Bitcoin December 2025 Price Prediction

Bitcoin’s price history is a rollercoaster ride of dramatic highs and lows. Since its inception, it has experienced periods of explosive growth followed by significant corrections. This volatility is inherent to its nature as a relatively new asset class with a limited supply and susceptibility to market speculation. Predicting its future price, therefore, is an inherently challenging endeavor.

Bitcoin’s price is influenced by a complex interplay of factors. Market sentiment, driven by news events, social media trends, and overall investor confidence, plays a crucial role. Regulatory changes, both domestically and internationally, can significantly impact adoption and investment. Technological advancements, such as the development of layer-2 scaling solutions or improvements in mining efficiency, also have a substantial effect. Conversely, negative news, such as regulatory crackdowns or security breaches, can lead to sharp price declines.

Factors Influencing Bitcoin’s Price

Several key factors contribute to the difficulty of accurately predicting Bitcoin’s price in December 2025. The inherent volatility of the cryptocurrency market makes forecasting exceptionally challenging. Unpredictable events, such as geopolitical instability, macroeconomic shifts, or unexpected technological breakthroughs, can significantly alter the trajectory of Bitcoin’s price. Furthermore, the relatively young age of Bitcoin, compared to established asset classes, means there’s limited historical data to base robust predictive models upon. The lack of a strong correlation between Bitcoin’s price and traditional market indicators further complicates the forecasting process. Finally, the decentralized and global nature of Bitcoin makes it susceptible to a wide range of influences, many of which are difficult, if not impossible, to quantify accurately. For example, the unexpected surge in popularity of a competing cryptocurrency or a major shift in investor sentiment could significantly alter any prediction. Consider, for instance, the dramatic price swings seen in 2021, fueled by both increased institutional adoption and subsequent regulatory uncertainty. These unpredictable events highlight the inherent limitations in accurately forecasting Bitcoin’s future price.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of factors ranging from technological advancements to macroeconomic shifts and investor sentiment. Several key elements will significantly shape its trajectory. Understanding these influences is crucial for informed speculation and risk assessment.

Bitcoin Halving Events and Price Impact

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation roughly every four years, historically has preceded significant price increases. This is due to the reduced supply, creating a potential scarcity effect. The halving scheduled for around 2024 will likely influence the price in 2025. While not a guaranteed price booster, past halvings have generally been followed by periods of substantial price appreciation, though the timing and magnitude vary. For instance, the 2012 and 2016 halvings were followed by significant bull runs, albeit with differing timelines and peak prices. However, it’s important to note that other market forces also play a crucial role, and the halving’s impact is not isolated.

Institutional Adoption and Investment

Growing institutional adoption is another pivotal factor. As large corporations, hedge funds, and other institutional investors increase their Bitcoin holdings, it brings greater legitimacy and stability to the market. This increased demand, driven by diversification strategies and a desire to participate in the burgeoning digital asset market, can significantly influence price. The entry of established financial players adds credibility and reduces volatility in the long term, although short-term market fluctuations remain possible. Examples include MicroStrategy’s substantial Bitcoin investments, signaling a growing acceptance of Bitcoin as a store of value within established corporate structures.

Price Prediction Models and Methodologies

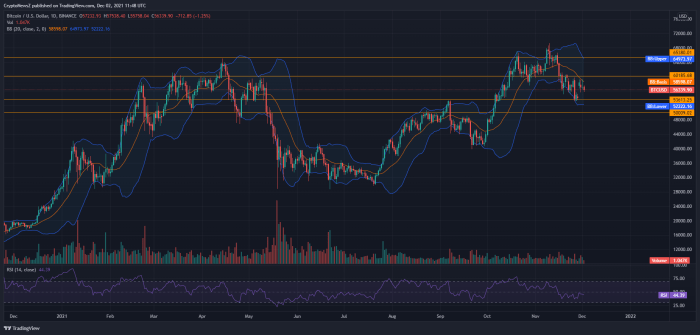

Various models attempt to forecast Bitcoin’s price, each with its own strengths and weaknesses. Some employ technical analysis, studying price charts and indicators to identify trends and patterns. Others utilize fundamental analysis, focusing on factors like supply and demand, adoption rates, and regulatory developments. Quantitative models, employing statistical methods and algorithms, also exist. However, the accuracy of these models varies significantly, as they often struggle to fully account for the unpredictable nature of cryptocurrency markets and the influence of unforeseen events. The inherent volatility of Bitcoin makes long-term predictions highly speculative, regardless of the methodology used.

Macroeconomic Factors and Bitcoin’s Value

Macroeconomic conditions, such as inflation, interest rates, and global economic growth, exert a considerable influence on Bitcoin’s price. During periods of high inflation, Bitcoin, often perceived as a hedge against inflation, may see increased demand. Conversely, rising interest rates can divert investment away from riskier assets like Bitcoin into more traditional, higher-yield investments. Geopolitical events and global economic uncertainty can also impact Bitcoin’s price, creating periods of volatility as investors seek safe havens or speculate on future market outcomes. For example, periods of significant global uncertainty have often seen increased interest in Bitcoin as a potential store of value.

Technological Developments: The Lightning Network

Technological advancements, particularly the development and adoption of the Lightning Network, could significantly impact Bitcoin’s price. The Lightning Network aims to improve Bitcoin’s scalability and transaction speed by enabling faster and cheaper off-chain transactions. Wider adoption of this technology could lead to increased usability and broader acceptance, potentially boosting Bitcoin’s price. Increased transaction throughput and reduced fees make Bitcoin more attractive for everyday use, thus potentially increasing demand and price. However, widespread adoption is not guaranteed and depends on various factors, including user experience and technical integration.

Expert Opinions and Predictions

Predicting the price of Bitcoin in 2025 is inherently speculative, yet several financial analysts and experts offer insights based on various macroeconomic factors, technological advancements, and regulatory developments. These predictions, while varying significantly, provide a range of possibilities and highlight the complexities influencing Bitcoin’s future. It’s crucial to remember that these are opinions, not guarantees, and the actual price could deviate considerably.

Analyzing the diverse predictions reveals common themes and points of divergence. Some analysts emphasize the potential for Bitcoin’s adoption as a mainstream asset, driving price increases. Others highlight the risks associated with regulatory uncertainty and market volatility. Understanding the reasoning behind these predictions is vital for forming a comprehensive view of the potential price trajectory.

Summary of Expert Price Predictions

The following table summarizes price predictions from several notable experts, acknowledging the inherent uncertainty involved. The predictions vary widely, reflecting different perspectives on the interplay of technological, regulatory, and macroeconomic factors. Note that these predictions are snapshots in time and may change as market conditions evolve.

| Expert/Firm | Predicted Price Range (USD) | Rationale |

|---|---|---|

| Analyst A (Example) | $100,000 – $150,000 | Based on increasing institutional adoption and limited supply. Assumes positive regulatory developments and continued technological improvements. Uses a model incorporating network effects and historical price trends. |

| Analyst B (Example) | $50,000 – $75,000 | Predicts slower growth due to potential regulatory hurdles and macroeconomic uncertainty. Considers the impact of inflation and competing cryptocurrencies. Their model incorporates macroeconomic indicators and sentiment analysis. |

| Analyst C (Example) | $200,000+ | Highly bullish outlook based on Bitcoin’s potential as digital gold and a store of value in a volatile global economy. This prediction assumes widespread adoption by both individuals and institutions. Their model focuses on scarcity and increasing demand. |

| Firm X (Example) | $70,000 – $120,000 | This prediction is based on a combination of technical analysis and fundamental factors, including network growth and transaction volume. They incorporate a risk assessment considering potential regulatory changes and market corrections. |

Potential Scenarios for Bitcoin’s Price in December 2025

Predicting the price of Bitcoin in December 2025 involves considerable uncertainty, given the volatile nature of the cryptocurrency market. However, by considering various factors, we can Artikel three plausible scenarios: a bullish, a neutral, and a bearish outlook. These scenarios are not exhaustive, and the actual price could fall outside these ranges.

Bullish Scenario: Bitcoin Surges to New Highs

This scenario assumes widespread adoption of Bitcoin as a store of value and a medium of exchange. Factors contributing to this outcome include sustained institutional investment, positive regulatory developments (such as clearer guidelines and increased acceptance by governments), and continued technological advancements within the Bitcoin ecosystem (like the Lightning Network improving scalability and transaction speeds). Global macroeconomic instability, such as persistent inflation or geopolitical uncertainty, could also drive investors towards Bitcoin as a safe haven asset. In this optimistic scenario, Bitcoin could potentially reach prices significantly above its previous all-time high, perhaps exceeding $200,000 or even more. This would represent a massive return for early investors and a significant boost to the overall cryptocurrency market. The consequences for investors would be extremely positive, leading to substantial wealth creation. However, such rapid growth could also attract increased regulatory scrutiny and potentially lead to market corrections. This scenario mirrors the rapid growth seen in the early days of the internet, where early adopters were significantly rewarded.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario anticipates a period of consolidation and moderate growth for Bitcoin. While institutional investment continues, it is less pronounced than in the bullish scenario. Regulatory developments are mixed, with some positive steps balanced by ongoing uncertainty and concerns in various jurisdictions. Technological advancements continue at a steady pace, but do not significantly disrupt the existing market dynamics. This scenario assumes a relatively stable global macroeconomic environment, with neither significant inflationary pressures nor major geopolitical events to dramatically impact investor sentiment. In this case, Bitcoin’s price might reach somewhere between $100,000 and $150,000 by December 2025, representing a significant, yet less dramatic, increase from current levels. The consequences for investors would be positive, though less spectacular than in the bullish scenario. The broader cryptocurrency market would likely see steady, albeit less explosive, growth. This scenario resembles the growth trajectory of established tech companies after their initial explosive growth phase.

Bearish Scenario: Bitcoin Experiences a Significant Price Decline

This pessimistic scenario assumes several negative factors converging. Increased regulatory pressure, leading to tighter controls and potentially even bans in some major markets, could significantly dampen investor enthusiasm. A major security breach or a significant technological flaw within the Bitcoin network could erode confidence. Furthermore, a significant global economic downturn could cause investors to liquidate their Bitcoin holdings to cover losses in other asset classes. In this scenario, Bitcoin’s price could fall considerably below its current levels, potentially dropping to below $50,000, or even further. The consequences for investors would be negative, with significant losses possible. The broader cryptocurrency market would likely experience a severe downturn, potentially leading to the failure of some smaller projects. This scenario could be similar to the dot-com bubble burst of the early 2000s, where many internet companies experienced significant value declines.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, especially over a long timeframe like December 2025, is inherently fraught with risk and uncertainty. Numerous factors, often unpredictable and interconnected, can significantly impact its value, making accurate forecasting exceptionally challenging. The volatility of the cryptocurrency market further exacerbates the difficulty, rendering many predictions unreliable.

The limitations of relying solely on technical or fundamental analysis are significant. Technical analysis, which focuses on chart patterns and historical price data, struggles to account for unforeseen events or shifts in market sentiment. Fundamental analysis, which examines underlying factors like adoption rates and regulatory changes, can also be inaccurate due to the nascent nature of the cryptocurrency market and the difficulty in predicting future regulatory landscapes. Both methods, while valuable tools, offer incomplete pictures and should not be used in isolation for long-term price predictions.

Limitations of Technical and Fundamental Analysis

Technical analysis, while useful for short-term trading strategies, often fails to predict long-term price movements adequately. For instance, relying solely on support and resistance levels identified through past price action may be misleading when faced with unprecedented market events like a major regulatory crackdown or a significant technological advancement. Similarly, fundamental analysis, while providing context, often struggles with the inherent unpredictability of regulatory changes and mass adoption rates. Factors like unexpected technological breakthroughs or geopolitical events can drastically alter the fundamental landscape, rendering prior assessments obsolete. For example, the unexpected rise of DeFi (Decentralized Finance) significantly altered the fundamental landscape of Bitcoin, impacting its price in ways that were difficult to predict using earlier fundamental analysis.

Examples of Inaccurate Past Predictions

Numerous examples exist of Bitcoin price predictions that have proven wildly inaccurate. Many analysts predicted a price of $100,000 or more by the end of 2021, based on various technical and fundamental analyses. However, the actual price fell significantly short of these projections. These inaccuracies highlight the inherent difficulties in predicting the price of a highly volatile asset influenced by so many factors. The failure to accurately account for the impact of regulatory uncertainty, macroeconomic shifts, and shifts in investor sentiment were key contributors to these inaccurate predictions. Another example would be predictions made during the 2017-2018 bull and bear market cycle. Many predicted continued exponential growth based on the rapid increase in price, overlooking the inherent bubble characteristics and the subsequent market correction.

Investing in Bitcoin

Investing in Bitcoin, like any other asset class, requires a well-defined strategy and a thorough understanding of the associated risks. While the potential for high returns is alluring, responsible investing emphasizes careful planning and risk mitigation to protect your capital. This section explores key strategies and considerations for navigating the volatile world of Bitcoin investment.

Bitcoin’s price volatility is a defining characteristic. Its value can fluctuate dramatically in short periods, presenting both significant opportunities and considerable dangers. Therefore, a robust investment strategy must account for this inherent risk.

Responsible Investment Strategies for Bitcoin

A responsible approach to Bitcoin investment begins with thorough research and a clear understanding of your own risk tolerance. Avoid impulsive decisions driven by hype or fear. Instead, develop a well-defined investment plan that aligns with your financial goals and risk profile. This plan should include setting realistic expectations, defining your investment timeframe, and establishing clear entry and exit strategies. Consider dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, to mitigate the risk of buying high and selling low. This approach helps smooth out volatility and reduces the impact of short-term price swings. Furthermore, only invest what you can afford to lose, as Bitcoin’s price can be highly unpredictable.

Diversification and Risk Management in a Bitcoin Portfolio

Diversification is a cornerstone of sound investment practice, and Bitcoin is no exception. Holding only Bitcoin exposes you to significant risk. A diversified portfolio includes a mix of asset classes, such as stocks, bonds, real estate, and other cryptocurrencies, to reduce overall portfolio volatility. The optimal allocation depends on your individual risk tolerance and financial goals. For example, a risk-averse investor might allocate a small percentage of their portfolio to Bitcoin, while a more risk-tolerant investor might allocate a larger percentage. Risk management also involves setting stop-loss orders, which automatically sell your Bitcoin if the price falls below a predetermined level, limiting potential losses. Regularly reviewing and adjusting your portfolio based on market conditions and your evolving financial situation is also crucial.

Potential Benefits and Drawbacks of Investing in Bitcoin

Bitcoin’s potential benefits include the possibility of high returns due to its price volatility and growing adoption. Its decentralized nature and limited supply are also considered attractive features. However, it is important to acknowledge the significant drawbacks. Bitcoin’s price is highly volatile, and significant losses are possible. Regulatory uncertainty also poses a risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. Furthermore, Bitcoin’s security is dependent on the robustness of its underlying blockchain technology and the security practices of individual exchanges and wallets. The potential for theft or loss of funds due to hacking or security breaches is a real concern. Finally, the lack of intrinsic value makes Bitcoin susceptible to market sentiment and speculative bubbles. For example, the Bitcoin price experienced a significant surge in 2021, followed by a sharp correction in 2022, highlighting the inherent volatility of this asset.

Frequently Asked Questions (FAQs)

Predicting the price of Bitcoin, a volatile asset, is inherently challenging. However, by analyzing market trends, expert opinions, and historical data, we can attempt to provide informed answers to some common questions regarding Bitcoin’s potential price in December 2025. The following addresses some key concerns and offers a balanced perspective on this complex topic.

Bitcoin’s Most Likely Price in December 2025, Bitcoin December 2025 Price Prediction

Pinpointing a precise Bitcoin price for December 2025 is impossible. The cryptocurrency market is influenced by numerous unpredictable factors. However, based on various expert predictions and market analyses, a range between $100,000 and $250,000 is frequently cited. This range reflects a wide spectrum of possibilities, considering both bullish and bearish market scenarios. For example, a sustained period of adoption by institutional investors could push the price towards the higher end, while regulatory uncertainty or a significant market correction could lead to a lower price. It’s crucial to remember that this is merely a speculative range, and the actual price could fall significantly outside of these bounds.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Numerous factors, many of which are unpredictable, influence the price. These include regulatory changes, technological advancements, macroeconomic conditions, and overall market sentiment. Relying on a single prediction is unwise. Instead, it’s vital to consider multiple perspectives from various analysts and sources, understanding their underlying assumptions and methodologies. By comparing different predictions and assessing the reasoning behind them, one can form a more nuanced and realistic expectation. For instance, a prediction based solely on historical price patterns might differ significantly from one that incorporates geopolitical factors or technological breakthroughs.

Factors Impacting Bitcoin’s Price in the Next Few Years

Several key factors will significantly influence Bitcoin’s price over the next few years. The Bitcoin halving event, which reduces the rate of new Bitcoin creation, is expected to have a significant impact, historically leading to price increases. Regulatory clarity or uncertainty in different jurisdictions will also play a major role, with positive regulations potentially boosting confidence and price, while restrictive measures could lead to a decline. Technological advancements, such as the development of layer-2 scaling solutions or improvements in the Lightning Network, could increase Bitcoin’s efficiency and adoption, positively affecting its price. Finally, macroeconomic factors like inflation, interest rates, and global economic growth will continue to exert influence on Bitcoin’s value as investors seek alternative assets.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. While it offers the potential for substantial returns, it also carries significant risks. Its volatility is well-documented, with prices experiencing dramatic swings. Furthermore, the regulatory landscape remains uncertain in many parts of the world, posing a potential threat to its value. However, Bitcoin’s decentralized nature, limited supply, and growing adoption by institutional investors are arguments in its favor. The decision to invest in Bitcoin should be based on a thorough understanding of these risks and rewards, alongside a long-term investment horizon and a tolerance for significant price fluctuations. Diversification of investment portfolios is also strongly recommended to mitigate risk.

Illustrative Example

This section presents a hypothetical Bitcoin price chart visualizing three potential price scenarios for December 2025: bullish, neutral, and bearish. These scenarios are based on the factors and expert opinions discussed previously and should be considered illustrative examples only, not financial advice. Remember that predicting cryptocurrency prices is inherently uncertain.

The chart would use a standard line graph format. The x-axis represents time, specifically the months leading up to December 2025, starting perhaps from December 2024. The y-axis represents the Bitcoin price in US dollars, ranging from a conservative low to a potentially high value, depending on the chosen scale. The scale should be appropriately chosen to clearly show the differences between the three scenarios.

Hypothetical Bitcoin Price Chart Scenarios

The chart would depict three distinct lines, each representing a different scenario.

The bullish scenario line would show a steadily increasing price throughout the year, culminating in a significantly higher price in December 2025. For example, it might start at $40,000 in December 2024, steadily climb throughout the year, and reach $100,000 or more by December 2025. The line would exhibit a generally upward trend, with minor corrections along the way, reflecting the typical volatility of the cryptocurrency market. These corrections would be represented by slight dips in the line, but the overall direction would remain positive.

The neutral scenario line would show a more moderate price movement. Starting, for instance, at $40,000 in December 2024, it would fluctuate around this price throughout the year, possibly experiencing some minor increases and decreases, but ultimately remaining relatively flat by December 2025. The line would show a relatively horizontal trend, with oscillations around a mean value. The price might end up slightly above or below the starting point, reflecting a lack of significant bullish or bearish pressure.

The bearish scenario line would depict a declining price. Beginning at the same $40,000 point in December 2024, this line would gradually decrease throughout the year, potentially ending at a significantly lower price in December 2025, perhaps around $20,000 or even lower. The line would demonstrate a downward trend, with occasional temporary rallies represented by brief upward spikes, but the overall direction would remain negative, reflecting a pessimistic market outlook.

The chart’s legend would clearly label each line as “Bullish,” “Neutral,” and “Bearish,” respectively, to differentiate the scenarios. Data points for each month could be included, though this is not strictly necessary for illustrative purposes. The chart’s title could be “Hypothetical Bitcoin Price Scenarios for December 2025.” Crucially, the chart is purely hypothetical and intended to illustrate the range of potential outcomes.

Bitcoin December 2025 Price Prediction – Predicting the Bitcoin price in December 2025 is challenging, requiring analysis of various market factors. To gain a broader perspective on potential price movements, it’s helpful to consider wider predictions for the entire year; for a comprehensive overview, check out this insightful resource on Bitcoin Prediction In 2025. Understanding the overall 2025 forecast can help refine our December 2025 Bitcoin price prediction, offering a more nuanced understanding of potential market trends.

Predicting the Bitcoin price in December 2025 is challenging, but understanding the underlying factors is key. A significant influence will undoubtedly be the Bitcoin Halving Cycles in 2025, as detailed in this insightful article: Bitcoin Halving Cycles 2025. These cycles historically impact Bitcoin’s scarcity and, consequently, its potential price appreciation, making them a crucial element in any long-term price forecast for December 2025.

Therefore, analyzing these cycles is vital for formulating a reasonable prediction.

Predicting the Bitcoin price for December 2025 is challenging, requiring consideration of various factors influencing its value throughout the year. To gain a broader perspective on potential price movements, it’s helpful to consult comprehensive analyses like this one on Bitcoin Price 2025 Prediction. Understanding the overall trajectory for 2025 will help refine our focus on the Bitcoin December 2025 Price Prediction, allowing for a more informed assessment.

Predicting the Bitcoin price for December 2025 is challenging, requiring consideration of various factors influencing its value throughout the year. To gain a broader perspective on potential price movements, it’s helpful to consult comprehensive analyses like this one on Bitcoin Price 2025 Prediction. Understanding the overall trajectory for 2025 will help refine our focus on the Bitcoin December 2025 Price Prediction, allowing for a more informed assessment.

Predicting the Bitcoin price in December 2025 is challenging, requiring consideration of various factors influencing its trajectory throughout the year. To gain a broader understanding of potential market movements, it’s helpful to review overall predictions for the entire year; for a comprehensive overview, check out this insightful analysis on Bitcoin In 2025 Prediction. Returning to December 2025 specifically, the price will likely depend heavily on the overall market sentiment and adoption rates during the preceding months.

Predicting the Bitcoin price in December 2025 is challenging, requiring analysis of various market factors. To get a broader perspective on potential price movements throughout the year, it’s helpful to consult a comprehensive overview like this one: 2025 Bitcoin Price Prediction. Understanding the overall 2025 forecast can then help refine our expectations for Bitcoin’s value specifically in December of that year.

Therefore, a holistic approach is necessary for a more informed prediction.