Bitcoin ETF Price Predictions for 2025

Predicting the price of a Bitcoin ETF in 2025 is inherently speculative, given the volatile nature of cryptocurrency markets and the influence of numerous unpredictable factors. However, by considering various market scenarios and influential elements, we can construct a range of plausible price predictions. These predictions should be viewed as potential outcomes rather than definitive forecasts.

Factors Influencing Bitcoin ETF Price in 2025

Several key factors will significantly impact the price of a Bitcoin ETF by 2025. Regulatory approval in major markets like the US will be crucial, as widespread acceptance will likely increase institutional investment and market liquidity. The level of Bitcoin adoption by both individuals and businesses will also play a pivotal role, with broader adoption leading to increased demand and, consequently, higher prices. Macroeconomic conditions, including inflation rates, interest rates, and global economic growth, will also exert a considerable influence. Finally, technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s improvement for faster and cheaper transactions, could boost the appeal and value of Bitcoin.

Potential Price Ranges for a Bitcoin ETF in 2025

Considering the aforementioned factors, we can Artikel potential price ranges under different market scenarios:

- Bullish Scenario: A highly bullish market, characterized by widespread adoption, positive regulatory developments, and strong macroeconomic performance, could see the price of a Bitcoin ETF reach between $150,000 and $200,000 per Bitcoin by 2025. This scenario assumes continued institutional investment and a growing belief in Bitcoin as a store of value and a hedge against inflation. Similar to the 2021 bull run, but potentially even more significant due to ETF accessibility.

- Bearish Scenario: A bearish market, potentially triggered by negative regulatory actions, a major security breach impacting Bitcoin’s reputation, or a significant global economic downturn, could see the price of a Bitcoin ETF fall to a range between $20,000 and $40,000. This scenario mirrors the crypto winter of 2022, albeit with the mitigating factor of ETF availability potentially preventing an even steeper decline.

- Neutral Scenario: A neutral market, characterized by moderate adoption, limited regulatory changes, and stable macroeconomic conditions, would likely see the price of a Bitcoin ETF hover between $50,000 and $80,000. This scenario assumes a period of consolidation and sideways trading, similar to the price stability observed in certain periods after previous bull runs.

Analyst Predictions for Bitcoin ETF Price in 2025

The following table summarizes predictions from various analysts, highlighting the rationale behind their estimations. Note that these are subjective opinions and should not be considered financial advice.

| Analyst | Predicted Price (USD) | Rationale | Source (Illustrative – Replace with actual sources) |

|---|---|---|---|

| Analyst A | $75,000 | Moderate adoption, stable macroeconomic conditions. | Example Financial News Source |

| Analyst B | $120,000 | Strong institutional investment, positive regulatory outlook. | Example Research Firm |

| Analyst C | $35,000 | Concerns about macroeconomic instability and regulatory uncertainty. | Example Crypto News Website |

| Analyst D | $175,000 | High adoption rates, significant technological advancements. | Example Investment Bank Report |

Factors Affecting Bitcoin ETF Price in 2025

Predicting the price of a Bitcoin ETF in 2025 is inherently complex, relying on a confluence of factors that are difficult to isolate and predict with certainty. However, understanding the key influences can provide a clearer picture of the potential price trajectory. Several significant elements will likely shape the market, including regulatory landscapes, institutional participation, macroeconomic conditions, and the performance of Bitcoin itself.

Regulatory Decisions and Bitcoin ETF Price

Regulatory approval and subsequent oversight will profoundly impact the price of a Bitcoin ETF. A clear and favorable regulatory framework in major markets like the US, Europe, and Asia will likely boost investor confidence, leading to increased demand and higher prices. Conversely, stringent regulations or outright bans could severely limit accessibility and dampen enthusiasm, potentially suppressing the ETF’s price. The SEC’s decisions regarding Bitcoin ETF applications provide a prime example of this impact; approval would likely trigger a significant price surge, while continued rejection would likely maintain price volatility or even lead to a decline. The level of regulatory scrutiny concerning anti-money laundering (AML) and know-your-customer (KYC) compliance will also play a role.

Institutional Investment and Price Volatility

The entry of institutional investors, such as pension funds, hedge funds, and insurance companies, will significantly influence Bitcoin ETF price volatility. Large-scale institutional investment can stabilize the price by reducing the impact of individual traders and mitigating short-term price swings. However, a sudden mass withdrawal of institutional capital could trigger significant price drops. The increasing acceptance of Bitcoin as a legitimate asset class by these institutions is crucial for long-term price stability and growth. Consider the impact of BlackRock’s application for a Bitcoin ETF; their entry signifies a substantial shift in institutional acceptance, potentially influencing price trajectories.

Global Economic Events and Bitcoin ETF Value

Global macroeconomic events, such as inflation, recessionary periods, and geopolitical instability, can significantly impact the value of a Bitcoin ETF. During periods of high inflation, Bitcoin, and by extension its ETF, may be seen as a hedge against inflation, driving up demand and price. Conversely, during economic downturns, investors may liquidate their Bitcoin holdings, potentially causing price drops. The 2022 global economic slowdown, for instance, saw a significant drop in Bitcoin’s value, which would likely have been reflected in a Bitcoin ETF’s performance. Similarly, major geopolitical events can introduce uncertainty, influencing investor behavior and impacting price.

Bitcoin ETF Price Performance Compared to Bitcoin Price

The price performance of a Bitcoin ETF is expected to be closely correlated with the price of Bitcoin itself. However, there will likely be some divergence due to factors such as ETF management fees, trading volume, and market liquidity. Generally, a Bitcoin ETF is anticipated to track the price of Bitcoin relatively closely, but with some minor discrepancies. This close correlation means that any significant price movements in Bitcoin will likely be reflected in the ETF’s price, although the magnitude of the movement may differ slightly. This relationship makes understanding Bitcoin’s price movements crucial for predicting the ETF’s performance.

Comparing Bitcoin ETF with Other Investment Options in 2025: Bitcoin Etf Price 2025

Predicting the future of any investment is inherently uncertain, but by comparing projected returns and risk profiles of a Bitcoin ETF against established asset classes like gold, stocks, and bonds, we can gain a clearer perspective on its potential role within a diversified investment portfolio in 2025. This comparison considers various factors, including historical performance, volatility, and correlation with other assets.

Projected Returns Comparison

A comprehensive comparison requires acknowledging the inherent volatility of cryptocurrency markets. While past performance doesn’t guarantee future results, analyzing historical trends and expert forecasts can provide a framework for understanding potential returns. For example, some analysts predict a significant increase in Bitcoin’s value by 2025, potentially boosting the returns of a Bitcoin ETF. Conversely, others foresee a more conservative growth trajectory, or even potential price corrections. Comparing this range of possibilities against the projected returns of gold, stocks, and bonds allows for a more nuanced understanding of the potential risks and rewards.

| Asset Class | Projected Annual Return (Range) | Volatility | Correlation with Other Assets |

|---|---|---|---|

| Bitcoin ETF | 5% – 50% (highly variable, dependent on market conditions) | High | Low correlation with traditional assets |

| Gold | 2% – 8% (relatively stable, historically low correlation with other assets) | Moderate | Low to moderate correlation with stocks and bonds, negatively correlated with inflation in many cases |

| Stocks (S&P 500) | 6% – 12% (historical average, subject to market cycles) | Moderate to High | Generally positive correlation with other stocks, bonds have a weaker correlation. |

| Bonds (10-year Treasury) | 2% – 5% (relatively low risk, interest rate sensitive) | Low | Generally negative correlation with stocks, less sensitive to inflation than stocks. |

Diversification Benefits of Including a Bitcoin ETF, Bitcoin Etf Price 2025

Including a Bitcoin ETF in a diversified portfolio offers potential benefits due to its historically low correlation with traditional assets like stocks and bonds. This low correlation means that Bitcoin’s price movements often don’t mirror those of stocks or bonds. During periods of market downturn in traditional assets, Bitcoin could potentially offer some insulation or even growth, thereby reducing overall portfolio volatility. This diversification effect is crucial for mitigating risk and potentially enhancing long-term returns. For example, during periods of economic uncertainty, the price of gold typically increases as investors seek a safe haven asset, while the price of Bitcoin could also increase due to its perceived value as a hedge against inflation or fiat currency devaluation. The specific impact of diversification will depend on the overall portfolio composition and market conditions.

The Role of Technology in Shaping the Bitcoin ETF Market in 2025

The technological landscape is inextricably linked to the future of Bitcoin ETFs. Advancements in blockchain technology, the rise of decentralized finance (DeFi), and the burgeoning non-fungible token (NFT) market will all significantly influence the price, trading volume, and overall efficiency of Bitcoin ETF trading in 2025. Understanding these technological factors is crucial for accurately predicting the market’s trajectory.

Blockchain technology underpins Bitcoin’s existence, and its evolution directly impacts Bitcoin ETFs. Improvements in scalability, transaction speed, and security will translate into a more efficient and cost-effective ETF market. For instance, the development of layer-2 scaling solutions could drastically reduce transaction fees associated with Bitcoin ETF trading, making it more accessible to a wider range of investors. Conversely, security vulnerabilities within the underlying blockchain could negatively impact investor confidence and, consequently, the price of Bitcoin ETFs. The ongoing development and implementation of improved consensus mechanisms could also influence the overall stability and predictability of the Bitcoin price, affecting ETF values.

Blockchain Technology Advancements and Their Impact on Bitcoin ETF Price and Trading

Increased transaction throughput and reduced latency resulting from advancements in blockchain technology, such as sharding or improved consensus mechanisms, will likely lead to smoother and faster ETF trading. This efficiency could attract more institutional investors, increasing demand and potentially driving up the price. Conversely, significant technological setbacks or security breaches could trigger volatility and negatively impact the ETF’s price. Imagine a scenario where a major security flaw is discovered in the Bitcoin network; this would likely cause a sharp drop in Bitcoin’s value and subsequently affect the price of Bitcoin ETFs. The successful implementation of layer-2 scaling solutions, however, could potentially mitigate this risk by reducing congestion and increasing transaction speeds, thus enhancing the overall stability of the market.

The Influence of DeFi and NFTs on the Bitcoin ETF Market

The integration of decentralized finance (DeFi) protocols could revolutionize Bitcoin ETF trading by offering innovative lending, borrowing, and yield farming opportunities. This could create new avenues for investors to leverage their ETF holdings, potentially boosting demand. For example, investors could use their Bitcoin ETF holdings as collateral to borrow funds for other investments, or they might participate in DeFi protocols that offer interest-bearing accounts for Bitcoin ETFs. Similarly, the growing NFT market presents unique opportunities for innovation. While not directly impacting Bitcoin ETF prices in the same way as DeFi, NFTs could create new avenues for marketing and investor engagement, potentially increasing interest and overall market participation. Think of limited-edition NFT collectibles offered to Bitcoin ETF holders – this could enhance the appeal of the investment.

Technological Improvements and Bitcoin ETF Trading Efficiency

Technological advancements will undoubtedly influence the efficiency of Bitcoin ETF trading. The development of sophisticated trading algorithms and high-frequency trading (HFT) strategies will lead to faster order execution and potentially tighter spreads. Improved data analytics and predictive modeling tools will also enhance risk management and potentially lead to more informed investment decisions. However, the increased reliance on technology also introduces new risks. Algorithmic trading, while offering efficiency, can also contribute to market volatility and potentially exacerbate flash crashes. Furthermore, cybersecurity threats remain a significant concern, requiring robust security measures to protect against fraud and manipulation. The development and implementation of advanced cybersecurity protocols, along with regulatory oversight, are therefore crucial for ensuring the secure and efficient functioning of the Bitcoin ETF market.

Illustrative Scenarios for Bitcoin ETF Price in 2025

Predicting the price of a Bitcoin ETF in 2025 involves considering a multitude of interacting factors, from regulatory developments and macroeconomic conditions to the overall sentiment towards Bitcoin as an asset class. Two contrasting scenarios, one bullish and one bearish, illustrate the potential range of outcomes.

Scenario 1: Significant Price Surpass of Bitcoin’s Spot Price

In this optimistic scenario, the Bitcoin ETF price significantly outpaces the spot price of Bitcoin by 2025. This outcome hinges on several key factors converging positively. Firstly, widespread regulatory approval and the resulting increased institutional investment could drive demand far beyond current levels. The convenience and regulatory compliance offered by an ETF would attract investors hesitant to engage directly with the complexities of Bitcoin trading. Secondly, continued technological advancements in the Bitcoin ecosystem, such as the Lightning Network’s improved scalability and transaction speeds, could boost adoption and further enhance Bitcoin’s utility as a payment system and store of value. Thirdly, a sustained period of macroeconomic instability, such as persistent inflation or geopolitical uncertainty, could push investors towards Bitcoin as a safe haven asset, thereby increasing demand and driving up the ETF’s price. Finally, positive media coverage and growing public acceptance of Bitcoin could fuel a self-reinforcing cycle of price appreciation.

Visual Representation of Scenario 1

Imagine a graph charting the Bitcoin ETF price against the spot price of Bitcoin. The lines initially track relatively closely. However, from mid-2024 onwards, the Bitcoin ETF price line sharply diverges upwards. The divergence accelerates in late 2024 and early 2025, as institutional investment surges following several major regulatory approvals. Key market events marked on the graph would include the initial approval of a Bitcoin ETF in a major market, followed by subsequent approvals in other jurisdictions, each triggering a noticeable price jump. The graph culminates in 2025 with the Bitcoin ETF price significantly higher than the spot price, perhaps even double or more, reflecting the premium placed on the ETF’s ease of access and regulatory compliance. This premium could be likened to the price difference sometimes seen between a physical commodity and its futures contract.

Scenario 2: Bitcoin ETF Underperforms Compared to Bitcoin’s Price

Conversely, this bearish scenario envisions the Bitcoin ETF price lagging behind Bitcoin’s spot price by 2025. Several factors could contribute to this underperformance. Regulatory hurdles and delays could dampen institutional enthusiasm, limiting the influx of capital into the ETF. Negative media coverage or a significant security breach impacting the Bitcoin network could erode investor confidence. Furthermore, the emergence of competing investment vehicles or technological innovations offering superior returns could divert investor interest away from Bitcoin ETFs. A period of macroeconomic stability and a decline in investor risk appetite could also lead to a preference for more traditional assets, reducing demand for Bitcoin ETFs. Finally, high management fees associated with the ETF could reduce its overall attractiveness compared to direct Bitcoin ownership.

Visual Representation of Scenario 2

This graph would show a similar initial trajectory to Scenario 1, with both lines moving relatively in tandem. However, from late 2024, the Bitcoin ETF price line starts to flatten, while the spot price of Bitcoin continues to rise, albeit more slowly. Key events marked on the graph might include regulatory setbacks delaying ETF approvals, negative news stories impacting Bitcoin’s reputation, or the emergence of a successful competing cryptocurrency. The graph culminates in 2025 with the Bitcoin ETF price significantly below the spot price, illustrating a clear underperformance. This could be visualized as a clear divergence between the two lines, with the Bitcoin ETF line lagging significantly behind. The gap between the two lines would visually represent the underperformance, possibly reflecting the impact of high management fees or lack of investor confidence.

Frequently Asked Questions about Bitcoin ETF Price in 2025

This section addresses common inquiries regarding the potential price of a Bitcoin ETF in 2025, considering various influencing factors and comparing it to other investment options. Understanding these aspects is crucial for informed investment decisions.

Projected Price Range for a Bitcoin ETF in 2025

Predicting the precise price of a Bitcoin ETF in 2025 is inherently challenging due to the volatile nature of the cryptocurrency market. However, we can explore potential price ranges based on various scenarios and market analyses. Several analysts have offered projections ranging from conservative estimates of $50,000 to significantly more bullish predictions exceeding $100,000 per Bitcoin. These projections are often based on factors such as Bitcoin’s adoption rate, regulatory developments, macroeconomic conditions, and technological advancements. For example, a conservative scenario might assume moderate Bitcoin adoption and continued regulatory uncertainty, leading to a price range between $50,000 and $75,000. A more bullish scenario, however, might incorporate factors like widespread institutional adoption and positive regulatory changes, potentially pushing the price towards $100,000 or higher. It’s important to remember that these are just potential scenarios, and the actual price could fall outside these ranges.

Main Factors Influencing the Price of a Bitcoin ETF

Several key factors will significantly influence the price of a Bitcoin ETF in 2025. These include the overall price of Bitcoin itself, which is driven by supply and demand dynamics, investor sentiment, and macroeconomic events. Regulatory clarity regarding Bitcoin ETFs in various jurisdictions will also play a critical role. Increased regulatory acceptance tends to boost investor confidence and liquidity, leading to higher prices. Conversely, stricter regulations could dampen enthusiasm and negatively impact the price. Technological advancements, such as the development of layer-2 scaling solutions for Bitcoin, could also improve transaction efficiency and reduce costs, potentially driving demand and price appreciation. Finally, macroeconomic factors, such as inflation rates and interest rates, can influence investor appetite for riskier assets like Bitcoin, affecting the ETF’s price accordingly. For instance, high inflation might increase demand for Bitcoin as a hedge against inflation, driving the price upward.

Risks Associated with Investing in a Bitcoin ETF

Investing in a Bitcoin ETF carries inherent risks, primarily due to the volatility of Bitcoin itself. The price of Bitcoin can fluctuate dramatically in short periods, leading to significant potential losses. Regulatory uncertainty remains a risk, as changes in regulations could negatively impact the ETF’s value. Security risks associated with cryptocurrency exchanges and custodians are also a concern, although reputable ETFs will employ robust security measures to mitigate these risks. Market manipulation is another potential risk, although regulated markets are designed to minimize such occurrences. Finally, it is important to understand that the value of a Bitcoin ETF is entirely dependent on the underlying asset, Bitcoin, and its price fluctuations. Diversification of investments and thorough due diligence are crucial to mitigate these risks.

Comparison of a Bitcoin ETF with Other Investment Options

A Bitcoin ETF offers exposure to Bitcoin without the complexities of directly holding and managing the cryptocurrency. Compared to traditional investments like stocks and bonds, Bitcoin ETFs are considered higher-risk, higher-reward options. Their returns are potentially significantly higher but also subject to greater volatility. Compared to other cryptocurrencies, Bitcoin is generally viewed as more established and less volatile, although it still carries significant risk. The choice between a Bitcoin ETF and other investment options depends on individual risk tolerance, investment goals, and overall portfolio diversification strategy. A balanced portfolio incorporating various asset classes is generally recommended for risk management.

Bitcoin Etf Price 2025 – Predicting the Bitcoin ETF price in 2025 is challenging, hinging on various market factors and regulatory approvals. Understanding broader Bitcoin price predictions is crucial, and a good place to start is exploring community discussions like those found on Bitcoin Price 2025 Reddit. These discussions, while speculative, can offer insights into the sentiment surrounding Bitcoin’s potential value, which will indirectly influence the price of a Bitcoin ETF.

Predicting the Bitcoin ETF price in 2025 is challenging, hinging significantly on the overall market sentiment and regulatory landscape. A key factor influencing this prediction is the broader question of Bitcoin’s value, explored in detail at What Will Bitcoin Be Worth 2025. Ultimately, the success of a Bitcoin ETF and its price will be intrinsically linked to the future price of Bitcoin itself.

Therefore, understanding the potential trajectory of Bitcoin’s value is crucial for any Bitcoin ETF price forecast.

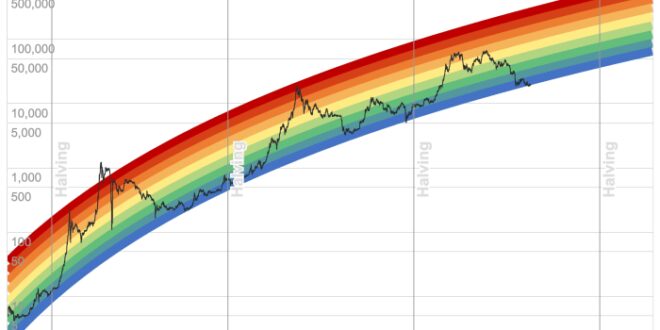

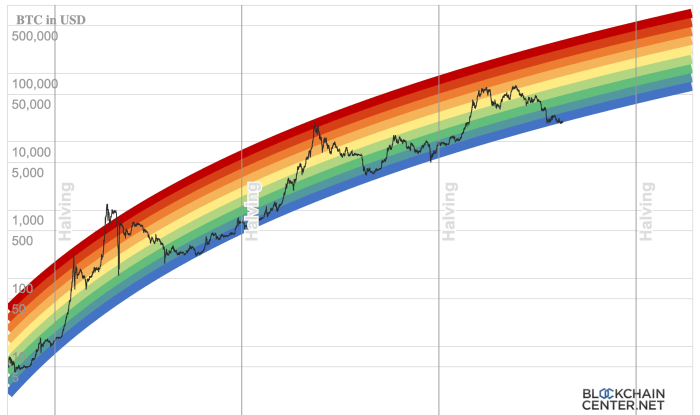

Predicting the Bitcoin ETF price in 2025 is challenging, heavily influenced by the overall market sentiment and regulatory landscape. Understanding potential price trajectories requires analyzing broader Bitcoin price movements, which you can explore via this helpful resource: Bitcoin Price Chart 2025. Ultimately, the Bitcoin ETF price will likely correlate closely with the Bitcoin price chart, making this chart a valuable tool for forecasting.

Predicting the Bitcoin ETF price in 2025 is challenging, heavily influenced by the overall market sentiment and regulatory decisions. A significant factor to consider is the potential for a Bitcoin price drop, as discussed in this insightful article: Bitcoin Price Drop 2025. Therefore, any projection for the Bitcoin ETF price in 2025 must account for this volatility and its potential impact on investor confidence and trading activity.

Predicting the Bitcoin ETF price in 2025 is challenging, hinging significantly on the overall Bitcoin price. To understand potential ETF valuations, it’s crucial to consider broader market predictions; for instance, check out this insightful analysis on What Price Will Bitcoin Reach In 2025 to gain perspective. Ultimately, the Bitcoin ETF price in 2025 will likely reflect the prevailing Bitcoin market value at that time, plus or minus a premium or discount based on market demand and ETF structure.