bitcoin Cash Price Prediction 2025 Usd – The following table summarizes the strengths and weaknesses of each cryptocurrency:

| Feature | Bitcoin (BTC) | Bitcoin Cash (BCH) |

|---|---|---|

| Strength | Established network, high security, strong brand recognition, considered a store of value | Faster transaction speeds, lower fees (generally), focus on usability as a medium of exchange |

| Weakness | Slower transaction speeds, higher fees during periods of high network activity, scalability limitations | Lower market capitalization, less widespread adoption, potentially less secure due to its relatively younger age and smaller network |

Frequently Asked Questions (FAQ)

This section addresses common queries regarding Bitcoin Cash, its differences from Bitcoin, investment potential, accessibility, and future prospects. Understanding these aspects is crucial for anyone considering involvement with this cryptocurrency.

Bitcoin Cash Definition

Bitcoin Cash (BCH) is a cryptocurrency that forked from Bitcoin in 2017. It aims to improve Bitcoin’s scalability by increasing the block size, allowing for faster transaction processing and lower fees. Essentially, it’s a separate digital currency designed to address some of the perceived limitations of the original Bitcoin.

Bitcoin Cash vs. Bitcoin

The key difference lies in their block size and transaction processing capabilities. Bitcoin has a smaller block size, leading to slower transaction speeds and higher fees during periods of high network activity. Bitcoin Cash, with its larger block size, aims to alleviate these issues. Other differences may include variations in mining algorithms and community governance structures, though these are less impactful for the average user. Consider the analogy of two different road systems: Bitcoin might be a congested highway with slow traffic, while Bitcoin Cash aims to be a wider, faster multi-lane highway.

Bitcoin Cash Investment Potential

Investing in Bitcoin Cash, like any cryptocurrency, carries both significant potential rewards and considerable risks. The rewards could include substantial price appreciation if the cryptocurrency gains wider adoption and market value. However, the risks are equally substantial, encompassing market volatility, regulatory uncertainty, and the inherent speculative nature of cryptocurrencies. Remember that past performance is not indicative of future results; the price of Bitcoin Cash has experienced dramatic swings in the past, illustrating this inherent volatility. For example, the price soared significantly in 2017 but later experienced considerable corrections.

Bitcoin Cash Acquisition Methods

Reputable cryptocurrency exchanges are the primary avenue for acquiring Bitcoin Cash. Examples include Binance, Coinbase, Kraken, and others. It’s crucial to research and select a regulated and secure exchange to mitigate risks associated with scams or security breaches. Always exercise due diligence when choosing a platform and prioritize security measures like two-factor authentication.

Bitcoin Cash Future Outlook

The future of Bitcoin Cash remains uncertain, as with any cryptocurrency. Potential scenarios discussed previously range from substantial price growth driven by increased adoption and network improvements to a more stagnant or declining market share if competing cryptocurrencies gain traction. Factors such as technological advancements, regulatory developments, and overall market sentiment will significantly influence its future trajectory. The success of Bitcoin Cash will depend heavily on its ability to attract users and maintain its position within the broader cryptocurrency landscape. It’s essential to remember that these are potential scenarios, and the actual outcome is unpredictable.

Disclaimer and Conclusion

Investing in cryptocurrencies, including Bitcoin Cash, carries significant risk. The cryptocurrency market is highly volatile and subject to rapid price swings influenced by a multitude of factors, many of which are beyond anyone’s control. Past performance is not indicative of future results, and any prediction about the future price of Bitcoin Cash is inherently speculative. This analysis should not be considered financial advice, and readers should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. Remember, you could lose some or all of your investment.

This analysis explored potential price scenarios for Bitcoin Cash in 2025, considering various factors that could influence its value. The projections presented are based on a combination of technical analysis, fundamental analysis, and consideration of broader market trends. It is crucial to remember that these are only potential outcomes, and the actual price could differ significantly.

Key Findings and Influencing Factors

The following factors were identified as significantly impacting the projected Bitcoin Cash price:

- Adoption Rate: Widespread adoption by merchants and users is crucial for price appreciation. Increased usage and transaction volume directly impact demand and price.

- Technological Developments: Upgrades and improvements to the Bitcoin Cash network, such as enhanced scalability and security features, can positively influence investor confidence and price.

- Regulatory Landscape: Clearer and more favorable regulatory frameworks globally can boost investor confidence and lead to higher prices. Conversely, stricter regulations could negatively impact the market.

- Market Sentiment: Overall market sentiment towards cryptocurrencies and Bitcoin Cash specifically plays a crucial role. Positive sentiment generally leads to price increases, while negative sentiment can trigger price drops. This is often seen in response to major news events or economic shifts.

- Competition: Bitcoin Cash faces competition from other cryptocurrencies. Its ability to differentiate itself and maintain its market share is a key determinant of its future price.

For example, the 2017 Bitcoin bull run saw many altcoins, including Bitcoin Cash, experience significant price increases due to overwhelmingly positive market sentiment and increased adoption. However, subsequent market corrections demonstrated the volatility inherent in the cryptocurrency market and the impact of negative sentiment. The price predictions presented here consider these past events and aim to account for the potential impact of similar market forces in the future. However, it’s impossible to predict the precise impact of unforeseen events.

Predicting the Bitcoin Cash price in 2025 USD is challenging, influenced by various market factors. Understanding the broader cryptocurrency landscape is crucial, and a key element of that is Bitcoin itself; for instance, checking projected Bitcoin values like those found in this forecast for Bitcoin Price 2025 January can offer valuable context. Ultimately, Bitcoin Cash’s future price remains speculative, dependent on both its own adoption and the overall health of the crypto market.

Predicting the Bitcoin Cash price in 2025 in USD is challenging, heavily influenced by broader market trends. A significant factor will be the overall cryptocurrency market performance, particularly the extent of a potential Bitcoin bull run; for insights into that, check out this analysis on Bitcoin Price Prediction 2025 Bull Run. Ultimately, Bitcoin Cash’s price will depend on its adoption rate and technological advancements relative to Bitcoin’s trajectory.

Predicting the Bitcoin Cash price in 2025 USD is challenging, requiring analysis of various factors impacting the cryptocurrency market. Understanding broader Bitcoin predictions is crucial, and a helpful resource for this is Plan B’s model, detailed in this insightful article: Bitcoin Price 2025 Plan B. While Plan B focuses on Bitcoin, its insights can inform our understanding of the potential trajectory for Bitcoin Cash, although its price is likely to be influenced by its own unique market dynamics.

Predicting the Bitcoin Cash price in 2025 in USD is challenging, requiring analysis of various market factors. Understanding broader Bitcoin trends is crucial, and discussions on Reddit offer valuable insights; for example, check out the conversation on Bitcoin Price 2025 Reddit to gauge overall sentiment. Ultimately, Bitcoin Cash’s future price will depend on its adoption rate and technological advancements.

Predicting the Bitcoin Cash price in 2025 USD is challenging, given the inherent volatility of cryptocurrencies. However, understanding the broader cryptocurrency market is crucial, and a helpful resource for this is the Bitcoin Price 2025 Forecast , which offers insights into potential market trends. Ultimately, Bitcoin Cash’s 2025 USD value will depend on various factors including its adoption rate and overall market sentiment.