Bitcoin Price Prediction: December 2025: Bitcoin December 2025 Prediction

Predicting the price of Bitcoin in December 2025 is inherently speculative, as numerous interconnected factors influence its value. However, by analyzing historical trends, current market dynamics, and potential future developments, we can construct plausible price scenarios. This analysis considers macroeconomic conditions, regulatory landscapes, technological advancements, and the impact of institutional and mainstream adoption.

Factors Influencing Bitcoin’s Price by December 2025

Several key factors will likely shape Bitcoin’s price trajectory over the next few years. Macroeconomic trends, such as inflation rates and global economic growth, will significantly impact investor sentiment and the appeal of Bitcoin as a hedge against inflation. Regulatory clarity (or lack thereof) in various jurisdictions will influence institutional investment and market accessibility. Technological advancements, including the development of layer-2 scaling solutions and improvements in transaction speed and efficiency, could enhance Bitcoin’s usability and appeal.

Comparison of Price Prediction Models

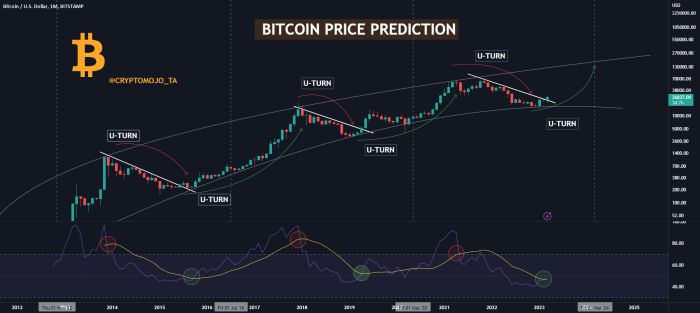

Various models attempt to forecast Bitcoin’s future price. Technical analysis, relying on chart patterns and historical price data, often yields highly variable predictions depending on the indicators used and the analyst’s interpretation. For example, some technical analysts might point to specific support and resistance levels to predict a price range, while others might focus on moving averages to identify potential trends. Fundamental analysis, focusing on factors like adoption rate, network security, and scarcity, provides a different perspective. Fundamental analysts often build models based on factors like the total market capitalization compared to gold or other established assets. These models can project significantly different values compared to technical analysis, highlighting the inherent uncertainty involved. It’s crucial to understand that neither approach guarantees accuracy.

Impact of Institutional Adoption and Mainstream Acceptance

Increased institutional adoption and mainstream acceptance are widely considered to be bullish for Bitcoin’s price. As large financial institutions integrate Bitcoin into their portfolios and offer related services, liquidity increases, reducing price volatility and potentially driving demand. Wider public acceptance, fueled by increased awareness and user-friendliness, can also contribute to substantial price appreciation. The successful integration of Bitcoin into everyday financial transactions, mirroring the adoption of credit cards or online payment systems, would represent a major milestone. However, the pace of this adoption remains uncertain and could be influenced by factors such as regulatory hurdles and the overall macroeconomic environment.

Potential Price Scenarios for Bitcoin in December 2025

The following table illustrates potential price scenarios based on different market conditions. These are estimations and should not be considered financial advice.

| Scenario | Price Range (USD) | Probability | Supporting Factors |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | 20% | Widespread institutional adoption, positive macroeconomic environment, significant technological advancements, and continued regulatory clarity. This scenario mirrors the rapid growth seen in previous bull markets, although reaching such high valuations would require sustained and widespread adoption. |

| Neutral | $50,000 – $100,000 | 60% | Moderate institutional adoption, stable macroeconomic conditions, incremental technological improvements, and a mix of positive and negative regulatory developments. This scenario reflects a more conservative outlook, assuming continued growth but at a slower pace compared to the bullish scenario. It takes into account potential market corrections and periods of consolidation. |

| Bearish | $20,000 – $40,000 | 20% | Limited institutional adoption, negative macroeconomic environment, regulatory crackdowns, and significant technological setbacks. This scenario assumes a period of decreased investor confidence and potential market downturn, possibly triggered by global economic instability or adverse regulatory actions. While a significant price drop is possible, Bitcoin’s underlying technology and limited supply could still provide a floor for its price. |

Bitcoin Adoption and Market Sentiment

By December 2025, Bitcoin’s adoption will likely be significantly more widespread than it is today, but the extent of that adoption remains uncertain. Several factors will play a crucial role, including regulatory clarity, advancements in user-friendly interfaces, and the continued development of supporting infrastructure. The interplay between these factors and prevailing market sentiment will ultimately dictate Bitcoin’s price trajectory.

The prevailing market sentiment – a mix of fear, uncertainty, doubt, and greed (FUD and greed) – will heavily influence Bitcoin’s price and trading volume. A positive sentiment, fueled by widespread adoption and positive regulatory developments, could drive prices upward and increase trading activity. Conversely, negative sentiment stemming from regulatory crackdowns or significant market downturns could lead to price drops and reduced trading. Predicting the precise balance of these forces is inherently challenging, but analyzing potential catalysts offers valuable insight.

Factors Influencing Bitcoin Adoption

Several factors will influence Bitcoin’s adoption rate by December 2025. Increased user-friendliness through simpler wallets and improved educational resources will attract a broader user base. Regulatory clarity, particularly the establishment of clear legal frameworks in major economies, will boost institutional confidence and investment. Furthermore, the development of robust payment infrastructure, such as lightning network scaling solutions, will improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. Conversely, a lack of regulatory clarity, persistent scalability issues, or the emergence of superior competing technologies could hinder adoption. For example, the slow adoption of Lightning Network, despite its potential, illustrates the challenges in transitioning to a more user-friendly experience. Similarly, the continued regulatory uncertainty in various jurisdictions poses a significant barrier to wider institutional investment.

Potential Catalysts Impacting Market Sentiment

Several events could significantly impact market sentiment leading up to December 2025. Positive catalysts include widespread adoption by major corporations, positive regulatory announcements from key governments, or technological breakthroughs enhancing Bitcoin’s scalability and security. Conversely, negative catalysts could include a major security breach impacting Bitcoin’s reputation, a significant market crash triggered by macroeconomic factors, or negative regulatory actions such as outright bans in influential markets. For example, a successful integration of Bitcoin into a major payment processing system could generate immense positive sentiment, while a significant hack of a major exchange could trigger widespread fear and selling. The impact of these events will depend on their scale and the overall market context.

Positive and Negative Factors Influencing Market Sentiment

The following points Artikel potential positive and negative factors and their likely impact on Bitcoin’s price:

- Positive Factors:

- Increased institutional adoption: Leading to higher demand and price appreciation.

- Positive regulatory developments: Reducing uncertainty and attracting further investment.

- Technological advancements: Improving scalability, security, and user experience.

- Widespread media coverage showcasing successful Bitcoin use cases: Building public trust and awareness.

- Negative Factors:

- Negative regulatory actions: Creating uncertainty and potentially suppressing demand.

- Major security breaches: Eroding trust and causing price volatility.

- Emergence of competing cryptocurrencies: Diverting investment and market share.

- Global macroeconomic instability: Leading to risk-off sentiment and a potential sell-off.

Technological Developments and Bitcoin’s Future

Technological advancements are poised to significantly shape Bitcoin’s trajectory by December 2025. The interplay between improved scalability, enhanced security, and the burgeoning DeFi ecosystem will be crucial in determining Bitcoin’s dominance and overall utility. The following sections delve into the anticipated impact of key technological developments.

Impact of Technological Advancements on Bitcoin

The Lightning Network, Taproot upgrades, and Layer-2 scaling solutions are expected to dramatically improve Bitcoin’s scalability and usability. The Lightning Network, a layer-2 solution, allows for near-instantaneous and low-fee transactions off the main Bitcoin blockchain. Taproot, a significant upgrade, enhances privacy and efficiency of smart contracts on Bitcoin. Layer-2 solutions, in general, alleviate congestion on the main chain, reducing transaction fees and improving overall transaction speed. By December 2025, widespread adoption of these technologies could lead to a substantial increase in Bitcoin’s transaction throughput, making it a more viable option for everyday payments and a broader range of applications. For example, imagine a scenario where microtransactions for online content or even coffee purchases become commonplace due to the negligible transaction fees facilitated by the Lightning Network. This increased usability could drive broader adoption and, consequently, price appreciation.

Bitcoin’s Position Against Competitors

Bitcoin’s first-mover advantage, established brand recognition, and robust security remain significant strengths against emerging competitors. However, newer cryptocurrencies offer faster transaction speeds and potentially lower energy consumption. The success of Bitcoin in maintaining its dominance will hinge on its ability to adapt and integrate these advancements effectively. For instance, if alternative blockchains manage to successfully overcome scalability limitations and offer significantly superior user experience, Bitcoin might face a decline in market share. Conversely, successful integration of layer-2 solutions and continued upgrades could solidify Bitcoin’s position as the leading store of value and digital gold. The ongoing competition will be a key factor in determining Bitcoin’s market position by December 2025.

Influence of Decentralized Finance (DeFi) on Bitcoin

The integration of DeFi applications with Bitcoin holds immense potential to expand its utility beyond a simple store of value. DeFi protocols could enable the creation of Bitcoin-backed lending and borrowing platforms, decentralized exchanges (DEXs), and other financial instruments. This could unlock new use cases and attract a broader range of users. For example, the emergence of wrapped Bitcoin (WBTC) – an ERC-20 token representing Bitcoin on the Ethereum blockchain – has already allowed Bitcoin to participate in the DeFi ecosystem. Further developments in cross-chain interoperability could lead to even greater integration, potentially driving demand and increasing Bitcoin’s price. However, the security and regulatory landscape surrounding DeFi will be critical in determining the extent of its impact on Bitcoin.

Hypothetical Scenario: Technological Advancements and Bitcoin Price in December 2025

Imagine a scenario where the Lightning Network is widely adopted, processing millions of transactions per second with minimal fees. Taproot upgrades have enhanced privacy and smart contract capabilities, attracting institutional investors and developers. Layer-2 solutions have significantly improved scalability, allowing Bitcoin to handle the increased transaction volume. Simultaneously, DeFi protocols have flourished, offering a wide array of Bitcoin-based financial services. This confluence of technological advancements could drive widespread adoption, leading to increased demand and a significant price surge for Bitcoin. In this hypothetical scenario, Bitcoin could reach a price significantly higher than its current value, perhaps in the range of $200,000 or more, reflecting its enhanced utility and established position as a dominant digital asset. This price increase wouldn’t be solely driven by speculation, but rather by a tangible increase in its utility and adoption fueled by these technological advancements.

Regulatory Landscape and Bitcoin’s Legal Status

By December 2025, the regulatory landscape for Bitcoin is expected to be significantly more defined than it is today, though the specifics will vary considerably across jurisdictions. This evolution will heavily influence Bitcoin’s price, adoption rate, and overall market stability. The interplay between innovation, risk mitigation, and differing national priorities will shape the future of Bitcoin regulation.

The increasing mainstream adoption of cryptocurrencies necessitates a clearer regulatory framework globally. This involves navigating the complexities of balancing innovation with consumer protection and preventing illicit activities. The lack of a unified global approach means that Bitcoin’s legal status will remain fragmented, leading to both opportunities and challenges for investors and businesses alike.

Bitcoin Regulation Across Major Economies

The regulatory approaches to Bitcoin vary significantly across major economies. The United States, for example, has seen a patchwork of state and federal regulations, leading to uncertainty. The European Union is working towards a more unified approach with the Markets in Crypto-Assets (MiCA) regulation, aiming to create a comprehensive framework for cryptocurrencies. China, on the other hand, maintains a strict ban on cryptocurrency trading and mining. These differing approaches create a complex and dynamic global regulatory environment.

Potential Regulatory Risks and Opportunities

Increased regulatory scrutiny poses both risks and opportunities. Increased taxation on Bitcoin transactions could dampen investor enthusiasm, potentially leading to price drops. However, clearer legal frameworks could increase institutional investment and overall market confidence, leading to price appreciation. The potential for stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations could limit illicit activities, bolstering Bitcoin’s legitimacy. Conversely, overly restrictive regulations could stifle innovation and limit adoption.

Regulatory Landscape Comparison, Bitcoin December 2025 Prediction

The following table summarizes the potential regulatory landscape for Bitcoin in several key regions by December 2025. These predictions are based on current trends and policy announcements, acknowledging the inherent uncertainty in forecasting future regulations. Significant changes in political climates or technological developments could significantly alter these projections.

| Region | Regulatory Status (Predicted December 2025) | Potential Impact on Bitcoin Price | Timeline |

|---|---|---|---|

| United States | Likely a mix of federal and state regulations, potentially including clearer tax guidelines and increased KYC/AML enforcement. Specifics remain uncertain. | Potentially mixed; increased clarity could boost price, while heavy taxation could dampen it. | Ongoing, with significant developments expected within the next few years. |

| European Union | MiCA likely implemented, providing a more comprehensive regulatory framework for cryptocurrencies, including Bitcoin. | Potentially positive, increasing institutional confidence and market stability. | Implementation expected by the end of 2024, with full effects seen by 2025. |

| China | Continued ban on cryptocurrency trading and mining is highly probable. | Minimal direct impact on global Bitcoin price, but potential indirect effects through reduced mining capacity. | Likely to remain unchanged. |

| Japan | Likely to maintain a relatively progressive regulatory stance, potentially leading to increased adoption and trading volume. | Potentially positive, attracting investment and increasing liquidity. | Ongoing development and refinement of existing regulations. |

Bitcoin’s Role in the Global Financial System

By December 2025, Bitcoin’s role in the global financial system is projected to be significantly more pronounced than it is today. Its potential impact hinges on its adoption as a store of value, medium of exchange, and inflation hedge, all while navigating evolving regulatory landscapes and macroeconomic shifts. The extent of its integration will depend on several interacting factors, including technological advancements, market sentiment, and global economic stability.

Bitcoin’s potential influence stems from its unique properties. Its decentralized nature, unlike traditional financial systems controlled by central banks, offers resilience against censorship and single points of failure. The inherent scarcity of Bitcoin, with a fixed supply of 21 million coins, positions it as a potential alternative to inflationary fiat currencies. Finally, the transparency of Bitcoin transactions, recorded on a public blockchain, enhances accountability and potentially reduces illicit financial activity, although this requires ongoing development and refinement of anti-money laundering (AML) and know-your-customer (KYC) compliance measures.

Comparison of Bitcoin with Traditional Assets

Bitcoin’s characteristics contrast sharply with those of traditional assets. Gold, a long-standing store of value, lacks the programmability and transactional efficiency of Bitcoin. Government bonds, while offering a degree of stability and return, are subject to counterparty risk and the inflationary pressures of the issuing government. Bitcoin, in contrast, offers a decentralized, scarce, and transparent alternative, although its volatility currently presents a significant hurdle to widespread adoption as a stable store of value. The comparison highlights the potential for Bitcoin to complement, rather than completely replace, existing financial instruments. For example, Bitcoin could be viewed as a digital equivalent of gold, offering diversification benefits in a portfolio.

Bitcoin’s Price Sensitivity to Macroeconomic Factors

Bitcoin’s price is highly susceptible to changes in global macroeconomic conditions. Rising inflation, for instance, could drive increased demand for Bitcoin as a hedge against currency devaluation, mirroring the historical behavior of gold during periods of economic uncertainty. Conversely, increases in interest rates, making traditional investments more attractive, might reduce demand for Bitcoin, leading to price corrections. Geopolitical events, such as international conflicts or sanctions, can also significantly influence Bitcoin’s price, often causing periods of high volatility as investors seek safe havens or react to uncertainty. The 2022 collapse of FTX, a major cryptocurrency exchange, serves as a recent example of how market sentiment and regulatory actions can significantly impact Bitcoin’s price.

Visual Representation of Bitcoin’s Integration in 2025

Imagine a stylized globe, with interconnected lines representing global financial flows. These lines are primarily thick, representing traditional financial systems (banks, payment processors, etc.). Superimposed on this are thinner, yet increasingly numerous, lines representing Bitcoin transactions. These Bitcoin lines connect various nodes: exchanges, wallets, businesses accepting Bitcoin payments, and even decentralized finance (DeFi) applications. The thickness and number of the Bitcoin lines indicate a growing, though still comparatively smaller, role in the overall global financial system. The color of the lines could represent the volume or value of transactions, with brighter colors indicating higher activity. The overall image portrays a future where Bitcoin coexists with, and increasingly interacts with, traditional financial systems, but does not entirely replace them. This image reflects a partial integration, not a complete takeover, representing a more realistic scenario for 2025.

Frequently Asked Questions (FAQ)

Predicting the future of Bitcoin, especially its price, is inherently challenging due to the cryptocurrency’s volatility and susceptibility to a wide range of influencing factors. While precise figures are impossible, exploring potential scenarios and considering key drivers can provide a more nuanced understanding.

Bitcoin’s Price in December 2025

Accurately predicting Bitcoin’s price in December 2025 is highly speculative. Numerous variables, including regulatory changes, technological advancements, macroeconomic conditions, and overall market sentiment, significantly impact its value. Consider these scenarios: a bullish scenario might see Bitcoin reaching significantly higher prices than its current value, potentially driven by increased institutional adoption and global economic uncertainty. A bearish scenario, however, could see a price decline due to factors like increased regulation or a broader cryptocurrency market downturn. A more moderate scenario might see relatively stable growth, mirroring the historical trends of gradual increase interspersed with periods of correction. Ultimately, any prediction is just that – a prediction, and the actual price will depend on the interplay of these unpredictable factors. For example, the 2017 bull run saw Bitcoin surge to nearly $20,000, followed by a significant correction. Similarly, the 2021 bull run saw a peak above $60,000 before another substantial downturn. These historical fluctuations highlight the inherent unpredictability of the market.

Bitcoin Adoption by 2025

The widespread adoption of Bitcoin by 2025 depends on several crucial factors. User-friendliness is paramount; simpler and more intuitive interfaces are needed to attract a broader user base beyond the tech-savvy. Regulation plays a significant role; clear and consistent regulatory frameworks across different jurisdictions will foster greater trust and encourage wider adoption. Infrastructure is also vital; improved payment processing speeds and lower transaction fees are necessary to make Bitcoin a viable alternative to traditional payment systems. While significant progress has been made, widespread adoption by 2025 remains uncertain. The current level of adoption, though growing, is still far from ubiquitous. Factors such as regulatory hurdles, technological limitations, and the inherent volatility of the cryptocurrency market could hinder its broader acceptance. However, continued technological advancements, increased regulatory clarity, and growing public awareness could accelerate adoption rates. The success of Bitcoin’s Lightning Network in improving transaction speeds is a positive indicator, while the ongoing debates surrounding regulation in various countries represent significant challenges.

Risks Facing Bitcoin by 2025

Bitcoin faces several key risks by 2025. Regulatory uncertainty remains a significant concern, with governments worldwide grappling with how to regulate cryptocurrencies. Stringent regulations could stifle innovation and limit Bitcoin’s growth. Technological vulnerabilities, such as potential hacking or security breaches, pose a constant threat. While Bitcoin’s blockchain technology is generally considered secure, vulnerabilities could still exist and be exploited. Market volatility continues to be a major risk factor; Bitcoin’s price is highly susceptible to market sentiment and external factors, leading to significant price swings that can impact investor confidence. These risks are interconnected and could amplify each other. For instance, negative regulatory actions could trigger a market downturn, exacerbating existing vulnerabilities. The collapse of FTX in 2022 serves as a stark reminder of the risks associated with centralized exchanges and the importance of responsible investment practices.

Safe Bitcoin Investment Practices

Investing in Bitcoin, like any other investment, involves risk. Responsible investment strategies prioritize risk management and due diligence. Thorough research is crucial before investing; understand the technology, market dynamics, and potential risks involved. Diversification is key; avoid investing all your funds in a single asset, including Bitcoin. Only invest what you can afford to lose; treat cryptocurrency investments as high-risk ventures and avoid investing funds you may need for essential expenses. Secure storage is vital; use reputable and secure wallets to protect your Bitcoin from theft or loss. Finally, consult with a qualified financial advisor before making any investment decisions. This advice should not be construed as financial advice; it is crucial to conduct your own research and seek professional guidance based on your individual circumstances.

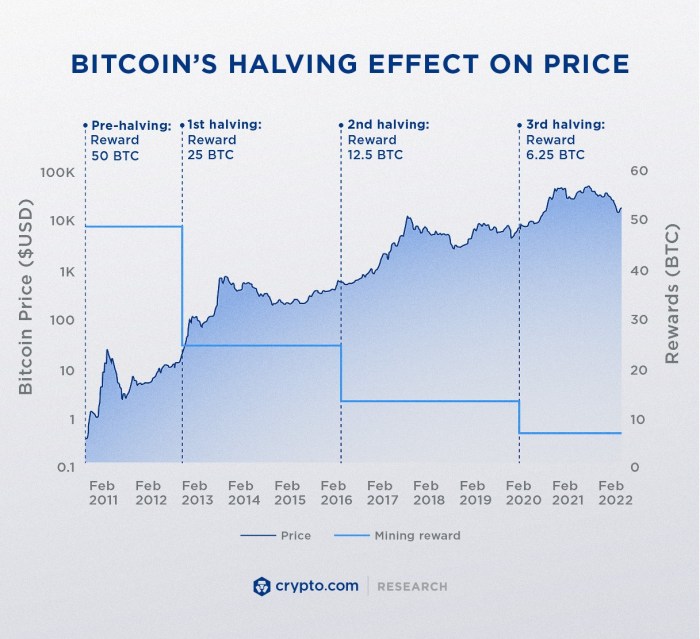

Bitcoin December 2025 Prediction – Predicting Bitcoin’s price in December 2025 is inherently speculative, but a key factor influencing the forecast is the upcoming halving event. Understanding the potential impact of the Bitcoin halving scheduled for April 2025, as detailed in this informative article Halving Bitcoin April 2025 , is crucial for any serious prediction. This halving will significantly reduce the rate of new Bitcoin creation, potentially impacting scarcity and thus, the December 2025 price.

Predicting Bitcoin’s price in December 2025 is inherently speculative, but a key factor influencing any forecast is the upcoming halving event. Understanding the potential impact of this reduction in Bitcoin’s issuance rate is crucial; for insights into this, check out this analysis on Expectations Bitcoin Halving 2025. Ultimately, the halving’s effect on scarcity and, consequently, the December 2025 Bitcoin price, remains a subject of ongoing debate and prediction.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors including macroeconomic conditions and technological advancements. A key event impacting this prediction is the next Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand its potential impact, it’s crucial to know precisely when this halving will occur; you can find that information by checking this resource: When In 2025 Is The Next Bitcoin Halving?

. Therefore, the timing of the halving will be a major factor in any accurate Bitcoin December 2025 price prediction.

Predicting Bitcoin’s price in December 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting future price is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand the timeline for the next halving’s influence on the December 2025 prediction, you should consult this resource: When Is The Next Bitcoin Halving After April 2025.

Understanding the halving’s timing is crucial for formulating any informed prediction about Bitcoin’s value in December 2025.

Predicting Bitcoin’s price in December 2025 is challenging, but understanding key events is crucial. A major factor influencing this prediction is the Bitcoin halving, scheduled for 2024; to learn more about this significant event, check out this resource on Que Es Halving Bitcoin 2025. The reduced supply post-halving will likely impact the market dynamics, ultimately shaping Bitcoin’s value by December 2025.

Predicting Bitcoin’s price in December 2025 is challenging, but a key factor to consider is the upcoming halving. Understanding the timing of this event, as detailed on this helpful resource regarding the Bitcoin Halving 2025 Fecha , is crucial for any serious price forecast. The halving’s impact on Bitcoin’s scarcity and potential price appreciation in the following months will significantly influence the December 2025 prediction.