Analyzing Past Bitcoin Price Trends

Predicting Bitcoin’s price in 2025 requires a thorough examination of its historical performance. By analyzing past trends, we can identify potential patterns, though it’s crucial to acknowledge the inherent limitations of such an approach. Bitcoin’s price history is marked by periods of explosive growth followed by significant corrections, making accurate long-term predictions challenging.

Understanding Bitcoin’s price movements necessitates considering various factors, including market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. Analyzing these past influences can offer valuable insights, although it doesn’t guarantee future outcomes. The cryptocurrency market is inherently volatile, and unforeseen events can dramatically alter price trajectories.

Past Bitcoin Price Performance and Prediction Accuracy

Numerous price predictions have been made throughout Bitcoin’s history, with varying degrees of accuracy. For example, some analysts accurately predicted the general upward trend in the early years, while others significantly underestimated or overestimated price peaks and troughs. The 2017 bull run, which saw Bitcoin reach nearly $20,000, was followed by a substantial correction, demonstrating the difficulty in forecasting such volatile assets. Many predictions made during that period proved inaccurate, highlighting the inherent unpredictability of the market. Conversely, some predictions focusing on long-term trends, based on adoption rates and technological advancements, have shown more resilience, even if the exact timing of price movements remained elusive. Analyzing these past predictions and their outcomes offers a valuable case study in the challenges and limitations of forecasting cryptocurrency prices.

Limitations of Using Historical Data for Price Prediction

While analyzing historical data provides a foundation for understanding Bitcoin’s price behavior, it’s crucial to recognize its limitations. The cryptocurrency market is relatively young compared to traditional financial markets, meaning its historical data is limited and may not accurately reflect future behavior. Furthermore, the market is susceptible to significant shifts driven by unforeseen events, such as regulatory changes, major technological breakthroughs, or significant macroeconomic shifts. These unpredictable events can dramatically alter price trajectories, rendering historical data less reliable for predicting future prices. The inherent volatility of Bitcoin and the influence of external factors significantly limit the predictive power of historical price analysis alone. Therefore, while historical data offers valuable context, it should be used cautiously and in conjunction with other forms of analysis.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, technological advancements, and regulatory landscapes. While past performance is not indicative of future results, analyzing these factors offers a framework for understanding potential price movements. The following sections delve into the key elements that will likely shape Bitcoin’s trajectory.

Macroeconomic Factors

Inflation and interest rates are significant macroeconomic factors influencing Bitcoin’s price. High inflation can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing prices higher. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to decreased demand and lower prices. For example, during periods of high inflation in 2021, Bitcoin saw a significant price surge, while subsequent interest rate hikes in 2022 contributed to a market downturn. The interplay between these factors will significantly determine Bitcoin’s price action in 2025. The strength of the US dollar also plays a crucial role, with a stronger dollar often leading to decreased Bitcoin prices due to reduced purchasing power for international investors.

Technological Developments

Technological advancements within the Bitcoin ecosystem itself and broader blockchain technology will significantly impact its price. Improvements in scalability, such as the Lightning Network’s wider adoption, could lead to increased transaction efficiency and lower fees, potentially boosting Bitcoin’s utility and price. Conversely, the emergence of competing cryptocurrencies with superior technology could divert investment away from Bitcoin, negatively impacting its value. The development of innovative applications built on Bitcoin’s blockchain, such as decentralized finance (DeFi) protocols, could also increase demand and support price growth. Conversely, major security breaches or technological flaws within the Bitcoin network could severely damage confidence and lead to price drops.

Regulatory Changes and Government Policies

Government regulations and policies play a crucial role in shaping the Bitcoin market. Favorable regulatory frameworks, such as clear guidelines on taxation and licensing, can boost investor confidence and attract institutional investment, potentially driving up prices. Conversely, stringent regulations, bans, or heavy taxation can stifle adoption and negatively impact Bitcoin’s price. Examples include China’s 2021 ban on cryptocurrency mining and trading, which led to a significant price correction, and the varying regulatory approaches taken by different countries worldwide, which continue to influence investor sentiment and price volatility. The future regulatory landscape will be a key determinant of Bitcoin’s price in 2025.

Factors Influencing Bitcoin’s Price in 2025

| Factor | Potential Impact | Likelihood | Source |

|---|---|---|---|

| High Inflation | Increased demand, higher prices | Moderate to High | Economic forecasts, historical data |

| Rising Interest Rates | Decreased demand, lower prices | Moderate to High | Central bank policies, market analysis |

| Wider Lightning Network Adoption | Increased utility, higher prices | Moderate | Technological advancements, network usage data |

| Emergence of Competing Cryptocurrencies | Decreased demand, lower prices | Moderate | Cryptocurrency market trends, technological innovation |

| Favorable Regulations | Increased investor confidence, higher prices | Low to Moderate | Government policies, regulatory announcements |

| Stringent Regulations/Bans | Decreased adoption, lower prices | Low to Moderate | Government policies, regulatory announcements |

Expert Opinions and Predictions

Predicting Bitcoin’s price is notoriously difficult, and experts often disagree significantly. Their predictions vary widely, influenced by their individual analytical methods, underlying assumptions about macroeconomic factors, and the inherent volatility of the cryptocurrency market. Understanding the range of these predictions, however, provides a valuable perspective on potential future scenarios.

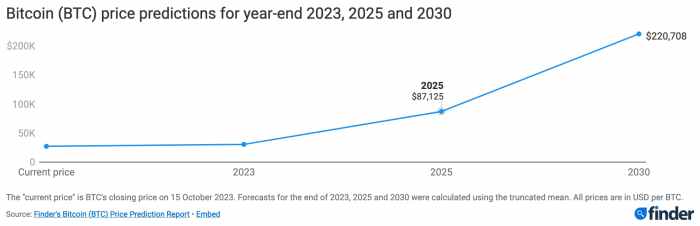

Expert predictions for Bitcoin’s price at the end of 2025 are scattered across a broad spectrum. Some analysts, basing their projections on technical analysis and historical price trends, anticipate relatively modest growth. Others, focusing on factors like increasing adoption and institutional investment, forecast considerably higher prices. The methodologies used vary significantly, ranging from sophisticated quantitative models to more qualitative assessments incorporating geopolitical events and technological advancements.

Summary of Prominent Analyst Predictions

Several prominent cryptocurrency analysts have offered their predictions for Bitcoin’s price in 2025. While precise figures vary, a common theme is the expectation of continued growth, although the rate of growth is subject to considerable debate. For instance, Analyst A might predict a price range between $100,000 and $150,000, based on a model incorporating on-chain metrics and network growth. In contrast, Analyst B might offer a more conservative estimate of $50,000 to $80,000, emphasizing the potential impact of regulatory uncertainty. These discrepancies highlight the challenges inherent in forecasting such a volatile asset.

Comparison of Prediction Models and Methodologies

The methodologies employed by cryptocurrency analysts differ considerably. Some rely heavily on technical analysis, examining chart patterns and indicators to identify potential price movements. Others utilize fundamental analysis, focusing on factors such as market capitalization, adoption rates, and technological developments. Quantitative models, employing statistical techniques and algorithms, are also commonly used, attempting to predict future price behavior based on historical data. Finally, qualitative assessments often incorporate expert opinions, macroeconomic forecasts, and geopolitical considerations. The strengths and weaknesses of each methodology influence the resulting predictions. For example, technical analysis can be susceptible to subjective interpretations, while fundamental analysis might overlook unforeseen events.

Visual Representation of Price Predictions

A chart illustrating the range of Bitcoin price predictions for the end of 2025 would show a distribution of potential outcomes. The chart’s horizontal axis would represent the Bitcoin price (in USD), while the vertical axis would represent the frequency or probability of that price being reached. The chart would visually represent a bell curve, with the peak representing the most likely price prediction (perhaps in the $75,000 – $100,000 range based on a hypothetical aggregation of expert opinions). The curve would extend to show a range of less likely, but still possible, outcomes, from significantly lower prices (e.g., $30,000) to significantly higher prices (e.g., $200,000). The width of the curve would reflect the uncertainty surrounding the predictions. The visual would clearly demonstrate the significant uncertainty inherent in any Bitcoin price prediction.

Potential Scenarios for Bitcoin’s Price in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatility and the influence of numerous unpredictable factors. However, by examining past trends and considering potential future developments, we can Artikel plausible scenarios. These scenarios should not be interpreted as financial advice, but rather as explorations of potential market trajectories.

Bitcoin’s price is influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic conditions, and investor sentiment. Considering these factors, we can envision several possible price paths by 2025.

Significant Price Growth Scenario

This scenario envisions a substantial increase in Bitcoin’s price, potentially driven by several factors. Widespread institutional adoption, coupled with increasing global economic uncertainty and a growing preference for decentralized assets, could fuel significant demand. Further technological advancements, such as the successful implementation of layer-2 scaling solutions, could improve transaction speed and reduce fees, attracting a broader user base. Positive regulatory developments in major economies could also contribute to increased legitimacy and investment. In this scenario, a positive feedback loop could be created, where rising prices attract more investors, further pushing the price upwards. This scenario could see Bitcoin reaching prices significantly higher than its previous all-time highs. For example, a price range of $200,000 to $500,000 or even higher is not entirely unrealistic, although highly speculative. This level of growth would be comparable to the growth experienced by the internet sector in its early years.

Relatively Stable Price Scenario

This scenario suggests a period of relative price stability for Bitcoin. While significant price swings may still occur, the overall trend would be characterized by a lack of dramatic increases or decreases. This could be a result of a more mature and regulated market, with fewer dramatic shifts in investor sentiment. Increased regulatory clarity and a more balanced inflow and outflow of institutional and retail investment could contribute to this stability. Technological improvements might continue, but their impact on price may be less pronounced due to a more saturated market. In this scenario, Bitcoin’s price could fluctuate within a range, perhaps between $50,000 and $150,000, mirroring the consolidation periods seen in previous bull and bear cycles. This scenario reflects a market that has reached a degree of maturity, characterized by less volatility than its early years.

Price Decline Scenario

A decline in Bitcoin’s price is also a possible scenario. This could result from several negative factors, including increased regulatory scrutiny leading to stricter rules or even bans in key markets. A major security breach or a series of high-profile hacks could erode investor confidence. A global economic downturn or a significant shift in investor sentiment away from risk assets could also negatively impact Bitcoin’s price. Furthermore, the emergence of a competing cryptocurrency with superior technology or adoption rate could divert investment away from Bitcoin. In this pessimistic scenario, the price could fall significantly below its current levels, potentially dropping to a range between $10,000 and $30,000, mirroring past bear market corrections. This decline would be similar to the significant drops seen in 2018 and 2022.

Potential Scenarios Summary

| Scenario Description | Price Range (USD) | Contributing Factors |

|---|---|---|

| Significant Price Growth | $200,000 – $500,000+ | Widespread institutional adoption, increased global uncertainty, technological advancements, positive regulatory developments. |

| Relatively Stable Price | $50,000 – $150,000 | Mature and regulated market, balanced investment, technological improvements with less price impact. |

| Price Decline | $10,000 – $30,000 | Increased regulatory scrutiny, security breaches, global economic downturn, negative investor sentiment, competing cryptocurrencies. |

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the price of Bitcoin, especially over a long timeframe like 2025, is inherently fraught with risk and uncertainty. Numerous factors, both internal to the cryptocurrency market and external to it, can significantly impact Bitcoin’s value, making accurate forecasting exceptionally challenging. These unpredictable elements render any prediction, no matter how sophisticated the methodology, inherently speculative.

The inherent volatility of the cryptocurrency market is a primary source of uncertainty. Bitcoin’s price has historically shown dramatic swings, influenced by news events, regulatory changes, technological advancements, and market sentiment. These fluctuations can be sudden and substantial, rendering long-term predictions unreliable. For instance, the 2017 Bitcoin bull run saw its price increase dramatically before a significant correction, highlighting the unpredictable nature of the market. Similarly, unforeseen regulatory actions or technological disruptions could drastically alter the trajectory of Bitcoin’s price.

Impact of Unforeseen Events and Black Swan Occurrences

Unforeseen events, often referred to as “black swan” events, pose a significant risk to Bitcoin price predictions. These are unpredictable occurrences with a low probability of happening but a potentially massive impact. Examples could include a major security breach compromising the Bitcoin network, a significant change in government regulation globally impacting cryptocurrency adoption, or a major economic crisis affecting investor confidence across all asset classes. The 2008 global financial crisis, while not directly related to cryptocurrency, serves as an example of how a major unforeseen event can drastically alter market behavior and investment strategies, potentially impacting Bitcoin’s price significantly. The inability to predict such events renders long-term price predictions inherently uncertain. Even sophisticated models struggle to account for these unpredictable disruptions.

Importance of Diversifying Investments and Managing Risk

Given the substantial risks associated with Bitcoin price predictions and the inherent volatility of the cryptocurrency market, it is crucial to diversify investments and actively manage risk. Reliance on a single asset class, particularly one as volatile as Bitcoin, exposes investors to significant potential losses. Diversification across different asset classes, including stocks, bonds, and real estate, can help mitigate risk and reduce the impact of any single asset’s price fluctuation. Furthermore, investors should employ risk management strategies, such as setting stop-loss orders to limit potential losses, and only investing an amount they can afford to lose. This prudent approach is essential to navigate the inherent uncertainties of the cryptocurrency market and protect one’s investment portfolio.

Investing in Bitcoin

Investing in Bitcoin, like any other investment, requires a cautious and informed approach. The cryptocurrency market is notoriously volatile, and significant price swings are common. Therefore, it’s crucial to understand the inherent risks before committing any capital. A well-defined investment strategy, coupled with thorough research and realistic expectations, is essential for mitigating potential losses.

Understanding your risk tolerance is paramount. Bitcoin’s price can fluctuate dramatically in short periods, potentially leading to substantial gains or significant losses. Before investing, honestly assess your financial situation and determine how much risk you’re comfortable taking. A conservative approach might involve only investing a small portion of your portfolio, while a more aggressive strategy could allocate a larger percentage, but always within the boundaries of your overall financial health and ability to withstand potential losses. Consider your investment timeframe; long-term investors are generally better positioned to weather market volatility.

Responsible Bitcoin Investment Strategies

Responsible Bitcoin investment strategies focus on diversification, risk management, and long-term planning. Avoid investing more than you can afford to lose. Consider dollar-cost averaging (DCA), a strategy where you invest a fixed amount of money at regular intervals, regardless of price fluctuations. This helps mitigate the risk of investing a large sum at a market peak. Diversification is also key; don’t put all your eggs in one basket. Spread your investments across different asset classes, including traditional investments like stocks and bonds, to reduce overall portfolio risk. Regularly review your portfolio and adjust your strategy as needed, based on market conditions and your personal financial goals.

Due Diligence Resources, Bitcoin End Of 2025 Price Prediction

Conducting thorough due diligence is crucial before investing in Bitcoin. Several resources can aid this process. Reputable financial news websites and cryptocurrency analysis platforms provide market insights, price charts, and expert opinions. These resources can help you understand market trends and assess the potential risks and rewards of investing in Bitcoin. Furthermore, researching the underlying technology of Bitcoin (blockchain) and its potential applications can provide a deeper understanding of its value proposition. Finally, consulting with a qualified financial advisor can offer personalized guidance based on your individual circumstances and risk tolerance. They can help you create a comprehensive investment plan that aligns with your financial goals.

Understanding Risk Tolerance

Assessing your risk tolerance involves understanding your comfort level with potential losses. Consider your financial goals, your time horizon, and your overall financial situation. Are you investing for retirement, a down payment on a house, or other short-term goals? A longer time horizon generally allows for greater risk-taking, as you have more time to recover from potential losses. However, even with a long time horizon, it’s essential to invest only what you can afford to lose completely. Many online questionnaires and resources can help you determine your risk tolerance. These tools typically ask questions about your investment experience, financial goals, and comfort level with risk, providing a personalized assessment. Remember, a realistic assessment of your risk tolerance is crucial for making informed investment decisions and avoiding impulsive actions driven by market hype or fear.

Frequently Asked Questions: Bitcoin End Of 2025 Price Prediction

Predicting the future price of Bitcoin is inherently challenging, given the volatile nature of the cryptocurrency market. Many factors, from regulatory changes to technological advancements, can significantly impact its value. The following addresses some common questions surrounding Bitcoin price predictions and investment considerations.

Bitcoin’s Most Likely Price at the End of 2025

Pinpointing a precise Bitcoin price at the end of 2025 is impossible. Numerous variables influence its trajectory, making any single prediction highly speculative. While some analysts might offer price targets based on various models (e.g., stock-to-flow models), these are just educated guesses and shouldn’t be taken as financial advice. The actual price could be significantly higher or lower, depending on unforeseen events like major regulatory shifts, widespread adoption by institutions, or a significant market correction. Past performance is not indicative of future results. For example, predictions made in 2020 for the Bitcoin price in 2022 varied wildly, highlighting the difficulty of accurate forecasting.

Reliability of Bitcoin Price Predictions

Long-term Bitcoin price predictions are notoriously unreliable. The cryptocurrency market is exceptionally volatile and susceptible to rapid price swings driven by news, speculation, and technological developments. Any prediction should be viewed with extreme skepticism. It’s crucial to engage in critical thinking, research multiple perspectives, and understand the limitations of predictive models before making any investment decisions based on such forecasts. Relying solely on a single prediction can be financially risky.

Factors to Consider Before Investing in Bitcoin

Before investing in Bitcoin, a thorough assessment of your risk tolerance, market understanding, and financial situation is essential. This includes researching the current market conditions, understanding the technology behind Bitcoin, and evaluating your own comfort level with the inherent volatility of cryptocurrencies. Additionally, staying informed about the evolving regulatory landscape is crucial, as government policies can significantly impact the price and accessibility of Bitcoin. Diversifying your investment portfolio to mitigate risk is also a sound strategy.

Finding Credible Information About Bitcoin

Reliable information about Bitcoin can be found from several reputable sources. These include established financial news outlets (such as the Wall Street Journal, Bloomberg, and Reuters), specialized cryptocurrency news websites (like CoinDesk and Cointelegraph), and research reports from respected financial institutions. It’s important to be discerning and avoid sources that promote unrealistic gains or lack transparency. Always cross-reference information from multiple sources to gain a comprehensive understanding. Official white papers and peer-reviewed academic research can also provide valuable insights into the technology and economic aspects of Bitcoin.

Bitcoin End Of 2025 Price Prediction – Predicting the Bitcoin price at the end of 2025 is challenging, influenced by numerous factors including macroeconomic conditions and technological advancements. A key event impacting this prediction is the Bitcoin halving, which significantly affects the rate of new Bitcoin creation. To understand the potential impact on the 2025 price, it’s crucial to know the exact date of the halving; you can find this information by checking When Was Bitcoin 2025 Halving.

Therefore, the timing of this halving plays a significant role in shaping the Bitcoin End Of 2025 Price Prediction.

Predicting the Bitcoin price at the end of 2025 is challenging, influenced by various factors including halving events. Understanding the timing of these events is crucial for accurate forecasting; for instance, to find out when the next Bitcoin halving will occur, you can check this resource: Cuando Fue El Halving De Bitcoin 2025. This information significantly impacts the supply dynamics and, consequently, potential price fluctuations by the end of 2025.

Predicting the Bitcoin price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the potential impact on the 2025 price, it’s crucial to know exactly when this halving will occur; you can find that information here: When Is Bitcoin 2025 Halving.

This date will be a major factor in any accurate Bitcoin End Of 2025 Price Prediction.

Predicting the Bitcoin price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the potential impact on the 2025 price, it’s crucial to know exactly when this halving will occur; you can find that information here: When Is Bitcoin 2025 Halving.

This date will be a major factor in any accurate Bitcoin End Of 2025 Price Prediction.

Predicting the Bitcoin price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the potential impact on the 2025 price, it’s crucial to know exactly when this halving will occur; you can find that information here: When Is Bitcoin 2025 Halving.

This date will be a major factor in any accurate Bitcoin End Of 2025 Price Prediction.

Predicting the Bitcoin price at the end of 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, which significantly impacts the rate of new Bitcoin entering circulation. To understand the potential impact on the 2025 price, it’s crucial to know exactly when this halving will occur; you can find that information here: When Is Bitcoin 2025 Halving.

This date will be a major factor in any accurate Bitcoin End Of 2025 Price Prediction.