Bitcoin Halving 2025

The Bitcoin halving, a programmed event occurring approximately every four years, reduces the rate at which new Bitcoins are created. This reduction in supply is a core component of Bitcoin’s deflationary monetary policy and has historically been associated with significant price movements. Understanding the impact of the 2025 halving requires analyzing past events and considering current market conditions.

Historical Impact of Bitcoin Halvings on Price

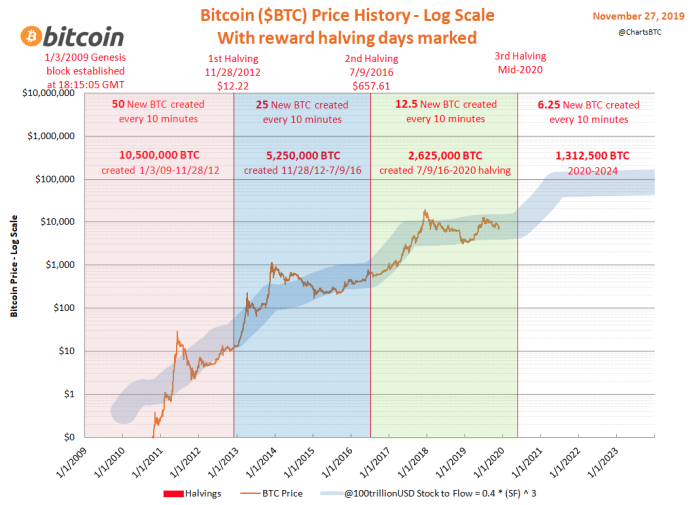

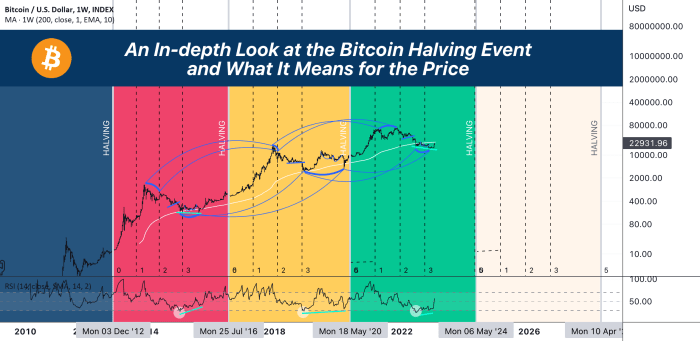

Previous Bitcoin halvings have demonstrated a consistent pattern: a period of price increase following the event. The first halving in 2012 saw the block reward reduced from 50 BTC to 25 BTC. While the immediate impact wasn’t dramatic, the price experienced a substantial surge in the following months and years. Similarly, the 2016 halving (from 25 BTC to 12.5 BTC) and the 2020 halving (from 12.5 BTC to 6.25 BTC) were also followed by periods of significant price appreciation, although the timing and magnitude of these increases varied. It’s crucial to note that other factors, such as market sentiment, regulatory changes, and technological advancements, also play a role in price fluctuations. However, the halving’s impact on the supply dynamics is considered a significant contributing factor.

Expected Supply Reduction in 2025 and Potential Effects

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a 50% decrease in the rate of new Bitcoin creation. This reduction in supply, all else being equal, should exert upward pressure on the price. The extent of this price increase will depend on several interacting factors, including overall market demand, the rate of Bitcoin adoption, and macroeconomic conditions. A higher demand with a reduced supply generally leads to price appreciation, as seen in basic economic principles of supply and demand.

Comparison of Market Conditions Across Halvings

Comparing the market conditions surrounding previous halvings to the current environment is essential for informed speculation. The 2012 halving occurred during the early stages of Bitcoin’s development, with a relatively small market capitalization and limited institutional involvement. The 2016 and 2020 halvings took place in more mature markets, with increasing institutional adoption and higher trading volumes. The 2025 halving will likely occur in a market shaped by further institutional involvement, growing regulatory scrutiny, and potentially, a different macroeconomic landscape. This complex interplay of factors makes predicting the precise impact challenging.

Potential Short-Term and Long-Term Price Reactions

Predicting short-term price reactions is inherently speculative. Some analysts suggest a period of price anticipation leading up to the halving, followed by a post-halving price surge. Others anticipate a more gradual increase. The long-term impact, however, is arguably more predictable. The reduced supply should contribute to Bitcoin’s scarcity and potentially drive long-term price appreciation, assuming continued or increased demand. However, this long-term effect is subject to numerous variables and unforeseen events. The historical data suggests a positive correlation between halvings and subsequent price increases, but it does not guarantee a similar outcome in 2025.

Key Metrics of Previous Bitcoin Halvings

| Date | Block Reward (BTC) | Price Before Halving (USD) | Price After Halving (USD) |

|---|---|---|---|

| November 2012 | 50 -> 25 | ~13 | ~1000 (approx. 1 year later) |

| July 2016 | 25 -> 12.5 | ~650 | ~20000 (approx. 2 years later) |

| May 2020 | 12.5 -> 6.25 | ~9000 | ~60000 (approx. 1 year later) |

Altcoin Performance Around Halving Events: Bitcoin Halving 2025 Altcoins

The Bitcoin halving, a programmed event that reduces the rate of new Bitcoin creation, has historically been associated with significant market volatility, impacting not only Bitcoin’s price but also the performance of altcoins. Understanding the historical trends in altcoin behavior around these events is crucial for investors seeking to navigate the cryptocurrency market effectively. This analysis will explore the common patterns observed in altcoin price movements during and after Bitcoin halvings, examining the correlation between Bitcoin’s price and altcoin prices, and highlighting specific examples.

Altcoin price movements following Bitcoin halvings exhibit diverse patterns, defying simple categorization. While some demonstrate a strong positive correlation with Bitcoin’s price, others display independent behavior, sometimes significantly outperforming or underperforming Bitcoin. This complexity stems from a confluence of factors, including market sentiment, technological developments within specific altcoin projects, and broader macroeconomic conditions. The lack of a consistent, predictable relationship necessitates a detailed examination of historical data to discern meaningful trends.

Historical Altcoin Performance During and After Halvings, Bitcoin Halving 2025 Altcoins

Analyzing past Bitcoin halvings reveals a mixed bag for altcoins. Following the 2012 halving, many altcoins experienced a period of growth, although this was largely overshadowed by Bitcoin’s own price surge. The 2016 halving saw a more pronounced altcoin season, with several altcoins significantly outperforming Bitcoin in the months following the event. However, the 2020 halving resulted in a less clear-cut pattern, with some altcoins experiencing substantial gains while others lagged behind Bitcoin. This variability underscores the importance of considering individual project fundamentals and market sentiment rather than relying solely on the halving event as a predictive factor. For example, Litecoin, often considered a Bitcoin “silver” to Bitcoin’s “gold,” has historically shown periods of strong performance around halvings, while other altcoins with less established market positions or weaker fundamentals may have seen limited gains or even losses.

Correlation Between Bitcoin and Altcoin Prices

The correlation between Bitcoin’s price and altcoin prices is not always strong or consistent. While a general positive correlation exists during periods of overall market growth, this relationship often weakens or even reverses during periods of market correction or volatility. This decoupling is particularly evident around Bitcoin halving events, where altcoins can display significant price swings independent of Bitcoin’s movements. This lack of consistent correlation highlights the importance of diversifying investments and conducting thorough due diligence on individual altcoin projects. Relying solely on Bitcoin’s price as a predictor of altcoin performance is a risky strategy.

Examples of Altcoin Performance

Several altcoins have exhibited diverse performances around past halvings. Some, like Ethereum, often experience periods of substantial growth, benefiting from increased investor interest in the broader cryptocurrency market. Conversely, other altcoins with less robust ecosystems or weaker fundamentals may struggle to maintain value, even during periods of overall market growth. Specific examples and their performances will vary depending on the halving event and the specific altcoin. The variability highlights the need for thorough individual research and risk assessment before investing.

Potential Reasons for Altcoin Price Fluctuations During a Bitcoin Halving

The following factors contribute to the complex price fluctuations observed in altcoins during and after Bitcoin halvings:

- Increased Investor Attention to Bitcoin: The halving often brings increased attention and investment into Bitcoin, potentially drawing capital away from altcoins in the short term.

- Market Sentiment and Speculation: Anticipation of the halving and its potential impact on Bitcoin’s price can lead to significant market volatility, impacting altcoins both positively and negatively.

- Altcoin-Specific Developments: Technological advancements, partnerships, regulatory changes, or other news specific to individual altcoin projects can significantly influence their price, independent of Bitcoin’s performance.

- Macroeconomic Factors: Broader economic conditions, such as inflation or interest rate changes, can influence investor risk appetite, affecting both Bitcoin and altcoin prices.

- Network Effects and Liquidity: The overall health and liquidity of the cryptocurrency market, including the performance of major exchanges and trading platforms, can significantly impact altcoin price movements.

Investor Sentiment and Market Speculation

The Bitcoin halving event of 2025 is anticipated to significantly impact investor sentiment and market speculation within the cryptocurrency ecosystem. Leading up to the event, a complex interplay of factors will shape investor behavior, including past halving performance, macroeconomic conditions, and regulatory developments. Understanding these dynamics is crucial for navigating the potential volatility.

Investor sentiment leading up to the 2025 halving will likely be a mixture of optimism and caution. The historical correlation between halving events and subsequent price increases will fuel bullish expectations among many investors. However, macroeconomic uncertainty, potential regulatory crackdowns, and the ever-present risk of market corrections will temper this enthusiasm. The level of overall market confidence will significantly influence the extent of speculative activity.

Speculation and Fear of Missing Out (FOMO)

Speculation will undoubtedly play a significant role in the market leading up to and following the 2025 halving. The anticipation of scarcity, driven by the reduced Bitcoin supply, will likely attract new investors and encourage existing holders to accumulate more. This heightened demand, coupled with the fear of missing out (FOMO), could lead to substantial price increases. However, this speculative bubble is vulnerable to bursting if negative news emerges or if macroeconomic conditions deteriorate. History has shown that FOMO can drive irrational exuberance, leading to unsustainable price rallies followed by sharp corrections. The 2017 Bitcoin bull run, largely fueled by FOMO, serves as a prime example of this phenomenon.

Regulatory Impact on Bitcoin and Altcoins

Regulatory changes will significantly influence investor sentiment and market behavior. A supportive regulatory environment could attract institutional investment, boosting Bitcoin’s price and potentially spilling over into the altcoin market. Conversely, stricter regulations could stifle growth, leading to price declines and increased volatility. The regulatory landscape varies significantly across jurisdictions, and differing approaches could create arbitrage opportunities or hinder cross-border transactions. For example, a nation adopting a clear, pro-cryptocurrency regulatory framework might attract significant investment, leading to higher prices within that jurisdiction, while stricter regulations in other regions could create a relative price differential.

Investor Strategies During a Halving Event

Investors will likely employ diverse strategies in anticipation of the 2025 halving. Some may adopt a “HODL” (hold on for dear life) strategy, accumulating Bitcoin and holding it for the long term, expecting significant price appreciation after the halving. Others might pursue a more active trading approach, attempting to profit from short-term price fluctuations. A third group might focus on altcoins, anticipating that the attention on Bitcoin will create opportunities in other cryptocurrencies. Each strategy carries its own set of risks and rewards. The “HODL” strategy minimizes trading fees but requires significant patience and risk tolerance. Active trading requires skill, timing, and risk management expertise. Investing in altcoins offers potential for higher returns but also exposes investors to greater volatility and risk.

Hypothetical Investor Reactions to Price Movements

Let’s consider a hypothetical scenario. Suppose Bitcoin’s price increases steadily in the months leading up to the halving, reaching $100,000. Long-term HODLers might feel confident in their strategy, while some active traders might take profits, fearing a correction. If the price then unexpectedly drops to $80,000, HODLers might remain unfazed, viewing it as a buying opportunity. However, traders who sold at $100,000 might experience regret (FOMO). Conversely, if the price continues its upward trajectory after the halving, reaching $150,000, HODLers will be rewarded, while traders who missed the initial rise might experience intense FOMO. This illustrates how different investor strategies and risk tolerances lead to varied reactions to price movements.

Technical Analysis and Price Predictions

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, relying heavily on technical analysis and market sentiment. While no method guarantees accuracy, various approaches offer potential insights into future price movements. These range from simple moving averages to more sophisticated models incorporating on-chain data and macroeconomic factors. The accuracy of past predictions varies widely, highlighting the inherent uncertainty in forecasting cryptocurrency prices.

Technical Analysis Methods

Technical analysis uses past price and volume data to identify patterns and predict future price movements. Several methods are commonly employed to analyze Bitcoin’s price. Moving averages, such as the 50-day and 200-day simple moving averages (SMA), are used to identify trends and potential support and resistance levels. Relative Strength Index (RSI) helps determine overbought or oversold conditions, suggesting potential price reversals. Fibonacci retracements identify potential support and resistance levels based on historical price swings. Analyzing candlestick patterns provides insights into market sentiment and potential price movements based on the shape and arrangement of candlesticks on a price chart.

Bullish and Bearish Price Predictions

Bullish predictions often cite the historical correlation between Bitcoin halvings and subsequent price increases. For example, some analysts predict a price surge to $100,000 or more by the end of 2025, based on past halving cycles and the increasing scarcity of Bitcoin. These predictions often incorporate factors like increased institutional adoption and growing global demand. Conversely, bearish predictions highlight the inherent volatility of the cryptocurrency market and potential macroeconomic headwinds. Some analysts suggest a more conservative price range, potentially remaining below current levels or experiencing only a modest increase after the halving, citing factors such as regulatory uncertainty and potential economic downturns. These predictions often focus on potential negative impacts on the overall market sentiment.

Price Prediction Models and Underlying Assumptions

Various models exist for predicting Bitcoin’s price, each with its underlying assumptions. Some models are purely technical, relying solely on price and volume data. Others incorporate on-chain metrics, such as the number of active addresses or the miner’s revenue, to assess network activity and potential price impacts. Stock-to-flow models, for example, attempt to predict Bitcoin’s price based on its scarcity relative to its production rate. These models often make assumptions about future adoption rates, regulatory developments, and overall market sentiment, all of which significantly impact the prediction’s accuracy.

Accuracy of Past Price Predictions

Comparing past price predictions with actual outcomes reveals a wide range of accuracy. Many predictions made before previous halvings significantly overestimated or underestimated the actual price movements. This highlights the challenges of accurately forecasting cryptocurrency prices, influenced by unpredictable market events and evolving investor sentiment. While some analysts might have correctly predicted the general direction of the price movement, the magnitude of the change often proved difficult to forecast precisely. This underscores the limitations of relying solely on any single prediction model.

Visualization of Price Prediction Scenarios

| Scenario | Price Range (USD) by End of 2025 | Underlying Assumptions |

|---|---|---|

| Bullish | $100,000 – $200,000 | High adoption, strong market sentiment, limited regulatory impact |

| Neutral | $50,000 – $100,000 | Moderate adoption, stable market sentiment, some regulatory uncertainty |

| Bearish | $25,000 – $50,000 | Slow adoption, weak market sentiment, significant regulatory headwinds |

Risks and Opportunities for Altcoin Investors

The Bitcoin halving event, while historically correlated with bullish Bitcoin price action, presents a complex landscape for altcoin investors. While the reduced Bitcoin supply can theoretically drive capital into alternative cryptocurrencies, significant risks accompany this potential opportunity. Understanding these risks and employing appropriate strategies is crucial for navigating this volatile period.

Potential Risks Associated with Altcoin Investment Around a Bitcoin Halving

The increased volatility surrounding a Bitcoin halving significantly impacts altcoins. Many altcoins experience price movements that are highly correlated with Bitcoin’s price. A sharp Bitcoin price correction, even after an initial halving-related surge, can trigger substantial losses in altcoin investments. Furthermore, the halving often attracts new investors, some of whom may lack the experience to properly assess the risks associated with altcoins. This influx can lead to speculative bubbles, making it difficult to identify fundamentally sound projects from those destined for a sharp decline. Finally, the development and adoption of altcoins can be highly unpredictable. Projects that seem promising may fail to gain traction, leading to significant losses for investors. The inherent risk of a complete project failure is ever-present in the volatile altcoin market.

Opportunities for Savvy Altcoin Investors

Despite the risks, the Bitcoin halving can present lucrative opportunities for discerning altcoin investors. Historically, periods of increased Bitcoin price volatility have often been followed by altcoin “seasons,” where numerous altcoins experience significant price appreciation. This phenomenon is often attributed to investors seeking diversification and higher potential returns beyond Bitcoin. Savvy investors can capitalize on this by identifying undervalued altcoins with strong fundamentals and development teams. Furthermore, the increased market activity around the halving can create opportunities for arbitrage and short-term trading strategies. Finally, the increased investor interest can attract further development and adoption for promising projects, further increasing their long-term value.

Strategies for Mitigating Risks and Maximizing Potential Returns

A crucial strategy for mitigating risk is thorough due diligence. This involves carefully researching the technology, team, and market position of any altcoin before investing. Diversification across multiple altcoins, with varying levels of risk and market capitalization, is also essential. This reduces the impact of any single project failing. Employing a dollar-cost averaging (DCA) strategy, where investments are made in regular intervals regardless of price fluctuations, can help mitigate the impact of market volatility. Setting stop-loss orders to limit potential losses is another crucial risk management technique. Finally, a long-term investment horizon can help weather short-term price fluctuations, allowing investors to benefit from the potential long-term growth of promising altcoins.

Importance of Diversification in an Altcoin Portfolio

Diversification is paramount in mitigating risk within an altcoin portfolio. Investing in a single altcoin is akin to putting all your eggs in one basket. A diversified portfolio includes altcoins from different sectors, such as DeFi, NFTs, or metaverse projects, reducing the impact of sector-specific downturns. Diversification also considers market capitalization; holding a mix of large-cap and small-cap altcoins balances risk and potential reward. Consider a portfolio spread across multiple promising projects, minimizing reliance on the success of any single asset. This reduces overall portfolio volatility and increases the chance of positive returns even if some investments underperform.

Checklist of Considerations for Altcoin Investors Before/After the Halving

Before investing in altcoins around a halving, investors should carefully consider the following:

- Thorough due diligence on each project’s technology, team, and market potential.

- Assessment of the project’s tokenomics and potential for long-term growth.

- Analysis of the overall market sentiment and potential for price volatility.

- Development of a well-defined risk management strategy, including stop-loss orders.

- Implementation of a diversified investment strategy across multiple altcoins and sectors.

After the halving, investors should continue to monitor market conditions, news, and project developments. Regularly review the portfolio’s performance and adjust the investment strategy as needed, always remaining vigilant to potential market shifts and project updates.

The Role of Mining and Hash Rate

Bitcoin halving events, occurring approximately every four years, significantly impact the profitability of Bitcoin mining and, consequently, the network’s hash rate. Understanding this interplay is crucial for comprehending the broader implications of halving on Bitcoin’s price and overall market dynamics. The reduction in block rewards directly affects miners’ revenue streams, triggering adjustments within the mining ecosystem.

Impact of Bitcoin Halving on Mining Profitability

A Bitcoin halving cuts the reward miners receive for successfully adding a block to the blockchain in half. This immediately reduces their income per block. For example, the reward was 50 BTC before the first halving, then 25 BTC, and subsequently 12.5 BTC. After the 2024 halving, the reward will be 6.25 BTC. This decrease necessitates miners to reassess their operational costs, including electricity, hardware maintenance, and facility expenses. Miners with high operational costs might become unprofitable and be forced to shut down or switch to more profitable cryptocurrencies. Conversely, miners with lower costs and access to cheap energy sources can maintain operations and potentially gain market share. The profitability of mining becomes highly sensitive to Bitcoin’s price; a price increase can offset the reduced block reward, while a price drop can exacerbate the negative impact of halving.

Potential Effects on Bitcoin Network’s Hash Rate

The hash rate, a measure of the total computational power dedicated to securing the Bitcoin network, is directly influenced by mining profitability. A decrease in profitability often leads to a temporary decline in the hash rate as less-profitable miners exit the network. This is because miners are incentivized to contribute computational power based on the potential reward they can receive. A lower reward translates to less incentive, leading some miners to switch off their equipment. However, historically, the hash rate has generally recovered and even increased after halving events, driven by several factors. These include the anticipation of future price increases, the entry of new, more efficient mining hardware, and the consolidation of mining power among larger, more cost-effective operations.

Relationship Between Mining Profitability, Hash Rate, and Bitcoin’s Price

These three factors are intricately linked. Higher Bitcoin prices generally lead to increased mining profitability, attracting more miners and boosting the hash rate. A higher hash rate strengthens network security and enhances the perceived value of Bitcoin, potentially further increasing its price. Conversely, lower Bitcoin prices decrease profitability, causing some miners to leave the network, reducing the hash rate, and potentially creating a negative feedback loop impacting the price. The halving event disrupts this equilibrium, initially reducing profitability and potentially impacting the hash rate before the market adjusts. The price of Bitcoin often anticipates the halving effect, showing price increases leading up to the event.

Comparison of Mining Landscape Before and After Previous Halvings

Before the 2012 halving, the mining landscape was characterized by a more distributed network with smaller-scale miners. After the halving, larger, more industrialized mining operations with economies of scale gained prominence. This trend continued with subsequent halvings, leading to greater centralization of mining power. The 2024 halving is expected to further solidify this trend, with only the most efficient and well-capitalized miners remaining profitable.

Interconnectedness of Mining, Hash Rate, and Bitcoin Price

Frequently Asked Questions

This section addresses common queries regarding Bitcoin halvings and their impact on both Bitcoin and altcoins, providing clarity on the mechanics, historical trends, and potential implications for investors. Understanding these dynamics is crucial for navigating the market effectively around the 2025 Bitcoin halving.

Bitcoin Halving Mechanism

The Bitcoin halving is a programmed event built into the Bitcoin protocol. It occurs approximately every four years, reducing the rate at which new Bitcoins are created (mined) by half. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time. The initial block reward was 50 BTC, halved to 25 BTC, then 12.5 BTC, and will be reduced to 6.25 BTC after the 2025 halving.

Bitcoin Halving’s Price Impact

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The halvings of 2012 and 2016, for instance, were followed by substantial bull runs. This is often attributed to the decreased supply of newly minted Bitcoin, increasing scarcity and potentially driving up demand. However, it’s crucial to note that other market factors, such as regulatory changes, technological advancements, and overall economic conditions, also play a significant role in price movements. It’s not a guaranteed outcome that a price increase will automatically follow a halving.

Risks and Opportunities for Altcoin Investors During a Bitcoin Halving

The Bitcoin halving presents both risks and opportunities for altcoin investors. A potential risk is that investors may shift their focus and capital towards Bitcoin, leading to a decline in altcoin prices. This is because Bitcoin is often viewed as a safe haven asset during periods of market uncertainty. Conversely, an opportunity exists for altcoins with strong fundamentals and unique value propositions to attract investors seeking diversification or higher returns. The increased attention and liquidity surrounding Bitcoin during a halving cycle might inadvertently benefit some altcoins through increased overall market activity.

Preparing for the 2025 Bitcoin Halving

Preparing for the 2025 Bitcoin halving requires a multifaceted approach. Investors should thoroughly research and diversify their portfolios, considering both Bitcoin and altcoins with strong underlying technology and adoption rates. Risk tolerance should be carefully assessed, and investment strategies should be adjusted accordingly. Staying informed about market trends, technological developments, and regulatory changes is also crucial. This informed approach, coupled with a long-term perspective, can help investors navigate the potential volatility surrounding the halving event and capitalize on opportunities that may arise.

Bitcoin Halving 2025 Altcoins – The Bitcoin Halving in 2025 is a significant event expected to impact the cryptocurrency market, particularly altcoins. Many believe the reduced Bitcoin supply will influence the price, potentially creating opportunities or challenges for alternative cryptocurrencies. To understand the potential ripple effects, pinpointing the precise date is crucial; you can find a detailed analysis of the predicted Date For Bitcoin Halving 2025.

Therefore, keeping abreast of this date is essential for anyone invested in, or considering investing in, the broader cryptocurrency landscape beyond Bitcoin itself, including the performance of various altcoins.

The Bitcoin Halving in 2025 is expected to significantly impact the altcoin market. Many believe the reduced Bitcoin supply will influence investor sentiment, potentially shifting attention and capital towards alternative cryptocurrencies. To understand the potential implications, it’s crucial to know the precise date; you can find the projected timing by checking this resource on Bitcoin Halving Time 2025.

Therefore, carefully tracking this date is essential for anyone interested in the future of Bitcoin Halving 2025 Altcoins.

The Bitcoin Halving in 2025 is expected to significantly impact the altcoin market, potentially causing volatility and shifts in market dominance. Understanding the precise timing is crucial, and you can find details about the exact date on this resource dedicated to Bitcoin Halving Day 2025. Therefore, keeping a close eye on this date is vital for investors interested in both Bitcoin and altcoin performance in the coming years.

The Bitcoin Halving in 2025 is anticipated to significantly impact the altcoin market, potentially causing price volatility. Understanding the mechanics of this event is crucial for informed investment decisions; for a detailed analysis, refer to this comprehensive resource on the Halving Bitcoin 2025. Consequently, investors should carefully consider the interconnectedness between Bitcoin’s halving cycle and the performance of alternative cryptocurrencies in the following months.

The Bitcoin Halving in 2025 is expected to significantly impact the cryptocurrency market, particularly altcoins. Many analysts believe the halving will drive up Bitcoin’s price, potentially affecting the overall market sentiment and the relative value of altcoins. To understand the potential price movements, it’s crucial to consider predictions surrounding the event; for instance, check out this insightful analysis on Bitcoin Prediction Halving 2025.

Ultimately, the interplay between Bitcoin’s price action and the performance of altcoins post-halving remains a key area of speculation for investors.

The Bitcoin Halving in 2025 is anticipated to significantly impact the altcoin market, potentially causing volatility and shifts in market dominance. Precisely pinpointing the halving’s date requires careful consideration; for a detailed breakdown of the timing, check out this resource on Bitcoin Halving 2025 Time. Understanding this timing is crucial for investors navigating the potential ripple effects on altcoin performance leading up to and following the event.