Alternative Scenarios and Predictions

Predicting Bitcoin’s price in 2025 is inherently speculative, but by considering various macroeconomic factors and technological advancements, we can construct plausible scenarios. These scenarios, while not exhaustive, illustrate the range of potential outcomes and highlight the key drivers influencing Bitcoin’s price. Remember, these are just possibilities, and the actual price could deviate significantly.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a robust Bitcoin price appreciation by 2025, potentially exceeding previous all-time highs significantly. This outcome hinges on several key factors. Firstly, widespread institutional adoption continues, with major financial institutions integrating Bitcoin into their portfolios and offering Bitcoin-related services. Secondly, regulatory clarity emerges globally, reducing uncertainty and encouraging further investment. Thirdly, technological advancements, such as the Lightning Network’s wider implementation, improve Bitcoin’s scalability and transaction speed, boosting its usability. Finally, macroeconomic instability, such as persistent inflation or geopolitical uncertainty, drives increased demand for Bitcoin as a safe-haven asset. This scenario could see Bitcoin’s price reaching, for example, $250,000 or more, driven by increased demand exceeding supply. A comparable situation would be the rapid growth of the internet in the late 1990s, where early adoption and belief in the technology drove significant price increases in related companies.

Bearish Scenario: Bitcoin Experiences a Significant Correction

In this pessimistic scenario, Bitcoin’s price undergoes a substantial correction in 2025, potentially falling well below current levels. This outcome is predicated on several factors. Firstly, increased regulatory scrutiny and restrictive policies globally could stifle Bitcoin’s growth and negatively impact investor confidence. Secondly, a major security breach or a significant technological flaw in the Bitcoin network could erode trust and trigger a sell-off. Thirdly, a broader economic downturn or a cryptocurrency market crash could drag down Bitcoin’s price along with other digital assets. Finally, the emergence of a more compelling competitor cryptocurrency could divert investment away from Bitcoin. In this scenario, Bitcoin’s price might fall to, say, $10,000 or even lower, mirroring the significant corrections seen in previous bear markets for other assets like stocks during periods of economic uncertainty.

Neutral Scenario: Bitcoin Consolidates and Stabilizes

This scenario assumes a more moderate outcome, where Bitcoin’s price neither dramatically increases nor decreases. Bitcoin’s price fluctuates within a relatively narrow range throughout 2025, consolidating its position in the market. This scenario suggests a balance between positive and negative factors. Widespread adoption progresses at a slower pace than in the bullish scenario, while regulatory challenges remain but are not overly restrictive. Technological advancements continue, but their impact on price is less pronounced. Macroeconomic conditions are relatively stable, neither boosting nor hindering Bitcoin’s growth. In this scenario, Bitcoin’s price might remain within a range, for instance, between $30,000 and $60,000, reflecting a period of market maturity and consolidation similar to the periods of sideways movement observed in the stock market after periods of significant growth or decline.

Visual Representation of Scenarios

Imagine three lines on a graph representing Bitcoin’s price over time from the present to 2025.

Bullish Scenario: This line shows a steep upward trajectory, steadily rising to a significantly higher point in 2025, representing a substantial price increase.

Bearish Scenario: This line displays a downward trend, showing a steep decline from the present to a much lower point in 2025, indicating a significant price drop.

Neutral Scenario: This line shows a relatively flat trajectory, fluctuating within a defined range throughout the period, suggesting price stability and consolidation. The range of fluctuation is considerably smaller compared to the other two scenarios.

Risk Mitigation Strategies for Investors

Navigating the volatile cryptocurrency market requires a proactive approach to risk management. A potential Bitcoin crash in 2025 necessitates a robust strategy encompassing diversification, risk management techniques, and long-term investment considerations. The following strategies aim to minimize potential losses while still participating in the market’s potential gains.

Diversification Strategies

Diversification is crucial to mitigate risk. Instead of concentrating solely on Bitcoin, spreading investments across different asset classes reduces the impact of a single asset’s downturn. This includes allocating funds to other cryptocurrencies, stocks, bonds, real estate, and precious metals. A well-diversified portfolio can cushion the blow of a Bitcoin crash by providing stability from other performing assets. For example, if Bitcoin experiences a sharp decline, gains in the stock market could offset some of the losses. The optimal diversification strategy will depend on individual risk tolerance and financial goals.

Risk Management Techniques

Effective risk management involves employing strategies to limit potential losses. Dollar-cost averaging (DCA) is a popular method where investors invest a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. Stop-loss orders automatically sell an asset when it reaches a predetermined price, limiting potential losses. However, stop-loss orders can trigger premature selling if the market experiences temporary volatility. Hedging involves using financial instruments to offset potential losses from a specific investment. For example, an investor might use Bitcoin futures contracts to hedge against a potential price drop. While hedging can be effective, it involves additional costs and complexity.

Long-Term Investment Approaches

Adopting a long-term investment horizon can help weather short-term market fluctuations. Bitcoin’s price has historically shown periods of significant volatility followed by periods of growth. A long-term perspective allows investors to ride out temporary downturns and benefit from potential future price appreciation. However, a long-term strategy requires patience and the ability to withstand potential short-term losses. Holding Bitcoin through market corrections requires a strong conviction in its long-term value proposition. For example, investors who held Bitcoin throughout the 2018 bear market saw significant gains when the price recovered.

Expert Opinions and Predictions

Predicting the future of Bitcoin, or any cryptocurrency for that matter, is notoriously difficult. However, several prominent figures in the industry have offered their perspectives on the possibility of a Bitcoin crash in 2025, providing a range of opinions and underlying rationales. Analyzing these predictions allows for a better understanding of the potential market dynamics at play.

Analyzing the predictions of prominent figures reveals a divergence of opinions, reflecting the inherent uncertainty in the cryptocurrency market. Some experts foresee a significant correction, while others remain bullish, highlighting the complexity of predicting future price movements. Understanding the basis for these predictions is crucial for navigating the potential volatility.

Diverse Predictions on Bitcoin’s Future in 2025

Several prominent figures within the cryptocurrency space have offered predictions regarding Bitcoin’s price trajectory in 2025. These predictions vary significantly, reflecting the differing analytical frameworks and underlying assumptions employed. For example, some analysts, basing their predictions on historical price cycles and macroeconomic factors, anticipate a substantial price correction, potentially mirroring past bear markets. Others, focusing on Bitcoin’s growing adoption as a store of value and the increasing institutional investment, predict continued price appreciation, albeit possibly with periods of consolidation. It’s crucial to consider that these predictions are not guarantees, but rather informed estimations based on available data and market analysis.

Comparison of Viewpoints and Areas of Agreement/Disagreement

While predictions diverge widely, some common themes emerge. Many experts agree that macroeconomic factors, such as inflation rates, interest rate policies, and regulatory changes, will significantly influence Bitcoin’s price. There is also a general consensus that the level of adoption by both retail and institutional investors will play a critical role. However, disagreement arises concerning the relative importance of these factors and their likely impact on Bitcoin’s price. Some analysts prioritize macroeconomic trends, suggesting that a global economic downturn could trigger a significant Bitcoin price drop. Others place greater emphasis on technological advancements and the long-term growth potential of the cryptocurrency market, suggesting that Bitcoin’s price will remain resilient despite short-term volatility. The differing weighting assigned to these factors leads to vastly different predictions.

Evaluation of Credibility and Potential Biases

The credibility of any prediction depends on the source’s expertise, track record, and potential biases. Some analysts may be overly optimistic due to their vested interests in the cryptocurrency market, while others may be overly pessimistic due to concerns about market risks. It’s essential to critically evaluate the methodology used by each expert, considering the data sources and assumptions employed. For instance, analysts relying solely on technical analysis may overlook crucial macroeconomic factors, while those focusing primarily on macroeconomic trends might underestimate the impact of technological innovation. A balanced approach, incorporating both technical and fundamental analysis, along with a critical assessment of the source’s potential biases, is crucial for forming an informed opinion. For example, a prediction from an analyst heavily invested in a competing cryptocurrency might carry a greater potential for bias than one from an independent researcher.

FAQ: Bitcoin Crash 2025 Prediction

Predicting a Bitcoin crash in 2025, or any year for that matter, is inherently speculative. However, understanding potential contributing factors and implementing risk mitigation strategies can help investors navigate the volatile cryptocurrency market. This section addresses frequently asked questions concerning a potential Bitcoin crash in 2025.

Likely Causes of a Bitcoin Crash in 2025, Bitcoin Crash 2025 Prediction

Several interconnected factors could trigger a Bitcoin crash in 2025. Macroeconomic conditions, such as a global recession or significant inflation, could severely impact investor risk appetite, leading to widespread selling. Regulatory changes, including stricter anti-money laundering (AML) rules or outright bans in major jurisdictions, could significantly reduce Bitcoin’s liquidity and market capitalization. Technological disruptions, such as the emergence of a superior cryptocurrency or a major security breach compromising the Bitcoin network, could also erode investor confidence. Finally, shifts in market sentiment, driven by news events, influencer opinions, or speculative bubbles bursting, can cause dramatic price swings. For example, the collapse of FTX in 2022 demonstrated the significant impact of negative news on investor confidence and market stability.

Investor Protection Strategies Against a Bitcoin Crash

Protecting investments against a potential Bitcoin crash involves a multifaceted approach. Diversification across different asset classes, including stocks, bonds, and real estate, reduces reliance on Bitcoin’s performance. Stop-loss orders automatically sell Bitcoin when it reaches a predetermined price, limiting potential losses. Dollar-cost averaging, which involves investing a fixed amount of money at regular intervals regardless of price, reduces the impact of volatility by averaging out the purchase price. Furthermore, thorough due diligence, understanding the inherent risks associated with Bitcoin, and only investing what one can afford to lose are crucial protective measures. For example, an investor might allocate only 5% of their portfolio to Bitcoin, employing a stop-loss order at a 20% loss and consistently investing $100 per week regardless of price fluctuations.

Accuracy of Bitcoin Crash Predictions

Accurately predicting a Bitcoin crash is exceptionally challenging. Cryptocurrency markets are notoriously volatile and influenced by a complex interplay of factors, making precise forecasting extremely difficult. While analytical models and technical indicators can provide insights, they are not foolproof. Historical data can be helpful but doesn’t guarantee future performance, as market conditions and influencing factors constantly evolve. For instance, many analysts predicted a Bitcoin crash in 2018 and 2022 based on historical patterns and technical analysis, but the actual market behavior was more complex and nuanced than the predictions.

Long-Term Consequences of a Bitcoin Crash

A significant Bitcoin crash could have wide-ranging consequences. The broader cryptocurrency market would likely experience a severe downturn, impacting the value of other digital assets. Investor confidence in cryptocurrencies could plummet, leading to decreased investment and market participation. Depending on the severity and duration of the crash, it could also negatively impact the overall financial system, particularly if it triggers contagion effects in related markets. The extent of the consequences would largely depend on the depth and duration of the crash, as well as the regulatory response and market sentiment recovery. The 2018 Bitcoin crash, for example, led to a prolonged bear market and a significant loss of investor confidence, highlighting the potential for long-term repercussions.

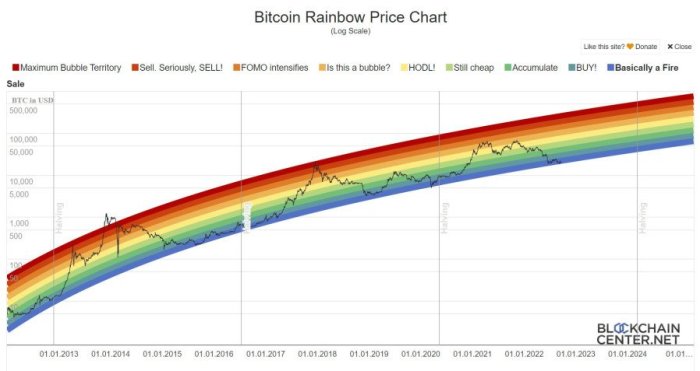

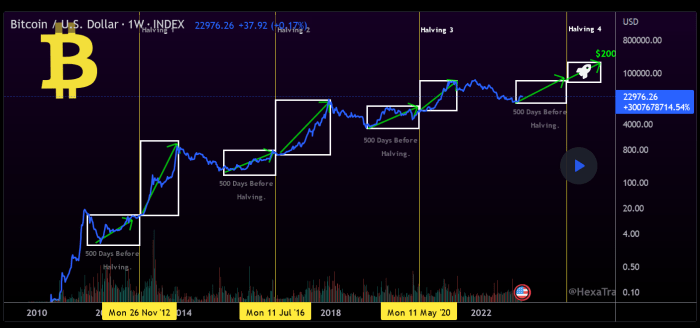

Bitcoin Crash 2025 Prediction – Predicting a Bitcoin crash in 2025 is a complex undertaking, influenced by numerous factors. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the supply of new Bitcoins. For detailed information on this crucial event, refer to this insightful article on Bitcoin. Halving. 2025.

Understanding the halving’s potential effects is vital for any accurate prediction of a potential 2025 market crash.

Predicting a Bitcoin crash in 2025 involves considering various factors, including the potential impact of the next halving. Understanding the dynamics of the upcoming halving is crucial for informed speculation; for detailed information, check out this resource on Halving Day Bitcoin 2025. Ultimately, whether the halving will mitigate or exacerbate a potential crash remains a subject of ongoing debate and analysis within the cryptocurrency community.

Predicting a Bitcoin crash in 2025 is a complex endeavor, influenced by numerous factors. A key event to consider is the timing of the next Bitcoin halving, which significantly impacts the supply of new Bitcoins. To understand the potential impact on price, it’s crucial to check when this halving will occur, as detailed on this informative page: Wann Bitcoin Halving 2025.

Ultimately, the halving’s effect on the 2025 Bitcoin crash prediction remains a subject of ongoing debate among experts.

Predicting a Bitcoin crash in 2025 is a complex endeavor, influenced by various factors. A key event to consider is the Bitcoin Halving, which significantly impacts the cryptocurrency’s supply and potentially its price. To understand the timing of this crucial event, check out the details on the Bitcoin Halving Event 2025 Date and how it might influence the likelihood of a market downturn next year.

Ultimately, the 2025 Bitcoin crash prediction remains speculative, heavily dependent on this and other market forces.

Predicting a Bitcoin crash in 2025 is a complex undertaking, heavily influenced by various market factors. A key element to consider is the Bitcoin price post-halving in 2025, as explored in this insightful article: Bitcoin Price Post Halving 2025. The price action following the halving will significantly impact the likelihood and severity of any potential crash later that year.

Therefore, understanding the post-halving dynamics is crucial for assessing the 2025 Bitcoin crash prediction.

Predicting a Bitcoin crash in 2025 is a complex endeavor, influenced by numerous factors. Understanding the Bitcoin halving events is crucial for such predictions, as they significantly impact the supply of Bitcoin. To get a clear picture of the timing of these events, check out this resource on when the 2025 Bitcoin halving occurred: Cuando Fue El Halving De Bitcoin 2025.

This information can then be used to better assess the potential for a market crash in 2025, considering the historical relationship between halvings and subsequent price movements.