Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is a significant occurrence in the cryptocurrency’s lifecycle. Understanding its mechanics and historical impact is crucial for predicting its potential effects on the market in 2025. This event, occurring approximately every four years, has historically been followed by periods of significant price appreciation, although other factors also play a crucial role.

Bitcoin Halving Mechanics and Historical Price Impact

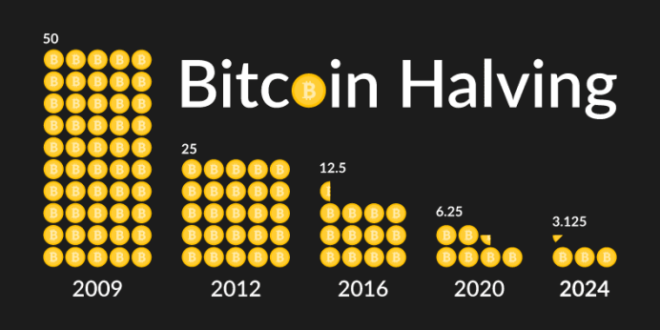

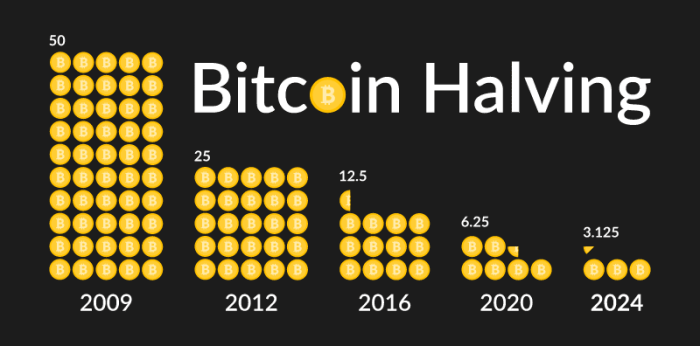

The Bitcoin halving mechanism is embedded in the Bitcoin protocol. It cuts the block reward, the amount of Bitcoin miners receive for verifying transactions and adding them to the blockchain, in half. This reduction in the supply of newly created Bitcoin is intended to control inflation and maintain the scarcity of the asset. Historically, halvings have been followed by periods of price increase, although the magnitude and duration of these increases have varied. This correlation isn’t guaranteed, and other market forces heavily influence Bitcoin’s price. The reduced supply, however, is often cited as a contributing factor to bullish price action.

Timeline of Past Bitcoin Halvings and Price Movements

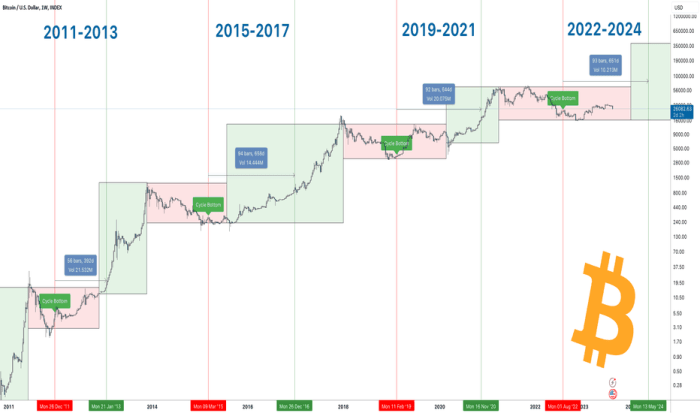

A detailed examination of past halvings reveals a complex relationship between the event and subsequent price changes.

| Halving Date | Price Before Halving (USD) | Price Around Halving (USD) | Price 1 Year After Halving (USD) |

|---|---|---|---|

| November 28, 2012 | ~ $13 | ~ $12 | ~ $100 |

| July 9, 2016 | ~ $650 | ~ $650 | ~ $2000 |

| May 11, 2020 | ~ $8700 | ~ $8700 | ~ $29000 |

*Note: These figures are approximate and represent the general price trend. Precise values fluctuate significantly.*

Expert Opinions and Market Analyses for 2025 Halving

Many analysts predict a positive impact on Bitcoin’s price following the 2025 halving. However, the extent of this impact is subject to debate. Some experts suggest a price surge similar to previous halvings, while others point to potential macroeconomic factors that could moderate or even negate this effect. For instance, some analysts believe that increased institutional adoption and continued technological advancements could drive price increases, while others warn about potential regulatory headwinds or broader economic downturns. The general consensus leans towards a positive price impact, but the degree remains uncertain.

Influence of Macroeconomic Factors on Bitcoin’s Price Post-2025 Halving

Global economic conditions, inflation rates, monetary policies, and geopolitical events can significantly impact Bitcoin’s price. For example, periods of high inflation or economic uncertainty can increase demand for Bitcoin as a hedge against inflation or a safe haven asset. Conversely, tightening monetary policies or negative economic news could lead to a sell-off. The 2025 halving’s impact will be intertwined with the prevailing macroeconomic climate, making accurate prediction challenging. The 2020 halving, for example, occurred amidst the COVID-19 pandemic and subsequent economic stimulus, which arguably contributed to the significant price increase that followed.

Comparative Table: Past Halvings vs. Projected 2025 Outcomes

Predicting the future is inherently uncertain, but comparing past halvings with potential 2025 outcomes can provide valuable insights. Note that these are projections, and actual results may differ significantly.

| Factor | 2012 Halving | 2016 Halving | 2020 Halving | Projected 2025 Halving |

|---|---|---|---|---|

| Price Before Halving (USD) | ~ $13 | ~ $650 | ~ $8700 | (Highly Variable, depends on market conditions) |

| Price Increase Post-Halving (approx. %) | ~769% | ~200% | ~234% | (Highly Variable, potential for significant increase, but uncertain magnitude) |

| Time to Peak Price Post-Halving | ~1 year | ~1 year | ~1 year | (Potentially longer due to various factors) |

| Market Maturity | Early stages | Growing | Mature | Mature, but with potential for further growth |

The Impact on Bitcoin Mining: Date Of Bitcoin Halving 2025

The Bitcoin halving, occurring approximately every four years, significantly impacts the profitability of Bitcoin mining. This event reduces the block reward miners receive for verifying transactions and adding new blocks to the blockchain, directly affecting their revenue streams. Understanding the consequences of this reduction is crucial for analyzing the future of Bitcoin mining and the overall health of the network.

The halving’s effect on miner profitability is primarily a decrease in revenue per block mined. Since the cost of mining (electricity, hardware maintenance, etc.) remains relatively constant, the reduced reward forces miners to re-evaluate their operational efficiency and explore strategies to maintain profitability. This often leads to a period of adjustment and consolidation within the industry.

Miner Profitability and Responses

The 2025 halving will likely lead to a decline in profitability for many Bitcoin miners. Those with high operational costs or less efficient mining hardware will be disproportionately affected. In response, miners may adopt several strategies, ranging from upgrading their equipment to improve efficiency, to consolidating operations to leverage economies of scale, or even shutting down less profitable operations entirely. The previous halvings demonstrated this dynamic, with many smaller, less efficient mining operations forced to exit the market. This process, however, also leads to a more efficient and resilient mining network in the long run.

Hashrate Changes Following the 2025 Halving

The hashrate, a measure of the total computational power dedicated to Bitcoin mining, is expected to experience some fluctuation following the 2025 halving. While an immediate and drastic drop is unlikely, a period of adjustment and potential temporary decline is anticipated. Miners who find themselves unprofitable might temporarily reduce their hashing power, leading to a lower hashrate. However, the subsequent increase in Bitcoin’s price, often seen following a halving, typically incentivizes new miners to enter the market and existing miners to maintain their operations, eventually leading to a recovery and even an increase in the hashrate over time. The 2012 and 2016 halvings both showed an initial dip followed by significant long-term growth in hashrate.

Comparison of Mining Landscapes Across Halvings

The mining landscape has evolved significantly since the first halving in 2012. Initially, individuals and small groups could participate effectively in mining. Subsequent halvings have led to increased consolidation, with large-scale mining operations, often backed by significant capital investment and located in regions with low electricity costs, dominating the space. Technological advancements, such as the development of more energy-efficient ASICs (Application-Specific Integrated Circuits), have also played a significant role. The 2016 halving, for instance, saw a significant increase in the adoption of more efficient ASICs, which helped to mitigate the impact of the reduced block reward. The 2025 halving is likely to further accelerate this trend, favoring large, well-capitalized operations with access to advanced technology.

Challenges Faced by Bitcoin Miners Post-2025 Halving

Post-2025, Bitcoin miners will face several key challenges. Maintaining profitability in the face of reduced block rewards will be paramount. Competition will remain intense, requiring miners to constantly optimize their operations and invest in the latest technology. Regulatory uncertainty and potential government crackdowns on cryptocurrency mining in certain jurisdictions will also pose a significant risk. Fluctuations in Bitcoin’s price, though expected to rise eventually, can create short-term instability. Finally, securing access to affordable and reliable energy will continue to be a crucial factor for success.

Potential Miner Strategies to Maintain Profitability

Miners will need to adopt strategic measures to navigate the post-halving landscape. Here are some potential approaches:

- Upgrade Mining Hardware: Investing in newer, more energy-efficient ASICs to reduce operational costs and increase hashing power.

- Optimize Energy Consumption: Implementing energy-saving measures, such as utilizing renewable energy sources and optimizing cooling systems, to minimize electricity expenses.

- Consolidate Operations: Merging with other mining operations to leverage economies of scale and reduce overhead costs.

- Diversify Revenue Streams: Exploring alternative revenue streams, such as offering mining services or participating in other blockchain activities.

- Strategic Location Selection: Relocating mining operations to jurisdictions with favorable regulatory environments and lower electricity costs.

Bitcoin’s Price Prediction Post-Halving

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors, from macroeconomic conditions to regulatory shifts and evolving market sentiment, contribute to the wide range of forecasts offered by analysts and institutions. While no one can definitively predict the future, examining various perspectives provides valuable insight into potential price trajectories.

Diverse Price Predictions from Analysts and Institutions

Several prominent cryptocurrency analysts and financial institutions have published their Bitcoin price predictions following the 2025 halving. These predictions vary significantly, reflecting different methodologies and underlying assumptions. For instance, some analysts employ quantitative models based on historical price data and halving cycles, while others incorporate qualitative factors such as adoption rates and regulatory developments. These models often differ in their weighting of various factors, leading to divergent outcomes. For example, one prominent analyst might project a price of $100,000 based on a model emphasizing historical price trends following previous halvings, while another might forecast a more conservative figure of $50,000 due to concerns about macroeconomic headwinds. The discrepancy highlights the inherent challenges in accurately predicting future price movements.

Analytical Models and Their Price Behavior Predictions, Date Of Bitcoin Halving 2025

Different analytical models offer varying perspectives on Bitcoin’s post-halving price behavior. Stock-to-flow (S2F) models, for example, focus on the scarcity of Bitcoin and project substantial price increases based on the reduced supply after each halving. These models often generate bullish price forecasts. Conversely, models incorporating macroeconomic factors, such as interest rates and inflation, may produce more bearish or conservative predictions. These models might incorporate economic indicators and anticipate potential market downturns impacting Bitcoin’s price. Furthermore, some analysts employ on-chain metrics, such as transaction volume and network activity, to gauge market demand and predict future price movements. The interplay of these diverse models creates a spectrum of possible price scenarios.

Factors Contributing to Variance in Price Predictions

The considerable variance in Bitcoin price predictions stems from a confluence of factors. Market sentiment, often influenced by news events, technological advancements, and regulatory changes, plays a crucial role. A positive news cycle, such as widespread institutional adoption, could significantly boost prices, while negative news, such as increased regulatory scrutiny, could lead to price declines. Furthermore, macroeconomic conditions, including inflation rates and interest rate policies, significantly influence investor behavior and risk appetite, affecting Bitcoin’s price. Finally, the degree of uncertainty surrounding future technological developments and the broader adoption of cryptocurrencies contributes to the range of price forecasts.

Comparison of Bullish and Bearish Price Scenarios

Bullish scenarios typically assume sustained growth in Bitcoin adoption, positive regulatory developments, and a robust macroeconomic environment. These scenarios often rely on the historical precedent of price increases following previous halvings and anticipate strong investor demand. In contrast, bearish scenarios consider factors such as increased regulatory pressure, macroeconomic instability, and a potential loss of investor confidence. These scenarios might forecast price stagnation or even a significant price correction. For instance, a bullish prediction might visualize a price exceeding $200,000 within a year of the halving, based on a continued influx of institutional investment and growing mainstream adoption. A bearish prediction, on the other hand, might suggest a price range between $30,000 and $50,000, factoring in potential economic downturns and stricter regulatory frameworks.

Potential Price Trajectories Under Different Market Conditions

Under a bullish scenario, characterized by strong investor demand and positive market sentiment, the price trajectory could be represented by a steep upward curve, possibly exceeding previous all-time highs. This would involve a rapid price increase in the months following the halving, driven by increased scarcity and anticipation of future price appreciation. Conversely, under a bearish scenario, the price trajectory could be depicted as a relatively flat or slightly downward sloping line, reflecting a lack of significant price movement or a gradual decline. A neutral scenario might show a moderate upward trend, reflecting a balance between bullish and bearish forces. A scenario with significant market volatility could be visualized as a fluctuating line, with periods of both substantial gains and losses. These are merely illustrative representations; actual price movements are likely to be more complex and unpredictable.

Investing in Bitcoin Before and After the Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, significantly impacts the cryptocurrency’s supply and demand dynamics. Understanding these dynamics is crucial for investors considering exposure to Bitcoin before and after the 2025 halving. This section Artikels strategies, risks, rewards, and best practices for navigating this period.

Date Of Bitcoin Halving 2025 – Investors often anticipate price appreciation following a halving due to the reduced supply. However, this is not guaranteed, and market sentiment, regulatory changes, and macroeconomic factors also play significant roles. Therefore, a well-informed approach, incorporating risk management and diversification, is essential.

Bitcoin Investment Strategies Before and After the Halving

Successful Bitcoin investment strategies around the halving often involve a combination of timing and risk tolerance. Some investors opt for a gradual approach, utilizing dollar-cost averaging (DCA) to mitigate risk by purchasing Bitcoin regularly regardless of price fluctuations. Others prefer lump-sum investments, betting on significant price appreciation after the halving. The optimal approach depends on individual financial goals and risk appetite. Historically, the period leading up to a halving has seen increased volatility, while the post-halving period has sometimes shown price increases, though not always immediately or dramatically. For example, the 2016 halving led to a significant price increase over the following year, but the 2020 halving saw a more gradual increase.

Risks and Rewards of Bitcoin Investment

Investing in Bitcoin carries substantial risk. Its price is highly volatile, subject to market manipulation, regulatory uncertainty, and macroeconomic factors. The halving itself doesn’t guarantee price appreciation; it merely reduces the rate of new Bitcoin entering circulation. Conversely, the potential rewards are equally significant. Bitcoin’s limited supply and growing adoption as a store of value and medium of exchange could lead to substantial price appreciation over the long term. The potential for significant gains must be weighed against the considerable risk of substantial losses.

Risk Management and Diversification

Effective risk management is paramount when investing in Bitcoin. Diversification across asset classes is crucial to reduce overall portfolio risk. Allocating only a portion of one’s investment portfolio to Bitcoin, while the rest is invested in less volatile assets like bonds or stocks, is a common strategy. This approach helps cushion against potential losses in the Bitcoin market. Furthermore, understanding your own risk tolerance and investment timeline is crucial in determining the appropriate level of Bitcoin exposure in your portfolio.

Comparing Investment Approaches: Dollar-Cost Averaging vs. Lump-Sum

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy mitigates the risk of investing a large sum at a market peak. A lump-sum investment, on the other hand, involves investing a significant amount of money at once, hoping to capitalize on anticipated price increases. The choice between DCA and a lump-sum investment depends on an investor’s risk tolerance and market outlook. DCA is generally considered less risky, while lump-sum investments offer the potential for higher returns but also greater losses.

Securely Purchasing and Storing Bitcoin: A Step-by-Step Guide

Purchasing and securing Bitcoin requires careful planning and execution. Here’s a step-by-step guide:

- Choose a reputable cryptocurrency exchange: Research and select a well-established exchange with a strong security track record and positive user reviews. Consider factors like fees, security measures, and available features.

- Verify your identity: Most exchanges require Know Your Customer (KYC) verification to comply with anti-money laundering regulations. This usually involves providing identification documents.

- Fund your account: Deposit funds into your exchange account using a secure payment method. Be cautious of phishing scams and ensure you’re using the official exchange website.

- Purchase Bitcoin: Once your account is funded, place an order to buy Bitcoin. Specify the amount you wish to purchase and confirm the transaction.

- Transfer Bitcoin to a secure wallet: Do not leave Bitcoin on the exchange for extended periods. Transfer your Bitcoin to a secure hardware wallet or a reputable software wallet for enhanced security.

- Secure your wallet: Protect your wallet’s seed phrase or private keys. These are crucial for accessing your Bitcoin and should be kept offline and in a safe place. Never share them with anyone.

Frequently Asked Questions (FAQ) about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. Understanding its mechanics and potential impact is crucial for anyone interested in Bitcoin. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined). This reduction is by half, hence the term “halving.” The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin. It’s a key part of Bitcoin’s deflationary monetary policy.

Expected Date of the 2025 Bitcoin Halving

While the exact date is subject to minor variations depending on block times, the 2025 Bitcoin halving is anticipated to occur around the Spring or early Summer of 2025. The precise date will be determined by the time it takes miners to solve the complex cryptographic puzzles required to add new blocks to the blockchain. Historically, these halvings have been fairly predictable, with only minor deviations from the four-year cycle.

Impact of the Halving on Bitcoin Supply

The halving directly impacts the supply of newly mined Bitcoin. Before the halving, miners receive a certain number of Bitcoins as a reward for successfully adding a block to the blockchain. After the halving, this reward is cut in half. This reduction in the rate of new Bitcoin creation contributes to the overall scarcity of the cryptocurrency. For example, if the reward was 6.25 BTC per block before the halving, it would become 3.125 BTC per block afterward.

Historical Relationship Between Halvings and Price Increases

Historically, Bitcoin’s price has often seen upward trends following previous halvings. This correlation is often attributed to the decreased supply of new Bitcoins entering the market, potentially increasing demand and driving up the price. However, it’s crucial to note that other factors, such as market sentiment, regulatory changes, and technological advancements, also play significant roles in Bitcoin’s price fluctuations. The 2012 and 2016 halvings, for example, were followed by substantial price increases, though the timing and magnitude of these increases varied.

Guaranteed Price Increase After the 2025 Halving

No, a price increase after the 2025 halving is not guaranteed. While historical data suggests a correlation between halvings and price increases, it’s not a causal relationship. Numerous other market forces can influence Bitcoin’s price, including macroeconomic conditions, regulatory announcements, technological developments, and overall investor sentiment. Therefore, predicting the price with certainty is impossible. Past performance is not indicative of future results.

Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin, particularly around a halving event, carries inherent risks. Increased volatility is common during periods of anticipation and following the halving itself. The price can fluctuate significantly, potentially leading to substantial gains or losses. Furthermore, the cryptocurrency market is subject to manipulation and speculative bubbles. Investors should thoroughly research and understand the risks before investing any capital. Diversification of investments is also a recommended risk management strategy.

The Broader Crypto Market Impact

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its effects ripple outwards, influencing the broader crypto market in complex and often unpredictable ways. Understanding these potential impacts is crucial for navigating the landscape leading up to and following the 2025 halving. The interconnectedness of cryptocurrencies means that Bitcoin’s price movements often strongly correlate with the performance of other digital assets, creating both opportunities and risks for investors.

The correlation between Bitcoin’s price and altcoin performance is generally positive, meaning they tend to move in the same direction. However, the strength of this correlation varies over time and depends on various factors, including market sentiment, regulatory developments, and technological advancements within specific altcoin projects. Past halvings have shown a mixed bag of reactions in the altcoin market, sometimes experiencing significant gains alongside Bitcoin, and other times exhibiting more muted or even negative responses. This variability underscores the need for careful analysis and diversification in any investment strategy.

Bitcoin Halving and Altcoin Price Movements

Historically, Bitcoin halvings have often been followed by periods of increased Bitcoin price volatility. This volatility often translates into similar price fluctuations for altcoins, although the magnitude of the impact varies considerably depending on the individual altcoin and its market capitalization. For instance, during the 2021 bull run following the 2020 halving, many altcoins experienced substantial price increases, mirroring Bitcoin’s upward trajectory. However, the 2016 halving was followed by a period of relative price stagnation for Bitcoin and many altcoins, highlighting the unpredictable nature of these events. The extent of correlation is influenced by factors like the overall market sentiment, the specific characteristics of the altcoin, and the broader macroeconomic climate.

Past Halving Reactions in the Broader Crypto Market

Analyzing past Bitcoin halvings offers valuable insights into potential future scenarios. The 2012 halving saw a gradual increase in Bitcoin’s price over the subsequent year. While altcoins existed, their market capitalization was significantly smaller, and the correlation wasn’t as pronounced as in later halvings. The 2016 halving was followed by a period of consolidation before a substantial price surge in 2017. Altcoins also experienced significant gains during this period, although the market was still relatively nascent. The 2020 halving saw a significant price increase for Bitcoin and many altcoins in 2021, showcasing a strong positive correlation. However, it’s important to note that these past events are not necessarily predictive of future performance. Each halving occurs within a unique macroeconomic and market context.

Investment Opportunities and Risks in the Altcoin Market

The period leading up to and following the 2025 halving presents both significant opportunities and substantial risks for altcoin investors. The potential for increased price volatility, coupled with the uncertainty surrounding the halving’s impact, requires a cautious approach. Investors might consider allocating a portion of their portfolio to altcoins with strong fundamentals, active development teams, and a clear use case. Conversely, the risk of significant price drops remains, particularly for altcoins with weak fundamentals or those susceptible to market manipulation. Diversification across various altcoin projects and sectors is essential to mitigate risk.

Potential Impact on Different Crypto Sectors

The following table illustrates the potential impact of the 2025 Bitcoin halving on various sectors within the broader cryptocurrency market. Note that these are potential outcomes and actual results may differ significantly.

| Crypto Sector | Potential Positive Impact | Potential Negative Impact | Overall Outlook |

|---|---|---|---|

| DeFi | Increased user activity and trading volume driven by higher Bitcoin prices; potentially leading to increased demand for DeFi tokens. | Reduced liquidity if investors move funds from DeFi to Bitcoin; potential for smart contract vulnerabilities to be exploited in periods of high volatility. | Potentially positive, but subject to significant volatility. |

| NFTs | Increased demand for NFT art and collectibles if broader market sentiment is positive; potential for new NFT projects to gain traction. | Reduced trading volume and lower prices if the overall market experiences a downturn; increased risk of scams and fraudulent activities during periods of high volatility. | Highly dependent on broader market sentiment; potential for both significant gains and losses. |

| Layer-1 Blockchains | Increased adoption if users seek alternatives to Bitcoin’s high transaction fees (if they increase); potential for new projects to gain market share. | Reduced activity if the overall market experiences a downturn; increased competition amongst various Layer-1 blockchains. | Mixed; some projects may benefit, while others may struggle. |

| Meme Coins | Potential for short-term gains driven by speculative trading and hype; rapid price increases in response to positive Bitcoin price action. | High risk of significant price drops if the broader market experiences a downturn; extremely volatile and prone to manipulation. | Highly speculative; high potential rewards but also high risk of losses. |